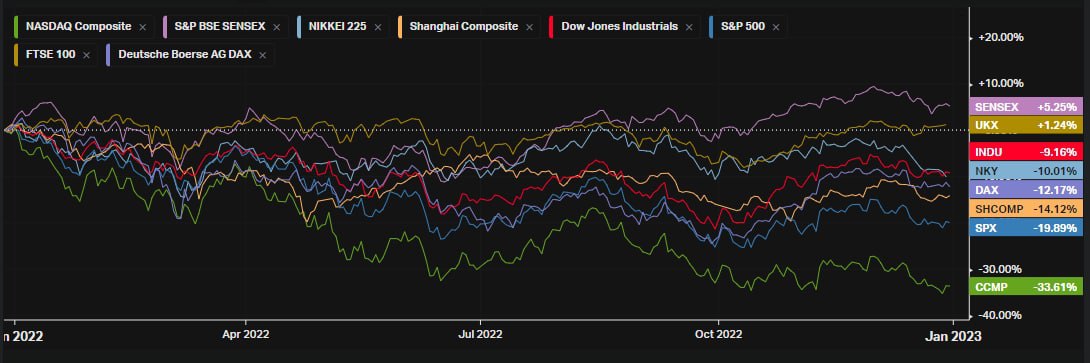

Are you looking to stay ahead of the market and get the best return on your investments? If so, you’ll want to start researching the best stocks to buy in 2023. In this article, we’ll provide you with an overview of the best stocks to buy in 2023, so you can make informed decisions about your investments. But first, here is an overview of the views of many top analysts. With the dollar soaring in 2022 and the Nasdaq plunging, the dislocations lead to opportunities.

And to be clear in this article I’m talking about investing not trading.

A Quick Look Back at 2022

What stocks have the most potential for growth in 2023?

It’s difficult to predict which stocks will have the most potential for growth in 2023, as the stock market can be unpredictable. However, there are certain stocks that may be worth considering. For example, technology stocks such as Apple, Microsoft, and Amazon have been performing well in recent years and may continue to do so in the future. Additionally, companies in the healthcare sector, such as Pfizer and Johnson & Johnson, may also be good investments due to the increasing demand for medical products and services.

Finally, renewable energy stocks, such as SolarEdge Technologies and Tesla, may be worth looking into as the world continues to shift towards more sustainable energy sources. The latter has bottomed it seems.

The 12 Best Stocks to Buy for 2023 Says Kiplinger

“Move beyond the utilities and consumer staples stocks – these defensive plays are likely too expensive now. Healthcare is an exception, offering both growth and defensive characteristics.” They say. Now may be a good time to tilt toward value-oriented companies and small-cap stocks.

So, in their list: Advanced Micro, Amazon (I own), Deckers Outdoor, Halliburton (I own), Rexford Industrial Realty, T-Mobile US, Workday (on my shortlist), Matador Resources, Merck (I own), Lululemon, Archer-Daniels-Midland, Amgen.

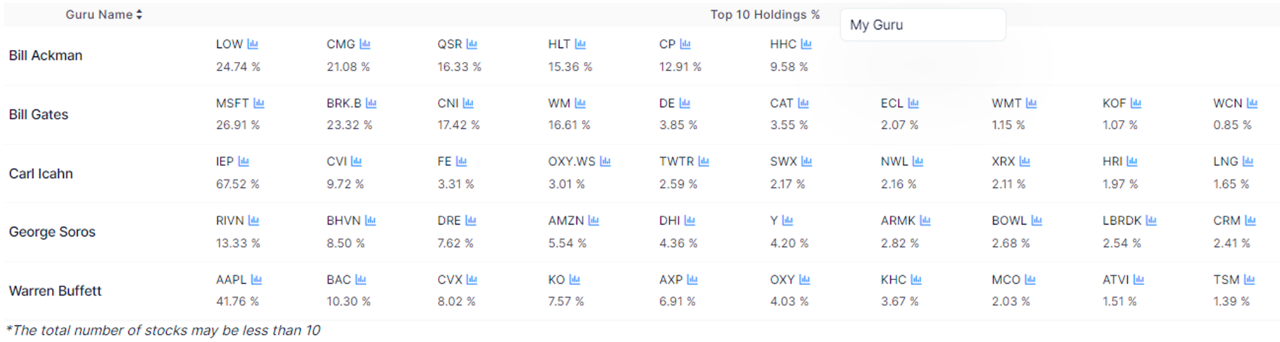

What’s in the Portfolios of the Billionaires?

These are the 11 top stocks to buy for 2023 to position for a recession and recovery says Bank of America

“We select these stocks primarily based on alignment with our 2023 themes including quality, value, free cash flow generation, domestic versus global exposure, dividend growth potential, and we looked for companies with earnings resilience given the expected recession — either from top down strength (e.g., capex/automation beneficiaries) and/or margin stability,” said Bank of America and here are their calls:

Fox, Tractor Supply (one for the MPs), Walmart, ExxonMobil, Arch Capital, Humana, Honeywell, Analog Devices, The Mosaic Company, Welltower, Duke Energy.

What stocks offer the best dividend yields in 2023?

There are some stocks that have historically offered high dividend yields and may continue to do so in 2023. These include real estate investment trusts (REITs), utility stocks, and some large-cap stocks. REITs typically offer higher yields than other stocks, as they are required to pay out at least 90% of their taxable income as dividends. Utility stocks, such as those in the energy sector, also tend to offer higher yields than other stocks. Large-cap stocks, such as those in the S&P 500, may also offer higher yields than other stocks.

Top Wall Street analysts say buy these stocks in a 2023 according to CNBC

CNBC analysed analysts with a track record of getting it right. These stocks they came up with:

Nova Measuring (the company has gained at a compound annual growth rate of 15% to 20% over the past five years), Costco, Amazon (I own), Meta (I own), Ambarella (the company now has deals with two of the top three global Tier 1 automotive original equipment manufacturers).

14 Best Stocks To Buy Before the Recession in 2023 According to Yahoo Finance

Yahoo a database of 920 hedge funds and picked the top 14 stocks that are recession proof. They belong to defensive sectors like alcohol, consumer staples, healthcare, and finance; many with good dividend histories.

Diageo, Church & Dwight, Ross Stores, O’Reilly Auto (I own), McDonalds, Coca-Cola (in Buffet’s portfolio), Abbott Laboratories, Walmart, Procter and Gamble, Costco (I recently sold), Pepsi, AbbVie (I own), Bank of America (Another Buffett one), UnitedHealth (I sold recently).

What stocks are the safest to buy in 2023?

First, research the stocks you’re interested in and understand the risks associated with them. Look at the company’s financials, its management team, and its track record. This will help you determine whether the stock is a good investment or not. Go for profitable companies this year. The market is not in a dash for growth. Go also for dividend players with volatility below 20%.

Second, diversify your portfolio. Investing in a variety of stocks from different sectors and industries can help reduce your risk. This way, if one stock performs poorly, you won’t be affected as much. This will be especially important this year, but my key focus sectors are healthcare, financials and energy. But there are opportunities in consumer cyclicals as we look beyond rising rates and cost of living crisis.

Finally, consider investing in index funds. Index funds are a type of mutual fund that tracks a specific index, such as the S&P 500. This type of investment is considered to be relatively safe, as it is diversified and not tied to any one company or sector. I am considering 2x leverage S&P500 ETF at some point in the coming months. Will let you know when.

Ultimately, the safest stocks to buy in 2023 will depend on the individual investor and their risk tolerance. If in doubt, leave it out is my motto.

What stocks offer the best value in 2023?

First, look for stocks with a strong track record of growth and profitability. Companies that have been consistently profitable over the past few years are more likely to continue to be successful in the future. Additionally, look for stocks with a low price-to-earnings ratio, which indicates that the stock is undervalued relative to its peers.

But cross-reference this with P/B too and keep an eye on forecasted earnings (yes they are over-optimistic) but that is more important this year than historic earnings because of the sharp economic downward pivot where trends are broken.

Finally, consider the company’s dividend yield, which is the percentage of the stock’s price that is paid out as dividends. Stocks with higher dividend yields are generally considered to be better value investments.

These Will Be The Best 9 Stocks In 2023, Analysts Say, According to Business Insider

They say “Analysts think nine stocks in the S&P 500, including Dish Network (DISH), Tesla (TSLA) and Amazon.com (AMZN), will gain 60% or more in the next 12 months. These are the stocks analysts’ price targets show the greatest potential to make money in 2023, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence.”

What the Commentators and Banks Are Saying On Wall Street About S&P 500 and Returns

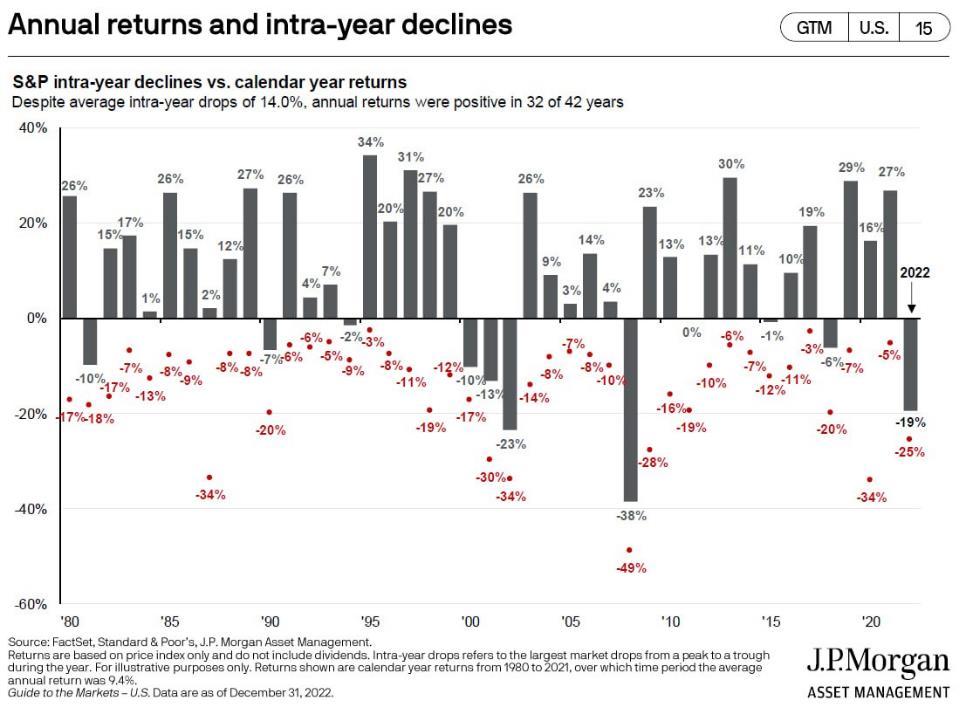

The S&P 500 is expected to continue its upward trend of past years in 2023 according to many analysts and some predicting a return of up to 10%. This is due to the continued strength of the US economy and the recovery of the global economy.

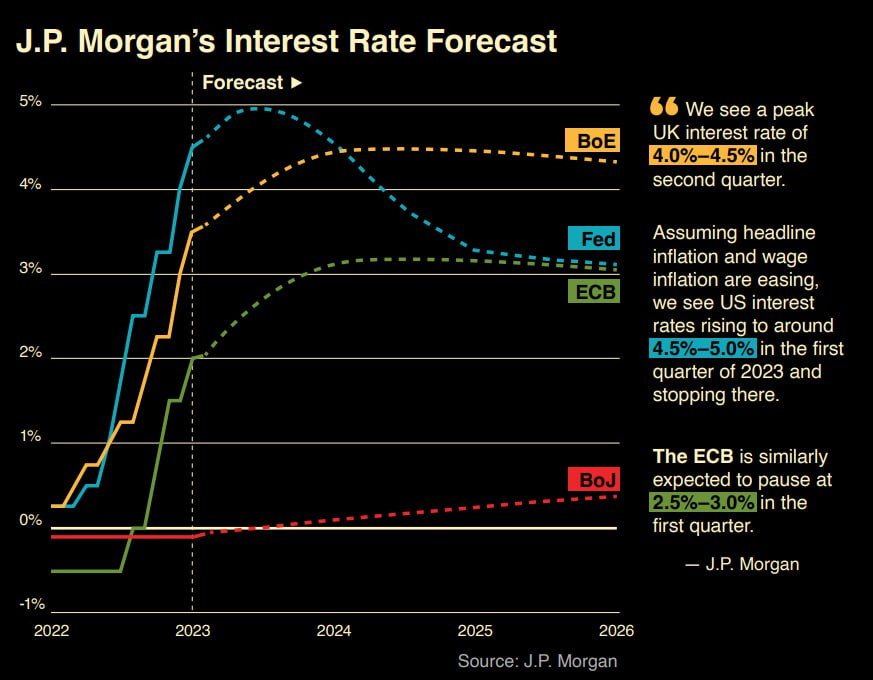

Additionally, the Federal Reserve has indicated that it will top raising at some point possibly this year, which should help to support stock prices. |Wall Street analysts are also bullish on the S&P 500, with many predicting that it will reach new highs in the coming year.

This is due to the strong performance of the US economy and the continued growth of the global economy. Additionally, the low interest rates should help to support stock prices.

Overall, the outlook for the S&P 500 in 2023 is positive, and investors should consider investing in stocks that are expected to benefit from the continued growth of the economy. Additionally, diversifying your portfolio and investing in index funds can help to reduce risk and maximize returns.

Markets Insider

Despite a looming recession in the US, Deutsche Bank expects global equities to drop sharply by mid-2023. According to Deutsche Bank chief economist David Folkerts-Landau, major stock markets will plunge 25% when the US recession hits, but then recover completely by year-end 2023, assuming the recession lasts only several quarters.

Goldman Sachs

In 2023, Goldman Sachs Research predicts the bear market in stock markets will intensify before giving way to more hopeful signals. Goldman Sachs Research predicts that the global stock market will enter its “hope” phase later this year. Recovery usually begins during recessions when valuations rise. In the past, investing in stocks after the bottom has produced better returns than investing before it: average 12-month returns are higher after the bottom than before it. Therefore, Goldman Sachs strategists think it’s too early to position for a bull market transition.

Forbes

Federal Reserve interest rate hikes and high inflation aren’t going anywhere in the near future, unfortunately. The U.S. economy could do much better in 2023 if the Fed controls inflation and navigates a soft landing.

According to CME Group, there is an 86% chance of another Fed rate rise by June 2023. The first quarter of 2023 is expected to see a 1.7% rise in earnings for the S&P 500, but only a 1.7% decline in the fourth quarter of 2022.

IFA Magazine

With good earnings momentum, UK equities offer significant value in a currency that is currently undervalued. UK listed equities should benefit from nominal growth in an undervalued market. Some of the most likely beneficiaries will be high quality, cash-generating companies, which form a significant part of our portfolios.

Kiplinger

The stock of Amazon.com (AMZN) has had a terrible year so far in 2022, but Wall Street says the company is poised to outperform next year.

According to Doug Anmuth, a J.P. Morgan analyst, Amazon stock is one of the firm’s top 2023 ideas. AMZN’s price target of $145 was reiterated, along with an Overweight recommendation (buy).

Market Screener

A “mild” recession is expected to begin in the second half of 2023 as the Federal Reserve’s efforts to tame inflation weigh on consumer spending and investments.

The US economy is expected to suffer from slower consumer spending by December of 2023, according to Gapen. Despite the continued decline in inflation, Gapen doesn’t see inflation reaching the Fed’s 2% target in 2023.

Markets Insider

Bank of America reports that a large majority of Wall Street money managers expect stagflation in 2023, similar to the 1970s.

92% of funds managers in the bank’s most recent survey predict low economic growth and high inflation in 2023, while only ten percent anticipate a bullish “goldilocks” scenario in which the economy avoids recession.

Reuters

Rising interest rates and slowing growth are further dampening the outlook for fourth-quarter U.S. earnings after a disappointing third quarter.

IBES data from Refinitiv showed analysts were expecting S&P 500 earnings to decline 0.4% year over year in the fourth quarter. According to their forecast on Oct. 1, the increase would be 5.8%.

Benzinga

Ethan Harris, an economist at the University of Texas at Austin, says the Federal Reserve might not be able to control inflation without tipping the U.S. economy into recession.

In Harris’s projections, the Federal Reserve will increase interest rates by another 0.5% in December and February, and by another 0.25% in March, bringing the terminal fed funds rate range to 5%-5.15 percent.

Yahoo Finance

Recently, JP Morgan Asset Management released its Long-Term Capital Market Assumptions (LTCMAs). As a result of lower valuations and higher yields in asset markets today, these projections provide a 10- to 15-year view of risks and returns. Over the next 10–15 years, a USD 60/40 stock-bond portfolio is expected to generate an annual return of 7.20%, up from 4.30% last year.

A Few of My Shares ; What stocks offer the highest potential returns in 2023?

My hurdle for my US stocks is 40% and half that for UK stocks. I want companies which tick the value, growth, income, momentum, cashflow, dividend boxes and more.

Here are some, not all of mine.

Hibbet, Horizon Therapeutics, Quest Diganostics, Cambium Networks, Comcast, JP Morgan. In the UK, some of my picks: Association British Foods, Atalaya Mining, Entain, Jupiter Fund Management.

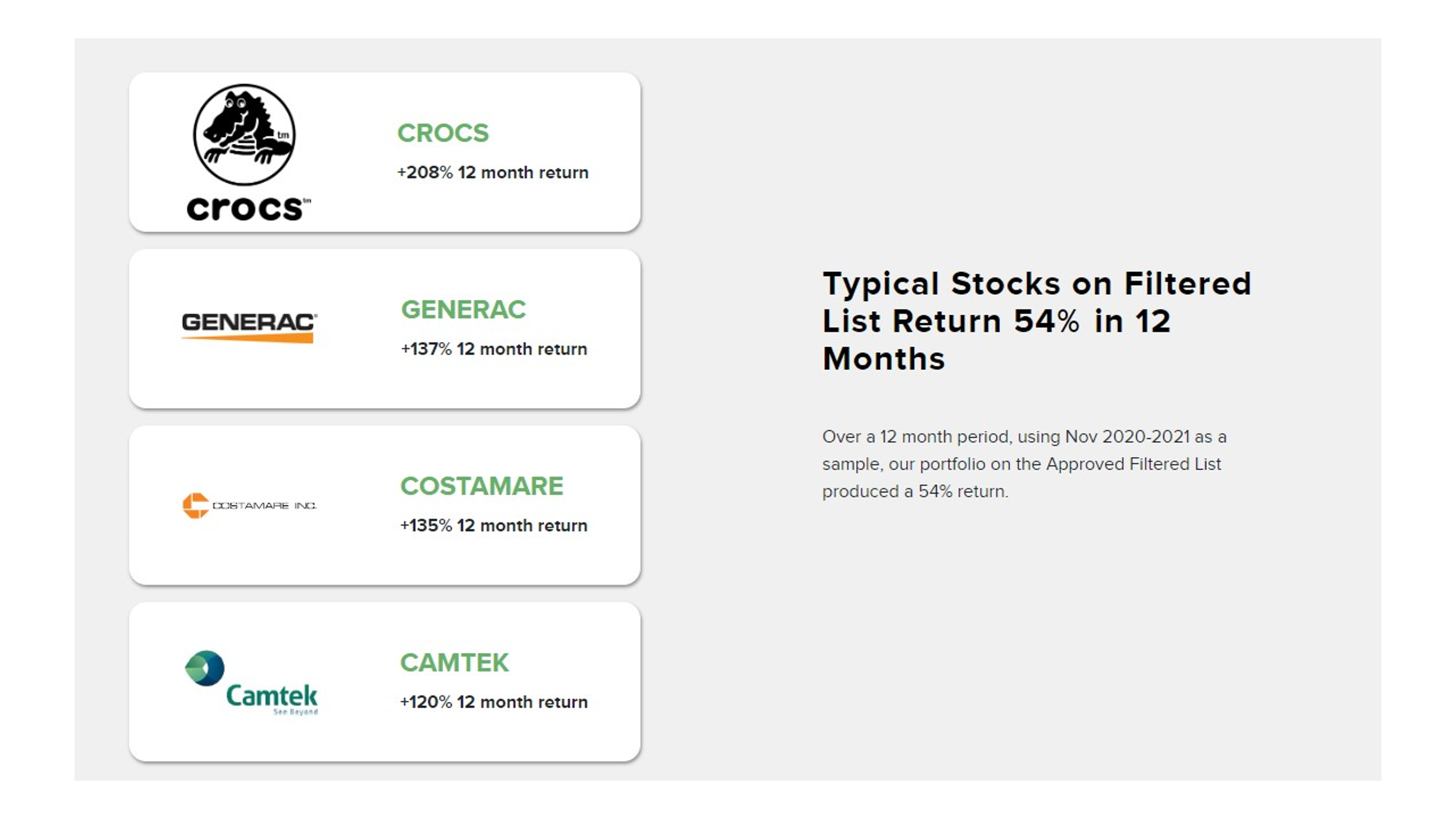

What a Good Year Looks Like

When I apply my approach to a market with a tail wind, this is the outcome.

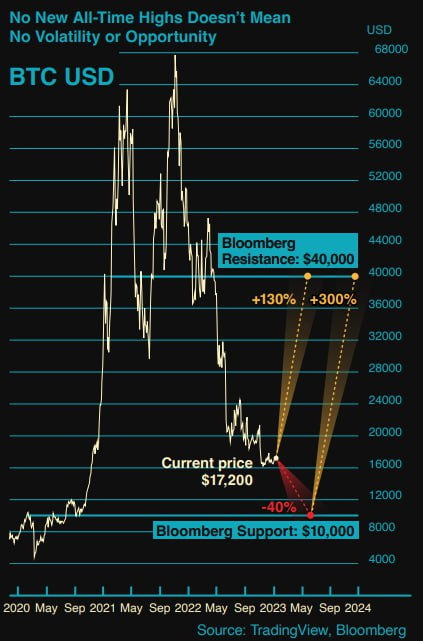

And finally, one for the Bitcoin Enthusiasts

Okay, that’s me done for now. My Campaign for a Million is to teach, free, a million people about investing better. You can get free resources like my books, articles, videos, blog at www.campaignforamillion.com

Alpesh Patel OBE

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.