Profiting from Folly and Disaster

Old fashioned companies such as TP ICAP have started putting strong trading statement out which is strange times indeed. This is an old-fashioned voice broker of financial products. The staff are renowned for loud and boisterous traditional city behaviour which resulted in a £15m settlement with the regulator for their lack of controls to deal with the risk of improper broker conduct. With Wework woes, Woodford’s demise, and the decline of Peer 2 peer lenders it is easy to believe that we may be returning to a pre bubble world.

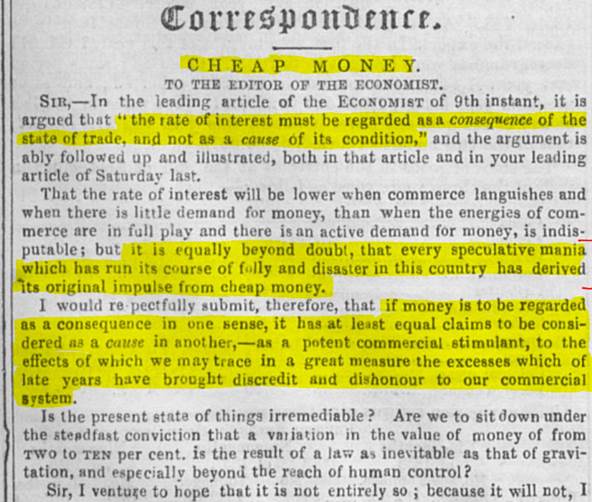

I was pleased to find an article from The Economist magazine from 1858 lamenting that “every speculative bubble that has run its course of folly and disaster……derived its original impulse from cheap money”. If only analysts used such language today. Instead of “Sell” recommendations companies such as Uber could be labelled “Folly and disaster” stocks.

Source: Jamie Catherwood

The 10-year outperformance of growth stocks is slowly starting to change in recent weeks, but this means there is a lot of clearing up of the previous “speculative mania” to be done. Brokers have been sending round lists of Woodford holdings to fund managers in a city equivalent of the car boot sale. Large stakes have been switching hands often at discounts to prices shown on screen enabling funds to profit. For investors at this point is a cycle there is money to be made from owning value stocks but there is also money to be made from clearing up the remains of the folly and disaster.

Folly and Disaster Trades

At times like this it is sometimes possible to watch the crash in slow motion. On TV we can sometimes watch a car chase heading to an incomplete bridge and immediately we know that the car is going to make a trajectory through the air enduing up in the river below. And we don’t take our eyes away from the screen even though we think we know how it ends. Some things are predictable. Like when Timothy Dalton escapes from a burning land rover falling out of a plane in The Living daylights it may well be predictable that there is a super yacht with a single female on board to help him out of his problem.

There are situations that follow periods of market folly and disaster that are similarly predictable. Such as the extraordinary situation at Non-Standard Finance, where it is possible to see events ahead unfolding and rather than just watch them it may well be possible to profit from them if we can understand the motives that drive the players.

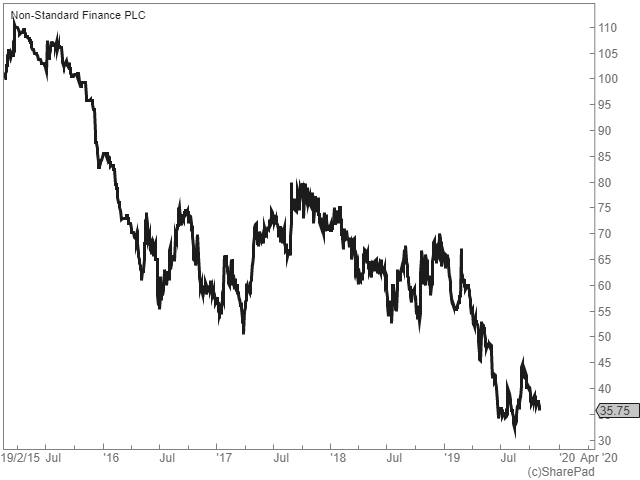

Non-Standard Finance Plc

Share Price 36p

Mkt Cap £111m

History

This was a lending company set up by John Van Kuffeler who was Chief Executive and then Chairman of Provident Financial Plc for a combined total of 22 years. It floated as a cash shell in February 2015 with £102m of cash raised at a price of £1 per share from Neil Woodford and Mark Barnet, his successor at Invesco, amongst others. The aim of the company was to acquire lending businesses in order to capitalise on the gap that had been left by banks post the credit crunch. When a company raises £100m and public announces the types of lender it aims to acquire it doesn’t take long for the vendors willing to sell over-priced assets started to form an orderly queue.

- In July 2015 the company acquired the home collected credit business from S&U for £82.5m which was 12.5X the profits and 2.5X the book value.

- In August 2015 the company acquired Everyday Loans for £235m raising fresh equity of £160m at 85p per share, below the original IPO price of 85p per share. This represented a multiple of 18.1 times the after-tax profit at the time.

- Then in August 2017 George Banco, a guaranteed loan business was acquired to £53m in cash which was 13X the pre tax profit it was generating at the time.

All these prices are higher than banks or specialist lenders trade at in the stock market so it is hard to understand why allegedly experienced investors and management teams would raise equity to pay premiums for companies when investors can buy them cheaper on the stock market. The answer must be that new management felt they could add value with a new strategy.

Strategy

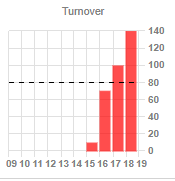

The strategy was to grow the loan book fast which was defined as more than 20% per annum while achieving a 20% return on investment. Which is a flawed strategy because in the world of lending new customers are riskier than lending to repeat customer who you have known for some time. As a result, high growth lenders experience high bad debts. The result was fast turnover growth, but the company has as yet failed to report a profit.

Source: SharePad

Funding Circle, likewise, have found that fast turnover growth doesn’t equate to strong investor returns. Save for a peer 2 peer platform it was the customers who do the lending, so the customers experience the impairments which ultimately ends up with customers deserting the platform. Today there is a queue of more than 100 days to sell a loan on Funding Circle’s platform. Funding Circle came to market at 440p per share in September 2018, a little over a year ago and have never traded at 440p since. Today they trade 73% lower at 118p per share.

Reasons

The surprising thing is that Non-Standard Finance’s experienced management team backed by experienced investors ignored their experience and believed they could do it better this time. This is what happens during a bubble. Bolstered by the dopamine inducing free money management believed we are in a new world, much as we thought we were in 2000 when the internet was creating a new world. But the catalyst for the internet bubble was in fact the interest rate cuts during the 1998 far east crisis which meant that cheap money could fuel ideas of a new world to create the bubble. This time it is the low rates that persuaded investors we were in a new world left vacant by the retraction of the large banks since the credit crisis.

This duping of investors is motivated by management’s need to be successful and make money. A look at the incentive scheme for Non-Standard Finance finds that founder shares were issued entitling the founders to 5% of the company if it spends at least £50m on acquisitions and achieves a 25% increase in the share price over 5 years. On top of this an LTIP exists where 15% of the value accruing above 110p per share is awarded to the directors. These schemes mature in March 2020.

It is hard to understand why allegedly sane people would incentivise management on a share price target when it is a lending business. Share price incentives encourage excessive risk taking and for lenders usually end in folly and disaster. But with the hallucinogenic free money encouraging risk taking it happened. This share price incentive may well explain why it is the only £110m market cap company I know which employs full time investor relations staff.

Of course, this incentive plan encourages the company to take more risk as the share price falls and the incentive scheme comes closer to the March 2020 maturity. It is therefore unsurprising to see management make an audacious nil premium all share £1.3bn bid for Provident Financial in April 2019, when the shares were around 45p and there are only 11 months left to reach the incentives target prices of 110p and 125p. It happened that Woodford and Invesco were the largest shareholders in both companies. In June this year regulatory reasons were cited as the reason for the bid failing, leaving shareholders to foot the £25m exceptional item for the bid costs.

What Happens next?

The departure of Miles Cresswell-Turner, a founding director was announced on 21 October. The reason given was that in the absence of the Provident business to run he was not utilising his skills. The announcement made no reference to the fact that the potentially lucrative incentive scheme needed a hurricane force wind behind the share price by March 2020 and consequently the directors are lacking motivation. With a diminished financial incentive those that are financially motivated may well look at the valuation of the company and see better ways of making money than being employed by it. A PER of 6.4X and yield of 8.1%. But with £27m headroom of the £285m facility at the end of June we may question the company’s ability to continue the growth and the dividend without new funding- which is being sought.

Private Equity – It has been said that venture capitalists can be financially motivated. Prior to Non-Standard Finance Miles Cresswell-Turner was at Duke Street Capital and Palamon partners for 10 years prior to that. I can’t imagine it would be difficult to persuade private equity of the potential gains to be had from taking NSF private at a time when new debt facilities are being sought and management incentives are expiring while it trades on 6.4X earnings just as growth is slowing and profitability is set to expand. It may be true that in the absence of the Provident combination and a slowing roll out of branches there is less to do at NSF.

Valuation Potential – The NAV of the company is £210m, of which £154m is intangible. This is after £33m of those intangibles have been amortised so NAV at cost is £243m, some 109% ahead of the current market cap. The existing management team were after all the people who believed it was right to pay £243m to acquire these companies so one may imagine that they would believe there is money to make when the market values these businesses at £111m.

With Alchemy (having bought Woodford’s stake) holding 19% and Invesco holding 28% it can’t be long until a non-public markets outcome is found. One has to imagine there is 50% upside on a bid or break up.

No doubt the irony of launching a bid for NSF wouldn’t be lost on the board of Provident, which trades on a PE of 9.4X and 1.6X NAV. But they could face private equity competition. Then we have Amigo, the guarantor loans business trading on a PE of 4X. I suspect we are going to experience some M&A activity in the sector.

Risks

Of course, the risk when buying a stock for its bid potential is that it gets a lot cheaper before it gets bid for. So, we need to check the down side risks. The first stopping off point on the safety checks in the balance sheet.

Balance Sheet – This is a highly geared lender with a net asset value of £181m at June 2019. The share premium account, which shows how much of the assets have been created from shareholders injecting money stands at £255m while the retained losses amount to some £88m, portraying the disastrous history.

A look at the other side of the balance sheet shows goodwill of £128m and other intangible assets of £11m, so stripping this out reduces the NAV from £181m to NTAV of only £42m, well below the market cap of £111m. However, if we add back to profits the amortisation of intangibles and exceptional bid costs the company is profitable which means the NAV is likely to grow going forwards. Analysts tend to forecast on a pre amortisation and pre-exceptional basis and the share price has some earnings support while it trades on a multiple of 6.4X profits. So, it looks like we don’t have asset protection on the downside but there is some earnings protection. Given the company is now slowing the growth this is a time when profitability is likely to expand for the reason that new customers are the riskiest loans and with fewer new customers impairments reduce.

Debt – The loan book stood at £339m at June 2019 which was financed by £302m of bank debt, though the company also has £17.4m cash so net debt was £285m. The facilities are from Royal Bank of Scotland who provide at £45m revolving credit facility at LIBOR plus 3.5% and a group of institutional investors led by Alcentra who provide a term loan repayable in 2023 at LIBOR plus 7.25%. The company says it is in discussion to obtain a lower cost debt facility which can be used to fund further growth. Certainly, in the absence of further facilities it looks like the balance sheet is close to maxed out and the dividend could therefore be at risk if no further facilities are obtained.

It may well be this process of seeking to refinance the debt that unearths a bid for the company. Private equity certainly like to provide debt alongside equity in order to leverage the returns on their investments.

Regulation – Regulation is an ever-present risk to these businesses. The FCA carried out a review of home collected credit in 2018 which focussed on repeat customers where a lower cost long term loan may be a better outcome for the customer. This company was not impacted by the review which is encouraging that their procedures are appropriate. The FCA is now gathering information to study the Guarantor Loans market. The company retorts that it believes its policies and procedures are appropriate. The FCA is also due to publish guidance for the treatment of vulnerable customers but we have no reason to suppose that Non-Standard Finance has any issues.

Personal View

With management incentives lapsing in March 2020 top management have started to leave. This is a team that is experienced and from a background of doing deals. With new debt facilities also being sought it would appear highly likely that at the current valuation the company may fall to a bid, either from a competitor or from private equity. With a stable balance sheet and profitability starting to improve the downside risks appear controllable. However, in all these special situations I find it important to maintain discipline. If no bid arrives it is important to sell and move on and not invent new reasons for holding it. Though it would appear the odds may be favourable for a bid.

Summary

As the valuation bubble caused by cheap money since the credit crunch passes there are two ways of investors profiting. We could own stocks which are undervalued and neglected, for example small cap stocks, or we could try and profit from the bid activity that always follows as the process of cleaning up the mess created by the folly and disaster. In my personal opinion there is a good likelihood of Non-Standard Finance being bid for in the next six months and there could be 50% upside on the share price in that event, while the downside the shares seem to have some valuation support as profits are at last starting to come through.

Forthcoming Events

For the last few years Non-Standard Finance has hosted a November investor day. It may be telling that no such day is scheduled this year. We may however expect a period end pre close trading update in early January.

Weekly Commentary: 04/11/19 – Profiting from Folly and Disaster

Profiting from Folly and Disaster

Old fashioned companies such as TP ICAP have started putting strong trading statement out which is strange times indeed. This is an old-fashioned voice broker of financial products. The staff are renowned for loud and boisterous traditional city behaviour which resulted in a £15m settlement with the regulator for their lack of controls to deal with the risk of improper broker conduct. With Wework woes, Woodford’s demise, and the decline of Peer 2 peer lenders it is easy to believe that we may be returning to a pre bubble world.

I was pleased to find an article from The Economist magazine from 1858 lamenting that “every speculative bubble that has run its course of folly and disaster……derived its original impulse from cheap money”. If only analysts used such language today. Instead of “Sell” recommendations companies such as Uber could be labelled “Folly and disaster” stocks.

Source: Jamie Catherwood

The 10-year outperformance of growth stocks is slowly starting to change in recent weeks, but this means there is a lot of clearing up of the previous “speculative mania” to be done. Brokers have been sending round lists of Woodford holdings to fund managers in a city equivalent of the car boot sale. Large stakes have been switching hands often at discounts to prices shown on screen enabling funds to profit. For investors at this point is a cycle there is money to be made from owning value stocks but there is also money to be made from clearing up the remains of the folly and disaster.

Folly and Disaster Trades

At times like this it is sometimes possible to watch the crash in slow motion. On TV we can sometimes watch a car chase heading to an incomplete bridge and immediately we know that the car is going to make a trajectory through the air enduing up in the river below. And we don’t take our eyes away from the screen even though we think we know how it ends. Some things are predictable. Like when Timothy Dalton escapes from a burning land rover falling out of a plane in The Living daylights it may well be predictable that there is a super yacht with a single female on board to help him out of his problem.

There are situations that follow periods of market folly and disaster that are similarly predictable. Such as the extraordinary situation at Non-Standard Finance, where it is possible to see events ahead unfolding and rather than just watch them it may well be possible to profit from them if we can understand the motives that drive the players.

Non-Standard Finance Plc

Share Price 36p

Mkt Cap £111m

History

This was a lending company set up by John Van Kuffeler who was Chief Executive and then Chairman of Provident Financial Plc for a combined total of 22 years. It floated as a cash shell in February 2015 with £102m of cash raised at a price of £1 per share from Neil Woodford and Mark Barnet, his successor at Invesco, amongst others. The aim of the company was to acquire lending businesses in order to capitalise on the gap that had been left by banks post the credit crunch. When a company raises £100m and public announces the types of lender it aims to acquire it doesn’t take long for the vendors willing to sell over-priced assets started to form an orderly queue.

All these prices are higher than banks or specialist lenders trade at in the stock market so it is hard to understand why allegedly experienced investors and management teams would raise equity to pay premiums for companies when investors can buy them cheaper on the stock market. The answer must be that new management felt they could add value with a new strategy.

Strategy

The strategy was to grow the loan book fast which was defined as more than 20% per annum while achieving a 20% return on investment. Which is a flawed strategy because in the world of lending new customers are riskier than lending to repeat customer who you have known for some time. As a result, high growth lenders experience high bad debts. The result was fast turnover growth, but the company has as yet failed to report a profit.

Source: SharePad

Funding Circle, likewise, have found that fast turnover growth doesn’t equate to strong investor returns. Save for a peer 2 peer platform it was the customers who do the lending, so the customers experience the impairments which ultimately ends up with customers deserting the platform. Today there is a queue of more than 100 days to sell a loan on Funding Circle’s platform. Funding Circle came to market at 440p per share in September 2018, a little over a year ago and have never traded at 440p since. Today they trade 73% lower at 118p per share.

Reasons

The surprising thing is that Non-Standard Finance’s experienced management team backed by experienced investors ignored their experience and believed they could do it better this time. This is what happens during a bubble. Bolstered by the dopamine inducing free money management believed we are in a new world, much as we thought we were in 2000 when the internet was creating a new world. But the catalyst for the internet bubble was in fact the interest rate cuts during the 1998 far east crisis which meant that cheap money could fuel ideas of a new world to create the bubble. This time it is the low rates that persuaded investors we were in a new world left vacant by the retraction of the large banks since the credit crisis.

This duping of investors is motivated by management’s need to be successful and make money. A look at the incentive scheme for Non-Standard Finance finds that founder shares were issued entitling the founders to 5% of the company if it spends at least £50m on acquisitions and achieves a 25% increase in the share price over 5 years. On top of this an LTIP exists where 15% of the value accruing above 110p per share is awarded to the directors. These schemes mature in March 2020.

It is hard to understand why allegedly sane people would incentivise management on a share price target when it is a lending business. Share price incentives encourage excessive risk taking and for lenders usually end in folly and disaster. But with the hallucinogenic free money encouraging risk taking it happened. This share price incentive may well explain why it is the only £110m market cap company I know which employs full time investor relations staff.

Of course, this incentive plan encourages the company to take more risk as the share price falls and the incentive scheme comes closer to the March 2020 maturity. It is therefore unsurprising to see management make an audacious nil premium all share £1.3bn bid for Provident Financial in April 2019, when the shares were around 45p and there are only 11 months left to reach the incentives target prices of 110p and 125p. It happened that Woodford and Invesco were the largest shareholders in both companies. In June this year regulatory reasons were cited as the reason for the bid failing, leaving shareholders to foot the £25m exceptional item for the bid costs.

What Happens next?

The departure of Miles Cresswell-Turner, a founding director was announced on 21 October. The reason given was that in the absence of the Provident business to run he was not utilising his skills. The announcement made no reference to the fact that the potentially lucrative incentive scheme needed a hurricane force wind behind the share price by March 2020 and consequently the directors are lacking motivation. With a diminished financial incentive those that are financially motivated may well look at the valuation of the company and see better ways of making money than being employed by it. A PER of 6.4X and yield of 8.1%. But with £27m headroom of the £285m facility at the end of June we may question the company’s ability to continue the growth and the dividend without new funding- which is being sought.

Private Equity – It has been said that venture capitalists can be financially motivated. Prior to Non-Standard Finance Miles Cresswell-Turner was at Duke Street Capital and Palamon partners for 10 years prior to that. I can’t imagine it would be difficult to persuade private equity of the potential gains to be had from taking NSF private at a time when new debt facilities are being sought and management incentives are expiring while it trades on 6.4X earnings just as growth is slowing and profitability is set to expand. It may be true that in the absence of the Provident combination and a slowing roll out of branches there is less to do at NSF.

Valuation Potential – The NAV of the company is £210m, of which £154m is intangible. This is after £33m of those intangibles have been amortised so NAV at cost is £243m, some 109% ahead of the current market cap. The existing management team were after all the people who believed it was right to pay £243m to acquire these companies so one may imagine that they would believe there is money to make when the market values these businesses at £111m.

With Alchemy (having bought Woodford’s stake) holding 19% and Invesco holding 28% it can’t be long until a non-public markets outcome is found. One has to imagine there is 50% upside on a bid or break up.

No doubt the irony of launching a bid for NSF wouldn’t be lost on the board of Provident, which trades on a PE of 9.4X and 1.6X NAV. But they could face private equity competition. Then we have Amigo, the guarantor loans business trading on a PE of 4X. I suspect we are going to experience some M&A activity in the sector.

Risks

Of course, the risk when buying a stock for its bid potential is that it gets a lot cheaper before it gets bid for. So, we need to check the down side risks. The first stopping off point on the safety checks in the balance sheet.

Balance Sheet – This is a highly geared lender with a net asset value of £181m at June 2019. The share premium account, which shows how much of the assets have been created from shareholders injecting money stands at £255m while the retained losses amount to some £88m, portraying the disastrous history.

A look at the other side of the balance sheet shows goodwill of £128m and other intangible assets of £11m, so stripping this out reduces the NAV from £181m to NTAV of only £42m, well below the market cap of £111m. However, if we add back to profits the amortisation of intangibles and exceptional bid costs the company is profitable which means the NAV is likely to grow going forwards. Analysts tend to forecast on a pre amortisation and pre-exceptional basis and the share price has some earnings support while it trades on a multiple of 6.4X profits. So, it looks like we don’t have asset protection on the downside but there is some earnings protection. Given the company is now slowing the growth this is a time when profitability is likely to expand for the reason that new customers are the riskiest loans and with fewer new customers impairments reduce.

Debt – The loan book stood at £339m at June 2019 which was financed by £302m of bank debt, though the company also has £17.4m cash so net debt was £285m. The facilities are from Royal Bank of Scotland who provide at £45m revolving credit facility at LIBOR plus 3.5% and a group of institutional investors led by Alcentra who provide a term loan repayable in 2023 at LIBOR plus 7.25%. The company says it is in discussion to obtain a lower cost debt facility which can be used to fund further growth. Certainly, in the absence of further facilities it looks like the balance sheet is close to maxed out and the dividend could therefore be at risk if no further facilities are obtained.

It may well be this process of seeking to refinance the debt that unearths a bid for the company. Private equity certainly like to provide debt alongside equity in order to leverage the returns on their investments.

Regulation – Regulation is an ever-present risk to these businesses. The FCA carried out a review of home collected credit in 2018 which focussed on repeat customers where a lower cost long term loan may be a better outcome for the customer. This company was not impacted by the review which is encouraging that their procedures are appropriate. The FCA is now gathering information to study the Guarantor Loans market. The company retorts that it believes its policies and procedures are appropriate. The FCA is also due to publish guidance for the treatment of vulnerable customers but we have no reason to suppose that Non-Standard Finance has any issues.

Personal View

With management incentives lapsing in March 2020 top management have started to leave. This is a team that is experienced and from a background of doing deals. With new debt facilities also being sought it would appear highly likely that at the current valuation the company may fall to a bid, either from a competitor or from private equity. With a stable balance sheet and profitability starting to improve the downside risks appear controllable. However, in all these special situations I find it important to maintain discipline. If no bid arrives it is important to sell and move on and not invent new reasons for holding it. Though it would appear the odds may be favourable for a bid.

Summary

As the valuation bubble caused by cheap money since the credit crunch passes there are two ways of investors profiting. We could own stocks which are undervalued and neglected, for example small cap stocks, or we could try and profit from the bid activity that always follows as the process of cleaning up the mess created by the folly and disaster. In my personal opinion there is a good likelihood of Non-Standard Finance being bid for in the next six months and there could be 50% upside on the share price in that event, while the downside the shares seem to have some valuation support as profits are at last starting to come through.

Forthcoming Events

For the last few years Non-Standard Finance has hosted a November investor day. It may be telling that no such day is scheduled this year. We may however expect a period end pre close trading update in early January.