Investing in shares is risky but if you want to grow the value of your investments you have to take some risk.

Getting the balance between risk and potential returns is one of the key decisions you must make as an investor.

There’s often a lot of focus on gains but very little on risk.

When you see someone shouting about how much they’ve made from a share on social media, do you ever see anyone asking them how much risk they took to achieve it?

Very rarely or ever in my experience.

If the share concerned was a loss-making micro-cap, then the answer often is a lot of risk. The next risky investment they make may lose them a lot of money and you can almost guarantee that they won’t be saying much about it.

One of the best ways to generate healthy long-term returns from shares is to avoid taking excessive risks which can blow big holes in the value of your portfolio.

Big losses are difficult to recover from and can offset good performances elsewhere.

In this article, I am going to look at some of the risks that come with companies and share investing and how you might go about avoiding or controlling them.

The lure of small company shares

I totally understand why many private investors focus on the shares of smaller companies or small caps.

They are often under-researched and offer a diligent investor an opportunity to get an edge. The rewards for good research can be outstanding.

It is also important to acknowledge that some companies are small for the good reason that they cannot get any bigger or are shrinking.

Small companies also come with bigger risks.

For example, younger and smaller companies tend to have a higher failure rate than older and more established ones.

One of the most meaningful risks is that small-cap shares often have very low levels of liquidity – it is difficult to buy and sell sizeable amounts.

It does not take much buying and selling activity to see big movements in share prices.

Bulletin boards and social media are packed with individuals promoting the shares of small companies.

Sometimes this can cause a share price to rocket and make them look brilliant even if the company concerned is currently losing money and might never go on to make a profit.

The rule of what goes up must come down often applies here.

Some bad news from the company concerned will have people stampeding to sell only to find that the price they must accept for getting someone to buy their shares off them results in a painful loss.

If you want to sleep well, then staying clear of these individuals and the shares of the risky companies they promote is a wise decision.

The other thing to bear in mind when investing in the shares of smaller companies is that it’s hard for stockbrokers to make money from them. As a result, the difference between the buying and selling price (known as the bid-offer spread) can be big.

It’s common for the spreads of very small shares (known as micro caps) to be as big as 10 or 20 percent or even more which means you need a reasonable gain just to get back what you paid for a share.

Source: SharePad

In recent years investors have not been compensated for owning smaller company shares in general.

During the last 5 years, a basket of shares of the FTSE 100 has comfortably outperformed its FTSE Small Cap comparators. The FTSE AIM 100 -which admittedly also contains some larger companies – has lost money.

Invest in good, growing businesses that you can understand

Good companies provide products and services that people want and tend to do it better than their competitors can.

Such companies come with – or have a good chance of delivering – desirable financial characteristics such as high returns on capital employed (ROCE) combined with strong and growing cash flows.

Many investors have done well from investing in large companies that already have these characteristics. They feel more comfortable with the ones they see that have already won rather than betting on a potential winner.

Spending time identifying whether the company you are looking at has what it takes to be a good or great business is a key part of risk control.

You need to get behind the numbers in the financial statements and understand the company’s business model.

If you can tell a friend in a couple of minutes why it is a good company, that is usually a reassuring sign. If you can’t, then perhaps you might want to think again before investing.

I can’t understate the importance of growth when it comes to investing in shares.

Without the potential for a company to grow its profits sustainably over many years, you are unlikely to do well, even if the shares are cheap.

Strong Finances

Weak finances are often the death knell of companies and find them out when their trading performance deteriorates.

A company’s lenders and pension fund are ahead of its shareholders when it comes to getting paid a share of its profits.

Companies with too much debt and big pension fund deficits can see them eat up most or all of its profits in tough times, leaving the shareholders with nothing.

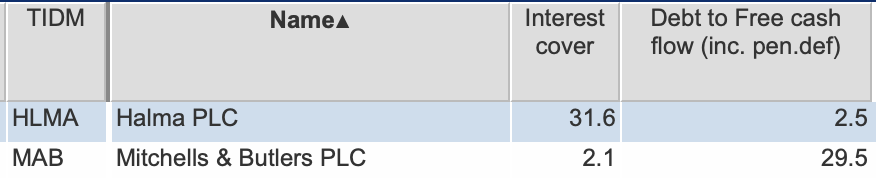

I tend to weigh up a company’s financial position with two ratios:

- Interest cover – how many times operating profit or EBIT cover the annual interest bill? The higher this number, the less risky a business tends to be.

- Total Borrowings to free cash flow – this tells me how long it would take a company to pay off all its borrowings with its current annual free cash flows. The shorter the time period, the better it is for shareholders.

Source: SharePad

Here we have two companies with vastly different financial positions. A shareholder in Halma is unlikely to worry about potential bankruptcy.

However, one in Mitchells & Butlers could have some sleepless nights if trading profits fall sharply.

When you are looking at the cyclical companies and calculating a ratio such as interest cover, it’s a good idea to consider where its profits are in terms of its business cycle.

A low level of interest cover when profits are at or near a cyclical peak could be a sign of trouble ahead if and when profits fall back.

Clean Accounting

Dodgy or aggressive accounting will eventually find a company and its shareholders out – even if it has persisted for some time.

To be a shareholder of a company that announces that its accounts weren’t a true reflection of what was going on is a painful and often very costly experience

Tim Steer’s excellent book, The Signs Were There is a catalogue of warning signs that showed that a company was heading for the rocks.

Spotting companies with questionable accounting isn’t always easy but there are things that you can look for which might be a sign that something isn’t quite right.

Four checks that you can do are:

- See how well profits turn into free cash flow by comparing earnings per share (EPS) with free cash flow per share (FCFps)

- Examine the quality of revenues (turnover or sales) by looking at how much is made on credit. You can do this by looking at the trade debtors-to-sales ratio.

- Look at the potential profit problems from increasing stock or inventory levels by calculating the stock-to-turnover ratio.

- Be wary of large and recurring exceptional costs that are stripped out of underlying profit measures.

The first three of these checks can be done very quickly and easily in SharePad.

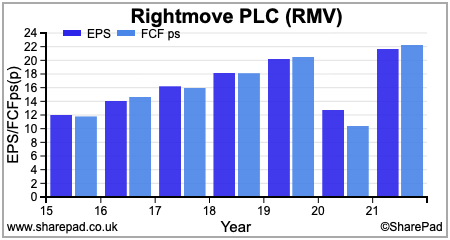

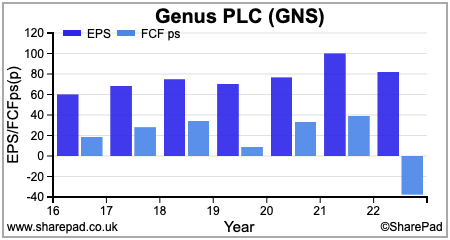

EPS vs FCFps

For an established company, you ideally want to see EPS and FCFps at similar levels as with Rightmove below.

Companies such as Genus where EPS has been significantly higher than FCFps will require investigation to explain why this has been happening. Sometimes there are valid reasons which should not cause concern.

One of the most common reasons for FCFps being less than EPS is because a company is investing heavily in new assets (often referred to as capital expenditure or Capex) to boost future profits.

You should not penalise a company for investing in projects that will generate high future returns. In this case, low or negative free cash flow can be a sign of strength, not weakness.

However, sometimes companies have high capital expenditure because they are treating costs as assets.

This can be an issue with development expenditure and needs to be checked out to see if a company is overcapitalising its costs and flattering its profits.

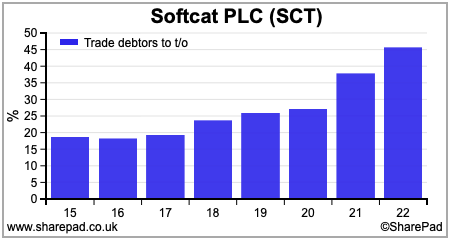

Quality of revenues: Trade debtors to turnover

One way to accelerate a company’s revenue growth is to offer more generous credit terms to customers by giving them a longer period to settle their invoices.

This will increase a company’s trade debtors to turnover ratio. This is fine if invoices get paid, but there is always a risk that as more credit is given that some of it will not get paid back and reduces profits due to rising bad debts.

Softcat’s trade debtors to turnover ratio has increased significantly in recent years. There may be a plausible explanation, but I would want some reassurance in this case.

When looking at a company’s financial ratios, it is worthwhile checking out similar companies to see if the one you are looking at it out of step with its peers. If it is, then this could be a major cause for concern

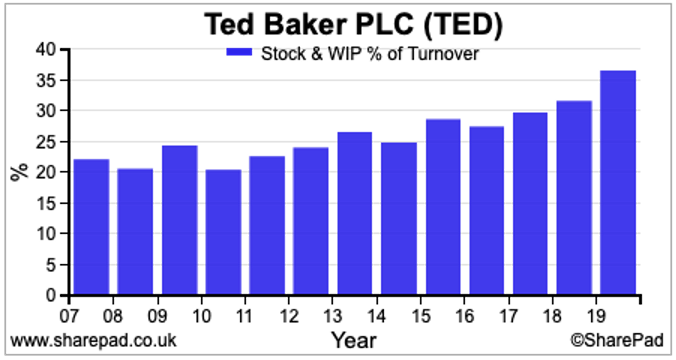

Increasing stock levels

Rising stock levels as a percentage of turnover can be a warning of trouble ahead. This is especially true of stock-heavy sectors such as retail and manufacturing.

An increasing stock-to-turnover ratio can be a sign of slow-moving stock and sales weakness. If so, then the stock may have to be sold at a loss to clear it.

Overhead costs are often included in the cost of stock and are another example of how companies can shift costs from the income statement where it would reduce profits to the balance sheet where it doesn’t – until reduced values are recognised.

This may also explain a rising stock-to-turnover ratio.

Sometimes a rising ratio can be explained by a stock build-up in advance of stronger future sales which is a good thing.

Most companies will tell you if this is the case. When stocks rise faster than turnover and the company says nothing it might be time to worry.

Ted Baker’s stock levels had been high and rising for quite a while before it announced in 2019 that their values were overstated, blowing a big hole in its profits.

Large and recurring exceptional costs

Exceptional items are called exceptional because they are supposed to be one-off and non-recurring. It’s amazing how this is just not the case with some companies.

Year after year, exceptional costs can be stripped out of ongoing or adjusted profit numbers to make the company’s performance look better.

They are therefore not exceptional or one-off.

Some companies also like to think that paying their employees with shares (share-based payments) are not actual costs and that amortisation of intangible assets such as software (which do not last forever) can be ignored as well.

Check out Richard Beddard’s recent articles on adjusted performance measures here and here.

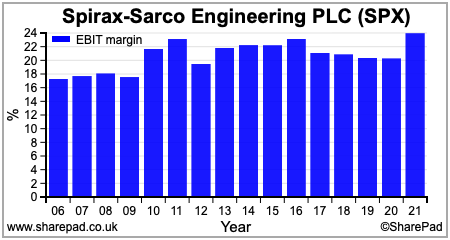

Revenue and profit stability

Companies with more stable revenues and profits tend to be valued more highly by the stock market. With steady ongoing growth, they can make very good long-term investments.

A good first check of a company’s stability and resilience is to see how its profits held in a recession such as 2008-09.

If they suffered then and the business has not changed in the meantime then there is a good chance they will again when the next recession comes along.

I like to look for companies with stable operating margins as evidence of resilience. Spirax-Sarco – which has been a successful long-term investment – checks out very well on this measure.

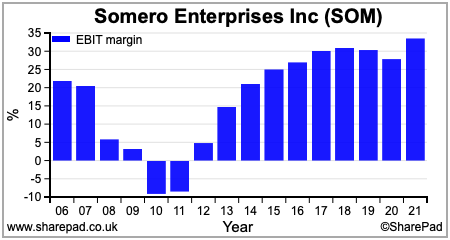

Sometimes, companies that look good may not be what they seem and may often be experiencing only a brief moment of prosperity. Cyclical companies at the peak of a business cycle are a fitting example of this.

Somero Enterprises, a provider of concrete levelling equipment is very profitable when times of good and construction activity is buoyant. When the economy turns down those profits can disappear. They fell sharply in 2008-09 and became losses in 2010-11.

Over the years, I have seen plenty of investors mistake a cyclical company with peak profits for a cheap growth stock only for them to find out the shares were cheap for a reason – profits were about to go down.

This may explain why Somero shares currently only trade on 8.6 times rolling one-year forecast EPS. If it had a better reputation for profit stability, its valuation would be a lot higher than this.

Acquisitive companies

Companies that rely on growing by buying other companies (acquisitions) are rightly treated with suspicion by investors. This is because so many have unravelled over the years.

Buying similar companies can allow for big cost savings and a boost to future profits which investors tend to like. Often when the cost savings run out another acquisition is made, and the process begins again.

For a while, this can see a soaring share price. The problem occurs when each acquisition has to be more meaningful to keep profits growing, particularly if it is to hide the fact that the company’s underlying profits are shrinking.

When the acquisitions and cost savings stop, profit warnings often follow, and things can get messy for shareholders. This is especially true if the acquisitions have been made with lots of borrowed money.

Shares in Stagecoach and Carillion are brutal past examples of how this strategy can badly unravel.

The share price chart of Future plc suggests that investors might be worried that this could be a big concern here. A highly acquisitive company has seen its CEO leave and followed this up with a more downbeat earnings outlook. What comes next?

Not all acquisitive companies create problems for their shareholders. Companies such as Bunzl and Judges Scientific have been successful at buying and integrating companies and created a lot of extra value for their investors.

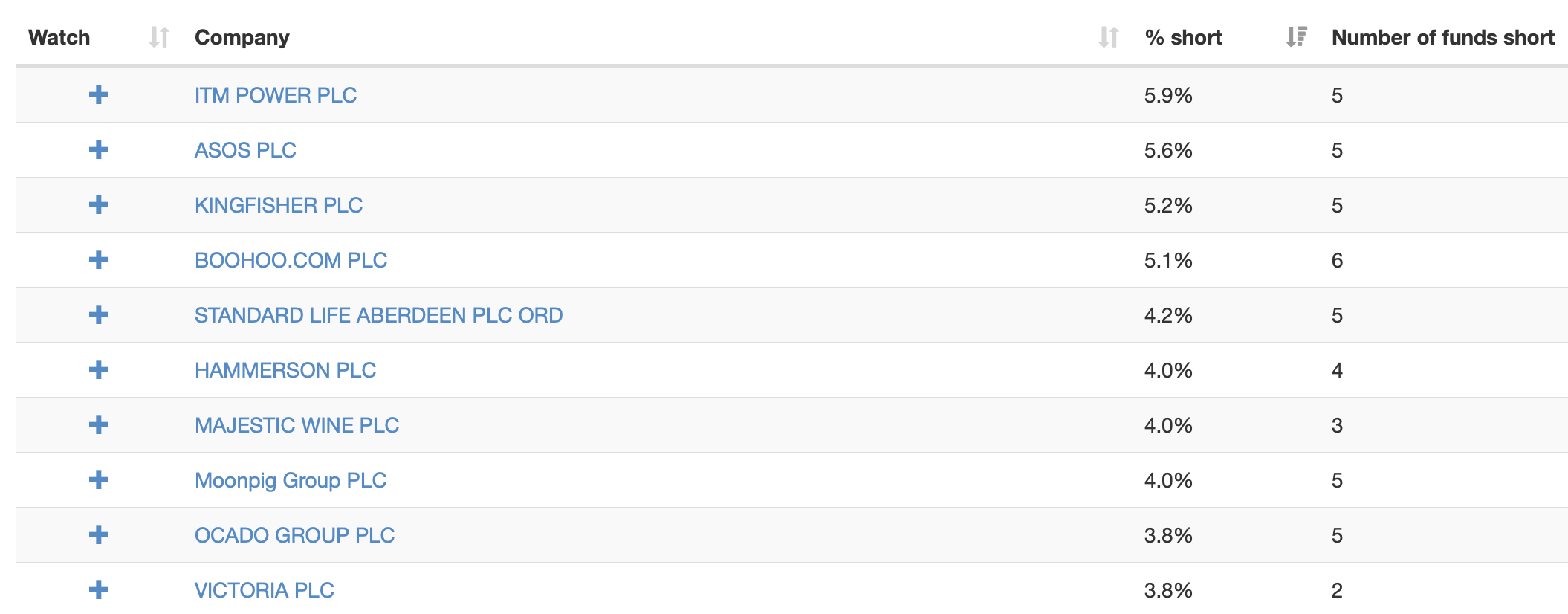

Short Sellers

Short sellers bet on share prices going down to make money.

Some of the smartest and most diligent professional investors spend their time shorting shares.

Before investing in a UK share it is not a bad idea to check out the shorttracker.co.uk website which lists the proportion of a company’s shares that are being shorted.

If the company you are looking at is on this list, you might want to do some more research before parting with your cash. Short sellers are not always right but being informed of what they are doing can be helpful.

The most shorted shares in early March 2023

Source: shorttracker.co.uk

High valuations

The price you pay for a share has a big say in what returns you will get from owning it. Paying too much is something that you should try and avoid.

High valuations mean lofty expectations of future growth. If that growth falls short of hopes, then share prices can collapse.

This is a particular risk with so-called momentum shares. Rapid growth combined with regular upgrades to future profit forecasts can see soaring share prices and eye-watering expensive valuations.

When the momentum stops, those valuations are too steep to attract new buyers and a sharp fall can result, leaving later buyers nursing painful losses.

Shares in Boohoo Group are a good example of this. Some investors were once happy to pay sky-high valuations for this stock. Now it is expected to make losses and has few friends.

~

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.