Markets sold off last week as virus case rises rose (FTSE 100 fell to below 5800 before recovering slightly later in the week, Nasdaq down 4% to 10,800). The virus itself seems reasonably predictable, everyone has been expecting cases to rise as summer turns to autumn. What hasn’t been predictable is Government responses around the world.

Last week three high-performing, acquisitive companies reported: Learning Technologies Group, Judges Scientific and SDI. They are up 5.3x, 3.3x and 6.5x respectively in the last 5 years.

I came across this fascinating talk on YouTube by Alta Fox Capital, who have done a 645 slide presentation on multi-baggers: https://youtu.be/D7mSv0G2ZzA?t=1724 . One point they make is that although more than half (perhaps as high as 80%) of acquisitions are deemed as failures, among high performing companies many do grow successfully by acquisition. I’ve had to re-examine my own bias: having been a banks analysts for so many years. I have seen first-hand not only Royal Bank ABN Amro at the beginning of the financial crisis and Lloyds HBOS at the end. But even without a financial crisis bankers are rubbish at buying other banks, for example: HSBC’s bought sub prime Household, and before that private bank Safra Republic (New York and Switzerland) which has got them into hot water for money laundering breaches.

I will try to practice Shoshin or “beginners mind” when I look at acquisitive companies in other sectors. “In the beginner’s mind there are many possibilities, in the expert’s mind there are few.” Maybe Keywords last week, and LTG, Judges and SDI which I write about below can execute their “buy and build” models without the wheels coming off?

Finally Litigation Capital Management reported FY to June results. Many put this sector in the “too hard” pile, so I asked management about their thoughts on historic cost accounting v fair value.

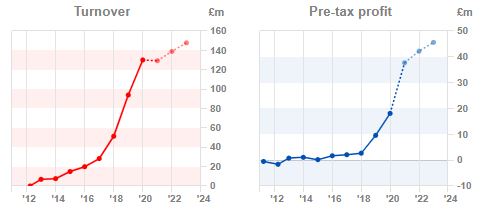

Learning Technologies Group – H1 June 2020 Results

Source: SharePad – Single page summary

Not all online businesses are doing well from the virus. I have a particular interest in the online education sector, because I tried to co-found an online financial education business. It was not successful. Theoretically online learning should be a huge growth area for the internet, but in practice no one has managed to find a successful formula. Perhaps because there is a lot more to education than simply filling minds up with information, only for it to be later regurgitated over several hours under exam conditions.*

Corporate training for adults (very often a legal and compliance necessity) probably is easier than educating restless children with a short attention span. Thus Learning Technologies Group has enjoyed decent success since 2013 when it reversed into a cash shell called (In-Deed plc) to list on AIM. Management then bought LINE Communications in April 2014, to start a ‘buy and build’. Since then they’ve grown with multiple acquisitions, including PeopleFluent a US company for $150m. They now employ around 800 people in 20+ locations across Europe, the United States, Asia-Pacific and South America. They then did an £82m placing this May, and have made another acquisition (eCreators) announced last week at the time of their H1 results. At the time of the placing the company set a target of circa £230m revenues and EBIT of circa £66m by the end of 2022 through a combination of organic growth and additional strategic bolt-on acquisitions. This compares to £64m H1 20 revenues, and £18m adjusted H1 20 EBIT.

Source: SharePad

As an aside, SharePad have had a design update – I really like it, the addition of the Single page summary makes it significantly easier to digest the performance of a share at a glance. I’ve only started using the site a couple of months ago, but I can imagine the additional new view might take a bit of getting used to, if you have been using the standard split screen view for a while. Bear with it, perhaps try approaching the new layout with shoshin.

81% of LTG revenues are recurring. Yet on an organic, constant currency basis revenues were down 7%. This is because LTG is focussed on the corporate sector, or “work place learning” and revenue is presumably driven by recruitment (ie new employees joining an organisation). I’ve heard from friends in The City that the job market in finance has been terrible for the last 6 months, but now that the initial shock of the virus has worn off, hiring has just begun again. Certainly, LTG’s targets of circa £230m revenue suggest that management believe the first 6 months of 2020 do not indicate a permanent disruption.

Source: SharePad

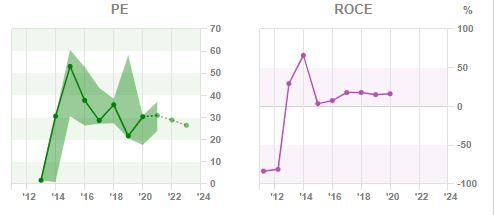

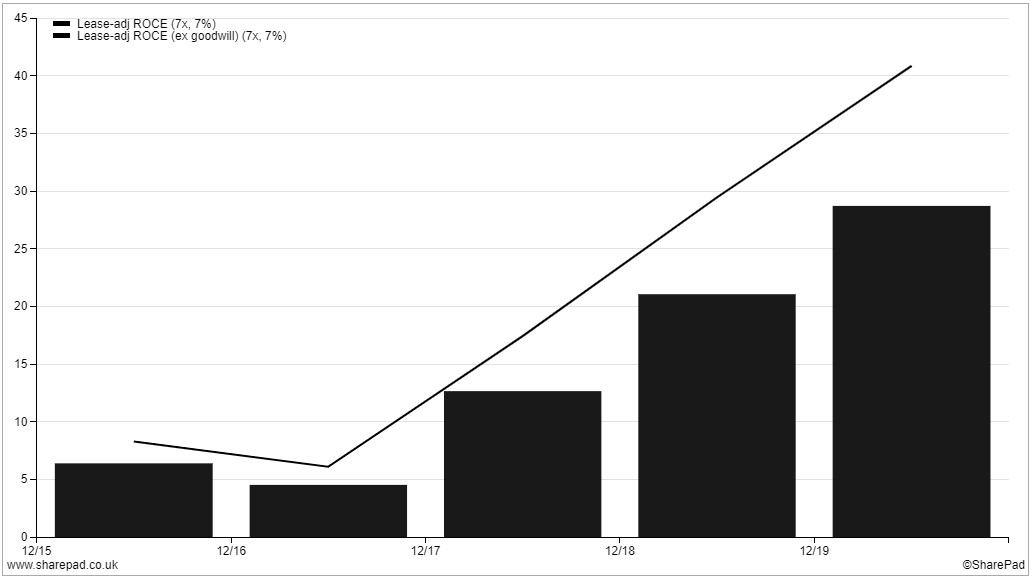

For acquisitive companies, I like to take a close look at RoCE with and without goodwill, excluding goodwill from the denominator of the calculation always generates a higher ROCE number. If management are consistently allocating capital buying other companies, then they should be judged on their track record with goodwill (the premium they’ve paid for past acquisitions included in the capital employed). In short, there is no single ratio to evaluate performance, but calculating returns with and without goodwill both give a useful overview of performance. For LTG the chart below shows ROCE at 15%, rising to 30% ex goodwill which probably does justify the high PER ratio of 26x 2022 forecast earnings, and market cap of just under £1bn.

Source: SharePad

Liontrust 11%, Jupiter 6%, Janus Henderson 5% are the institutions on the shareholder register. LTG could be an interesting investment, I’d like to spend more time understanding the opportunities in online education.

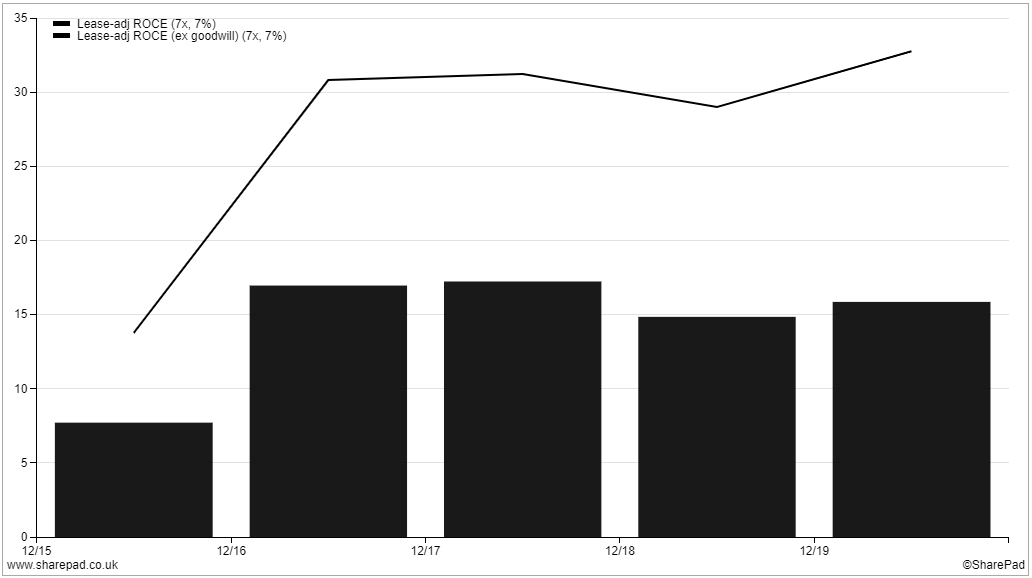

Judges Scientific – H1 June 2020 Results

Judges reported H1 results last week. Management have a track record of a disciplined approach of buying companies making scientific instruments. They look for an established product range, an international customer base and attractive sales, profits and cash generation. They particularly look for companies with a strong commercial position in a niche world market. David Cicurel, the current CEO, who founded Judges in 2002, has a background as a turnaround specialist.

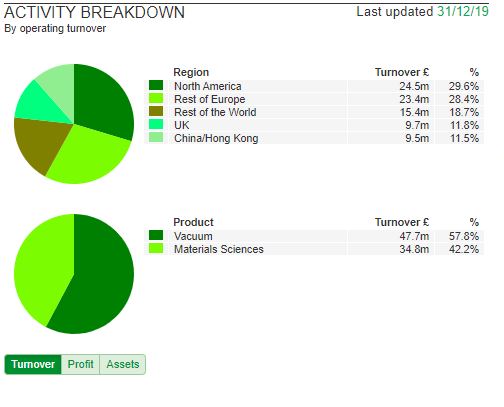

Normally this would be viewed as a relatively defensive business model in times of recession, as a key driver is research funding to universities. But organic revenue fell 12% v H1 19, with the decline caused by the closure of universities, the cancellation of scientific conferences and travel restrictions meaning that the sales team could not close deals in face to face meetings. Many industrial customers also froze capital expenditure on equipment too. North America was particularly badly hit with revenues down 32%. As the pie chart shows this was just under a third of FY revenues.

Source: SharePad

According to the company operational gearing would suggest that a 12% reduction in organic revenue would ordinarily result in operating profit dropping by a third. However, savings from travel, not attending scientific conferences, reduced sales bonuses, deferred projects etc. meant adjusted PBT was down 24% to £6.4m H1 2020. In terms of financial gearing, goodwill and other intangibles are £25m or 80% of net assets. Net debt is £6.4m or 19% of net assets. Adding both goodwill and net debt together, does suggest that the balance sheet could become a concern if deferred orders don’t materialise. Cashflow was down 40%, a much greater decline than adjusted PBT, to £5.1m as working capital increased from stockpiling inventory.

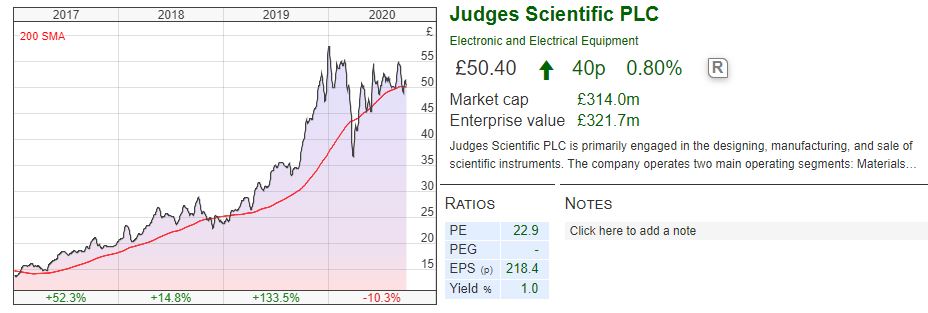

That said, the order book began to recover in May and was just over 13 weeks to the end of August, which means the Board is “cautiously confident” meeting existing FY market expectations. SharePad consensus forecast suggest EPS of 169p for FY 2020 and 182p for 2021, suggesting a PER of 28x next year’s earnings. Judges has an enviable track record and impressive RoCE figures (see chart below), so that rating does not seem particularly excessive.

Conservative dividend cover allows management to pay an interim dividend, grown by 10% to 16.5p. David Cicurel owns 23% of the company, but Liontrust (9.4%), Schroders (4.5%), Polar Capital (3.8%) are all on the shareholder register. I like it, but prefer SDI Group which is smaller and less leveraged.

Source: SharePad

SDI Group – Trading update (April year end)

SDI, which I own, reported a “very good” trading update last week. This compares to “good” in the trading statement September last year, results reported in December 2019 showed organic revenue growth of 6.4%. I think we can infer that organic revenue growth is probably higher than 6.4% then.

The shares were up 12% on the day. I listened into the AGM and management confirmed that they were affected by many of the same issues as Judges (for instance difficult to make sales to US customers at the moment) but were happy with market expectations (FinnCap is broker and published a note forecasting 3.7p of EPS FY Apr 2021). This puts the company on 17x PER Apr 2021 forecast earnings.

I mention it because last year Richard Beddard wrote a very good piece comparing the different “buy and build” strategies at both companies. https://knowledge.sharescope.co.uk/2019/07/10/how-to-work-out-whether-a-firm-is-good-acquirer/ The 2 major differences are i) Judges Scientific uses debt to finance acquisitions, while SDI has mostly issued shares, and ii) SDI tries to buy companies that fit with units it already owns. Judges is more agnostic, and if the investment case makes sense doesn’t worry about strategic fit.

Litigation Capital Management – FY June 2020

Litigation Capital Management, the Sydney headquartered litigation finance company founded in 1998, that listed on AIM in December 2018 have released their FY results (June year end). The Chief Executive is being re-located to London, which seems a clear statement of intent that the opportunities are in the northern hemisphere. I’m wary about how competition could destroy the high returns reported by all companies in the sector – the fact that LCM has copied Burford and launched a third party asset management vehicle suggests that competitive advantages are unlikely to be in broad strategic choices, and instead in hard to quantify areas such as relationships with law firms or quality of cases rejected/funded.

We probably won’t see a smooth gradual decline in reported profitability – instead if my experience of following UK banks (which also have long duration, hard to value financial assets) is any guide, results and outlook statements will be fine, until there are sudden “kitchen sink” writedowns. Although no new litigation funders have entered the sector, the fact that Burford and LCM have third party asset management businesses, suggests that there are few constraints on how much capital can chase diminishing returns.

LCM makes an interesting comment on duration of legal matters. The time for completion is 25-27 months (v Burford Weighted Average Life 2.4 years). But litigants fight longer and harder over larger sums of money, and hence LCM management expect that as their commitments to larger disputes grow, it will take longer for matters to conclude. We can see this with Burford already, who openly admit that they are still fighting at least one case from their 2010 vintage.

Results:

Statutory PBT was down 21% to A$ 8.05m. Inevitably the company has its own adjusted PBT which excludes things like IPO costs (one off), non-recurring fees (by definition non-recurring, but which occur in both years!) and share based payments which shows PBT down 10%. The company has guided for gross profit of A$30m to A$47m compared to A$21.7m in 2020, and A$20.3m in 2019. Shares were down 5% on the day of results.

Accounting:

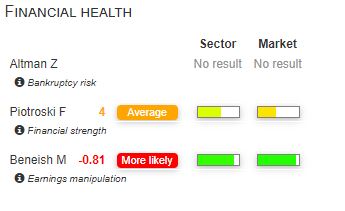

LCM only recognise revenue when money is earned using historic cost accounting, not writing up the fair value through its p&l statement. Despite using this more conservative approach, LCM doesn’t score particularly well on the Beneish M, which assess the potential for financial manipulation. The score is probabilistic, but it was successful and highlighting problems with Enron before they became widely known. If you click on the “i” in Sharepad, there’s an explanation about how each score is calculated.

Source:SharePad

I logged into the management presentation on www.piworld.co.uk especially to ask about accounting. Burford say on page 59 of their Annual Report that IFRS “requires” them to value legal disputes at fair value through the p&l. LCM management say that they could have chosen to use fair value accounting when they listed on AIM in 2018, but preferred not to. They are still reporting under Australian Accounting Standards, but if the jurisdiction of their assets shifts, then they said that it is possible that they could report using the fair value accounting. They point out that rather than fair value v. historic cost accounting, fair value gives management discretion, and that they would be conservative in the fair values that they assign.

This seems a good observation which reminded me that in 2007 Goldman Sachs marked to model a credit derivative swap with AIG at a 40% discount. AIG on the other hand, valued the same credit derivative swap at face value (ie no discount at all). Both companies had PwC as auditors, who were happy for the companies to value exactly the same asset at widely different values.** Similarly even if Burford were required to value assets using fair value, I’m not convinced that management were forced to write up the value of the Petersen case by $734m of unrealised gain, and then not disclose the figure until April this year. Burford reports H1 to June on 1st October.

All litigation companies warn that they can’t forecast earnings, because the timing of settlements is too uncertain, but the company’s guidance range at least suggests that last year’s 21% decline in statutory profits is unlikely to be repeated. I like it LCM, and management came across well on the call, but I want to limit my exposure to only one company in the sector. I think that the greatest upside is Burford (which I’ve owned since 2015) or possibly Manolete, though both firms face risks.

Bruce Packard

* Coursera, perhaps the market leader in the sector is worth around $1bn according to this article. That compares to over $200bn for Netflix. https://techcrunch.com/2019/04/25/online-learning-startup-coursera-picks-up-103m-now-valued-at-1b

** Bean Counters –The Triumph of the Accountants by Richard Brooks. Page 134.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 28/09/20 – Beginner’s mind and Buy and Build

Markets sold off last week as virus case rises rose (FTSE 100 fell to below 5800 before recovering slightly later in the week, Nasdaq down 4% to 10,800). The virus itself seems reasonably predictable, everyone has been expecting cases to rise as summer turns to autumn. What hasn’t been predictable is Government responses around the world.

Last week three high-performing, acquisitive companies reported: Learning Technologies Group, Judges Scientific and SDI. They are up 5.3x, 3.3x and 6.5x respectively in the last 5 years.

I came across this fascinating talk on YouTube by Alta Fox Capital, who have done a 645 slide presentation on multi-baggers: https://youtu.be/D7mSv0G2ZzA?t=1724 . One point they make is that although more than half (perhaps as high as 80%) of acquisitions are deemed as failures, among high performing companies many do grow successfully by acquisition. I’ve had to re-examine my own bias: having been a banks analysts for so many years. I have seen first-hand not only Royal Bank ABN Amro at the beginning of the financial crisis and Lloyds HBOS at the end. But even without a financial crisis bankers are rubbish at buying other banks, for example: HSBC’s bought sub prime Household, and before that private bank Safra Republic (New York and Switzerland) which has got them into hot water for money laundering breaches.

I will try to practice Shoshin or “beginners mind” when I look at acquisitive companies in other sectors. “In the beginner’s mind there are many possibilities, in the expert’s mind there are few.” Maybe Keywords last week, and LTG, Judges and SDI which I write about below can execute their “buy and build” models without the wheels coming off?

Finally Litigation Capital Management reported FY to June results. Many put this sector in the “too hard” pile, so I asked management about their thoughts on historic cost accounting v fair value.

Learning Technologies Group – H1 June 2020 Results

Source: SharePad – Single page summary

Not all online businesses are doing well from the virus. I have a particular interest in the online education sector, because I tried to co-found an online financial education business. It was not successful. Theoretically online learning should be a huge growth area for the internet, but in practice no one has managed to find a successful formula. Perhaps because there is a lot more to education than simply filling minds up with information, only for it to be later regurgitated over several hours under exam conditions.*

Corporate training for adults (very often a legal and compliance necessity) probably is easier than educating restless children with a short attention span. Thus Learning Technologies Group has enjoyed decent success since 2013 when it reversed into a cash shell called (In-Deed plc) to list on AIM. Management then bought LINE Communications in April 2014, to start a ‘buy and build’. Since then they’ve grown with multiple acquisitions, including PeopleFluent a US company for $150m. They now employ around 800 people in 20+ locations across Europe, the United States, Asia-Pacific and South America. They then did an £82m placing this May, and have made another acquisition (eCreators) announced last week at the time of their H1 results. At the time of the placing the company set a target of circa £230m revenues and EBIT of circa £66m by the end of 2022 through a combination of organic growth and additional strategic bolt-on acquisitions. This compares to £64m H1 20 revenues, and £18m adjusted H1 20 EBIT.

Source: SharePad

As an aside, SharePad have had a design update – I really like it, the addition of the Single page summary makes it significantly easier to digest the performance of a share at a glance. I’ve only started using the site a couple of months ago, but I can imagine the additional new view might take a bit of getting used to, if you have been using the standard split screen view for a while. Bear with it, perhaps try approaching the new layout with shoshin.

81% of LTG revenues are recurring. Yet on an organic, constant currency basis revenues were down 7%. This is because LTG is focussed on the corporate sector, or “work place learning” and revenue is presumably driven by recruitment (ie new employees joining an organisation). I’ve heard from friends in The City that the job market in finance has been terrible for the last 6 months, but now that the initial shock of the virus has worn off, hiring has just begun again. Certainly, LTG’s targets of circa £230m revenue suggest that management believe the first 6 months of 2020 do not indicate a permanent disruption.

Source: SharePad

For acquisitive companies, I like to take a close look at RoCE with and without goodwill, excluding goodwill from the denominator of the calculation always generates a higher ROCE number. If management are consistently allocating capital buying other companies, then they should be judged on their track record with goodwill (the premium they’ve paid for past acquisitions included in the capital employed). In short, there is no single ratio to evaluate performance, but calculating returns with and without goodwill both give a useful overview of performance. For LTG the chart below shows ROCE at 15%, rising to 30% ex goodwill which probably does justify the high PER ratio of 26x 2022 forecast earnings, and market cap of just under £1bn.

Source: SharePad

Liontrust 11%, Jupiter 6%, Janus Henderson 5% are the institutions on the shareholder register. LTG could be an interesting investment, I’d like to spend more time understanding the opportunities in online education.

Judges Scientific – H1 June 2020 Results

Judges reported H1 results last week. Management have a track record of a disciplined approach of buying companies making scientific instruments. They look for an established product range, an international customer base and attractive sales, profits and cash generation. They particularly look for companies with a strong commercial position in a niche world market. David Cicurel, the current CEO, who founded Judges in 2002, has a background as a turnaround specialist.

Normally this would be viewed as a relatively defensive business model in times of recession, as a key driver is research funding to universities. But organic revenue fell 12% v H1 19, with the decline caused by the closure of universities, the cancellation of scientific conferences and travel restrictions meaning that the sales team could not close deals in face to face meetings. Many industrial customers also froze capital expenditure on equipment too. North America was particularly badly hit with revenues down 32%. As the pie chart shows this was just under a third of FY revenues.

Source: SharePad

According to the company operational gearing would suggest that a 12% reduction in organic revenue would ordinarily result in operating profit dropping by a third. However, savings from travel, not attending scientific conferences, reduced sales bonuses, deferred projects etc. meant adjusted PBT was down 24% to £6.4m H1 2020. In terms of financial gearing, goodwill and other intangibles are £25m or 80% of net assets. Net debt is £6.4m or 19% of net assets. Adding both goodwill and net debt together, does suggest that the balance sheet could become a concern if deferred orders don’t materialise. Cashflow was down 40%, a much greater decline than adjusted PBT, to £5.1m as working capital increased from stockpiling inventory.

That said, the order book began to recover in May and was just over 13 weeks to the end of August, which means the Board is “cautiously confident” meeting existing FY market expectations. SharePad consensus forecast suggest EPS of 169p for FY 2020 and 182p for 2021, suggesting a PER of 28x next year’s earnings. Judges has an enviable track record and impressive RoCE figures (see chart below), so that rating does not seem particularly excessive.

Conservative dividend cover allows management to pay an interim dividend, grown by 10% to 16.5p. David Cicurel owns 23% of the company, but Liontrust (9.4%), Schroders (4.5%), Polar Capital (3.8%) are all on the shareholder register. I like it, but prefer SDI Group which is smaller and less leveraged.

Source: SharePad

SDI Group – Trading update (April year end)

SDI, which I own, reported a “very good” trading update last week. This compares to “good” in the trading statement September last year, results reported in December 2019 showed organic revenue growth of 6.4%. I think we can infer that organic revenue growth is probably higher than 6.4% then.

The shares were up 12% on the day. I listened into the AGM and management confirmed that they were affected by many of the same issues as Judges (for instance difficult to make sales to US customers at the moment) but were happy with market expectations (FinnCap is broker and published a note forecasting 3.7p of EPS FY Apr 2021). This puts the company on 17x PER Apr 2021 forecast earnings.

I mention it because last year Richard Beddard wrote a very good piece comparing the different “buy and build” strategies at both companies. https://knowledge.sharescope.co.uk/2019/07/10/how-to-work-out-whether-a-firm-is-good-acquirer/ The 2 major differences are i) Judges Scientific uses debt to finance acquisitions, while SDI has mostly issued shares, and ii) SDI tries to buy companies that fit with units it already owns. Judges is more agnostic, and if the investment case makes sense doesn’t worry about strategic fit.

Litigation Capital Management – FY June 2020

Litigation Capital Management, the Sydney headquartered litigation finance company founded in 1998, that listed on AIM in December 2018 have released their FY results (June year end). The Chief Executive is being re-located to London, which seems a clear statement of intent that the opportunities are in the northern hemisphere. I’m wary about how competition could destroy the high returns reported by all companies in the sector – the fact that LCM has copied Burford and launched a third party asset management vehicle suggests that competitive advantages are unlikely to be in broad strategic choices, and instead in hard to quantify areas such as relationships with law firms or quality of cases rejected/funded.

We probably won’t see a smooth gradual decline in reported profitability – instead if my experience of following UK banks (which also have long duration, hard to value financial assets) is any guide, results and outlook statements will be fine, until there are sudden “kitchen sink” writedowns. Although no new litigation funders have entered the sector, the fact that Burford and LCM have third party asset management businesses, suggests that there are few constraints on how much capital can chase diminishing returns.

LCM makes an interesting comment on duration of legal matters. The time for completion is 25-27 months (v Burford Weighted Average Life 2.4 years). But litigants fight longer and harder over larger sums of money, and hence LCM management expect that as their commitments to larger disputes grow, it will take longer for matters to conclude. We can see this with Burford already, who openly admit that they are still fighting at least one case from their 2010 vintage.

Results:

Statutory PBT was down 21% to A$ 8.05m. Inevitably the company has its own adjusted PBT which excludes things like IPO costs (one off), non-recurring fees (by definition non-recurring, but which occur in both years!) and share based payments which shows PBT down 10%. The company has guided for gross profit of A$30m to A$47m compared to A$21.7m in 2020, and A$20.3m in 2019. Shares were down 5% on the day of results.

Accounting:

LCM only recognise revenue when money is earned using historic cost accounting, not writing up the fair value through its p&l statement. Despite using this more conservative approach, LCM doesn’t score particularly well on the Beneish M, which assess the potential for financial manipulation. The score is probabilistic, but it was successful and highlighting problems with Enron before they became widely known. If you click on the “i” in Sharepad, there’s an explanation about how each score is calculated.

Source:SharePad

I logged into the management presentation on www.piworld.co.uk especially to ask about accounting. Burford say on page 59 of their Annual Report that IFRS “requires” them to value legal disputes at fair value through the p&l. LCM management say that they could have chosen to use fair value accounting when they listed on AIM in 2018, but preferred not to. They are still reporting under Australian Accounting Standards, but if the jurisdiction of their assets shifts, then they said that it is possible that they could report using the fair value accounting. They point out that rather than fair value v. historic cost accounting, fair value gives management discretion, and that they would be conservative in the fair values that they assign.

This seems a good observation which reminded me that in 2007 Goldman Sachs marked to model a credit derivative swap with AIG at a 40% discount. AIG on the other hand, valued the same credit derivative swap at face value (ie no discount at all). Both companies had PwC as auditors, who were happy for the companies to value exactly the same asset at widely different values.** Similarly even if Burford were required to value assets using fair value, I’m not convinced that management were forced to write up the value of the Petersen case by $734m of unrealised gain, and then not disclose the figure until April this year. Burford reports H1 to June on 1st October.

All litigation companies warn that they can’t forecast earnings, because the timing of settlements is too uncertain, but the company’s guidance range at least suggests that last year’s 21% decline in statutory profits is unlikely to be repeated. I like it LCM, and management came across well on the call, but I want to limit my exposure to only one company in the sector. I think that the greatest upside is Burford (which I’ve owned since 2015) or possibly Manolete, though both firms face risks.

Bruce Packard

* Coursera, perhaps the market leader in the sector is worth around $1bn according to this article. That compares to over $200bn for Netflix. https://techcrunch.com/2019/04/25/online-learning-startup-coursera-picks-up-103m-now-valued-at-1b

** Bean Counters –The Triumph of the Accountants by Richard Brooks. Page 134.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.