The oil price fell to a 3 month low in the middle of last week to below $40 a barrel. Oil is in contango (futures price higher than spot price) which suggests that despite production cuts, traders are still worried about demand over the next few months.

Ironically Tesla shares were off even more sharply down 26% from the start of this month, although this was probably more to do with some investors buying in August, trying to “front run” possible inclusion in the S&P 500. Index trackers and closet index trackers would have been “forced buyers”. Tesla’s sharp sell off was attributed by many to the fact it didn’t manage to get past the S&P inclusion committee.

As the shift to index trackers takes place, these funds will have more and more say about capital allocation. Trackers are a cost effective way to track the performance of all the companies listed on an exchange. But there is an inherent conflict of interest between stock exchange gate keepers (lawyers, accountants, corporate financiers, even the stock exchanges themselves) who receive fees for listing companies, and investors who want to avoid investing in lower quality or overpriced companies. We saw what happened with WeWork, when potential buyers refused to accept the price that the seller (SoftBank) wanted – yet it was the investors who policed this, not the gate keepers, who are rewarded by companies wanting to raise money.

Last week 2 USA incorporated AIM listed stocks reported H1 results, with the share prices up sharply on the day. Investors should be particularly sceptical of foreign incorporated companies on AIM, because there is a risk that the companies have sought out the stock exchange with the weakest governance or most pliable gate keepers. “Adverse selection” is a concept borrowed from insurance, where one party (normally the buyer of insurance, or the seller of risk) knows more than the other party.

These companies share prices fell 75% and 95% within a year or two of listing on AIM. But ten years on, that is now in the past. I take a detailed look at Spectra Systems (bank note authentication) and Somero (concrete screed) below.

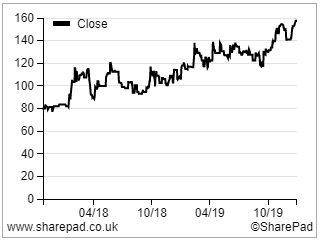

Spectra H1 Results to June

Price 161p

Mkt Cap £72m

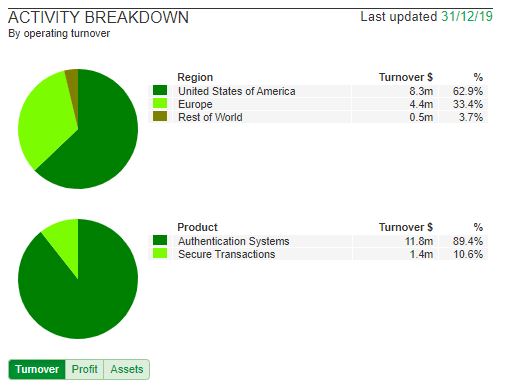

Unlike De La Rue, which prints bank notes, Spectra’s machines authenticate bank notes, and other high value documents. The company’s customers are 20 Central Banks, including 2 G7. These would be hard institutions to sell to, but once a relationship had been established sales are likely to be recurring. There is significant customer concentration, just 2 customers represent around half of sales. Given that the US represents 63% of revenue, presumably the Federal Reserve is the largest customer.

Source: SharePad

History

Spectra was founded in 1996 by its current President and CEO Nabil M. Lawandy. Dr. Lawandy began his career at NASA (he really was a rocket scientist!) specialising in lasers. From 1981 to 1999, Dr. Lawandy was a tenured full professor of Engineering and Physics at Brown University where his work focused on instabilities in single and multimode lasers and a wide spectrum of non-linear optics and atom-field interaction problems. He currently owns 2.2m shares and is paid $594K in total compensation. He also owns 2.5m options to purchase the shares with a strike price at 50p.

Spectra raised $20m in 2011 on AIM. Issuing 18.6m shares at 75p, which was 41% of the enlarged share capital. As part of the company’s admission on to AIM all classes of preferred stock converted into common stock. This meant there were 26.6m shares outstanding at the time of the placing 9 years ago, compared to 48.6m diluted shares outstanding as of Jun 2020. So investors in the placing have suffered significant dilution. Not only that, but within a year the shares had fallen by 73% to below 20p after the company reported ballooning losses (despite claiming that revenue was ahead of their expectations).

The US has the largest capital markets in the world, so a US company shouldn’t need to come to London to find investors. In which case you might wonder if there was some adverse selection going on, and the company wasn’t able to list in the USA for any reason.

In the Admission Document, management say that the reason for coming to AIM was to increase its corporate standing and profile, particularly in the UK. The proceeds were to be spent on i) bringing manufacturing in house, ii) improving their bank note fitness technology iii) marketing of security features to Central Banks of India and China. In total these amounted to £2.7m, versus £12.8m of proceeds raised.

6 months after admission, the company was told by one of its shareholders that they believed they were owed $2.1m for back payments on a licensing agreement signed in 1999. This licensing agreement was mentioned in the Admission Document, but there was no mention of a potential dispute over back payments. The company went into negotiations, and eventually settled in 2014, resulting in a loss in 2013 as a contingent liability of $1.8m was taken through the p&l and recorded on the balance sheet. Perhaps the losses so soon after listing and the dispute with a shareholder were all simply a bit of bad luck?

The company also acquired Inksure for $1.4m, which it said increased its prospects in banknote and product authentication. The Board believed that they had excellent prospects and would perform strongly in 2014. This was factually correct, but somewhat misleading.

Revenue was up sharply to $17m in 2014, but then in the years afterwards had fallen back to $11m in 2016, the same level as in 2013. The company blamed the falling revenue on an exceptionally positive year in 2014, which they did warn that this would not be repeated in the 2014 outlook statement.

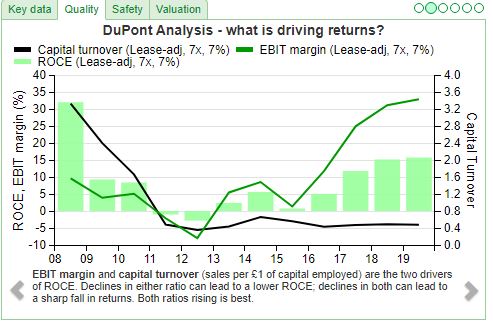

Despite the fall in revenue in 2016 EBITDA was up, driven by the decision to bring manufacturing in house. The SharePad chart below tells a similar story, over the last decade Spectris has changed from a high capital turnover business, to a high EBIT margin business RoCE recovering to over 10%.

Source: SharePad

Results 30 June 2020

Revenue was up 2% to $6.5m and profits were down 1%. Management didn’t put the profit fall in their highlights, instead choosing to highlight Adjusted EBITDA before stock compensation expense which was also down less than 1% to $2.4m. I don’t really like companies that have this communications approach of emphasising Adjusted EBITDA instead of profits.

Cash was $10.9m also down on the previous year, in part because of $40K donated to charities during Covid.

Despite the rather flat results the shares were up 16% on the day of results. This was probably due to comments in the outlook statement which flagged “discussions with central banks during H1 have reinforced our belief that worldwide demand for banknotes will be significantly higher this year than last year and that this will positively impact our earnings in H2 of this year.” This is clearly a positive, particularly as there has been some concern that Covid was accelerating the trend away from cash to card and phone payments. The guidance for the FY was that they are “on track to achieve record earnings for the full year and expects both revenue and earnings to significantly exceed market expectation for the full year.”

The company also highlighted a new technology (machine readable covert polymer substrate) that could increase authentication revenues by “an order of magnitude” ($11.8m in the previous full year) and hopes to market this at a Banknote Conference in July 2021.

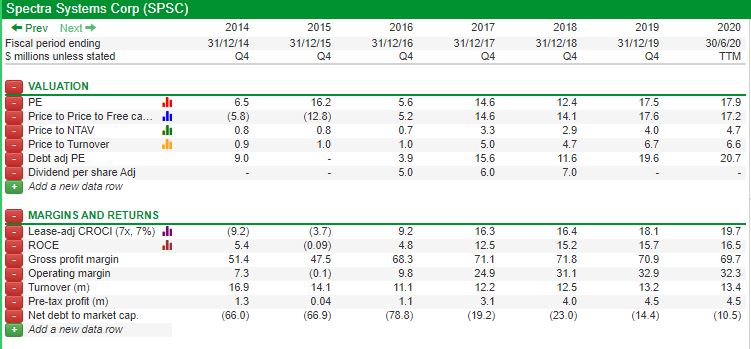

Valuation

Spectra is trading on a PER of 18x, a price to net tangible book of 4.7x and price to sales of 6.6x. There was a special dividend declared last year (paid in June this year) of $c9, but management anticipate a dividend more like the FY 18, which was $c7. That comes out at a dividend yield of 3.8%.

Source: SharePad

Verdict

This looks like it could be very exciting. The gross profit margin has been over 70% and lease adj CROCI was 18.1% in the FY 2019. Once the technology has been developed, and the relationships with Central Banks established, this should be a highly cash generative business. Herald Investment Management, who specialise in technology investing own 6.4% of the company.

There is some risk that the patents expire, or the company is affected by the long term shift to cashless payments. Also De La Rue’s share price history (from £10 in 2013 to less than 30p June this year) shows that having authentication technology and relationships with Central Banks is not always a licence to print money. Hopefully you can tell from my comments, I’m not entirely comfortable with the CEO’s track record of communications with shareholders.

Finally, be aware that the ticker is SPSY. There is a small illiquid rump, of a SPSC shares also listed in London and easy to confuse with the ordinary shares.

Somero H1 Results to June

Price 257p

Mkt Cap £145m

Somero, another US company listed on AIM also reported H1 to June this week. The business was founded by members of the Somero family in 1986, the year in which it introduced the first model of the Laser Screed, for making sure that concrete floors are flat. Although concrete might not sound particularly exciting technology, their machines and processes are protected by 73 patents and patent applications. The company does operate in China, and has said that their machines are relatively easy to reverse engineer. But their competitive advantage comes from training and customer support. The company trains customers to use and maintain their machines at Fort Myers in Florida, but also offers 24/7 customer support around the globe. Concrete is horribly complicated, and if you get it wrong is very expensive to correct, mistakes are literally set in stone. And concrete dries within an hour, construction companies really value the company’s support.

Source: Company Annual Report

Similar to Segro (former Slough Estates), which has been a long term winner from e-commerce because it specialises in warehouses and fulfilment centres, Somero has also benefited from this trend. Somero’s core laser screed machine product categories are in demand, because if you are going to have large stacks of product in your fulfilment centre, you need a flat concrete floor.

The company was listed on AIM in 2006 by California based private equity backers (Gore). The shares fell from 125p (the placing price when they started trading on AIM in November 2006) to below 10p a share in November 2008. Yet another example of a private equity backed company listing, that then reports disappointing results shortly afterwards. Revenue fell 64% from $66m FY Dec 2007 to $24m FY Dec 2009. To be clear, management cannot be blamed for their former backers cashing out at the top of the cycle. This was during the financial crisis, when activity levels in construction hit a wall.

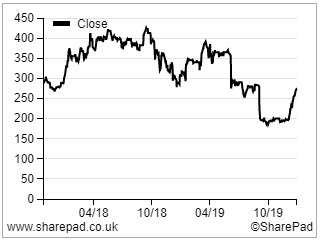

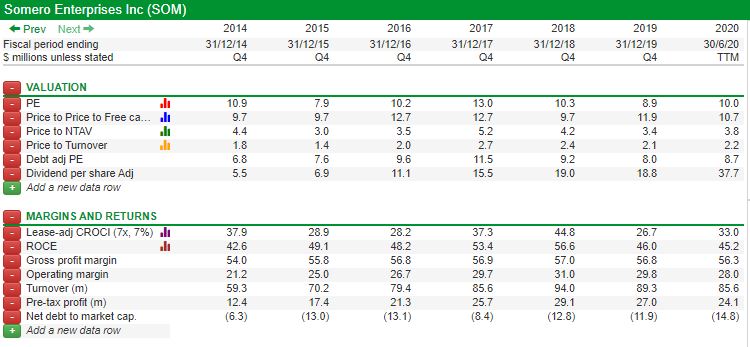

Somero is undoubtedly cyclical. However revenues recovered strongly following the financial crisis, to peak at $94m in 2018, with RoCE peaking in the same year at 57%. A good rule of thumb is that it is normally better to buy cyclical stocks when they appear expensive, because profitability is depressed, but conditions will improve, than when they appear cheap, because their financials are unsustainably positive.

I think that there are good reasons to believe that Somero will not be as badly hit in this downturn as the financial crisis. For a start the company has just reaffirmed FY guidance of $75m of revenue, implying a 20% decline on 2 years ago. The difference also is that now the balance sheet is in much better shape, the company was loaded with debt going into the financial crisis (net debt/market cap peaked at 167%) whereas the company has $27m of net cash (Jun 2020).

Currently 79% of sales are in the US, although the company has a foothold on all continents. The bull story is that the company can export its machines to countries where the technology is just beginning to be accepted.

Aside from management guidance, Somero should benefit from the same trends that have lifted tech stocks like Amazon through the lockdowns (+72% since the start of the year) investors should feel confident that these trend are accelerating, not reversing.

The company has a number of institutional shareholders on its register, including Polar Capital 7%, Jupiter 5.5%, Janus Henderson 4.2%, Aberdeen 2.7% and BlackRock 2.6%. Management also do a good job of courting retail investors, there is a results webinar on https://www.piworld.co.uk/ this afternoon (Monday 14th Sept).

Results

Despite reporting H1 2020 revenues down 9% to $35.3m, and PBT down 29% to $7.5m, the share price was up 24% on the day of results last week. This is probably due to the company reaffirming previous FY guidance of $75m revenue, adjusted EBITDA of $19m and net cash of approximately $20m. Plus resuming dividends sends a strong signal (FY 19 dividend was deferred, and interim combined is $0.25 a share), and a small buyback.

Valuation

The company’s broker (FinnCap) is forecasting EPS of $c24 FY 2020, which at 257p puts the company on a PER of 13.9x. For reference, peak earnings in 2018 were $c38. The 2020 forecast dividend is $c17, which puts the company on an attractive dividend yield of 5.1% (even after the 24% positive reaction to results). This feels significantly undervalued for a company that reported RoCE of above 50% in 2017 and 2018 (see SharePad table below).

Source: SharePad

Verdict

Somero’s volatile share price history shows that the company is cyclical. However the company was much better prepared for this downturn versus the financial crisis, with a strong balance sheet and more resilient revenue. I am positive and have held the shares since 2015.

One slight concern is that the Non Exec Chairman Lawrence Horsch is 85 years old, and the President and Chief Executive Jack Cooney is 73 years old. I haven’t seen any public statements on succession planning, but it can’t have escape the notice of the non Executive directors that they would need good succession planning in place.

Bruce Packard

The author owns shares in Somero

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 14/09/20 – Americans on AIM

The oil price fell to a 3 month low in the middle of last week to below $40 a barrel. Oil is in contango (futures price higher than spot price) which suggests that despite production cuts, traders are still worried about demand over the next few months.

Ironically Tesla shares were off even more sharply down 26% from the start of this month, although this was probably more to do with some investors buying in August, trying to “front run” possible inclusion in the S&P 500. Index trackers and closet index trackers would have been “forced buyers”. Tesla’s sharp sell off was attributed by many to the fact it didn’t manage to get past the S&P inclusion committee.

As the shift to index trackers takes place, these funds will have more and more say about capital allocation. Trackers are a cost effective way to track the performance of all the companies listed on an exchange. But there is an inherent conflict of interest between stock exchange gate keepers (lawyers, accountants, corporate financiers, even the stock exchanges themselves) who receive fees for listing companies, and investors who want to avoid investing in lower quality or overpriced companies. We saw what happened with WeWork, when potential buyers refused to accept the price that the seller (SoftBank) wanted – yet it was the investors who policed this, not the gate keepers, who are rewarded by companies wanting to raise money.

Last week 2 USA incorporated AIM listed stocks reported H1 results, with the share prices up sharply on the day. Investors should be particularly sceptical of foreign incorporated companies on AIM, because there is a risk that the companies have sought out the stock exchange with the weakest governance or most pliable gate keepers. “Adverse selection” is a concept borrowed from insurance, where one party (normally the buyer of insurance, or the seller of risk) knows more than the other party.

These companies share prices fell 75% and 95% within a year or two of listing on AIM. But ten years on, that is now in the past. I take a detailed look at Spectra Systems (bank note authentication) and Somero (concrete screed) below.

Spectra H1 Results to June

Price 161p

Mkt Cap £72m

Unlike De La Rue, which prints bank notes, Spectra’s machines authenticate bank notes, and other high value documents. The company’s customers are 20 Central Banks, including 2 G7. These would be hard institutions to sell to, but once a relationship had been established sales are likely to be recurring. There is significant customer concentration, just 2 customers represent around half of sales. Given that the US represents 63% of revenue, presumably the Federal Reserve is the largest customer.

Source: SharePad

History

Spectra was founded in 1996 by its current President and CEO Nabil M. Lawandy. Dr. Lawandy began his career at NASA (he really was a rocket scientist!) specialising in lasers. From 1981 to 1999, Dr. Lawandy was a tenured full professor of Engineering and Physics at Brown University where his work focused on instabilities in single and multimode lasers and a wide spectrum of non-linear optics and atom-field interaction problems. He currently owns 2.2m shares and is paid $594K in total compensation. He also owns 2.5m options to purchase the shares with a strike price at 50p.

Spectra raised $20m in 2011 on AIM. Issuing 18.6m shares at 75p, which was 41% of the enlarged share capital. As part of the company’s admission on to AIM all classes of preferred stock converted into common stock. This meant there were 26.6m shares outstanding at the time of the placing 9 years ago, compared to 48.6m diluted shares outstanding as of Jun 2020. So investors in the placing have suffered significant dilution. Not only that, but within a year the shares had fallen by 73% to below 20p after the company reported ballooning losses (despite claiming that revenue was ahead of their expectations).

The US has the largest capital markets in the world, so a US company shouldn’t need to come to London to find investors. In which case you might wonder if there was some adverse selection going on, and the company wasn’t able to list in the USA for any reason.

In the Admission Document, management say that the reason for coming to AIM was to increase its corporate standing and profile, particularly in the UK. The proceeds were to be spent on i) bringing manufacturing in house, ii) improving their bank note fitness technology iii) marketing of security features to Central Banks of India and China. In total these amounted to £2.7m, versus £12.8m of proceeds raised.

6 months after admission, the company was told by one of its shareholders that they believed they were owed $2.1m for back payments on a licensing agreement signed in 1999. This licensing agreement was mentioned in the Admission Document, but there was no mention of a potential dispute over back payments. The company went into negotiations, and eventually settled in 2014, resulting in a loss in 2013 as a contingent liability of $1.8m was taken through the p&l and recorded on the balance sheet. Perhaps the losses so soon after listing and the dispute with a shareholder were all simply a bit of bad luck?

The company also acquired Inksure for $1.4m, which it said increased its prospects in banknote and product authentication. The Board believed that they had excellent prospects and would perform strongly in 2014. This was factually correct, but somewhat misleading.

Revenue was up sharply to $17m in 2014, but then in the years afterwards had fallen back to $11m in 2016, the same level as in 2013. The company blamed the falling revenue on an exceptionally positive year in 2014, which they did warn that this would not be repeated in the 2014 outlook statement.

Despite the fall in revenue in 2016 EBITDA was up, driven by the decision to bring manufacturing in house. The SharePad chart below tells a similar story, over the last decade Spectris has changed from a high capital turnover business, to a high EBIT margin business RoCE recovering to over 10%.

Source: SharePad

Results 30 June 2020

Revenue was up 2% to $6.5m and profits were down 1%. Management didn’t put the profit fall in their highlights, instead choosing to highlight Adjusted EBITDA before stock compensation expense which was also down less than 1% to $2.4m. I don’t really like companies that have this communications approach of emphasising Adjusted EBITDA instead of profits.

Cash was $10.9m also down on the previous year, in part because of $40K donated to charities during Covid.

Despite the rather flat results the shares were up 16% on the day of results. This was probably due to comments in the outlook statement which flagged “discussions with central banks during H1 have reinforced our belief that worldwide demand for banknotes will be significantly higher this year than last year and that this will positively impact our earnings in H2 of this year.” This is clearly a positive, particularly as there has been some concern that Covid was accelerating the trend away from cash to card and phone payments. The guidance for the FY was that they are “on track to achieve record earnings for the full year and expects both revenue and earnings to significantly exceed market expectation for the full year.”

The company also highlighted a new technology (machine readable covert polymer substrate) that could increase authentication revenues by “an order of magnitude” ($11.8m in the previous full year) and hopes to market this at a Banknote Conference in July 2021.

Valuation

Spectra is trading on a PER of 18x, a price to net tangible book of 4.7x and price to sales of 6.6x. There was a special dividend declared last year (paid in June this year) of $c9, but management anticipate a dividend more like the FY 18, which was $c7. That comes out at a dividend yield of 3.8%.

Source: SharePad

Verdict

This looks like it could be very exciting. The gross profit margin has been over 70% and lease adj CROCI was 18.1% in the FY 2019. Once the technology has been developed, and the relationships with Central Banks established, this should be a highly cash generative business. Herald Investment Management, who specialise in technology investing own 6.4% of the company.

There is some risk that the patents expire, or the company is affected by the long term shift to cashless payments. Also De La Rue’s share price history (from £10 in 2013 to less than 30p June this year) shows that having authentication technology and relationships with Central Banks is not always a licence to print money. Hopefully you can tell from my comments, I’m not entirely comfortable with the CEO’s track record of communications with shareholders.

Finally, be aware that the ticker is SPSY. There is a small illiquid rump, of a SPSC shares also listed in London and easy to confuse with the ordinary shares.

Somero H1 Results to June

Price 257p

Mkt Cap £145m

Somero, another US company listed on AIM also reported H1 to June this week. The business was founded by members of the Somero family in 1986, the year in which it introduced the first model of the Laser Screed, for making sure that concrete floors are flat. Although concrete might not sound particularly exciting technology, their machines and processes are protected by 73 patents and patent applications. The company does operate in China, and has said that their machines are relatively easy to reverse engineer. But their competitive advantage comes from training and customer support. The company trains customers to use and maintain their machines at Fort Myers in Florida, but also offers 24/7 customer support around the globe. Concrete is horribly complicated, and if you get it wrong is very expensive to correct, mistakes are literally set in stone. And concrete dries within an hour, construction companies really value the company’s support.

Source: Company Annual Report

Similar to Segro (former Slough Estates), which has been a long term winner from e-commerce because it specialises in warehouses and fulfilment centres, Somero has also benefited from this trend. Somero’s core laser screed machine product categories are in demand, because if you are going to have large stacks of product in your fulfilment centre, you need a flat concrete floor.

The company was listed on AIM in 2006 by California based private equity backers (Gore). The shares fell from 125p (the placing price when they started trading on AIM in November 2006) to below 10p a share in November 2008. Yet another example of a private equity backed company listing, that then reports disappointing results shortly afterwards. Revenue fell 64% from $66m FY Dec 2007 to $24m FY Dec 2009. To be clear, management cannot be blamed for their former backers cashing out at the top of the cycle. This was during the financial crisis, when activity levels in construction hit a wall.

Somero is undoubtedly cyclical. However revenues recovered strongly following the financial crisis, to peak at $94m in 2018, with RoCE peaking in the same year at 57%. A good rule of thumb is that it is normally better to buy cyclical stocks when they appear expensive, because profitability is depressed, but conditions will improve, than when they appear cheap, because their financials are unsustainably positive.

I think that there are good reasons to believe that Somero will not be as badly hit in this downturn as the financial crisis. For a start the company has just reaffirmed FY guidance of $75m of revenue, implying a 20% decline on 2 years ago. The difference also is that now the balance sheet is in much better shape, the company was loaded with debt going into the financial crisis (net debt/market cap peaked at 167%) whereas the company has $27m of net cash (Jun 2020).

Currently 79% of sales are in the US, although the company has a foothold on all continents. The bull story is that the company can export its machines to countries where the technology is just beginning to be accepted.

Aside from management guidance, Somero should benefit from the same trends that have lifted tech stocks like Amazon through the lockdowns (+72% since the start of the year) investors should feel confident that these trend are accelerating, not reversing.

The company has a number of institutional shareholders on its register, including Polar Capital 7%, Jupiter 5.5%, Janus Henderson 4.2%, Aberdeen 2.7% and BlackRock 2.6%. Management also do a good job of courting retail investors, there is a results webinar on https://www.piworld.co.uk/ this afternoon (Monday 14th Sept).

Results

Despite reporting H1 2020 revenues down 9% to $35.3m, and PBT down 29% to $7.5m, the share price was up 24% on the day of results last week. This is probably due to the company reaffirming previous FY guidance of $75m revenue, adjusted EBITDA of $19m and net cash of approximately $20m. Plus resuming dividends sends a strong signal (FY 19 dividend was deferred, and interim combined is $0.25 a share), and a small buyback.

Valuation

The company’s broker (FinnCap) is forecasting EPS of $c24 FY 2020, which at 257p puts the company on a PER of 13.9x. For reference, peak earnings in 2018 were $c38. The 2020 forecast dividend is $c17, which puts the company on an attractive dividend yield of 5.1% (even after the 24% positive reaction to results). This feels significantly undervalued for a company that reported RoCE of above 50% in 2017 and 2018 (see SharePad table below).

Source: SharePad

Verdict

Somero’s volatile share price history shows that the company is cyclical. However the company was much better prepared for this downturn versus the financial crisis, with a strong balance sheet and more resilient revenue. I am positive and have held the shares since 2015.

One slight concern is that the Non Exec Chairman Lawrence Horsch is 85 years old, and the President and Chief Executive Jack Cooney is 73 years old. I haven’t seen any public statements on succession planning, but it can’t have escape the notice of the non Executive directors that they would need good succession planning in place.

Bruce Packard

The author owns shares in Somero

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.