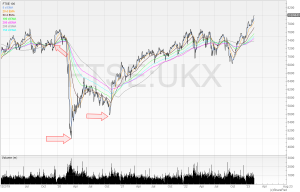

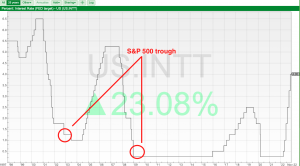

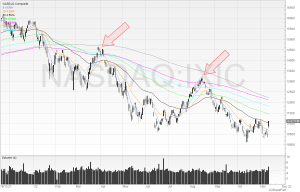

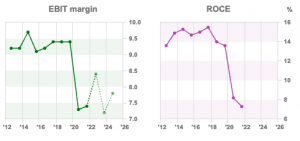

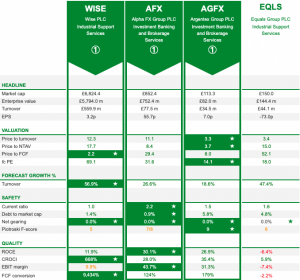

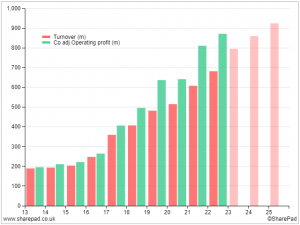

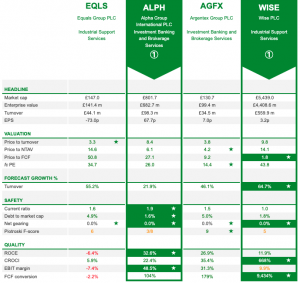

The Swiss Central Bank’s balance sheet in 2022 shows signs that Credit Suisse’s problems were well understood, but harder for the authorities to resolve. Companies covered KAPE, SDRY, ALPH and EQLS. The FTSE rose +1% to 7476 in the last five days, most of which was on Monday morning. The Nasdaq100 was up +2% and […]