R is a component in trading that we use to define risk. It is a crucial aspect of trading systems and by thinking in terms of R we can improve our results.

In this article I will introduce to you the concept of R and how to use it for your own trading. It is an unescapable fact that we must risk our hard-earned cash in order to make money and profit.

Losing is inevitable, although how much we lose is at our discretion.

What is R?

R stands for risk, and it represents the amount that we risk on every trade. The best traders are experts in cutting their losses, and successful traders know how much they are risking on every trade.

This is because if you don’t have an exit plan, then how do you know what will happen? It is the equivalent of driving a car without any brakes. You have no control over where you will stop, and if you place a trade without knowing your risk you have no idea where you will get out.

Stop losses are an essential part of any system, whether these are mental or physical.

An example of R

Let’s assume we want to take a short position in ASOS (ASC). We can see the red line has acted as support in the past, and it is now acting as resistance for the stock to break through.

If we open our position at 2100p we want to know where we’re getting out of the stock if our trade idea proves wrong.

Let’s look closer at the price action.

Those two candles have long wicks above the upper body, which makes it a shooting star candle. We looked at candlesticks in a past article here.

We want to position our stop above the stop loss liquidity, so let’s say we pick 2250p as our get out price.

With an entry of 2100p to short the stock and an exit of 2250 to buy back and close our short position, this means our risk on the trade is 150p. Our R is therefore 150p.

In my opinion, traders should not be risking more than they expect to gain. The goal of trading is to take good risk/reward trades in our favour, and if we risk 150p to only make 100p then if we are right 50% of the time then we are losing money.

I will sometimes take a trade with a risk/reward of 1:1 but only if I think there is a 50%+ chance of the trade going in my favour – otherwise net of fees the trade is a loser at 50%.

If we decide our take profit target is 300p from our entry then that means our target price for the short is 1800p and the trade yields a reward of 2 for our risk of 1.

If we leave the trade to run, then there are now two outcomes. We either take a 1R loss or a 2R win, as our risk is 150p.

Why our losers should always be a maximum of 1R

If we are consistently getting losers in our trading journal that are higher than 1R, then our trading journal is telling us that something is clearly going wrong.

Why are we having losers above 1R? This could be for several reasons. We might not be cutting our losses as we should, or we might be getting slippage from our broker with our stops in the market.

Either way – it needs remedying. Losses should always be 1R or below.

As we should not be risking more than what we stand to gain, wins should always be at least 1R.

Trading is a game of capturing multiples of our risk. The less risk we can deploy in order to capture the maximum reward will make us the most money.

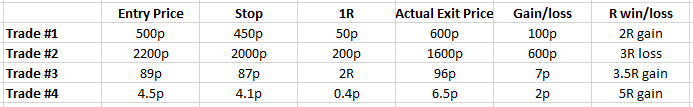

Look at the trades listed below that have been logged.

In our four trades, over all we made a 7.5R gain. We know this because we have calculated our net R by taking the sum of our R wins and losses.

This is an example, and such high gains over four trades is unrealistic. But it does go to show the power of capturing multiples of our risk. Cutting losses, and running winners is what will do that for us.

Using R can also tell us if we are successful in our trading. Four trades is a small sample size, but if we are not having positive R after 50 trades – perhaps there is something wrong.

Net R tells if our system is profitable or not – assuming R is the same monetary amount each trade.

Maybe it’s because we are not consistent with R. Maybe it’s because we are entering wrong, or exiting wrong. But a negative net R will show us that we need to improve our system.

However, it is also possible to have a positive net R but actually lose money in your account. This is what can happen in R is not consistent.

Overriding R

Sometimes my losses are well below 1R. This is because I make a judgement call on whether or not I should still be in the trade.

For example, if I buy a stock that is gapping up and expect that stock to continue moving upwards only to be met with large selling or an iceberg order (a “reloader” on Level 2), then the reason for holding that stock no longer exists.

I then have to make a decision. If selling pressure persists, and buy side volume is dropping off, then it may be worth getting out of the stock at a better price rather than letting the supply of stock come into the market and push the price down to my intended exit price.

Or, I can stay in the stock and hope that the bulls can overpower the bears and the stock can continue rising.

This is discretionary, and there is no step-by-step method to trading perfection. It doesn’t exist. One has to look at all the cards in play and make the best judgement on what you are seeing.

However, I have often found that in this situation it is often better for me to exit sooner and improve my R loss. I often find that if the reason for the trade no longer exists, then it is best for me to get out of the trade.

Key takeaway

- Look at your own trades and work out your net R

- Was R consistent in your trading? If not – why not?

- Use your journal to review the feedback given from net R and your trading P&L

Michael Taylor

You can download Michael’s trading handbook from his website at www.shiftingshares.com

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.