It would be convenient to report that I diligently pick every share I investigate from a Sharepad filter of exquisite construction, but it would be untrue. Sometimes I click around randomly until I find an interesting stock. I had heard Bunzl had had a “good pandemic”, and when I saw that its PE ratio and […]

Weekly Commentary: 31/08/20 – Let the future ≠ the past

Nasdaq continued to hit new highs, at 11,666 up +30% from the start of the year and up 2.5x in the last 5 years. I can’t think of anyone suggesting in January that all three of I) Gold, II) Govt bonds and III) Nasdaq would be up strongly from the start of the year. Such […]

My two ETF Growth Portfolios

This week I am focusing not on my usual subject of investment trusts but switching attention to exchange traded funds or ETFs. These are a useful vehicle for investors, and I think they can easily sit alongside investment trusts. What do I mean by that? Let’s say for instance that you want to have exposure […]

The Trader: Working Through Rough Periods

Unless you’re an Instagram trader, set with a laptop by the pool and a Lamborghini in the background, everybody goes through rough patches in trading. It is a fact. So much of this business is uncertain, and ironically people want to get into trading for the ‘freedom’ it provides. But free we are not, and […]

Weekly Commentary: 24/08/20 – Searching for uncorrelated returns

Rightmove released a survey showing that the UK housing agreed sales picked up strongly to a record £37bn. A day later Persimmon reported half year results to end of June, adding that reported sales since the start of July were up 49% vs the same period last year. This would not have come as a […]

The Trader: A Day In The Life of a Stock Trader

One of the questions I’m frequently asked is how I structure my day. Time is a trader’s most important currency because sometimes it can be the first person eats, the second person goes hungry. Being alert and organised is the key to performing well. My day starts early compared to most at 04:45. Before I […]

A safety first stock

I found James Latham a couple of months ago when I was trawling for cheap shares with strong balance sheets. The shares are still cheap, James Latham’s Price Earnings (PE) ratio is 13, and the balance sheet should remain strong… Centuries trading timber James Latham has a long and storied history. It manufactured plywood for […]

UK banks – in the eye of the storm?

Every crisis presents opportunities. A contrarian strategy of buying bank shares during the point of maximum gloom during a recession has often, but not always, been a good idea. It most definitely failed in 2008 when banks needed to raise capital and had to rely on Government bail outs. But it has worked in previous […]

Weekly Commentary: 10/08/20 – The last “forever” stock

The last “forever” stock For Jeremy’s last weekly note he reviews his value investing mistakes and aims to find the stock that in 10 years’ time will ensure he is remembered fondly. Read more

Preparing for the worst, capitalising on the best

Listening to Porvair’s long-standing chief executive Ben Stocks talk about the challenges ahead, it is clear the company is bracing itself. Phrases like “preparing for the worst, hoping for the best”, and “the overall balance is negative”, come readily to him. This is a company I have long admired, but I have never had the […]

The Trader: Knowing Your Market

We have covered many aspects of trading in previous articles, such as Why You Should Be Using R, Exit Strategies, and How To Avoid Blowing Your Account, and having had conversations with recent traders it is clear that knowing your market in what you trade is a necessary criterion. This article will introduce new traders […]

Weekly Commentary: 03/08/20 – Lessons

Lessons In the spirit of reflection in a year of uncertainty and extremes, Jeremy analyses some past weekly notes and takes another look at one he wants to dig his heels in on and say “I am sure I am right”. Read more

Prudent 15: Ecofin Global Utilities and Infrastructure Trust (EGL)

I do not think it is unfair to say that over the last decade we have seen a powerful shift in sentiment towards utility stocks, arguably in a very negative direction. For much of the last few decades, private investors could not get enough of these boring stocks. They paid out a generous dividend, seem […]

Screening For My Next Long-Term Winner: Fever-Tree Drinks

They say mums always know best. Mine has bought Fever-Tree tonic waters for some years now and I recently asked whether she remained a customer. This was her response. “While we don’t buy many commercial drinks for home consumption these days I would still definitely buy Fever-Tree, generally the original tonic water. I went into […]

Weekly Commentary: 27/07/20 – The Relative Value Trade

The Relative Value Trade With a huge injection of liquidity last week the valuation differential between large US tech stocks and UK small companies is becoming extreme. Jeremy takes a look at the relative merits of LoopUp vs Zoom and Beeks Financial Cloud vs RobinHood. Read more

Making a new discoverIE

I discovered discoverIE using a simple and fruitful method of finding new investment ideas: a list of shares sorted in SharePad by previous annual report date. Having squinted for a few minutes at financial charts showing profitability, cashflow and debt (more on that later), I thought the company looked promising: Sorting a list in SharePad […]

Weekly Commentary: 20/07/20 – Clearing up the debris

Clearing up the debris The pace of structural change is faster, perhaps, than ever before and there are an increasing number of quoted companies dedicated to managing this change. A new entrant into the insolvency funding market, RBG Holdings, could well be set to benefit despite a number of red flags. Read more

Prudent 15: International Public Partnerships

The safe bet on infrastructure: INPP (International Public Partnerships) Over the next couple of articles, we’ll be adding two new funds to our Prudent 15 list, both in the broad infrastructure and utilities space. My next article will be on a fund that invests very broadly in the shares of other infrastructure and utility companies […]

Screening For My Next Long-Term Winner: Headlam

Let me start by thanking you for clicking on an article with Headlam in the title. Rest assured, not everyone will want to read about this rather dull business that has suffered badly during the pandemic. But for us contrarians, now may be the time to consider such stocks — unloved names that the market […]

Weekly Commentary: 13/07/20 – Flight to Quality

Flight to Quality As the bubble spreads from large tech to healthcare and motor companies in anticipation of a flight to quality Jeremy takes a look at Judges Scientific and SDI Group. Read more

Volex: Reassuringly above average

If you’ve read my recent articles you will know I have been ranking shares using basic financial statistics. I found Bioventix by ranking five criteria. The objective was to find profitable companies mostly financed by equity rather than debt, with high quality assets and low valuations. The more profitable, the more conservatively financed, and the […]

Weekly Commentary: 06/07/20 – Inflation

Inflation The growth bubble continues, but eyeing inflationary storm clouds gathering over the horizon Jeremy takes a look at Melrose Industries as a potential hedge against inflationary threats. Read more

Dynamic 35: Witan Investment Trust

Witan – a long term buy and hold globalist fund with a value bias Investing should really be about simplicity. Take global investing. Nearly every investor should have some exposure to a globally diversified mix of developed world stock markets. How big that exposure depends on your risk tolerance and your own appetite for global […]

Weekly Commentary: 29/06/20 – Director Dealing

Director Dealing As markets tread water after extreme volatility Jeremy finds that directors have a 77% win rate on their purchasing during the volatility. A trawl of those still underwater may indicate some treasures that are overlooked. Read more

The Trader: Examining Retail Trading Behaviour

One of the many oft-repeated quotes around traders is that 90% of traders lose money. However, this depends on how one classifies a ‘trader’. Many people – and I can believe that it is 90%+ of people – lose money when they enter trading. But often newcomers aren’t coming into the market prepared. There’s a […]

A cheap profitable share with a strong balance sheet

Today I have added two more criteria to turn the list of cheap shares with strong balance sheets I made in my last article into a list of cheap profitable shares with strong balance sheets! The profitability criteria are free cash conversion and return on capital employed. This table shows the individual and aggregated rankings […]

Weekly Commentary: 22/06/20 – High Conviction from here on

High Conviction from here on With the seamless transition from bear market to bubble Jeremy suspects that now is a time to make sure we have conviction in our holdings. Tatton Asset management is his highest conviction holding. Read more

Ranking potential bargains

A SharePad customer, Chris, reminded me of the power of ranking recently, when he emailed to say (among other things): “I find that I am playing with spreadsheets to get the data in place rather than actually making decisions. I guess sometimes too much data can be detrimental…” Decisions are hard, and messing around with […]

Weekly Commentary: 15/06/20 – On-line valuations

On-line valuations The silly valuation of the latest US IPO causes Jeremy to ponder some of the UK online valuations and finds the spreadbetters to be under appreciated by UK markets Read more

Prudent 15: The SDCL Energy Efficiency Income Trust

The SDCL Energy Efficiency Income Trust The idea of investing in a fund which will help facilitate the transition towards a more sustainable energy mix has spawned a small army of London listed closed end funds and investment trusts. At last count there are over a dozen such funds listed and with all of them […]

Screening For My Next Long-Term Winner: Frontier Developments

Has the market become too obsessed with ‘pandemic-proof’ shares? I ask because my SharePad screening has brought Frontier Developments to my attention. The shares of this computer-game developer have leapt 66% so far this year as industry sales rally during the lockdown. However, Frontier’s accounting looks rather questionable and the near-£800 million market cap seems […]

Weekly Commentary: 08/06/20 – The Recovery Trade

The Recovery Trade In this strong market the pain trade is to buy. There are reasons this could be right and Jeremy suggests the carpet retailers recovery potential hasn’t yet been reflected. Read more

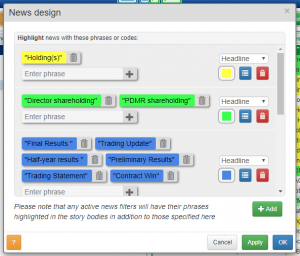

The Trader: Taking advantage of ShareScope News

In this article, I’ll show how you to set up your news feed in order to get the best out of your subscription. First of all, we need to click “News” at the top of our ShareScope across the main toolbar. This brings up the raw RNS feed that we need to filter and make […]

Weekly Commentary: 01/06/20 – Dash to Trash

Dash to Trash After 14 years of growth out-performance, value is now set to perform in a recovery. Jeremy takes a look at the value available in the high street banks and wonders if the value will out. Read more

Getting to grips with software companies

First, an admission. The software biz is a bit of a mystery to me. There’s a vast ecosystem of enterprise solutions, software that businesses increasingly need to operate, but how do those of us whose technical skills extend little further than Word and Excel decide whether these solutions and the companies that code them are […]

Dynamic 35: Hg Capital

A smarter way of buying into the right kind of private growth businesses It is an unfortunate truth that more and more high growth businesses are choosing to stay private and ignore the public markets. Collectively we investors, institutional and private have done our best to make life difficult for highly rated , fast growing […]

Weekly Commentary: 25/05/20 – Investing in Intangibles

Investing in Intangibles Intangibles take greater precedence today. Both accountants and governments struggle with this while markets are quick to find answers through royalty companies. Trident looks potentially interesting while Duke Royalty may have a good concept but may have strayed into private equity land. Read more

The Trader: Five rules for traders

A combination of market volatility and being locked in during lockdown has led to many turning their eye to getting involved in the stock market. The failure rate for traders is estimated to be around 90%, and many of the spread bet firms report that 70%+ of clients lose (the real figure I believe is […]

Weekly Commentary: 18/05/20 – Investing in Acquirors

Investing in Acquirors Jeremy worries about software valuations and is concerned that returns at Ideagen and Tracsis could turn out to be far less than markets appraise them to be. Read more

The changing shape of QinetiQ

I have picked QinetiQ from my “Cash King” filter because it was one of the more reasonably priced companies that passed all the criteria. It’s debt-adjusted PE ratio is 14. QinetiQ makes Rattler, a supersonic target that simulates air-launched anti-radiation missiles. Source: QinetiQ annual report 2019 The company is a defence technology business, once part […]

Screening For My Next Long-Term Winner: Hikma Pharmaceuticals

One way to invest during the pandemic is to consider shares that have climbed higher as the market has dropped. Such companies may well be ‘safe havens’ — businesses that are coping well with the lockdown, or perhaps even benefitting from the crisis. I applied the following simple criteria within SharePad to identify potential ‘pandemic-proof’ […]

Dynamic 35: Edinburgh Worldwide

Edinburgh Worldwide – a great long-term home for growth investors Investors in funds such as Scottish Mortgage will have noticed a very peculiar phenomenon over the last few turbulent weeks. On paper many of the growth-oriented businesses sitting in its portfolio stand on huge valuations (very high price to earnings ratios) which means that they […]

Weekly Commentary: 11/05/20 – The 50-year view

The 50-year view As equity markets squeeze up Jeremy suggests equities may have further to go on the back of credit markets. A screen of resilient dividend payers finds 3 strong fund managers to be some of the best performers in the current money printing environment. City of London Investment Group is the recovery situation […]

The Trader: How to Avoid Blowing Your Account

The market is moving with extreme volatility in recent weeks. This offers traders many opportunities to prosper and profit, but volatility is a double-edged sword. It can be your best friend one day and your worst enemy the next. Many traders love volatility when the trade is going in their favour, but struggle to deal […]

Weekly Commentary: 04/05/20 – The Small Cap Opportunity

The Small Cap Opportunity With markets squeezing up, pushed by central banks money printing we are at a moment of opportunity for overlooked small cap stocks. Jeremy takes a look at Eddie Stobart Logistics and FBD Holding as two complex and therefore potentially overlooked situations. Read more

In search of the cash kings

While the stock market and the pandemic may have stabilised, I’m still thinking about financially strong firms. We never know when the next shock will happen, and a cash cushion gives us confidence a company will make it through when revenue melts away. I spent the last two articles experimenting with filters to find financially […]

Weekly Commentary: 27/04/20 – To the Future

To the Future With markets trending sideways Jeremy sees inflation ahead and takes at look at the food manufacturers which could be beneficiaries. Devro’s sausage casings could benefit in due course while Greencore could be a recovery stock. Read more

The Trader: Why You Should Be Using R

R is a component in trading that we use to define risk. It is a crucial aspect of trading systems and by thinking in terms of R we can improve our results. In this article I will introduce to you the concept of R and how to use it for your own trading. It is […]

Prudent 15: Ruffer Investment Company

The Ruffer Investment Company – big bets on a global new normal “There are decades where nothing happens; and there are weeks where decades happen” Lenin Generally, I have a very dismissive attitude towards the idea of absolute returns funds. The concept sounds alluring, whereas the delivery tends to be fairly dismal. The key idea […]

Weekly Commentary: 20/04/20 – Depression in a Wall of Money

Depression in a Wall of Money The market is caught between an oncoming depression and a wall of money inflating valuations. In this environment the bar bell approach is more appropriate than ever. Jeremy looks at Genus, Aquis Exchange and Urban Exposure as companies at differing ends of the bar bell. Read more

Filtering for financial fortresses

The conclusion of my last article on finding companies with strong finances contained two caveats. Companies with seasonal cash flows can look like they have strong finances at the end of the financial year, when they report, but be weaker at other times during the financial year. Also, strong finances are not necessarily the result […]

Weekly Commentary: 13/04/20 – With Recovery comes Refinance

With Recovery comes Refinance It is easy to stress over whether we are in a bear rally or the start of a bull market. But we know that companies have stressed balance sheets from disruption. Rather than chase individual opportunities it may be simpler to own the quoted brokers. This could be their time. Read more

Screening For My Next Long-Term Winner: A Covid-19 Special

Let me start with a confession.This Covid-19 ‘Special’ may not be all that special. I have just applied a new SharePad screen to seek ‘quality bargains’ amid the market chaos — and sadly the results were not that inspiring. The problem is nothing to do with me or my filters or SharePad. Instead, the Covid-19 […]

Weekly Commentary: 06/04/20 – After Value comes Recovery

After Value comes Recovery In a world full of value Jeremy takes a look at what a recovery may look like and picks a couple of cyclical recovery stocks with strong balance sheets that should benefit strongly in recovery. Mission Group and Zotefoams. Read more

Dynamic 35: Augmentum

A big bet on Fintech worth taking at this price – Augmentum OK, I’m not going to beat around the bush. l readily concede that now is not a great time, all things considered, to be talking about investing in a high-risk venture capital fund that invests in equally high risk private European fintech firms, […]

Putting safety first

Funny thing (peculiar, not ha! ha!). Search SharePad news for the phrase “strong balance sheet” and there are dozens of companies every day confirming their finances are strong as they reflect on the prospect of reduced, or in some cases, no revenue for a while. Search SharePad news for the phrase “weak balance sheet” though […]

The Trader: Why the trend is your friend

“It is a truth universally acknowledged, that a single man in possession of a good fortune, must be in want of a wife.” Whether or not you agree with Jane Austen’s opening line in Pride and Prejudice, by the end of this article I hope you will agree with my version. “It is a truth […]

Weekly Commentary: 30/03/20 – Value time

Value time With no earnings visibility it is easy to forget there are green shoots over the horizon. This is a time to seek value. A SharePad screen reveals 11 situations, of which 6 look worthy of further research. Read more

Weekly Commentary: 23/03/20 – Irrational or True?

Irrational or True? We are now in a market of fear and there are signs of inefficiency and irrational behaviour, which is a time of opportunity. Jeremy highlights Plus 500 with conviction. Read more

Prudent 15: BH Global

Kicking off with BH Global (BHGG) You can always read more about my views on funds at my blog www.adventurousinvestor.com. I update this most days, especially useful during these volatile times when new investment opportunities emerge very quickly. I’m not going to bore readers with speculation about viruses and volatility but simply ask them to […]

Getting more out of return on capital

How we measure return on capital depends on what we want to know: whether a company is good at making profit from its operations, or whether it is good at buying other businesses. As I write, the stockmarket is crashing. I have invested in strong businesses that should prosper through thick and thin, but that […]

Weekly Commentary: 16/03/20 – Timing is everything

Timing is everything With the current crisis Jeremy dusts off the recovery stocks folder. Airlines that survive will have huge upside on the back of a lower oil price. The opportunity may be in the likely refinancing issues, and Primary bid is a useful tool to enables retail investors to participate. Jeremy registers his interest […]

The Trader: Exit Strategies

In April 2017, I had a real nightmare. I had been trading full time on the market for four months and had had enormous success buying bubbley story stocks and riding them upwards. I was convinced that I knew what I was doing. I made all the classic mistakes of complacency, which turned into denial […]

Screening For My Next Long-Term Winner: AB Dynamics

Recent market ructions have sent many shares tumbling — and perhaps created some buying opportunities. Amid the mayhem, I devised a straightforward screen. I simply looked for decent-sized businesses that were still expected to grow, paid a dividend and were conservatively financed, too I applied the following criteria within SharePad to identify some respectable candidates: […]

Weekly Commentary: 09/03/20 – Purging Excess

Purging Excess Bear markets cleanse excess. Jeremy takes a look at the growth narratives and accounting adjustments that have been adopted and suspects the bear market may continue until these are cleansed. Read more

Going for repeat business

Fundsmith Equity probably needs no introduction. Since its launch in November 2010 the fund has racked up class-leading annualised returns of more than 18%, compared to less than 12% for an index of global equities, by investing in high quality businesses at attractive valuations. You can, of course, make further comparisons, and explore the makeup […]

Dynamic 35: Syncona

The genomics revolution and the appeal of Syncona It’s easy to get carried away with the short to medium term noise coming out of stock markets. The corona virus has sent investors in the developed world heading for the exit. But in truth some sectors of the giant ‘technology’ sector were already beginning to suffer […]

Weekly Commentary: 02/03/20 – Correction or Bear Market?

Correction or Bear Market? The question of whether the sudden market correction is a temporary contagion of fear, or the beginning of a bear market is key now. Fearing the bear, Jeremy finds a lot of attractions in Andrew Sykes. Read more

The Trader: Optimising Your RNS Feed

In this article, I’ll show you how to clean up and manage your RNS feed by adding a filter and removing noise, colour coding your RNSs, and highlighting words and phrases within the stories itself. We’ll also get rid of all stocks without EPIC codes. The RNS feed is an important part of the screen […]

Weekly Commentary: 24/02/20 – Barbell Portfolio

Barbell Portfolio The tax advantages of technology companies and private equity combined with quantitative easing are shrinking stock markets. Until this changes the shrinkage will continue. In this environment a Barbell portfolio is likely to outperform. Jeremy suggests Alpha FX and Non Standard Finance as two companies at polar opposites of the valuation spectrum. Read […]

Taking back control

Richard investigates Dialight, a supplier of industrial LED lighting that flared up ten years ago briefly setting the stock market alight, and subsequently dimmed alarmingly. What are its prospects now it is taking back control of manufacturing? Ten years ago Dialight was a feted, fast growing business in a booming industry, LED lighting, but it […]

Dynamic 35: Scottish Mortgage

I must say I’m very excited to be writing for SharePad and ShareScope. I’ve been an avid user of both for more than 10 years and I know that both products are widely used by smart investors who want to a more in-depth analysis of stocks and funds. Many of you will know me from […]

Weekly Commentary: 17/02/20 – Dinosaurs don’t gallop

Dinosaurs don’t gallop Jim Slater coined the term “elephants don’t gallop” and in this technology enabled era it may be better termed “dinosaurs don’t gallop”. In a hunt for tech enabled small companies Jeremy finds himself enamoured with Plus 500. Read more

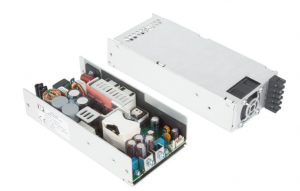

XP POWER

Older readers may recall a distant era when electrical devices used to plug straight into the wall. Nowadays, everything electrical seems to need an annoying little box between it and the wall. That box is called a power supply and these are the business of XP Power. But not the annoying ones. XP doesn’t do […]

Screening For My Next Long-Term Winner: Boohoo

Cash flow movements can often indicate whether or not a business enjoys a powerful operational advantage. A strong business might: Receive customer payments upfront for goods/services it has yet to deliver, and/or; Pay suppliers months after goods/services have been received. However, a weak business might: Receive customer payments months after its goods/services have been delivered, […]

Weekly Commentary: 10/02/20 – Employee Culture

Employee Culture With quality as the watchword a review of staff feedback can tell us much about the culture of a company. A review of all companies on AIM underlines conviction in some highly rated companies while underlining that Applegreen, the petrol forecourt operator is more about financial leverage than staff welfare. Read more

A market of stocks or a stock market?

January was a good month, despite the FTSE 100 closing down nearly 3.5% and the outbreak on coronavirus soon to kill us all. Or is it? Well, it’s been declared a global health emergency by the World Health Organisation. But what seems likely is that the media has whipped up the story in order to […]

When bad news is good news

Richard investigates Vitec, which has reported some bad news in 2019. It could be an opportunity to buy shares in a high quality business at a low valuation. I don’t always follow up on reader suggestions, sometimes people recommend companies so repugnant it’s difficult to believe they have ever read a line of mine. But […]

Weekly Commentary: 03/02/20 – Acquirers in a low interest world

Acquirers in a low interest world In the continuing world of cheap money the buy and build companies have generally performed well. But its important to be wary of company adjusted numbers. Jeremy finds all may not be what it seems at Ideagen. Read more

Taste the Feeling

Taste the Feeling is a Coca-Cola slogan from 2016. I think it’s a very good, because Coca-Cola isn’t just a product. It’s a religion. The fervour seen during the launch of New Coke, launched in 1985, as a response to Pepsi’s taste tests showing consumers preferred a sweeter alternative, showed that it wasn’t about the […]

Weekly Commentary: 27/01/20 – Mind the gap

Mind the Gap It’s been a good few months. The FTSE small cap is up 14% since October, while the FTSE 100 is up around 7%. Suddenly the buy ideas start to disappear with prices adjusting upwards as the arrival of dawn reminds us the party is nearing a close. Which is often a useful […]

Screening For My Next Long-Term Winner: Greggs

‘Run your winners’ is popular stock-market advice. Great companies often remain great investments for a lot longer than most people expect… … and can deliver life-changing rewards to anyone who refrains from selling out too soon. Where can we find potential winners to run? I thought the best performing shares of 2019 would provide a […]

Death in paradise

The demise of Thomas Cook impacted the whole package tour industry including London listed Online Travel Agent, On The Beach. Whether you trust the accounting regulations or On The Beach’s adjustments makes a big difference to the company’s profitability in 2019. Richard unravels the exceptional items. It’s January, The BBC is screening Death in Paradise, […]

Weekly Commentary: 20/01/20 – Culture in payments

Culture in Payments There were no spare seats when I arrived at Panmure Gordon’s offices last week for the Non-Standard Finance investor day titled “Culture driven Performance”. The presentation was riddled with keywords such as “Integrity”, “Clarity”, “Respect”, “Trust”, “Empathy” etc. I particularly liked John Van Kuffeler’s description of the loan correspondence he has from […]

Why mindset is the most important factor

“Nature versus nurture” has been a debate that has raged for hundreds of years. Sir Francis Galton (pictured above), who was a Victorian era statistician and psychologist (amongst investor, explorer, and other disciplines) coined the phrase in his book Hereditary Genius. He had been influenced by Charles Darwin’s Origin of the Species, and so in […]

Weekly Commentary: 13/01/20 – Culture

Culture Luck plays a part in investing but there is also a theory that you make your luck. Both K3Capital and Dart Group are cyclical businesses which performed strongly in the second half of last year. It could be that they got lucky with the cycle going in their favour or Thomas Cook going bust, […]

Out with the old, in with the new

Richard enters 2020 with a cleaned-up SharePad setup primed to help him find companies developing competitive advantages. He expects it to make him a better long-term investor too. Happy New Year! As a full time writer/investor the festive season is the only set time in the year when I fully shut down. Like an ancient […]

Weekly Commentary: 06/01/20 – The Roaring 20’s

The Roaring 20’s Nothing quite starts a new decade as reassuringly as Greggs Vegan Steak Bake causing late night queuing in Newcastle. With Pizza Hut’s vegan pepperoni pizza, Costa’s vegan ham and cheese toastie, KFC’s vegan chicken burger and M&S’ vegan chicken Kiev and Macdonald’s veggie dippers this could be a good decade to be […]

Weekly Commentary: 30/12/19 – Change Alley

Change Alley Suggesting that Scrooge’s drive and self-discipline was something we should aspire to didn’t go down well with my millennial children. I rationalised the barrage of criticism as the product of low rates, plentiful debt and cheap money making the concept of being economical unpopular. Scrooge’s world was one of narrow dark alleyways -similar […]

The Wright brothers were not capitalists

Warren Buffett is famous to have said “If a capitalist had been present at Kitty Hawk back in the early 1900s, he should have shot Orville Wright”. This is because the airline industry is deemed to have sucked huge amounts of money and destroyed shareholder value more than any other sector. But is that fair? […]

Alpha FX speaks my language

In response to a reader’s suggestion, Richard investigates Alpha FX. It is exactly the kind of people-first business that could be building a long-term competitive advantage and consequently grow inexorably. As I was considering what to write about for my last article before the Christmas break, a present from a reader arrived in my inbox. […]

Weekly Commentary: 23/12/19 – Lessons for 2020

Lessons for 2020 It has been rather enjoyable as the year draws to a close. The Boris Bounce was a pleasant experience for investors. Excitingly for some it was a rally in the value stocks. Top of the leader board was the FTSE Small cap rising 5.6% closely followed by those high yield stocks while […]

Screening For My Next Long-Term Winner: Mears

This article has not turned out as I had expected. I searched on SharePad for magnificent dividend histories, and thought I would be evaluating a business with glorious financials and tip-top management. I have instead ended up with accounting alarm bells and a dissident shareholder trying to oust the boardroom. The screen I applied in […]

Weekly Commentary: 16/12/19 – The Golden Era of Small Caps

The Golden Era of Small Caps The fear was palpable last Thursday as I sat in a broking office. The millennials queuing at the voting booths put the fear of God into those traders worrying about a labour government. The traders’ buy to let property portfolios that they had constructed in the image of the […]

The ultimate competitive advantage

Business schools identify the sources of competitive advantage that tie customers to companies and what they produce. Fundamentally though, there is only one true competitive advantage: people. If I could recommend one book for long-term investors, it would be “Intelligent Fanatics Project” by Sean Iddings and Ian Cassell, which is subtitled “How great leaders build […]

Weekly Commentary: 09/12/19 – The Volatility Reduction Trade

The Volatility Reduction Trade The gating of M&G’s property fund caused the press to become excitable last week. The Questor column in The Telegraph advised investors they were “crazy” to have money in open ended property funds as Aberdeen Property fund redemptions accelerated. Brexit crisis and retail gloom also featured as news wires sensed a […]

Cups and bowls

Cups and handles, and bowls, have been very popular with trend traders. These patterns can be powerful as they show sentiment of the stock gradually changing and buyers slowly overpowering suppliers of the stock. This is a classic cup and handle pattern. The cup is the deeper bowl, along with a handle which is the […]

Weekly Commentary: 02/12/19 – Shrinking Markets

Shrinking Markets The liquidation of Nautilus Minerals caught my eye last week. This was a company which was to be one of the first underwater miners aiming to recover gold, silver and copper from deep water off the coast of Papua New Guinea. Such escapades are not new. In the 1680’s the government “found” some […]

Skin in the game: Two for the watchlist

Richard uses his “Skin in the game” table to find companies whose directors are major shareholders. The experiment starts off badly with Asset Co., but gets better. Frontier Development and Focusrite could be great owner-managed businesses. To recap: We can use SharePad to find companies that are run by managers who are themselves significant shareholders. […]

Weekly Commentary: 25/11/19 – Superstocks

Superstocks I have been living with value stock affliction for some time. It can be irritating particularly when the wind is blowing the wrong way. In the past it has led to text messages from colleagues saying “What price did you get into G4M – oh dear you don’t have any” – just after they […]