One of the questions I’m frequently asked is how I structure my day.

Time is a trader’s most important currency because sometimes it can be the first person eats, the second person goes hungry. Being alert and organised is the key to performing well.

My day starts early compared to most at 04:45. Before I made the move to trading full time, this was an abhorrent time of the morning that I’d only ever seen in my student days after a big night. But now if I don’t set an alarm I will almost certainly wake well before 06:00.

Once my alarm goes off, I go downstairs and pour a coffee. It’s important to build up habits that ease the routine. Knowing there is a fresh pot of coffee that is already brewed makes it a lot easier. Setting it up the night before and putting it on a timer means one less job in the morning.

During my coffee I’ll sit down and check my Twitter, just in case there’s anything I need to be aware of for the morning open. I’ll also just enjoy the calm and silence, and after twenty minutes or so I’d work out in my home gym and run along the beach, and now that I’ve moved to London I’ll hit the gym and/or run through Primrose Hill.

I would strongly urge any trader to do physical exercise in the morning before the day’s onslaught begins. I did get an email from a gentleman recently saying that, at 76, he probably wasn’t going to undertake a strenuous physical routine (which is entirely understandable) – but even just a brief walk outside can work wonders. Trading is a brutal profession and despite being sat around for long periods of time it can require fast attention and action at any moment, and the stresses and strains of losing money or missing out can be tough.

Having a few losing trades in a row can be frustrating, and there is always the niggle to increase your position size to make it back, or to stop trading even though you know you have a winning system. You need to be able to discipline your emotions and the best way to do that is to have discipline as a habit.

I finish my exercise around 06:45, and sit down at my screens.

The Regulatory News Service

The London Stock Exchange’s RNS feed begins rolling at 07:00. Before that, I check Twitter again and one of the chatrooms I’m a part of to see if anybody has posted any interesting news.

Contrary to what a lot of people believe I don’t consume mainstream media. I don’t watch news or read any newspapers (not even FT) because it’s not an effective use of my time. Anything of interest will get picked up on in my network of traders who I speak to, on the main feed on Twitter, or in the chatroom or my Facebook group.

There are enough people who do watch news who act as a filter for me and save me time – anything that may be worth reading will make its way to me without me having to spend time scanning news.

For example, Boohoo has been the subject of many newspaper articles the past way. I don’t need to read the entire article of a headline that suggests Boohoo uses slave labour to know what the article is about. Nor do I need to read it when several independent investigations found no evidence of slave labour.

What matters is how the price is going to respond to the headlines, and so this is why I don’t read or watch news.

Around 06:50-55 I will load up SharePad and check the charts of my positions. Do I need to buy or sell? If so, I’ll note this down.

At 07:00 the Regulatory News Service (RNS) feed begins running. This is where companies announce price sensitive news and the official channel for communicating with the market. Financial results, contract wins or losses, trading updates, directorate changes, placings, and other announcements are all released here.

This hour between 07:00 and 08:00 is the most important part of a UK stock trader’s day. In SETSqx stocks, the market makers can begin to set their prices whenever they want. The market makers aren’t obliged to deal until the market opens at 08:00, but I’ve often dealt in the pre-market (before 08:00) with the market makers well before the market opens. Therefore, if you can spot an opportunity, and the market makers will deal, you can pick up competitive prices for stock.

Four in play

At 07:28, I’ll begin to pick four stocks in play. The stocks in play are the stocks that I feel have the greatest potential for volatility, and as traders we want to be in these stocks. You can be the best trader in the world – but you won’t make a penny in a dead stock that’s not moving.

Once I’ve picked up to four stocks in play, I’ll then look at the chart and make notes on what can happen, and how I intend to trade the stock. Using “if X then Y” statements can be great because it removes discretion. For example, if the stock is gapping up then I get long, and if the stock breaks down through a level I sell. Many traders run around like headless monkeys when the bell begins, frantically dealing anything and everything, and by 09:00 they wonder why they’re down. Having a clear plan will mean you are able to move swiftly and decisively.

At 07:50 I’ll start preparing my tickets and the opening SETS auction begins. This is the time to start getting potential orders ready to be sent to the market. I’ll look at the indicative volume and price and submit limit orders to the market to get involved.

I’ll make sure that the stocks in play are on my 1 minute candle charts so I can keep track of the price.

From 08:00, the market makers are obliged to make a market, the opening auctions begin to uncross, and trading begins.

After the close

A lot of trading is about waiting – waiting for the optimum setup and the optimum entry. If I don’t see what I want to see then I’m not going to trade it. In this instance trading is like poker only we don’t have to play every hand and there is no penalty for not doing so.

However, this does not mean the day is complete.

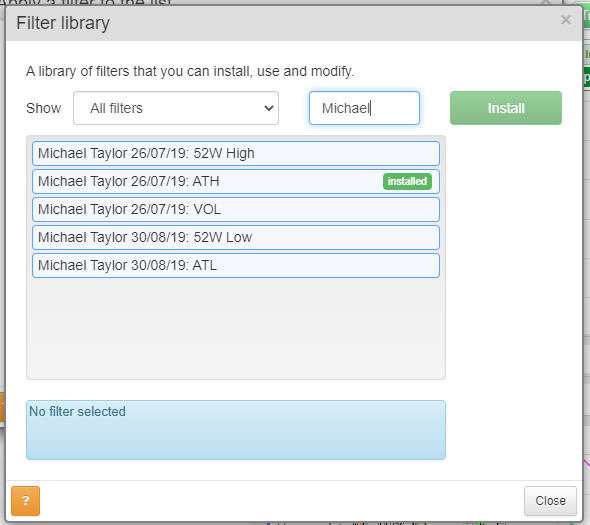

Once the market has closed and the closing auctions are complete, I’ll then load up my filters on SharePad. You can also use my filters, by searching my name. Here they are.

I usually run the 52W high and VOL ones, although if it is a downtrending market I’ll be looking for stocks plumbing new lows and so I’ll use the 52W Lows.

If any of these filtered stocks are of interest, I’ll add them to my watchlist, or if I want to trade them tomorrow I’ll add them to my evening review sheet.

This is where I write down what happened, a brief commentary on the market, and positives and negatives of the day. I also use it to write down trading ideas for the next day.

Structuring your day, and building consistency through habits, brings about certainty in an uncertain profession. It also makes everything easier, because a trader without discipline will soon become an ex-trader.

Michael Taylor

Michael has released his UK Online Stock Trading Course sharing his knowledge and how he trades the stock market. ShareScope & SharePad subscribers can take advantage of an introductory offer by visiting www.shiftingshares.com/online-stock-trading-course

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.