Last week Andy Haldane at the Bank of England gave an interesting speech on “Economic Anxiety” noting that pessimism can be as contagious as the disease. Haldane is most famous for his “Dog and the Frisbee” speech, which he co-wrote with the famous psychologist Gerd Gigarenzer in 2012. Catching a frisbee is difficult; theoretically it might require calculus and solving partial differential equations to judge the flight of the Frisbee through the air. Yet a dog manage to catch the moving object in its mouth, not because the dog can do PhD level calculations in its head, but by using a simple heuristic. Heuristics can be remarkably useful when it comes to investing, and work well in times of uncertainty when more complicated models break down because the future does not resemble the past.

In last week’s speech Haldane noted the puzzling degree of pessimism in consumer confidence, despite the complete recovery in consumption by households. The historic correlation between consumer confidence and spending has broken down. He attributes this pessimism to our hunter-gatherer past, where it made sense to worry excessively about existential threats (predators, other tribes, disease). We lack in the confidence future because of the uncertainty that virus has introduced, yet our spending behaviour (as measured by household consumption) has recovered.

Last week 3 stocks I own reported announcements, ULS Technology, AirPartner and Burford. All three are covered by a cloud of uncertainty, and the latter two have reported questionable accounting in the past. I’m not entirely confident in the bull case on any these 3 stocks, nevertheless I prefer to focus on the payoffs if things go well. To me, the rewards from learning to live with the uncertainty look far greater than the risks.

ULS Technology

A curious announcement from ULS Technology, the online conveyancing company last week. The shares had fallen 22% on no news since the start of September. Then, at the start of last week, the company announced that the Chief Executive Steve Goodall was leaving with immediate effect, the Board had found a successor, but weren’t going to tell the market who he was yet. At the same time, the company said current trading is strong, instructions were running significantly ahead of last year, and that margins should be higher (customers buying houses rather than re-mortgaging).

So it sounds like he isn’t being replaced because results have been disappointing. But rather curious all the same. ULS is a platform company, it sits in the middle between solicitors and mortgage brokers, who use the platform to select solicitors, by filtering on price, location and service rating. The mortgage brokers (either a big Group of introducers like Lloyds, or smaller individual brokers) pay ULS for access to the platform. Up until now solicitors have also paid fees to ULS to access the eConveyancer platform, but technology companies can not stand still and the group is rolling out a new product: DigitalMove. The Group has a 3% market share of conveyancing, so is not reliant on housing market transactions if it can grow its share of the market.

History

Founded in 2003 by Andrew Weston (who is still on the Board as IT Director) and Nigel Hoath (who stepped down from the Board as non Executive Director in August 2016). The latter owned just under 10% of the company, but sold down his stake 2 years ago.

In 2011 Lloyds Bank’s private equity arm invested. In the same year, Lloyds Bank Group agreed to deepen its relationship with ULS, through their branches and their in-house mortgage. They signed a 5 year contract with Lloyds, and ULS became provider of conveyancing services to the bank (which has around 30% mortgage market share), with ongoing extension. In the most recent Annual Report the loss of this Lloyds contract is listed as the number 1 key risk, as it is worth just under 30% of gross margin (and presumably a higher percentage of Group revenue). Recently ULS lost 2 significant introducer contracts, one was Moneysupermarket.

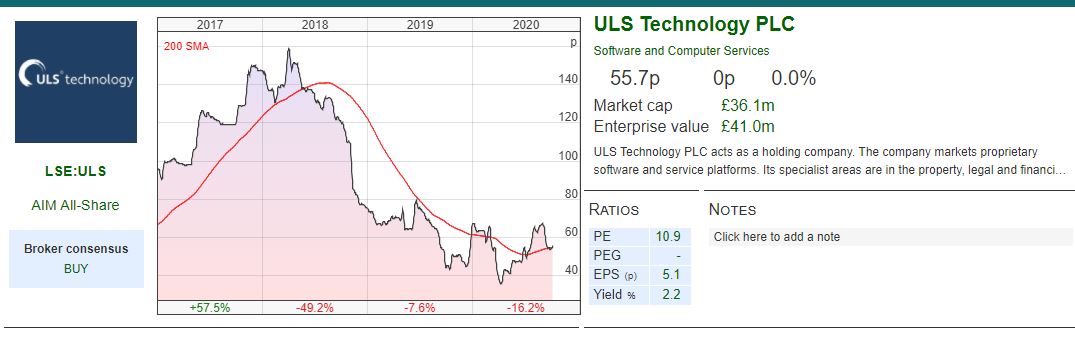

The shares have been trading on AIM since 2014, when it raised £3.7m of new capital through a placing at 40p and valuing the Group at £26m market cap. By April 2018 the share price peaked at over 160p per share, with the Group reporting revenues of £30.7m, and underlying PBT of £5.5m. The share price has fallen right back down to 55p this month though.

Like any platform business, the challenge is to attract both sides of the transaction. If you can get that right, there are huge network effects and increasing returns. Mortgage brokers want to use a platform that has access to lots of solicitors, and solicitors want access to lots of conveyancing flow from brokers. Think ebay, stock exchanges, Uber, Facebook etc.

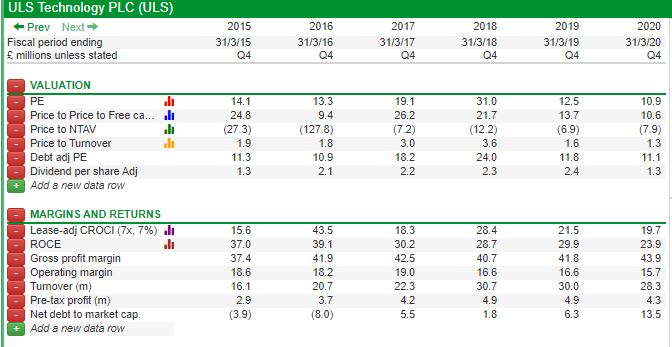

ULS has been rather dependent on some large introducers of mortgage business (eg Lloyds Bank, but also others such as the 2 large introducers which it lost). The company said these large scale customers were high volume, but lower margin. This assertion was supported by 2020 FY March results, where revenue fell, due to the contract losses, but gross margin improved in percentage terms to 44% as the company focused on smaller mortgage brokers. The company now has 3,800 mortgage intermediaries using its platforms.

So in 2019 the company launched “DigitalMove” a digital conveyancing solution and rolled it out heavily this year. Previously, the company charged both mortgage brokers and solicitors (who naturally passed the cost on to the end customer – the house buyer or re-mortgager). But solicitors are allowed on to the DigitalMove platform for free, with ULS gaining revenues from property searches (£100 a package) and other moving related requirements such as utility contract changes. The DigitalMove platform looks to me like a real improvement, rather than just giving access to rated solicitors, it is a whole work flow management system where customers can upload documents, check on progress, communicate securely (which reduces fraud, a big problem with a large transaction like buying a house). The company says that it increases the speed of conveyancing by up to 6 weeks, compared to non-digital conveyancing. There’s a 2 minute YouTube video here https://www.youtube.com/watch?v=iWpsWAH-2Zo

As the table above shows, revenue and profits were expected to fall away from the old model, as DigitalMove gradually takes hold. This means the upcoming results are particularly important in terms of how the group is progressing. Given the sensitive timing of the transformation, it seems a very odd time for the Chief Executive to depart especially if everything is going to plan with “instructions significantly ahead of the same period last year” as stated in the announcement last week. Although the share price had fallen 22% in September, there wasn’t a strong reaction when the announcement came out, which suggests that perhaps some sellers of the shares in early September had more insight than was publicly available?

The Group should report a trading update in November, and H1 results in December. I own the shares and will follow progress with interest. Kestrel Partners own 28% and have a seat on the Board since January 2020, Schroders 11%, Herald 7%, Gresham House 6%.

Air Partner H1 results to July 2020

Another company I own reported disappointing half year results to July 2020: Air Partner. The shares fell 17% on the 2 days after results came out. I have to admit I bought this share a few years ago without doing too much research, attracted by the high dividend yield and that Lord Lee owned it. Though it has a market cap of less than £50m, it is listed on the LSE Main Market, rather than AIM.

Another company I own reported disappointing half year results to July 2020: Air Partner. The shares fell 17% on the 2 days after results came out. I have to admit I bought this share a few years ago without doing too much research, attracted by the high dividend yield and that Lord Lee owned it. Though it has a market cap of less than £50m, it is listed on the LSE Main Market, rather than AIM.

History

Founded in the early 1960’s as a pilot training school, launched air charter broking in the 1980s. This is a service aimed at Governments, corporations and other organisations, for instance flying football teams to convenient airports and private terminals for UEFA Champions League matches. In 2000, they introduced “JetCard” programme, a flexible private jet charter service. Buffett owns NetJets which does something similar.

In April 2018 the company disclosed accounting problems. Profits had been overstated by a cumulative £4m, and PwC and Rosenblatt Solicitors were called in to investigate. There was a large balance sheet item, which should have been expensed through the p&l (effectively a bad debt where the company was unlikely to receive the cash), instead it was recorded on the balance sheet as an asset. At the time, the company made clear that the cash position was unaffected, and that it would still achieve underlying PBT of £6.4m for FY 31 Jan 2018. No further problems were discovered and the shares have since just about recovered.

At the end of last year the company bought Redline, a training company for airline and airport security, for £10m. The company raised £7.1m at 75p per share through a placing in June this year, to pay down debt associated with this acquisition.

Results

H1 to July showed that in the short term they have benefited from the virus. AirPartner was very busy organising charters for the Foreign Office to repatriate UK citizens back from remote locations (including from Wuhan, where the virus started). Group Charter made a gross profit of £12.3m (H1 2019: £7.2m). Freight also reported a very strong first half, with gross profit of £8.6m (H1 2019: £1.9m), as companies needed to charter flights to keep their global supply chains operating and governments had emergency supplies of protective equipment (masks etc) flown in from abroad. On the other hand Private Jets was down 23.3%, delivering gross profit of £4.6m (H1 2019: £6.0m) as football teams, groups attending conferences etc obviously badly hit as events were cancelled and no one wanted to travel.

In all H1 2020 statutory PBT was up 3.2x to £8.9m, and the interim dividend was reinstated but at a lower level 0.8p v 1.8p last year. This implies a 55% fall in the FY dividend to 2.5p (2019 FY dividend was 5.6p). At 65p this puts the stock on FY 3.9% yield, on an already cut dividend which should prove supportive.

Despite the very positive results in H1, the shares reacted badly falling 17% over the 2 days following results, as the company suggested the one off positives in H1 wouldn’t repeat, and they would barely make a profit in H2. It seems likely that next year will be more in line with H2 than the very positive H1.

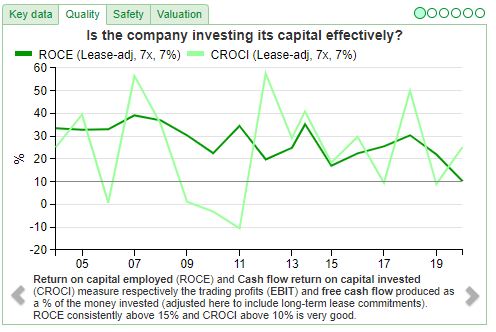

That said, I’m happy to hold this share through the tough times. AirPartner has always been a cyclical stock, as the chart below shows. It has experienced a dramatic drop in profitability in downturns, particularly on cash based profitability measures (eg CROCI). However, that is a good argument for the conservative balance sheet structure (£18m of net cash – which excludes the £18m of cash customers have prepaid on to their JetCards). The company is asset light, owning no aircraft, which offers flexibility when navigating a crisis.

Amati owns 8%, Schroders 6%, and Miton 5%. Lord Lee has increased his stake and now appears on the shareholder register owning 5%, which looks like a high conviction position from an individual who has followed the company closely over many years.

Burford H1 results to June 2020

Burford released very late H1 results to June 2020, suggesting that their proposed US listing had delayed the announcement. In the event, total income was down 12% versus H1 last year to $250m, and profit after tax was down 29% to $161m over the same time period. For most companies this would be seen as disappointing – however the company has come under attack from Muddy Waters, the famed short seller, in August last year. There were already some doubts raised before the attack, and the shares have fallen 86% peak to trough. Persistent doubts have lingered, and the results seem to have reassured the market, with the shares up 16% on the morning of results.

Burford released very late H1 results to June 2020, suggesting that their proposed US listing had delayed the announcement. In the event, total income was down 12% versus H1 last year to $250m, and profit after tax was down 29% to $161m over the same time period. For most companies this would be seen as disappointing – however the company has come under attack from Muddy Waters, the famed short seller, in August last year. There were already some doubts raised before the attack, and the shares have fallen 86% peak to trough. Persistent doubts have lingered, and the results seem to have reassured the market, with the shares up 16% on the morning of results.

Dispute with the Argentinian Government

One highlight is that in H1 results last year, a whopping $188m (or 66%) of income came from a fair value gain related to their dispute with the Argentinian government over the expropriation / nationalisation of YPF, an Argentinean listed oil company. Burford management could have chosen to disclose this figure last year, but for some reason chose not to. I went back and checked their H1 2019 statement for this $188m and it wasn’t there.

Burford’s most recent sale of its YPF asset to third party investors was in June 2019 and the carrying value on the Dec 2019 balance sheet was $773m. Burford management dryly note that the fair value accounting “does not imply that these assets will henceforth be carried based on trading in the secondary market for the Petersen interests.” In other words, Burford have marked up the value when they have achieved a favourable selling price, but they are not going to continuously mark-to-market the asset every six months, presumably because this could mean writing down the value based on market prices. The rest of the fair value gain on Burford’s balance sheet is $106m, which is small in the context of $1.5bn of net assets.

SEC approval for NY Stock Exchange listing

One day before the results Burford was approved by the SEC for a dual listing on the New York Stock Exchange, and the shares should start trading there in mid-October. This is significant for a couple of reasons: bears claimed that Burford management had deliberately chosen AIM’s lighter corporate governance requirements in order to avoid scrutiny. The secondary listing should also allow a wider range of US investors to buy shares, who previously might not have been able to because they didn’t have a mandate to invest in an AIM listed company.

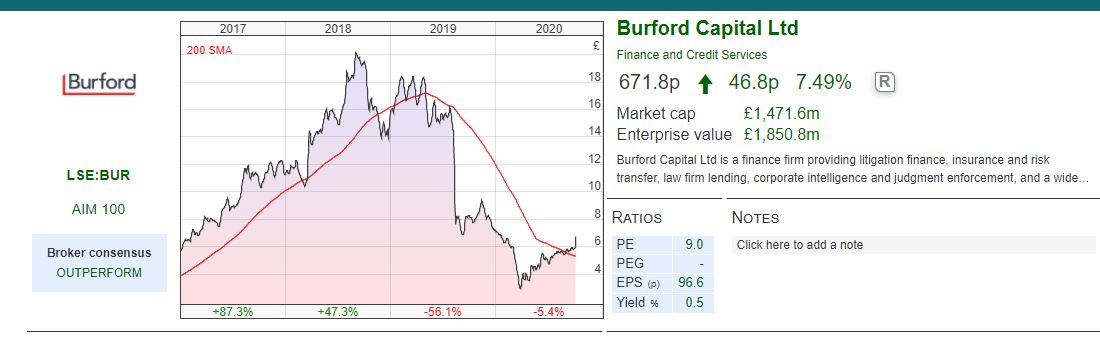

The 5 year chart tells a great story. With the company 10 bagging from below £2 to peak at over £20, bouncing of its 200 day moving average, until it broke down following the Muddy Waters report in early August last year. From that point it suffered a drastic decline back to below £3 in mid-March this year. This is clearly not a stock for the faint hearted, but since March the share price has recovered to £6, and has now broken through the significant moving average.

Excluding YPF, Burford reports a 10 year ROIC of 69% and an IRR of 26%. This compares to LCM which reports (using historic cost accounting) ROIC of 134% and IRR of 78% over 9 years.

Messy results

The results were rather messy, with line items like: “Burford-only realised gains from capital provision-direct assets” up 57% to $183 million. Some of this complexity is due to the fact Burford uses its own balance sheet to fund cases, but also invests alongside investors in its fund.

But I can’t help thinking that the expression is awkward because Burford would like investors to treat realised gains as “revenue”, yet can’t denote them as such under IFRS, because there remains too much uncertainty about when the gains convert into cash. There were $281m of receivables on Burford’s balance sheet at the June year end, which compares to H1 total income of $252m. That said, as of 15 September 2020, Burford held $316m in cash, including $86m of cash which was recorded as a settlement receivable in the balance sheet at the end of June but has now been paid in cash.

I have held the shares since 2015, as I think the a-symetric returns (high upside, but some risk of loss) make sense for my risk tolerance. This is not a share where forecasts can be relied upon, because the timing and amounts of cashflows depends on client settlements and court judgements. In the past I think Burford management have trodden a fine line between making their investment case and over promoting their stock. However, with the share price’s precipitous decline and now recovery I feel this is well understood. Shares were up 16% on the morning of results, before pulling back to 672p ending the day up 7.5%. This compares to H1 NAV per share (ie book value) of 609p. There are likely to be a number of positive events in the future: US listing, rise in disputes following Covid, and hopefully an adjudication on YPF in their favour, so I’m happy to hold on for the (rather wild) ride.

Bruce Packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 05/10/20 – On uncertainty and confidence

Last week Andy Haldane at the Bank of England gave an interesting speech on “Economic Anxiety” noting that pessimism can be as contagious as the disease. Haldane is most famous for his “Dog and the Frisbee” speech, which he co-wrote with the famous psychologist Gerd Gigarenzer in 2012. Catching a frisbee is difficult; theoretically it might require calculus and solving partial differential equations to judge the flight of the Frisbee through the air. Yet a dog manage to catch the moving object in its mouth, not because the dog can do PhD level calculations in its head, but by using a simple heuristic. Heuristics can be remarkably useful when it comes to investing, and work well in times of uncertainty when more complicated models break down because the future does not resemble the past.

In last week’s speech Haldane noted the puzzling degree of pessimism in consumer confidence, despite the complete recovery in consumption by households. The historic correlation between consumer confidence and spending has broken down. He attributes this pessimism to our hunter-gatherer past, where it made sense to worry excessively about existential threats (predators, other tribes, disease). We lack in the confidence future because of the uncertainty that virus has introduced, yet our spending behaviour (as measured by household consumption) has recovered.

Last week 3 stocks I own reported announcements, ULS Technology, AirPartner and Burford. All three are covered by a cloud of uncertainty, and the latter two have reported questionable accounting in the past. I’m not entirely confident in the bull case on any these 3 stocks, nevertheless I prefer to focus on the payoffs if things go well. To me, the rewards from learning to live with the uncertainty look far greater than the risks.

ULS Technology

A curious announcement from ULS Technology, the online conveyancing company last week. The shares had fallen 22% on no news since the start of September. Then, at the start of last week, the company announced that the Chief Executive Steve Goodall was leaving with immediate effect, the Board had found a successor, but weren’t going to tell the market who he was yet. At the same time, the company said current trading is strong, instructions were running significantly ahead of last year, and that margins should be higher (customers buying houses rather than re-mortgaging).

So it sounds like he isn’t being replaced because results have been disappointing. But rather curious all the same. ULS is a platform company, it sits in the middle between solicitors and mortgage brokers, who use the platform to select solicitors, by filtering on price, location and service rating. The mortgage brokers (either a big Group of introducers like Lloyds, or smaller individual brokers) pay ULS for access to the platform. Up until now solicitors have also paid fees to ULS to access the eConveyancer platform, but technology companies can not stand still and the group is rolling out a new product: DigitalMove. The Group has a 3% market share of conveyancing, so is not reliant on housing market transactions if it can grow its share of the market.

History

Founded in 2003 by Andrew Weston (who is still on the Board as IT Director) and Nigel Hoath (who stepped down from the Board as non Executive Director in August 2016). The latter owned just under 10% of the company, but sold down his stake 2 years ago.

In 2011 Lloyds Bank’s private equity arm invested. In the same year, Lloyds Bank Group agreed to deepen its relationship with ULS, through their branches and their in-house mortgage. They signed a 5 year contract with Lloyds, and ULS became provider of conveyancing services to the bank (which has around 30% mortgage market share), with ongoing extension. In the most recent Annual Report the loss of this Lloyds contract is listed as the number 1 key risk, as it is worth just under 30% of gross margin (and presumably a higher percentage of Group revenue). Recently ULS lost 2 significant introducer contracts, one was Moneysupermarket.

The shares have been trading on AIM since 2014, when it raised £3.7m of new capital through a placing at 40p and valuing the Group at £26m market cap. By April 2018 the share price peaked at over 160p per share, with the Group reporting revenues of £30.7m, and underlying PBT of £5.5m. The share price has fallen right back down to 55p this month though.

Like any platform business, the challenge is to attract both sides of the transaction. If you can get that right, there are huge network effects and increasing returns. Mortgage brokers want to use a platform that has access to lots of solicitors, and solicitors want access to lots of conveyancing flow from brokers. Think ebay, stock exchanges, Uber, Facebook etc.

ULS has been rather dependent on some large introducers of mortgage business (eg Lloyds Bank, but also others such as the 2 large introducers which it lost). The company said these large scale customers were high volume, but lower margin. This assertion was supported by 2020 FY March results, where revenue fell, due to the contract losses, but gross margin improved in percentage terms to 44% as the company focused on smaller mortgage brokers. The company now has 3,800 mortgage intermediaries using its platforms.

So in 2019 the company launched “DigitalMove” a digital conveyancing solution and rolled it out heavily this year. Previously, the company charged both mortgage brokers and solicitors (who naturally passed the cost on to the end customer – the house buyer or re-mortgager). But solicitors are allowed on to the DigitalMove platform for free, with ULS gaining revenues from property searches (£100 a package) and other moving related requirements such as utility contract changes. The DigitalMove platform looks to me like a real improvement, rather than just giving access to rated solicitors, it is a whole work flow management system where customers can upload documents, check on progress, communicate securely (which reduces fraud, a big problem with a large transaction like buying a house). The company says that it increases the speed of conveyancing by up to 6 weeks, compared to non-digital conveyancing. There’s a 2 minute YouTube video here https://www.youtube.com/watch?v=iWpsWAH-2Zo

As the table above shows, revenue and profits were expected to fall away from the old model, as DigitalMove gradually takes hold. This means the upcoming results are particularly important in terms of how the group is progressing. Given the sensitive timing of the transformation, it seems a very odd time for the Chief Executive to depart especially if everything is going to plan with “instructions significantly ahead of the same period last year” as stated in the announcement last week. Although the share price had fallen 22% in September, there wasn’t a strong reaction when the announcement came out, which suggests that perhaps some sellers of the shares in early September had more insight than was publicly available?

The Group should report a trading update in November, and H1 results in December. I own the shares and will follow progress with interest. Kestrel Partners own 28% and have a seat on the Board since January 2020, Schroders 11%, Herald 7%, Gresham House 6%.

Air Partner H1 results to July 2020

History

Founded in the early 1960’s as a pilot training school, launched air charter broking in the 1980s. This is a service aimed at Governments, corporations and other organisations, for instance flying football teams to convenient airports and private terminals for UEFA Champions League matches. In 2000, they introduced “JetCard” programme, a flexible private jet charter service. Buffett owns NetJets which does something similar.

In April 2018 the company disclosed accounting problems. Profits had been overstated by a cumulative £4m, and PwC and Rosenblatt Solicitors were called in to investigate. There was a large balance sheet item, which should have been expensed through the p&l (effectively a bad debt where the company was unlikely to receive the cash), instead it was recorded on the balance sheet as an asset. At the time, the company made clear that the cash position was unaffected, and that it would still achieve underlying PBT of £6.4m for FY 31 Jan 2018. No further problems were discovered and the shares have since just about recovered.

At the end of last year the company bought Redline, a training company for airline and airport security, for £10m. The company raised £7.1m at 75p per share through a placing in June this year, to pay down debt associated with this acquisition.

Results

H1 to July showed that in the short term they have benefited from the virus. AirPartner was very busy organising charters for the Foreign Office to repatriate UK citizens back from remote locations (including from Wuhan, where the virus started). Group Charter made a gross profit of £12.3m (H1 2019: £7.2m). Freight also reported a very strong first half, with gross profit of £8.6m (H1 2019: £1.9m), as companies needed to charter flights to keep their global supply chains operating and governments had emergency supplies of protective equipment (masks etc) flown in from abroad. On the other hand Private Jets was down 23.3%, delivering gross profit of £4.6m (H1 2019: £6.0m) as football teams, groups attending conferences etc obviously badly hit as events were cancelled and no one wanted to travel.

In all H1 2020 statutory PBT was up 3.2x to £8.9m, and the interim dividend was reinstated but at a lower level 0.8p v 1.8p last year. This implies a 55% fall in the FY dividend to 2.5p (2019 FY dividend was 5.6p). At 65p this puts the stock on FY 3.9% yield, on an already cut dividend which should prove supportive.

Despite the very positive results in H1, the shares reacted badly falling 17% over the 2 days following results, as the company suggested the one off positives in H1 wouldn’t repeat, and they would barely make a profit in H2. It seems likely that next year will be more in line with H2 than the very positive H1.

That said, I’m happy to hold this share through the tough times. AirPartner has always been a cyclical stock, as the chart below shows. It has experienced a dramatic drop in profitability in downturns, particularly on cash based profitability measures (eg CROCI). However, that is a good argument for the conservative balance sheet structure (£18m of net cash – which excludes the £18m of cash customers have prepaid on to their JetCards). The company is asset light, owning no aircraft, which offers flexibility when navigating a crisis.

Amati owns 8%, Schroders 6%, and Miton 5%. Lord Lee has increased his stake and now appears on the shareholder register owning 5%, which looks like a high conviction position from an individual who has followed the company closely over many years.

Burford H1 results to June 2020

Dispute with the Argentinian Government

One highlight is that in H1 results last year, a whopping $188m (or 66%) of income came from a fair value gain related to their dispute with the Argentinian government over the expropriation / nationalisation of YPF, an Argentinean listed oil company. Burford management could have chosen to disclose this figure last year, but for some reason chose not to. I went back and checked their H1 2019 statement for this $188m and it wasn’t there.

Burford’s most recent sale of its YPF asset to third party investors was in June 2019 and the carrying value on the Dec 2019 balance sheet was $773m. Burford management dryly note that the fair value accounting “does not imply that these assets will henceforth be carried based on trading in the secondary market for the Petersen interests.” In other words, Burford have marked up the value when they have achieved a favourable selling price, but they are not going to continuously mark-to-market the asset every six months, presumably because this could mean writing down the value based on market prices. The rest of the fair value gain on Burford’s balance sheet is $106m, which is small in the context of $1.5bn of net assets.

SEC approval for NY Stock Exchange listing

One day before the results Burford was approved by the SEC for a dual listing on the New York Stock Exchange, and the shares should start trading there in mid-October. This is significant for a couple of reasons: bears claimed that Burford management had deliberately chosen AIM’s lighter corporate governance requirements in order to avoid scrutiny. The secondary listing should also allow a wider range of US investors to buy shares, who previously might not have been able to because they didn’t have a mandate to invest in an AIM listed company.

The 5 year chart tells a great story. With the company 10 bagging from below £2 to peak at over £20, bouncing of its 200 day moving average, until it broke down following the Muddy Waters report in early August last year. From that point it suffered a drastic decline back to below £3 in mid-March this year. This is clearly not a stock for the faint hearted, but since March the share price has recovered to £6, and has now broken through the significant moving average.

Excluding YPF, Burford reports a 10 year ROIC of 69% and an IRR of 26%. This compares to LCM which reports (using historic cost accounting) ROIC of 134% and IRR of 78% over 9 years.

Messy results

The results were rather messy, with line items like: “Burford-only realised gains from capital provision-direct assets” up 57% to $183 million. Some of this complexity is due to the fact Burford uses its own balance sheet to fund cases, but also invests alongside investors in its fund.

But I can’t help thinking that the expression is awkward because Burford would like investors to treat realised gains as “revenue”, yet can’t denote them as such under IFRS, because there remains too much uncertainty about when the gains convert into cash. There were $281m of receivables on Burford’s balance sheet at the June year end, which compares to H1 total income of $252m. That said, as of 15 September 2020, Burford held $316m in cash, including $86m of cash which was recorded as a settlement receivable in the balance sheet at the end of June but has now been paid in cash.

I have held the shares since 2015, as I think the a-symetric returns (high upside, but some risk of loss) make sense for my risk tolerance. This is not a share where forecasts can be relied upon, because the timing and amounts of cashflows depends on client settlements and court judgements. In the past I think Burford management have trodden a fine line between making their investment case and over promoting their stock. However, with the share price’s precipitous decline and now recovery I feel this is well understood. Shares were up 16% on the morning of results, before pulling back to 672p ending the day up 7.5%. This compares to H1 NAV per share (ie book value) of 609p. There are likely to be a number of positive events in the future: US listing, rise in disputes following Covid, and hopefully an adjudication on YPF in their favour, so I’m happy to hold on for the (rather wild) ride.

Bruce Packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.