If you are brave enough to be a growth investor – a tough vocation in the current climate – then I think at some stage you need to have some exposure to the world of private businesses, preferably fast-growing ones which might turn into tomorrow’s tech leviathans. The best way to get this exposure is through a venture capital firm, a handful of which are listed on the London stockmarket. Arguably the most high-profile firm in this space is called Chrysalis Investments. I say high profile because it has been in the media for two main stories. The first was a massive row about the fees the managers generated when times were good and shares in the fund traded at a massive premium. The second story is that many of the key investments in the Chrysalis portfolio have had a horrible 12 months and have seen their valuations absolutely plummet. As a consequence, the share price is down 67% since its peak in September 2021, when the shares were trading on a premium.

At this point, I have to say that the controversy surrounding both the fees debate and the recent performance is entirely justified. The fee structure was clearly skewed only to the upside and made the managers a small fortune. In essence, the remuneration package was, in my humble opinion, indefensible. Thankfully it has now been renegotiated. According to a recent report by fund analysts at Numis, the headline performance fee has been “significantly from 20% to 12.5%. Significantly, the high-water mark of 253p has been maintained and further protections have been put in place to prevent a repeat of performance fee payouts in the event of a subsequent NAV decline.”

As for the share price plunge, this was also warranted. Chrysalis focused on late-stage, pre-IPO firms – well-known names include Klarna and Starling. The portfolio is a high-quality one and I can see why investors got excited, but times have changed. There is close to zero chance of an IPO for a year or more and many late-stage VC-backed investments have experienced massive writedowns. Until very recently I was of the view that the whole VC industry was in self-denial and was refusing to put sensible valuations on businesses. I still think this is largely true and but less so of late-stage, post-Series C and D deals. Crucially Chrysalis has introduced much more rigour to its valuation process and its board is to be applauded for taking an active stance on how to value private businesses.

My core view is that whatever number VCs quoted in late 2021 and the beginning of 2022, you should discount that by at least 80% if not 90% to get to a sensible value. That’s still not true for Chrysalis – that would probably take us closer to 60p a share – but Chrysalis is much closer to that valuation hit that I regard as a realistic VC valuation. In sum the funds NAV was down 41% in the year to September 2022, predominantly due to the impact of a down funding round for Klarna (-56p), with the rest of the portfolio collectively down 46p, including write-downs to Starling and declines in listed holdings (THG, Wise and Revolution Beauty).

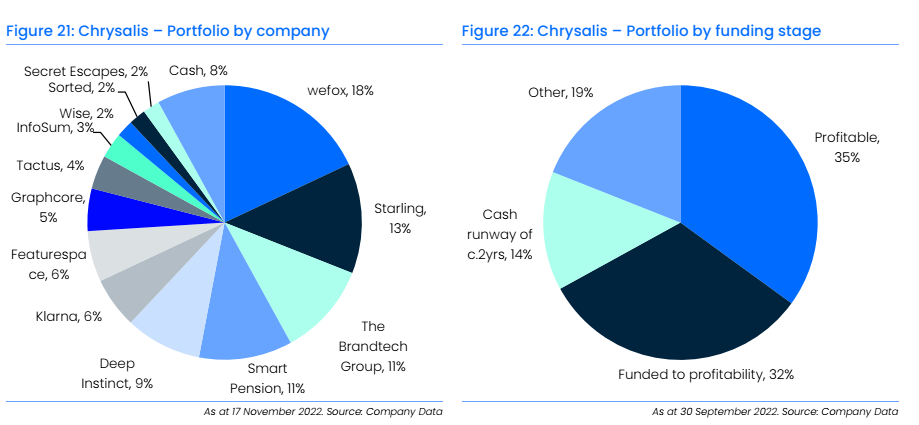

The upside is that Chrysalis has a great collection of mature private businesses in go-go sectors such as Insuretech, Fintech and Cybersecurity. I realise hardened cynics will rightly say these sectors were oversold and valuations got out of hand, but there is real disruption afoot in all three of these spaces and I think the long-term potential for change is huge. And crucially many of these businesses are what I regard as high quality. Again according to Numis “as of 30 September, 35% of the portfolio was profitable, 32% funded through to profitability based on company budgets, and a further 14% have a cash runway of around two years. The remaining 19% were either expected to either be funded by Chrysalis or other investors or will be sold.” I would cite one example – I bank with Starling and having banked with many others, I regard it as quite the best online bank. Its technology works, its accounts are competitive and it’s even communicative with its clients. The two charts below from Numis again flesh out the portfolios in more detail.

Numis’ core view is that there has been “an excessive amount of bad news factored into the current share price. Even though shares have recovered somewhat, we believe that the brave buyers at the current discount of c.38% could be rewarded over the medium to long term, albeit volatility is to be expected.”

I wouldn’t go quite so far as Numis. Looking at the chart below it’s obvious that the shares have bounced from recent lows, but I think another bear turn in the market could see the shares fall back again and I would be a buyer once they were back below 75p.

Healthcare

The healthcare sector had a good bear market. Most healthcare funds – bar biotech funds – produced positive returns for 2022. And although healthcare as a sector has underperformed the market so far in 2023, many large healthcare firms like UnitedHealthcare are releasing more than decent numbers.

But there is a more important long-term argument for looking at healthcare as a sector. Although it contains within it a broad range of niches (biotech and data services through to old-school big pharma), overall the sector has strong defensive characteristics in a slowing economy wracked by higher-than-expected inflation. As a broad sector, it comprises lots of companies with resilient margins and high pricing power. I think this argument has best been put by StoneX’s spiky strategist Vincent Deluard who has crunched the sector-level data. After his interrogation, he reckons that healthcare is more recession-proof, especially compared to everyone’s favourite defensive safe haven consumer staples. According to Deluard “pharmaceuticals have maintained 15-20% margins throughout the past 40 years. They have almost no exposure to energy and basic material costs: their main expenses are research and development, marketing, and lobbying….the US healthcare sector is [also] monopolistic or oligopolistic with great price-gouging pricing power. Inflation in drug prices and medical services has been twice that of the broad consumer price index in the past forty years. “

I would also add that on most valuation metrics the healthcare sector doesn’t look too far out of whack in terms of valuations. Sure, the historic sector PE for say the US majors is currently around 22 – which is a bit on the high side – but that falls to a forecast 16.81 times earnings for 23. In sum, healthcare tends to outperform in a recession, has pricing power in a more inflationary environment, is benefitting from strong secular growth drivers (we are all ageing!) and is not egregiously overvalued. So, if you buy into this thinking, what are your choices in funds land?

Your first decision is whether to look at the broad healthcare sector including both biotech and mainstream pharma/health services or stick to one sub-sector. Mainstream pharma/health services is more keenly priced (on a PE multiple) but is less exciting. It’s classic defensive investing.

Biotech by contrast is much more exciting and growth-oriented but is volatile and risky. Personally, I have a preference for the biotech space as I think it’s now two years into a bear market and due to a reversal but I entirely understand why defensive types might run a mile.

Within the biotech (and medical devices) space you also have an additional choice. Do you focus on ‘mainstream’ biotech and innovation firms or do you go all next generation and only focus on those funds with a focus say on genomics? In ETF land that is echoed in a trade-off between the Invesco NASDAQ Biotech UCITS ETF (mainstream biotech) or iShares PLC NASDAQ US Biotech UCITS (also mainstream) against more innovative portfolios such as the iShares Healthcare Innovation UCITS or the Legal & General Healthcare Breakthrough UCITS ETF.

Next up you have to decide which geography to focus on. This is a simple choice – the US, Europe or the world. If you are focusing on biotech, then it’s basically the US and a long tail of smaller UK and European firms. In the ETF space, your default choice is a fund called X-trackers (IE) PLC X MSCI World Health Care while in the active space, it’s Bellevue Healthcare Trust PLC and Polar Capital Global Healthcare Trust PLC. If you are thinking of investing in healthcare more broadly (including biotech and big pharma) I think your best choice might be to invest at the global level, so you don’t miss out on innovative UK and Swiss firms. The main world ETF is the X-trackers (IE) PLC X MSCI World Health Care ETF.

One last crucial question – active vs passive? In the table below I have broke-out-performance for s range of ETFs and actively managed funds over various time frames starting from the last month to the last five years. I would make two observations.

The first is that by and large passive has performed as well as most active funds. There is no obvious active advantage at work. That said I think the Polar Capital Global Healthcare Trust does have an excellent track record and has produced consistently great results. It’s also prudently managed and has a defensive, income focus. Over in ETF land, I also think the track record of the iShares S&P 500 Health Care Sector ETF, ticker IHCU, stands out. It invests in a deep, liquid pool of well-run US businesses and this shows in the performance data.

In the next table below, I have broken out the top holdings for the iShares fund S&P 500 ETF versus the Polar Cap fund.

| iShares S&P 500 Health Care Sector ETF | |

| Name | Weight (%) |

| UNITEDHEALTH GROUP INC | 9.03 |

| JOHNSON & JOHNSON | 8.76 |

| MERCK & CO INC | 5.53 |

| ELI LILLY | 5.42 |

| ABBVIE INC | 5.25 |

| PFIZER INC | 5.03 |

| Polar Capital Global Healthcare Trust PLC | |

| Name | Weight (%) |

| Johnson & Johnson | 7 |

| Eli Lilly & Co | 6 |

| AbbVie | 6 |

| AstraZeneca | 5.3 |

| Novartis | 4.9 |

| Boston Scientific Corp | 3.7 |

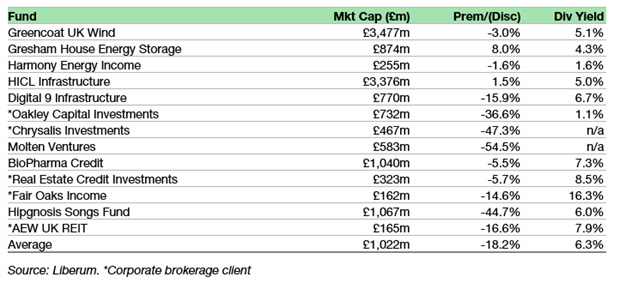

Liberum Alt Funds for 2023

Last week UK bank Liberum released its 2023 picks for alternative funds. Liberum has a great research reputation in the alternative listed funds space so it’s worth paying attention to their shortlist. They note that alternative funds ended 2022 on a 19% weighted average discount (ex-3i), having started the year at a 1% premium. Their 2023 portfolio comprises 13 funds based on “our view of risk-adjusted return potential. It aims to deliver a consistent level of diversified income and the potential for capital returns attributable to NAV growth and share price re-ratings.” It is worth noting though that their 2022 portfolio wasn’t a star performer – especially in H2 – with a total shareholder return of -13% from 11 January 2022 to the year-end. This is compared with -5.2% for the FTSE UK Private Investor Balanced Index and -0.5% for FTSE All-Share.

I am personally invested in the following: Gresham House Energy Storage, Harmony Energy Income, HICL Infrastructure, Digital 9, Oakley Capital Inv, Molten Ventures, Biopharma Credit, and Hipgnosis Songs. I would also have on my close watch list Chrysalis Investments (see above) and Fair Oaks. The only two funds I wouldn’t be interested in from this list are Greencoat UK Wind (an excellent fund btw but just not for me) and Real Estate Credit Investments (I’m wary of the whole real estate sector at the moment). The same goes for AEW UK REIT.

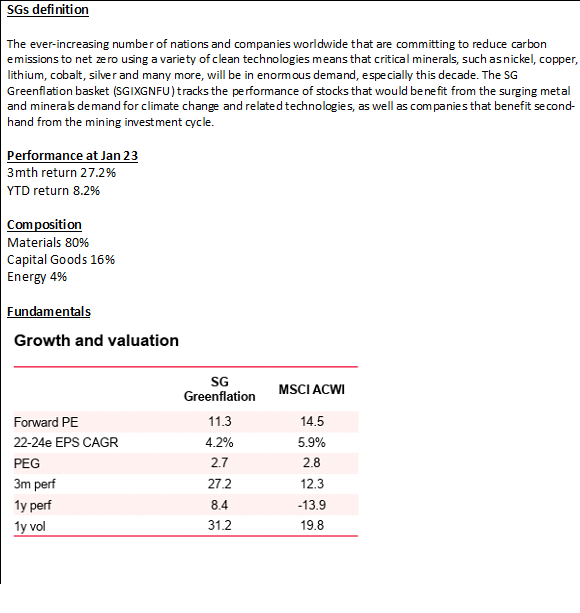

A Greenflation basket of stocks

Analysts at French bank SocGen have been talking a fair bit about their range of stock baskets. The idea here is to catch some big trend that is multi-sectoral and then build a smaller basket of stocks that capture that trend – call it an even more focused thematic approach. Less index, more stock-picking.

I think this approach makes sense and I would highlight their Greenflation basket (in later reports we’ll come back to their Reshoring Basket). I will be ‘mining’ this theme – excuse the pun – over the next year because I have a basic long-term contention: we simply don’t have enough metals to make the transition work without significant price inflation. The only way capacity for the metals involved in decarbonisation to increase is if the price of said metals increases substantially – thus prompting capex expansion. Even then I’m still not entirely convinced we have enough, and that innovation may be required to source new processes and metals. So, as I said, it’s a theme I will keep returning to but for now, let’s quickly sprint through the basket of stocks. I can’t 56 stocks in their basket and their approach is suitably broad – they include lots of Chinese firms and also they include much more than miners – their list includes plenty of engineering-focused businesses. So, it’s broad enough in sector and geography terms but concentrated enough in stock terms. The first table below outlines the approach and rationale – you’ll also see initial performance numbers plus some fundamentals which don’t look outrageous to me.

The SG Greenflation Basket

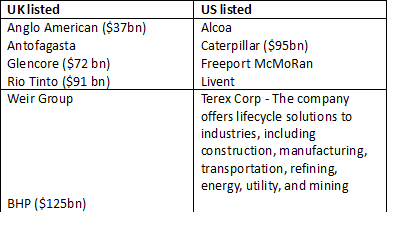

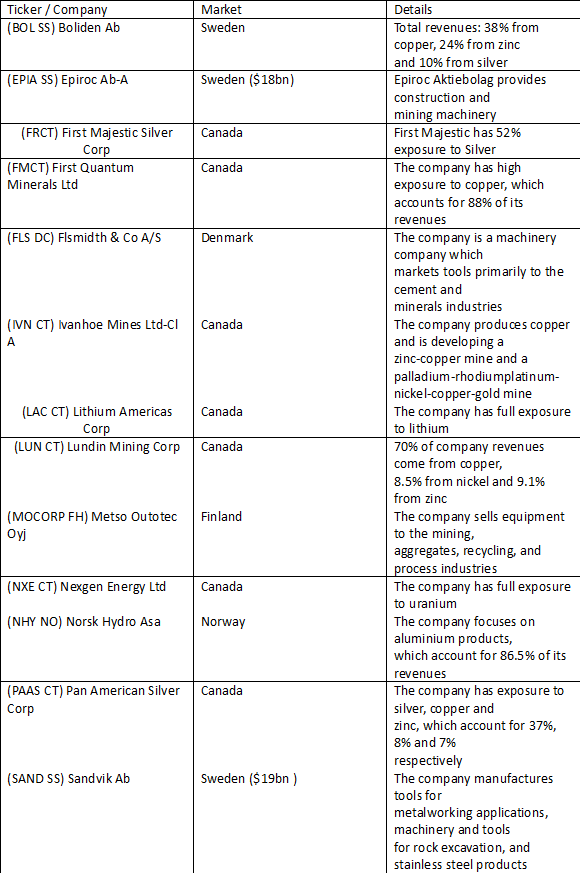

Sadly, there are no ETFs tracking this approach though the basket is available to their institutional clients – see Bloomberg ticker in the box above. What I have done for mere mortal investors is in the next two boxes listed the stocks that are available, first in the main UK and US exchanges and then additionally in easy-to-access European and Canadian exchanges. I’ve also for a few big firms listed their market capitalisation.

The investable companies in UK and US

The investable companies in Europe and Canadian

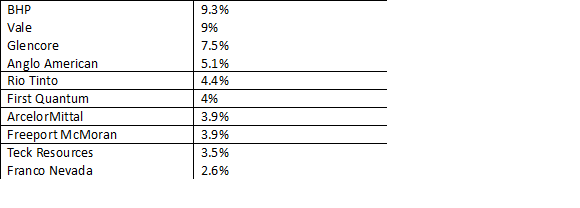

If you want a quick and messy way to access the very biggest companies (by market cap) in this list, I would suggest looking at the BlackRock World Mining investment trust. I invest in this actively managed fund and have continued to allocate more money over the last year. Nearly all the big names by market cap in the SG Greenflation list are present in the BlackRock fund but there are some crucial differences.

BlackRock is, as the title suggests, an almost exclusively mining-focused fund, and thus there’s no substantive engineering exposure. That means missing out on interesting names like Swedish players Sandvik and Epiroc plus Caterpillar of course. I’ll return to those Swedish names in later reports – along with Caterpillar and Deere and Co. The Sg list also includes a string contingent of Chinese listed names but they’re not much in evidence in the BlackRock portfolio and are largely inaccessible to UK-based private investors.

So to repeat, if you buy the following line of thought, then I would argue that the concepts of Greenflation and Decarbonisation represent the great re-industrialization driver of our age:

– We need to reduce emissions, especially in industrial processes

– That requires a complete re-engineering of many processes

– That in turn requires massive investment in CAPEX for industrials

– All this new technology requires copious quantities of industrial metals

– Capex spending on mining has been running below long-term norms and will require a step change increase

– At some point, the market must respond to the constrained supply and surging demand by pushing up prices for many metals

If this makes sense to you then I would suggest that it requires a thought thorough long-term investing approach which will be volatile and messy but ultimately productive in my view.

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.