Markets recovered slightly towards the end of the week, with the FTSE 100 at 5888. Nasdaq was at 11662.

Last week Netflix reported Q3 results, with “only” 2m net new subscribers in the quarter, v 16m in Q1 and 10m in Q2. The company had previously guided that subscribers would slow in Q3 to 2.5m net new subscribers and the shares fell 6%, (though are still up 60% from the start of this year). They currently have just under 200m subscribers. The shares are trading on a PER of 100x, and almost 11x historic revenues.

The market seems to be separating into “expensive quality” and “cheap value” names. Over the last 10 years, paying up for quality has been the right strategy, but “quality at an unreasonable price” is unlikely to outperform indefinitely.

Executive Remuneration

I listened into a ShareSoc webinar on executive remuneration. Cliff Weight a director of ShareSoc with over 30 years’ experience as a remuneration consultant led a discussion on bonuses, LTIPs, nil cost options and all the other aspects of executive pay.

Abuses seem to be worse in large companies, where Chief Executives should be rewarded as “stewards”, whereas smaller companies should reward entrepreneurial risk taking. Persimmon Chief Executive’s incentives were intended to prevent the housebuilder buying up too much land at the top of the cycle. Instead Jeff Fairburn the Chief Executive could have received £110m total remuneration, helped by the Government’s ill thought out “Help to Buy” scheme. After the financial crisis Lloyds Bank did try to withhold Eric Daniel’s (former Chief Exec) bonus because of his disastrous acquisition of HBOS, but he took them to court and won.

But if governance is good, and management incentives are well aligned this can indicate a company that is doing other things well. He gave the example of Impax Asset Management which he’d bought into because he liked the governance. That wasn’t my investment thesis, but I do like the company too and own the shares. Below is the link to ShareSoc’s smaller company remuneration guidelines. https://www.sharesoc.org/wp-content/uploads/2018/07/ShareSoc-Remuneration-Guidelines-Smaller-Companies-2018.07.06.pdf

Last week Tristel, the chemical infection prevention company reported FY results to June. Then two companies I own Solid State and SDI Group released trading updates, suggesting business is returning to normal.

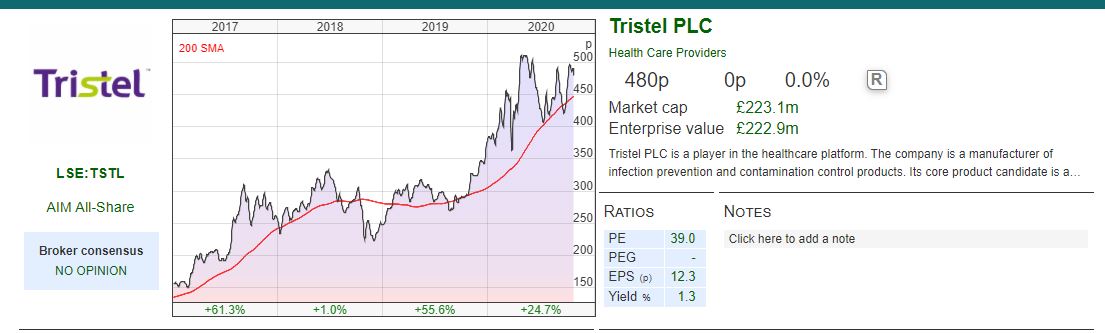

Tristel – FY Results to end of June

Tristel reported FY results to end of June, with revenue up 21% to £31.7m and statutory PBT up 40% to £6.6m. The company makes chlorine dioxide a disinfectant of medical instruments. For instance, it is used in Ear Nose Throat (ENT) clinics to decontaminate and sterilise endoscopes. I won’t go into detail, but the product is also used to clean medical instruments for other orifices.

Though results were encouraging, the company hasn’t benefitted as much from the virus as you might think because many standard procedures have been postponed, which has led to a fall in demand for the core product. However, fortune favours the prepared. The company had already been working on a hospital surface disinfectant (brand name: the Cache Collection) They had been building inventory of Cache product components and benefitted from hospitals desperately buying up all types of disinfectant products. They already had regulatory approval in several markets, including the UK, Belgium, the Netherlands, France, Hong Kong, and China. Management are feeling validated.

A chemical moat

Tristel has a gross profit margin of 80%, and Return on Capital Employed is 19%, which might seem unlikely for a business that produces a commodity chemical like chlorine dioxide. For instance breweries have switched from brewing beer to mass producing alcohol disinfectant.

A chemical engineer friend told me that chlorine dioxide is a more effective disinfectant against a virus than alcohol (something to do with alcohol works by evaporation which is good at killing semi-permeable bacteria, but not so effective against smaller microbes like viruses). But even if competitors were able to mass produce the chemical, Tristel uses a proprietary formulation containing an organic acid blend to inhibit corrosion. Any chemical needs regulatory approval for its use to clean medical instruments. Traceability procedures of cleaned devices are sophisticated and at 30 June the company held 265 patents granted in 37 countries providing legal protection. So the company looks to have a competitive “moat” and high returns look sustainable.

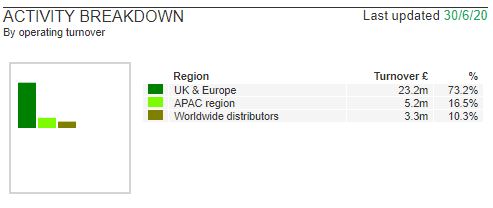

60% of sales come from outside the UK. Overseas sales grew by 32% whilst UK sales grew by 7%, which the company says is because of the high market penetration they already enjoy in the UK. One slight concern is that management don’t say anything about potential disruption of a no-deal BREXIT, which seems odd given the company sells to so many markets within the EU.

Barriers to entry?

Since 2014 the company has been trying to gain entry to sell its products in the US, and this has supported the demanding valuation. 5 years ago, I was at a presentation where management were quizzed on why it took so long to receive FDA approval. Paul Swinney, the Chief Executive’s responses were diplomatic. But some of the questioners let it be known that they thought the US was implementing protectionist policies by the backdoor, making it awkward for a foreign company with a superior product to sell into the US market. 6 years on and the company has received approval for from the Environmental Protection Agency (EPA) to use its product as an intermediate level disinfectant in the US. But they are still preparing a submission to the FDA to use their product as a high-level disinfectant.

History: Founded in 1998 and listed on AIM in 2005, raising a net £1m at 37p, valuing the company at £8.8m after admission. The stock had a disappointing first 8 years, falling 46% to a low of 20p. But since 2013 it has more than 20-bagged. I like to call these Robert Graves stocks, after the best selling author of “I, Claudius”, who joined the British Army in 1914, was left to die from his shrapnel wounds at the Battle of the Somme but somehow recovered and returned to the front line. For good measure he then caught bronchitis and also Spanish Flu at the end of the war. Investors in this type of stock endure much early on, but they go on to enjoy the rewards of compounding success later.*

As do management.

Executive pay: The Chief Executive’s salary is £250K, and total remuneration is £377K. He owns just over 2% of the company’s shares (worth c. £3.2m). However he has been awarded 654K of options with a strike price of 1p, and which are worth £3.3m. In all there are 1.5m of options with a strike price of 1p, as part of Senior Management Schemes, worth approximately £7.5m. Not significant versus the company’s market cap of £223m, but substantial compared to one year’s administration costs (£15m).

I’m not a fan of (almost) free options, I think that there are better ways of aligning incentives. As noted in the introduction ShareSoc are also against this type of reward structure, because management can benefit even if the share price disappoints. The award of more options seems to be linked to the achievement of the targets set out below, but the remuneration report does not make clear how many options are awarded if the targets are only partially achieved.

Targets: A year ago management set a plan for 3 years to FY June 2022. The first 2 targets do seem relatively demanding, but it’s hard to imagine a scenario where they are achieved and the third one is not:

i) sales growth in the range of 10% to 15% per annum as an annual average over the three years;

ii) the achievement in each year of an EBITDA margin (excluding share-based payment charges) of at least 25%, and

iii) to increase profit before tax (excluding share-based payments) year-on-year, independently of the other two KPI’s.

Ownership: The company seems to be a favourite among private client stockbrokers, with Charles Stanley 8.9%, Investec WM owns 6.5%, Hargreaves Lansdown 6.4%. Montanaro, Unicorn and Amati all own disclosable stakes (ie greater than 3%). Francisco A Soler, a founding shareholder and Non Exec Chairman when the company listed, still owns over 15% of the company.

Valuation

This is an expensive company on any metric you care to choose (8x historic sales, 20x Tangible book, 44x historic earnings). Their broker (FinnCap) is forecasting 12.7p EPS 2021F, and 14.1p EPS 2022F, so using the forecast 2 years out the PER falls to 34x in 2022, which is still expensive. However, that was also my conclusion when I saw management present 5 years ago, so if you’re investment style is “expensive quality” Tristel fits this profile.

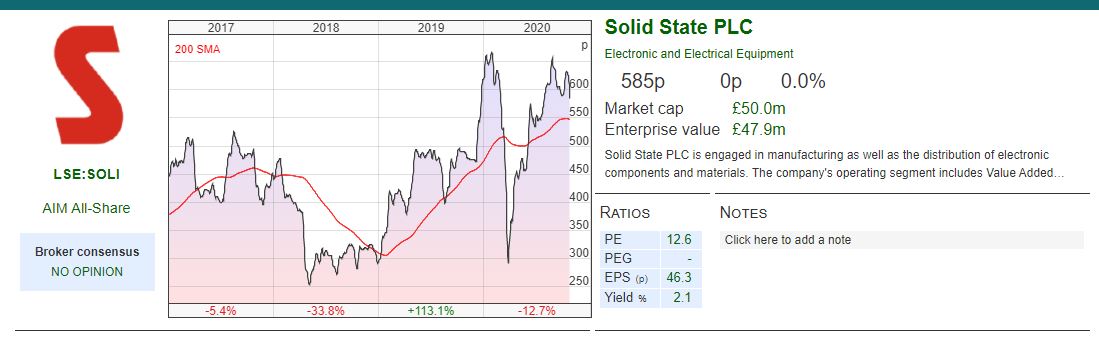

Solid State – Trading Statement

Solid State released a H1 trading statement which seemed to disappoint some; the shares were down 6%.

This electronics group makes durable components for computers and batteries that operate in harsh environments is in my ISA. It was founded in 1971 and listed on AIM since 1996. For 10 years after it listed the shares traded around 60p level, before then crashing down to 12p (March 2009) and then bouncing up to 879p (July 2015). Buying Solid State at the March 2009 low would have given you 73x return in 6 years, which is even better than Tristel’s 26x share price increase from their low in 2013 to 520p peak earlier this year. These are companies that make tangible products, have a decent moat and report 15-25% Returns on Capital. I once met a professor from Warwick Business School, who told me that it wasn’t possible for any retail investor to “buy and hold” a hundred bagger (we were discussing Unilever), because that would contradict Efficient Markets Theory. I agreed with him that the facts contradicted Efficient Markets Theory.

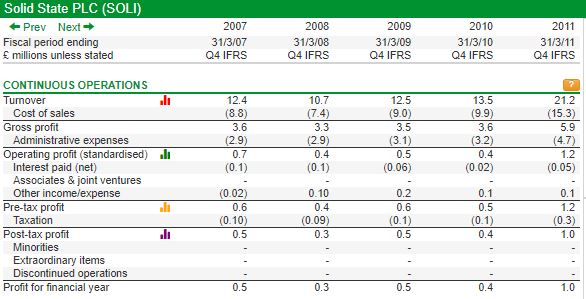

Many of Solid States customers are in the oil & gas industry plus also aviation, hence I was expecting a disappointing update. As these industrial customers make large orders, revenue can be volatile: SharePad shows that in the 2008 financial crisis the top line fell 14%, operational gearing meant profits fell over 40%.

One of my favourite SharePad features is the ability to go back many years and look at the financials during the last crisis. This gives a good idea of how sensitive a company is to a downturn, but also shows the best time to buy companies can be when revenue temporarily disappoints.

The company has a March year end, and showed 4% organic revenue growth to FY March 2020. Statutory revenue was £67.4m helped by an acquisition the previous financial year: Pacer Technologies which fortuitously has given them access to the medical sector.

Last week management reported an open order book of £34m at the end of September (down from £38m end of May). The company expects revenue to be approximately £33.0m for this H1 (2019: £33.6m) with adjusted profit before tax of approximately £2.50m (2019: £2.67m).

Despite the recent acquisition, the balance sheet is good, with £3.4m of net cash at the end of September. The net cash number is real, the company has repaid deferred VAT and PAYE, and hasn’t drawn down any Government support measures. The company has restarted it’s capex programme and is also now actively seeking more acquisitions. They paid a 7.25p dividend in September which is also a good signal.

Valuation

H1 results will be out on the 8th December. The shares are trading on 0.7x sales and 13x historic earnings, which is in-line with history.

The balance sheet is fine, and longer term even if the oil and gas customers continue to struggle, electrical components that function in difficult environments seems to me a good niche.

FinnCap their broker hasn’t published any 2021 forecasts, and instead the company has said results should be “broadly similar to last year” which means slightly below.** Reported FY PBT to end of March £4.0m, reported EPS 40p, adjusted EPS 46p. It looks to me like that revenue and EPS could disappoint at some point in the next 6-12 months, but if the share price overreacts then that could be good entry point. This share is in my ISA, and I’m happy to be a long term holder.

SDI – Trading Statement

SDI released a trading statement for H1 (May-Oct first half); the shares were up 15% in the two days following. Positive results should not really have been a surprise: I noted in September the company’s AGM statement was guiding to a “very good” start to the year versus a “good” start last year. This implied that we could expect revenue to be ahead of 6.4% organic growth achieved last year. FinnCap their broker have now raised their forecasts 11% revenue growth in FY 2021, and Adj EPS of 4.2p in Apr 2021.

Two of their businesses i) Atik Cameras (DNA amplification) and ii) MPB Industries (flowmeters for respirators) had benefited from one off orders, which probably won’t continue into the next financial year. So FinnCap’s FY to Apr 2022 forecasts are unchanged at 4.1p, which implies a slightly decrease 2022F v 2021F.

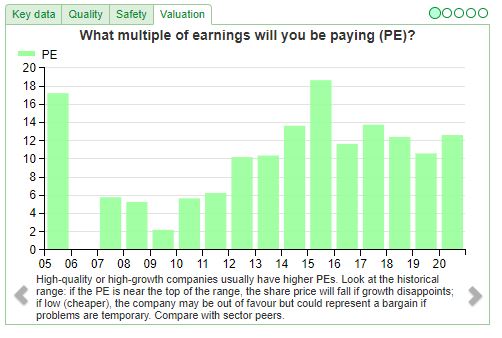

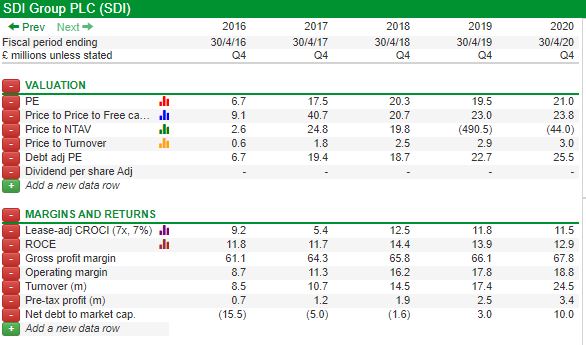

Valuation

The shares are trading on a PER of 18x 2022F earnings. Returns on Capital Employed and CRCOCI are low double digits. Revenue is up around 2.5x to £24.5m since 2015 which is a CAGR of 26%. One thing to mention is that because the company has grown through acquisitions, net tangible book value is negative. That can put off strict value investors who like to see tangible assets on the balance sheet. I’m comfortable that the value of the company is in the future free cashflows and have owned the shares since 2016 when I bought at just below 14p (and kicking myself hard for not having higher conviction).

The Group expects to publish its interim results for the six months to 31 October 2020 on 9 December.

Bruce Packard

Notes

The author owns shares in Impax AM, Solid State and SDI. The author’s mother owns shares in Tristel.

*Yes, like KWS, Tristel is yet another multi-bagger that my mother bought around 5 years ago and still owns. Interestingly her investment process now seems to be tilting away from “expensive quality” towards “value investing”: last week she increased her position size in Bank of Georgia (the Tbilisi head quartered bank that I listed on the LSE 10 years ago. In contrast to Tristel and KWS, BGEO shares are trading on 3x 2022 forecast earnings.) I also own BGEO.

** I’m not really sure why companies say “broadly in-line” when they actually mean “slightly below”. I did some analysis on share price reactions to statements that were “broadly in-line” and the share price falls anyway. There is some research by Frank Zhao at S&P to suggest that management liken to use obfuscation to “soften” bad news.

https://brucepackard.com/signals-in-obfuscation/

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 26/10/20 – Paying up for quality?

Markets recovered slightly towards the end of the week, with the FTSE 100 at 5888. Nasdaq was at 11662.

Last week Netflix reported Q3 results, with “only” 2m net new subscribers in the quarter, v 16m in Q1 and 10m in Q2. The company had previously guided that subscribers would slow in Q3 to 2.5m net new subscribers and the shares fell 6%, (though are still up 60% from the start of this year). They currently have just under 200m subscribers. The shares are trading on a PER of 100x, and almost 11x historic revenues.

The market seems to be separating into “expensive quality” and “cheap value” names. Over the last 10 years, paying up for quality has been the right strategy, but “quality at an unreasonable price” is unlikely to outperform indefinitely.

Executive Remuneration

I listened into a ShareSoc webinar on executive remuneration. Cliff Weight a director of ShareSoc with over 30 years’ experience as a remuneration consultant led a discussion on bonuses, LTIPs, nil cost options and all the other aspects of executive pay.

Abuses seem to be worse in large companies, where Chief Executives should be rewarded as “stewards”, whereas smaller companies should reward entrepreneurial risk taking. Persimmon Chief Executive’s incentives were intended to prevent the housebuilder buying up too much land at the top of the cycle. Instead Jeff Fairburn the Chief Executive could have received £110m total remuneration, helped by the Government’s ill thought out “Help to Buy” scheme. After the financial crisis Lloyds Bank did try to withhold Eric Daniel’s (former Chief Exec) bonus because of his disastrous acquisition of HBOS, but he took them to court and won.

But if governance is good, and management incentives are well aligned this can indicate a company that is doing other things well. He gave the example of Impax Asset Management which he’d bought into because he liked the governance. That wasn’t my investment thesis, but I do like the company too and own the shares. Below is the link to ShareSoc’s smaller company remuneration guidelines. https://www.sharesoc.org/wp-content/uploads/2018/07/ShareSoc-Remuneration-Guidelines-Smaller-Companies-2018.07.06.pdf

Last week Tristel, the chemical infection prevention company reported FY results to June. Then two companies I own Solid State and SDI Group released trading updates, suggesting business is returning to normal.

Tristel – FY Results to end of June

Tristel reported FY results to end of June, with revenue up 21% to £31.7m and statutory PBT up 40% to £6.6m. The company makes chlorine dioxide a disinfectant of medical instruments. For instance, it is used in Ear Nose Throat (ENT) clinics to decontaminate and sterilise endoscopes. I won’t go into detail, but the product is also used to clean medical instruments for other orifices.

Though results were encouraging, the company hasn’t benefitted as much from the virus as you might think because many standard procedures have been postponed, which has led to a fall in demand for the core product. However, fortune favours the prepared. The company had already been working on a hospital surface disinfectant (brand name: the Cache Collection) They had been building inventory of Cache product components and benefitted from hospitals desperately buying up all types of disinfectant products. They already had regulatory approval in several markets, including the UK, Belgium, the Netherlands, France, Hong Kong, and China. Management are feeling validated.

A chemical moat

Tristel has a gross profit margin of 80%, and Return on Capital Employed is 19%, which might seem unlikely for a business that produces a commodity chemical like chlorine dioxide. For instance breweries have switched from brewing beer to mass producing alcohol disinfectant.

A chemical engineer friend told me that chlorine dioxide is a more effective disinfectant against a virus than alcohol (something to do with alcohol works by evaporation which is good at killing semi-permeable bacteria, but not so effective against smaller microbes like viruses). But even if competitors were able to mass produce the chemical, Tristel uses a proprietary formulation containing an organic acid blend to inhibit corrosion. Any chemical needs regulatory approval for its use to clean medical instruments. Traceability procedures of cleaned devices are sophisticated and at 30 June the company held 265 patents granted in 37 countries providing legal protection. So the company looks to have a competitive “moat” and high returns look sustainable.

60% of sales come from outside the UK. Overseas sales grew by 32% whilst UK sales grew by 7%, which the company says is because of the high market penetration they already enjoy in the UK. One slight concern is that management don’t say anything about potential disruption of a no-deal BREXIT, which seems odd given the company sells to so many markets within the EU.

Barriers to entry?

Since 2014 the company has been trying to gain entry to sell its products in the US, and this has supported the demanding valuation. 5 years ago, I was at a presentation where management were quizzed on why it took so long to receive FDA approval. Paul Swinney, the Chief Executive’s responses were diplomatic. But some of the questioners let it be known that they thought the US was implementing protectionist policies by the backdoor, making it awkward for a foreign company with a superior product to sell into the US market. 6 years on and the company has received approval for from the Environmental Protection Agency (EPA) to use its product as an intermediate level disinfectant in the US. But they are still preparing a submission to the FDA to use their product as a high-level disinfectant.

History: Founded in 1998 and listed on AIM in 2005, raising a net £1m at 37p, valuing the company at £8.8m after admission. The stock had a disappointing first 8 years, falling 46% to a low of 20p. But since 2013 it has more than 20-bagged. I like to call these Robert Graves stocks, after the best selling author of “I, Claudius”, who joined the British Army in 1914, was left to die from his shrapnel wounds at the Battle of the Somme but somehow recovered and returned to the front line. For good measure he then caught bronchitis and also Spanish Flu at the end of the war. Investors in this type of stock endure much early on, but they go on to enjoy the rewards of compounding success later.*

As do management.

Executive pay: The Chief Executive’s salary is £250K, and total remuneration is £377K. He owns just over 2% of the company’s shares (worth c. £3.2m). However he has been awarded 654K of options with a strike price of 1p, and which are worth £3.3m. In all there are 1.5m of options with a strike price of 1p, as part of Senior Management Schemes, worth approximately £7.5m. Not significant versus the company’s market cap of £223m, but substantial compared to one year’s administration costs (£15m).

I’m not a fan of (almost) free options, I think that there are better ways of aligning incentives. As noted in the introduction ShareSoc are also against this type of reward structure, because management can benefit even if the share price disappoints. The award of more options seems to be linked to the achievement of the targets set out below, but the remuneration report does not make clear how many options are awarded if the targets are only partially achieved.

Targets: A year ago management set a plan for 3 years to FY June 2022. The first 2 targets do seem relatively demanding, but it’s hard to imagine a scenario where they are achieved and the third one is not:

i) sales growth in the range of 10% to 15% per annum as an annual average over the three years;

ii) the achievement in each year of an EBITDA margin (excluding share-based payment charges) of at least 25%, and

iii) to increase profit before tax (excluding share-based payments) year-on-year, independently of the other two KPI’s.

Ownership: The company seems to be a favourite among private client stockbrokers, with Charles Stanley 8.9%, Investec WM owns 6.5%, Hargreaves Lansdown 6.4%. Montanaro, Unicorn and Amati all own disclosable stakes (ie greater than 3%). Francisco A Soler, a founding shareholder and Non Exec Chairman when the company listed, still owns over 15% of the company.

Valuation

This is an expensive company on any metric you care to choose (8x historic sales, 20x Tangible book, 44x historic earnings). Their broker (FinnCap) is forecasting 12.7p EPS 2021F, and 14.1p EPS 2022F, so using the forecast 2 years out the PER falls to 34x in 2022, which is still expensive. However, that was also my conclusion when I saw management present 5 years ago, so if you’re investment style is “expensive quality” Tristel fits this profile.

Solid State – Trading Statement

Solid State released a H1 trading statement which seemed to disappoint some; the shares were down 6%.

This electronics group makes durable components for computers and batteries that operate in harsh environments is in my ISA. It was founded in 1971 and listed on AIM since 1996. For 10 years after it listed the shares traded around 60p level, before then crashing down to 12p (March 2009) and then bouncing up to 879p (July 2015). Buying Solid State at the March 2009 low would have given you 73x return in 6 years, which is even better than Tristel’s 26x share price increase from their low in 2013 to 520p peak earlier this year. These are companies that make tangible products, have a decent moat and report 15-25% Returns on Capital. I once met a professor from Warwick Business School, who told me that it wasn’t possible for any retail investor to “buy and hold” a hundred bagger (we were discussing Unilever), because that would contradict Efficient Markets Theory. I agreed with him that the facts contradicted Efficient Markets Theory.

Many of Solid States customers are in the oil & gas industry plus also aviation, hence I was expecting a disappointing update. As these industrial customers make large orders, revenue can be volatile: SharePad shows that in the 2008 financial crisis the top line fell 14%, operational gearing meant profits fell over 40%.

One of my favourite SharePad features is the ability to go back many years and look at the financials during the last crisis. This gives a good idea of how sensitive a company is to a downturn, but also shows the best time to buy companies can be when revenue temporarily disappoints.

The company has a March year end, and showed 4% organic revenue growth to FY March 2020. Statutory revenue was £67.4m helped by an acquisition the previous financial year: Pacer Technologies which fortuitously has given them access to the medical sector.

Last week management reported an open order book of £34m at the end of September (down from £38m end of May). The company expects revenue to be approximately £33.0m for this H1 (2019: £33.6m) with adjusted profit before tax of approximately £2.50m (2019: £2.67m).

Despite the recent acquisition, the balance sheet is good, with £3.4m of net cash at the end of September. The net cash number is real, the company has repaid deferred VAT and PAYE, and hasn’t drawn down any Government support measures. The company has restarted it’s capex programme and is also now actively seeking more acquisitions. They paid a 7.25p dividend in September which is also a good signal.

Valuation

H1 results will be out on the 8th December. The shares are trading on 0.7x sales and 13x historic earnings, which is in-line with history.

The balance sheet is fine, and longer term even if the oil and gas customers continue to struggle, electrical components that function in difficult environments seems to me a good niche.

FinnCap their broker hasn’t published any 2021 forecasts, and instead the company has said results should be “broadly similar to last year” which means slightly below.** Reported FY PBT to end of March £4.0m, reported EPS 40p, adjusted EPS 46p. It looks to me like that revenue and EPS could disappoint at some point in the next 6-12 months, but if the share price overreacts then that could be good entry point. This share is in my ISA, and I’m happy to be a long term holder.

SDI – Trading Statement

SDI released a trading statement for H1 (May-Oct first half); the shares were up 15% in the two days following. Positive results should not really have been a surprise: I noted in September the company’s AGM statement was guiding to a “very good” start to the year versus a “good” start last year. This implied that we could expect revenue to be ahead of 6.4% organic growth achieved last year. FinnCap their broker have now raised their forecasts 11% revenue growth in FY 2021, and Adj EPS of 4.2p in Apr 2021.

Two of their businesses i) Atik Cameras (DNA amplification) and ii) MPB Industries (flowmeters for respirators) had benefited from one off orders, which probably won’t continue into the next financial year. So FinnCap’s FY to Apr 2022 forecasts are unchanged at 4.1p, which implies a slightly decrease 2022F v 2021F.

Valuation

The shares are trading on a PER of 18x 2022F earnings. Returns on Capital Employed and CRCOCI are low double digits. Revenue is up around 2.5x to £24.5m since 2015 which is a CAGR of 26%. One thing to mention is that because the company has grown through acquisitions, net tangible book value is negative. That can put off strict value investors who like to see tangible assets on the balance sheet. I’m comfortable that the value of the company is in the future free cashflows and have owned the shares since 2016 when I bought at just below 14p (and kicking myself hard for not having higher conviction).

The Group expects to publish its interim results for the six months to 31 October 2020 on 9 December.

Bruce Packard

Notes

The author owns shares in Impax AM, Solid State and SDI. The author’s mother owns shares in Tristel.

*Yes, like KWS, Tristel is yet another multi-bagger that my mother bought around 5 years ago and still owns. Interestingly her investment process now seems to be tilting away from “expensive quality” towards “value investing”: last week she increased her position size in Bank of Georgia (the Tbilisi head quartered bank that I listed on the LSE 10 years ago. In contrast to Tristel and KWS, BGEO shares are trading on 3x 2022 forecast earnings.) I also own BGEO.

** I’m not really sure why companies say “broadly in-line” when they actually mean “slightly below”. I did some analysis on share price reactions to statements that were “broadly in-line” and the share price falls anyway. There is some research by Frank Zhao at S&P to suggest that management liken to use obfuscation to “soften” bad news.

https://brucepackard.com/signals-in-obfuscation/

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.