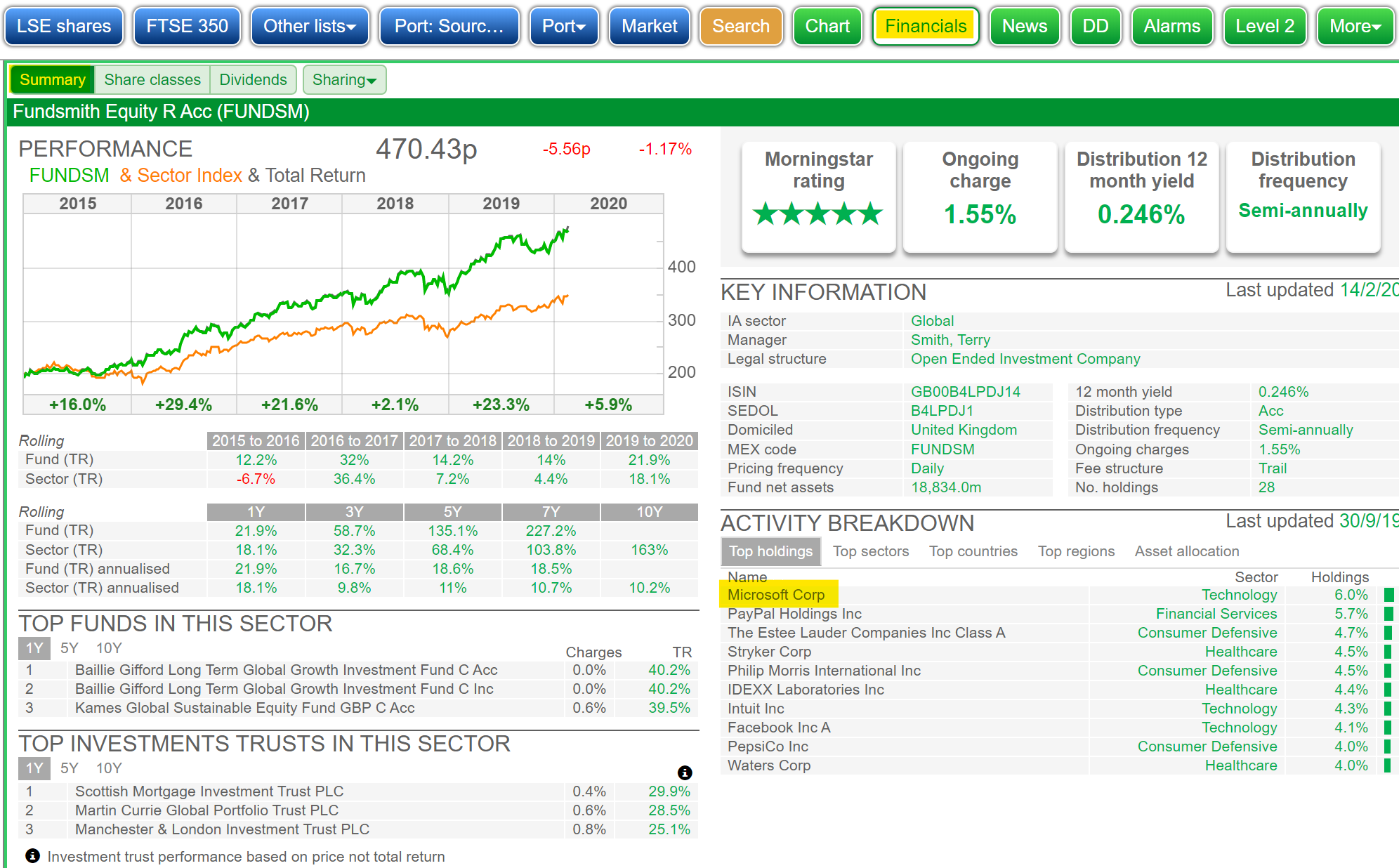

Fundsmith Equity probably needs no introduction. Since its launch in November 2010 the fund has racked up class-leading annualised returns of more than 18%, compared to less than 12% for an index of global equities, by investing in high quality businesses at attractive valuations.

You can, of course, make further comparisons, and explore the makeup of the fund in SharePad:

However, I’m not here to sell you the fund, but to investigate what it considers to be a high quality business. Fundsmith is a massive fund invested in a modest number of companies so, by design, it can only invest in very large businesses such as those listed in its top ten holdings – headed by Microsoft.

As private investors we have a big advantage. We can invest in firms of any size. And we can use SharePad to find high-quality businesses, because Fundsmith defines them quite precisely.

Defining a “high quality business”

To find out how, we need to hit the Fundsmith Owner’s Manual (here’s the PDF). Fundsmith says it invests in companies capable of earning a sustainable high return on operating capital employed in cash. As phrases go, it’s not one that trips of the tongue, but every word is important.

Return on capital is a measure of profitability, return (profit) as a percentage of capital (money invested to run the business). Since profit ultimately fuels investor returns and capital is the resources available to the company to generate it, the higher the Return on Capital the better.

Capital can be calculated in many ways but Fundsmith’s focus on operating capital means it is not too concerned about goodwill, which is included in some definitions of capital. Goodwill is a historical cost arising from acquisitions, not investment in factories, offices, or new products required to continue operating the business.

The fund’s emphasis on cash returns probably reflects founder Terry Smith’s mistrust of accountants. In the nineties, Smith was employed by UBS to analyse banks, but he was sacked after his book, “Accounting for Growth”, was published. The book exposed the accounting trickery used by firms to massage profits, some of them his employer’s clients.

While we can see from a company’s record that it has been profitable in the past, what matters to investors is the returns we can expect in future, hence Fundsmith’s insistence on sustainability. If returns are likely to vary a lot, Fundsmith is not interested. The Owner’s manual says repeat business is an important contributor to sustainability. It elaborates:

“A company that sells many small items each day is better able to earn more consistent returns over the years than a company whose business is cyclical, like a steel manufacturer, or “lumpy”, like a property developer.”

Fundsmith rules out most companies that sell equipment to other companies. Often these are not small items but big machines companies buy infrequently. When recession hits, customers defer investment. In the same way, we might put off buying a car for a year or two, patching up the old banger instead. We’re much more likely to go on buying cosmetics and toiletries almost unthinkingly.

Reasoning like this has led Fundsmith to invest heavily in companies that supply goods and services to consumers and businesses that use them routinely, Payments firms like Paypal and Visa, cosmetics companies like Estee Lauder and business service companies like Intuit (it supplies tax and accounting software services).

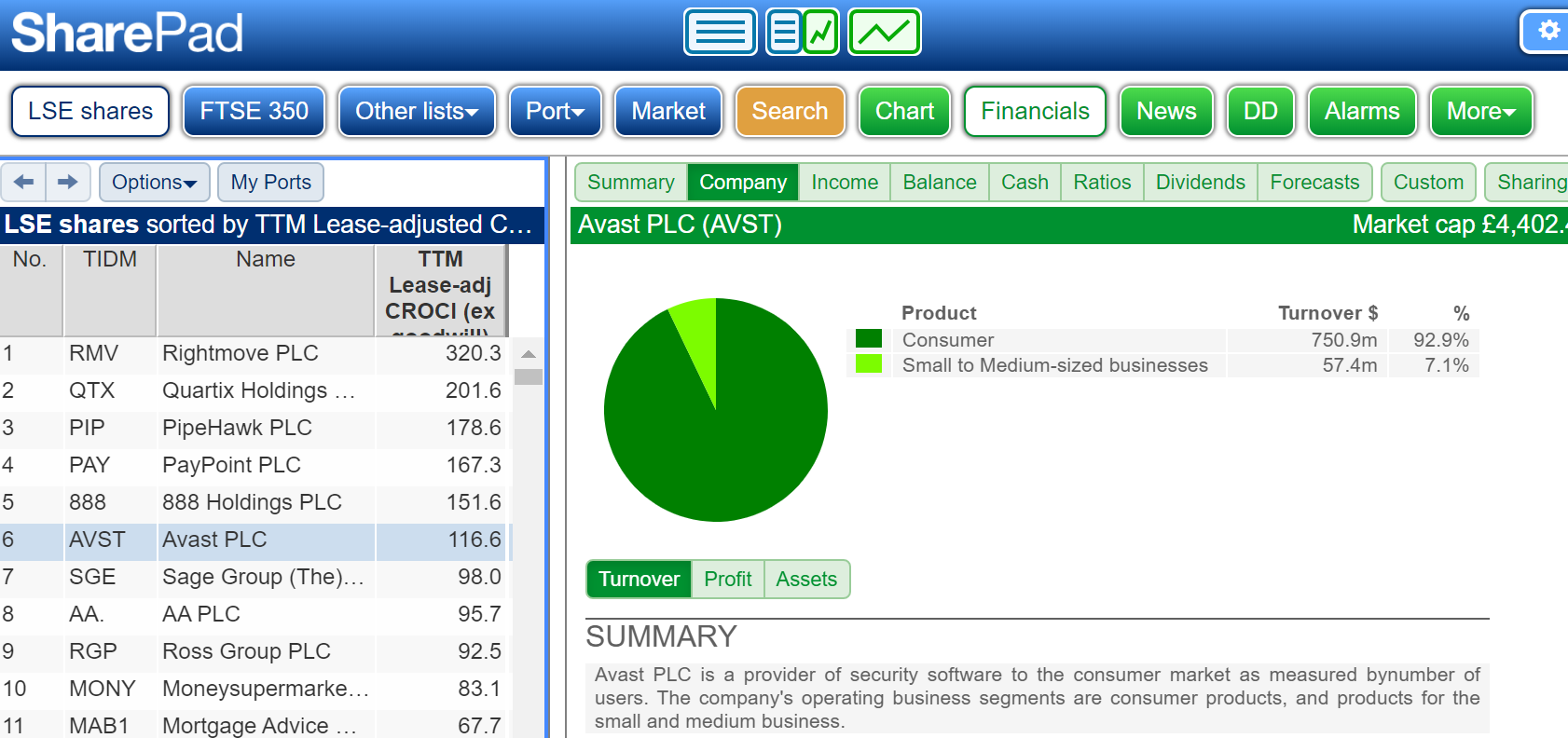

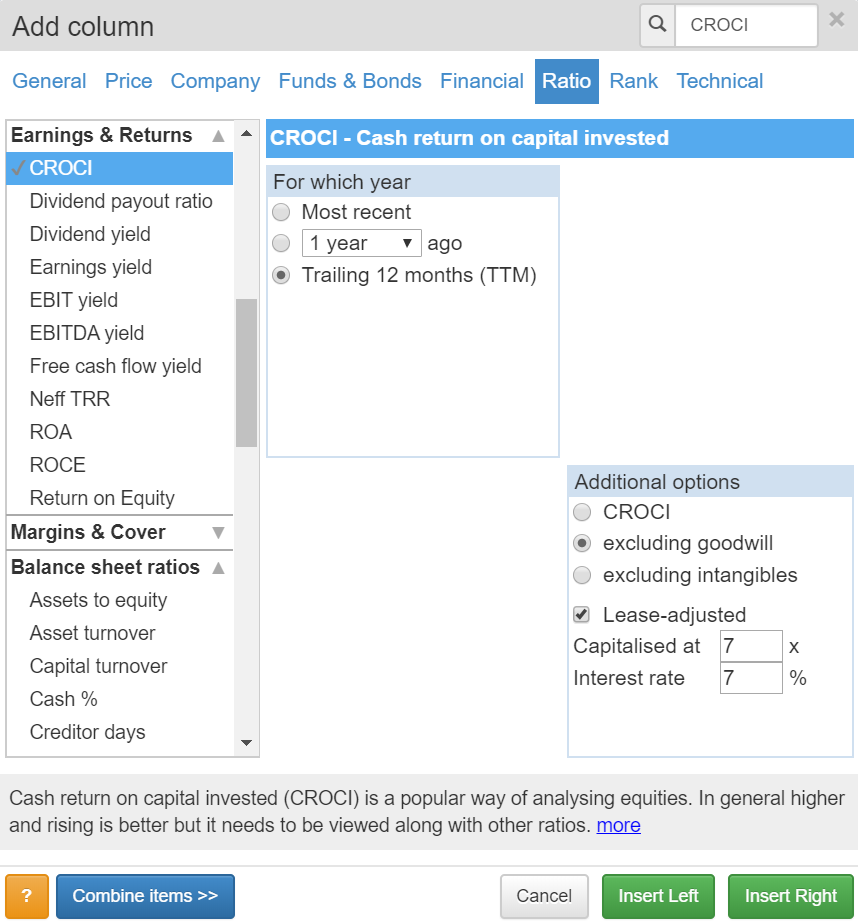

A hit list of high CROCI companies

The rather elegant thing about Fundsmith’s definition of a quality business, is that the financial aspects of it are encapsulated in a single ratio, CROCI (Cash Return on Capital Invested). Here I have created a new table in SharePad, and sorted it from highest to lowest CROCI:

Not only did I exclude Goodwill from my calculation of CROCI to get a measure of Return on operating capital, but I threw every weapon in SharePad’s arsenal to get the best measure I could, selecting a Trailing Twelve Month time frame to get the most up to date data, and adjusting for operating leases:

The list is 1,996 companies long but that doesn’t mean there are 1,996 good investments. The majority in fact earned negative CROCI, which means they lost money in cash terms. Since we are looking for high CROCI companies, we work down from the top, establishing whether a big element of a company’s profitability is derived from repeat purchases.

This may sound easy, but sometimes companies are coy about exactly how they make money. Let’s have a look at three of the highest ranked firms.

Rightmove😕

Top of the list is Rightmove with a CROCI of 320%. It is the nation’s biggest property listing website. Rightmove’s customers are estate agents and property developers, who pay an average of £1,000 a month to list properties on the company’s website.

I must admit Rightmove has immediately put me in a quandary. It definitely benefits from repeat business, and although customers complain about fees, they may be relatively modest compared to the fees estate agents earn from selling or letting a property. That said, houses are the biggest purchase most of us make in our lifetimes so the property market gives me the heebie-jeebies. Rightmove tries to reassure investors in its annual report:

Our business model is robust because the majority of our revenue comes from the subscriptions our customers pay to be part of that marketplace. As such, we are not directly linked to housing transaction volumes and neither participate in the upside nor downside of all but the most extreme events of the cyclical home sales market.

Reading between the lines, though, a minority of revenue comes from other sources, like additional advertising products, which may be more directly linked to the buoyancy of the housing market, and just how vulnerable is Rightmove to “extreme events” (i.e house price crashes)?

Quartix😊

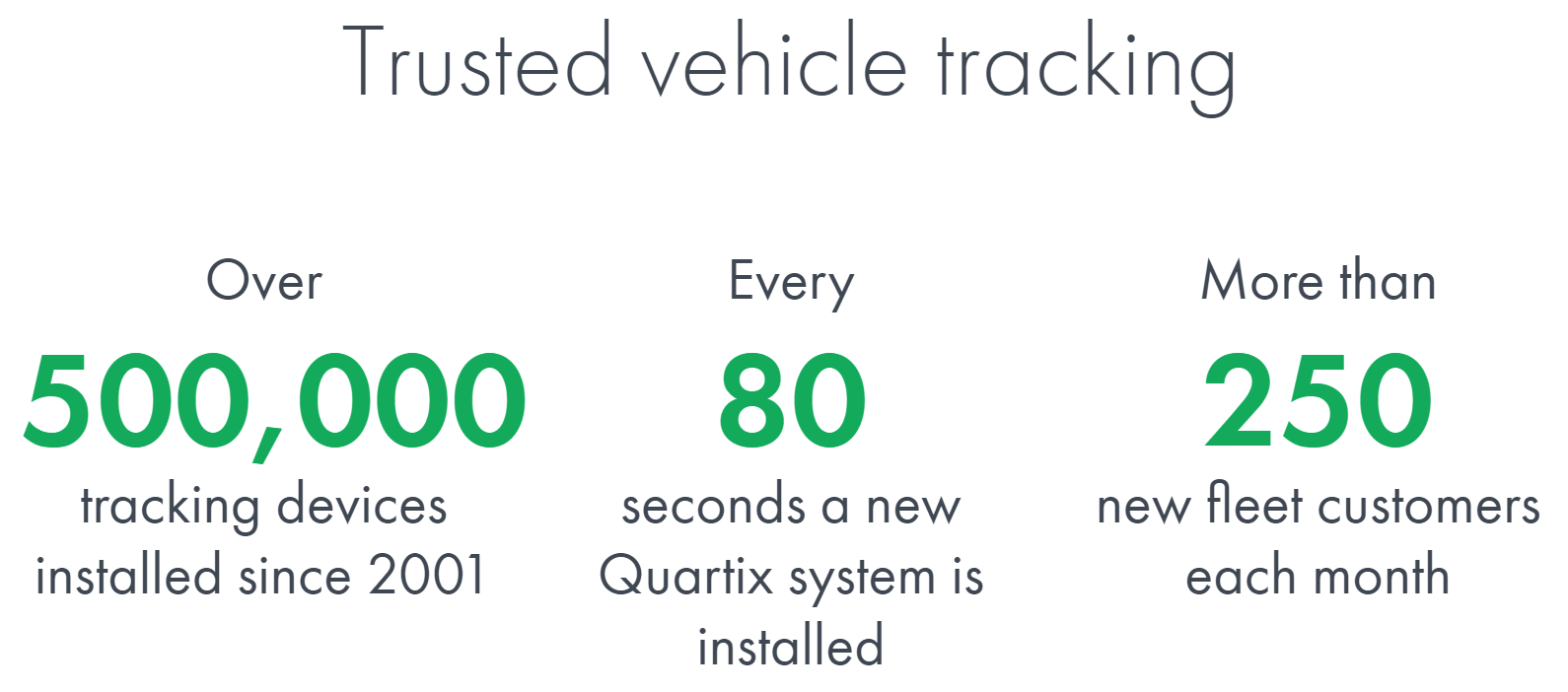

Quartix is one of my favourite firms and it earned 201% CROCI in 2019. The company supplies vehicle tracking services to small fleet operators. Typically these are small businesses that deliver products or provide services, from fine teas to fitting fire alarms. They want to know where their vans are, and how well they are being driven. Customers pay a modest monthly fee for the service, which is of course a great source of repeat business demonstrated by the fact that customers are not tied in to annual contracts after the first year and yet the company only loses about 10% of its customers a year. Quartix does not supply consumers, but there are millions of small businesses in the UK alone, and the company is growing in the USA and Europe, so it has a large and diverse market.

Pipehawk😨

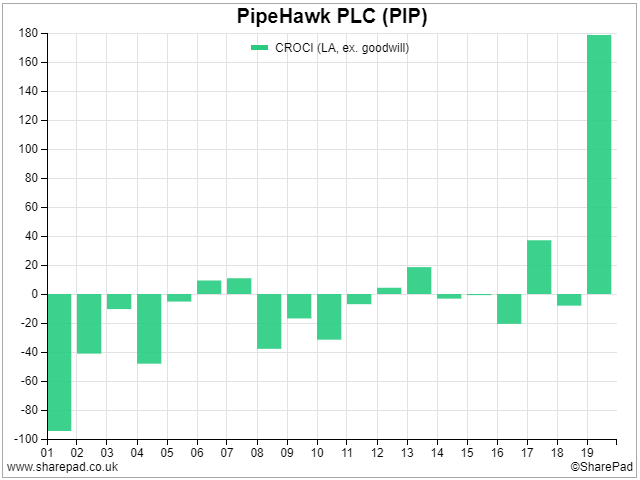

Third placed Pipehawk is a tiny group of loosely related businesses with a market capitalisation of just £2.5m. Since it has been listed since 2000 that in itself disqualifies it as a profitable business would surely have grown into a reasonable size since then. Pipehawk develops Ground Penetrating Radar systems used in construction to detect, map and avoid subterranean structures like pipes. Although it generated high CROCI in 2019, it hasn’t sustained high levels in the past. In fact, it hasn’t sustained positive CROCI.

Pipehawk’s customers are cyclical businesses, and it sells capital equipment, two more reasons to discount it.

There’s more to Fundsmith’s strategy!

So my list has resulted in confusion (😕), joy (😊) and fear (😨), but a list like this can only be a starting point. Fundsmith’s analysis goes beyond identifying predictable businesses like these because one of the things we can predict about them is their highly profitable business models will attract competition.

Other firms will try and deploy capital in a similar way to earn similar high returns. To withstand competition and sustain repeat business, high quality firms need a hold on their customers that differentiates them from the competition.

Of these companies, Quartix is the one I know best. Its advantage is cost. It has resisted the temptation to add lots of bells and whistles, like some competitors, and supplies a generic service that can be marketed directly and installed and configured by customers at low cost.

This appears to be exactly what customers want.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.