Jamie Ward Jamie is a highly-regarded equity analyst and fund manager. He began his career in investment management running the research process for equities for private clients and IHT portfolios. He moved over to portfolio management in 2013 and has managed hedge funds and long-only equity funds, including a seven-year stint as the manager of […]

Search Results for: "jamie ward"

Advantages You Have Over Professionals

This week, investment professional, Jamie Ward discusses the ways in which private investors are at an advantage to professional investors. He then describes practical steps to exploiting these advantages and avoiding the pitfalls. From the outside, the life of a fund manager looks to be a charmed life. Indeed, if you are interested in markets […]

Monthly Fund Focus: Gold, Nutshell growth, Biotech opportunities

Gold prices are moving steadily higher, yet most investors shun the shiny precious stuff. This month’s funds article looks at gold as an asset class, why professionals dislike it, and why UK investors have done well out of the precious metal. It also examines an innovative new way to invest in gold AND generate an […]

On Durability

This week, Jamie Ward rewatched an old interview with an investor whose style might be considered rogue in today’s professional investment landscape. He believes that the lessons espoused could be useful for private investors who consider whatever wealth they have accumulated to be precious and irreplaceable. He then suggests a few businesses that might form […]

Quality investing is not what it was

This week, Jamie talks about how the phrase ‘quality investing’ has been distorted and why complacency in investing can be really bad for your returns. He then explains why he thinks Unilever, a darling of quality investment portfolios, might not be as good as some perceive. As is so often the case, seemingly minor events […]

Do what your heart tells you

This week, Jamie talks about the narrow education professional investors receive and why it is important to keep learning. He then discusses why you can make a compelling case for Burberry yet he does not own it currently as he puts into practice the lessons he’s learned later in his career. When I passed my […]

The World is a lot bigger than Omaha, Nebraska

This week, a podcast that Jamie listened to inspired a little research project, which reiterated an important lesson in investment. He asks what makes a good business and what impact buying back of company shares has or hasn’t had over the last ten years. I listened to a podcast, recently where the host interviewed a […]

Weekly Market Commentary | 23/04/2024 | DOCS, AML | A Clairvoyant’s View of the Economy

This week Jamie returns to a topic mentioned late last year; the use of Google Trends to get a sense of how sections of the economy are performing. He then discusses what, if any, investment ideas can be narrowed down. He then reviews the travails of two ex-private equity businesses with similar names. One he […]

Weekly Market Commentary | 16/04/2024 | SDY, NXR | As Safe as Houses

This week Jamie talks about the economics of the UK housing market and why he thinks that the house builders’ apparent cheapness is an illusion. He then discusses what he believes are better ways to invest in housing construction and rounds off by reviewing the trading updates of two companies, whose fortune is somewhat determined […]

Weekly Market Commentary | 09/04/2024 | ARR, FDEV, FUTR | Rising from the Ashes

This week Jamie talks about the remuneration of investment companies, reveals one of his personal investment trust holdings and explains his rationale. He then reviews the current state of Frontier Developments, which has gone from micro-cap to super-star mid-cap and back again in the past few years. Finally, he provides a brief review of the […]

Article & Insight page

ARTICLES& INSIGHT All the latest articles & insight from our investment writers to inspire your own research and analysis. Author Index Alpesh Patel OBE Ben Hobson Bruce Packard David Stevenson Jamie Ward Author Index Jason Needham Maynard Paton Michael Taylor Phil Oakley Richard Beddard Twin petes’ Investing Podcast How Do YOU SharePad? Facebook Twitter Youtube

Weekly Market Commentary | 20/02/2024 | GNS, ANIC | Yo Adrian, I did it

This week, Jamie discusses a solution to using return on capital employed when the capital employed part of the equation is missing. He does so through the lens of ARM Holdings, which became the third-largest UK company by market capitalisation last week. You have to feel somewhat for whoever compiled and proofread the trading update […]

Weekly Market Commentary | 13/02/2024 | RSW, DCC, BDEV | Rent vs. Own

This week, Jamie talks about two types of equity investment those which should be held with the intention of an indefinite horizon and those that are expected to be sold. He then compares three companies, two of which he thinks should be long term holds and the other one only to be traded. The commentary […]

Weekly Market Commentary | 06/02/2024 | SDY, SDRY | Where there’s muck there’s brass

Jamie Ward takes over this week’s Weekly Market Commentary. Companies covered: SDY & SDRY. After a prolonged period of unpredictable economic data, most of the big releases last week were either in line with expectations or slightly better. Most of it wasn’t good in an absolute sense but taken as a snapshot, last week’s figures […]

Christmas Commentary | 29/12/23 | DWHT/DWHA | Google is your friend | Screening for Bargains

This week, Jamie Ward briefly talks about the latest update from Dewhurst. He then demonstrates that markets are frequently not efficient by reviewing the performance of a couple of the COVID winners to see if it can inform future investment decisions. Finally, he shows how to use Sharepad to screen for businesses that attempt to […]

Weekly Market Commentary | 28/11/2023 | DPLM, SRC, CRH | Trust Your Process

This week, Jamie Ward talks about why missing out on some great investments might not be a bad thing, especially when thinking of the wider context where you may have invested in something better. He believes that having a process is far more important than whether you did or did not buy a security and […]

Weekly Market Commentary | 21/11/2023 | DCC, OCN | Low-Cost Mediocrity

This week, Jamie Ward returns to talk about how passive investing is logical but isn’t really investing. He also posits that passive investment cannot exist without active investment but the reverse is not true. Companies covered: DCC, OCN. US inflation data set the tone for markets last week. The previous readings for US core and […]

Weekly Market Commentary | 14/11/2023 | DGE, BEZ, WRKS | Excessive Ebullience

While away on an Australian retreat, Bruce asked ex-fund manager and private investor Jamie Ward to manage his weekly commentary for the upcoming weeks. Jamie takes a look into Diego DGE, Beazley BEZ and The Works WRKS. Markets had a poor end to an otherwise rather uneventful week. This resulted in equity markets being down […]

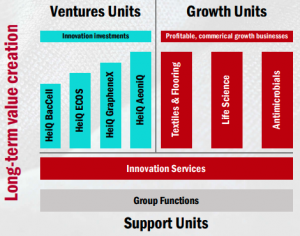

Weekly Market Commentary | 7/11/23 | AML, ULTP, HEIQ | The bids keep coming

With two more bids coming in for small-cap stocks, Bruce looks at the average premiums being offered by buyers. Companies covered: AML, ULTP and HEIQ. The FTSE 100 was up +1.3% to 7,426 last week. Meanwhile, there was a very strong rally in the US markets with Nasdaq100 +6.4% and the S&P500 up +5.9%. […]

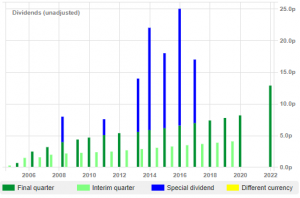

When Return of Capital trumps Return on Capital

Jamie Ward returns with his last article for ShareScope to discuss risk and complacency in the market and suggests that the past few years might not be an adequate guide for the future. Markets always go up… Since the Great Financial Crisis (GFC) in 2008, there has been a received wisdom to always ‘buy the […]

Roll-out, Roll-up and public market arbitrage | SBRY, PRZ, COST, DCC, MRL, BREE

Jamie Ward takes a detailed walk through two expansion strategies and outlines the types of company and sectors where investors are likely to find these strategies as well as highlighting how to spot companies using them well. Two common ways for profitable growth for many companies can be summarised as roll-out and roll-up. Roll-out is […]

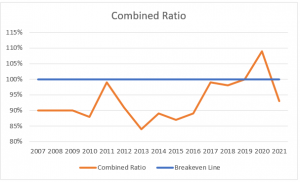

Beazley PLC | Property & casualty insurance and diversification (LSE : BEZ)

The task of investors is to find businesses that have created value, have a good chance of doing so in the future and are run by honest actors. This task is complicated by certain sectors where businesses don’t ‘look’ like most businesses. Jamie Ward returns with a look at Insurance through the lens of one […]

Weekly Market Commentary 14/02/22 |PZC, K3C, SOLI| Never says “never banks” again?

Bruce suggests that while long term “expensive quality” investments have become increasingly popular as discount rates have fallen, a natural hedge for such a portfolio is bank shares, which could now benefit as rates rise with inflation. The FTSE 100 was up +2% to 7,617 last week. The S&P500 and Nasdaq100 were flat. The real […]

Weekly Market Commentary 07/02/22 |RSW, JHD, JOUL| Quality can’t be quantified…

While he is away skiing, Bruce asked ex-fund manager (with 16 years experience) and private Investor Jamie Ward to manage his weekly commentary this week. Jamie looks at the best things about being a private investor compared to being in the Square Mile as well as results from three companies that at some points in […]