In this article, I’ll show you how to clean up and manage your RNS feed by adding a filter and removing noise, colour coding your RNSs, and highlighting words and phrases within the stories itself. We’ll also get rid of all stocks without EPIC codes.

The RNS feed is an important part of the screen for traders because those who can react fast can beat others in the race to be first. I’ve made great trades by being the first buyer in the market reacting to an RNS both on SETS and SETSqx – and spotting RNS announcements that have otherwise gone unnoticed and ignored by the market.

The RNS feed is the London Stock Exchange’s official conveyor belt of information and we don’t want to miss anything important. Remember, many other traders and investors, as well as market makers, brokers, and fund managers, will all be using this same feed. Many of them will be using ShareScope too. Any edge we can give ourselves will be beneficial for ourselves.

One of the recent updates in ShareScope has been my suggestion to improve the RNS feed and allow for greater custom optimisation. Given the amount of noise and news in the market, it’s important that we see the market with as much clarity as possible. Therefore, the improvements in filtering that I have suggested will allow you to take greater control of your own ShareScope and lead to better results.

Filtering RNSs and removing noise

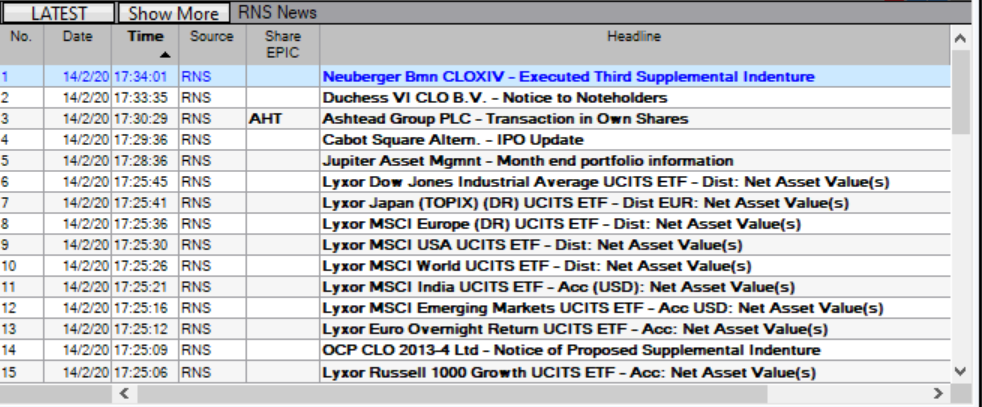

First of all, let’s clean this up. Almost none of these RNS announcements mean anything to me.

Do we care about the net asset value of the Lyxor Dow Jones Industrial Average UCITS ETF? My guess is probably not – and if you do hold this instrument in your portfolio, you’re likely invested for the long term and so don’t need this noise.

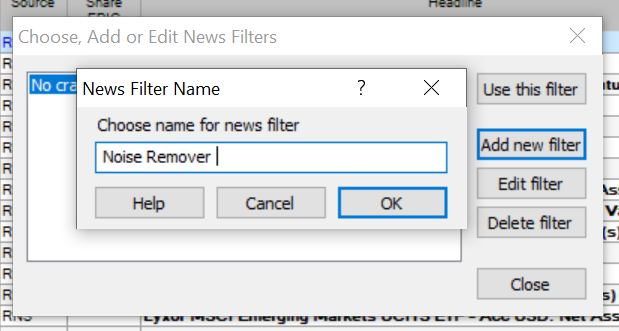

Let’s get rid of it. To do this, we right click with our cursor over the news, and scroll down to “Set news filter…”. Click this, and click “Add new filter”, and you will see this screen.

Choose a name for this filter. When you’re done, click OK, and you’ll then see this.

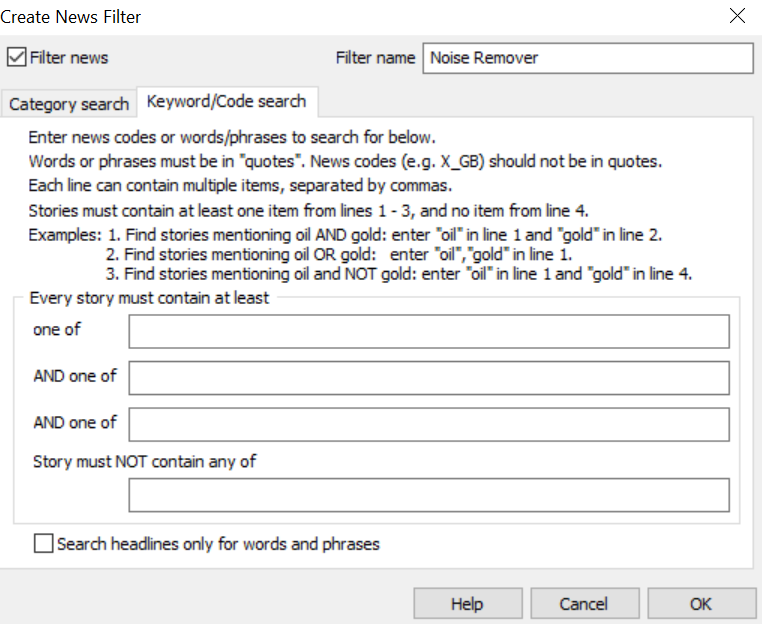

Now, we can go to town getting rid of all the noise that we don’t want or need to see.

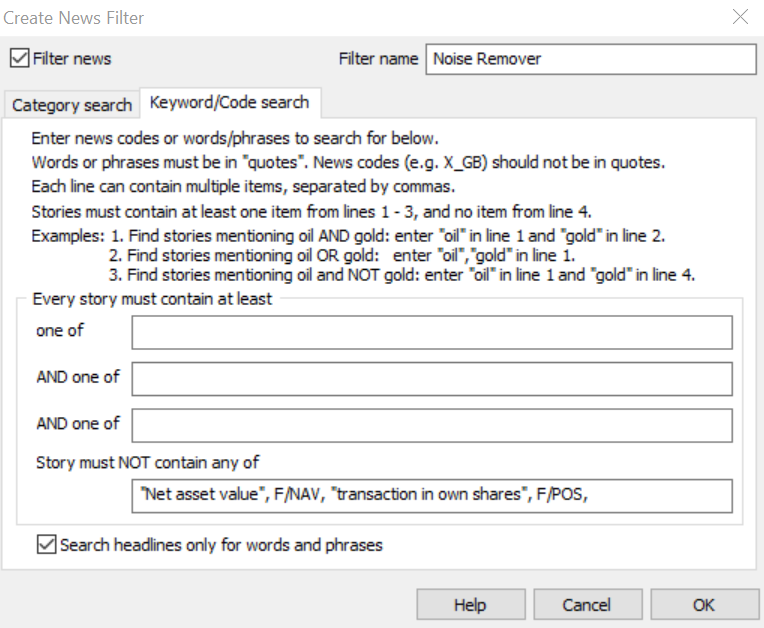

It’s important that we click the bottom box too – “Search headlines only for words and phrases”. If we don’t click this, then the filter will remove all RNS announcements with any of these phrases inside the RNS. These may be casual mentions in results or another RNS where the main headline isn’t about net asset value or transaction in own shares.

You’ll see that I’ve added the code of net asset value as well as the phrase, and I’ve done the same with transaction in own shares. One can never be too careful.

To give you an idea of some other words and phrases I’ve muted:

- “Euronext”

- “Wisdomtree”

- “Form 8.5”

- “Form 8”

- “Form 8.6”

- Any “Form [+ number]” that keeps popping up and isn’t relevant

- “Price Monitoring Extension” (only if you don’t trade auctions)

Have a look at the RNS feed for yourself and decide to take out what you want. If you find Holdings RNSs boring and useless – then it’s simple. Get rid of them and filter them out.

Coding RNSs

Once we’ve taken out the trash, it’s now time to get our highlighter pens out and start scribbling.

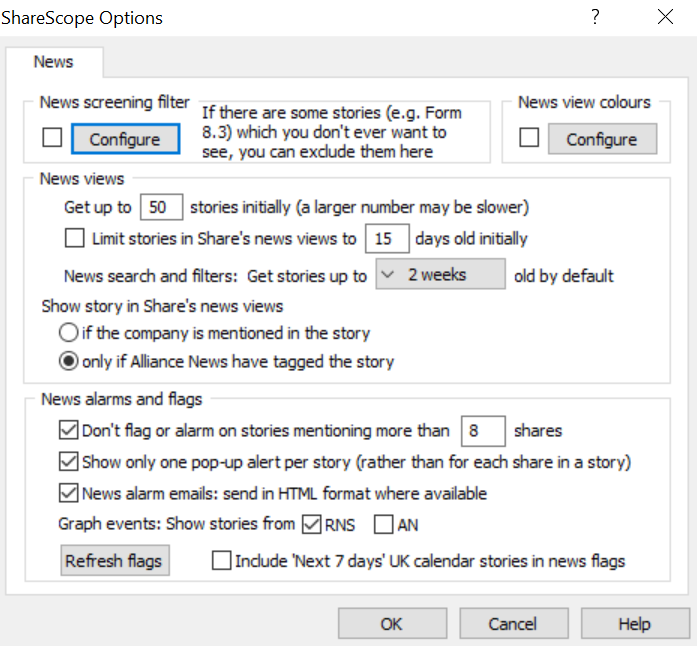

By right clicking with our cursor again over the RNS feed, we need to scroll down and click “News options…”.

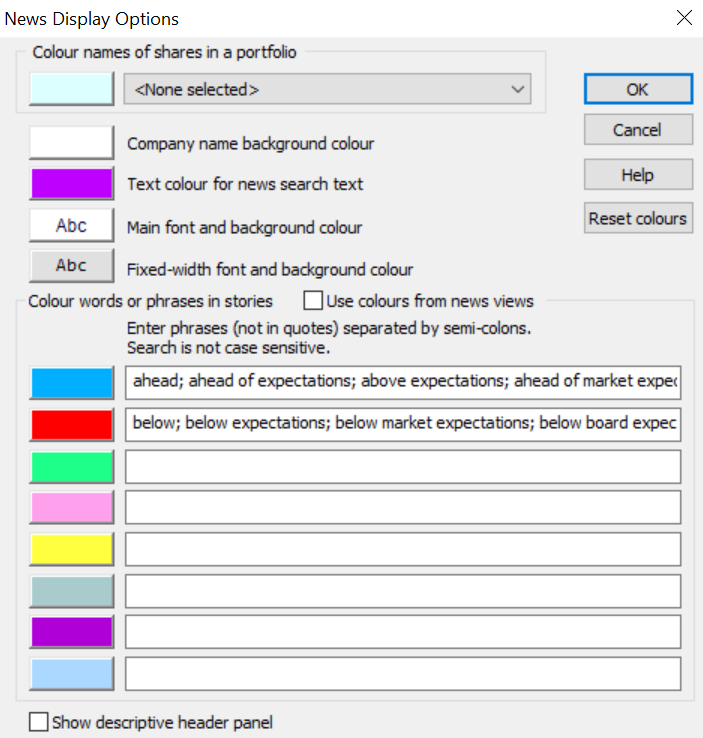

Doing this will then bring up this window.

We need to click the tick box on “News view colours” and then hit “Configure”.

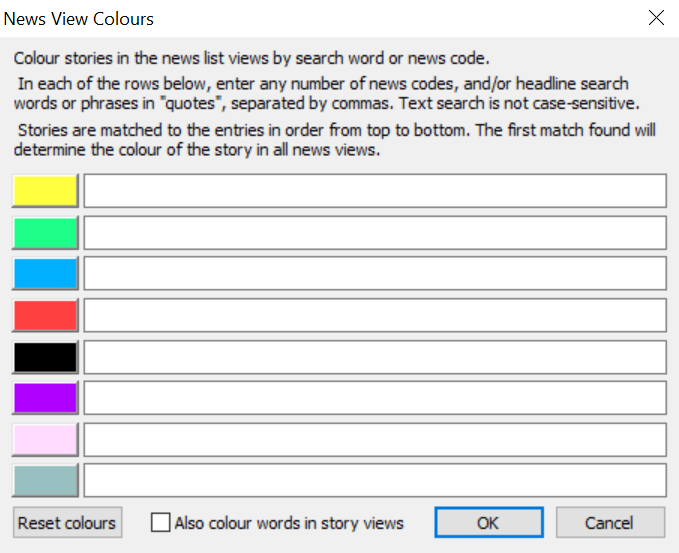

We now have a total of eight different colours to play around with and code.

For yellow, I am going to have Holdings RNSs. I don’t want to delete these from my screen, because when the feed starts running at 07:00 there may be an interesting new shareholder pop up in a stock that I know about, that I otherwise might’ve missed. Holdings RNSs are only really of use to me if it’s a stock I hold already.

To colour code these RNSs, I’ve entered “Holdings” – with ShareScope providing me with the relevant code. Make sure “Also colour words in story views” is unticked – we want to code only the headlines at this stage.

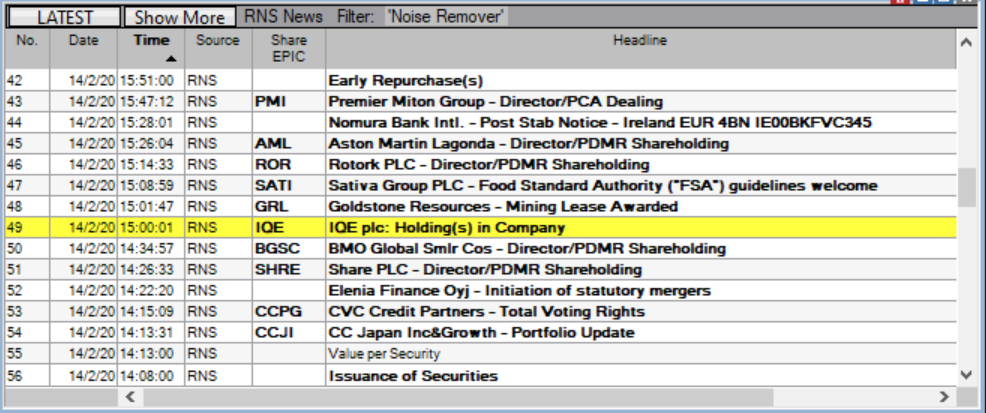

If we click OK, and go back to our RNS feed, we can see that the holdings RNS from IQE has been correctly coded.

We can then go back and code more.

When you enter an RNS headline, very often the code will automatically come up.

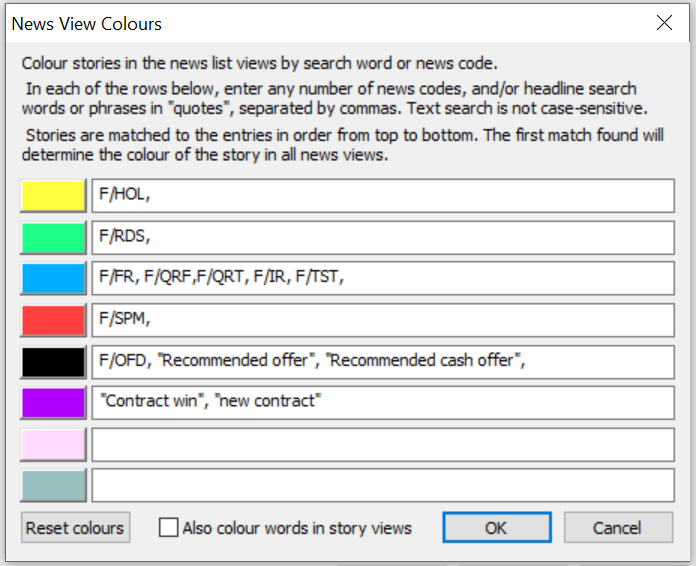

For example, when I searched “Holdings” – immediately the code for a holdings RNS (F/HOL) came up. A quick list of what I have coded:

- Yellow is for holdings RNSs

- Green is for Director shareholdings RNSs – if not all of these are coding correctly then perhaps add “PDMR”

- Blue is for results and trading updates – enter “results” and hit all the codes, and do the same for trading update, trading statement etc. There was no code for “Half-year results” so if that hasn’t coded blue then I’ll add the phrase in quotations

- Red is for “Statement re share price movement” – you could also add the code for “Statement re press comment” and “Statement re” (which could be anything that might move the price) to this, which I have now done

- Black is for “Recommended offer” – these RNSs can be highly lucrative if you can catch them quickly – for example, Haynes Manuals (the books your Dad used to have on cars) was the subject of a takeover offer last week at 700p, but the market makers and the entire market was asleep. Well over a minute had passed before anyone had bought and someone managed to buy twice at 515p – not a bad trade! The code is black, which means of course I won’t be able to read the title, but it will stand out significantly on the RNS feed.

- Purple is for contract win as these can also move prices

Feel free to play around this however you want and what is important to you.

If you want to stop the placings announced each morning – you can now code for that too. Directorate changes can also be coded.

Coding RNS content

As well as coding RNS headlines, there are now far more options to code RNS content which now make this a viable tool for traders.

This option now allows us to code for more words.

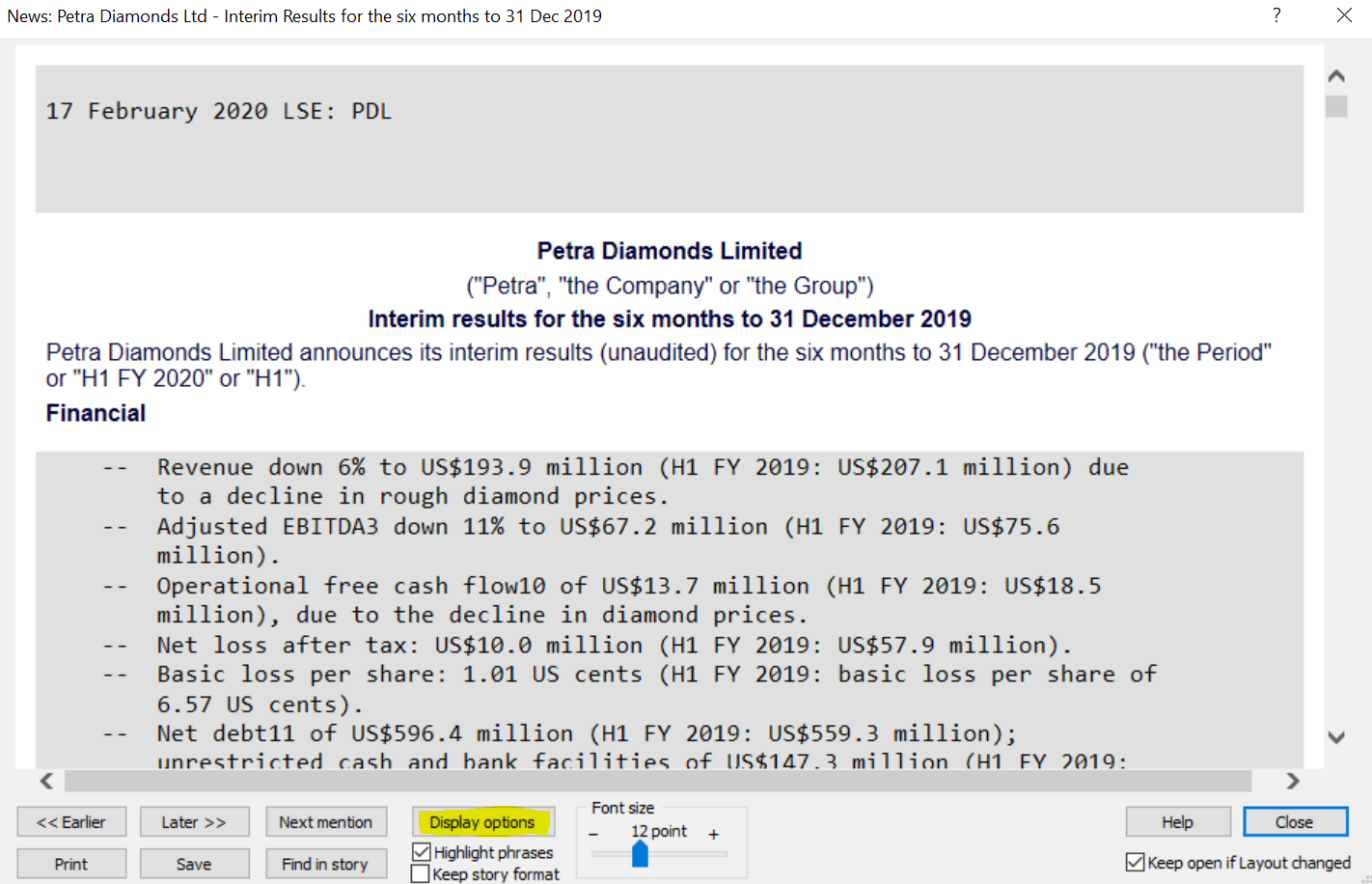

For example, I have used blue to code for all positive words such as “ahead; ahead of expectations; above expectations; ahead of market expectations; above market expectations; ahead of board expectations; above board expectations”. You can see that I’ve tried to use as many variations as possible.

Similarly, I’ve coded “below; below expectations; below market expectations; below board expectations” as red, because I want this to stand out as an avoid or a potential short candidate.

(You may be wondering why I haven’t used a traffic light system of red, amber, and green – the answer is because I have a red and green colour blindness deficiency. I would never have known this had I not been given a test in primary school. The woman with the book of colour blindness diagrams told me that it was nothing to worry about as long as I didn’t want to be a firefighter or a fighter pilot – adding “but you didn’t want to be one of those anyway, did you?”

“No”, I responded, whilst holding back the tears inside as my dreams of flying a Grumman F-14 Tomcat were shattered.

And so I became a share trader instead. Which isn’t too bad. But anyway – if you want to code in a traffic light system – then of course do that. Whatever works for you.)

We can also code for “broadly” – which means that the company narrowly avoided a profit warning. Another one I like is “H2 weighting” or “second half weighting” – which usually means that the company is now hoping for a stronger half to avoid putting out a profit warning. “Challenging” and “tough” are also good words to code.

Between the time of the RNS feed rolling and the opening auctions we have just 50 minutes, and 1 hour for SETSqx stocks, so speed is key. Being able to quickly understand the gist of an RNS, and being able to make a decision on an RNS at an increased pace, will help in the morning race to find trading opportunities.

Clearing out RNSs from the feed

Finally, we want to optimise the actual RNS feed before it even goes through our filter.

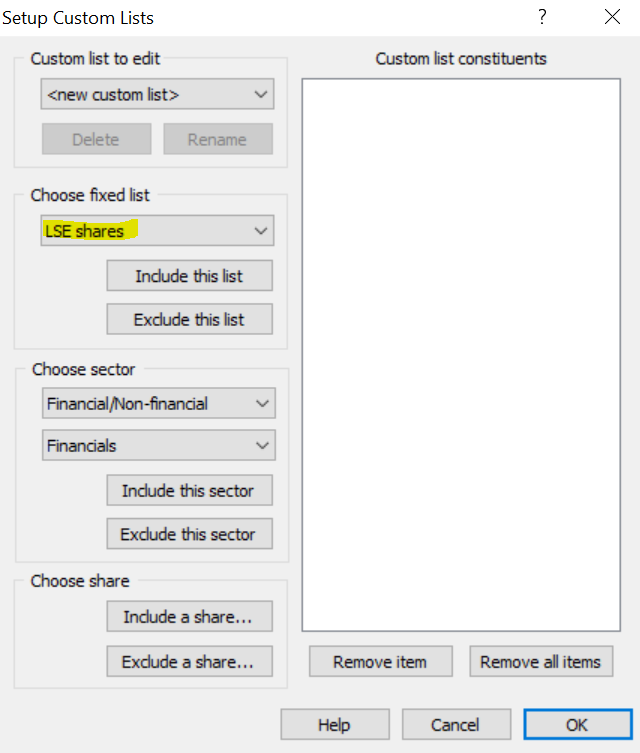

We can do this by creating a new window with a list using “LSE shares”.

We then right click and go on to “Change list” and scroll down to “Custom lists” and “Create/edit lists”.

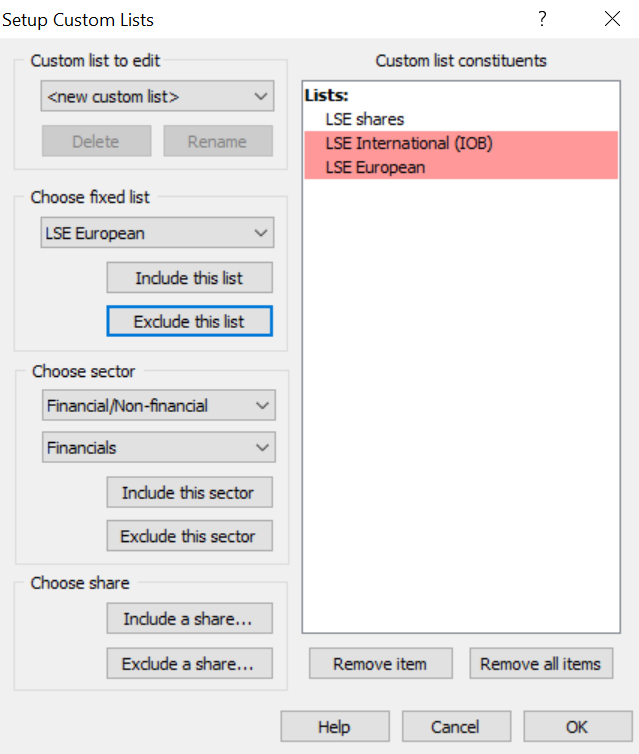

We should then see this window. Make sure “Choose fixed list” is set to LSE shares.

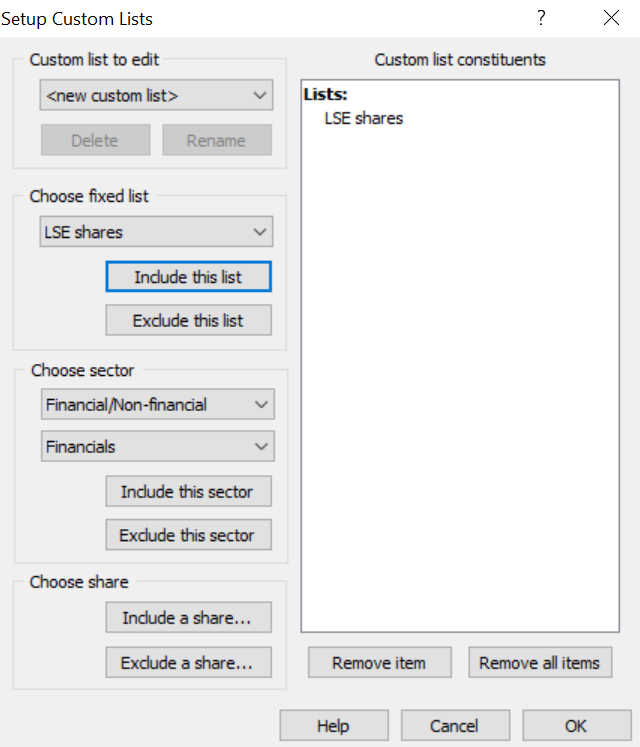

To create a custom list, we click “Include this list”.

This then gives window.

We now have LSE shares on our custom list, and we want to exclude LSE international shares.

Simply head to “UK/LSE lists on the dropdown box and choose “LSE International (IOB)” and then press “Exclude this list”.

Do the exact same for LSE European, and we should now see this window.

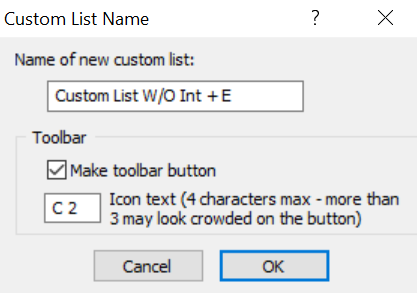

Don’t forget to name your list either.

Once we’ve done this – click OK when you’ve excluded the two lists. The list is now set up.

What we need to do now is link this to the RNS feed and this will strip out International and European shares that we don’t want to see.

We need to right click on the table and click “Link window”, and then link this list to our RNS feed.

Once this is complete, we have now completed the task of optimising our news feed. Don’t forget to back up your ShareScope so that your work isn’t wasted.

To conclude, let’s take a step back and see what we’ve done

- We have added a filter to our RNS feed too, so that we can get rid of RNS statements that are of zero value to us such as “net asset value”, and “transaction in own shares” etc.

- We have included colour coding onto the RNS headlines, so that we can make certain types of RNS stand out when we need them to (for example, an offer)

- We have also colour coded content inside the RNS so that we can quickly skim and understand the underlying message of the RNS (is it an ahead statement, is it a profit warning, how does the directorspeak sound..)

- Finally, we have included an extra overlay to excluse LSE International and LSE European stocks, so that we only get LSE stocks with EPIC codes

Having the extra versatility to colour code RNSs how you want them is in the latest edition of ShareScope.

If you have any questions, reach out to ShareScope support who will be on hand to help should you get stuck, or join my Facebook group.

I will be working with ShareScope to improve the product for traders and we are already discussing other new features which I hope we can release soon.

Michael Taylor

You can download Michael’s free books on the UK stock market at www.shiftingshares.com