There is an old stock market maxim that says we should “sell in May and go away.” Like most proverbs or cliches, it has a foundation in truth.

There is an old stock market maxim that says we should “sell in May and go away.” Like most proverbs or cliches, it has a foundation in truth.

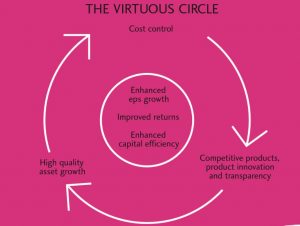

Moneysupermarket wants to get to know us, so it can sell us more products. Innovation and diversification are the pillars of a strategy responding to a maturing market.

It’s good to have management with experience of boom and bust cycles, so Bruce looks at two companies run by Chairmen over 80 years old. With the FA Cup and Champions League Final later this month he starts with some football stories from his time at Seymour Pierce.

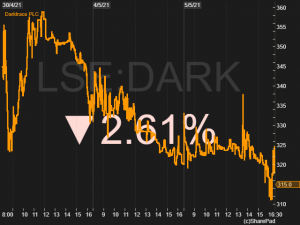

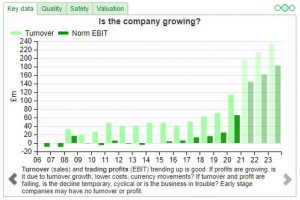

We take a look at UK IPOs listed on the LSE throughout April 2021 and how they’ve performed upon opening.

Bruce looks at tech stocks reporting Q1 results in the US, Google vs Facebook, and the resurgence of Microsoft. Plus a mix of UK companies reporting this week, including Tristel, Water Intelligence, HeiQ and Sylvania.

Do we wait for dips? Buy now? Buy more? Is it all over now, again?

Markets have been very strong recently, so it’s important not to get carried away. Bruce looks at stocks with accrued income, % revenue recognition, acquisition and fair value accounting adjustments.

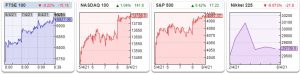

April is typically a strong month – perhaps because of all the tax-selling clearing and reducing sell pressure. New ISA money tends to enter the market too. Cash is a position, but many punters feel it burning a hole in their pockets and so tend to end up spending it.

I like companies that boast significant net cash. I therefore apply certain filter criteria to identify some reasonable cash-flush businesses.

Bruce wonders if value vs momentum factors is really the best way to think about companies on the stock market. He also looks at the Novacyt profit warning, The Mission, and two high performance stocks: Volex and Impax.

What defines a worthy stock for investment or retirement income? Unfortunately, for many investors, the answer is a stock that pays dividends. While dividends are a factor (among many) that can be used to judge a stock, it isn’t necessarily the most important or profitable determination to make when investing.

Investing in mining stocks is always a speculative exercise. Where are we in the cycle?

A company’s strategy should not just tell us what it wants to achieve, but why and how. Richard introduces a simple framework for analysing strategy and highlights a good strategy, and one that is more difficult to fathom.

We are most of the way through result season for companies with December year ends. Bruce discusses how companies with patchy track records can border on evasive in their RNS disclosure, without quite crossing the line to unacceptable. Often the share price reactions suggests that investors aren’t fooled though.

I run my filter every week, usually on a Saturday morning. By running the filter every week, it allows five trading sessions to pass and therefore potentially offer up new stocks. Time is a trader’s greatest asset, and it makes no sense to run the filter every day when almost all of the stocks will be the same.

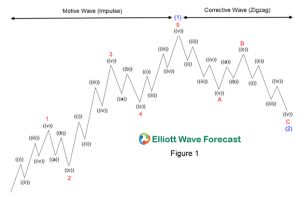

How do you answer that age-old investment conundrum – when to get in and when to get out? Here’s a technical approach to finding the best recovery candidates as they emerge.

Tech stocks were strong performers last year. The pandemic meant that providers of remote services like Zoom Video Communications or Peloton Interactive experienced massive sales growths, while a whole host of cybersecurity and cloud hosting companies did well alongside the usual big players like Microsoft, Apple and Amazon. However, as the economy bounces back from the disruption of COVID-19, tech stocks have slumped.

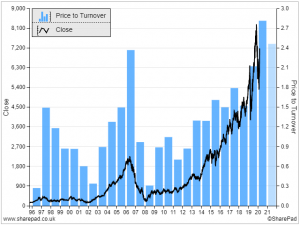

I am probably jinxing it now, but owning shares in Howden Joinery has never lost me sleep. Despite the pandemic and a fall in profit, this year’s annual report has the same calming effect it does every year, and not just because of the pictures. Howdens explains the business very well, and quietly delivers on the promise.

There have been at least 15 ten baggers since the March low in the UK. Bruce looks at 4 stocks that now have a fair wind behind them, that should be geared into further recovery.

A few months ago, SharePad released a new feature called the Single Page. Learn to use it and maximise your productivity.

Let me start by confessing this article covers pension deficits. What follows may not be that thrilling and does require you to concentrate. But please stick with me, especially if you have ever fallen victim to a ‘value trap’.

In these articles about funds, I have tended to steer clear of the many, many alternative funds listed on the London market. That is not because these funds are not interesting – many of them are – but because I felt their business model hasn’t entirely been proved.

Bruce compares a couple of Direct Carrier Billing (DCB), mobile payment platforms: Boku v Bango. He wonders if platform economics has become too popular, with the benefits well recognised but not downside. Also Ocean Wilsons, the Brazilian (Salvador, Bahia) port business.

It has been a difficult few years for UK investment fund managers.

Between the debacle of the Woodford Equity Income Fund and the COVID-19 pandemic, “star” funds that promised so much have led only to disappointment for investors.

Over the years I have ignored Kingspan because it is big, acquisitive, and supplies building materials. My gut reaction to these facts is that Kingspan is best avoided, but my gut could well be wrong.

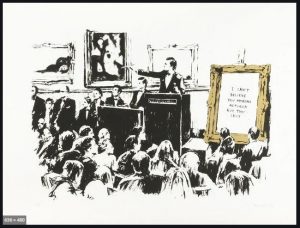

Bruce looks at the fungible vs non fungible assets, using examples from recent events in the art markets. Stocks covered this week are Kape, Somero and Tremor.

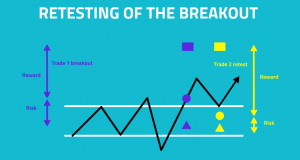

The breakout retest is a great way of trading a breakout if you missed the initial rally. We looked at how traders should look to play these and the importance of a well-timed buy.

One of my favourite SharePad screens identifies good-quality companies that have grown without acquisition. One such is Best of the Best.

With Scottish Mortgage Inv Trust down 9% last week, Bruce looks at the debate between Lawrence “usually a mistake to sell” Burns of Baillie Gifford and Andrew “take profits” Dickson of Albert Bridge Capital. Companies covered Renishaw, Solid State, K3 Capital and Franchise Brands.

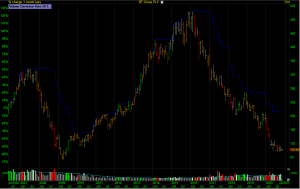

As the Dow Jones Index took a tumble at the end of February, many analysts saw this as the beginning of a long-overdue market correction. Some have floated talk of a stock market bubble for a while, but despite the challenging conditions of the last year, the market rebounded and finished out the year strongly. However, the dip on the 24th of February — which saw the index shed 1000 points — has led some traders to talk of an opportunity to cash in on the slide.

Recently, I have adapted my SharePad setup so I can turn over even more rocks. The cornerstone of my setup remains the KISS+ filter. KISS, stands for Keep it Simple (Stupid) and the plus sign is just a reminder that I have improved this filter over the years.

Everyone likes a turnaround. This is because people like the idea of buying at the bottom and reaping the rewards.

However, trading turnarounds can take a lot of time. Businesses are often slow to change and it is not a quick process.

This article will show you how to trade some potential turnaround stocks and give you some pointers to look at next time you are considering trading a turnaround.

Nasdaq sold off last week, down 7% since the middle of February, though still up since the start of the year. Tesla fell to $680, versus a peak of $896 earlier in February. US 10y yields hit 1.49% last week up over 50bp in the last month Financial bubbles don’t pop because speculators suddenly start […]

Let’s start with a wealth warning: This article covers bitcoin miner Argo Blockchain; I am not a bitcoin expert; The bitcoin price is highly unpredictable; Argo’s share price is highly unpredictable, and; Argo issues frequent updates. The upshot is my logic and calculations may be completely wrong or out-of-date by the time you read what […]

At midnight, on 1st January this year, the K.L.F. released their back catalogue of music (hits such as 3AM Eternal, Justified and Ancient, Last Train to Trancentral) on Spotify and uploaded their old videos to YouTube. This was their first activity as a band since 1992, when they announced they were leaving the music industry […]

After a dip caused by the COVID-19 pandemic in March of 2020, the US stock market rallied back and closed out the year at an all-time high. This has continued throughout the start of 2021, with the Dow Jones Industrial Average now at over 31,000 points. But despite the vaccine rollout, unemployment and economic disruption […]

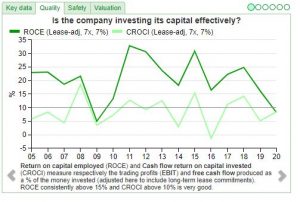

If you look DotDigital, as I did a few years ago, you will find much to like about the business: Source: SharePad financial summary It is highly profitable in terms of Return on Capital Employed and profit margin. The exciting thing about a company like this is, as long as it can reinvest the cash […]

Last week Bloomberg reported that junk bond yields in the US fell below 4% the lowest level ever recorded and down from 11.5% peak yield in March last year. This is the opposite direction to the yield on the “risk free rate” of US 10y bond (hitting 1.18% last week) which has been steadily rising […]

For some time now IG Group has been flashing on my SharePad filters. The three screenshots just below show IG offers: High margins; Decent returns on equity; Cash-rich accounts; Attractive five-year growth; A lack of past acquisitions, and; A modest P/E. Those characteristics are an unusual mix in a market presently bereft of obvious quality […]

Private equity fund in transition – new addition to Dynamic 35 Listed private equity funds have had a chequered record on the London Stock Exchange. On paper they are a great innovation, allowing private investors access to usually institutional grade alternative assets. Crucially they allow investors to put money to work in profitable, scaled up […]

Back in the middle of August I outlined two growth-oriented portfolios, comprising a gaggle of exchange traded funds. The first was a Global Trends portfolio, a collection of eight ETFs which aim to track a selection of key thematic big trends. To monitor performance, I established two live portfolios on the SharePad platform, with the […]

Moonpig IPO’ed last week at 350p, valuing the company at £1.2bn, and the shares rose +24% to 430p the following day. Meanwhile the FT reported that Elon Musk is expecting SpaceX to be valued at $60bn in a funding round later this month. Virgin Galactic is up +163% in the last 3 months. Valuations are […]

Bunzl, a company I investigated last year, is a classic roll up A distributor of everyday items consumed by businesses and organisations, it routinely acquires much smaller distributors, improves their efficiency and creates economies of scale. This reduces customer’s procurement costs, and improves the profitability of the mothership. To grow, the company has repeated this […]

My last article detailed my new filter. If you missed it then you can read about it here. As discussed, this filter looks for stocks that are uptrending and are off their recent highs. It provides trading ideas that we can then dig further into. Here are some recent results. Calnex Solutions (CLX) Calnex is […]

Some of the speculative exuberance has spilled over the punch bowl at the cryptocurrency party into a number of glass half empty equities. GameStonk, err I mean GameStop, rose from below $20 a share earlier this month to over $500 per share, as retail traders from the Reddit thread “Wall Street Bets” piled in to […]

In this article I will continue focusing on primary and secondary trends but this time I will use moving averages to define market phases. You can also view Part 1 of this article Lessons from the Trend (Part 1): Breakouts for more primary trend details that relate to what we are talking about here. For […]

Welcome to a series of occasional articles in which I shine an investigative spotlight on particular small-caps. My aim is to demonstrate how to analyse companies in SharePad and beyond to help you become a more informed investor. I start today with LoopUp (LOOP), a £44 million developer of software for remote meetings and conference […]

I was initially unimpressed by the UK’s mass vaccination rollout. However it is important to keep updating your beliefs when data is better than you had been expecting and not miss the inflection point. From below 150K per week in December, we now have almost 5m vaccinated. My mistake was to extrapolate in a linear […]

Another captivating headline – this time from Forbes. So what are the facts, and why is it increasingly a stock pickers market, where if a rising tide doesn’t raise all boats, but instead the tide goes out, then we don’t want to be left standing without clothes on. The stock market has been on a […]

Barr makes Irn Bru, which I drank once, getting on for forty years ago in Scotland. Irn Bru is to Barr what Coke is to Coca-Cola and Vimto is to Nichols, the drink upon which the business was built. Being a southern softy I may not have been a regular drinker of Irn Bru, but […]

In the early days of a new Democrat presidency, the President’s campaign manager observed that: “I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a 0.400 baseball hitter. But now I want to come back as the bond market. You can intimidate anybody.” The […]

I released a new filter several weeks ago. This was a new filter I was testing and mentioned this in my Investors Chronicle column. I’ve released it onto the library due to popular demand and in this article I’ll explain how to get the best out of this filter. First of all, you can find […]

“While we have this euphoria it’s pretty hard to imagine the bubble breaking. But look at the data and you think this thing could go…” (Grantham, GMO, Dec 2020). “In every portfolio, you need to ask yourself what is going to be more relevant [in] five to 10 years versus today. The most interesting trend […]

Happy 2021! I trust SharePad will help bring you good fortune in what could be another twelve months of financial thrills and spills. As usual I plan to trawl the market for interesting shares that I hope assists your company analysis and stock-picking. I start the year with Avon Rubber, a FTSE 250 member that […]

The FTSE 100 started the year strongly +6% during the week to 6857. Both the S&P 500 +1.3% to 3804 Nasdaq +1.4% to 13068 were more subdued, though largely unaffected by events in Washington. 10 years ago when I was in Tbilisi, I remember a US dignitary explaining to the Georgians that the point of […]

Happy New year. This year, I have resolved to keep things simple, which is not easy in investing. Aide memoire… Just before Christmas Chris, a SharePad customer, emailed me with a request: When I look at company reports which often run to a couple of hundred pages I find the position somewhat daunting… It would […]

“Until the day when God shall deign to reveal the future to man, all human wisdom is summed up in these two words… wait and hope.” – The Count of Monte Cristo The FTSE 100 finished the year at 6460, down 14% from 7585 this time last year. There were some odd movements in share […]

The FTSE 100 closed around 6,487 to 24 December down -15% from the start of the year. From a peak of 7670 in mid-January the index fell by -35% to a low of 4998 at the end of March before recovering +30%. A reminder of the importance of pound cost averaging, because a -30% drop, […]

This year has confirmed that most of the news is at best irrelevant to me as an investor. Worse, the news stressed me out. It regularly fed my mind with impossible problems to solve. Companies I admired closed down, temporarily I hoped. They raised money in emergency fund-raisings. They furloughed staff. So far, the determination […]

The FTSE stayed level around 6580, while Nasdaq hit a new high of 12752. Bitcoin rose through $20,000 for the first time. I have a dim memory of a party in South London, around 2006-2007, when someone began trying to convince me that everyone could create their own electronic currency. After all, he said, money […]

All the best trends in the market need to start somewhere. I’m going to show you how to define a trend using two methods and offer some thoughts and reasoning on position management. For my next two articles I will focus on primary trends. If you are unsure what I mean by primary trends please […]

After a strong November and start of December the FTSE 100 was largely unchanged this week at 6566. More broadly, the signs of a cyclical recovery are evident: oil price rose through $50 a barrel and copper and other industrial commodities have also been strong. Airbnb IPO’ed with the shares closing on their first day […]

Having prospected for investments in the soft drinks industry, I think Nichols is perhaps the most intriguing of quite an interesting group. It has been enormously profitable and a steady grower, unlike the other candidate, Fever-Tree, which has experienced both extraordinary profit and extraordinary growth. Fever-Tree makes me nervous. Explosive growers rarely keep growing rapidly […]

The best performing FTSE 100 stock last week was Rolls Royce, up 19%. The worst was Unilever down 6.5%, which suggests expectations of a vaccine are inoculating investors against risk. On Nasdaq, the vaccine stock Moderna, was the best performing up 44% in the last 5 days, while Zoom was the second worst performing down […]

“Goldman Sachs says these stocks are set to rally in 2021” It’s a captivating headline, isn’t it? Don’t worry; I’ll tell you which stocks in a moment and whether I agree with Goldman’s. And between Goldman’s history and my own, you might want to bet on me. The US market’s Dow Jones Industrial Average just […]

Traditionally most investors tend to regard the division between developed markets (DM) and emerging markets (EM) as a simple divide. We all put more money in the DM but then try and make sure we have some, smaller exposure, to the broad gaggle of national markets which represents the developing world or EM for short. […]

FTSE weakened slightly to 6300 in the second half of last week, but the bounce of former “Covid losers” continued with Rolls Royce, Glencore, Shell and BP all up 8% in the last 5 days. Nasdaq continued to rise to 12152 and Tesla’s value exceeded half a trillion dollars. airbnb IPO Last week airbnb filed […]

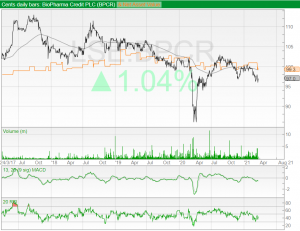

The pharmaceuticals sector is another popular sector with private investors and retail traders. This is because the volatility is high and traders are often attracted to the blue-sky lottery ticket type stocks. The road for a junior pharmaceutical company is long and hard. First of all, drugs need to go through three phases of testing […]

I know this is going to make me sound like an alcoholic, but I rarely drink soft drinks. When a reader requested an overview of the soft drinks sector, I was not, therefore, particularly enthusiastic. For me, liking the product, or at least seeing its value, is a prerequisite for investment, and, on health grounds, […]

We are beginning to see companies operating in the “real” economy announce raised guidance. Somero (exceeding previous revenue guidance by +7%), but also Headlam (materially ahead), Acesso (comfortably ahead). Saga share price was also up +57% during the week. The FTSE 100 is currently 6378, which is the same level as early March this year. […]

I am always looking for ‘multi-baggers’ — investments that can double, triple, quadruple or more. And here’s some very good news: I have stumbled on a company that can find them for me. Not just the occasional five-bagger or ten-bagger mind, but 20-baggers. It’s incredible stuff, especially as the track record of success extends for […]

Like humans, such perfection doesn’t exist in stocks. Like humans, fish in a big enough pond, and for a while, some get as close as possible. Are they the brands people love the most? Some research by MBLM suggests so. See these images: Wow, great performing companies, and they outgrow their peers. Plus, they are […]

Banks and other “covid losers” were up strongly at the start of last week as Pfizer announced they believe they have a credible vaccine. US Treasuries 10 year yield jumped up to 0.98% (the red dot on the chart below) from the 0.79% last week. This is a significant move, the yield curve seems to […]

The commodities sector is popular with private investors and retail traders. Life changing gains (and life changing losses) can be made on this sector. Back the right minor and you can see stocks appreciate in value several-fold, although the vast majority never amount to anything other than value destruction through endless placings. In this article […]

This week I have a very adventurous addition to my list of 35 Dynamic funds. I admit that it’s not without risk and its recent track record hasn’t been fab if I’m honest but I think the seeds for a rapid turnaround are being laid and if nothing else a future redemption opportunity might provide […]

When I told my wife I was researching Hotel Chocolat and my first action would be to buy some chocolate, she reminded me that the most important thing about research is to include lots of participants. Scuttlebutting chocolate 70% dark chocolate promised to be our optimal pleasure point, and so it was. When I brought […]

The US Presidential election turned out to be closer than most people expected. Nasdaq up almost +10% over the week to 12078. Tech stocks reacted well to the uncertainty, but so did 10 year US Bond yields, which initially jumped to 0.9% before falling back to 0.78%. I’m not sure if you’d predicted the result, […]

There is no shortage of stocks that are delivering triple digit returns. Scholar Rock, Miragen, Zedge, Socket Mobile – even Tupperware is up nearly 1,000%. Source: ShareScope – Alpesh Patel Special Edition (click on image to enlarge) The problem is hindsight is great, but each of these and the other climbers have huge problems in […]

Today I have returned to one of my favourite SharePad screens. This screen applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE). The main filter criteria are: 1) An operating margin (latest and 10-year average) of 20% or more, and; 2) An ROE (latest and 10-year average) of 20% […]

Last week markets sold off into the rising cases of Covid. The FTSE 100 fell 5% last week to 5561. Large UK banks HSBC and NatWest reported encouraging results, although the sector remained unloved. Directors selling Given the strength of the market’s rally over the last 6 months, and then last week’s sell off, I […]

James Halstead makes vinyl flooring, the kind we see in hospital corridors, GP surgeries, clinics, schools, offices, laboratories, prisons, factories, shops, trains and boats around the world. James Halstead’s biggest brand is Polyflor. The company’s social media accounts are a good way to get a feel for the product and you can take the Commercial […]

Markets recovered slightly towards the end of the week, with the FTSE 100 at 5888. Nasdaq was at 11662. Last week Netflix reported Q3 results, with “only” 2m net new subscribers in the quarter, v 16m in Q1 and 10m in Q2. The company had previously guided that subscribers would slow in Q3 to 2.5m […]

A new addition to the Dynamic 35 Aurora Investment trust I wanted to start this article with an immediate declaration. I am a non-executive director at my new addition to the Dynamic 35, the Aurora investment trust. As a general rule I tend not to discuss any fund where I have some form of professional […]

The automobile sector is not one I usually deal in. However, by using the RNS service each morning and sifting through company reports, it’s easy to keep on top of various sectors and how they’re performing. Customer spending has seen a large boom as people are restricted from going on holiday and eating out (aside […]

“Fad companies are companies with good business models or good products. So, why would we be interested in shorting a company that has a good product? Because of the threat it presents to others and their likely response to that threat. For example, Netflix had a terrific idea of renting DVDs through the mail, which […]

In this article I’m going to cover some big picture charting and try my best to bring across to the reader three different time frames of managing money or lanes of investing that every investor can connect with in one form or another. In addition, I also want to offer some reasoning as to why […]

Before I started fishing for a share to investigate for this week’s article, I culled my personal filter library. Many of the filters are derivations, refinements that effectively render older filters redundant. Some are failed experiments. Being a simple sole, I cut the library down to four: The old ones are the good ones – […]

Last week the FTSE recovered to just over 6000. The (perhaps inappropriately named) Bond film No Time to Die, was postponed until next year by its Hollywood studio, MGM, which has left cinemas in trouble. Cineworld is on the brink, a victim of an overly leveraged balance sheet but no product to distribute. Up until […]

The hospitality sector has been smashed in recent months. This is for several reasons. Lower footfall in high streets, offices closed and the work from home trend, and finally because many were already being hit in the casual dining crisis that is far from over. In the aftermaths of the Great Financial Crisis restaurants boomed. […]

Last week Andy Haldane at the Bank of England gave an interesting speech on “Economic Anxiety” noting that pessimism can be as contagious as the disease. Haldane is most famous for his “Dog and the Frisbee” speech, which he co-wrote with the famous psychologist Gerd Gigarenzer in 2012. Catching a frisbee is difficult; theoretically it […]

This article was not supposed to be about paper maker James Cropper. I set out to write about Animalcare, a veterinary pharmaceutical company, but I quickly became disillusioned, wretched even. You probably will hear about Animalcare one day, because it is an interesting business, but it is also complicated and its complicatedness was epitomised by […]

I have a new addition to my Dynamic 35 list of investment trusts and closed end funds. It is called RTW Venture and it is a venture capital fund which invests in life sciences businesses – mainly in the biotech and MedTech space. Its key differentiator is that it invests in later stage private businesses […]

Markets sold off last week as virus case rises rose (FTSE 100 fell to below 5800 before recovering slightly later in the week, Nasdaq down 4% to 10,800). The virus itself seems reasonably predictable, everyone has been expecting cases to rise as summer turns to autumn. What hasn’t been predictable is Government responses around the […]

One of the effects on Coronavirus has been to crash the entire stock market only to see it recover strongly. However, the impact of Coronavirus for the private investor and retail trader has been huge. Social media has contributed to market inefficiency It is a widely held view that the internet has created a more […]

The FTSE 100 just about held its level above 6000 last week. Last week was Chilean Independence Day. It is a little known footnote in history that Lord Cochrane, who was involved in the great Stock Exchange scam of 1814 (accused of starting rumours of Napoleon’s death via the Admiralty’s semaphore telegraph) helped not one, […]

If you watch Design Group’s annual results presentation, you may detect a bashful smile on chief executive Paul Fineman’s face. Paul Fineman, chief executive of Design Group. Source: Design Group Full Year Results 2020 (video). Despite unexpected tariffs on products imported into the USA from China and the onset of the pandemic, Design Group was […]

The oil price fell to a 3 month low in the middle of last week to below $40 a barrel. Oil is in contango (futures price higher than spot price) which suggests that despite production cuts, traders are still worried about demand over the next few months. Ironically Tesla shares were off even more sharply […]

Spread betting is another way of buying and selling shares. Instead of buying the actual stock when we purchase through our broker, in spread betting we are literally placing a bet on the stock that it will either rise or fall as defined by the spread. The spread is the price to buy and the […]

First, a wealth warning. The last price-to-book ‘bargain’ I looked at for SharePad was Hammerson. Back then the property group’s £5 billion asset base could be acquired for a £1.6 billion market cap. Investors were in theory able to purchase £1 of assets for just 30p. Twelve months on, and the share price below tells […]

St Leger Day, as in ““Sell in May and go away, don’t come back till St Leger Day”, is approaching. I’ve always wondered who St Leger was, and why a saint might have had a horse race named in his honour. Was Saint Leger the patron saint of book making? Well no, it turns out […]