Technically, Sharepad’s ROCE calculation is ROACE or Return on Average Capital Employed. It is a good refinement of perhaps the most revealing performance statistic for a business.

Sometimes readers ask me why my figure for a certain financial statistic is different from SharePad’s, or the figure quoted by the company.

Usually, it is because the way we calculate them is different. In fact, since there are a number of component statistics in any statistic, the way we calculate each of them can be different too.

When a company changes the way it calculates one of the statistics I rely on, it can be revealing to work out why.

Treatt has changed the way it measures Return on Capital Employed (ROCE) in its annual report for the year to September 2022. From now on it is using Return on Average Capital Employed (ROACE).

ROCE/ROACE is an important statistic, perhaps the kingpin of the six financial statistics I spend most of my time thinking about*. Investors need to know whether the capital, the money the company has raised from borrowing and from investors in the form of equity, is generating a good return, which is another word for profit.

Profit is, after all, what will pay for our dividends and future investment so the business can grow. The more profit a company makes from the capital it employs (which is invested in things like factories, vehicles, stock and intangible assets), the better.

Treatt’s version of ROACE is different from the one I have encoded into my spreadsheets and from SharePad’s, so there is something new to learn deep in note 31 on page 148 of Treatt’s annual report.

How Treatt calculates Return on Average Capital Employed

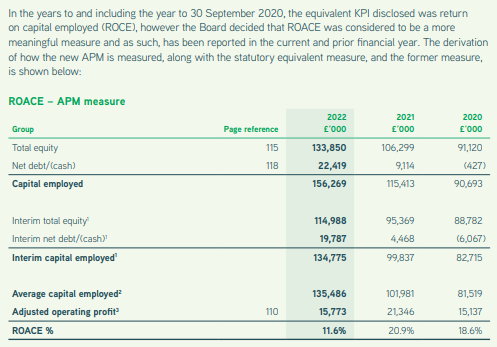

This is where Treatt tells us how it calculates ROACE:

Source: Treatt annual report 2022

The numerator in the ROACE calculation, profit, is the same as in its ROCE calculation, but as the name implies, ROACE uses average capital employed instead of the capital employed as measured by the firm’s balance sheet at the year-end.

To calculate average capital employed I, and I thought, the rest of the world, just sum the capital employed at the end of the previous financial year (in this case 2021) and the capital employed at the end of the most recent financial year (2022) and divide the result by two.

Treatt adds a refinement, it includes the capital employed at the half year in its average (and divides by three).

A cynic might ask why, if Treatt’s simple calculation of ROCE was a perfectly good measure all those years, has Treatt changed to ROACE?

It is a good sign that Treatt uses any form of ROCE as a key performance indicator (KPI). Not all companies do.

But Treatt had a bad year in 2022, by which I mean the numerator on the return on capital calculation, profit, declined and the denominator, capital employed, increased significantly. A smaller numerator and a larger denominator can only mean one thing: Return on Capital Employed (however we measure it) was much lower than usual.

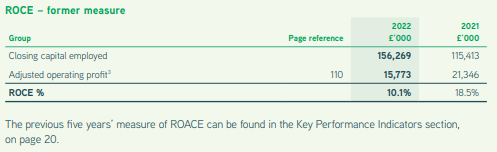

ROACE was 11.6% in 2022, but ROCE was 10.1%, so the new measure makes Treatt look a bit better.

We know this because Treatt calculates its former measure for us later in the same note:

Source: Treatt annual report 2022

I do not think we need to be cynical though. The difference is not great, and anyway, using average capital employed is a better measure because the returns were earned over the course of the year, and over the course of the year the amount of capital employed can vary dramatically.

Treatt is using much more capital than it was because it is equipping its new plush headquarters and new manufacturing facilities here and in the USA. The construction of these facilities was funded by debt and, a few years ago, by selling more equity to investors, in other words by raising more capital.

Treatt is a manufacturer of mostly natural flavours and aromas that are used by drinks manufacturers and their suppliers, flavour houses, in the main. Like many companies in 2022, the company dealt with shortages in supply by stocking up on raw materials and finished products to ensure it could continue supplying customers. This also tied more capital up in the business.

As a result Treatt’s capital employed has increased dramatically, by 27% in 2021 and by 35% in 2022, so the difference between ROCE and ROACE in these years is much more obvious than it would have been in years when the variation in capital employed was much smaller.

Taking the year-end value capital employed and using it in the ROCE calculation gives a false impression.

ROACE is ROCE in Sharepad

To be honest, I am a bit surprised Treatt was not already using ROACE, as I think most people use average capital employed when they calculate ROCE. Certainly I do.

Fortunately, SharePad’s ROCE calculation uses the average of capital employed in the most recent year and the previous year. It is, therefore, effectively ROACE.

SharePad also uses average capital employed to calculate capital turnover, one of the two components of return on capital used in the DuPont analysis, which, as Phil said in his seminal article, is a “a simple, quick and very powerful way to analyse a company”.

Purists might prefer Treatt’s method, but since it requires data from the half-year results (and quarterly if you want to go there) it takes more effort to calculate and, I think, taking the simple average probably does most of the work.

~

*The other five numbers I obsess about are: acquisition spend as a percentage of free cash flow, cash return on capital invested (CROCI), turnover growth, net debt as a percentage of capital employed, and the share count.

For net debt as a percentage of capital employed, I use capital employed at the year-end, not the two-year average. This is because debt is also a year-end balance sheet number.

Last month, I described how I use a custom table in SharePad to display these ratios over time and get form a quick impression of a business.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.