Here is a slice of stock market history for you, an interview with Peter Lynch from 1996. Lynch was a famous American fund manager. Asked the secret of his success, he replied:

“Well, I think flexibility is one of the key things… I always thought there were good opportunities everywhere and I researched my stocks myself… So I think it was just looking at different companies and I always thought if you looked at ten companies, you’d find one that’s interesting, if you’d look at 20, you’d find two, or if you look at hundred you’ll find ten. The person that turns over the most rocks wins the game. And that’s always been my philosophy.”

Much like a private investor, Lynch did his own research. I will speak for me, rather than you, when I say he must have had a much more highly developed work ethic. In his book “Beating The Street” he talked of turning over thousands of rocks a year.

Lynch retired in 1990, and so in one respect he was at a great disadvantage to the modern-day private investor. He must be amazed at the data available now though. Recently, I have adapted my SharePad set up so I can turn over even more rocks.

Keep it simple

The cornerstone of my setup remains the KISS+ filter. KISS, stands for Keep it Simple (Stupid) and the plus sign is just a reminder that I have improved this filter over the years. The point is to quickly rule out companies I am most unlikely to invest in, because:

- They are loss-making and unsuitable for analysis using the ratios I lean most heavily on like return on capital employed, cash conversion, and pe ratios.

- They have made very large acquisitions, changing the nature of the business and making it harder to understand.

- They are heavily indebted, and consequently more risky for long-term investors due to the effect of gearing, which amplifies profit both as it goes up and as it goes down.

- They listed in the last four years, and therefore have very short track records for us to judge them by.

These criteria are discussed in more detail here.

Knowing what not to turn over

There is no point in turning over rocks if we know that we are not going to find what we want under them (in Lynch’s analogy it was grubs). But, as a reader pointed out to me, one element of the KISS filter was perhaps reducing the number of rocks with something precious hidden under them. The original KISS filter ruled out a long list of sectors that I do not feel qualified to analyse or am just prejudiced against.

Mostly these are highly cyclical sectors (they experience wild swings in profitability) but that does not mean every company in them is cyclical. Often for historical reasons, companies are sometimes categorised in sectors that no longer apply to them, and so the KISS+ filter overlooked shares I would be interested in. In some cases it ruled out shares I already owned.

Secondly the point of turning over rocks is to find something new, but by only turning over rocks in sectors we are familiar with that will become increasingly difficult.

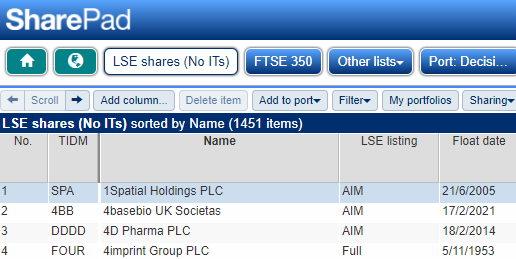

So I have scrapped the sector criterion and instead filter a list of all shares on the stock exchange except Investment Trusts, a total pool of 1,451:

Source: SharePad. You can select a list like LSE shares (No ITs) by clicking the Other lists button.

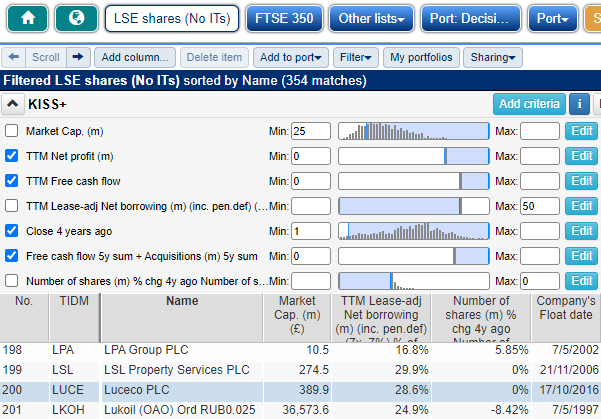

The screenshot below shows the results of the filter with only the criteria I consider to be nigh-on non-negotiable activated:

- Profit above zero over the last twelve months reported

- Free cash flow above zero over the last twelve months reported

- Close price above 1p four years ago (i.e. the company was listed then)

- Free cash flow earned by the company is greater than the total amount spent on acquisitions

Incredibly, only 354 out of the 1,451 shares meet these loose stipulations. Still that is 354 rocks to turn over. The unticked criteria are:

- A market capitalisation of at least £25m

- A Net debt to capital ratio of less than 50%

- And no increase in the share count over the last four years

If I were to tick them, the number of rocks would fall to 99.

Source: SharePad. Of the 1,451 shares, only 354 meet my basic criteria

A share is not interesting because it meets these criteria, it just might be. However tightly we define our filter at some point we need to move on and consider other factors, start turning rocks over in other words.

Until recently I would click around in SharePad noting things that heightened my interest, mainly in Financial charts and in the Financials, News, and DD tabs (the DD tab tells us who owns the firm).

But since SharePad introduced the Single Page Summary there is a less haphazard way of turning over rocks quickly. It allows us to gather information from around SharePad on the same page:

![]()

Source: SharePad. The Single Page Summary is in the middle of SharePad’s main menu, just to the right of the orange Search button.

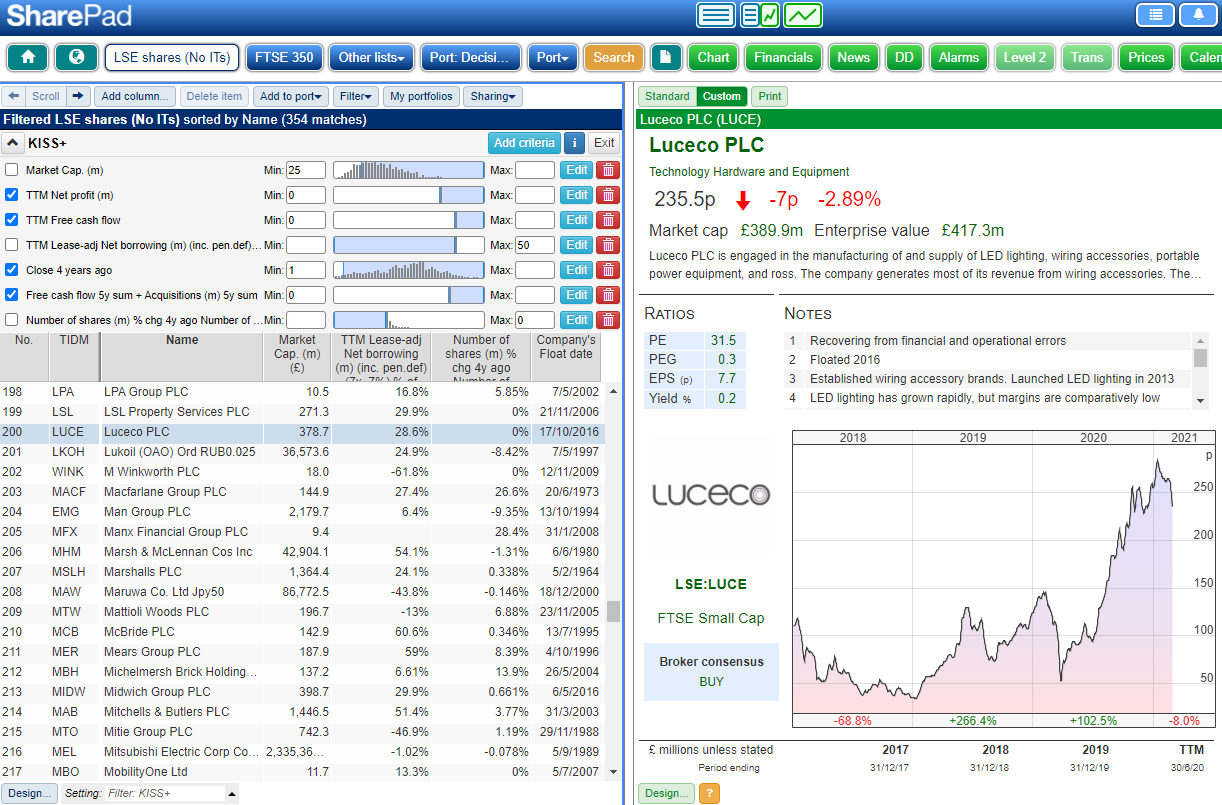

Normally the Single Page Summary fills the whole of SharePad, which is inconvenient if we are using the spacebar to move through a list, but we can replace the information in the right-hand panel of SharePad’s standard dual view layout by pressing SHIFT as we click on the button. This means we can move down through a list and immediately see the information we need on the right:

Source: SharePad. The Single Page Summary alongside the KISS+ filter and results. Click on the image for a full-sized version.

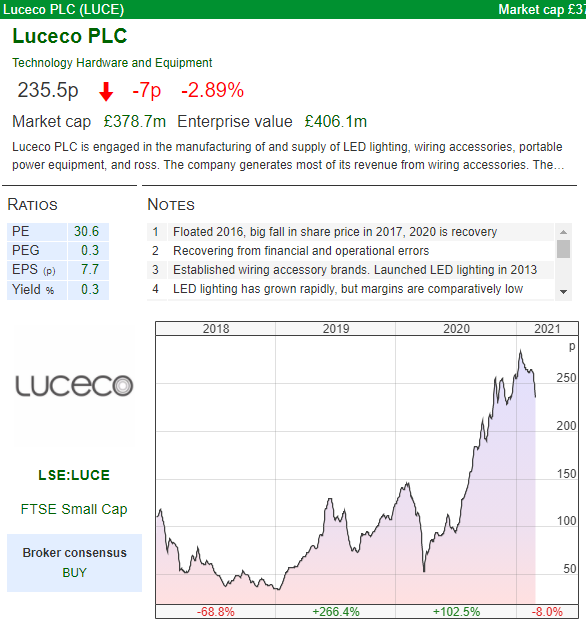

Although we cannot change the layout or components of the first section containing the share price chart, we can add notes, which is useful as we build our impression of each firm. I have chosen Luceco:

Source SharePad: The top section of the Single Page Summary contains a useful notes section.

The Financial Overview will bend to our every whim though. Here you can see how I have used it to tell me more about the company’s performance:

Source: SharePad. The Financial Overview section of the Single Page Summary can be customised to show the data you need.

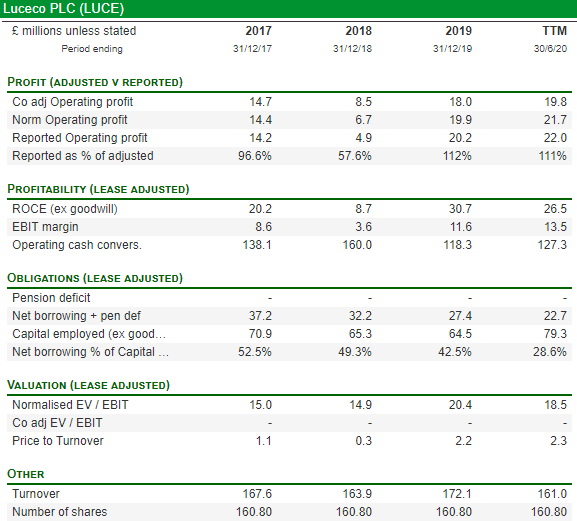

The first section of this table is copied straight from one of my Custom tables. It shows the discrepancy between reported and company adjusted profit. Ostensibly, companies adjust profit to give us a better understanding of how the company has performed, but they can also use adjustments to exaggerate.

If there is a large discrepancy between reported and adjusted profit, as there was in 2018 when Luceco’s reported profit was little more than 57% of company adjusted profit, it is a complication that will need investigating.

The other sections allow us to see how profitable and indebted the company has been over time. Apart from that blip in 2018, Luceco has been highly profitable, and debt is coming down. It could be my kind of company.

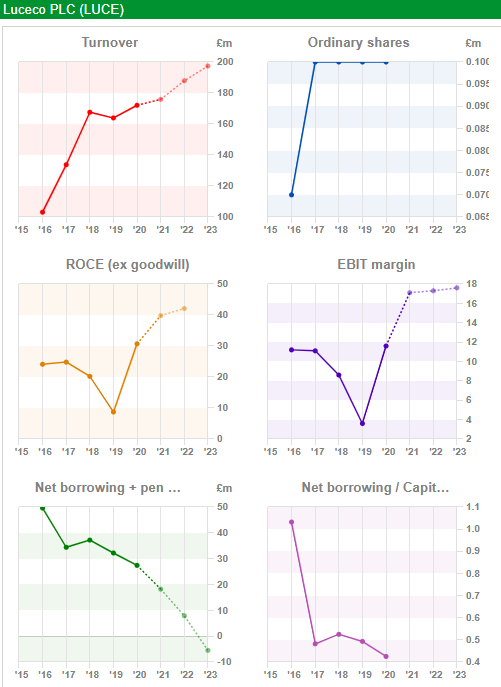

As well as giving us the same data in visual form, the Mini Charts in the next section also allow us to see further back into the past, and further forward into the future (the dotted lines are forecasts):

Source: SharePad. The Mini Chart section of the Single Page Summary shows us selected data of our choice over a longer time period.

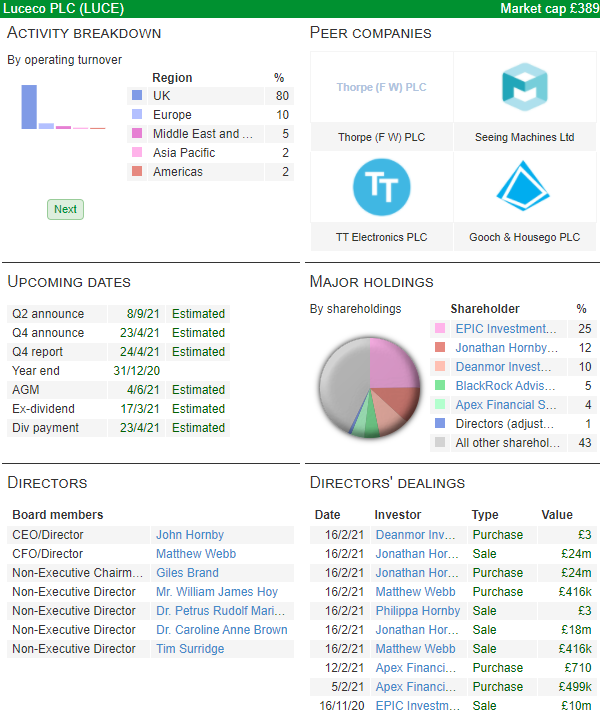

The final section, a collection of Data Boxes, collects data from all around SharePad:

Source: SharePad. This is a selection of the Data Boxes available. My design includes two others: News and Company Information (the company’s address, telephone number and website).

The Major Shareholdings caught my attention. Jonathan Hornby is the chief executive and owns 12%. He has led the firm through two successive buyouts, the latest involving the major shareholder EPIC Investments, which floated the company in 2016 and retains a 25% shareholding.

It is reassuring they have retained substantial holdings, although perhaps less so that judging by recent dealings they have been net-sellers.

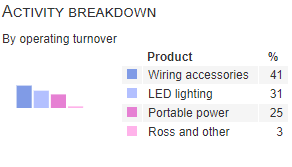

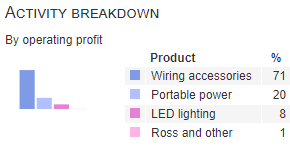

The Activity Breakdown is also interesting. Click ‘next’ to move beyond the geographical breakdown and you will see the turnover and profit from Luceco’s operating segments:

|

|

Source: SharePad Single Page Summary

The company’s biggest division by turnover is Wiring accessories (plug sockets, fuse boxes and so on) marketed under the BG brand. Its second biggest division is Luceco, which makes LED Lighting. Rather excitingly Luceco only launched its first lighting range in 2013 and it has grown to be 31% of a business turning over £160m. Clearly the company thinks lighting is the future as it has adopted the name for the whole group.

But Luceco only contributes 8% of the firm’s profit. That the company places so much emphasis on LEDs makes me wonder about the growth prospects of its highly profitable but somewhat staid electrical accessory ranges. And if the growth is to come from Luceco, I wonder how profitable it will be…

Complications. At some point you hit them. I must decide whether to learn more about Luceco and perhaps overcome these doubts, or put down this rock and pick up another one.

If I do that, at least my work has not been wasted. My notes are stashed in SharePad, should I return to Luceco.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard