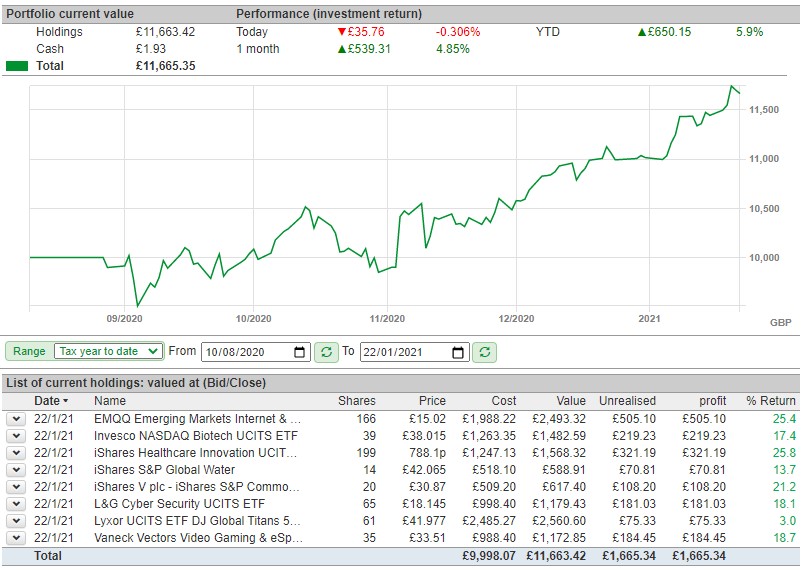

Back in the middle of August I outlined two growth-oriented portfolios, comprising a gaggle of exchange traded funds. The first was a Global Trends portfolio, a collection of eight ETFs which aim to track a selection of key thematic big trends. To monitor performance, I established two live portfolios on the SharePad platform, with the graphic below showing progress to date for the first of these portfolios, Global Trends – with data correct to Friday 22nd January 2021.

Global Trends Portfolio

Over the period this portfolio of eight, easily accessible ETFs has returned 11.6%. By comparison over the same period the US blue chip equity benchmark the S&P 500 has recorded a gain of 9.3%. If I use a more demanding benchmark, namely the return of first-rate global equity funds such as Scottish Mortgage and Witan, the return from my model portfolio is much less impressive.

Scottish Mortgage or SMT, with its idiosyncratic but successful strategy of backing disruptive entrepreneurs is up a staggering 42% over the same period while Witan – much more generalist in its approach – has been on a tear and has chalked up a gain of 23%. On a side note, both Scottish Mortgage and Witan figure prominently in my Dynamic 35 list.

Digging into the portfolio, the star performer has been the iShares Healthcare Innovation ETF with a 12.5% portfolio allocation and a 25.8% return over the period in question. I’m also pleasantly surprised by the returns from the iShares Agribusiness ETF which is up 21% over the same period. I stick by more core contention which is that the food complex – which includes agribusiness – is one of the most compelling investment opportunities over the next decade.

My biggest disappointment has been the returns from the largest allocation – the Lyxor Global Titans index which is up only 3% over the same period. My guess is that its portfolio of high quality, market leading leviathans across a number of sectors has been left in the shade by the explosive growth in tech stock valuations.

Any changes to the allocation? I won’t deny that the returns from the Global Titans ETf of mega large cap quality stocks has been under whelming, but I regard this fund as useful counterweight to the obvious preponderance of tech influenced stocks. Overall, I’m making no changes to the portfolio. Being frank, I would have been much happier if returns from this portfolio were closer to 15%, but it what it is!

Adventurous portfolio

The second Adventurous portfolio comprises of another eight ETFs but is slightly more conventional in that it is not focused on macro global trends but rather on key geographies, which is a rather more conventional approach. The biggest holding is a US S&P 500 blue chip index tracker from X Trackers, but with a twist. It invests in an equal weighted basket of stocks not by market capitalisation. That means it has a skew towards smaller to mid-cap stocks in the S&P 500, which has probably been the right move in the last six months.

Overall returns have been almost identical to the Global Trends portfolio, with a return of 11.6% since mid-August. In terms of benchmarks, again the S&P 500 was up 9.3%, while the Witan fund (a much more comparable reference point) was up 23%.

Digging into the portfolio there are a bunch of standout stars – there’s that iShares Healthcare ETF again but I’d draw attention to two small, specialist ETFs, both issued by HANetf. Their EM Internet tracker – EMQQ – has recorded a 25% return while the multi strategy, multi theme ETF ITEK is up 29%.

The biggest loser is perhaps an obvious one – the VanEck Gold Miners ETF. I expected this to substantially underperform as it is a contrarian idea almost certain to struggle in a very bullish, growth stocks market. But I would add that the large, low-cost gold miners are making huge profits even while gold spot prices are stuck around $1850 an ounce.

Any changes to the allocation? I was tempted to make a big change in this portfolio and cut my exposure to US equities and switch into emerging market equities. Why this switch? I am growing increasingly cautious about returns from the US market. It is expensive and there are numerous examples of irrational exuberance – almost on a weekly basis now. I think avoiding the US makes zero sense, but there are some compelling opportunities elsewhere in the world. My sense is that the dollar might weaken on aggressive reflationary measures and we’ll also see growth pick up speed in both china and the wider emerging markets. The combination of a weaker dollar, a stronger China in Asia, and reflationary policies in key emerging markets is I think the perfect environment for EM equities.

But I have decided not to make this switch this early on in the portfolio’s development – though I was extremely tempted! On balance I think there is some still more mileage in the US markets, especially mid to small caps as optimism about a post corona virus reflationary rebound gathers speed.

By contrast if you think that I’m too cautious and that one should make the switch I’d suggest a useful ETF which is certainly on my watch list. There are a large number of mainstream MSCI Emerging Markets trackers around, many of them very cheap and equally effective. But they have exposure to sectors which I am not terrifically keen on, such as materials (miners and energy stocks) or large but boring national banks and insurance companies in key geographies.

I think if you do make the move into emerging markets you probably need to have a heavy sector bias towards businesses servicing consumers plus tech focused businesses. I also think that an Asian focus makes sense, probably – with some caveats – with China figuring prominently. In that case I would probably opt for an ETf called the Deutsche X Trackers MSCI Emerging Markets ESG UCITS ETF 1C, ticker XESE . This has a TER of 0.25%, and is already up over 20% over the last year already. Crucially you’ll see that it has those totemic letters ESG in its title. That means there’s a screen which focuses on environmental, social and governance issues. I have my own doubts about ESG screens but in practical terms this means you have an ETF that invests across the EM space into businesses with more consumer and tech focus. Rather inadvertently these sectors tend to score rather highly on climate change criteria. For our purposes that focus is useful.

So dig around in the ETF and you’ll find it has a – surprise, surprise – Tech and consumer sector bias, in that 31% of the value of the fund is the Consumer discretionary sector, another 17% in communication services and 9% in IT. By contrast financials are only at around 18% of the portfolio and the combined materials and energy sector at just under 10%. In geographical terms, the tracker fund has 49% exposure to China, 11% to India, and 7% exposure to Taiwan and South Korea. Biggest holdings in the fund include Alibaba (19%), Tencent 14%), Meituan at 4% and Reliance at 2.6%.

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com