Let me start with a confession.This Covid-19 ‘Special’ may not be all that special.

I have just applied a new SharePad screen to seek ‘quality bargains’ amid the market chaos — and sadly the results were not that inspiring.

The problem is nothing to do with me or my filters or SharePad. Instead, the Covid-19 crisis has turned so many companies upside down…

…that trying to identify dependable shares right now is not exactly straightforward.

But fear not! To make amends, I have run through my previous SharePad articles — and highlighted some interesting names for your consideration.

A Covid-19 bargain hunt

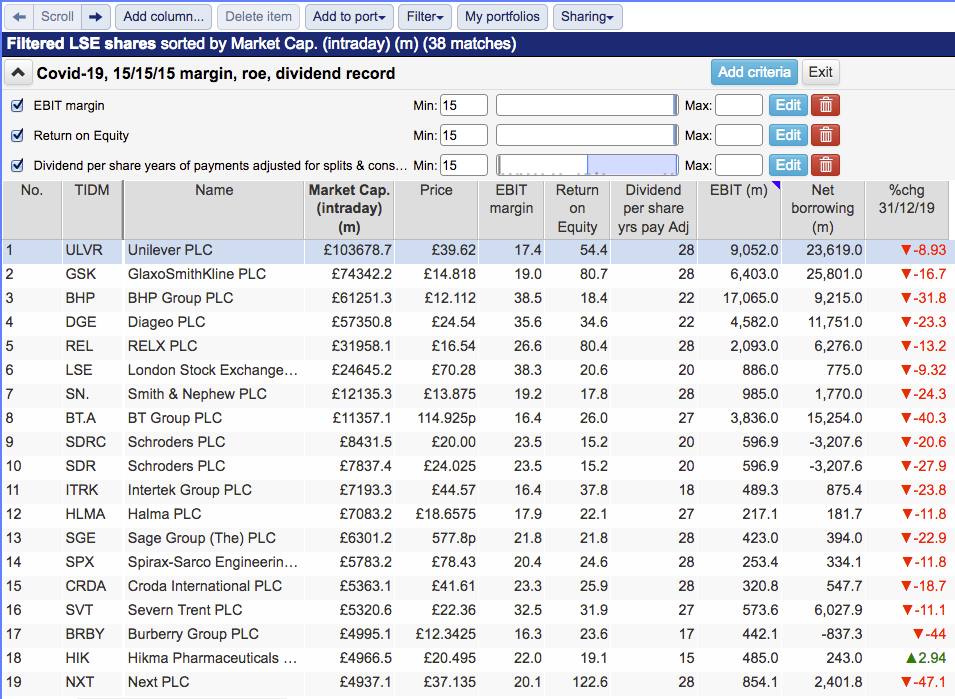

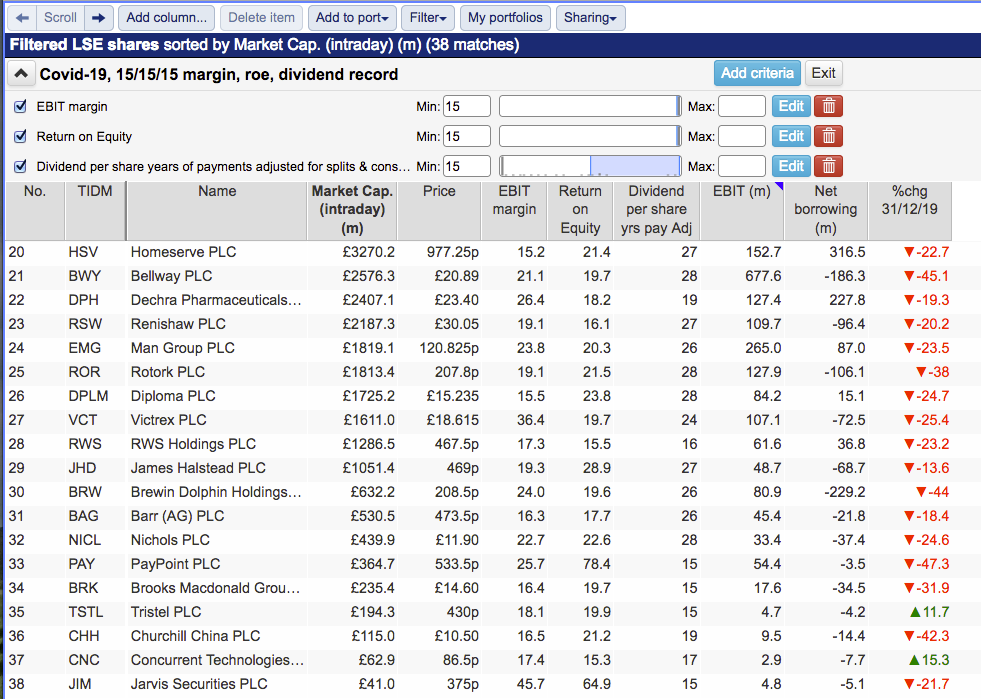

Similar to many of the ‘quality’ screens I have employed in the past, the businesses I have focused on this time exhibit high margins and high returns on equity (ROE).

I have also ensured my filtering includes only companies that paid dividends before, during and after the 2008 banking crisis. Such a reliable payout history ought to be another sign of quality.

The exact criteria I applied were:

- An operating margin of 15% or more;

- An ROE of 15% or more, and;

- A 15-year or more record of dividend payments.

SharePad returned 38 matches:

(You can run this screen for yourself by selecting the “Maynard Paton 08/04/20: Covid-19 Special” filter within SharePad’s comprehensive Filter Library. My instructions show you how.)

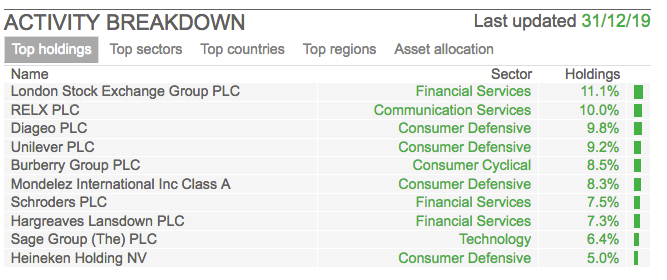

Glancing at the larger names on the list, I may have inadvertently discovered the SharePad filters that Nick Train employs.

The ace fund manager has placed Unilever (position 1 in my results), Diageo (4), RELX (5), London Stock Exchange (6), Schroders (9), Sage (13) and Burberry (17) as top-ten holdings within his Finsbury Growth & Income investment trust:

(Mr Train’s holding in Nasdaq-traded Mondelez International also meets my SharePad criteria.)

Rather than work out whether Unilever is a better bet than, say, Diageo, you could spread your risk by simply backing Mr Train’s Finsbury Growth & Income vehicle.

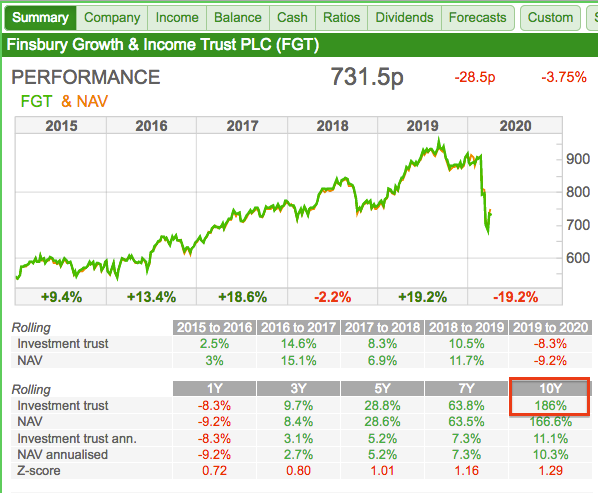

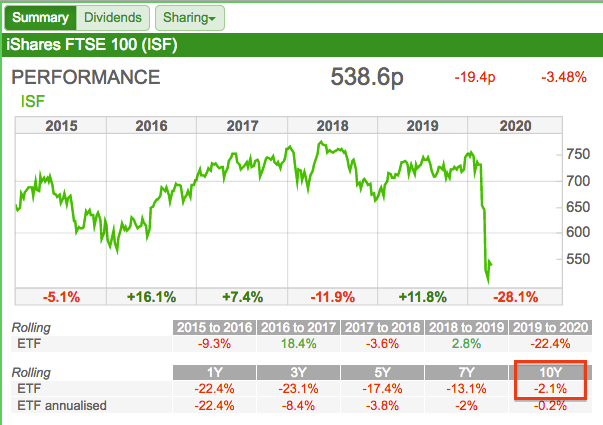

SharePad confirms the trust has trounced a bog-standard FTSE 100 exchange-traded fund over time — up 186% since 2010 versus a small loss for the tracker:

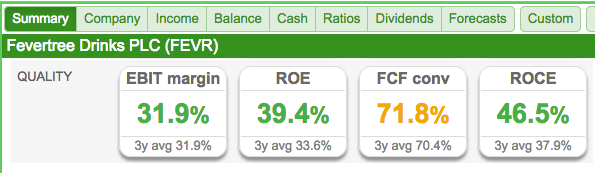

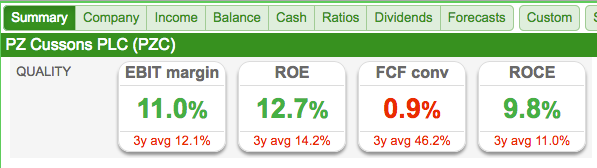

Mr Train recently added Fevertree Drinks and PZ Cussons to Finsbury’s portfolio — implying he had been “presented with an exceptional opportunity to access the shares of… exceptional companies”.

SharePad suggests Fevertree has the more attractive Quality ratios:

Very worrying dividend decisions

Truth be told, I was hoping this Covid-19 ‘bargain hunt’ would offer some obviously compelling opportunities.

I have instead become alarmed by the cash-rich names on the short-list that have suspended, withdrawn or cut their dividends.

Bellway (21), Rotork (25), James Halstead (29), Nichols (32) and Paypoint (33) all enjoy high margins, high ROEs, illustrious dividend records and net cash…

…and yet all have announced varying degrees of dividend disappointments during the last few weeks.

Those actions do make me wonder how the more indebted businesses on the list will fare during the months ahead.

I guess stock-picking from that short-list (or any other short-list) now boils down to one of three options:

1) Rely on obvious safe havens: Water firm Severn Trent (16) for example is unlikely to experience a drop in demand for its services. A statement last week confirmed: “There has been no material change to current year business performance”.

2) Rely on obvious beneficiaries: Disinfectant specialist Tristel (35) for example said the other week that it was “experiencing very strong demand in all our markets due to the COVID-19 pandemic.” The company supplies the NHS with sprays and wipes.

3) Rely on your own research: Sorry to break this to you, but more work is sadly now required to unearth possible winners (and avoid likely losers!) within this very unpredictable market.

I will use Spirax-Sarco (14) as a brief example of the extra research we should all be undertaking right now.

Spirax is a FTSE 100 member that designs and manufactures what it describes as “industrial and commercial steam systems”, which apparently include “condensate management controls and thermal energy management products”.

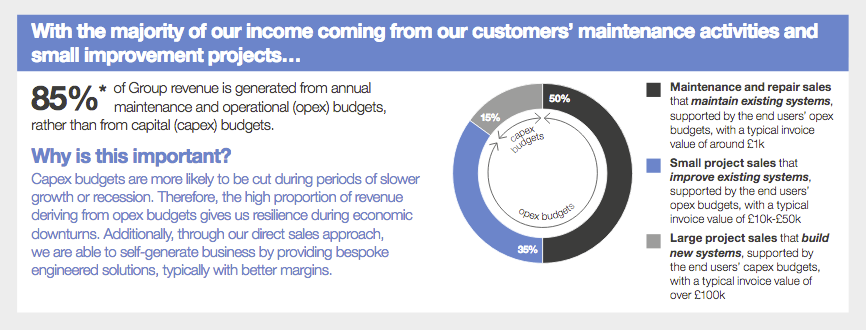

Page 18 of the firm’s 2018 annual report is an excellent example of what to look for:

Spirax states 85% of its revenue is generated from their customers’ annual maintenance and operational (opex) budgets. The group claims:

“Capex budgets are more likely to be cut during periods of slower growth or recession. Therefore, the high proportion of revenue deriving from opex budgets gives us resilience during economic downturns.”

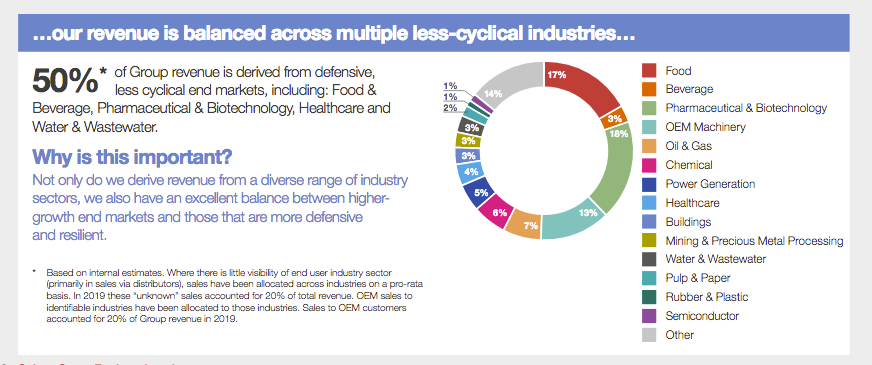

What’s more, Spirax notes 50% of revenue is derived from “defensive, less cyclical end markets”, such as food and drink manufacturers, pharmaceutical groups and water utilities.

Significant levels of ongoing revenue alongside customers that are not at the forefront of the crisis seem a good combination to me at present.

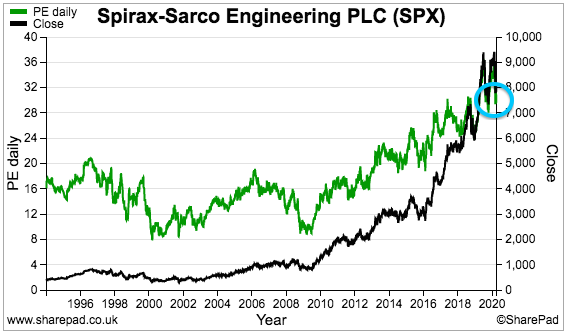

The market seems to agree. The chart below shows Spirax’s trailing P/E remaining at an elevated 30x (green line, blue circle):

Now for some interesting possibilities from my previous SharePad articles.

The SFMNLTW archives

To date I have reviewed 30 companies in the Screening For My Next Long-Term Winner article series.

I have created a SFMNLTW portfolio within my SharePad set-up and ordered the 30 companies on net borrowing — with the least indebted (i.e. the most cash-rich) first:

I thought some of the following shares could be of interest.

Plus 500 and CMC Markets

Two companies in the SFMNLTW archives — Plus 500 and CMC Markets — have actually seen their share prices increase this year.

Both companies are spread-betting operators and the market’s recent volatility has suddenly prompted a lot more trading. CMC said last week that its CFD trading income had doubled during the year:

“The Group expects CFD net trading revenue to be approximately £214 million (FY 2019: £110.2 million). The Group is encouraged by the continued trading of its loyal client base, in addition to new clients who have joined the platform and existing clients have been reactivating their accounts.”

The figures imply CMC’s second-half CFD revenue surged almost 175%.

I was never keen on Plus 500’s colourful history, but CMC is worth revisiting. One potential positive is CMC’s founder/chief executive retains a 57%/£285m shareholding — he therefore ought to be very motivated to keep his business booming.

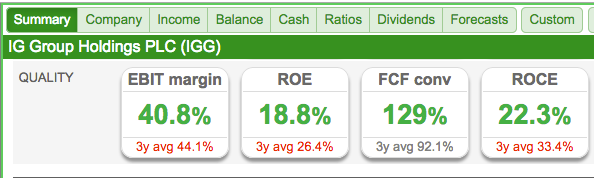

I would also look at IG Group, another spread-bet operator that has a £2.5 billion market cap versus CMC’s £500 million. IG last said it was performing “strongly” and the SharePad ‘Quality’ measures look good:

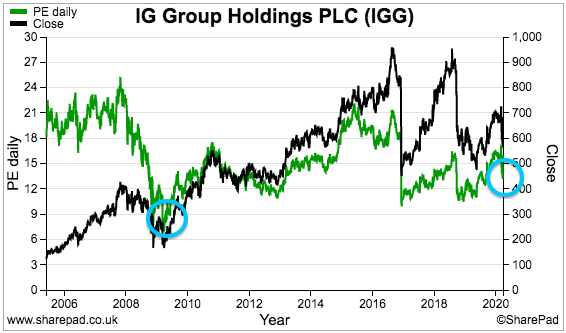

Bear in mind that IG’s share price did not escape the 2008 crash, with the P/E then going single-digit versus low-teens of late (green line, blue circles):

Hargreaves Lansdown and Jupiter Fund Management

Hargreaves Lansdown and Jupiter Fund Management both offered cash-rich, high-margin, high-ROE accounts when I evaluated them last year.

Of the two, I prefer Hargreaves. The company’s revenue is derived mostly from platform fees charged on a diverse range of investments, and the overall business benefits from a powerful ‘network effect’.

In addition, Hargreaves’ current revenue may be enhanced by additional stockbroking commissions from greater dealing volumes.

In contrast, Jupiter’s income remains dependent on the success of a few funds and fund managers — the latter being able to walk out of the door and have important clients follow them.

Jupiter also announced a sizeable acquisition during February, which in hindsight was not the best-timed of deals.

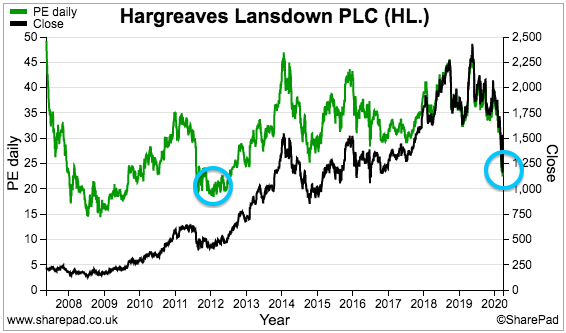

The trailing P/E of Hargreaves was recently the lowest since 2012 (green line, blue circles):

The share price then was a fiver, and tripled within three years.

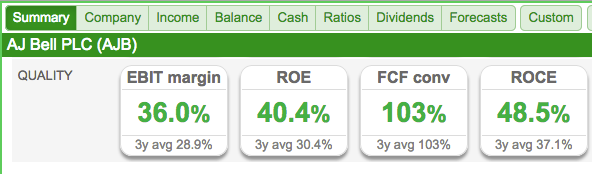

I would also look at AJ Bell, which operates an investment platform similar to that of Hargreaves… but unlike Hargreaves, does not have the high charges and the damaged reputation/suspect marketing following the Woodford failure.

AJ Bell sports a £1 billion market cap and offers robust Quality numbers:

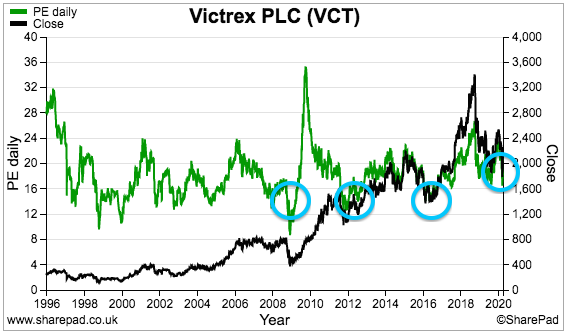

Renishaw and Victrex

Two SFMNLTW companies I like are Renishaw and Victrex.

Renishaw designs and manufactures precision-measuring equipment for industries such as aerospace, electronics and energy.

Victrex meanwhile manufactures polyetheretherketone, a high-performance polymer know as PEEK, and also serves industries such as aerospace, electronics and energy.

Both are FTSE 250 names with entrenched competitive ‘moats’ that underpin cash-rich, high-margin, high-ROE accounts. However, their earnings can become very unpredictable when the global economy turns south.

Revenue and profit at the two companies were hit during the 2008/2009 downturn, and Renishaw has already warned of squeezed earnings and cancelled a previously declared dividend.

Victrex updated investors this week, saying first-half trading had been “solid” but added cash-conservation measures were now in force and future dividends were “under review”.

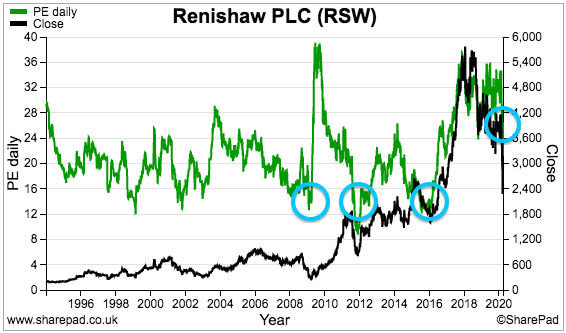

My original write-ups suggested the best time to buy both shares during the last 15 years had occurred when their trailing P/Es dropped below 16x.

I have updated the charts below (green lines, blue circles):

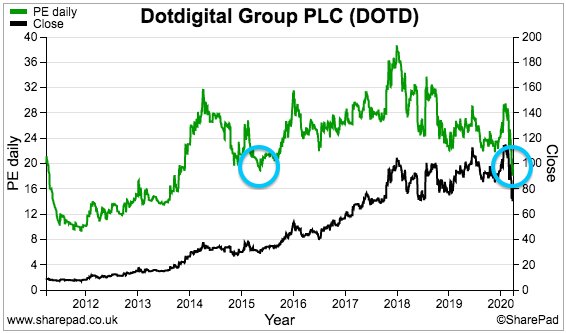

Craneware and Dotdigital

Software businesses ought to be more resilient than most during the current crisis. I presume their employees are able to work remotely and operations therefore won’t have to close.

My SFMNLTW archives include studies of Craneware and Dotdigital. Again, the pair are both cash-rich, high-margin, high-ROE businesses.

I am not sure how Craneware is performing at present. The company sells software to US hospitals — which will have more pressing matters to consider than IT upgrades right now.

That said, Craneware enjoys multi-year contract revenue and declared an interim dividend at the start of March that has yet to be cancelled.

However, a notable accounting downside is the group’s capitalisation of development costs — which has flattered earnings significantly compared to the wider software sector.

Dotdigital might be an easier share to evaluate. This email-service provider sells to a broad range of industries and approximately 90% of revenue comes from recurring subscriptions. The company capitalises costs, too, but not to the same extent as Craneware.

Dotdigital’s trailing P/E rating recently dropped below 20x for the first time in five years (green line, blue circles):

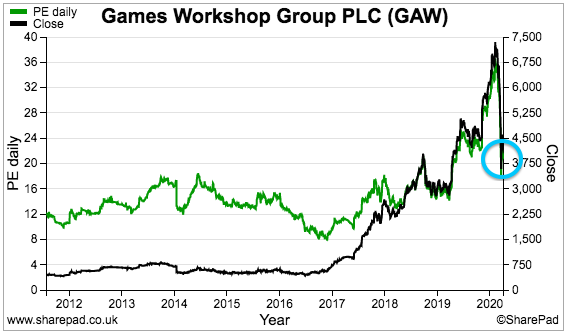

Games Workshop

Among the other names in the SFMNLTW archives, I would probably keep an eye on Games Workshop.

The fantasy games specialist is yet another cash-rich, high-margin, high-ROE business, which — following a decade or two of going nowhere — has exhibited rapid earnings growth during the last few years.

Upbeat statements during 2019 suggest Games Workshop’s incredible progress was not a flash in the pan — and perhaps this business really has developed a unique ‘franchise’ within its niche wargaming sector.

Right now, though, the group’s shops, offices and facilities have been closed — and how badly that will affect near-term earnings is anyone’s guess.

If Games Workshop’s customers really are as fanatical as many prominent shareholders have claimed — then you’d expect the business to bounce back sooner rather than later.

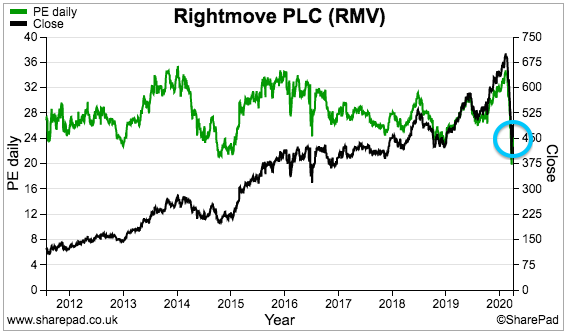

Rightmove

I will round off with Rightmove — a well-known ‘quality’ name that I would not consider.

Yes, the property website offers some mind-boggling ratios due to its dominant industry position.

However, the business has squeezed its estate-agent customers over many years through regular price lifts — and maybe Covid-19 will bring some sort of comeuppance.

Estate agents have essentially shut up shop for the next few months as the housing market freezes over. Rightmove has chopped its fees by 75% until August to keep agents on board, but questions remain. In particular:

* Will estate agents survive over the summer?

* If so, will the survivors be happy to use Rightmove when things ‘get back to normal’?

* If so, will they then be happy to pay Rightmove’s ‘normal’ fee rates?

I have my doubts. Widespread industry support for a SayNoToRightmove website is quite telling — as is Rightmove’s recent decision to pull its dividend. The company’s competitive ‘moat’ will count for little if all the customers go broke.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Disclosure: Maynard owns shares in Tristel.