A smarter way of buying into the right kind of private growth businesses

It is an unfortunate truth that more and more high growth businesses are choosing to stay private and ignore the public markets. Collectively we investors, institutional and private have done our best to make life difficult for highly rated , fast growing businesses, arguably aided by the regulators who seem keener to come up with ever more rules rather than encourage entrepreneurs to list their businesses on the stockmarket.

Obviously, a few businesses, especially in the technology space, do squeeze through and fund managers such as Baillie Gifford (through their Scottish Mortgage fund for example) have made a point of backing these businesses through thick and thin. But by and large many entrepreneurs in growth businesses have become cautious about the glare of public markets, preferring instead to shelter in private businesses backed by private equity firms and venture capitalists.

This forces private investors into an invidious position – how do we access these private growth businesses? Some traditional fund managers have tried reinvent themselves as private equity wizzes but after the Woodford affair I think it’s fair to say we’ve all grown a bit disenchanted with this particular ‘changes of clothes’. Private equity seems better suited to this world but many of the really successful firms are not open to private investors. The one exception is the small number of listed private equity funds on the London Stock exchange, many of which such as Hg Capital – the focus of this article – and Oakley Capital are first rate. Unfortunately, an equally large number of these funds – arguably a majority – aren’t of such high quality.

Investing in private equity even via a listed fund poses a number of challenges for investors. Critics in the media will point to any number of egregious practises such as high fees for the underlying funds, and long lock ins. These are all valid criticisms in my view but they hide a bigger risk – leverage. For too long the private equity industry has gorged on high levels of debt as a way of juicing up returns. I completely accept that smart PE firms deploy real operational expertise but all too frequently this comes at the expense of eye watering levels of debt, all of which is tax deductible.

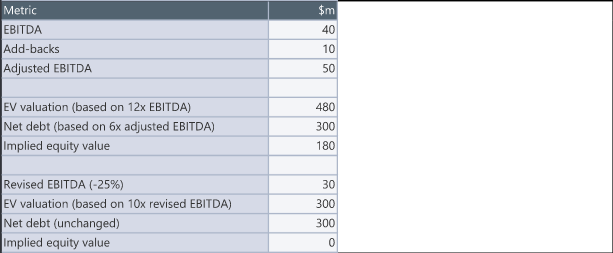

Let’s explain why this is a problem, by way of a recent note on the sector by Matt Hose, the highly rated funds analyst at investment bank Jefferies. You may have just about noticed we are now in a severe recession which is proving challenging for everyone. Leverage sort of works as long as the underlying businesses in a portfolio produce actual cash profits AND the implicit valuations for each deal stay stable or go up – not down!

The problems begin when these firms are hit by a combination of headwinds such as the length and depth of the economic contraction, the revenue exposure, and the degree of leverage. According to Matt if everything goes wrong, it is “highly likely that some underlying investments within the funds will go to zero”. In the table below Matt shows a highly “stylised example of a buyout deal with 6x leverage, EBITDA add-backs (so actual net debt of 7.5x), and an initial 12x valuation multiple. Here a 25% decline in EBITDA, coupled with a 2x de-rating, would wipe out the equity value.”. The point here is that a relatively straight forward decline in earnings can end up destroying all the equity in the investment.

Stylised example of a buyout deal

Leverage at the wrong valuation, in the wrong businesses and in the wrong macro economic environment can thus destroy valuations. So, with this warning ringing in our ears, we turn to one of the few listed private equity firms that I think warrants inclusion on my Dynamic 35 list. The fund may be familiar to many readers and is called Hg Capital. As we’ll see it’s been a standout success within the listed space. In the past there have been some worries about changes in leadership but these are now largely dealt with (we hope). Crucially our sense is that now may be a decent time to look again at this star in the European PE firmament, whilst accepting that its business model is not without possible short-term challenges.

Basics: Hg Capital

Ticker HGT

Mkt Cap £868m

Prem/(disc) -9.9%

Div yield 2.3%

Unlike many private equity firms which boast a range of strategies , Hg Capital is very focused on mid sized European businesses operating in the business support services sector, all with a strong technology angle. Hg invests in companies which focus on critical activities such as delivering legal, health and safety advice to many thousands of businesses globally, helping these companies to pay taxes and payroll, deliver healthcare services, audit and manage supply chains and provide many other services.

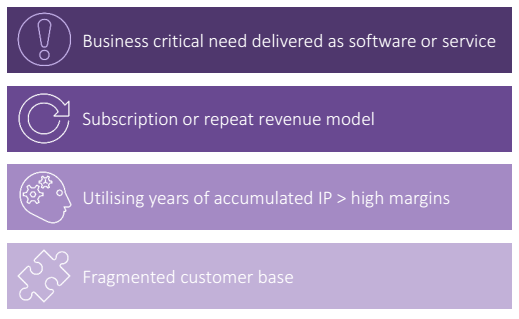

According to fund analysts art Numis Hg portfolio businesses tend to sell “business-critical and non-discretionary software and services to their underlying customers, typically with highly predictable business models and robust levels of recurring revenue. Hg believes that the combination of the long-term nature of listed private equity investment with the types of business that Hg invests in and the scale of the structural opportunities that these can deliver will continue to drive long-term growth.”

This all sounds a bit jargon heavy but in essence Hg’s trick is to look at a service that can probably be supplied to most businesses via technology platforms and then scale up. What do we mean by scale up? Typically, Hg might try and put together a bunch of related businesses, combine them in one business entity, and then invest to grow the revenues, all the while hoping to increase the valuation of the portfolio businesses. The graphic below from Hg Capital sums up the main business segments the fund manager operates in…

In practical terms Hg Capital likes businesses which operate in the Software-as-a-Service (SaaS) space as an example. The vast majority of HgCapital Trust’s investments have highly predictable, strong earnings growth and are very cash generative, crucially making them well-suited to debt financing.

The second graphic below, also from Hg, maps out Hg likes to add ‘value’ to their portfolio businesses.

How successful has Hg Capital been?

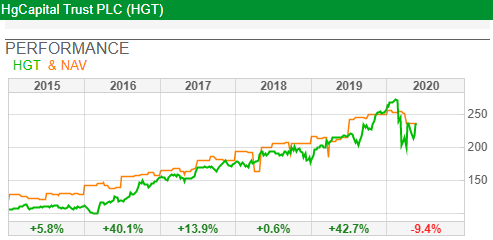

In short, very successful up till now. Overall, the fund has provided investors with 20-year NAV total return of 13.6% pa. outperforming the FTSE All Share by 10.1% pa. In fact, the fund was recently recognised by the AIC, which marked the twenty first anniversary of ISAs by identifying those investment trusts which have delivered the highest returns to investors who subscribed to an ISA over that period. The company delivered a return that put it into second place of all UK listed investment companies.

What about recent performance? We’re fortunate in that Hg have very recently released their Q1 results. The downside is that these numbers don’t include the full impact of the Covid emergency but they’re not far off. Overall, the numbers are probably what the market was expecting – there were losses as you’d expect but nowhere near the worst case estimates of 10 to 20% losses.

I’ve listed the main headlines form these results below:

- NAV per share at 31 March 2020 was 236.3p, representing a NAV total return of -6.2% in Q1 2020. This compares with a 25.1% fall for the FTSE All-Share Index. The portfolio valuation fell 7% over the quarter. This is made up of the following changes: portfolio multiples meant there was a valuation decline of 11% partially offset by 5% appreciation from the trading performance of the underlying portfolio companies. An increase in net debt caused a further 1% reduction.

- New investments. During the quarter Hg made new investments totalling £123m and a further investment to existing portfolio company Achilles of £11m. In Q1, HgCapital Trust completed £134.4m in investments such as Argus Media (£34.8m), P&I (£34.6m), Intelerad (£31.2m) and smartTrade (£18.1m) for the Hg Saturn, Hg Genesis and Hg Mercury funds. Hg expects investment activity in 2020 to continue – cautiously and with discipline – into companies that it has tracked for many years. Since quarter end, the company invested an additional $28m in Visma via the HgSaturn 2 fund.

- Realisations in the period totalled £3.1m.

The portfolio

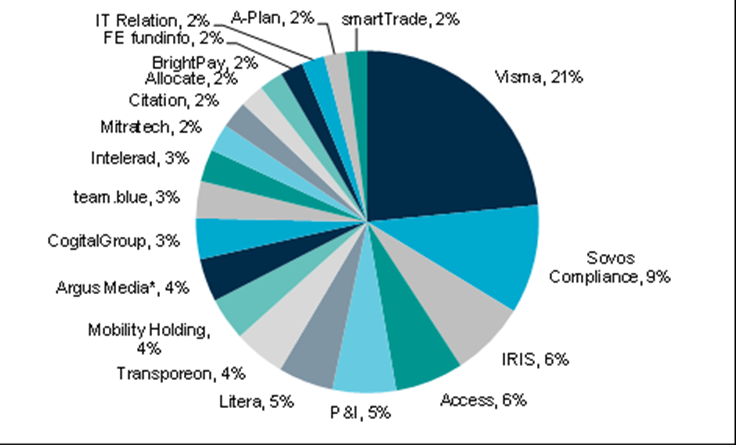

The two charts below summarise the portfolio as it stands at the end of March 2020.

In the first graphic we can see that the portfolio is heavily skewed towards European businesses – at 80% of the portfolio. The 20% US interest is in just one firm Sovos.

The next graphic looks at the company level – 20 companies in the portfolio are listed, with nearly 30% invested in just two businesses Visma and Sovos Compliance. The former is a Norwegian based business that provides business optimisation and management tools for SMEs – other investors include Cinven and Intermediate Capital. The latter is a leading global provider of software that safeguards businesses from the burden and risk of modern transactional taxes and is based in the US. One of the brand names is called Taxware.

HgCapital Trust – Portfolio at 31 March

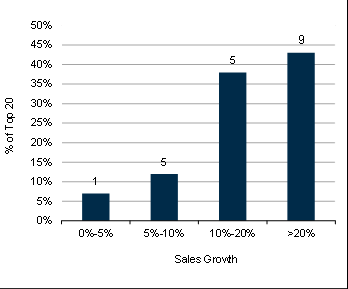

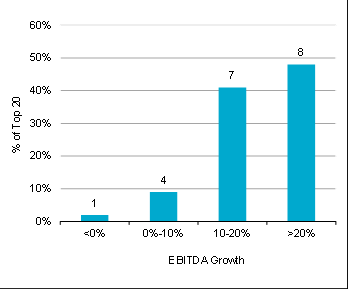

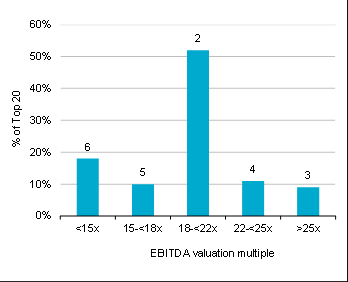

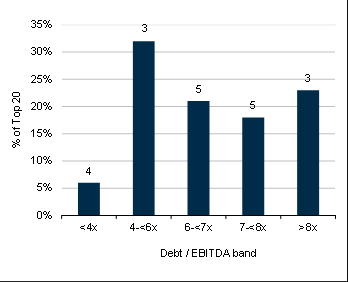

How have these portfolio businesses been performing over the last year? The top 20 investments (88% of net assets) have reported aggregate sales of £4.0bn and EBITDA of £1.2bn over the last twelve months. In terms of growth, the top 20 companies (88% of portfolio) reported sales growth of 24% and EBITDA growth of 32%. And what about valuations? The average EV/EBITDA multiple for these investments was 19.6x (Dec-19: 19.8x) and the Net Debt/EBITDA ratio was 6.5x (Dec-19: 6.2x). On a like-for-like basis, the EV/EBITDA multiple fell 1.5x since 31 December 2019. The average debt/EBITDA multiple of the top 20 buyouts was 6.5x at 31 March, up from 6.2x at December 2019. According to Numis, “the vast majority of HGT’s investments have highly predictable, strong earnings growth and are very cash generative, making them well-suited to debt financing.”

The next bunch of charts map out these growth dynamics in more detail. My only slight nagging concern is that there seems to be about a quarter of the portfolio where sales and earnings growth (annually) is running below 10%, which could mean these businesses are ever so slightly struggling.

HgCapital Trust – Last 12 months Sales Growth

Last 12 months Earnings Growth

HgCapital Trust – Portfolio EBITDA Multiples (avg. 19.6x)

Number of investments within associated band. At 31 March 2020. Source: Company data

HgCapital Trust – Portfolio Debt/EBITDA Multiples

Number of investments within associated band. At 31 March 2020 Source: Company data

Leverage risks and the danger of running out of capital

We’ve already identified what I think is the one big risk for all private equity funds, listed or not. Leverage or debt! Most analysts think that these funds went into the Global Financial Crisis over leveraged and also over committed. What do we mean by this latter term, committed?

By and large private equity funds tend to carry a large amount of cash on their balance sheets alongside all that debt. That cash is usually held for reinvestment in the portfolio businesses at a later date.

In essence the managers of the private equity funds hold cash to make sure they can keep to their funding commitments as they build their portfolio businesses. So, whilst lots of cash sounds great be aware that most if not all that cash will probably already be committed. This matters in a downturn because investors might suddenly go very cold on the existing portfolio but find themselves committed to investing more cash (at agreed valuation multiples from before the downturn) at exactly the time you might want to keep the cash ! That last point is crucial. Many buyouts deals take years to work through and investors need to be careful that the pipeline might be packed with deals agreed at very high multiples. In fact, according to a recent Bain report, the proportion of U.S. buyout deals with over 6x net debt/EBITDA has surpassed its 2007 peak – even then, EBITDA add-backs may still understate some multiples.

Fund analysts at Jefferies have crunched the numbers on Hg Capital’s balance sheet (and commitments) and come up with the following:

- Latest cash £146m

- Available RCF £80m

- Total liquidity £226m

- Commitments £336m

On paper these numbers might suggest some concerns about the future commitments, especially as the fund steps up its commitments to a new internal fund ($400m into Saturn 2) but the good news is that Hg does pass the (stress) test according to Jefferies. Crucially Hg has clauses written in to its fund terms which allows it to opt out if needs be of new commitments. Analysts at Numis also report that the fund managers will “not be activating c. €475m (c.£416m) of these commitments until Q1 2021.” On a side note this big new Hg Saturn 2 is expected to make around 8-10 investments in total over the next four to five years, with HGT investing around $40-50m in each holding.

The Risks

My view is that investing in listed private equity funds is only for the more adventurous private investor. Although its easy to buy and sell shares in these funds, the underlying structures are illiquid and long term, by design. That mismatch means that many listed private equity funds can trade at sizeable discounts to the supposed book value of their holdings. Discounts of between 20 and 40% are not uncommon if private equity deals go sour and although Hg ‘s discount is tighter than in recent months, it’s always possible that a big investment in say Visma or Sovos might go wrong and the discount could widen.

There are other obvious risks, some of which I have detailed. Leverage is a big concern and I remain to be convinced that policy makers won’t attack the privilege to write tax off against business loans. More and more politicians on the left and right are noting that seemingly profitable businesses seem to pay no tax because the owners have loaded up on debt and paid themselves dividends. My sense is that in the new normal of Corona this may be hard to defend when everyone else is forced to pay more tax!

Private equity is also still the preserve of the 2 and 20 fees world. Annual fees of 2% or more are still common and the managers behind the fund usually also take a cut of returns above a threshold. Personally, I find these charges across the industry inexcusable but be aware that the PE managers are nearly always extraordinarily well paid.

A more topical concern is that many deals happen between PE firms, passing assets between each other, frequently at hugely inflated multiples. Thus, we never do quite see whether the prices paid are realistic because the portfolio businesses rarely make it into the public markets. That said the few businesses that do make it on to the public markets are outrageously overpriced, over leveraged and more than likely end up disappointing stock market investors in the first few years.

Also in terms of timing, my sense is that although the current economic malaise might be conducive towards bargain basement new deals (and thus the new Saturn fund could be well timed), the real sense of fear lurking around say a second wave of infection could cause drastic valuation haircuts in the next few months. My sense is that 20 to 40% cuts in asset values this year will not be uncommon as the recession turns into a depression.

Bottom Line

Still, despite my long list of concerns and risks I think that Hg Capital is worth a long-term investment and thus deserves to make it on to my Dynamic 35 list. Its board has gone out of their way to address some of my concerns, making it private investor friendly. .

I also think its singular focus on European mid-sized tech and business support services outfits is a great sweet spot. Over in the listed markets by the end of the first quarter of this year, the S&P500 Software and Services index, which has historically correlated well with the Hg Capital portfolio according to Numis, has returned to Q1 2019 valuation multiples. The S&P 500 Software and Services total return index was down 8.9% ytd 31 March but it has increased by 18% since (in US Dollars).

Another way of looking at the same point is if we imagined that Hg Software Inc was just one business, according to Numis, it would actually end up being one of the largest tech companies in Europe, with £4bn revenues and over £1.2bn EBITDA. Not unsurprisingly that leads Numis researchers to conclude that Hg “provides value [ at a near 10% discount] as it is best placed to benefit from the anticipated accelerated growth of cloud services and SaaS businesses as a result of the pandemic.”

I would agree with that verdict. Investing in this fund is not without risk, but it is a quality play, investing in fast growth businesses in the right sectors in Europe. It possesses deep sector knowledge and has contacts in all the right places. I rate this a solid buy at current prices.

David Stevenson

You can read more about my market views, and latest investment ideas at my daily blog –www.adventurousinvestor.com