I do not think it is unfair to say that over the last decade we have seen a powerful shift in sentiment towards utility stocks, arguably in a very negative direction. For much of the last few decades, private investors could not get enough of these boring stocks. They paid out a generous dividend, seem to be backed by real assets that threw off lots of cash, and they also seemed wonderfully defensive.

But then, after the global financial crisis, something changed. Perhaps because the recovery from the global financial crisis proved so protracted and difficult, investors began to notice that utilities were becoming the subject of intense public attention. The regulators, especially in the UK, noticed this zeitgeist change and also changed their attitudes. Until fairly recently these faceless bureaucrats seemed happy to allow the utility businesses to up charges so that they fund extra capital spending. But customers noticed and utility bills even became the subject of intense general election political scrutiny. How many of us chortled when Ed Milliband talked about price caps, but that amusement soon vanished when a Conservative government introduced a price cap.

Arguably the logic behind increasing customer bills to allow for increased capital spending hadn’t gone away. The debate around climate change meant that many utility businesses needed to engineer a reboot of their whole energy infrastructure which would in turn require huge extra expense. But customers, regulators and politicians seemed collectively unwilling to pay. The same seemed also to be true for other utilities such as telecoms and broadband. Sure, we collectively want more next gen broadband and mobile telephony but competition remains intense and most customers don’t seem terribly happy to pay anything extra for the ‘new experience’.

Stepping back from this by the beginning of the last decade no one could miss the bigger picture. More investment was needed, but customers were not willing to pay and regulators were not happy to countenance big new spends funded by higher consumer prices. Margins started falling sharply, debt levels crept up inexorably but spending on new capex did not seem to go away. Utilities suddenly became unloved. Their dividends also seemed to be increasingly uncovered by cash flows and investors started to take note, tempted as they were by dazzling, new growth models emerging out of the new technology infrastructures emerging.

At the same time as this disillusionment with utilities became pronounced, another alternative claim on investors’ attention emerged. Infrastructure funds. From just a handful of funds during the GFC, this sector has exploded in scale in the UK and now comprises tens of billions of pounds in dozens of funds. What was once seen as alternative is now absolutely regarded as mainstream – see our last note two weeks ago on INPP.

This huge growth in investor interest in infra assets has sucked money away from the utility sector. And one can in truth understand why. Many of these infrastructure funds don’t seem massively concerned by operational risk. They have contracted, stable cashflows, backed by governments which can be paid out directly as dividends. In a sense, infrastructure is a de risked version of utility investing. In this new investment model, there is no need to worry so much about say price caps. You just wait for the government backed or mandated cheque to arrive like clockwork.

But as the infrastructure space has expanded almost exponentially, these specialist funds have run into a challenge. There is only a limited number of classic public private partnership business models and projects available to suck up all that money – especially as PFI and PPP projects have been scaled back in the UK. That in turn has forced the infrastructure funds to move into classic utility projects – INPP for instance owns the gas network Cadent which is the UK’s largest gas distribution network. This is, of course, a valuable piece of infrastructure but it is also a utilities business and in truth price caps have had some impact on its business model. So, as we head into a new decade, we start to see a convergence, between the boring, unloved utilities sector and exciting, low risk infrastructure investing. The circle is closed and more and more infra specialists find that they are in reality operating classic utility assets. Equally more and more classic utilities operators such as SSE are dumping their customer facing operations and focusing instead on purely infrastructure-based projects.

This is the background behind our latest Prudent 15 funds, Ecofin. The lead manager is Jean-Hugues de Lamaze and he has 29 years of experience in equities and utilities/ infrastructure investments. Earlier versions of this fund focused exclusively on utility stocks but over time the managers realised that the bigger opportunity was this convergence of utility and infrastructure assets. Thus, the new version of the fund emerged a few years back with an explicit two-part focus, on both sectors – utilities and infrastructure assets.

Currently the portfolio has around 40 equity investments, across a relatively broad remit and is able to invest in:

- Transport – including roads, railways, ports and airports.

- Utilities – including generation and distribution of gas, electricity and liquid fuels together with renewable energy.

- Water & environment – water supply and wastewater together

I think this new dual focus makes a great deal of sense. Many utilities have traded at a decent discount whereas many infrastructure assets have traded at big premiums. These two sectors will now converge and Ecofin is a smart way to play this trade, with the discount on the fund slowly tightening over the next few years. In addition, you get access to a concentrated portfolio of real assets, with real inflation protection and a generous, well covered income stream.

FUND BASICS

|

What is in the fund?

In the table below I’ve pulled out some key metrics on the main portfolio holdings – as you can see you’re getting a truly global mix of assets, mostly large cap, in a sensible mix of underlying sectors, with classic utilities the largest single sub sector. Looking at the biggest holdings in the fund, Enel is a huge Italian energy company, also heavily involved in natural gas. After that comes NextEra Energy which is a major US – Florida based – player in renewable power with over 46,000 megawatts of generating capacity with assets such as Florida Power and Light. Although its legacy business is huge – it’s the largest regulated electric utility in the US domestic home market – it is also the world’s largest generator of wind and solar power. RWE is a German Utility business moving aggressively into renewable power as is its Spanish peer Iberdrola and National Grid from the UK needs no introduction for a UK audience.

| Portfolio Composition: Geography

North America 40% Continental Europe 38% UK 12% Portfolio Composition: Sectors Utilities 24% Transportation 16% Integrated 39% Renewables inc yield cos 21% Largest Holdings Enel 5.9% NextEra Energy 5.2% RWE 4.5% Iberdrola 4.4% EDP 4.3% Endesa 3.9% National Grid 3.7% Exelon 3.2% Spark Infra 3.2% Engie 3% |

Perhaps a more useful way of understanding how the portfolio has evolved is to look at some of the more recent purchases in the fund. Analysts at Marten and Co recently reported on these recent trades, noting that the manager is currently “favouring toll roads over airports as he expects much faster recovery in road traffic than air travel. Airport companies have been hit by loss of retail income as well as landing fees. With many airlines in trouble, there may be pressure on fees going forward”. Other additions to the portfolio include Atlas Arteria (formerly Macquarie Atlas roads) and Ferrovial, Heathrow’s owner. These are both existing holdings within EGL’s portfolio which have been increased. One other slightly more adventurous addition is China Longyuan Power Group, Asia’s largest wind power producer, which was also added to the portfolio in recent months.

Performance

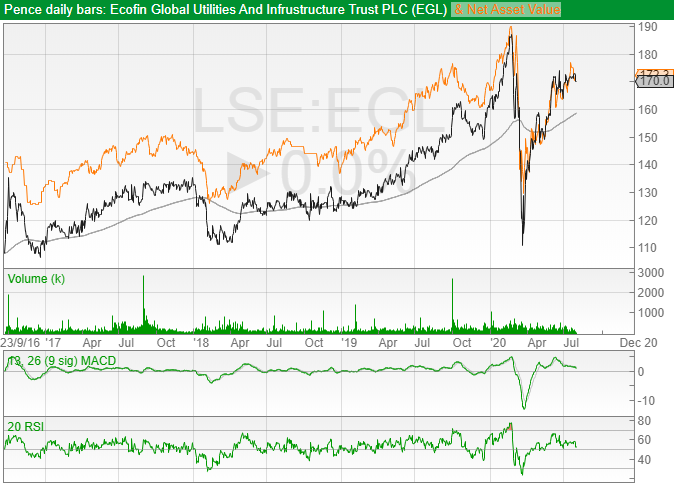

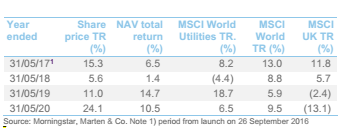

Since emerging in its current form in Autumn 2016 – earlier versions included a split capital structure – returns have been strong. In the year to 30/04/20 the NAV TR has gained 25.4% and the share price 66.8%. Over the same period, the S&P Global Infrastructure Index is up +1.5% and the MSCI World Utilities Index has risen +23.4%. The table below sums up the returns to the fund on a year by year basis – the fund has beaten the MSCI World utilities index in all but one year since 2016.

In terms of recent numbers, we now have data for the second quarter of 2020 – according to a note by Marten and Co on performance, “NAV performance was very strong in Q2 as a whole, on an absolute and relative basis, and year-to-date the NAV and share price have registered total returns of 1.7% and 3.6% apiece, while the MSCI World Utilities and S&P Global Infrastructure indices have registered returns of -1.9% and -13.9%, respectively, and the MSCI World Index has returned 1.3%.”.

And what about the impact of the CoVid-19 emergency? How has this impacted this most defensive of asset classes.? Overall, as you would expect the impact has been muted, if not marginally positive for some businesses in the portfolio. For instance the managers point to NextEra Energy (www.nexteraenergy.com), which says it will be disappointed if it is not able to deliver financial results at or near the top end of its adjusted EPS expectation ranges for 2020, 2021 and 2022. The US energy giant predicts 12% dividend growth in 2020 and around 10% growth in 2021 and 2022. For many other utility businesses such as National Grid it’s a similar steady as she goes story.

The Bottom line: dividends and some capital growth

First and foremost, I would argue that EGL is a quality equity income play, targeting a dividend yield of at least 4% on its net assets. Crucially that income is largely backed by strong, reliable cashflows. For the year ended 30 September 2019, the trust’s revenue was 5.48p per share, sufficient to cover the dividend 0.86x, with shareholder reserves accumulate dover time filling in the gap. The equivalent figures for FY18 were 4.82p and 0.75x. In December 2019, the board resolved to increase the quarterly dividend by 3.1% to 1.65p per share, per quarter, equivalent to 6.6p per annum.

I also like the fact that the fund is diversified geographically, with only 15% of assets in the UK. The foreign investments all strike me as boring, dependable businesses, many of which are transforming themselves from operationally risky utilities businesses into more dependable infrastructure investors. Also, crucially, much of that ‘repositioning’ in businesses such as Iberdrola, a big Spanish player, is in the fast-growing renewables space where Ecofin is building a strong position.

Risk

There are some risks with this fund though. It is an equity income play and thus its shares can prove volatile and the funds likely long-term returns will be dependent on the strength of the underlying cashflows from the mega cap corporates in its portfolio. Intense pressure form regulators might push those cashflows down, especially if more countries start to adopt stringent price caps. It’s also worth noting that many of the portfolio business boast high levels of gearing, which might undermine consumer confidence. Add up all these factors and it’s quite possible that the fund’s shares might prove more volatile than expected, moving in and out of discounts. As a general rule I wouldn’t be keen to buy this fund on a premium but would absolutely top up if the discount widened out to 5% or more. I personally rate this fund a solid, long term buy.

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com