The Ruffer Investment Company – big bets on a global new normal

“There are decades where nothing happens; and there are weeks where decades happen”

Lenin

Generally, I have a very dismissive attitude towards the idea of absolute returns funds. The concept sounds alluring, whereas the delivery tends to be fairly dismal. The key idea is that a fund manager will try and make a positive return through thick and thin, bear and bull markets. In addition, its not unreasonable to expect that the share price won’t move up or down very much and that the key measure – price volatility – should be subdued. Last but by no means least, you’d also reasonably expect that those positive absolute returns will be in excess of returns from cash over the long term.

The vast majority of absolute or target return funds dismally fail these multiple challenges. Either volatility is too high or the active fund managers still lose money in a bear market. On paper this shouldn’t happen as one of the core weapons of an active absolute returns manager is that they can be both long (bullish) and short (bearish) on a financial asset such as a bond or share. Thus, if markets are falling, on paper, a smart active manager with a clear long short strategy should be making money – positive returns – even while the rest of the market is collapsing in value.

A small number of funds have a track record of making money in bear markets and one of them is the Ruffer Investment Company, the flagship fund for a London based boutique manager. The Ruffer fund has a simple aim – to deliver consistent positive returns, regardless of how financial markets perform. In practice that means it’s willing to go long and short assets, is willing to use unconventional options and products to achieve what are called asymmetric payoffs (big profits) and is careful in assembling a portfolio of defensive assets that should/might perform well in a sell off.

What in practice do we mean by these portfolio strategies? Ruffer boasts a fairly standard collection of assets such as equities, bonds and cash. Within those broad categories it will maybe use more adventurous structures such as inflation linked bonds to guard against inflationary pressures. Outside of these three broad asset classes the fund’s managers are also willing to use options and other more exotic structures to boost payoffs.

Overall, this practical implementation is guided by a notably cautious investment strategy which looks upon radical monetary and fiscal policy with some concern. The fund’s managers Hamish Baillie and Duncan MacInnes run the fund with a capital preservation mind-set which seeks to protect their investors cash against the worst excesses of central bankers, policy makers and over enthusiastic momentum based institutional investors.

Past performance?

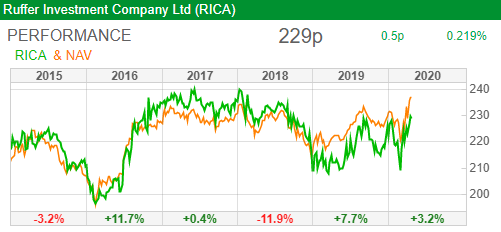

As we’ll shortly discover, during the Corona this London listed fund has performed admirably but its track record is nevertheless long and impressive. During the last global financial crisis, while the FTSE All Share experienced a peak-to-trough fall of 48.8%, the NAV of the fund increased by 18.9%. Overall, the fund has an impressive long-term track record of delivering consistent growth with low volatility: since launch in July 2014, the NAV total return is 187% (6.9% pa).

Source: SharePad

That said, the fund has not always been a star performer. According to a report on the fund by investment trust analysts at Investec, “Ruffer’s unconventional protective assets (options and credit protections) have been a dragging anchor on returns in recent years. However, these have made a significant contribution to the more recent performance”.

And its that recent performance that should be the focus of our attention moving forward. Even before the Corona virus came along the fund’s managers had been growing increasingly cautious, warning investors late last year that they remained “wary of the outlook for the global economy in the year ahead“, citing “the combination of highly indebted corporates and consumers, a widespread insouciance on inflation and growing concerns about liquidity mismatches in financial markets”.

During March, the net asset value of Ruffer rose by 4.2% after allowing for the dividend of 0.95p paid during the month. This compares with a fall of 15.1% in the FTSE All-Share index.

According to the managers “the company’s derivative protections proved critical, blunting equity losses: we sold the VIX calls (adding +3.0% for the Company during March) and (most) equity put options (+1.7%); credit spreads blew out in Europe and the US lifting our credit protections (+5.8%)…..capital preservation has allowed us to acquire mispriced assets amidst the volatility including gold mining equities; fixed income gyrations allowed us to add long-dated US TIPS (+20% in USD since purchase) at attractive yields. “

The current portfolio asset allocation on a look through basis as at 24 March is mapped out in the first box below:

| Asset Class | % |

| Non-UK index-linked bonds | 23 |

| UK index-linked gilts | 10 |

| Cash | 18 |

| Gold & gold equities | 9 |

| Credit protections | 11 |

| Options | 1 |

| UK equities | 11 |

| Japan equities | 8 |

| US equities | 6 |

| Europe equities | 2 |

| Asia equities | 1 |

According to Ruffer’s managers, the portfolio has around 35% in cash and highly liquid cash equivalents to take advantage of emerging opportunities.

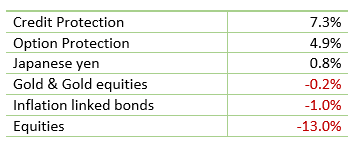

The next table below specifies exactly how those impressive absolute returns were achieved over the first few months of 2020.

Portfolio attribution from 31 December 2019 to 17 March 2020

| Fund basics

Ongoing costs charged to the fund: 107 bps Current: NAV £2.36 Current share price: 228/231p Ticker: RICA |

The Rise of helicopter Money

As we’ve already intimated, the Ruffer Investment Company hasn’t always outperformed. Over many years during the run up to 2018/2020, the fund delivered pedestrian though positive returns. In particular critics have in the past charged its managers with being far too conservative and a cynic could argue that in the past the managers have taken a number of big bets, only some of which have paid off. They worried that volatility might erupt again, a bet that has paid off handsomely. They also worried that as central banks kept easing, inflation would shoot up – that bet hasn’t (yet) been a big success. Lastly, the managers have tended to favour contrarian investments, focused on more value based situations. For many years for instance, the Ruffer managers were strongly of the view that Japanese were cheap – they were right on one level, those equities were cheap, but no obvious catalyst for a re-rating appeared.

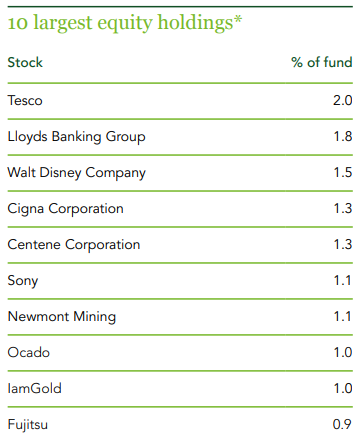

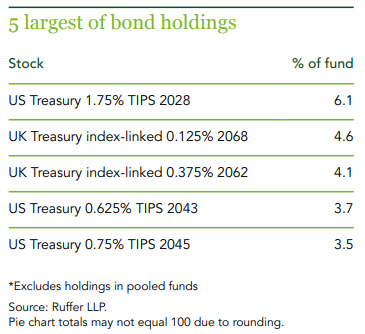

The table below from the Ruffer monthly report for March, shows the key investment holdings in the fund as at 31 March 2020, with a focus on equities and bonds. The tenor of the equities allocation is obvious – mega large cap, reliable, safe names with strong cash flows. Not quite value stocks nor obviously quality stocks, but defensive, nevertheless.

The managers are also running a big cash position, with the portfolio currently at 30% invested in cash and highly liquid cash equivalents “to take advantage of emerging opportunities”. The fund notes that both gold equities and index-linked bonds have the potential to add “significant protection” going forward and if markets continue to deteriorate, the derivative protection should continue to perform.

Fund analysts at Investec also observe that the “valuation lag on options and credit protections in the portfolio makes it harder for investors to understand their true exposure and valuation, particularly if there were large moves in equity/credit markets on the day the NAV is struck.“

The Bottom Line

I think the Ruffer Investment Company is an absolutely classic, core Prudent 15 fund. It has a distinctive strategy, a good absolute returns track record and a solid set of investments. The obvious caution here is that the managers can take big bets that don’t always pay off. And what might those big bets be now? We can catch a glimpse of their current thinking in their most recent reports where they report on what they call the rise of “game-changing ‘helicopter money’ – central bank financing of fiscal stimulus for the real economy – [which] has arrived. Our bet remains that deeper financial repression will result, with inflation-linked bonds and gold the key defences”. I have some sympathy for this view but equally I’m not entirely convinced we will see a rapid re-emergence of inflationary pressures.

Don’t invest in this fund if you want a more unconstrained growth opportunity, with a willingness to invest in expensive tech stocks for instance. This is for the defensive, cautious investor who wants to minimise volatility but still have some upside exposure to equities.

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.