Welcome to my first article for SharePad. All being well, this marks the start of a regular column from me exploring ideas, themes and strategies for investing in shares.

On the face of it, that sounds like a tall order.

I’ve been writing about shares and stock markets for more than 20 years, and one thing I know is that no two investors are the same. We’ve all got different perspectives. Some are happy to set-it-and-forget-it, some are full-time DIYers, strategists or tacticians. Some are just getting started and others are professional, there are lifelong learners and some dip in and out.

But whatever type of investor you are, I think there are always good reasons to put your beliefs to the test and explore new ideas.

And what a time to start. We’ve had a year-long market sell-off, double-digit inflation, rising rates, and now unsettling reminders of what a banking crisis looks like. But as Sir John Templeton once said: “Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria.”

If we’re somewhere near the beginning of Sir John’s view of the world, then perhaps this is a great time to start. It’s his approach to finding ‘bargains in the quality bin’ that I’m looking at this week.

But before that, let me tell you a story.

Back in 1999, Britney Spears was number one in the charts with ‘Baby One More Time’. In the news, there was growing unease about what would happen to the world’s computers when the year ticked over to 2000. Some feared the millennium bug would shut everything down. Missiles would launch, nuclear power stations would go haywire and banks would stop calculating interest properly.

Needless to say, the enduring memory is Britney rather than any kind of global catastrophe. But there was something else… something bigger… brewing.

At the time I was just out of university and working as a rookie journalist for a business magazine. I’d spent the past three years studying and socialising (the order of which varied), so I had next to no idea what was happening in the world.

One ongoing story assigned to me was about a new dot-com company that was riding the internet wave. In this case it was going online with a business that let customers print their own designs on t-shirts…

Now it’s easy to make fun of these things 20-odd years later. But bear in mind, this company raised millions of pounds from investors. Dot-com fever was rampant and there was a sense, for a time at least, that just about any business could transfer to the web.

PrintPotato.com floated on AIM in 2020 and lasted about a year before things went wrong. After that, it was a fairly predictable path of pivoting back and forth until the cash ran out.

From euphoria to pessimism and back again

As far as euphorias go, the dot-com boom that culminated in 2000 was stunning, and so was the collapse that followed a year later.

Of course, it wasn’t the first time the market had witnessed such dramatic shifts. One of the worst happened in the States in 1929. In just three years the Dow lost nearly 90% of its value as the Great Depression took hold.

In the years after the wipeout, John Templeton – then only in his mid-20s – bought $100 of every stock trading below $1 on the New York and American stock exchanges. In total, he paid around $10,400 for positions in 104 companies.

Four years later, 34 of those firms had gone bust but Templeton had made four times his money.

It was a winning start for a career contrarian. Templeton’s legacy lives on in the fund management giant Franklin Templeton, but his philosophy and strategy rules can be used by anyone.

So what was he looking for?

For a start, Templeton was prepared to look almost anywhere in the world for value. He was unconcerned by the near-term outlook, preferring instead to find bargains where others feared to tread. He saw beaten-down shares as opportunities to profit when a recovery eventually came.

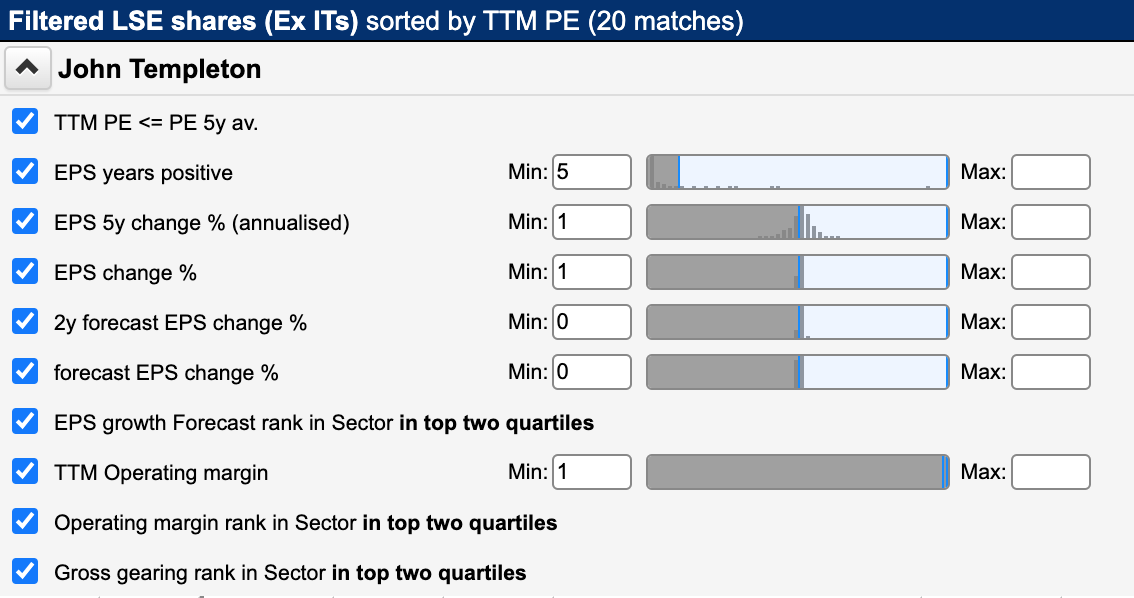

There are three components in the Templeton strategy: Value, Growth and Quality.

On value, it uses the popular price-to-earnings ratio. As always, these measures can be changed depending on your own preference. But the key here is to look at whether the share appears to be cheaper than it has been over the past five years.

On growth, the focus is on earnings: have they been positive and growing over the medium-term? And are they forecast to grow at rates above the industry average? For this, I’ve used SharePad’s ranking rule and pinned down the results to those shares with EPS forecast growth rates in the top half of their respective sectors.

Finally, on quality, there are a couple of points to look at, one of which is operating margins. Measures of quality often focus on the resilience of a company’s profitability: is it defendable? Are profits vulnerable to rising costs or competition? Margins can hint at that, although be careful when comparing companies in different sectors because margins can differ for good reasons.

Another quality measure is debt. You can measure debt in a few ways, but the essence is that too much borrowing can be bad news, especially when interest rates are rising. So you want to see debt levels that are low relative to the company’s own history or its sector.

Here’s a summary of those rules and a view of how they might be applied as a filter:

John Templeton – Finding bargains in the quality bin

Value

- Current price-to-earnings (P/E) ratio less than its five-year historical average

- Shares in the list are sorted by lowest P/E ratio

Growth

- Positive earnings growth over the past 12 months

- Positive annualised earnings growth over the past last five years

- Forecast earnings growth in the top half of the sector (using sector ranking)

Quality

- Positive operating margins over the past 12 months

- Operating margins in the top half of the sector (using sector ranking)

- Debt (gross gearing) in the top half of the sector (using sector ranking – where low gearing ranks higher)

(You can run this screen for yourself by selecting the “Ben Hobson’s Sir John Templeton filter” within SharePad’s Filter Library. To get to the filter library, click “Filter” on the blue screen, “Apply filter” and then “Library”. If you can’t see my filters just search for ‘Ben’)

This snapshot of the table shows how the trailing P/E ratios of these shares are all below their five-year averages. It’s not a guarantee that they are cheap, but it’s a pointer to look for potential mispricing, especially in bearish conditions like Templeton loved.

Table: SharePad

At the moment, the bulk of the cheapest shares are small-caps, with mining company Tharisa, brick maker Michelmersh and electrical components specialist Dewhurst, all on much lower P/Es. But larger shares also feature, with education group Pearson and National Grid sneaking in.

As the list shows, historic and forecast EPS growth is all positive, and the ranking rules put these shares in the top half of their sectors based on operating margins and gross gearing.

Table: SharePad

What can we learn from the John Templeton strategy?

This has been an interesting experiment. In some ways, the results give you a feel for the state of the market, and in this case, it seems things might not be as bad as some might think. Some of these shares are clearly cheaper than they have been but it doesn’t scream despair.

Bargain and value strategies tend to fill up with ideas in a crash. To get the best results you need the market – in Templeton’s words – to be pessimistic. Companies with reasonable quality earnings won’t sell off heavily until the market really capitulates. And nobody knows if or when that will happen.

Even so, we’ll keep an eye on these shares and come back and see how they are doing at a later date.

While this might not be a strategy for the current conditions, it could still come in useful. It is handy for detecting shares trading below their medium-term average P/Es. And in periods when the market does go on sale, the growth and quality rules may offer some defence against shares that are worth avoiding.

It’s a strategy not just for a rainy day, but a stormy day.

Thanks for reading.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.