Like humans, such perfection doesn’t exist in stocks. Like humans, fish in a big enough pond, and for a while, some get as close as possible.

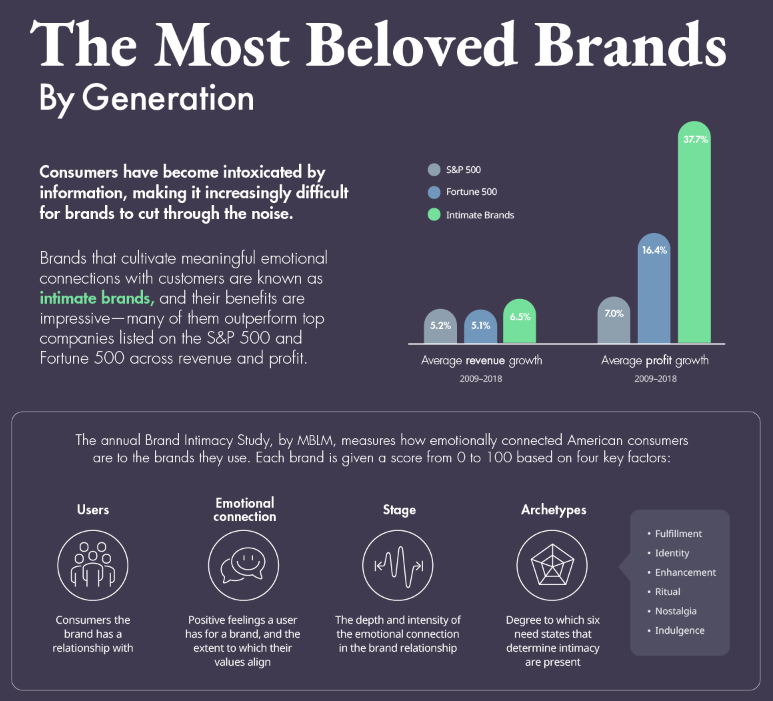

Are they the brands people love the most? Some research by MBLM suggests so. See these images:

Wow, great performing companies, and they outgrow their peers. Plus, they are names we recognise.

But indeed, while that’s a start, it’s not scientific enough. Should we not also look at our traditional factors, such as valuation, growth, and dividends.

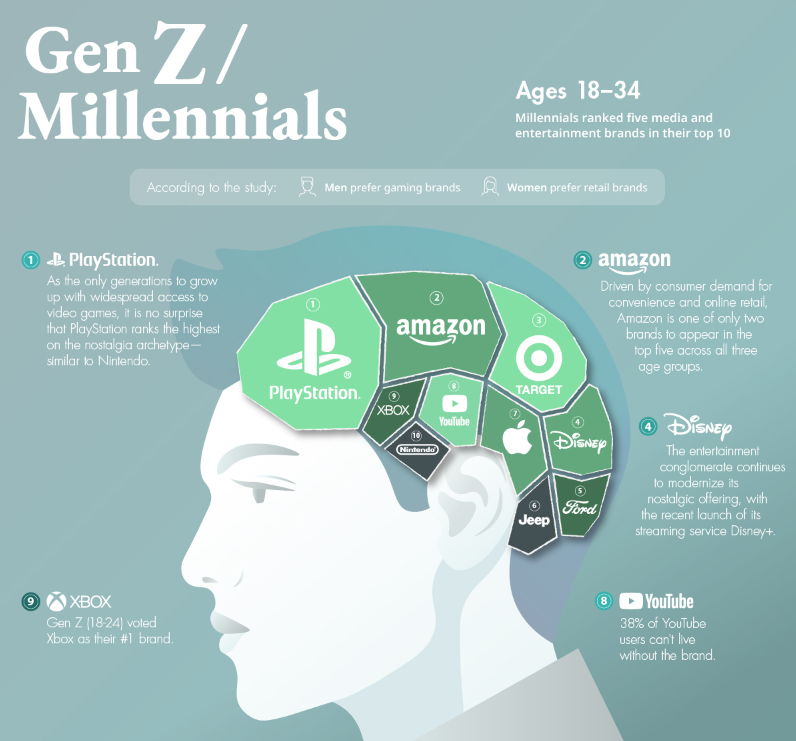

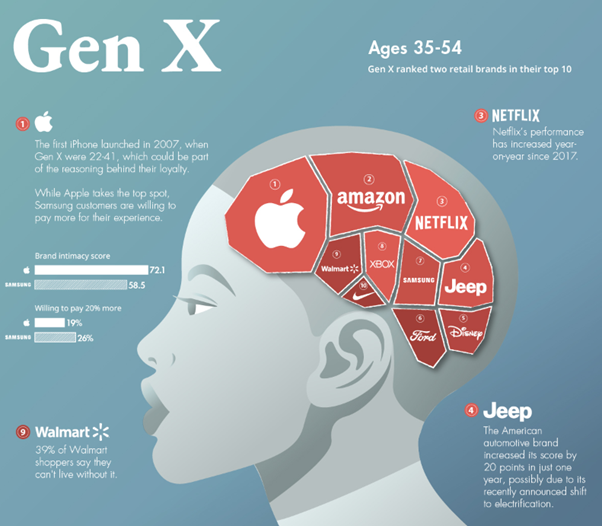

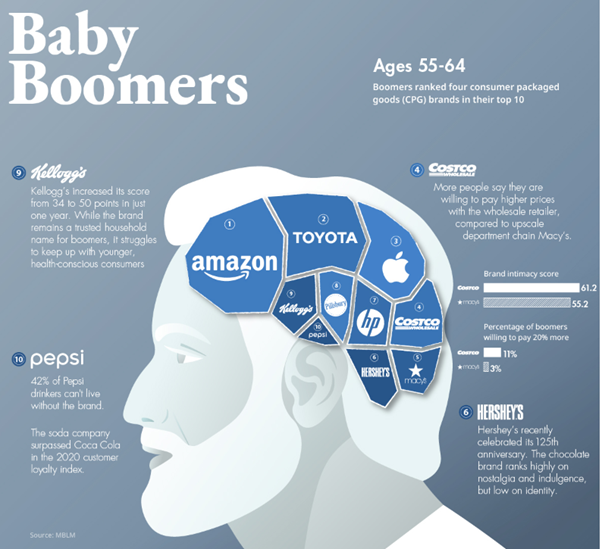

The problem is there is so much from which to choose. See image.

And let’s not forget the buzzword/fad of ‘factor’ investing and gambling on whether we should look only at value, or growth, or income. After all, in the US recently, we know ‘small-cap value stocks have this year been some of the best, outdoing most large-cap growth stocks’.

Sadly, the answer is definitely not ‘factor investing’ – and gambling on what may be the flavour of the month. Instead, you should “Refine Investing”. That means finding pure perfection companies by refining and filtering.

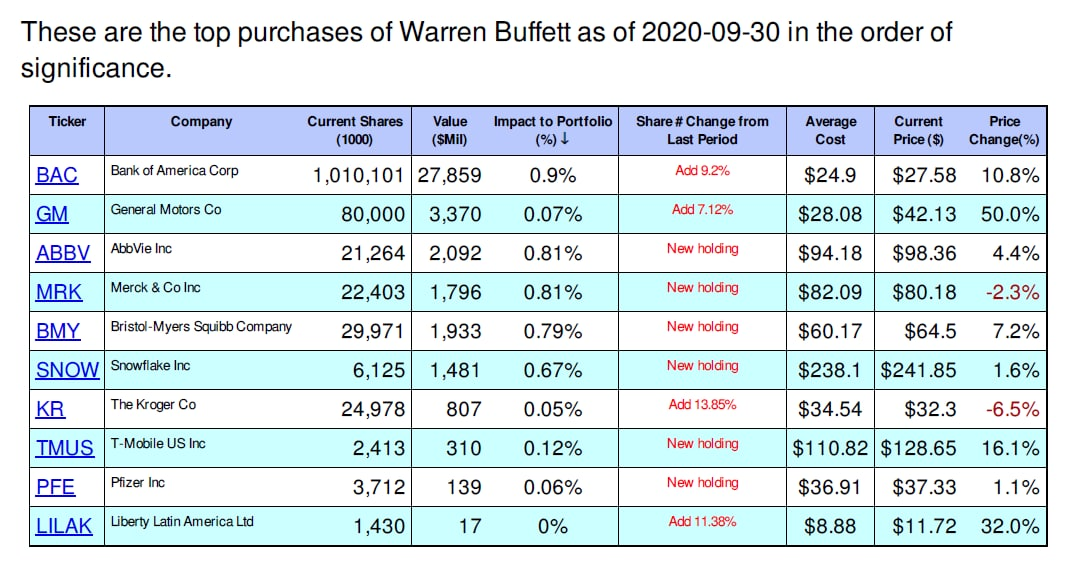

So should we let the experts do it for us and just ride their coat-tails:

You may just go for the helicopter view and say countries matter more than companies.

Since we started talking about big-name brands, let me focus on the S&P 500 with my checklist for investing

I started with the As and these four stood out for me based on their valuations, cash flow, dividends, volatility, performance, technical momentum. All for a 12-month outlook.

- Amcor

- AIG

- Applied Materials

- Assurant

More to follow in future columns. As ever, if any fall more than 25% from the highest point since entry, then exit would be my policy.

Alpesh Patel OBE

Founder of Alpesh Patel Special Edition of Sharescope

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.