Culture

Luck plays a part in investing but there is also a theory that you make your luck. Both K3Capital and Dart Group are cyclical businesses which performed strongly in the second half of last year. It could be that they got lucky with the cycle going in their favour or Thomas Cook going bust, but without their strong culture they wouldn’t have been in a strong position to get lucky. It is this culture that enables a cyclical business to hold to gether in a downturn in order to capitalise on their position when times get good again.

No where is it more evident than in the broking sector. Hugely cyclical and a natural partnership business where the partners sometimes went a year without earning much followed by some bumper years. Along came big bang and partners dividends were replaced by bonuses and the result has been dysfunctional. The great names such as Cazenove replaced by JP Morgan and James Capel disappearing into HSBC. Staff turnover is high and annual fighting over bonuses was rife until it was replaced by the annual redundancy rounds.

In weak markets strong businesses will build their franchise as competitors struggle while in strong markets businesses can milk their franchise. Only with a positive culture can a company build its franchise in weak markets and it is this factor which determines whether a company can achieve scale over time. If we invest in small companies because they can become large then this is a vital factor. If our investment style is more of a trader then it is of less relevance but I have always preferred to invest in small stocks that can become large. In management speak this culture is frequently termed “corporate governance” and yet I find that often a number of the shares that I own fail to comply with the code. Which is puzzling.

A good example of this can be seen in comparing Non-Standard Finance and Morse Club. Both are in sub- prime lending at high rates of interest. Non-Standard Finance came to market at £1 backed by Woodford in 2015 and today trades at 22p while Morses Club came to market in 2016 at 108p/share and today trades at 131p. Culturally Morses Club is run by experienced management who value integrity highly and are based in Batley, Yorkshire, while Non-Standard Finance has a head office above Berry Brothers wine merchants in St James’, Mayfair.

It is possible to argue that the incentive scheme at Non-Standard Finance had a strong role in dictating the outcome. Options over 5% of the company’s share capital were awarded to the founders back in 2015 subject to performance conditions of the Group making at least £50m of acquisitions and a 25% increase in shareholder value over 5 years. That implies a share price target of c 125p. If someone said to me “I will pay you a bonus for spending £50m of my money” it may not be surprising if I overpaid for acquisitions. The 5-year anniversary arrives in 2020 and with a share price target of 125p against a prevailing price of 55p in the market last year it may help explain the audacious nil premium all paper bid which NSF made for Provident Financial, a competitor c 9 times its size. One last throw of the dice perhaps. Meanwhile in December 2019 Morses Club won the Pro Share award for employee schemes in companies under 500 employees.

A useful new year health check for culture has led me to review the companies I know well, (I am afraid largely in the financial services sector by virtue of history) noting the top 3 or 4 factors for each stock that I sense has a strong culture. I find there are some recurring themes.

- Equity Holdings Management have a significant equity holding, not options or Long-Term Incentive Plan’s (LTIPs) but a straight equity holding. I know this from my own experience. I have been awarded options in the past. Participating in the upside is exciting and does motivate but the huge difference between options and equity is they didn’t cost you anything so when the hard times arrive and the upside isn’t there it is easy to walk away as the downside is nil. Whereas with equity there is downside from walking away.

- Customer focus – All of the strong cultures are focussed, most frequently on the customer. Sometimes its passion sometimes it is discipline but it all amounts to a focus on the customer.

- Staff Respect– One CEO said to me that he wanted to sell 30% of his business to the staff for a good price because the difference between entrepreneurs being successful and failing is often the finest line and whilst he has succeeded, he felt they deserve to have that chance. Another said there is no enjoyment making money on your own. This struck me working in an environment where ego’s in the city spend their time attaching their name to any successful transaction while “inner circle’s” of management frequently carve the bonus pots up, largely to themselves. For a business to have longevity the staff have to be respected by management and frequently this is subrogated to management’s requirement to own the trappings of success. Only if staff are respected will they build a business in a downturn.

Of the financial services stocks I know well the top of the culture pile comes up as:

| Culture Stocks |

FC PER |

Management Holding |

|

Mattioli Woods |

19.1 |

13% |

|

K3Capital |

15.1 |

33% |

|

Tatton I.M |

21.3 |

21% |

|

Manolete |

24.3 |

18% |

|

AJ Bell |

47 |

25% |

|

Alpha FMC |

17.9 |

2.50% |

|

Alpha FX |

43.4 |

31% |

|

Integrafin |

32.5 |

16% |

|

Liontrust |

19.8 |

3% |

|

Gateley |

14.5 |

6% |

Source: SharePad

These stocks are always good to tuck away and hold for long periods of time. They are the sort of stocks that Terry Smith tells us the hard bit is actually doing nothing and just letting them grow over time. Mr Smith does well to charge £87m for the discipline of not doing very much, while living in Mauritius.

Recognising these strong culture companies early can pay huge rewards. Hargreaves Lansdown – when Stephen Lansdown and Peter Hargreaves were at the helm – was one of these. It came to market in 2007 at 180p/share rising 34% on its first day of trading. The culture has now changed with the founders gone but notwithstanding that even today the shares trade at 1893p. An investor who got in at IPO would have enjoyed at 20% compound return over 13 years. This is similar to the return an investor in Warren Buffet’s fund in 1965 would have earned over the years.

If we compare that to the compound share price performance from (in my view) high quality culture companies highlighted above it looks like this:

|

IPO date |

IPO price |

Today |

CAGR |

|

|

(p) |

(p) |

p.a |

| Mattioli Woods |

Nov 2005 |

132 |

807 |

14% |

| K3Capital |

Apr-17 |

97 |

228 |

33% |

| Tatton I.M |

Jun-17 |

156 |

254 |

22% |

| Manolete |

Dec-18 |

175 |

430 |

146% |

| AJ Bell |

Dec-18 |

160 |

414 |

159% |

| Alpha FMC |

Oct-17 |

160 |

244 |

18% |

| Alpha FX |

Apr-17 |

196 |

1240 |

85% |

| Integrafin |

Feb-18 |

196 |

435 |

49% |

| Liontrust |

1999 |

115 |

1220 |

12% |

| Gateley |

Jun-15 |

95 |

211 |

19% |

Source: Prospectus

This is generally a strong annualised return bearing in mind this represents share price return only and excludes the dividend return. Two things are apparent from the above table:

- Firstly the two companies that have been quoted for the longest, Liontrust and Mattioli Woods, have the lowest rates of return. This is because they have experienced changes over the years and culture may exist now in the company but there have been times when it didn’t. Which implies culture is perishable. Fund managers such as Terry Smith, Nick Train and Anthony Cross who adopt this style of investing tend to invest in the larger companies where the culture is more engrained over a long period of time and arguably may be less perishable. But in smaller companies management change can change the culture more directly. Bob Woods left his executive role at Mattioli Woods in 2016 while Liontrust had a different culture before John Ions, the current CEO, joined in 2010.

- Secondly the better performers have a stronger competitive edge. Warren Buffett calls this a “moat”, Anthony Cross calls it “economic advantage” while Nick Train calls them “durable franchises”. Terry Smith refers to them as “quality companies”. In the table above Manolete is a market leader in a specialist market and AJ Bell is a very difficult platform to replicate. If I wanted to start a platform to compete with AJ Bell tomorrow I would need a lot of capital. The third best performer Alpha FX has a large inbuilt client base delivering recurring income which would take a long time to replicate. Argentex are trying but it will take time.

It is this latter factor of competitive advantage that is missing from my analysis of “culture”. The holy grail is to find culture and competitive advantage together. Both of these are soft factors and can’t always be seen in the numbers. Sustainably high ROE is evidence of a competitive advantage while remuneration can give evidence of the culture of a business, but other than that it can be slightly subjective. For that reason, it is important to meet with management. Increasingly there are interviews posted online but there is no substitute for the body language of an analyst meeting on the day of a very difficult profits warning. Mattioli Woods analyst meeting is one of the best attended analyst meetings I have attended. I counted 28 analysts at one meeting while there are a very small number of analysts that formally cover it. I surmised that most turn up to hear the inspirational Ian Mattioli introduction about how the industry it moving to a world of 20% margins because today the customer is getting a bad deal.

ROE

If we add the ROE to the table above to screen out those with a low competitive advantage, we can screen out Mattioli Woods and Alpha Financial Markets Consulting that make low ROE’s. Both these companies are in increasingly competitive markets of wealth and pension management for Mattioli Woods or fund manager consulting for Alpha Financial Markets consulting where they compete with the large accounting firms and consultants.

|

IPO date |

IPO price |

Today |

CAGR |

ROE |

PER |

|

|

(p) |

(p) |

p.a |

% |

(X) |

| Mattioli Woods |

Nov-05 |

132 |

807 |

14% |

12% |

19.1 |

| K3Capital |

Apr-17 |

97 |

228 |

33% |

51% |

15.1 |

| Tatton I.M |

Jun-17 |

156 |

254 |

22% |

45% |

21.3 |

| Manolete |

Dec-18 |

175 |

430 |

146% |

27% |

24.3 |

| AJ Bell |

Dec-18 |

160 |

414 |

159% |

40% |

47 |

| Alpha FMC |

Oct-17 |

160 |

244 |

18% |

15% |

17.9 |

| Alpha FX |

Apr-17 |

196 |

1240 |

85% |

22% |

43.4 |

| Integrafin |

Feb-18 |

196 |

435 |

49% |

36% |

32.5 |

| Liontrust |

1999 |

115 |

1220 |

12% |

39% |

19.8 |

| Gateley |

Jun-15 |

95 |

211 |

19% |

55% |

14.5 |

Then there is valuation. As a general rule I like to run my winners but I wouldn’t want to take a position in a stock trading above 30X which screens out AJ Bell, Alpha FX and Integrafin.

Which leaves K3Capital, Tatton Asset Management, Manolete, Liontrust and Gateley. It may be useful to consider the competitive advantage, cyclicality and culture of each of these.

Remuneration

But firstly, it is also useful to check the remuneration policies as this can add evidence to the culture. What is apparent is that the disclosure of performance targets for Long-Term Incentive Plan’s (LTIPs) is generally incomplete.

| Company |

Total Rem CEO |

Full Vesting LTIP target |

Form of LTIP award |

| Mattioli Woods |

1,675 |

12% EBITDA growth pa |

1p options |

| K3Capital |

243 |

No LTIP |

|

| Tatton A.M |

344 |

Undisclosed TSR |

Nil priced options |

| Manolete |

360 |

Undisclosed criteria |

Market priced options |

| AJ Bell |

1,906 |

Undisclosed measures |

Nil priced options |

| Alpha FMC |

584 |

15% EPS growth |

Nominal value options |

| Alpha FX |

314 |

Undisclosed revenue and profit growth |

Shares awarded |

| Integrafin |

769 |

No LTIP |

|

| Liontrust |

4,419 |

15% PBT growth and 20% EPS growth |

Nil priced options |

| Gateley |

330 |

Adjusted EPS growth |

Nil priced options |

|

|

|

|

Source: Report and Accounts

The following points are noteworthy from the above table:

- No LTIP Both Integrafin and K3 Capital have no LTIP which suggests that perhaps existing management shareholding are adequate to incentivise management. This is the ideal alignment with shareholders.

- Nil priced options dilute existing shareholders by transferring value from existing holders to management and EPS calculations exclude this value transfer. For that reason investors should prefer market priced options but sadly most companies use nil or minimally priced options.

- Targets Only Mattioli Woods, Alpha FMC and Liontrust disclose the growth target which vary from 12% to 20%.

- Corporate Responsibility AJ Bell also announced a £10m award to charity targeted at 100% EPS growth over 3 years and 150% over 5 years. The award has been underwritten by Andy Bell which is a novel way of announcing growth targets.

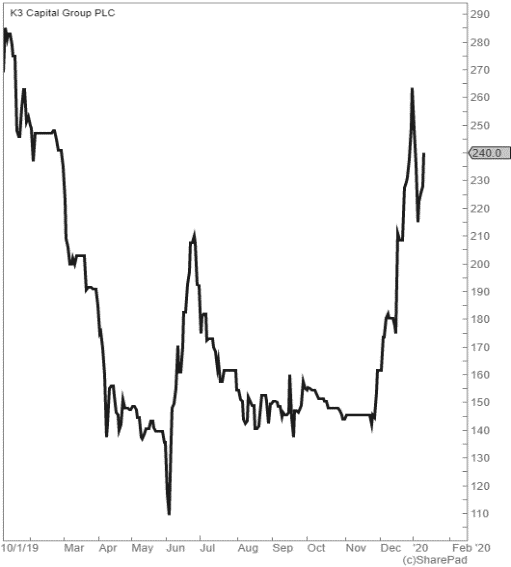

K3 Capital Group Plc

Share Price 240p

Mkt Cap £101m

- Cyclicality This stock is starting to be understood by the market. It is hugely cyclical as it earns its fees from selling businesses. It can be thought of as an estate agent for businesses and in a financial crisis less people decide to sell their business. Conversely if you have had Brexit uncertainty hanging over you for 3 years there could well be a backlog of people who decide to exit their businesses over the next few years.

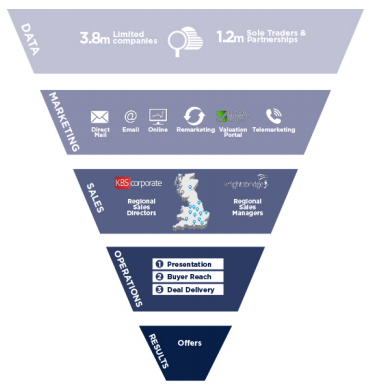

- Competitive Advantage Unlike any other competitor this company sources its leads from direct marketing. All their peers tend to rely on a network of introducers such as accountants and lawyers which leads to a fragmented market. K3 Capital harvests data from 3.8m limited companies and 1.2m sole traders and partnerships in the UK. Using Direct mail, email, telemarketing and a valuation portal all the leads are followed up and a field sales team sign up the customers. The customers are then dealt with by specialists sourcing buyers from an extensive database and a “buyer matching engine”. In this way K3Capital has become the largest transactor of businesses under £100m in the UK.

Source: Prospectus

I would argue this is a significant competitive advantage as if you have decided to sell your business it makes sense to use the company with the largest pool of buyers if I wanted to maximise the sale price of my life’s work. So, success breeds success.

- Culture There is significant management ownership of equity. The company has one office in Bolton where there is no issue with significant ego’s that can be apparent in some City based businesses.

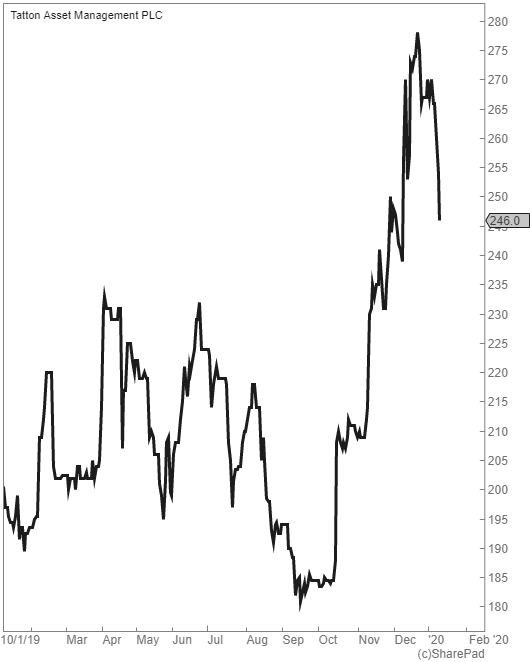

Tatton Asset Management

Share Price 246p

Mkt Cap £137m

- Cyclicality The largest division provides discretionary portfolio management to investors through IFA’s who may be unwilling or unable to manage money themselves. While the money is very sticky the assets (upon which a 15bps fee is charged) will go up and down with markets so the main cyclicality of the revenues is the market sensitivity.

- Competitive Advantage Their 15bps charge is the lowest in the market. Price is never a very strong competitive advantage as it can be eroded over time. However, with £7bn of AUM the company is now starting to achieve scale. It is very difficult for an IFA to switch its discretionary portfolio provider as client suitability has to be reviewed for each individual client. Consequently, as the company grows its adviser base the competitive advantage increases.

- Culture Based in Wilmslow the company is largely ego free in comparison to city firms while management have a significant stake. The focus of the management team on having faultless systems for their customer base as well as robust portfolio management processes is also admirable.

Manolete

Share Price 420p

Mkt Cap £183m

- Cyclicality As this company is litigating against directors of insolvent companies it could be argued that it is contra cyclical. However I suspect a better description would be “un correlated with markets”.

- Competitive Advantage The company frequently partners with an insolvency practitioner to share the proceeds which makes for a more capital light model than the other litigation funders and consequently higher potential return on capital. The relationships with licensed insolvency practitioners is key, of which there are c 1,600 in the UK. Reputation and the high level of specialist knowledge required is also a rare resource.

- Culture The staff are largely lawyers and accountants based in Gloucester Place, Marylebone. Management has a significant stake and perhaps it is the insolvency industry itself that keeps the down to earth humility in the culture.

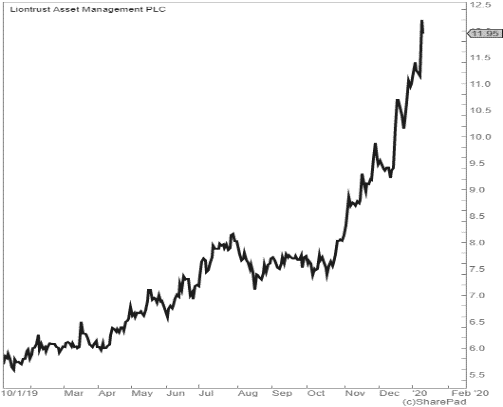

Liontrust Asset Management Plc

Share Price 1195p

Mkt cap £654m

- Cyclicality The revenue is clearly market sensitive to both equity and bond markets. Market sentiment will also affect inflows and outflows from the funds and there is also performance risks. Currently these factors are all positive for the company.

- Competitive Advantage There are a number of competitors in the fund management space. The “economic advantage” team, who account for 40% of the AUM have been with the firm for c.25 years and are unlikely to move to another firm to rebuild their franchise; however, it is not impossible. The remuneration scheme is differentiated whereby an LLP is formed for each team and a c 30% revenue share is awarded to the fund managers in each team. In this way fund managers are handsomely rewarded in a simple and transparent manner which doesn’t dilute the equity holders. By way of example the economic advantage team of 4 fund managers run £7.7bn of AUM. It we estimated this yielded an average revenue say 75 bps that would equate to £57m revenues. Sharing in 30% of this revenue would make most people unlikely to leave to set up around the corner.

- Culture Liontrust analyst meetings are a humorous and relaxed affair and in the offices there is the same feeling of energy. It has the feeling of a company thriving.

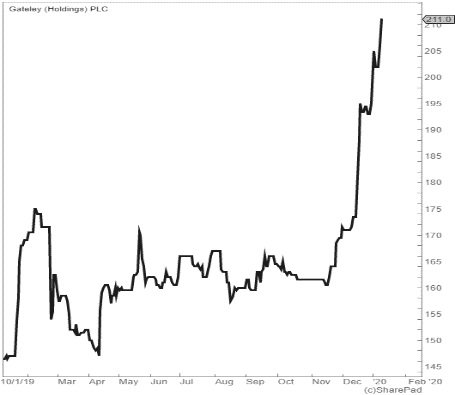

Gateley (Holdings) Plc

Share Price 211p

Mkt cap £242m

- Cyclicality At IPO in 2015 the company had 349 fee earning lawyers which has increased to 649 now. At IPO 38% of the fee earners were property lawyers and it is perhaps fair to assume the company has a skew to property transactions.

- Competitive Advantage Achieving scale in the regions enables the company to access the good quality corporate clients although their markets remain highly competitive. With platforms now starting to disrupt the space perhaps the competitive advantage is weaker than some others in this group

- Culture The CEO, Michael Ward has been with the firm since 1987. The company aims to be “dull” to use the CEO’s words which I always find reassuring, and the Birmingham base may also impact the culture. The majority of the shares are still held by the previous partners under a 5-year orderly markets agreement that has recently been renewed.

Conclusion

The two that most tempt me from these stocks are Tatton Asset Management as there is a new partnership to distribute their product with Tenet Group which suggest that inflows should accelerate this year while the rating is reasonable and Liontrust. With Liontrust I worry that I am the last one to the party as it is no longer cheap but with a cold towel over the head momentum usually feeds on itself for fund managers and the strong performance can carry on for a long time. I may have to force myself to own this.

Summary

As we enter a world where sustainability matters more the importance of culture is only increasing. A dedication to investing in companies with a strong sense of culture alongside a genuine competitive will guarantee outperformance over the long term. Evidence can be found in remuneration schemes and ROCE but to understand a company’s culture it is best to meet with the management. Because of this I am using companies I know well as a universe but amongst them I suspect that Tatton Asset Management and Liontrust could make very good “buy and forget” stocks.

Forthcoming Events

| Company |

Date |

Event |

| Mattioli Woods |

14-Jan-20 |

H1 Results |

| K3Capital |

23-Jan-20 |

FY Results |

| Tatton A.M |

04-Feb-20 |

H1 Results |

| Manolete |

04-Feb-20 |

H1 Results |

| AJ Bell |

31-Mar-20 |

FY Results |

| Alpha FMC |

22-May-20 |

H1 results |

| Alpha FX |

03-Jun-20 |

FY Results |

| Integrafin |

26-Jun-20 |

Q4 Update |

| Liontrust |

26-Jun-20 |

FY Results |

| Gateley |

05-Aug-20 |

H1 Results |

Source: SharePad

Weekly Commentary: 13/01/20 – Culture

Culture

Luck plays a part in investing but there is also a theory that you make your luck. Both K3Capital and Dart Group are cyclical businesses which performed strongly in the second half of last year. It could be that they got lucky with the cycle going in their favour or Thomas Cook going bust, but without their strong culture they wouldn’t have been in a strong position to get lucky. It is this culture that enables a cyclical business to hold to gether in a downturn in order to capitalise on their position when times get good again.

No where is it more evident than in the broking sector. Hugely cyclical and a natural partnership business where the partners sometimes went a year without earning much followed by some bumper years. Along came big bang and partners dividends were replaced by bonuses and the result has been dysfunctional. The great names such as Cazenove replaced by JP Morgan and James Capel disappearing into HSBC. Staff turnover is high and annual fighting over bonuses was rife until it was replaced by the annual redundancy rounds.

In weak markets strong businesses will build their franchise as competitors struggle while in strong markets businesses can milk their franchise. Only with a positive culture can a company build its franchise in weak markets and it is this factor which determines whether a company can achieve scale over time. If we invest in small companies because they can become large then this is a vital factor. If our investment style is more of a trader then it is of less relevance but I have always preferred to invest in small stocks that can become large. In management speak this culture is frequently termed “corporate governance” and yet I find that often a number of the shares that I own fail to comply with the code. Which is puzzling.

A good example of this can be seen in comparing Non-Standard Finance and Morse Club. Both are in sub- prime lending at high rates of interest. Non-Standard Finance came to market at £1 backed by Woodford in 2015 and today trades at 22p while Morses Club came to market in 2016 at 108p/share and today trades at 131p. Culturally Morses Club is run by experienced management who value integrity highly and are based in Batley, Yorkshire, while Non-Standard Finance has a head office above Berry Brothers wine merchants in St James’, Mayfair.

It is possible to argue that the incentive scheme at Non-Standard Finance had a strong role in dictating the outcome. Options over 5% of the company’s share capital were awarded to the founders back in 2015 subject to performance conditions of the Group making at least £50m of acquisitions and a 25% increase in shareholder value over 5 years. That implies a share price target of c 125p. If someone said to me “I will pay you a bonus for spending £50m of my money” it may not be surprising if I overpaid for acquisitions. The 5-year anniversary arrives in 2020 and with a share price target of 125p against a prevailing price of 55p in the market last year it may help explain the audacious nil premium all paper bid which NSF made for Provident Financial, a competitor c 9 times its size. One last throw of the dice perhaps. Meanwhile in December 2019 Morses Club won the Pro Share award for employee schemes in companies under 500 employees.

A useful new year health check for culture has led me to review the companies I know well, (I am afraid largely in the financial services sector by virtue of history) noting the top 3 or 4 factors for each stock that I sense has a strong culture. I find there are some recurring themes.

Of the financial services stocks I know well the top of the culture pile comes up as:

Source: SharePad

These stocks are always good to tuck away and hold for long periods of time. They are the sort of stocks that Terry Smith tells us the hard bit is actually doing nothing and just letting them grow over time. Mr Smith does well to charge £87m for the discipline of not doing very much, while living in Mauritius.

Recognising these strong culture companies early can pay huge rewards. Hargreaves Lansdown – when Stephen Lansdown and Peter Hargreaves were at the helm – was one of these. It came to market in 2007 at 180p/share rising 34% on its first day of trading. The culture has now changed with the founders gone but notwithstanding that even today the shares trade at 1893p. An investor who got in at IPO would have enjoyed at 20% compound return over 13 years. This is similar to the return an investor in Warren Buffet’s fund in 1965 would have earned over the years.

If we compare that to the compound share price performance from (in my view) high quality culture companies highlighted above it looks like this:

Source: Prospectus

This is generally a strong annualised return bearing in mind this represents share price return only and excludes the dividend return. Two things are apparent from the above table:

It is this latter factor of competitive advantage that is missing from my analysis of “culture”. The holy grail is to find culture and competitive advantage together. Both of these are soft factors and can’t always be seen in the numbers. Sustainably high ROE is evidence of a competitive advantage while remuneration can give evidence of the culture of a business, but other than that it can be slightly subjective. For that reason, it is important to meet with management. Increasingly there are interviews posted online but there is no substitute for the body language of an analyst meeting on the day of a very difficult profits warning. Mattioli Woods analyst meeting is one of the best attended analyst meetings I have attended. I counted 28 analysts at one meeting while there are a very small number of analysts that formally cover it. I surmised that most turn up to hear the inspirational Ian Mattioli introduction about how the industry it moving to a world of 20% margins because today the customer is getting a bad deal.

ROE

If we add the ROE to the table above to screen out those with a low competitive advantage, we can screen out Mattioli Woods and Alpha Financial Markets Consulting that make low ROE’s. Both these companies are in increasingly competitive markets of wealth and pension management for Mattioli Woods or fund manager consulting for Alpha Financial Markets consulting where they compete with the large accounting firms and consultants.

Then there is valuation. As a general rule I like to run my winners but I wouldn’t want to take a position in a stock trading above 30X which screens out AJ Bell, Alpha FX and Integrafin.

Which leaves K3Capital, Tatton Asset Management, Manolete, Liontrust and Gateley. It may be useful to consider the competitive advantage, cyclicality and culture of each of these.

Remuneration

But firstly, it is also useful to check the remuneration policies as this can add evidence to the culture. What is apparent is that the disclosure of performance targets for Long-Term Incentive Plan’s (LTIPs) is generally incomplete.

Source: Report and Accounts

The following points are noteworthy from the above table:

K3 Capital Group Plc

Share Price 240p

Mkt Cap £101m

Source: Prospectus

I would argue this is a significant competitive advantage as if you have decided to sell your business it makes sense to use the company with the largest pool of buyers if I wanted to maximise the sale price of my life’s work. So, success breeds success.

Tatton Asset Management

Share Price 246p

Mkt Cap £137m

Manolete

Share Price 420p

Mkt Cap £183m

Liontrust Asset Management Plc

Share Price 1195p

Mkt cap £654m

Gateley (Holdings) Plc

Share Price 211p

Mkt cap £242m

Conclusion

The two that most tempt me from these stocks are Tatton Asset Management as there is a new partnership to distribute their product with Tenet Group which suggest that inflows should accelerate this year while the rating is reasonable and Liontrust. With Liontrust I worry that I am the last one to the party as it is no longer cheap but with a cold towel over the head momentum usually feeds on itself for fund managers and the strong performance can carry on for a long time. I may have to force myself to own this.

Summary

As we enter a world where sustainability matters more the importance of culture is only increasing. A dedication to investing in companies with a strong sense of culture alongside a genuine competitive will guarantee outperformance over the long term. Evidence can be found in remuneration schemes and ROCE but to understand a company’s culture it is best to meet with the management. Because of this I am using companies I know well as a universe but amongst them I suspect that Tatton Asset Management and Liontrust could make very good “buy and forget” stocks.

Forthcoming Events

Source: SharePad