Regular readers will be aware that I have areas of interest when it comes to research and investing. The past few years these areas have been in the human microbiome, greener energy, including more recently in the transition to electric vehicles and the manufacturers of powertrains, electric batteries inside these motor vehicles, and pharmaceuticals. Today’s feature is a company have featured on my own site at Lemming Investor Research Newsletter.

In this editorial, I want to discuss an exciting small pharmaceutical company that’s listed on the aim market. The Company, Poolbeg Pharma Plc (AIM: POLB OTCQB: POLBF). Investing in the small-cap pharma sector is littered with failed Companies that had promised the earth or just a cure for cancer. They usually start by draining investors of their cash through dilutive placings, after all, is this not what AIM is designed for! It should not be like this, but it is and has been since its inception. However, there always exceptions to the usual dross, and Poolbeg appears to be, in my opinion, one of, if not the safest bets in the fledgeling small-cap pharma space. You may roll your eyes but allow me to explain.

The pharmaceutical sector is complex, high-risk, and therefore difficult for retail investors to understand, in addition, many investors do not understand the pace in which the sector moves…often, very slowly, therefore patience and a long-term strategy is a needed, and nerves that can stomach volatile rides.

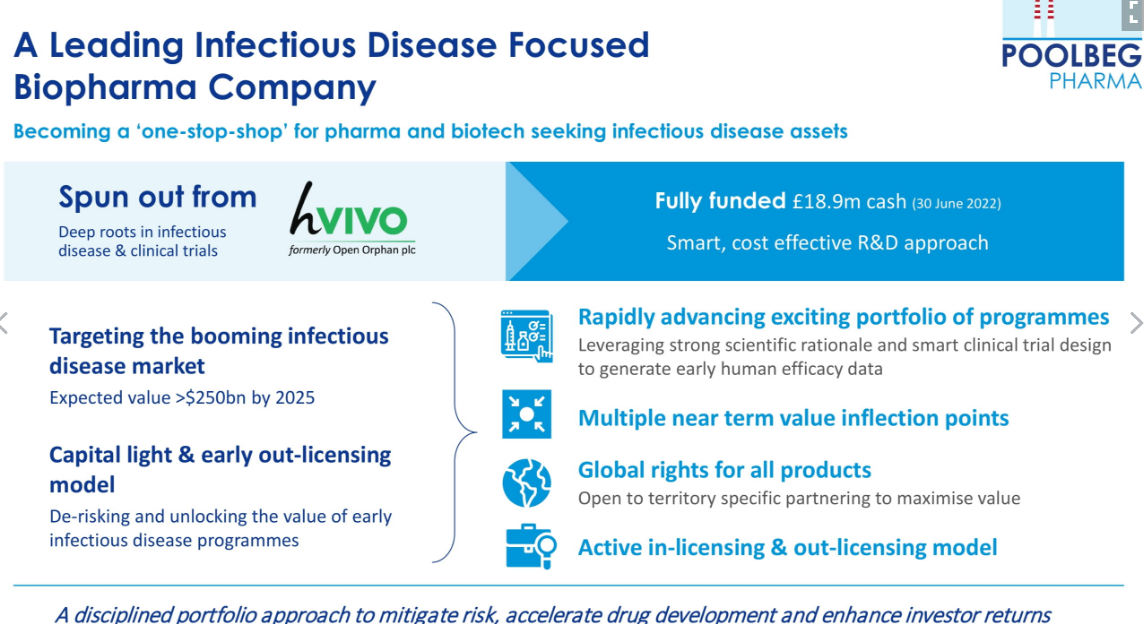

Poolbeg is a relatively safe bet in comparison to some pharma’s listed on the junior markets. I will not venture naming a host of them, other than to say there is no danger of Poolbeg going down the same highly dilutive wealth destruction route as 4D Pharma. Poolbeg has c£19 million cash (at 30 June 2022). We can see the Company has plenty of cash for a few years yet. Indeed, the Company has made a bold statement it repeats often during pressers, citing the Company will never need to raise cash again. A bold statement you may assume, given the sector and how often we have heard similar from fledgeling companies before. Before we get into the details why the Company is so confident of this statement, I better discuss who Poolbeg is, what it does, and how it arrived on AIM.

Relatively Safe – this is AIM!

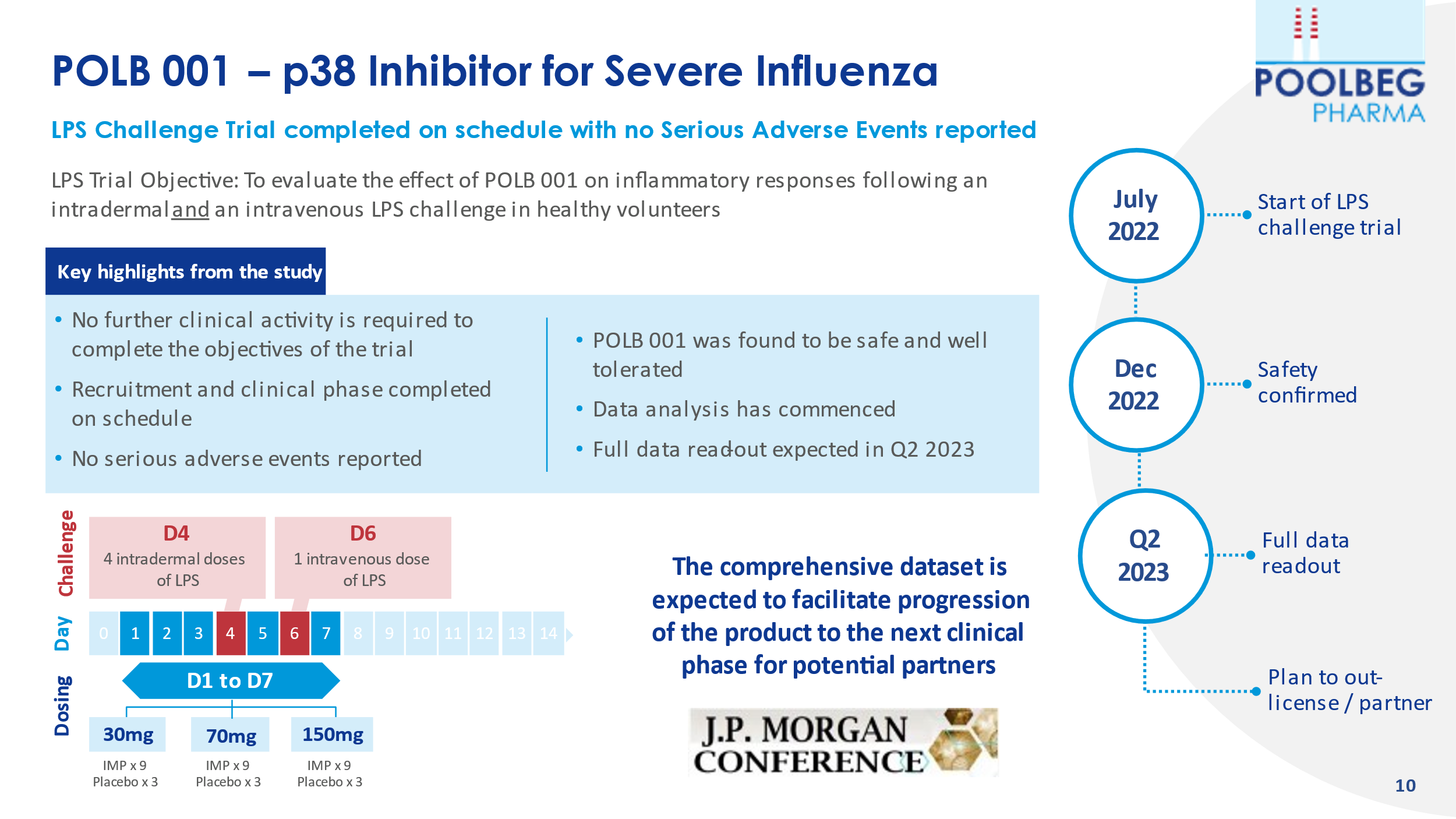

The shares took a tumble of 12 December on what should have been positive news the Company’s lead asset, POLB 001 had received the initial results having completed LPS human challenge clinical trial, on schedule, with no serious adverse events reported. However, the positive 5% upward tick in the share price did not last long at all before the selloff started. What was the reason for this? It appears some investors were expecting the deep-dive data and not just “initial” results. However, POLB 001 has previously been proven to be safe and well tolerated in a successful Phase I clinical trial, so the market is confused. But this now confirms that it is safe and well tolerated in Phase Ib where the volunteers’ immune systems have been activated (inflamed) so, closer to the disease setting. Very important that there are no Serious Adverse Events in this setting.

Investors are told to expect Data analysis and full data read-out is expected in Q2 2023. Investors appear to think the Company has kicked the can down the road. Yet, the board are in active discussions with potential license-out partners. Is it a case investor are playing it cautious due to the history of AIM Companies frequently being underwhelming?

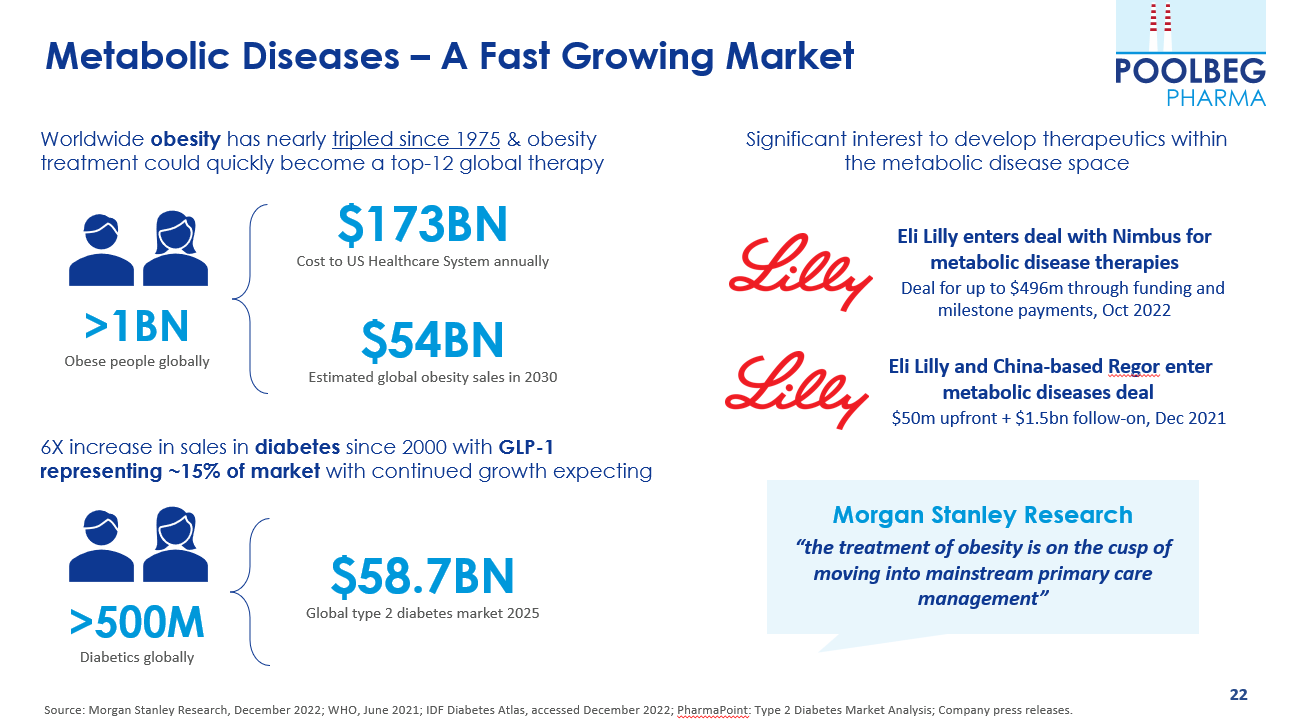

On 14 December, Poolbeg announced what could be an exciting exclusive licence with InsuCaps (the sister company of our Oral Vaccine Platform partner Anabio) to use its microencapsulation and nanoencapsulation oral delivery technologies for the treatment of metabolic syndrome-related diseases including obesity, pre-diabetes and diabetes.

Poolbeg will rapidly commence a proof-of-technology clinical trial to determine that a Glucagon-like Peptide 1 receptor (GLP-1) agonist can be safely delivered orally in humans. GLP-1 agonists, which are used to treat diabetes and obesity, represent an extremely large, fast-growing opportunity estimated to grow to c.$22bn per annum by 2025. At present, all but one GLP-1 products are injectables, which are more onerous for patients than oral delivery.

About

Poolbeg is a clinical-stage infectious disease pharmaceutical Company spun out of hVIVO Plc (AIM: HVO – formerly Open Orphan Plc) in 2021. The mother Company is the global leading contract research organisation (CRO) in testing infectious and respiratory disease vaccines and antivirals using human-challenge clinical trials, providing end-to-end early clinical development services. Both Poolbeg and hVIVO are closely linked.

Blossoming Partnerships

In November, Poolbeg announced that it has made a significant breakthrough in its Artificial Intelligence (AI) Programme with partner OneThree Biotech, Inc. through the discovery of novel drug targets for the treatment of Respiratory Syncytial Virus (RSV), which is unique and never been done before.

Poolbeg has been progressing with two AI programmes intending to identify drug targets and treatments for RSV and influenza, two diseases which affect significant numbers of individuals globally. There has been heightened awareness of RSV this Winter so far, which affects an estimated 50 million people annually, leading to 4 million global hospitalisations and an estimated 100,000 deaths in children under the age of 5 years.

Poolbeg has this unique RSV human challenge data set that no other pharma has, that identifies new targets that are already coming up with new drugs that will obviously have therapeutic benefits to those suffering from an RSV infection.

Through the analysis of unique human challenge trial data gathered by hVIVO, Poolbeg and OneThree Biotech have rapidly identified unique drug targets and can now commence the final stage of the programme to identify effective drug candidates to treat RSV.

Results of this stage are expected before year-end 2022.

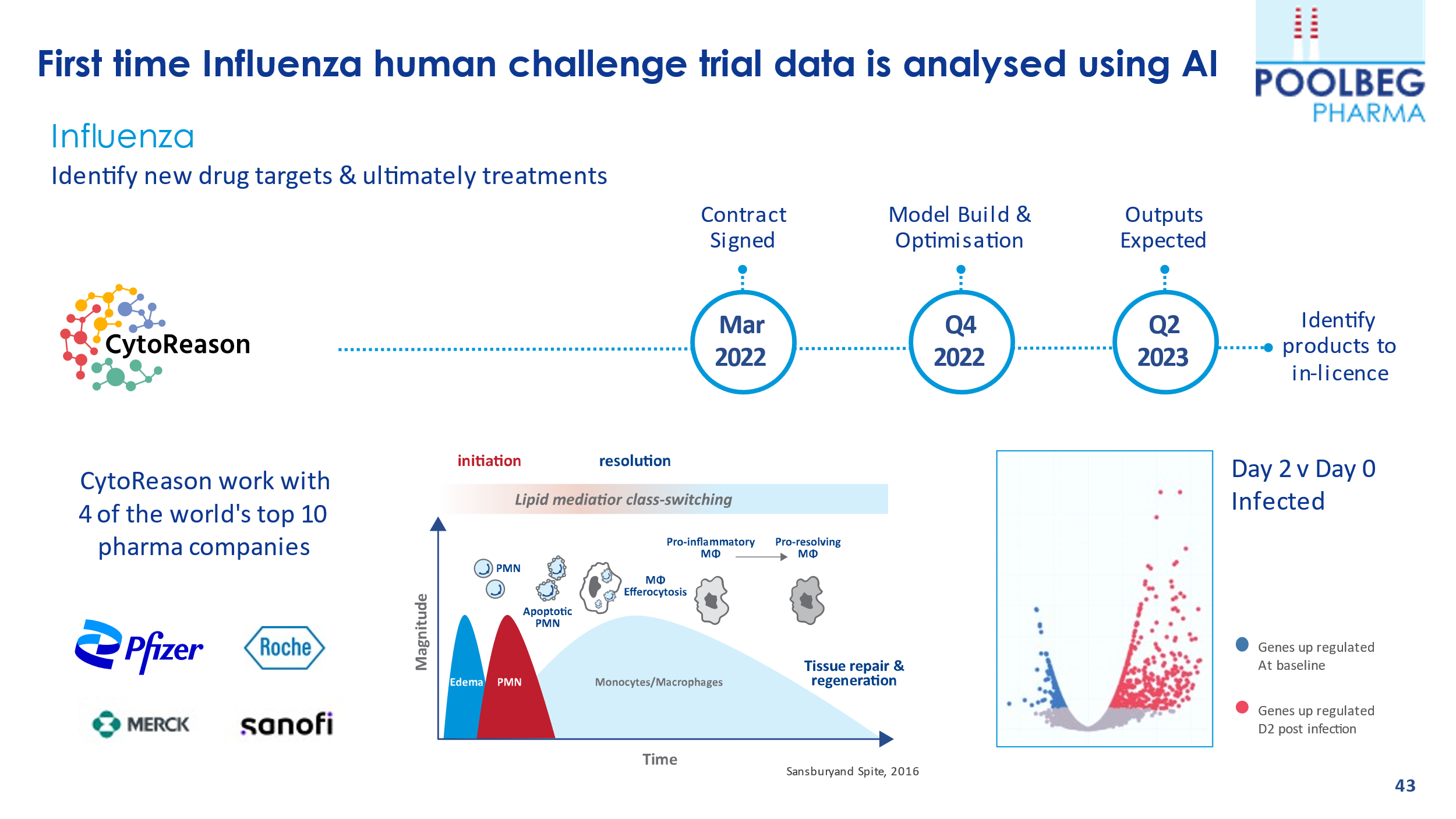

Their influenza AI programme is in partnership with CytoReason, which is a leading AI firm working with many of the top tier pharma companies – and who recently signed a $110m deal with Pfizer. The Company recently highlighted that they are seeing significant interest from potential partners in their AI programmes.

Poolbeg has an exclusive Licence Agreement with University College Dublin (UCD) through NovaUCD, the University’s knowledge transfer office, for a late preclinical stage vaccine candidate for Melioidosis, a disease for which there is no current approved vaccine available.

The disease can infect humans or animals; therefore, a highly unmet medical need for which there is no approved vaccine. The disease is caused by the bacteria Burkholderia pseudoma C. pseudomallei, which is found in contaminated soil and water. It is spread to humans and animals through direct contact with the contaminated source through inhalation, ingestion, or percutaneous inoculation (through an open wound).

The lengthy antibiotic treatment available is seeing an increasing incidence of antibiotic resistance. With growing incidence driven by climate change, there is currently an estimated 165,000 cases per year, around 54% of these fatal. However, the actual figure is expected to be much more prominent due to the significant underreporting of the disease.

Capital Light & Early Monetisation Model

As you can see from the example below, the capital outlay for each product is no more than £3 million to bring it to the point that big pharma picks up the baton and run through more costly phase II and III studies. This strategy mitigates expensive costs should the drug fail. The payback should be between 12 and 18 months.

The idea is to establish strong human data, because this provides the launch pad for big pharma to take to the next phases II/III.

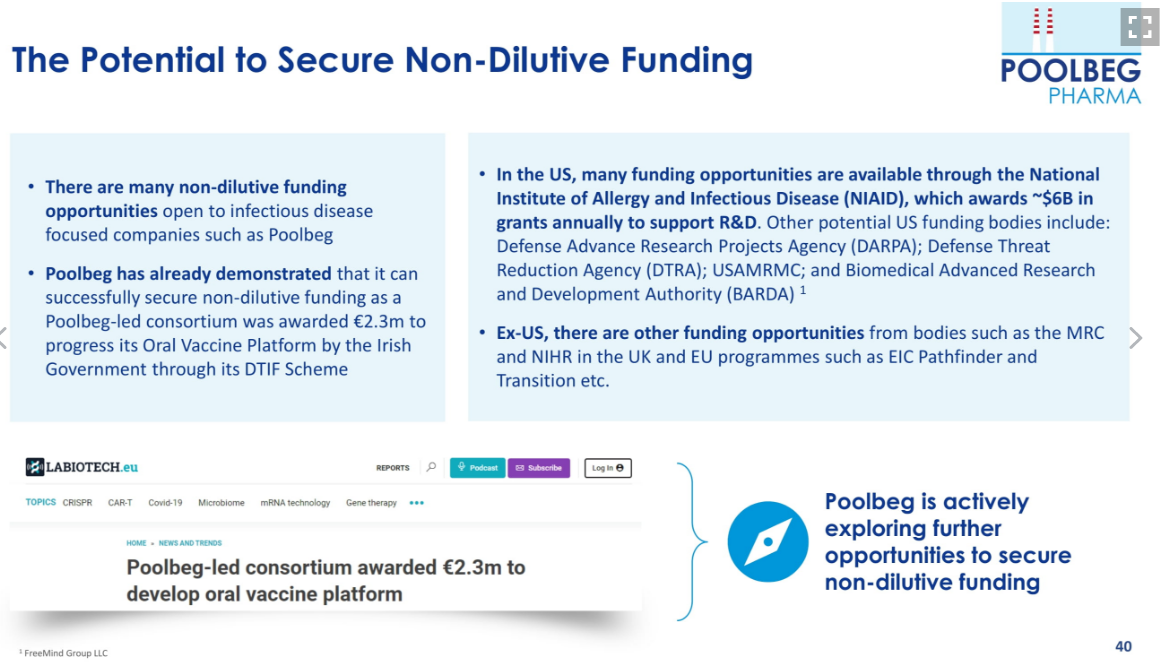

In addition to the capital-light approach, Poolbeg also actively seeks non-dilutive funding, extending the cash runway with each successful injection of new capital. For example, on 15 November the Company announced a consortium, led by Poolbeg was awarded €2.3m (over three years – unsure of the split), this is a significant milestone, the first non-dilutive funding grant received by the Company which is external validation of its Oral Vaccine Platform by the Irish Government. Such external validation often supports licensing discussions.

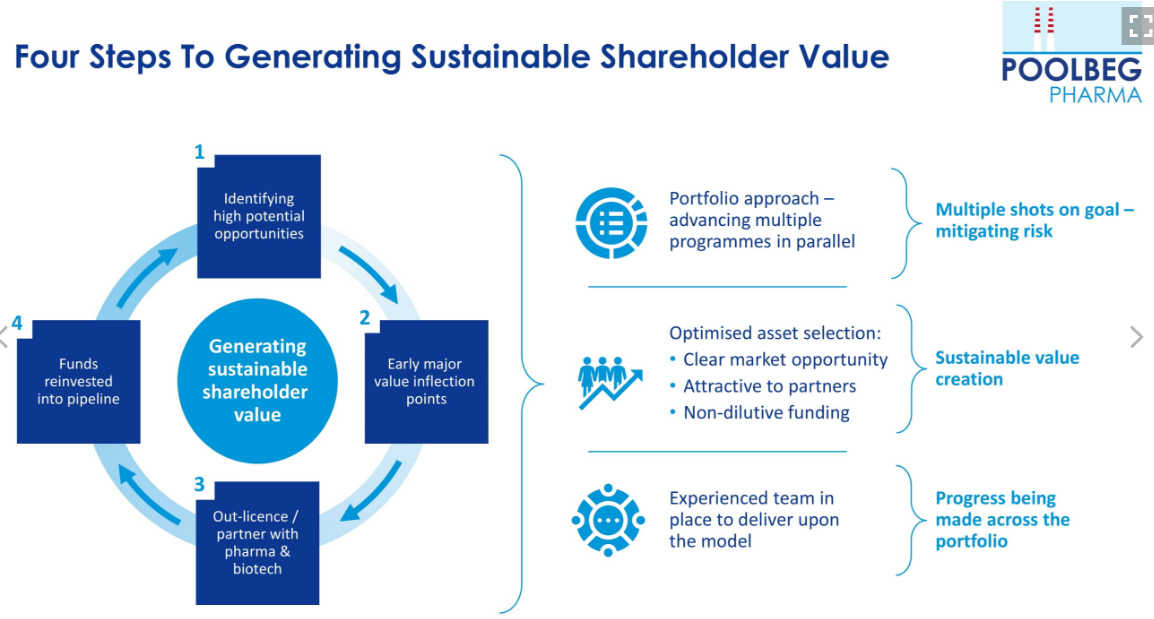

Of course, for this to be successful, Poolbeg needs to develop a portfolio of drugs that de-risks by providing multiple shots at goal.

The idea is to garner early human clinical data because big pharma loves human clinical data; at this stage, deals are struck between big pharma and Poolbeg, allowing the company to reinvest in new pipelines and expand its portfolio of drugs.

The four key areas:

- Identify high-growth areas for vaccines (influenza is a good example)

- Early-stage value inflection points

- Out-license with a partner

- Reinvest into the model and build on its portfolio

Phase Ib or IIa studies are lower cost and will show very quickly if a drug is worth taking to a full, larger-scale phase II, which is typically a big pharma domain.

Phase I is where a drug is tested for safety; in Phase Ib/IIa, a drug is tested for effectiveness in a low number of patients. Human challenge studies fall into the Phase Ib / IIa category – human challenge studies test vaccines and antivirals to see how effective they are by intentionally infecting healthy volunteers in a safe and controlled environment.

The grand plan is to get 5 – 6 assets under development to be ready for big pharma acquisition or licencing. For example, Inflazome, (CEO Jeremy Skillington’) previous company, was acquired by Roche in 2020 for €380m plus significant milestone payments based on Phase I safety and efficacy data in one patient. This shows the level of investment Big Pharma is willing to take on these types of assets.

Other examples:

- Evotec licenced their RNA target to Takeda in March 2021 for an undisclosed significant upfront payment plus $160m milestones per product developed using this RNA target, plus royalties.

- ReViral licenced their Respiratory Syncytial Virus (RSV) product to LianBio for c. $120m in March 2021.

- Pfizer partnered with Valneva in April 2020 to develop and commercialise Valneva’s Lyme disease vaccine for $130m upfront plus $1708m in milestones.

- It is worth noting recent M&A activity – Pfizer’s acquisition of ReViral demonstrates big pharma spends hefty ($525 million) to acquire assets, such as ReViral’s lead candidate, sisunatovir, currently being assessed in an international Phase II REVIRAL1 trial in paediatric subjects; this is precisely what Poolbeg has set itself up for.

- ReViral is a private clinical-stage biopharmaceutical company developer of antiviral therapeutics targeting respiratory syncytial virus (RSV). This deal shows the continuous and growing interest in the industry from Big Pharma in acquiring infectious disease assets and the strength of human challenge trial data (ReViral was acquired following positive data from a hVIVO run human challenge trial). So how long before Poolbeg is in the crosshairs of big pharma? It could be sooner than we think. H2 2022 could see Poolbeg deliver human data, which is key to dictating big pharma strategies.

Patent

In October of this year, Poolbeg strengthened its intellectual property (IP) position around its lead products, POLB 001, a small molecule immunomodulator for treating severe influenza; therefore, its important value should not be understated. Moreover, given the strength of the US pharma lobbyists, the patent grant is based on the “main claim,” suggesting POLB 001 has no viable rival patent. Typically, within the patent, there is something called “inside information” without that inside information, it would be hard for foreign manufacturers to reverse engineer patented vaccines. I mention this because we have seen battles with pharma Companies attempting to get access to patented COVID vaccine technologies. They have attempted to use a process called voluntary licensing.

The European Patent Office has granted an important patent for POLB 002 patent family, which protects the use of defective interfering (DI) influenza virus against infection by influenza.

The manufacturer pays the pharmaceutical company for the use of their technology, with the understanding that they won’t use that technology for anything else.

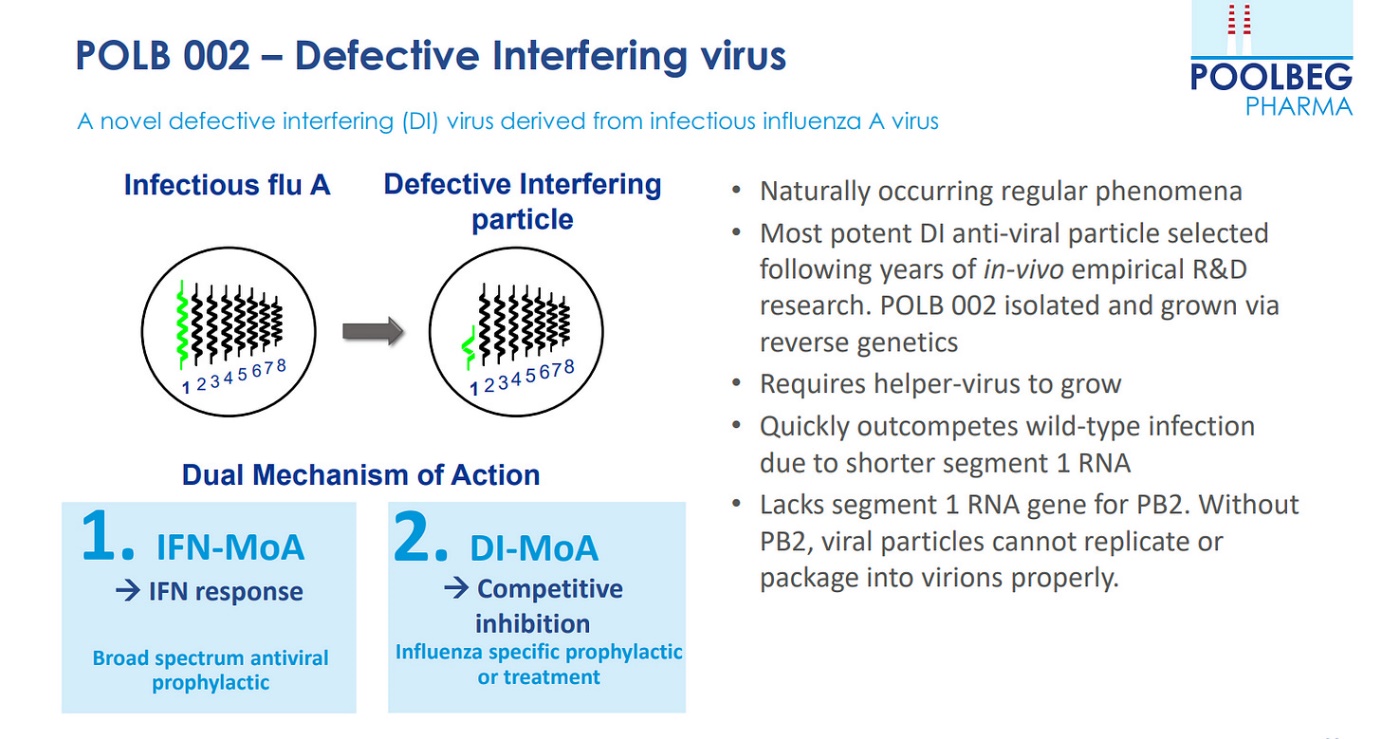

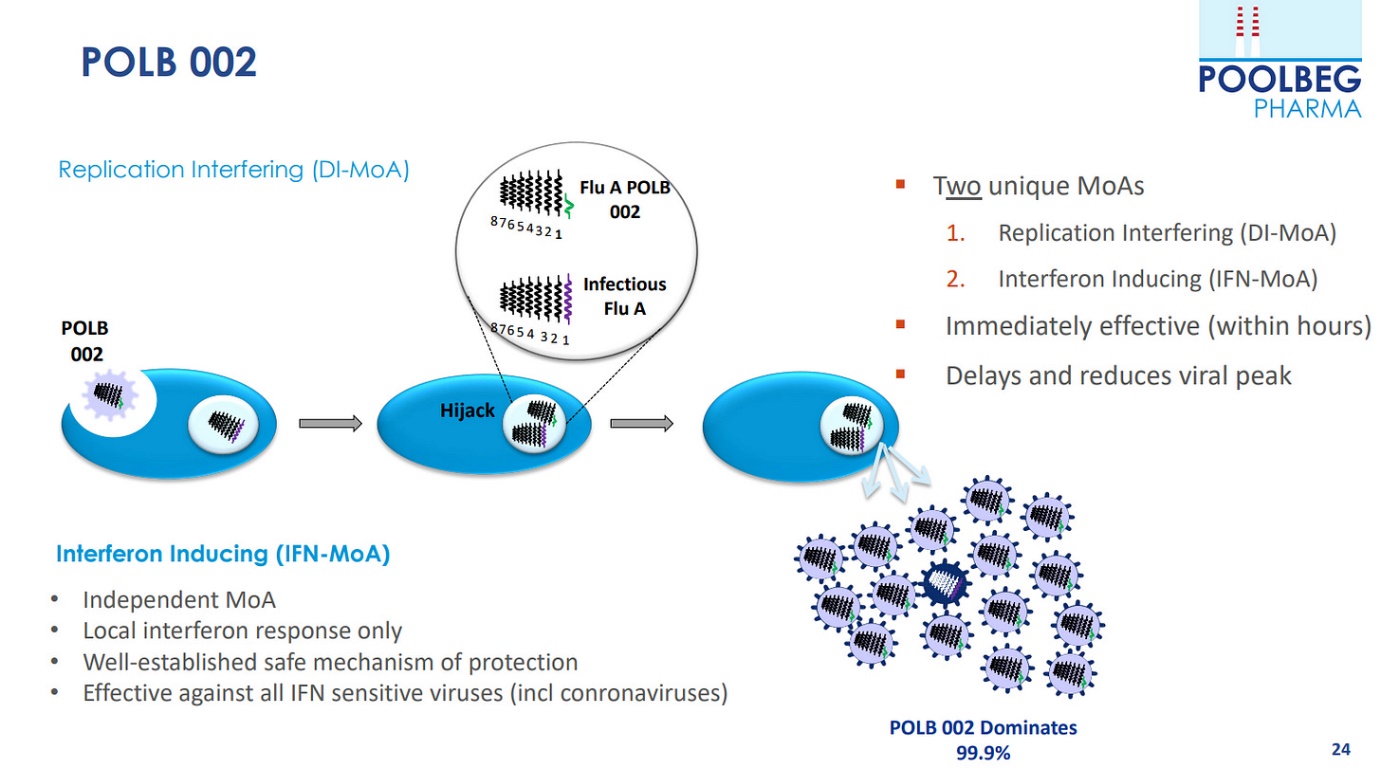

In January this year, Poolbeg secured an exclusive licence for the dual antiviral prophylactic and therapeutic candidate, developed as POLB 002. Data suggests it could provide pan-viral protection from respiratory virus infections, including influenza, respiratory syncytial virus (RSV), SARS-CoV-2 and others.

Portfolio

The Company has a good pipeline of potential products within its portfolio, which it plans to expand on as opportunities arise. The is a lot of near-term excitement around the lead product, POLB 001.

The current pipeline has POLB 001

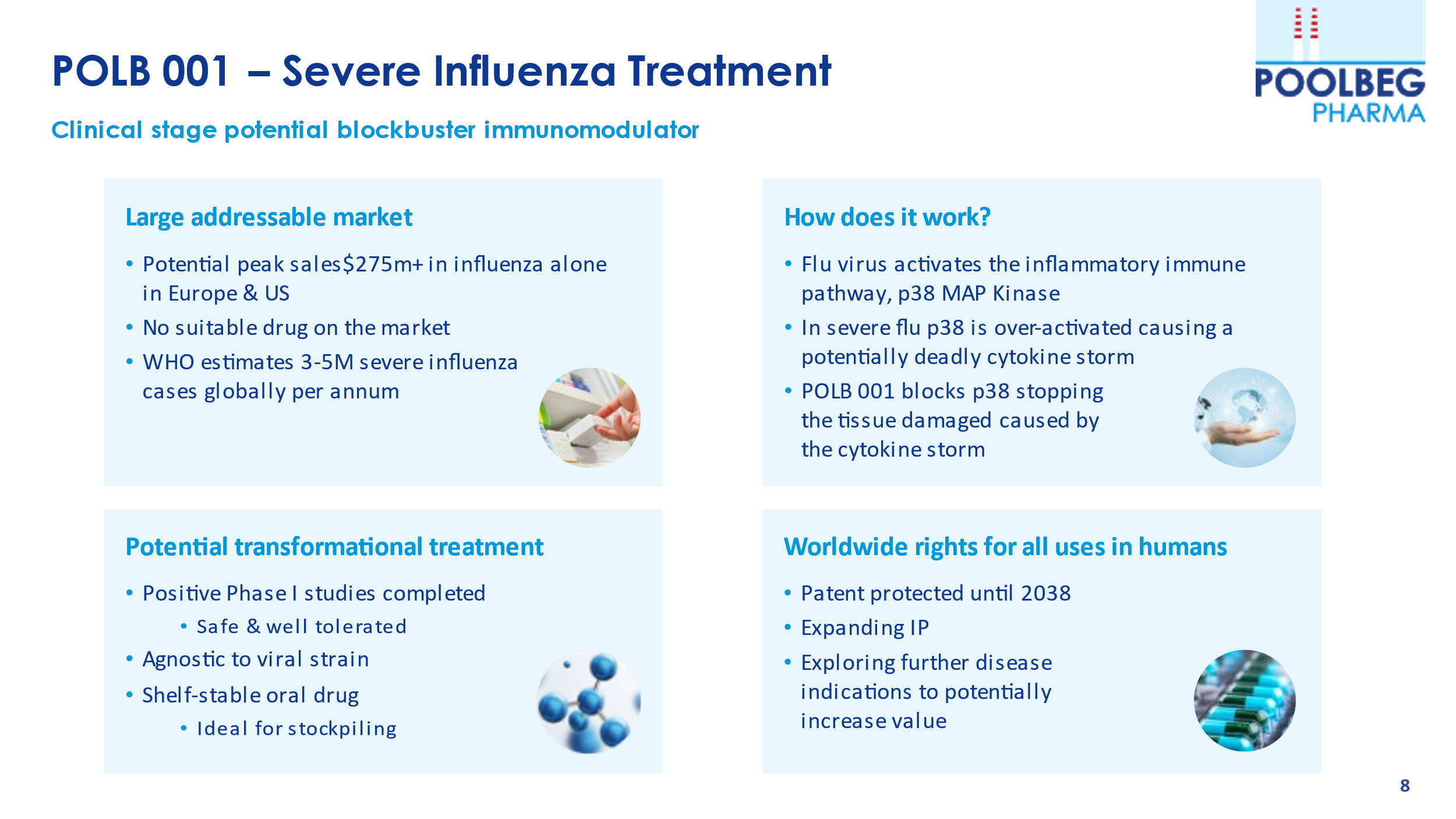

POLB 001 is the most advanced drug within the portfolio. POLB 001 is designed to reduce the systemic damage done by the immune system and improve outcomes for patients with severe influenza. POLB 001 is a small molecule immunomodulator which is ideally placed to address a significant unmet need in severe influenza. In cases of severe influenza, the body’s immune system can often overreact and can cause more damage to the patient than the virus itself. POLB 001 reduces this overreaction of the immune system (cytokine storm). As it treats the body’s reaction to the virus rather than the virus itself, it is strain agnostic and as a shelf-stable oral drug, it could prove an excellent candidate for stockpiling for seasonal and pandemic influenza.

An LPS human challenge trial has been conducted over the past number of months, and recently completed with no serious adverse events – which is very positive to see. The full trial read-out of the unblinded data will be in Q2 2023.

POLB 001 has a long patent life, which is critical to pharma if they are to take the drug to phase III.

POLB 002

The CEO Jeremy Skillington explained “late pre-clinical” to as: “data coming out of POLB 002 is a broad-spectrum, intranasally delivered RNA-based immunotherapy for respiratory viral infections on a granted exclusive licence for the dual antiviral prophylactic and therapeutic candidate, POLB 002. According to research, it may provide pan-viral protection against respiratory virus infections such as influenza, respiratory syncytial virus and SARS-CoV-2, according to the study.”

POLB 003

It is a late pre-clinical stage Melioidosis vaccine candidate. Melioidosis. Numbers: 165,000 estimated cases per annum, 54% of cases are fatal, and 0 vaccines available. Melioidosis, also known as Whitmore’s disease, is an infectious disease that can infect humans and animals.

While melioidosis infections have taken place all over the world, Southeast Asia and northern Australia are the areas in which it is primarily found – though climate change is having an impact on the spread of the disease. In the United States, the bacteria that causes melioidosis has been identified in Mississippi, and also in Puerto Rico and the U.S. Virgin Islands.

The current treatment course is a long period of antibiotics however these are often ineffective and are seeing growing levels of antibiotic resistance. So it would appear POLB 003 is in pole position if successful with stockpiling potential.

Given Melioidosis is categorised as a CDC-designated biothreat the Company is targeting non-dilutive grant funding for this drug, which could reduce the cash drawdown.

The Company is also assessing five other bacterial vaccine candidates from University College Dublin.

The business model is like that of a German company, Evotec, which takes its drug portfolio to phase II ready, at which point it partners with big pharma. The idea is they get an initial upfront payment (usually in the hundreds of millions range), with future milestones written into each deal and, hopefully, royalty payments. Some of these milestones can be worth well more than $100 million, the point being, little risk, big rewards. Of course, the neat trick is bringing the drugs through the lower cost phase I / IIa and partnering with big pharma, who then have the financial resources to take the drugs to the subsequent phases. Evotec has grown significantly with this model; over the past five years, as seen below.

Brutalised Pharma

As the world appeared to get back to some normality assured the pandemic was over, a sell-off in the pharma sector has damaged sentiment. However, there are signs it is not over until the fat lady sings. As far as China is concerned, the pandemic is upon the nation again, and their people are being subjected to harsh lockdowns again. Moreover, the pharma sector is planning for the next pandemic. We are warned there is not a question of if, but when the next global pandemic will arrive, and we better be better prepared, so, there is a rush for vaccine developments for a whole range of infectious diseases.

When discussed, the pending listing of Conviction Life Sciences Company (CSL) intends to float on the stock market, with trading set to start on December 16. MIDAS comments: “Life sciences is a broad church, covering all kinds of healthcare businesses, including pioneering drug developers, medical device makers, smart-thinking digital health firms and companies that test or make products for third parties.”

“The industry is huge, valued at more than £ 4.5 trillion worldwide. But most of the large firms are in the US, where investors seem happier to fund life sciences firms than their counterparts in the UK and Australia.”

The global focus seems to be on respiratory virus infections and when such viruses are considered a top-five global killer, resulting in more than three million annual deaths worldwide.

The question for me as an investor in both hVIVO and Poolbeg is simple. Will these minnows with huge promises and valuable data be swallowed whole by big pharma, or allowed to blossom first?

Hopefully, I have provided you with some research worthy of further investigation. Poolbeg, and indeed, its parent company, hVIVO are exceptionally well placed in the rapidly growing global market for infectious disease treatments is estimated to grow from $72.4 billion in 2021 to $106.3 billion by 2026, at a compound annual growth rate (CAGR) of 8.0% for the period of 2021-2026. Influenza growth is estimated to grow from $7.63 billion in 2022 to $11.49 billion by 2027 with a CAGR of 8.54%, which puts hVIVO in a strong position as the world’s leading CRO Company with the world’s largest database.

In summary, Poolbeg has a long cash runway, a strong portfolio with unique data, strong IP, with regulatory approval for its lead products. A capital-light model, and what appears to be encouraging drug discovery developments with AI partners, which brings the Company closer to the jackpot reward(s) that are out-licensing via big pharma.

For transparency, I have a financial interest in Poolbeg Pharma Plc and hVIVO Plc

Elric Langton of Small Company Champion & Lemming Investor Research Newsletter

Got some thoughts on this week’s article from Elric? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.