The safe bet on infrastructure: INPP (International Public Partnerships)

Over the next couple of articles, we’ll be adding two new funds to our Prudent 15 list, both in the broad infrastructure and utilities space. My next article will be on a fund that invests very broadly in the shares of other infrastructure and utility companies – the fund is called Ecofin. This week though we are focusing on what I think is the best quality, defensive play amongst the growing army of infrastructure funds listed on the London stockmarket. In essence, the broad listed infrastructure breaks down into four separate niches – core infra funds, renewables funds, social housing and property funds plus a small tail of alternative energy funds involved in energy efficiency or energy storage.

The most established niche are the core private public partnership funds which invest in UK and global PFI (private finance initiative), private public partnerships and other ‘outsourcing’ investment structures. This tight bunch of funds – currently five operate in this space – have amassed a huge amount of capital by investing in the equity of various state run projects around the world. HICL and INPP are the original and arguably still the best funds in this space – the former (HICL) is managed by InfraRed Capital Partners. If I’m honest I’d be perfectly happy investing in either of these two well established, popular funds, but on balance I think the former fund, INPP, is the slightly safer bet. INPP – which stands for International Public Partnerships – is managed by a very experienced team at Amber Infrastructure headed by Giles Frost.

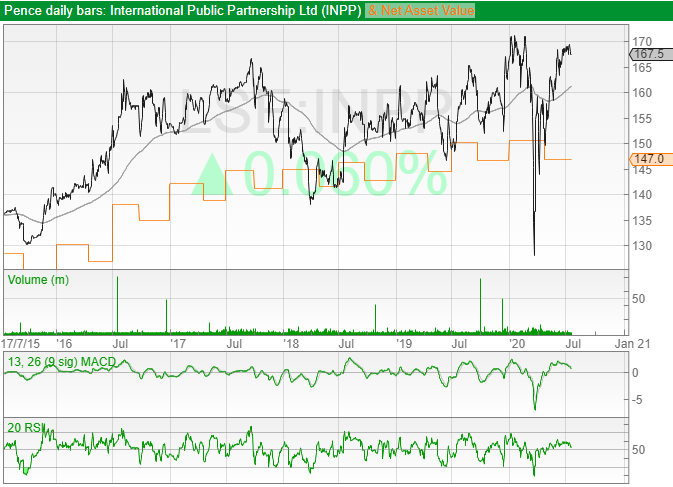

Source: SharePad

As we discuss above, this fund invests in a largely UK based portfolio of assets which range from PFI schools through to utility businesses, taking in military houses, police stations and train rolling stock. The core focus is on equity positions within complex public private partnerships which sit on top of a series of loans which help to finance a particular project. In the original business model, the focus was very much on PFI projects but as these have fallen out of favour – both amongst policy types and the Treasury – a wider range of business models have emerged, all of which involve some form of partnership model where (usually) some governmental entity operates an asset while the private sector helps fund the purchase of the asset. As the sector has grown that model has evolved and there are newer iterations of the business model which involve less state involvement and are in effect pure utility ownership structures (as in Cadent – see below).

But what unites all these various structures are a number of common features. The first is that we have (usually) rock solid counter parties in state entities who have a legal obligation to pay. Some funds invest in projects where revenues are dependent on the economic cycle and can thus vary whereas most core infra funds (INPP) tend to invest in projects where payments will be made regardless of the economic situation.

Many of these contracts also involve some inflation protection, buttressing regular cash flow payments. As we’ll discover these inflation clauses usually tend to assume inflation rates of between 2 and 3% but if rates exceed these levels, cashflows will increase in line with either RPi or CPI.

Stepping back from this we can see that these core infra funds tend to be defensively positioned with relatively low levels of risk and fairly predictable income payouts which should grow over time. That doesn’t mean there are no risks. As we’ll discuss, there are some explicit risks, especially around government policy, but our sense is that these risks have started to ebb.

Basic Facts about INPP

- 130 investments

- 89% in equity and 11% debt

- 91% operational

- 52% life of under 20 years

- Weighted average portfolio life 34 years

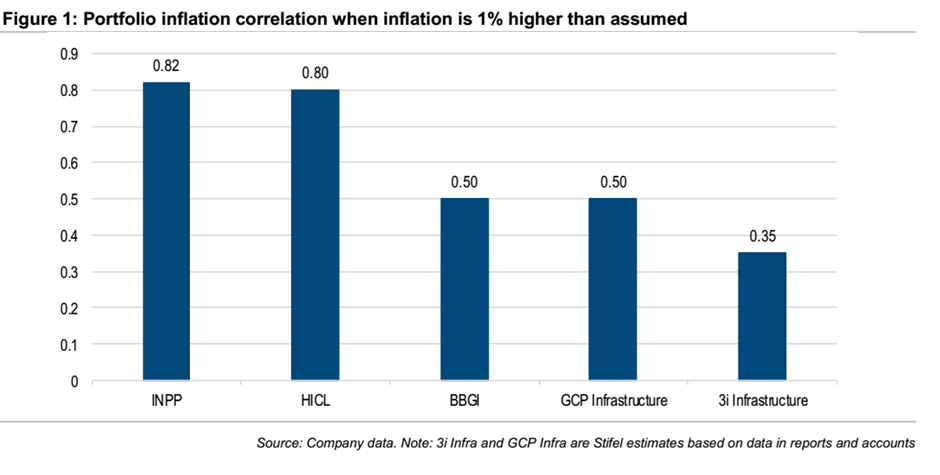

- Portfolio inflation linkage – 0.82% p.a. projected increase in return for a 1% increase over anticipated average inflation across portfolio

- 2020 dividend 7.36p, 2021 target 7.55p, AIC OCF 1.1%,

- Share price 169p

- NAV 152p

- Discount/premium 11%

- Yield 4.5%

- Market cap £2.7 bn

- 1 year Nav returns : 5.2%, 3 years 20%, 5 years 49.4%, 10 years 119%

- provide essential infrastructure to over 13m people

Portfolio

The best way to understand INPP is to look at its last most detailed report based around the end of 2019 numbers. At that point the INPP portfolio was valued at £2.38bn, and was churning out a portfolio return of around 7.5% per annum.

Sitting at the core of this portfolio are a series of long term contractual arrangements “current average remaining portfolio concession life of 34 years against a weighted average debt tenor of 32 years”. What that means is that INPP invests in a bunch of projects/concessions which have an average life span of around 34 years from now, under written by debt structures where the loans have an average 32 years to run. INPP’s equity sits on top of that debt.

So, what’s physically in the portfolio ? In terms of sectors the mix is as follows: energy transmission 22%, Transport 20%, Education 18%, Gas Distribution 17%, waste water 9%, plus some courts, military housing. In terms of geography its mostly but not exclusively UK focused – the UK comprises 73% of the value of the portfolio, Belgium 9%, Australia 8%, and Germany 4%.

Big investments include the following:

- NeNEX a German Rail business which leases rolling stock

- Cadent – an energy infrastructure business (see below)

- Various offshore Transmission Projects – these connect 1.5 GW of renewable energy to the UK grid, enough to power 1.3 million homes (individual projects include the Lincs OFTO, Ormonde OFTO plus Robin Rigg OFTO)

- The huge new Tideway super sewer under River Thames

- INPP has also committed £17m to UK digital broadband infrastructure

- German police headquarters in Offenbach

- 266 schools

- Reliance Rail in Australia

- A range of US Military Housing

As I’ve already alluded to, INPP (like HICL and other infra funds) has slowly moved with the times, investing less and less in ‘traditional’ PFI or PPP structures and more in hybrid structures or straight utility businesses. One of its biggest investments which fits nicely into this latter category is Cadent. This utility business supplies gas to c.50% of the UK population, connecting 11m UK homes and businesses through its monopoly ownership of its gas distribution network. INPP first invested in Cadent in 2017 as part of the Quadgas Consortium comprising Allianz, China Investment Corporation, Dalmore Capital, Hermes, Macquarie Infrastructure and the Qatar Investment Authority. In aggregate, INPP has invested c.£426m and now holds a 7.25% ownership interest in Cadent and as at the endo last year, INPP’s stake in Cadent was valued at £407.4m, representing 17.1% of the portfolio value, and was the largest single investment.

The investment in Cadent does pose more risks for a cautious player like INPP. There are some big risks here not least that the energy utility business is subject to an increasingly aggressive regulatory regime. In recent weeks that risk has come firmly into view as Ofgem have published their draft determinations in respect of the forthcoming price control period 2021-2026.

This controversial document openly talks about halving the allowed rate of return from where it was set in the previous price control period April 2013-March 2021. It’s fairly likely that INPP would have sensed that a tougher regulatory environment was on its way – it would have been difficult not to spot the political cues. And in fact INPP back in 2017 when it made the initial investment, anticipated a lower return in the future – and then subsequently reduced the valuation of its investment in anticipation of lower expected cashflows as a result of a tougher regulatory environment.

According to fund analysts at Numis there were some obvious “disappointing elements within the detail, as well as some positives. The review process is not complete, and any financial impact will be determined following the outcome of the consultation, and any other market events that may happen in the meantime. Any valuation adjustments, if required, are likely to be factored into INPP’s 31 December 2020 NAV….Our initial thoughts assume there is no need to materially adjust the Cadent valuation at this stage based on the proposed headline allowed return of 4.2%.”.

But this Ofgem review does highlight the policy risks of investing in utility assets. But they don’t stop there. Cadent is also playing an innovative role in supporting the UK Government’s net zero target through its green energy trial, ‘HyDeploy’, which is injecting up to 20% of hydrogen into an existing natural gas network. On paper that looks very promising and as we move to a carbon neutral energy system, Cadent could be in a sweet spot. But there also risks. A move to a new energy input could bring huge risks – and public attention – with some very obvious costs to consumers during the transition. One can only imagine what could go wrong – I can well imagine headlines could read something like the following, “Families can’t afford the transition from natural gas to hydrogen. Politicians demand inquiry and lower profits!”.

Recent Results

A few months ago, in April, INPP released its full year 2020 results, and as you’d expect from a cautiously run business the numbers were fairly solid. The total return in net asset value was a solid 10.3% for the year, with the NAV (after dividends paid out) increasing from 148.1p to 150.6p in 2019 while the 7.18p dividend for year, was up 2.6%. The board also announced dividend targets of 7.36p and 7.55p for 2021 and 2022 with a caveat around Covid-19 uncertainty. Crucially the board confirmed that there had been no material change to operational performance since update on 26 March. A fair bit of attention has been on the construction of the mega water project, the Thames Tideway (9% of NAV) which remains an obvious focus here given that construction has largely shut down. According to Matt Hose, a funds analyst at Jefferies “while there are clearly cost implications with doing so, the project’s valuation has weathered cost increases before due to a built-in buffer. “

Crucially INPP still has plenty of financial head room for new deals – the £400m revolving credit facility is currently only £13.4m cash drawn and the fund also has free cash reserves of £91m, albeit before the dividend payment. Looking at that dividend specifically, the fund has a healthy cash dividend cover of 1.3x for the year. The forward guidance on expected dividends has not been amended but the board is ‘mindful of the current COVID-19 related uncertainty‘.

Risks and Rewards: Inflation and Policy

The discussion around Cadent should have alert readers to what I think is the most obvious risk – policy and politics. Many of the infra funds fell sharply in 2018 and 2019 was the Labour party explicitly targeted the sector with confiscation and/or nationalisation. With the change in party leadership, my hunch is that that risk has diminished but not entirely gone away. In fact I wouldn’t be surprised to see some form of tougher regulatory environment promised by all the main parties in the next general election – whenever that is (currently 2024). Even the Conservatives have realised that there’s political capital to be had form being seen to be tough with the City and Big Finance.

I’m also specifically worried that as consumers realise the true cost of the energy transition, they’ll start to worry about the costs. As I’ve mentioned, the transition around home gas supplies is full of risk and I’m not confident that Cadent – and others – won’t turn into villains.

In the short term there’s also the risks associated with CoVid and the devastating economic after math. Most of INPP’s assets are fairly well insulated form this cycle but that doesn’t mean there won’t be impacts, not least on construction projects involving the Tideway. Most fund analysts expect to see some impact from Covid 19 movement restrictions for instance, representing 17.8% in aggregate of the portfolio, and there could also be unforeseeable longer term risks we can’t even quantify yet,

Another challenge, arguably less a risk, and more a “quandary” is that as more money floods into the infrastructure space, returns will start to fall. Everyone and their aunt in sovereign wealth land wants a piece of the action – solid, stable long term cashflow based assets – and that’s pushing up valuations which ahs the effect of reducing yields. To be fair to INPP, the fund is already ahead of the game on this ‘quandary’. It’s board recently took the view that it needed to lower its target return which has now been set at 7% pa. According to a Numis report on this move, “The Board concluded that the previous 8% target needed changing given the evolution of infrastructure into a mainstream asset class, the reduction in long-term interest rates to 1% pa from 5% pa when the initial target return was set, and the compression on returns across all real asset classes.”

But mixed in with all the risks is an opportunity – inflation. Most investors fear inflation but the evidence is that gentle rising inflation – without big blow out surprises – is actually positive for most equities as long as the rate doesn’t shoot away past say 6 or 8%. And infrastructure funds in particular could be big beneficiaries of an increase in inflation rates. Analysts at brokers Stifel, recently did some maths on inflation and infra funds and INPP came out on top.

According to Stifel, INPP assumes 2.75% long term inflation in UK, 2% in Europe and 2.5% in Australia. In terms of actual inflation measures used, INPP’s contracts are typically linked to RPI in UK whereas most non UK projects are linked to CPI. Cadent and Tideway are also linked to CPI using a version which includes owner occupied housing costs from 2021 through to 2030. Overall Stifel reckons that a 1% increase in inflation assumption over the life of the projects adds 10.2% NAV to the funds value. The chart below puts that upside for INPP within a wider sector content.

Stifel – the Inflation opportunity and Infra funds

Bottom line

Since IPO in 2006 to the end of 2019, INPP has delivered a total shareholder return of 209.3%, or 9.0% pa. That’s a remarkable return for what is supposed to be a boring asset class. My hunch is that over the next decade, those returns will be a great deal lower. I think the 7% estimate by the board at INPP is probably about right, with the income yield running at around 4.5% pa, plus a few per cent of capital gains. Still even if the return is between 6 and 7%, that is a decent steady number in a market where valuations look excessive. If we compare infrastructure funds with other real asset backed structures such as real estate investment trusts (REITs), I’d much prefer to be in businesses with cashflows that boast a higher proportion of predictable, government backed revenue streams , policy risks notwithstanding. INPP strikes me as the most interesting player in the space, with a strong balance sheet, good diversification between different sectors, a growing international presence and a highly respected management. That said I’d could easily see investors swapping back and forth between INPP’s nearest rival HICL which is also a quality play in similar markets and boasting similar metrics.

Numis View

INPP is “a core holding based on its high quality and predictable income stream, generated from a diversified asset base. The shares are trading on a 10.1% premium to NAV which compares with a weighted average premium of 16.2% for the peer group, and a prospective yield of 4.4% rising to 4.5% based on a target dividend for 2020 and 2021 financial years of 7.36p and 7.55p, respectively, in line with a target annual increase of c.2.5%. Management commented in its June update that it currently has good forward-visibility of project cash flows although it continues to monitor the portfolio for the impact of Covid-19 related risks that it has highlighted. Historic dividend cover at December was 1.3x.“

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.