The genomics revolution and the appeal of Syncona

It’s easy to get carried away with the short to medium term noise coming out of stock markets. The corona virus has sent investors in the developed world heading for the exit. But in truth some sectors of the giant ‘technology’ sector were already beginning to suffer before this big sell off. Life sciences firms, and especially those connected to the biotech complex have been consistently under performing for the last year. Investors initially bought into the euphoria around the genomics revolution but over the last 18 months a degree of cynicism has emerged. In simple terms, too much short term money was chasing an industry that takes many years to commercialise new treatments. Disappointment was almost baked in from the start.

But step back from this recent disappointment and I think a more interesting story emerges. The genomics revolution in therapy is only at the beginning stages of a decades long cycle. Analysts at wealth adviser Killik and Co have nicely summed up what I think is perhaps the most impactful change in decades thus:

“This emerging revolution in biotechnology, often termed the ‘third wave’, accelerated with the sequencing of the genome back in the year 2000. From this point research scientists could start to think about genetic linkages to diseases and treating them with ‘precision medicine’. Nearly two decades after this point, the technology developed out of this research effort is now starting to receive regulatory approvals. With over half of the clinical trials initiated last year using some form of genetic based selection, this looks set to have a highly disruptive impact on both patient care and the healthcare industry.”

Syncona, a UK venture capitalist investment trust listed on the London stock exchange, is at the heart of this revolution. For the record, I’ve long been a fan of this life sciences venture capital firm (formerly BACITs, a fund). I’ve invested all the way through, took some profits a year and a bit ago, and have invested more money because of the recent share price weakness.

Before I look in detail at this, a bit of background. BACITs was a London listed investment trust set up a few years back to invest in a range of alternative funds, with a strong hedge fund vibe. The idea was to access the best funds for an absolute return. But the main purpose of the fund was to provide funding, via fees, for research into cancer treatments. BACITs stood for Battle against Cancer investment trust.

The fund performed adequately but a few years back a better plan emerged. The Wellcome Trust had been quietly building an internal venture capital outfit which had amassed a portfolio of early stage firms focused on cell and gene therapy. BACITs in effect reverse merged into this life sciences outfit and Syncona was born, with a huge financial dowry of capital to invest.

Syncona thus started with two very unique differentiators. The first was that huge windfall of capital to invest. The second was that its connections to Wellcome gave it a unique inside track on the best talent in the science space. Put simply Wellcome and Syncona have a unique perspective on which research scientists have the best ideas.

Unlike many VCs who I assume think about areas they’d like to invest in and then try and find the right teams to approach them afterwards, Syncona operates a build and then find the right people to build it model. i.e it identifies an area of gene therapy, finds the best minds and practitioners and then builds the business.

This is a differentiated strategy and one that clearly has focus. But it also carries the usual narrative-led behavioural challenge i.e what happens if your vision of the world or market opportunity is plain wrong?

With the Wait and let them approach us VC model, you can fish for the best ideas and then blame the entrepreneurs when things go wrong, which they inevitably do most times. With the Syncona model, you only really have your own staff and partners to blame if it all goes wrong, as it will most of the time.

But on the upside Syncona retains considerable control over its businesses and understands better than anyone what the risks and opportunities are.

The Portfolio

The sales of portfolio holdings Blue Earth and Nightstar both completed in the second half of 2019. These two businesses were both founded by Syncona and generated significant value (IRRs of 87% and 72% respectively).

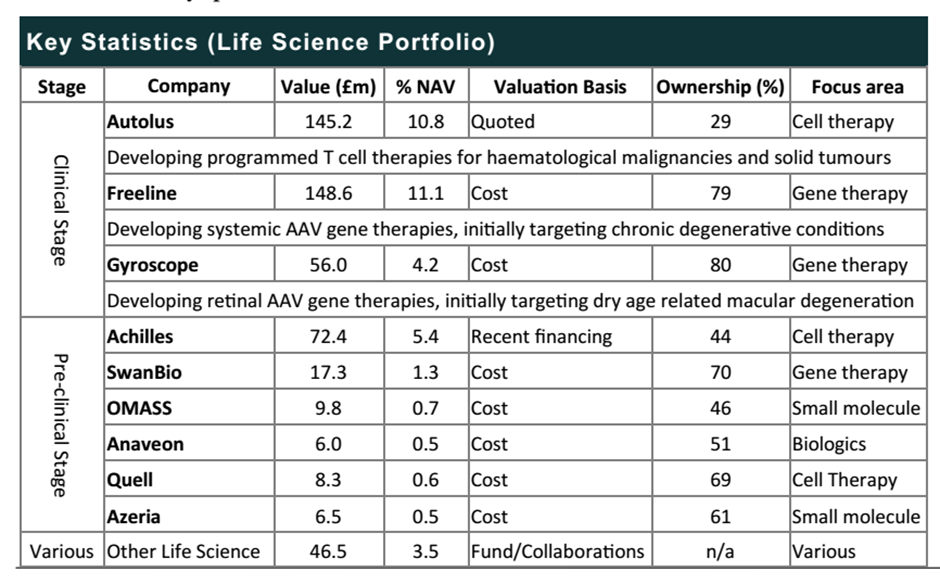

The remaining portfolio is listed below – the table is from Killik and Co’s report on Syncona.

I would suggest that the real focus should now be on the Stage 2 wave of businesses, plus the last remaining stage 1 business, Autolus (where there are plans to initiate a product programme this year or next), in which Syncona has invested £147m to date and has a 29% stake (comprising 10.8% of portfolio value).

In phase two we principally have three main businesses.

The big beast is Freeline – early data from its products programme is expected 2021 and clinical stage within 24 months. To date £149m with a 79% stake. Focused on systemic gene therapy production platform.

As this is a crucial investment, its worth digging a bit deeper into this business. Here’s the take of fund researchers from Numis on the business:

“Freeline was founded by Syncona in December 2015 via a £25m Series A financing, to develop and commercialise a gene therapy platform developed by Professor Amit Nathwani of the University College London, who was the first to show successful and sustained correction of bleeding symptoms in patients with severe haemophilia B using a gene therapy. Freeline aims to commercialise a next-generation version of the UCL technology in haemophilia B, as well as other gene therapies for diseases caused by malfunctioning or missing enzymes that can be addressed by delivery to the liver. Freeline previously raised capital in June 2019 via a £88.4m Series B financing, of which Syncona provided £85m, alongside £3.4m from the UCL Technology Fund. In December, Syncona committed $80m to Freeline in a Series C financing. Theresa Heggie was recently appointed CEO and she possesses a broad experience in rare diseases, a deep understanding of medicines for genetic diseases and direct experience in some of the indications. On 7 February, Freeline released encouraging data in its lead drug FLT180a in Haemophillia B. Freeline is held at cost in Syncona’s NAV.”

For more colour on Freeline, here’s the take of analysts at Killik and Co:

“Freeline is developing gene therapies, initially targeting chronic systemic conditions such as Haemophilia B. The company builds on the work of Professor Amit Nathwani, Professor of Haematology at UCL, who is Chief Scientific Officer for the company while Syncona CIO, Chris Hollowood currently holds the position of CEO as the operational team continues to be expanded as they progress various programs through the clinic. Freeline uses a proprietary capsid (a protein shell which encloses the genetic material) which is used as the delivery mechanism for the treatment and a strategic decision was made to control the manufacturing process (resulting in the acquisition of a development and analytics lab in Munich in 2016). This acquisition not only lays the groundwork for the business to scale operations it is also a crucial step in retaining the full value of the innovation as typically an early stage gene therapy business using a third-party manufacturing partner will be forced to split the rights to the intellectual property.”

There are two other businesses in this second wave worth mentioning. The first is Gyroscope – initial data on it’s products are reckoned to be coming in 2022, with capital invested by Syncona to date £56m, via an 80% stake. This business is focused on retinal gene therapy

There’s also Achilles – initial data on its products are expected 2022, with capital invested to date £49m, for a 44% stake

Overall this fits into a plan The long-term ambition to use the significant capital pool (>£820m as at 31 December 2019) to add 2 to 3 new portfolio companies per annum to the portfolio, building up to 15 to 20 companies in total over 10 years of which 3 to 5 companies have products ready for approval. That’s an impressive target and if it succeeds the upside from here might be huge.

Sitting beyond the phase two companies I mentioned above are the 3rd generation businesses, most of which one suspects won’t really be doing very much of anything for at least another two years:

- Swanbio, gene therapy focused on neurological disorders

- Quell – cell therapy approach using T regulatory cells

- Anvveon – an immune-oncology company

One observation – if we assume 10 to 15 portfolio businesses, and 3 to 5 businesses producing products ready for approval, then we’re assuming a fairly high 30% hit rate. That strikes me as punchy, but what do I know. I would have thought 10 to 15% might be a better bet.

Performance to date

To date far Syncona has had great success with its initial portfolio of businesses. It founded Nightstar, then sold it with a return (IRR) of 72% – this transaction was the 3rd largest UK biotech transaction in the last 20 years. Syncona also founded Blue Earth Diagnostics, also sold on for an 87% IRR. Overall since listing in December 2016, the total shareholder return for Syncona has been 68%.

On the downside Syncona produced a negative share price return over 2019 (-17%). According to Killik and Co analysts this in part reflects the “share price premium over the net asset value contracting over the year in addition to a negative NAV return in the second half of the year as uplifts from the sale of Blue Earth Diagnostics and an accretive funding round for Achilles Therapeutics were outweighed by a c. 60% decline in the share price of Autolus, the sole publicly-listed investment in the portfolio where a significant holding by Woodford IM weighed on the shares”.

Crucially I would argue that this share price weakness ignores encouraging data from all of the clinical stage companies in the portfolio. This includes Autolus in their AUTO1 programme to treat adult acute lymphoblastic leukaemia; data from Freeline’s programme to treat Haemophilia B; and Gyroscope continuing to progress its lead investigational gene therapy programme for Age-related Macular Degeneration (AMD).

What next for Syncona?

Back in February, Syncona held a Capital Markets Day in the City for investors and analysts. I attended and was genuinely surprised by the sheer number of people packed into a City hall. I’d been expecting maybe a few dozen to turn up, but my guess is that there were over three hundred in attendance. It was packed to bursting.

The session proved fascinating not least for the questions asked by investors, in which three really smart questions came up. The first is that the sheer number of approvals for novel therapies is apparently diminishing every year, I guess because of the sheer cost of developing this stuff. That means a large number of Life Sciences VCs are chasing after a smaller pie. That could work to Syncona’s advantage if it has scale, but it could also spell vastly increased R&D spending.

Which brings us to the next question – has Syncona got enough cash. Asked this, the CEO seemed relatively sanguine but one has to wonder whether it has enough pounds and dollars sitting around in the treasury to run the fund for another five or more years without any quick wins.

The last question follows on – that R&D pipeline will be manageable if the share price shoots up, allowing Syncona to raise more cash. But the share price has been becalmed in recent months and one audience member asked what’s happening to the share price? For which there seemed to be no real answer. And of course, there is only one real answer any Vc CEO can give – you need successful exits, which in turn means showing a big return on that Autolus stake.

Bottom Line

My hunch is that if you are looking to invest in the next wave of gene technologies, then Syncona has to be your best way of playing it via private (fast growing) businesses.

In asset allocation terms, my own view is that any self respecting long term growth investor needs 20% to 30% exposure to this sector and at least half of that needs to be in private businesses. For me that means investing in Syncona. I note also that the share price has fallen back after rallying in January and February. This is I think a brilliant buying opportunity for investors and I would rate Syncona a strong buy, and a very worthy addition to my Dynamic 35.

More detail on Syncona from brokers reports:

Numis updates from February

New Investment: Syncona has committed £16.6m to an extended Series A financing by OMass of £27.5m. In addition, Oxford Sciences Innovation (OSI) committed £10.4m, with the University of Oxford contributing £0.5m, which brings the Series A round up to £41.5m after the initial £14m round in 2018. Prior to this commitment, Syncona held a 46% valued at cost of £9.8m. Assuming it remains held at cost the investment will increase the investment to £29.1m, equivalent to 2.2% of Syncona’s net assets.

OMass is focused on the discovery and development of drugs to membrane-bound proteins using novel mass spectroscopy technologies from one of the leading academic groups in the world in this area (Prof/Dame Carol Robinson), and is one of the investments that diversifies Syncona beyond its core-focus in cell and gene therapy. The release today notes that OMass is developing drugs to target three potentially high impact GPCR membrane targets in immunological and genetic diseases, with the funding today giving it a 2-year funding runway to bring its lead candidate into pre-clinical development.

Positive data from Freeline on Fabry disease treatment. Syncona’s holding Freeline (11% of NAV) presented initial data from its second pipeline product FLT190, in development to treat Fabry disease, at the WORLD meeting in Orlando.

Numis Life Sciences Analysts View

Syncona is also covered by Life Sciences analyst Stefan Hamill, who’s comments are summarised below:

“Syncona’s gene therapy portfolio company Freeline (c.$290m company valuation post recent Series C once drawn down), presented some initial data from its second pipeline product FLT190, in development to treat Fabry disease, at the WORLD meeting in Orlando yesterday afternoon. This was preliminary data at the lowest starting dose in the dose escalation phase of the ongoing MARVEL Phase 1/2 trial, in only one patient, but is noteworthy as it is the first in vivo gene therapy clinical data seen in Fabry disease patients, emphasising Freeline’s potential first in class status in this area. The data showed that a one-time infusion of FLT190 led to a 3-to-4-fold increase in expression of the (missing) enzyme alpha galactosidase (αGLA). FTL190 shares many common features with Freeline’s lead product FLT180a (in Haemophilia B) and a key aspect of the trial was that learnings from that program have clearly been incorporated, with a higher starting dose tested (7.5×10^11vg/kg) and incorporation of the steroid conditioning regimen.”

“Given what was seen with FLT180a, the sense is that higher doses of FLT190 could deliver αGLA in the therapeutic range which is around five times the level seen in this first patient. As with FLT180a the efficient delivery of the Freeline vector led to a rise in liver enzymes, and our understanding is that the protocol in the trial has now been amended to adopt the same steroid regimen as in the FLT180a study (dose 4) and the patient also reported some heart inflammation (raised troponin levels) which was reversed following the steroid treatment. No data has yet been presented by Sangamo ($900m mkt cap) for its in vivo gene therapy ST-920, so it seems to us that Freeline is the first in vivo gene therapy in Fabry in the clinic (Avrobio c.$850m mkt cap has an ex vivo stem cell approach in a Phase 1/2 study). This initial data has been released earlier than we had anticipated and it is early days in the study, but the success in raising in vivo levels of αGLA is encouraging and we still look for a greater body of data from more patients and higher doses in this study in early 2021 as the key data for this program.”

Killik View from February 2020

“There remains a significant number of catalysts for the portfolio over short-, medium- and long-term time frames and we remain positive on the strategy for exposure to a basket of companies focused on gene therapy innovation.

Investment in any early-stage businesses carries greater risk and a number of the businesses within the Syncona portfolio will likely face challenges as they progress through the clinical phase.

However, cell and gene therapy is an area of science which looks set to have a transformational impact on both patient care and on the health care industry as a whole. The Syncona team are well placed to develop businesses from this area of research, the significant £800m capital pool also enables the team to maintain significant stakes as these company’s grow and the approach used has the potential to lay platforms that could expand well beyond that of the programmes currently going through the approval process and generate significant value to shareholders if successful. We reiterate our Buy recommendation.”

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.