A couple of months ago I wrote an article extolling the virtues of selling Covered Calls on FTSE 100 stocks. The technique involves selling Call options on shares you already own to bring in additional income. When you combine the technique with a portfolio of dividend-yielding shares, you can create a veritable income machine.

However, there is also a complementary strategy that allows you to generate an income stream before you even buy the shares in the first place! It’s called selling Cash-Secured Puts and that’s the subject of today’s article.

Picking up shares on the cheap

I know it’s the Yorkshireman in me, but I’m only content when I buy something if I get a bargain. My wife despairs that I’ll only ever buy clothes from discount stores, and I’ve never bought a new car in my life. Far better to get the one-year-old model that’s already shed 30% of its value. That just seems obvious to me.

So, imagine my enthusiasm for an investment strategy that allows you buy your favourite stocks at a discount…and pays you for the privilege! It’s like getting paid to go to the sales.

I’m a big fan of selling stock options and I’m going to show you an options strategy that will do exactly that. It will immediately put money into your broker account whilst you wait to buy the shares for a price that’s lower than they are currently trading at. And as well as paying you up front, the technique reduces the risk of simply buying the shares outright.

The technique involves selling Cash-Secured Puts. If you followed my previous article about selling Covered Calls, you will have no problem with this concept.

You see, a Put option works in pretty much the opposite way to a Call option.

Selling Cash-Secured Puts

Okay, let’s get the jargon out of the way.

A Put is an options contract that allows the holder to sell a set number of shares, at a fixed price, within a certain period of time.

Now, if you are thinking that the definition sounds familiar, it’s because it’s virtually the same as for a Call. I’ve simply swapped the word buy for sell.

I know that the mention of options will have some folks ready to hit the back button — please don’t. Options are bought and sold on regulated exchanges just like the shares you are already familiar with. And, with a little bit of study, they are just as easy to incorporate into your regular investing.

The key point here is that we are going to be selling Puts on shares that we would already like to own. In my case, that tends to be FTSE 100 dividend-yielders but there are plenty of others available including hundreds in the US. Selling Puts brings in premium.

We must ensure that we have the cash available to buy the shares if needs be. And that is where the Cash-Secured part comes in. It simply means that we must have the requisite amount of money ring-fenced in a broker account to pay for the shares if required. That’s one aspect of the approach that keeps the risk well under control.

So, let’s say that we have used SharePad to research some candidate stocks and decided that Big Co. Plc would be an excellent addition to our portfolio. The stock pays a good dividend and it’s currently trading at a price that we are happy to pay. A regular stock investor could march straight on in and buy a thousand shares. Job done.

There is absolutely nothing wrong with doing that. We could then sit back, watch the dividends roll in, and hope for the share price to increase over time.

Or, for no extra work, we could simply sell a put option on Big Co. Plc instead.

We select the price we wish to pay for the stock — the strike price — and the length of time we would like to honour the commitment for – the expiration date.

And in return for the obligation to fulfil the contract, we would be paid a premium that is ours to keep whatever the outcome.

Usually, you would select a strike price that was lower than the price the shares are currently trading at, and an expiration date that ranged from a week to several months into the future.

If the Put option is exercised by the holder, we will be obligated to buy the shares at the agreed strike price. In that case, we end up paying less for the shares than if we had simply bought them straight away… and we were paid a premium up front. The amount of premium varies, but 1% – 2% of the share price per month is certainly possible and it can be much higher on some of the more volatile US stocks. That sounds like a pretty good deal to me.

Let’s have a look at a real-life example to cement the concept.

Case Study: Aviva Plc

As I am sure you are aware, Aviva are a huge multi-line insurer headquartered here in the UK. They have been through several leaders and a restructuring process in recent years which means they are hopefully heading to a leaner and more profitable future.

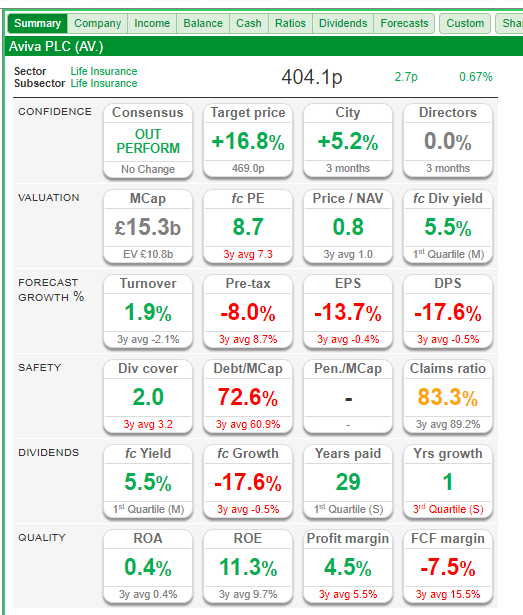

They also recently announced plans to return £4 billion to shareholders and — according to SharePad — have a forecast dividend yield of 5.5% that’s covered 2.1x. They also have a target price 16.8% higher than now and are trading on an undemanding forecast PE ratio of 8.7.

From a technical point of view, the shares are trading around the middle of a 9-month consolidation channel and are catching support from the 200-day EMA. The RSI is ticking up from 50, and the MACD is registering no obvious signals. Truth be told, it’s all a little unexciting – that’s perfect for the strategy.

So, all-in-all Aviva looks like it would be a good low-risk addition to any income-focused investors portfolio.

Question is, how much would we be willing to pay?

Well, to be honest, it looks pretty well priced at 404p. With the consensus price target and corresponding dividend yield I’d be happy to pay that.

Or, even better, what if we had a chance to pick it up for 400p and get paid 14p per share whilst we waited — that would be fantastic.

Well, we can. Welcome to the world of Cash-Secured Puts.

Crunching the numbers

My online broker’s platform is currently showing a range of Puts that I can sell on Aviva. There are a variety of strike prices and expiration dates for me to choose from. However, my eye is drawn to the January 400p Put that is selling for 14p per share.

As with calls, a single UK Put represents 1,000 shares (US options represent 100 shares).

So, if I sell a single Put, I am committing to paying £4,000 for a thousand Aviva shares if the Put option is exercised between now and January the 21st. That’s 65 days away.

The buyer of the Put will pay me £140 in return for that commitment. The premium will land in my broker account the following business day and is mine to keep whatever the outcome of the trade.

A quick back of an envelope calculation tells me that if I theoretically repeated that trade throughout the year, I would bring in £786 worth of premium. At the 400p strike price, that’s an annualised yield of 19.7%. Not too shabby considering we don’t even own the shares yet.

Two possible outcomes

If we decide to sell the Aviva Put we are entering into a commitment that primarily has two possible outcomes.

Either the share price ends up above 400p by the time the put expires in January, or it drops below 400p.

If Aviva’s share price is above 400p, the Put will simply expire worthless. We keep the £140 premium and are then free to sell another Put at a strike price and expiration of our choosing. Rinse and repeat.

That’s a pretty good source of income and it is quite possible that you can go through several cycles without the Put ever being exercised. My personal record was repeatedly selling Puts six times on GlaxoSmithKline a couple of years ago without ever being assigned. That’s six lots of premium paid straight into my broker account without ever having to buy any Glaxo shares.

What happens if the put is exercised?

Okay, that sounds great, but the obvious question is: What happens if the Aviva share price is below 400p on January 21st next year?

The simple answer is that the owner of the put will exercise it and you will be obligated to buy 1,000 Aviva shares for 400p each.

Is that a problem? Well, it shouldn’t be. Remember that we analysed Aviva and decided that we would be happy to own their shares for the long-term at 404p per share.

So, if you now only have to pay 400p for them and have collected at least one premium payment worth 14p in the process, that’s a pretty good deal. And remember, we could well go through several put-selling cycles before this happens and so the actual aggregate buy-in price could be considerably lower still.

And ending up with the shares is hardly the end of the world. As the proud owner of 1,000 Aviva shares you can now start to collect the dividend payments and sell Covered Calls on them to bring in even more premium.

I hope you can see how the two strategies fit so neatly together and represent a completely different approach to the usual ‘buy and hope’ approach most folks use.

What about the risk?

However, the eagle-eyed amongst you may have spotted the ‘risk’ with this strategy.

The buyer of the put has bought it for a reason. If the price of their shares drops below a certain level they want to ensure that they can sell them at a fixed price.

As the seller of this ‘insurance’ you have committed to pay 400p for the shares, regardless of the price they are trading for when the Put is exercised.

That might sound a little risky, but it’s actually less risky than simply buying the shares outright. And, with Aviva, we are talking about a relatively low-risk equity in the first place.

Let’s imagine you had bought the shares at 404p and that they then dropped to 380p by January. These are good quality shares, so there is certainly no need to panic, but you would be looking at a paper loss of 24p per share.

Now instead, assume you had sold the Put we just described. After the drop to 380p, the owner of the put would certainly exercise it and you would have to buy the shares for 400p each.

That’s a 20p unrealised loss on the shares. However, you were also paid 14p for selling the Put in the first place and so can offset your paper loss by that amount.

You are out of pocket by only 6p per share. That’s a whole lot better than the 24p loss if you had simply bought the shares outright.

And of course, you can go through several cycles before one of your puts is exercised. All that premium adds up to provide a very nice downside buffer if it’s ever required.

The risk is in the shares, not in selling the Put option.

Now, there is a secondary risk. And that is that the share price moves up, the put is never exercised, and you miss out on your chance to pick up the shares at your desired price. If you consider this a risk, then that’s the trade-off I’m afraid. Hopefully the premium you have pocketed will help to compensate for this. And, if you dig a little deeper into the world of options, you’ll soon find more advanced options techniques we can use to deal with this situation.

So, as long as you are happy to own the Aviva shares at some point, this is a great way to initiate a position.

You get to choose the price you wish to pay for the shares and then receive Put premium whilst you wait to be exercised. If, and when, that day arrives, you simply flip the process round and start to sell Covered Calls against your newly acquired stock to bring in more premium.

And of course — as an Aviva shareholder — there is always that 5.5% dividend to look forward to.

Greg Robinson

If you are interested to learn more about selling Puts as a strategy then please email me at greg@fire-revolution.co.uk or check out our website www.fire-revolution.co.uk where you can register for our next webinar

Our mission is to spread the word about these amazing techniques and educate savvy private investors how they can generate up to 4 different income streams from their stocks..

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.