This month another gaggle of four ideas for fund-oriented investors. I have included a short guide to buying US equity ETFs – as you can imagine there’s lots of choice and I think some of the less widely used indices are quite compelling. I also introduce what I think is a much more viable alternative to the increasingly discredited global emerging markets (GEM) way of thinking – focus on the recent winners amongst the developing world. In investment trust land I think a leading digital infrastructure fund is looking cheap and last but by no means least I introduce a unique family-run private equity fund which I think warrants your attention long term.

One to keep watching for the long term – Literacy Capital

Late last month I met up with the father and son team – Paul and Richard Pindar – behind the small listed private equity fund Literacy Capital. In a recent FT column, I was honest enough to say that I didn’t know much about this fund although recent performance has been excellent. Having dug around a bit more into the workings of the fund and met the key individuals I can say that I am impressed though currently ambivalent on the shares.

Literacy Capital has a fairly unique strategy – its focused on UK small to mid-cap private buyouts where, typically, the family/owner wants some kind of realisation event but doesn’t want a ‘typical’ large PE transaction with all that that entails i.e stripping out cost, lots of rolling businesses into each other, putting on leverage.

Its very focused on the UK domestic economy and its typical ticket price for an investment is between £2 and £10m. It also very carefully builds up the portfolio companies by bringing in expertise and investing in growth where necessary. In terms of peers I suppose Oakley Capital does similar stuff but with much bigger companies across Europe while EPE is probably the nearest competitor – this listed PE boasts a very patchy track record to put it mildly.

The fund came to the Specialist funds segment a few years ago and to date has a great track record and has consistently beaten its peers in terms of NAV growth – its increased NAV by 57% in the last year and over the last quarter increased NAV by 11.3%. Nut unsurprisingly given these numbers, for many moons the fund also traded at a whopping premium though this was largely a function of a tightly held share register where the Pindars are big shareholders and deploying their own capital – Paul built up Capita.

Crucially the fund also has a close relationship with a charity – also run by the Pindar family – called Bookmark which provides reading and learning support to children. The fund donates 0.9% to the fund on an annual basis to the charity, alongside the management fee. There is no performance fee either – a big plus in my books.

The current portfolio is valued on an EV/EBITDA multiple of 8x. According to Singers, the portfolio of companies has the earnings growth to continue to deliver 8-12% NAV growth PER QUARTER prior to multiple expansions and exits. In stark contrast to the dire predictions of UK domestic economic gloom, the portfolio companies do seem to be trading very well with most of the portfolio reporting very good momentum and the last 12 months EBITDA growth of 40%+ pa in each top 10 investment. According to Singers, virtually all performance has been from underlying earnings growth rather than any multiple expansion.

Crucially Literacy Capital is now trading at a discount for the first time in many months. On the screens, I can see a price of 373p versus NAV of 384.9p. By comparison, the average discount for UK-listed direct PE funds is currently running at 21% if we include 3i and 29% if we exclude 3i. That suggests to me now might not be the right time to buy the shares. Let’s assume that the fund continues to see progress in the portfolio companies even as the UK domestic economy slows down. That would suggest more incremental NAV increases over the next few quarters. The share register is fairly tight so I don’t see much liquidity in the shares and given the funds very low profile I don’t see a long queue of investors lining up to snap the shares up in an illiquid market. That suggests the discount could widen as NAV growth continues. In that scenario, once that discount got into double figures I’d be a very happy buyer of the shares. To be clear, Literacy has a unique strategy, and its unique structure means it has brilliant long-term alignment with your interests i.e no performance fee, founders have put their capital on the line. I’d ideally like to see how the portfolio businesses develop over the next tough 12 months but on paper, this looks like an absolutely core long-term holding when the price is right.

Looking cheap – Cordiant Digital Infrastructure Ltd

I’ve owned shares in the two digital infrastructure funds listed on the LSE since inception – Cordiant and Digital 9. For many months both funds seemed to float free of market turbulence, notching up solid gains as investors lapped up the digital growth story.

Over the last few months though this story has soured. First in the firing line was Digital 9 which announced a huge deal to buy UK-based infrastructure play Arqiva. This deal, and its associated lashings of debt, attracted a fair bit of flak from analysts at Investec who worried about the sheer scale of the debt

Both funds were also caught up in the infrastructure sell-off from a few weeks back as investors worried about increasing interest rates and their impact on private business valuations. Both funds were probably a tad vulnerable because their dividend yields were a tad low – in what I regard as the dangerous 4 to 5% territory.

Flash forward to this week and Digital Nine trades on an 8% discount while Cordiant has crashed to a 20% discount. But the last few days have brought some good news for Cordiant at least – it has finally announced that it has received the final regulatory approval from the Polish Ministry of the Interior for the acquisition of Emitel. The completion of this acquisition, which was first announced in January. The acquisition is expected to complete by mid-November 2022 and is the second large digital infrastructure platform acquired by the company and its largest investment since launch.

Here’s some deal specifics:

- Acquired Emitel for 1,920m PLN (£360m or 45.2% of NAV) before transaction costs and fees

- The deal also triggers full utilisation of its EUR 200m Eurobond facility announced in June 2022, EUR 80m of which was conditional on the closing of the acquisition. The Eurobond is currently unissued, matures on 30 September 2026, and EUR 165m is fixed at 6.02% and 6.27% with the rest being a floating rate note at 4.5-4.75% above 6-month Euribor.

- Emitel’s revenue profile consists of broadcast revenue contracts which have a weighted average duration of 8 years and mobile contracts which have an average 13 years for anchor tenants

- c75% of Emitel’s revenue have full or partial CPI inflation linkages.

- Emitel also routinely purchases 50-60% of its annual electricity requirement 1-2 years in advance via PPAs which provides significant hedging protection in a volatile power price environment.

- In 2021 revenues were PLN 486m and EBITDA of PLN 319m (or c£60m using today’s rate).

- As at 31 December 2021, Emitel had outstanding debt of PLN 1462m (c£274m using today’s rate), and PLN 131m in cash on hand

The company also in this update confirmed its dividend guidance – after the Emitel deal, the dividend will increase from 3.0p per share to 4.0p per share in respect of the year to 31 March 2023.

Fund Facts

- Share price 90p

- Dividend yield 4.9%

- Market cap £703m

- Numis est NAV 110.7p last published NAV 104.8p

- Bid offer spread 1.2%

- Management fee between 0.80% and 1% plus 12.5% performance fee

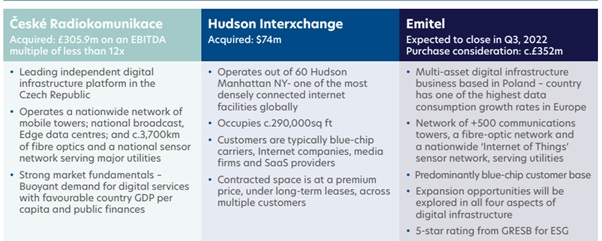

The graphic below breaks out the three key Cordiant businesses.

GRAPHIC 1 – Cordiant business units

For many months both Cordiant and D9 traded at sizeable premiums to NAV but this has now flipped aggressively in the case of Cordiant. The 20% discount is I think entirely unwarranted. I understand why say PE funds with a rag bag of relatively low-growth businesses might trade at cavernous discounts – circa 50% in some cases – but Cordiant is a targeted play on one of the fastest-growing segments of the modern global digital economy. It boasts quality assets in three areas – data centres fibre optic cables and mobile phone masts. Cordiant has seen its shares decline by over 20% over the last three months whereas HICL (which also owns a combination of boring PFI/PPP assets and digital infra) is down just 5% over the same period.

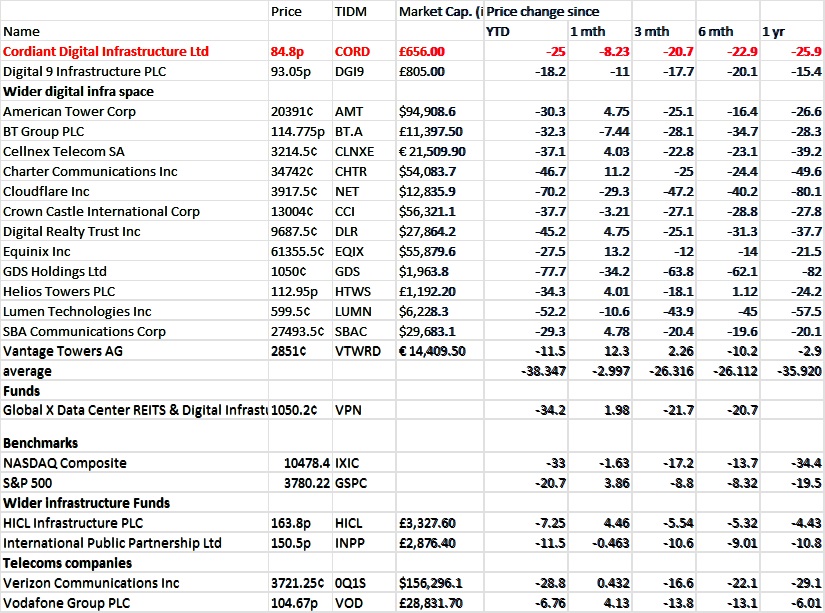

The table below breaks out returns from the wider digital infra space – Cordiant is probably in the middle of the pack but notice that Vantage Towers for instance is actually up 2.3% over the last three months while Cordiant is down 20%.

TABLE 2 – the wider digital infrastructure space

The core long-term logic for investing in this space hasn’t gone away – if anything it keeps growing by the year. Investors shouldn’t focus too much on that income stream – look at NAV growth over the next few years.

On that basis I think Cordiant (and Digital 9) will probably normalise around a discount of between 5 and 10% in the next six months.

Where’s your BIMCHIP equity funds?

I’ve been a fairly lonely voice arguing for increased exposure to emerging markets – with a twist. For me, the exposure to China and the greater China trading region (Taiwan, HK and South Korea) within most emerging markets funds (active and passive) is just too great. I think there are many more interesting geographies out there but you need to work hard to find the right companies – in particular, Latin America and India have been big winners over the last year.

The arch contrarian and Stone X strategist Vincent Deluard has nicely codified this thinking by coining a dreadful new acronym that explicitly excludes all things China-related.: the BIMCHIPs Brazil, India, Mexico, Chile, Indonesia, and Peru.

These markets have bucked the trend of the last year and produced very decent returns primarily due to rising earnings and high dividends, the most sustainable source of return. Their local bonds have also done well because of “their high coupon, early hikes, contained inflation, positive real rates, and their resilience from the global energy shock”.

Deluard also argues that eventually flows will follow these impressive returns – “Japanese and European investors in Brazilian equities earned a mind-boggling 57% and 39%, respectively, this year. Foreign direct investment which would have gone to Russia and China will be redirected towards closer and friendlier emerging giants: Mexico, Brazil, India, and Turkey.”

Lastly, these nations will “collect their demographic dividend in the next two decades, which should generate trade surpluses, dis-inflation, higher tax collections, and a stable, domestic source of investment for their economies.

The BIMCHIP nations are home to 2 billion people and they are all middle-income economies with more or less democratic institutions and a recent history of market reforms. They also have friendly relations with the US and the European Union and have deepened their ties with China, which has become their largest trade partner. Deluard also observes that with the exception of India, the BIMCHIP are large commodity producers and dominate certain markets (copper for Peru and Chile, silver for Mexico, and many agricultural commodities for Brazil).

In terms of recent returns most of those gains were driven by rapid earnings growth, while multiples compressed. Delaurd reckons that India remains expensive, but its growth is cheaper than it was last year. Brazil and Chile trade for 6.2 and 5.4 times forward earnings, and offer dividend yields of 11.6% and 6%.

So, summing it all up, if you like me think that global emerging markets (GEMs) is now a redundant term to describe a vastly varied asset classes (es), then I think you are forced to invest on either a region by region basis or using shorthand methods such as BIMCHIP. If you go for the latter worldview and buy into Deluard’s methodology, then I would shortlist the following funds that I think would fit the bill – some are actively managed investment trusts, others exchange-traded funds:

- Brazil, Peru and Chile – Aberdeen Latin American Income and BlackRock Latin America

- India – India Capital Growth and Ashoka India Equity

- Mexico – Xtrackers MSCI Mexico UCITS ETF 1C, ticker XMEX

- Indonesia – HSBC MSCI Indonesia UCITS ETF USD, ticker HIDR

US equity ETFs

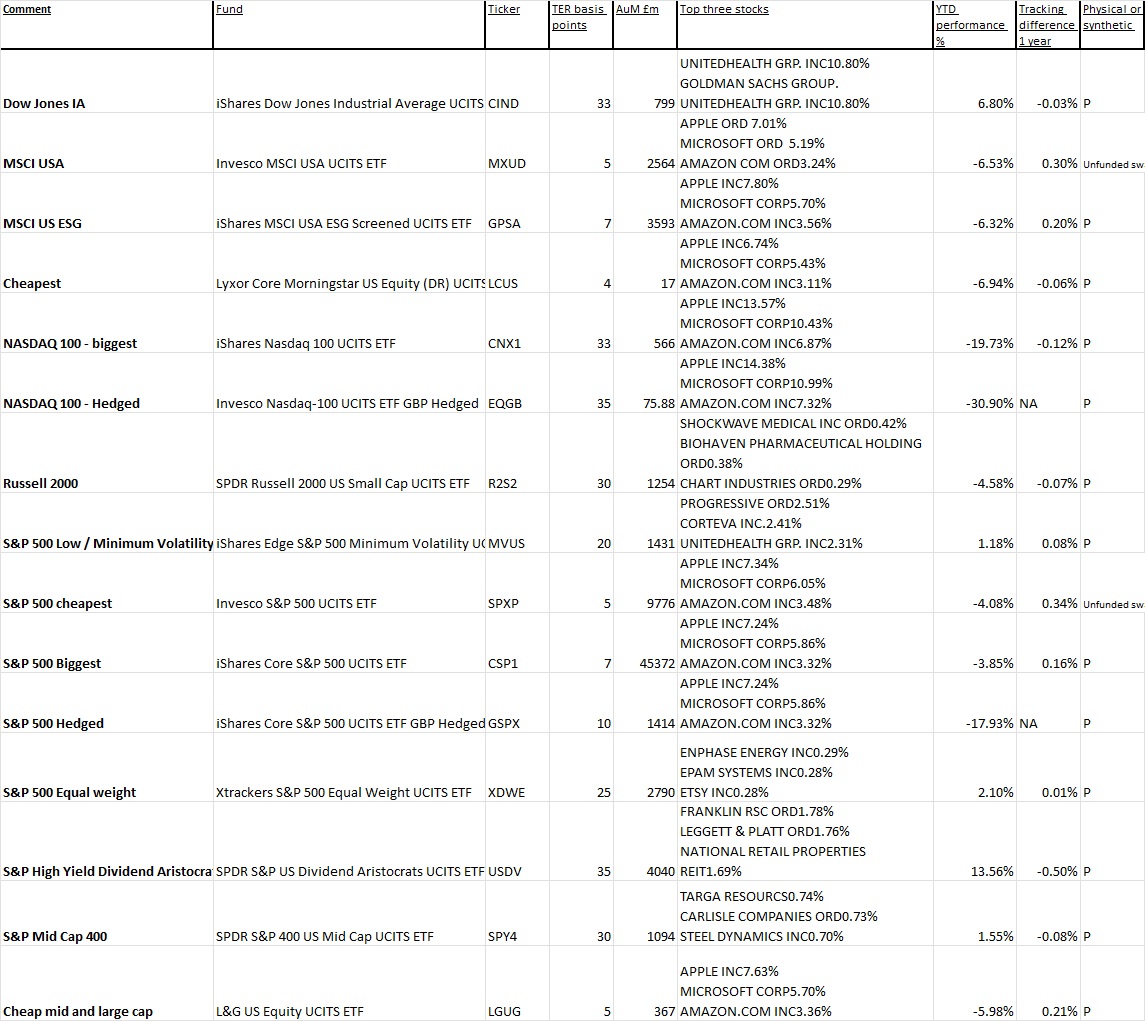

This month I’ve pulled together a shortlist of the most interesting US stock market ETFs.

As you can imagine this space is absolutely huge. By my calculations there are over 215 UK-listed US equity ETFs, some of which are very focused – say on MLP infrastructure – yet in the main benchmark’s there’s also intense competition.

Take the S&P 500 benchmark index – by my calculations, there are 11 ETF issuer families (distributing and accumulating versions of each) for the S&P 500 plus 7 hedged versions. For the S&P 500 the total expense ratio varies between 5 and 15 basis points. And that’s just the S&P 500. There are other indices including the NASDAQ, the Dow Jones Industrial and the MSCI USA index. Its massively confusing but I’ve tried to simplify the choice in the table below.

As you can imagine there’s lots and lots of choices but if you are looking for the cheapest way of buying into mid and large-cap equities I would go for the L&G US Equity ETF, the Invesco S&P 500 UCITS ETF, ticker SPXP or Lyxor’s Core Morningstar US Equity ETF, ticker LCUK. These three ETFs cost between 4 and 5 basis points each.

In terms of benchmarks to use, the default is still probably the S&P 500 although I think the MSCI USA index is more comprehensive. I would absolutely avoid the DJIA index which is in my view a terrible index, poorly constructed and not much value to man or beast. My own personal favourite index are equal weight indices. Over the long run, equal-weight indices tend to outperform because of their weighting to small and mid-cap stocks. In the vast majority of markets, you cannot buy equal-weight exposure – usually for trading and liquidity reasons. But the US is different and Deutsche X trackers offers an excellent product in this space at only 25 basis points.

In terms of the ‘style’ of index, you’ll notice that all the large cap indices tend to end up with the same sub set of giant tech leviathans (except for the DJIA index). That means lashings of FAANGs and such like. That might well worry many investors and thus I would think about different styles – two stand out namely dividend-weighted indices and low/minimum volatility indices. Personally I quite like dividend-weighted strategies, especially dividend aristocrat strategies are very useful. The grand daddy of progressive dividend strategies is the US and SPDR offers a US Dividend Aristocrats ETF which I Think is really very interesting. The US isn’t big on dividends – buybacks are more popular – but those companies that do offer them, progressively increasing year after year, tend to be quality stocks with sound balance sheets. Just the sort of businesses you want in a volatile market. And year to date the ETF is up 13.56%.

Minimum or low variance versions of indices have provided real protection in the last 12 months. iShares EDGE min vol ETF has produced a very credible gain in the year to date and logic would suggest that the quality stocks sitting in this basket will outperform if markets and economies stay volatile.

As for indices with different size biases (small vs large cap), I think that small-cap indices are really interesting as are mid-cap stocks. If you are into small caps check out the Russell 2000 index while the S&P offers a mid-cap basket called the S&P 400 which is tracked by an SPDR State Street ETF

Hedging the currency risk can make sense BUT it doesn’t always work. The obvious downsides are a) it costs extra in terms of fees (that hedging doesn’t pay for itself) and b) sometimes you can be on the wrong end of a hedged trade. This year the smart thing ahs been to take the strong dollar against the weak sterling. Next year though it might be different. The academic evidence on hedging equity risk is patchy and not terribly conclusive. That said I would hedge US bond exposure day in day out.

Tracking errors are surprisingly varied. For most of the physically backed ETFs the tracking error is usually very low – the X Tracker equal weight S&P 500 ETF has a tracking error of around 1 basis point according to Track Insight. But the swap-based ETFs can boast very big, positive numbers. The Invesco MSCI USA index ETF has a positive 30 basis points tracking error. Overall I’m surprised by how big these numbers for what is a large, deeply liquid market. I was expecting all the ETFs to have tracking errors in the low single digits.

David Stevenson