The US Presidential election turned out to be closer than most people expected. Nasdaq up almost +10% over the week to 12078. Tech stocks reacted well to the uncertainty, but so did 10 year US Bond yields, which initially jumped to 0.9% before falling back to 0.78%. I’m not sure if you’d predicted the result, that you would have then also predicted buying of both Nasdaq and safe haven Govt bonds? Predicting tomorrow’s headlines rarely gives you much investment edge.

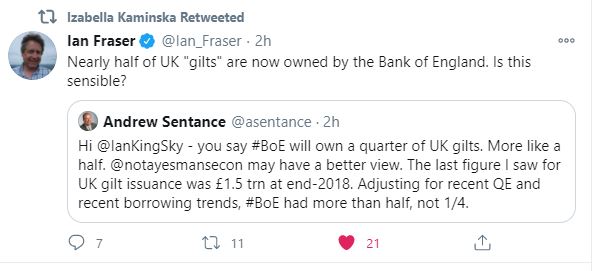

Ian Fraser, who has written a good book on the Royal Bank of Scotland debacle, posted this on Twitter about QE.

It’s the sort of thing that doesn’t make headlines, because a slow compounding of risk over many years can go unnoticed. More of the same is different. Perhaps it is the silent risks that we should be listening for?

Stocks this week:

Last week Oxford Metrics, which I own, reported a disappointing trading update. Positive news from Bango, who signed up BT as a customer and Medica made a decent sized acquisition and also updated on trading.

Oxford Metrics Sept Year End Trading Update

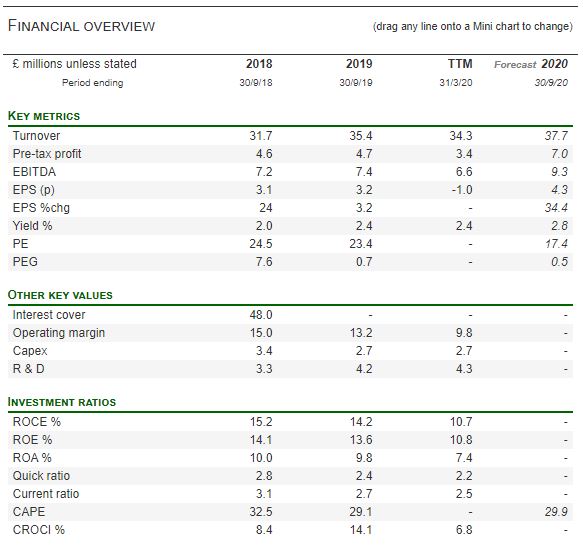

This “motion measurement” company which has a September year end, put out a trading statement last week. It withdrew guidance earlier this year but now expects to report revenue of £30.3m (down 14%) and an Adjusted PBT of £2.5m (down 55%) for the FY to September. The company didn’t put those percentage declines in the trading statement, I had to look them up. Funnily enough, when revenue grew last year that percentage growth rate did appear in the FY 19 Annual Report. We can obviously conclude that OMG management are only able to do percentage growth calculations when the result is positive. Their Admission Document is also very difficult to find on their website.

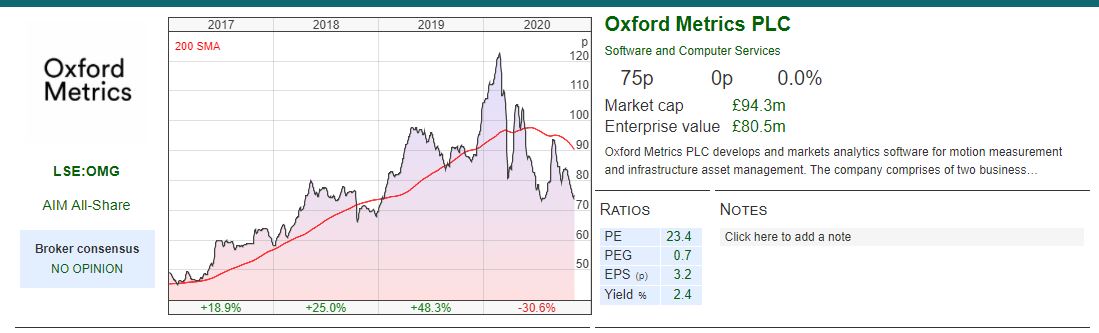

History: The business was founded in 1984, and listed on AIM in 2001 raising just under £6m at 75p per share placing price, valuing the company at £37m. Within a couple of years the price fell to below 5p in 2003 and then slowly recovered over the next decade and a half to hit a peak of 125p at the start of this year, before ending up at 75p currently. The company has issued shares in the meantime (for instance in 2013 issuing 31m shares at 29p to raise £9m to buy Mayrise Ltd). So shares outstanding have increased from less than 50m in 2001 to c. 125m today: hence the market cap has grown to £93m, while the share price is exactly the same level as 2001 when it came to the market. This could explain why the company hides away the Admission Document. Study silence to learn the music*.

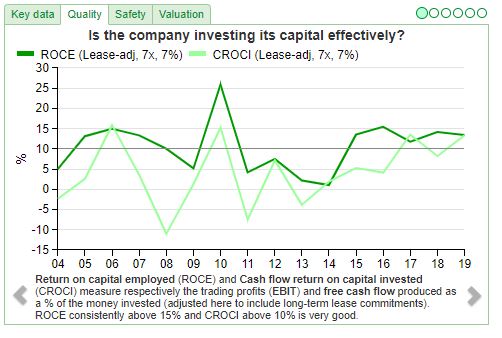

Activities: Around 80% of the company’s revenue comes from “motion measurement”, called Vicon. It is used by engineering companies (Thales and NASA mentioned in the Annual Report), hospitals, elite sports athletes, and also in film and video game special effects. The second business is Yotta, 20% of revenues, and loss making last year. This is a Software as a Service (SaaS) model which helps local authorities to manage their infrastructure, such as highways, roadworks and street lighting. Management say the switch away from perpetual licences to SaaS in Yotta has impacted profitability, but should be a long term positive because SaaS generates recurring revenues. The company has an impressive client list, and clever technology and a 5 year strategic plan to “amplify the core”. So far all this is sounds encouraging, but Return on Capital Employed has been less inspiring, as SharePad’s summary chart on the next page shows:

Management and incentives: Nick Bolton, the CEO’s total compensation was £305K FY 19, down considerably from £1.1m FY 18. He also has 1.2m of options with a 0p strike price and owns 2.4m shares or 1.9% of the share capital. He joined the management team in 2005, so wasn’t responsible for the 90% decline post IPO. Nevertheless his compensation does look rather generous for a company whose share price is at the levels when it listed in 2001. My reading of the remuneration report doesn’t reveal much about how the Key Performance Indicators feed into his rewards. There also doesn’t seem to be a Return on Capital Employed (or similar profitability metric) aspiration.

The company’s Chairman, Roger Parry is also Chairman of YouGov, which as I noted a couple of weeks ago has been a ten-bagger, so hopefully he can work some of his magic on OMG. He earns £65K a year and owns 229K of shares (0.18%).

Valuation: The Group finished the year with a strong cash position of £14.9m (15% of the market cap). Return on Capital Employed was over 14% FY 2018 and 2019, although given profits have halved it looks likely this will drop back below 10% when the company reports FY to September 2020 in December. This is fascinating, because my buy hypothesis was for increasing returns, but I think you could also make the case that returns might not recover from this year’s level. The company withdrew guidance, so I’m not sure that the forecast PER is relevant. Instead book value is £31m less goodwill and intangible assets of £12m because the group has grown by acquisition and also capitalised some development costs. This gives tangible book value of £19m, or almost 5x tangible book value which suggests to me the market is already giving management the benefit of the doubt.

Verdict

This is a company I bought in May 2017. I thought that RoE would increase, but I can’t remember why – all I have in my notes is an enigmatic “seems to be doing the right things”.** It is not unusual for company share prices to go nowhere for a decade (or two) before eventually hitting their stride and delivering significantly better returns on capital and revenue growth. Many stocks I own fit a similar profile: Sylvania Platinum, Creightons, Arcontech, SDI Group, Somero and Solid State. I’m hoping this is the case for Oxford Metrics, rather than vague management slogans: what investors really need is for them to deliver increasing Return on Capital Employed in the coming years.

The company expects to report FY results to end of September on Thursday, 3 December 2020.

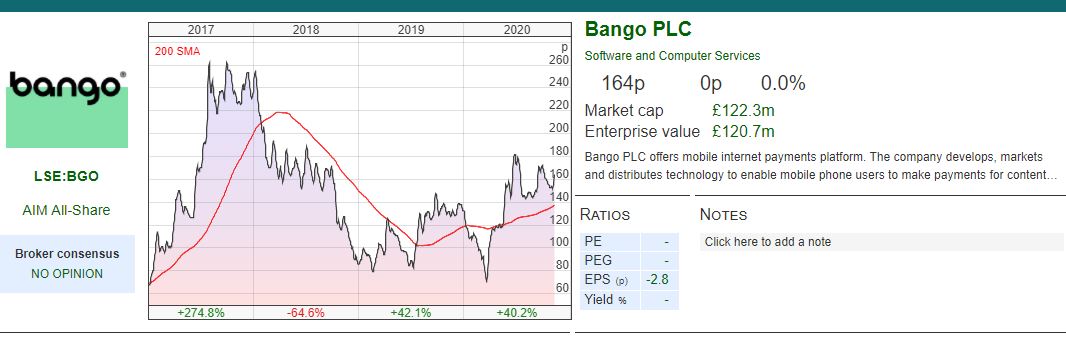

Bango signs up BT as a customer

Most of the time contract wins from loss making tech stocks can be ignored. But I’m intrigued at Bango’s announcement last week, that it will be managing BT’s subscription services. Bango earns payment revenue from transactions processed through the Bango Platform and data monetization revenue from the insights provided through this activity. The way the company likes to explain the model is Facebook and Google earn advertising dollars by allowing companies to target how those dollars are spent based on what we “like” or what we search for. Yet there are a lot of items we might like or search for, that we don’t actually want to buy.

Whereas Bango uses the payments data to allow advertisers to target their ad spend more effectively, on our revealed preferences of what we spend money on. There’s a summary video here that explains it in more detail: https://www.fmp-tv.co.uk/2020/02/28/video-bango-plc-2020-strategy-day/

At the most recent set of results (H1 to June) Bango’s revenues were growing at 50% year on year to £4.8m. The company was still making a small loss (£397K), but had £4.2m of cash on the balance sheet. What intrigues me is that the company reported a gross margin of 98% in H1 20, which suggests that if they can continue to grow revenue, the business is very scalable and that money should drop right through to the bottom line. At H1 20 there were £38m of accumulated losses recorded in shareholders equity, versus shareholders equity itself of £22.3m and tangible equity of £9.7m. There’s a deferred tax liability on the balance sheet too, but the accumulated losses suggest to me that the company won’t be paying much tax for the foreseeable future if it does start making a profit.

History: Founded in 1999 and listed on AIM in 2005 with a placing at 134p, raising £6.2m and valuing the company at £35m. The company has been loss making every single year since then – a track record that not even Royal Bank of Scotland can match! This has been funded by patient investors, shares outstanding has grown from 26m in 2005 to 72m at H1 2020. The market the company is going for is huge, the company estimates that phone users spend over $100Bn on apps a year, and app developers around $50Bn in marketing to grow their businesses, according to the 2019 Annual Report.

Shareholders: Liontrust Asset Management of 16%, Odey 12.2% and Herald 12.2% all own over 10%. Well done to the institutions for supporting the losses for this long – I hope that their patience is well rewarded.

Verdict

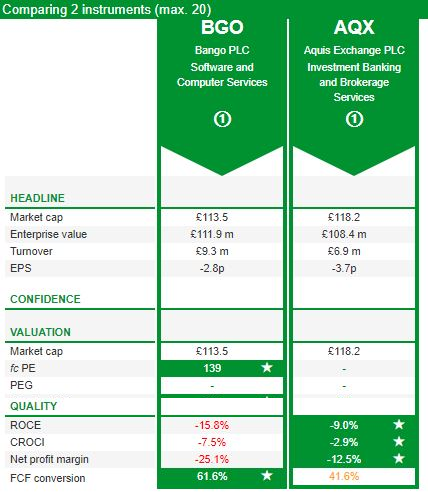

This looks rather similar to Aquis Exchange, a loss making, expensive but virtuous circle “platform” strategy with strong revenue growth. I can’t bring myself to pay 10x revenue for a loss making company, but I can see that if the positive feedback loop works, then returns could be very high. The network effects mean a small amount of capital well spent can be hugely amplified. But it also means that the best resourced product can lose out to competitors who are solving the need in a more efficient way. The classic example is the print edition of the 32 volume Encyclopædia Britannica, 100 full time editors, and more than 4,000 contributors. It was in print for 244 years, but it lost out to Microsoft Encarta and then Wikipedia.***

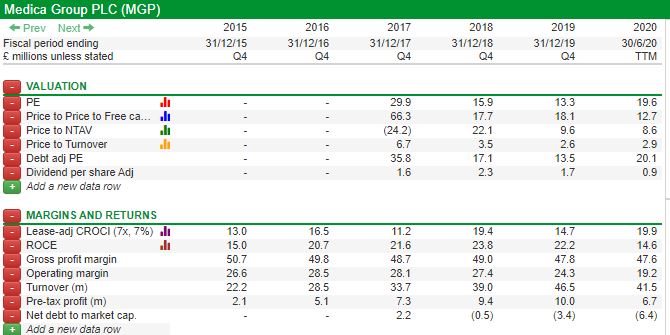

Medica trading update and acquisition

Medica the radiology diagnostics company has bought an Irish business in the same space, Global Diagnostics Ireland (GDI) for initial consideration £14.5m or €16m, plus €4m maximum deferred consideration and £0.7m of stamp duty costs. The company says the acquisition will be earnings accretive, which is a meaningless statement when interest rates are so low. More helpfully lower down the statement the company does say it expects a Return on Invest Capital (RoIC) to be double the company’s cost of capital. I’d assume a RoIC of more than 10%, so adding £1.5-£2m to PBT. The shares were up 10% on the announcement.

History: Set up in 2004, and later backed by Nuffield Health (the UK’s largest healthcare and private medicine charity) in the early years before they sold their majority shareholding to CBPE (previously Close Brothers Private Equity) in a management buy-out in May 2013. CBPE then listed Medica on the LSE main market in March 2017 raising £12m of new money with CBPE and other selling shareholders receiving £107m. The offer price was 135p, which valued the company at approximately £150m market cap.

They have the largest pool of General Medical Council registered consultant radiologist in the UK. The company offers an emergency service (Nighthawk) of interpreting radiology or CT scans, with a turn-around time of less than 60 minutes. Many of the consultants choose to re-locate overseas so that they can work the unsociable hours from a different timezone; Australia has been very popular. AI image recognition is often touted as a threat to qualified radiologists, the company believes technology is likely to be used as a decision support system, rather than to replace a qualified doctor. Professional liability means that doctors are unlikely to outsource final diagnostic decisions to a computer. The company is working with a leader in AI technology Qure.ai, on decision support tools and automated workflow improvement.

Shareholders: As you would expect from a company on the main LSE exchange, there are plenty of institutional shareholders. Liontrust own 12%, Aberforth 10.7%, Gresham House 10%, and M&G 9.7%.

At the bottom of last week’s announcement the company put out a trading update, saying performance has been inline with expectations (although it doesn’t say what those expectations are). Despite being a medical company, earlier in the year they were affected by lockdowns because many procedures were delayed. They don’t expect to be so severely affected this November as the previous lockdown in Spring.

So near term visibility on earnings is hard to gauge. Eventually demand for radiology interpretation and MRI (magnetic resonance imaging), CT (computerised tomography) and plain film (x-ray) images should pick up. Longer term the company was looking to double revenue over the next 5 years (organically, not relying on acquisitions), from the £46.5m reported FY 2019. The company is also investing in technology (up to £6m of capex over the next 2 years) to improve their systems.

Verdict

Historically Medica has enjoyed good top line growth and gross margin of around 50%. But that margin has been trending down over the years. The company says that there has been downward pressure on prices for some time as volumes increase and that this is expected to continue. This does worry me, because if the business is scaleable, theoretically margins should be improving as the company grows. My understanding is that although the company might have scale versus competitor companies, its major customer is the NHS who are able to extract the benefits of scale to their (well UK taxpayers’) advantage, rather than the company’s shareholders. This company has been on my watch list since early 2018, so far I’ve been put off by the demanding valuation, but I’m now following it more closely.

Bruce Packard

Notes

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 09/11/20 – Study silence to learn the music

The US Presidential election turned out to be closer than most people expected. Nasdaq up almost +10% over the week to 12078. Tech stocks reacted well to the uncertainty, but so did 10 year US Bond yields, which initially jumped to 0.9% before falling back to 0.78%. I’m not sure if you’d predicted the result, that you would have then also predicted buying of both Nasdaq and safe haven Govt bonds? Predicting tomorrow’s headlines rarely gives you much investment edge.

Ian Fraser, who has written a good book on the Royal Bank of Scotland debacle, posted this on Twitter about QE.

It’s the sort of thing that doesn’t make headlines, because a slow compounding of risk over many years can go unnoticed. More of the same is different. Perhaps it is the silent risks that we should be listening for?

Stocks this week:

Last week Oxford Metrics, which I own, reported a disappointing trading update. Positive news from Bango, who signed up BT as a customer and Medica made a decent sized acquisition and also updated on trading.

Oxford Metrics Sept Year End Trading Update

This “motion measurement” company which has a September year end, put out a trading statement last week. It withdrew guidance earlier this year but now expects to report revenue of £30.3m (down 14%) and an Adjusted PBT of £2.5m (down 55%) for the FY to September. The company didn’t put those percentage declines in the trading statement, I had to look them up. Funnily enough, when revenue grew last year that percentage growth rate did appear in the FY 19 Annual Report. We can obviously conclude that OMG management are only able to do percentage growth calculations when the result is positive. Their Admission Document is also very difficult to find on their website.

History: The business was founded in 1984, and listed on AIM in 2001 raising just under £6m at 75p per share placing price, valuing the company at £37m. Within a couple of years the price fell to below 5p in 2003 and then slowly recovered over the next decade and a half to hit a peak of 125p at the start of this year, before ending up at 75p currently. The company has issued shares in the meantime (for instance in 2013 issuing 31m shares at 29p to raise £9m to buy Mayrise Ltd). So shares outstanding have increased from less than 50m in 2001 to c. 125m today: hence the market cap has grown to £93m, while the share price is exactly the same level as 2001 when it came to the market. This could explain why the company hides away the Admission Document. Study silence to learn the music*.

Activities: Around 80% of the company’s revenue comes from “motion measurement”, called Vicon. It is used by engineering companies (Thales and NASA mentioned in the Annual Report), hospitals, elite sports athletes, and also in film and video game special effects. The second business is Yotta, 20% of revenues, and loss making last year. This is a Software as a Service (SaaS) model which helps local authorities to manage their infrastructure, such as highways, roadworks and street lighting. Management say the switch away from perpetual licences to SaaS in Yotta has impacted profitability, but should be a long term positive because SaaS generates recurring revenues. The company has an impressive client list, and clever technology and a 5 year strategic plan to “amplify the core”. So far all this is sounds encouraging, but Return on Capital Employed has been less inspiring, as SharePad’s summary chart on the next page shows:

Management and incentives: Nick Bolton, the CEO’s total compensation was £305K FY 19, down considerably from £1.1m FY 18. He also has 1.2m of options with a 0p strike price and owns 2.4m shares or 1.9% of the share capital. He joined the management team in 2005, so wasn’t responsible for the 90% decline post IPO. Nevertheless his compensation does look rather generous for a company whose share price is at the levels when it listed in 2001. My reading of the remuneration report doesn’t reveal much about how the Key Performance Indicators feed into his rewards. There also doesn’t seem to be a Return on Capital Employed (or similar profitability metric) aspiration.

The company’s Chairman, Roger Parry is also Chairman of YouGov, which as I noted a couple of weeks ago has been a ten-bagger, so hopefully he can work some of his magic on OMG. He earns £65K a year and owns 229K of shares (0.18%).

Valuation: The Group finished the year with a strong cash position of £14.9m (15% of the market cap). Return on Capital Employed was over 14% FY 2018 and 2019, although given profits have halved it looks likely this will drop back below 10% when the company reports FY to September 2020 in December. This is fascinating, because my buy hypothesis was for increasing returns, but I think you could also make the case that returns might not recover from this year’s level. The company withdrew guidance, so I’m not sure that the forecast PER is relevant. Instead book value is £31m less goodwill and intangible assets of £12m because the group has grown by acquisition and also capitalised some development costs. This gives tangible book value of £19m, or almost 5x tangible book value which suggests to me the market is already giving management the benefit of the doubt.

Verdict

This is a company I bought in May 2017. I thought that RoE would increase, but I can’t remember why – all I have in my notes is an enigmatic “seems to be doing the right things”.** It is not unusual for company share prices to go nowhere for a decade (or two) before eventually hitting their stride and delivering significantly better returns on capital and revenue growth. Many stocks I own fit a similar profile: Sylvania Platinum, Creightons, Arcontech, SDI Group, Somero and Solid State. I’m hoping this is the case for Oxford Metrics, rather than vague management slogans: what investors really need is for them to deliver increasing Return on Capital Employed in the coming years.

The company expects to report FY results to end of September on Thursday, 3 December 2020.

Bango signs up BT as a customer

Most of the time contract wins from loss making tech stocks can be ignored. But I’m intrigued at Bango’s announcement last week, that it will be managing BT’s subscription services. Bango earns payment revenue from transactions processed through the Bango Platform and data monetization revenue from the insights provided through this activity. The way the company likes to explain the model is Facebook and Google earn advertising dollars by allowing companies to target how those dollars are spent based on what we “like” or what we search for. Yet there are a lot of items we might like or search for, that we don’t actually want to buy.

Whereas Bango uses the payments data to allow advertisers to target their ad spend more effectively, on our revealed preferences of what we spend money on. There’s a summary video here that explains it in more detail: https://www.fmp-tv.co.uk/2020/02/28/video-bango-plc-2020-strategy-day/

At the most recent set of results (H1 to June) Bango’s revenues were growing at 50% year on year to £4.8m. The company was still making a small loss (£397K), but had £4.2m of cash on the balance sheet. What intrigues me is that the company reported a gross margin of 98% in H1 20, which suggests that if they can continue to grow revenue, the business is very scalable and that money should drop right through to the bottom line. At H1 20 there were £38m of accumulated losses recorded in shareholders equity, versus shareholders equity itself of £22.3m and tangible equity of £9.7m. There’s a deferred tax liability on the balance sheet too, but the accumulated losses suggest to me that the company won’t be paying much tax for the foreseeable future if it does start making a profit.

History: Founded in 1999 and listed on AIM in 2005 with a placing at 134p, raising £6.2m and valuing the company at £35m. The company has been loss making every single year since then – a track record that not even Royal Bank of Scotland can match! This has been funded by patient investors, shares outstanding has grown from 26m in 2005 to 72m at H1 2020. The market the company is going for is huge, the company estimates that phone users spend over $100Bn on apps a year, and app developers around $50Bn in marketing to grow their businesses, according to the 2019 Annual Report.

Shareholders: Liontrust Asset Management of 16%, Odey 12.2% and Herald 12.2% all own over 10%. Well done to the institutions for supporting the losses for this long – I hope that their patience is well rewarded.

Verdict

This looks rather similar to Aquis Exchange, a loss making, expensive but virtuous circle “platform” strategy with strong revenue growth. I can’t bring myself to pay 10x revenue for a loss making company, but I can see that if the positive feedback loop works, then returns could be very high. The network effects mean a small amount of capital well spent can be hugely amplified. But it also means that the best resourced product can lose out to competitors who are solving the need in a more efficient way. The classic example is the print edition of the 32 volume Encyclopædia Britannica, 100 full time editors, and more than 4,000 contributors. It was in print for 244 years, but it lost out to Microsoft Encarta and then Wikipedia.***

Medica trading update and acquisition

Medica the radiology diagnostics company has bought an Irish business in the same space, Global Diagnostics Ireland (GDI) for initial consideration £14.5m or €16m, plus €4m maximum deferred consideration and £0.7m of stamp duty costs. The company says the acquisition will be earnings accretive, which is a meaningless statement when interest rates are so low. More helpfully lower down the statement the company does say it expects a Return on Invest Capital (RoIC) to be double the company’s cost of capital. I’d assume a RoIC of more than 10%, so adding £1.5-£2m to PBT. The shares were up 10% on the announcement.

History: Set up in 2004, and later backed by Nuffield Health (the UK’s largest healthcare and private medicine charity) in the early years before they sold their majority shareholding to CBPE (previously Close Brothers Private Equity) in a management buy-out in May 2013. CBPE then listed Medica on the LSE main market in March 2017 raising £12m of new money with CBPE and other selling shareholders receiving £107m. The offer price was 135p, which valued the company at approximately £150m market cap.

They have the largest pool of General Medical Council registered consultant radiologist in the UK. The company offers an emergency service (Nighthawk) of interpreting radiology or CT scans, with a turn-around time of less than 60 minutes. Many of the consultants choose to re-locate overseas so that they can work the unsociable hours from a different timezone; Australia has been very popular. AI image recognition is often touted as a threat to qualified radiologists, the company believes technology is likely to be used as a decision support system, rather than to replace a qualified doctor. Professional liability means that doctors are unlikely to outsource final diagnostic decisions to a computer. The company is working with a leader in AI technology Qure.ai, on decision support tools and automated workflow improvement.

Shareholders: As you would expect from a company on the main LSE exchange, there are plenty of institutional shareholders. Liontrust own 12%, Aberforth 10.7%, Gresham House 10%, and M&G 9.7%.

At the bottom of last week’s announcement the company put out a trading update, saying performance has been inline with expectations (although it doesn’t say what those expectations are). Despite being a medical company, earlier in the year they were affected by lockdowns because many procedures were delayed. They don’t expect to be so severely affected this November as the previous lockdown in Spring.

So near term visibility on earnings is hard to gauge. Eventually demand for radiology interpretation and MRI (magnetic resonance imaging), CT (computerised tomography) and plain film (x-ray) images should pick up. Longer term the company was looking to double revenue over the next 5 years (organically, not relying on acquisitions), from the £46.5m reported FY 2019. The company is also investing in technology (up to £6m of capex over the next 2 years) to improve their systems.

Verdict

Historically Medica has enjoyed good top line growth and gross margin of around 50%. But that margin has been trending down over the years. The company says that there has been downward pressure on prices for some time as volumes increase and that this is expected to continue. This does worry me, because if the business is scaleable, theoretically margins should be improving as the company grows. My understanding is that although the company might have scale versus competitor companies, its major customer is the NHS who are able to extract the benefits of scale to their (well UK taxpayers’) advantage, rather than the company’s shareholders. This company has been on my watch list since early 2018, so far I’ve been put off by the demanding valuation, but I’m now following it more closely.

Bruce Packard

Notes

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.