A big bet on Fintech worth taking at this price – Augmentum

OK, I’m not going to beat around the bush. l readily concede that now is not a great time, all things considered, to be talking about investing in a high-risk venture capital fund that invests in equally high risk private European fintech firms, many of which are only a few years old. I can hear a collective gulp or gasp as I write those words but stick with me. I really do think that for those investors willing to think long term and ride through the market storm, this could be an essential fund.

Augmentum , ticker AUGM is the UK’s only publicly listed fintech venture capital fund. Now the cynic might say at this point that there is a damned good reason for that lonely status. The Eurofintech scene is still early in its development and as I said very risky. This is largely the preserve of big ticket venture capital firms that have deep pocketed institutional investors willing to sit tight for ten years or more.

All that is true and it’s hard not to also suddenly conjure up the image of Neil Woodford who also backed many a high risk, private firm, some of them in the fintech sector. What could possibly go wrong?! Plenty.

But I also think that plenty could go to plan and as I explain below, you are getting the chance to buy in at a much more sensible valuation.

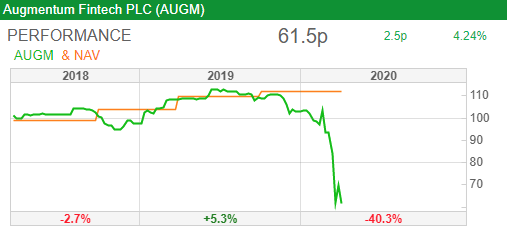

Source: SharePad

Why my guarded optimism? I’ve been editor in chief of the industry website www.altfi.com for many years now and understand the fintech industry very well. I am by nature a bit of a curmudgeon in the world of young thrusting entrepreneurs lurking around Old Street roundabout promising the earth. But I think the big banks and finance businesses now face a full frontal assault which will fundamentally change their business models. Neo banks such as Starling and Monzo are grabbing hundreds of thousands of new customers every month and although they have ‘challenges’ regarding their business model (how do they make a profit), the loyalty shown to big banking brands is slowly crumbling. But away from this frontline in the fintech wars there’s also a spectrum of niches where new businesses are pushing ahead with new business models. Some have emerged into full public view such as Funding Circle and run into challenges, others such BullionVault (more on that in a few paragraphs) are prospering. A profound disruption is working its way through the financial system and the current crisis won’t stop that change.

Also, I have a hunch that much of the most dynamic growth in a myriad of sectors over the next few decades will be in private companies – not listed businesses – utilising technology in some form. Investors need to have some exposure to these private business assets, and venture capital should form a small part of any growth investors portfolio. Which leads me back to Augmentum Fintech which currently boasts a portfolio of 18 private fintech companies. As I said above, this is the only listed way of playing the broad fintech space and boasts a highly respected team that was initially funded by the RIT Capital Partners outfit.

The portfolio

The table below sets out the Company’s NAV breakdown as of Sep 30th, 2019 adjusted for any investments since that date at cost.

| Company interactive investor Tide Monese Zopa Bullion Vault Onfido iwoca Receipt Bank Grover Habito Farewill Cash Other |

% 11.4 11.0 10.0 9.0 7.6 6.5 5.9 5.8 3.9 3.9 3.1 11.2 11.1 |

If you were interested in investing in this fund, I’d absolutely recommend a visit to each and every one of these businesses online so that you can make your own judgement about the likely success of each business. My summary would be as follows:

- Interactive investor is shaping up to be in the top tier of online only brokers in a space that is fast moving. Interactive Investor is a smart operator although I worry that valuations in this sector have got a bit toppy

- Tide is a new SME digital bank. And boy do we need new SME banks that can work with freelancers and smaller businesses. This is a great niche although I find Tide’s business proposition a tiny bit expensive compared to Starling

- Monese is in effect a digital bank for European expats in the UK (and beyond). My AltFi colleagues aren’t massively impressed with its offering but it’s a brilliant niche if they can make it work

- BullionVault is a great business. The original online gold storage option.

- Iwoca is an online lender to smaller businesses focused on working capital provision. It started off lending to eBay based businesses but has expanded quickly.

- Onfido is in a fantastic growth sector – online verification of your identity. Make that work and you have a fabulous business

- Farewill is potentially a brilliant business model. Online based will writing.

It’s also important to say that Augmentum is a relatively new fund and only came to the market a few years ago. So, its still early days in portfolio terms. Like most private equity and VC firms, these deals are either valued at cost, or based on a valuation point set by the most recent deal or market transaction. We can see that clearly in two recent portfolio events.

Most recently the value of the funds stake in Interactive Investor was pushed up after a deal which involved ii buying the Share Centre. Based on the implied valuation of £675m stated in the announcement of the purchase, Augmentum’s stake in Interactive Investor would be c.£20.7m, an uplift of £5.9m (or 40%) compared to the last valuation at 30 September 2019 of £14.8m and 4.5% uplift to the September NAV.

But those valuations can also go down, as they have done with one of the fund’s longest established holdings, Zopa, the peer to peer lender which is now transitioning into a digital bank. The fund wrote down its investment in Zopa in December 2019 leading to a 10% hit to NAV, based on a funding round which involved existing shareholders accepting a lower valuation.

Post Corona

Which brings us nicely to the current day. Augmentum has been quick to update the market after the virus knocked investor confidence. Many are worried, rightly, that the valuations put on some private tech businesses was way out of line – pushing down the price of many listed VC funds including Augmentum.

But the fund also reminded investors that the market chaos could work to the advantage of some of its businesses. In a recent announcement that fund argued that a “number of companies [in the portfolio] will perform counter-cyclically. Indeed, companies representing c.40% of NAV have experienced heightened demand, and are growing faster than in normal market conditions”.

It then proceeded to list these counter cyclical businesses in an update. I have quoted at length so investors can understand better the current dynamics at play.

Interactive Investor –“ii continues to see strong trading volumes in Q1 and that has not diminished in the past two weeks. As a digital, scaled, flat fee platform, ii has a highly resilient business and operating model which is not excessively reliant on treasury revenues. ii has switched to remote working and is focused on continuing to provide the best service to its customers while ensuring the welfare of the ii team”.

Zopa – “the rate of return for investors on the platform has historically shown little volatility relative to the public markets. Individual investments are spread across multiple borrowers which, together with world class underwriting and strong tech capability, is how they’ve been able to offer positive returns for the last 15 years through both downturns and upturns. …With £5bn+ lent in personal loans since inception, £1bn in 2019 alone, Zopa’s P2P business has been profitable since 2016“.

![]()

BullionVault – “offers customers direct, digital access to physical bullion and has seen trading volumes increase 387% over the last week from the previous 52-week average to total £14.3m per day across gold, silver and platinum”.

![]()

iwoca – “Having to date made £1bn in funds available to over 50,000 businesses across the country, iwoca has a strong balance sheet and is well prepared to weather the challenges ahead. Nevertheless, it is expected that iwoca will reduce their typical lending levels as they assess the impact of Covid-19 on the broader UK and German markets”.

![]()

Grover – “offers an affordable technology rental solution for business customers and has found a sweet spot with companies significantly increasing their IT resources for remote working. The company has seen a surge in demand from both B2B and B2C online channels as people and companies equip themselves for home working and self-isolation. The company grew its subscriptions 12% month-on-month to end of February, and this growth has continued into March. As a result, year-on-year revenue comparisons continue at 2.9x with the company well positioned to continue to perform strongly despite the uniquely adverse market conditions”.

![]()

Onfido – “Having seen 2.3x revenue growth year on year, identity verification and biometrics company Onfido continues to expand their customer focus beyond Financial Services. Traditional public services such as GPs are under increased pressure, and physical appointments with a GP are now discouraged. Onfido is working with the likes of online doctor Babylon to support their efforts in serving increased patient numbers”.

![]()

Farewill – “offers a nimble, affordable offering with outstanding customer service, which can be completed online 24 hours a day, seven days a week. The company is trading 10x in terms of revenues versus the same period last year and has seen 100% quarter on quarter growth”.

Valuations

This all sounds hopeful, but we have to be realists. Plenty could still go wrong and at this stage in the cycle we need to be realistic about the portfolio valuations. Talking to the funds highly respected managers – headed by Tim Levene – one gets the sense that they are comfortable they have enough money to support the businesses and that the businesses also have enough cash to continue growing.

The fund itself does not carry any debt on its balance sheet and has a current cash position of approximately £14m. With 117 million shares in issue, I reckon that works out at 12p a share in net cash. Crucially that net cash isn’t already automatically ear marked for later investments. The fund could return the cash and its certainly true that the fund has announced that it has recently bought back some shares.

The fund is currently trading at a 50% discount to NAV and at 60p a share, we also need to factor out that 12p a share in cash. That leaves us with a core portfolio currently valued at around 48p a share. I think that’s sensible discount – over 50% versus the amount invested – for these risky investments. I have a great deal of confidence in the management and many (though not all) of the portfolio companies. Clearly this is a risky investment at this stage in the cycle but I think for the long term, patient investor, this could be a great time to think about buying.

Broker Views

Numis View: “We believe Augmentum’s portfolio contains a number of interesting investments and provides exposure to the wider fintech space. We expect investors to closely watch the credit performance of Zopa and Iwoca in these tougher economic times, however, the portfolio now includes a wider spread of companies, rather than just peer-to-peer lending. Reflecting this, it is interesting to see that a number of portfolio companies are currently experiencing increased demand as a result of the early stages of Covid-19 impact and we expect this to be the case for a number of technology based businesses. Augmentum has a unique mandate among London-listed funds, and appears well-placed to exploit the rapid growth potential among European fintech companies, which are seeking to disrupt the business models of traditional banking and financial services. We rate the management team, headed by Tim Levene, highly.”

Liberum view: after most recent update- “Augmentum’s update highlights the benefits of many companies operating in the fintech sector. These companies tend to be more agile than larger, traditional businesses and are often well versed in working remotely, with relevant IT infrastructure already in place. Portfolio companies such as ii benefit from a subscription-based revenue model, which are more robust in volatile periods. BullionVault also appears to be a strong beneficiary of market conditions, with many investors seeking to acquire assets such as gold, silver and platinum. We note however, that certain parts of the portfolio (e.g. Zopa, iwoca) may experience a challenging period with much lower volumes and increased credit risks that could result in higher than average default rates on the loans.”

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.