Many quoted companies trumpet their TrustPilot ratings. But is Trustpilot itself a 5-star investment? Maynard Paton evaluates the review website’s financial progress and business model.

Read a set of company results, and chances are you will spot a reference to Trustpilot. Examples of quoted businesses mentioning the popular review website include:

- AJ Bell: “Our operational performance indicators have shown excellent levels of customer service as demonstrated by our high 4.5-star Trustpilot score.”

- AO World: “Over 350,000 Trustpilot ratings, averaging an “Excellent” 4.6/5 stars.“

- Big Yellow: “We have over 3,200 reviews from the independent review site TrustPilot. These reviews average a 4.7 out of 5-star rating, labelled as “Excellent” on the TrustPilot ratings scale.”

- Procook: “We are pleased to have retained our excellent-rated Trustpilot score of 4.8.“

- Redde Northgate: “Customer satisfaction is the cornerstone of our business success and the ‘excellent’ satisfaction scores achieved across our businesses from Trustpilot.“

- Redrow: “We continue to be rated as ‘excellent’ on Trustpilot.“

- ScS Group: “Improved Trustpilot rating to the maximum 5 stars, maintaining our ‘Excellent’ rating with over 370,000 reviews.”

- Travis Perkins: “The experience with Toolstation remains best-in-class with the business achieving a 4.6-star rating on Trustpilot.“

With so many quoted companies trumpeting their Trustpilot reviews, is Trustpilot itself worthy of a 5-star investment rating?

Let’s take a closer look.

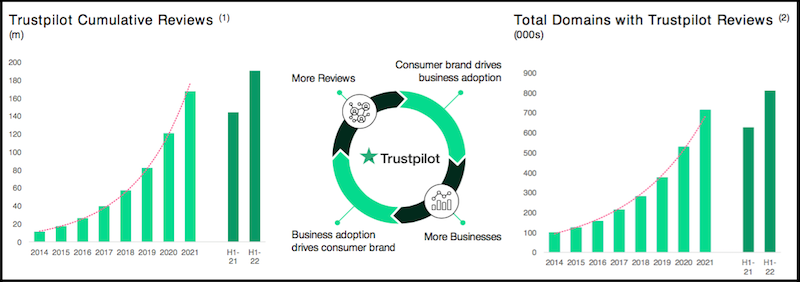

190 million ratings for 811,000 websites

“When I founded Trustpilot in 2007 in Aarhus, Denmark, buying things online just wasn’t common. Many people… simply weren’t sure who to trust and so wouldn’t engage. I was already a budding Internet entrepreneur but on a small scale. I remember talking to mum about this gap in trust online and realising ‘there is a huge and universal need here.”

So recounted Peter Mühlmann during this Business Matters interview about his initial inspiration for Trustpilot.

Mr Mühlmann launched the website from his parents’ garage and within a year had captured 3,000 reviews. The company’s early momentum attracted funding of $3 million during 2008 and by 2012 offices in London and New York complemented the Danish HQ.

Trustpilot today describes itself as a “leading global review platform” that at the last count had collected 190 million ratings of behalf of 811,000 websites. The group’s largest market is the UK followed by Europe and then the United States:

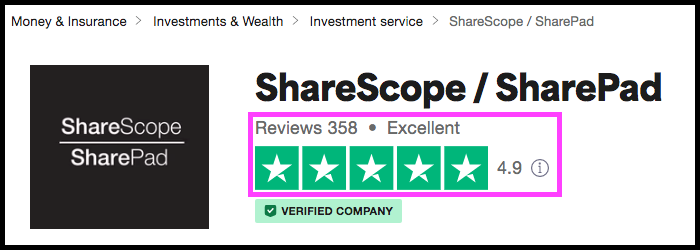

Businesses employ Trustpilot to gather and verify consumer reviews that in turn can be used for marketing purposes to prospective customers (and shareholders!). ShareScope/SharePad for example had collected 358 reviews at the time of writing that equated to a ‘TrustScore’ of 4.9 out of 5:

Just click here if you wish to read the ShareScope/SharePad reviews for yourself. Out of the 358 submissions, only two rated ShareScope/SharePad 1-star or 2-stars, with the other 356 almost entirely 5-stars:

Trustpilot operates a free plan as well as a standard plan for £225 a month that includes extra functions. Various add-ons beyond the standard plan are available at undisclosed prices.

My sources at ShareScope reveal the team did trial the paid version but eventually discovered the promised integrations and more detailed analytics were not forthcoming and so reverted to the free plan (with some in-house work to produce the necessary integration).

This ShareScope scuttlebutt is very instructive and may explain the overriding investment drawback to Trustpilot: despite the 190 million reviews on behalf of 811,000 websites, the platform has yet to reach profitability.

Revenue, losses and customer numbers

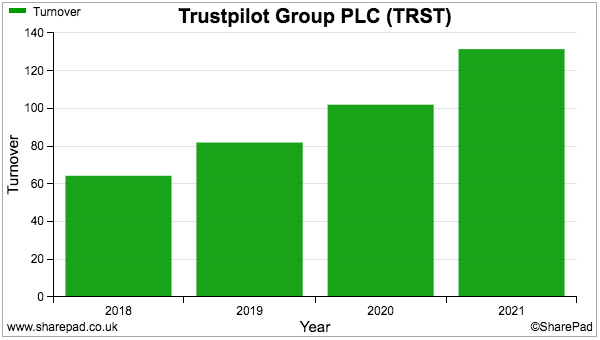

Trustpilot floated during 2021 and the financial history displayed within SharePad is therefore limited.

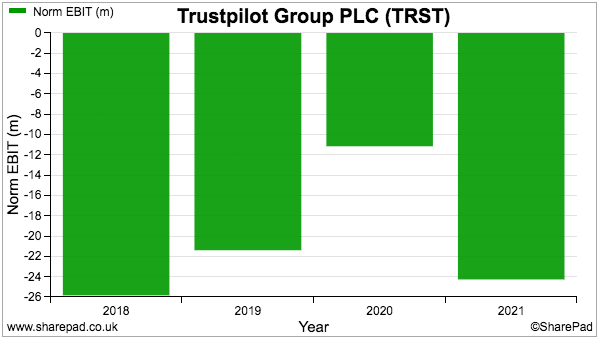

Although annual revenue has climbed higher to $131 million…

… losses have been persistent:

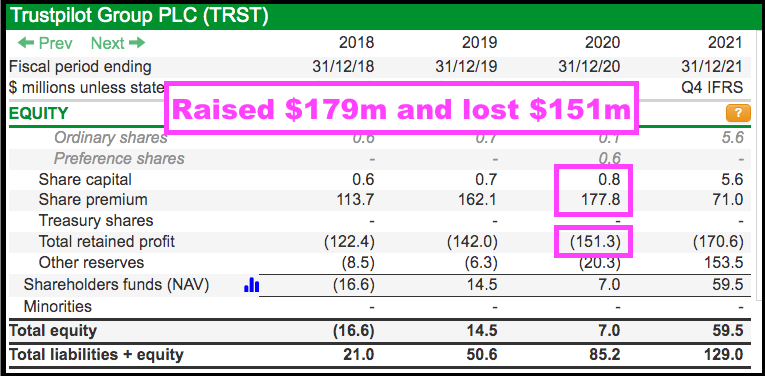

SharePad shows that, at the end of 2020 and before the flotation, the business had raised $179 million from investors and had reported cumulative losses of $151 million:

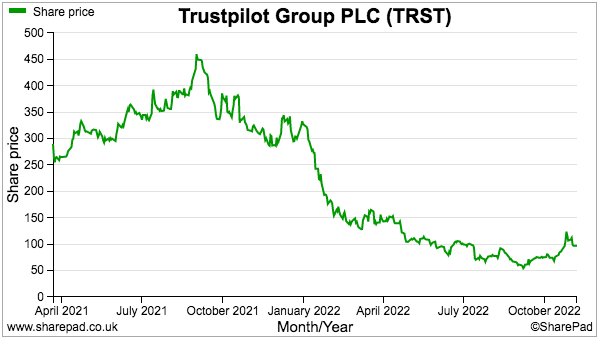

The shares joined the main market at 265p and enjoyed an initial spurt, but have since tumbled to 100p to support a £404 million market cap:

Trustpilot’s presentations go some way to explain the history of losses.

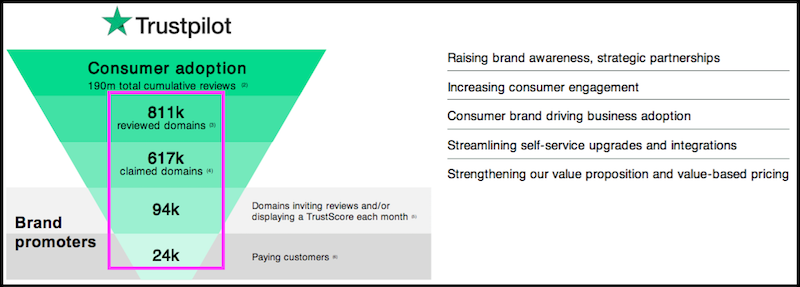

Of the 811,000 websites that have gathered reviews, only 94,000 are actively inviting reviews (which can be done free of charge) or displaying a TrustScore (which is a paid-for feature):

Customer numbers at only 24,000 also underline the notion that most businesses — even after they have actively created their Trustpilot profile — are simply not interested enough to pay for the service.

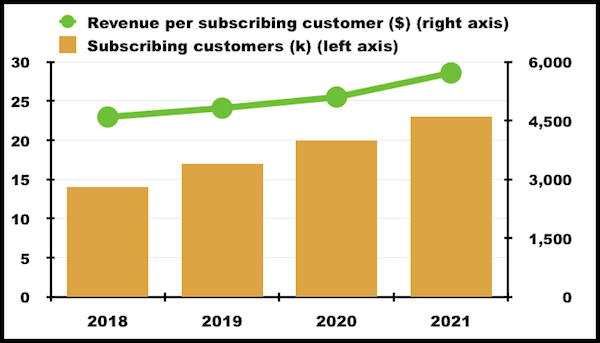

But those customers that are interested in the service appear to be paying more each year. My rough sums show revenue per subscribing customer approaching $6,000 (approximately £5,200) a year:

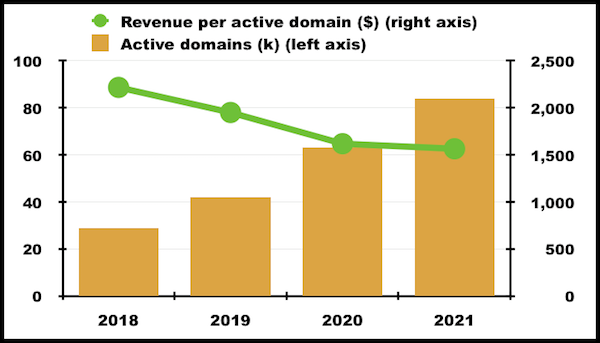

Mind you, revenue per active domain seems to be declining and suggests the majority of website owners remain happy with the free service:

Will Trustpilot deliver favourable ‘platform’ economics?

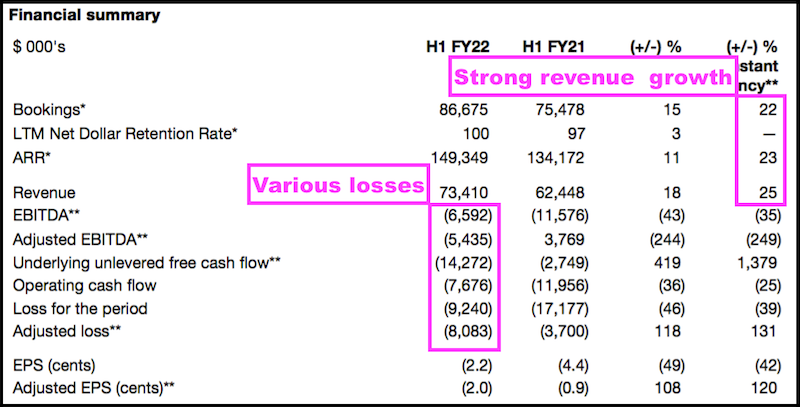

Half-year results published during September followed Trustpilot’s practice of delivering welcome top-line growth alongside ongoing operating losses:

Bookings and annualised recurring revenue (‘ARR’) are both forward indicators of near-term turnover and advanced more than 20% adjusted for the stronger US dollar.

The LTM retention rate meanwhile compares subscription renewals to subscription expiries during the last twelve months. The 100% figure means subscriptions that were cancelled were offset exactly by greater subscription renewals.

But within that summary above, no less than six measures of profit or cash flow all displayed negative figures.

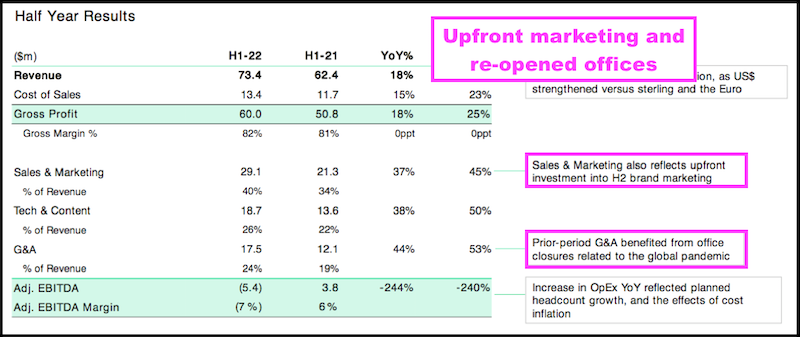

The $5 million adjusted Ebitda loss looks particularly alarming versus the Ebitda profit from the prior year. Trustpilot raised its expenditure during this latest half-year via upfront marketing costs and by re-opening offices post-pandemic:

September’s interim results claimed Trustpilot had a “strong balance sheet and a commitment to efficient growth and adjusted Ebitda and cash flow breakeven in FY24“.

Cash in the bank last stood at $73 million with no debt, so losses should be covered until 2024 when Trustpilot expects to reach cash-flow breakeven.

But do bear in mind the cash position is supported by upfront customer payments (‘contract liabilities’) of $30 million, and relying on such upfront payments to fund losses beyond 2024 will not be ideal.

The question of course is whether Trustpilot’s website will ever deliver favourable economics. Comparisons with proven ‘platform’ operators Rightmove and Auto Trader are instructive.

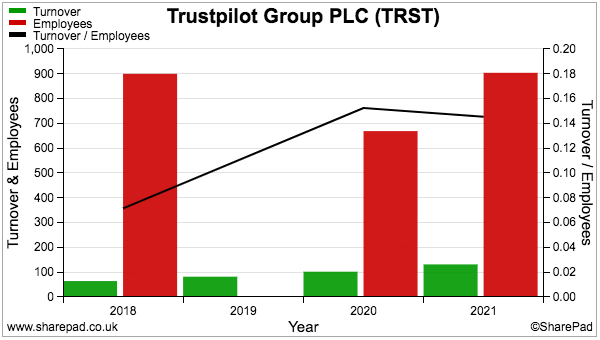

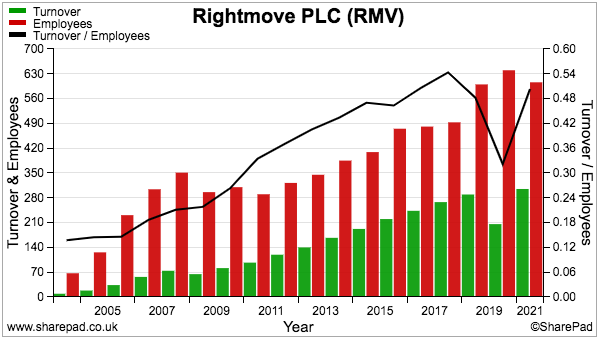

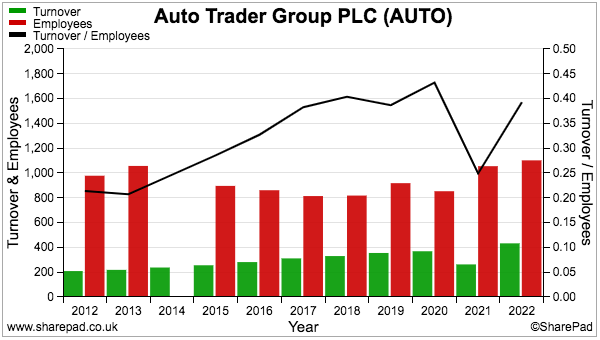

Revenue per employee at Trustpilot last year was approximately £145,000…

…versus £400,000 or more at Rightmove and Auto Trader:

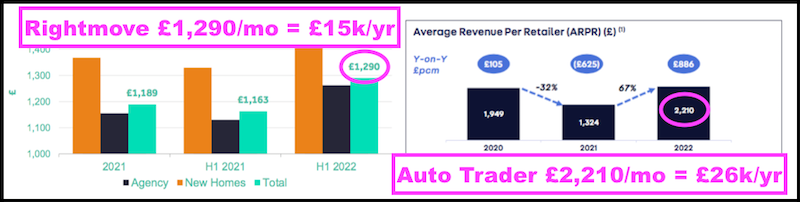

Note also that while Trustpilot’s customers pay approximately £5,200 a year,

the average revenue per customer at Rightmove surpasses £15,000 a year while the average revenue per customer at Auto Trader exceeds £26,000 a year:

For Trustpilot to ever join that top tier of platform winners, its employees will have to become more productive and/or the customers will have to pay higher fees.

Last year approximately 80% of Trustpilot’s revenue was expensed to employees — $105 million was paid to 786 workers — which does give the distinct impression of employing too many highly paid staff.

FTSE 350 customers such as AJ Bell and Redrow could meanwhile afford to pay far, far more than the aforementioned £5,200 a year average.

Management incentives and fake reviews

Founder Peter Mühlmann remains Trustpilot’s chief executive but his incentive arrangements sadly do not hint at the company reaching imminent profitability.

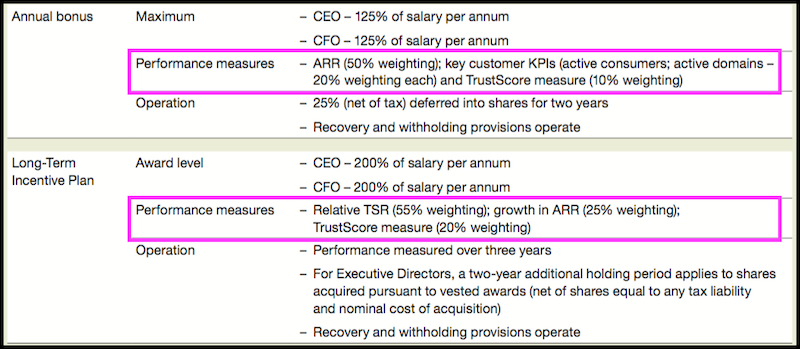

Bonus and LTIP measures include annualised revenue, active domains and Trustpilot’s own TrustScore, but nothing about Ebitda, cash flow, earnings or similar:

Mr Mühlmann retains a 2% (£9m) shareholding after selling half of his shares at the flotation.

Last year the board, unfortunately, talked more about executive pay (four committee meetings) than auditing (three meetings) and ‘trust and transparency’ (two meetings).

Trustpilot says its ‘trust and transparency’ committee is “responsible for establishing the policies and procedures to embed trust and transparency into the Group’s operations, and to maintain the integrity of its products and services.”

Trustpilot adds: “The Committee has supported management in developing the Trust and Transparency function and increasing its focus on customer service and quality assurance. In February 2022, the Committee undertook a deep-dive on how the Company manages complaints about reviews, and the detection and handling of fake and misleading reviews.”

“Fake and misleading reviews” are of course the scourge of all ratings sites.

Last year Trustpilot removed 2.7 million fake reviews (almost 6% of all submissions) from its website through automated software and manual intervention. Trustpilot commendably explains how the company combats fake reviews and how you can spot them.

But is Trustpilot doing enough? This small print within the annual report suggests City institutions want more information:

“Investors would also like to see increased disclosure around how Trustpilot manages to keep the credibility of the reviews high and maintain a platform that cannot be manipulated by any party aiming to gain a competitive advantage.”

Social media replies to the publication of Trustpilot’s 2022 Transparency Report were not exactly positive.

Lots of complaints were raised about genuine reviews being removed because of their low ratings, with allegations of Trustpilot’s bias towards the subscribing businesses. Some even say Mr Mühlmann should resign over “the fake reviews scandal“.

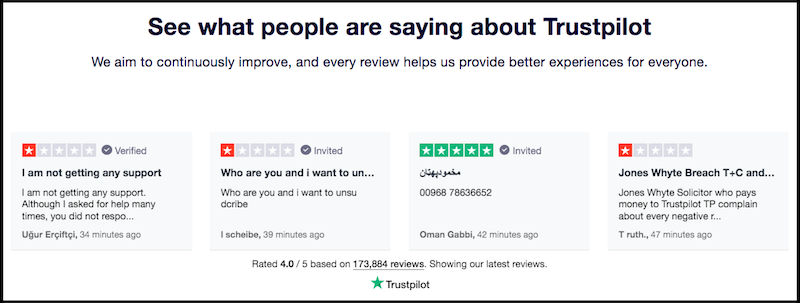

Perhaps I was unfortunate to stumble upon these 1-star reviews about Trustpilot on Trustpilot’s About page:

Valuation, business model and star rating

SharePad carries the following forecasts:

The estimates suggest Trustpilot will meet the company’s target of reaching cash-flow breakeven by 2024, which implies the £404 million market cap is supported by projections beyond the next few years.

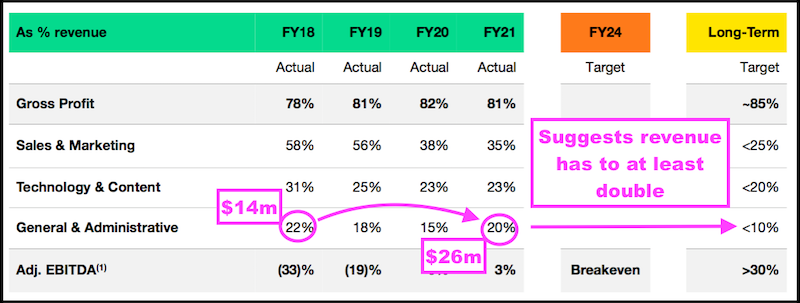

Trustpilot has presented this table indicating 30%-plus Ebitda margins are achievable in time:

The stated percentages imply revenue has to at least double from the $131 million witnessed during 2021 before General & Administrative costs represent less than 10% of the top line…

…assuming of course that General & Administrative costs remain unchanged.

The reality is General & Administrative charges have increased by $12 million to $26 million during the last three years. Were such expenditure to increase by another $12 million to support Trustpilot’s 30%-plus Ebitda margin ambition, revenue would then have to reach at least $380 million.

Trustpilot would reach revenue of $380 million by 2027 if the 2024 revenue forecast of $220 million proves accurate and the top line then grows at 20% annually for a further three years.

Whether Trustpilot will one day achieve a 30%-plus Ebitda margin and demonstrate attractive ‘platform’ characteristics is difficult to say.

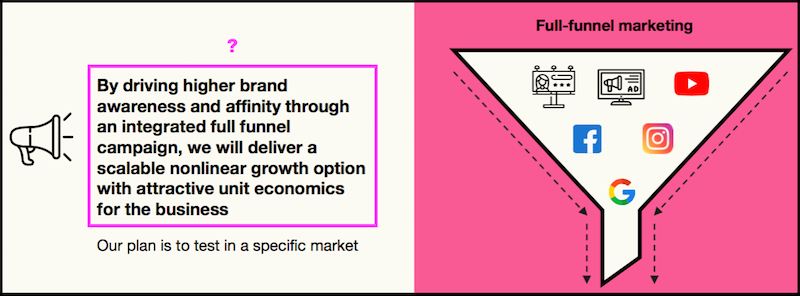

The company is confident of becoming “the universal symbol of trust for the internet economy“, but the financial history to date says the business model remains unproven. A revised (and buzzword-laden) marketing funnel introduced this year is not encouraging:

Perhaps Trustpilot will always face challenges trying to reach significant levels of profitability. From what I can tell, inherent disadvantages to the business model include:

- The general public can’t be relied upon to always give objective reviews or any reviews at all;

- Charlatans, spammers, bots and idiots will always plague open-to-all review sites, and;

- No business will pay to promote a load of negative reviews.

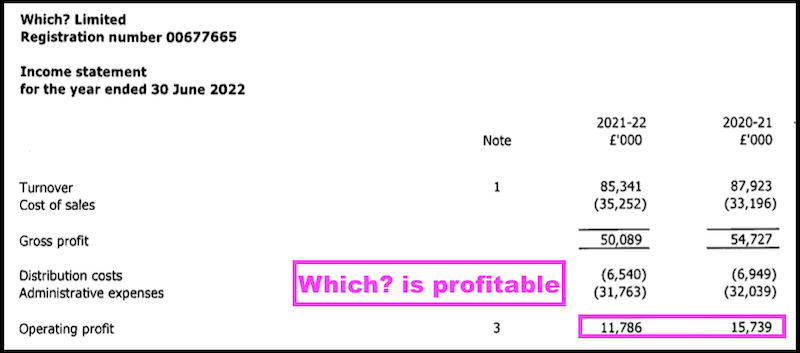

In contrast, the time-tested approach adopted by Which? — whereby the general public pays Which? to supply expert, in-depth and unbiased reviews — does deliver a useful profit:

After this review, I must sadly rate Trustpilot a 1-star for obvious investment potential at 100p.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Mark Atkinson. He does not own shares in Trustpilot.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.