Jamie Ward returns with his last article for ShareScope to discuss risk and complacency in the market and suggests that the past few years might not be an adequate guide for the future.

Markets always go up…

Since the Great Financial Crisis (GFC) in 2008, there has been a received wisdom to always ‘buy the dip’ or BTD – it has almost taken on memetic qualities at this point. Investors have been handsomely rewarded for doing so because the wall of money going to capital markets has ensured a near permanent bid for most assets. Only periods of tight liquidity, caused by all and sundry, from the Euro crisis of 2012 to the COVID sell-off in 2020 has seen reasonable sized dips at all. As time has progressed these dips, however sharp, have seen ever quicker recoveries. The COVID sell-off saw the S&P decline by a third in less than month but, in less than six months, had broken its previous high. Economically, the world was in a worse place by this point than it had been prior to the selloff but, markets were nonplussed by the disruption.

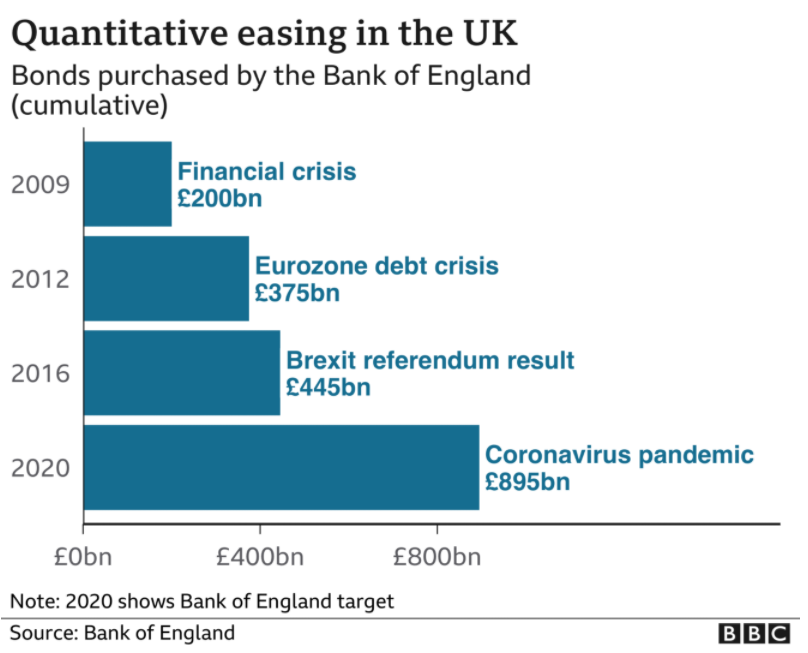

The reason was the rapidity and scale of the monetary easing, which in recent years has taken on the form of quantitative easing whereby a central bank creates deposits to buy securities from the private sector. In the UK alone, its scale in response to COVID-19 was slightly more than the previous eleven years combined.

The response of every downturn has been more easing. More easing means a private investment sector (banks, insurers, pensions funds, institutional managers etc) has had to seek returns one rung along the risk curve. The effect is a concertina of higher valuations, eventually leading to some pretty grotesque economic inequality as asset owners become richer in nominal terms and the non-asset owners see the price of assets drift further away from affordability.

Over the years then, a trend has emerged that any potential market adversity is met with robust and positive response from central banks ensuring any financial discomfort is only temporary. There is an old market adage about trends, ‘the trend is your friend’. Alas, many only remember the first part of this and neglect the oft-forgotten conclusion. In full it goes…

Trend is your friend, except at the end

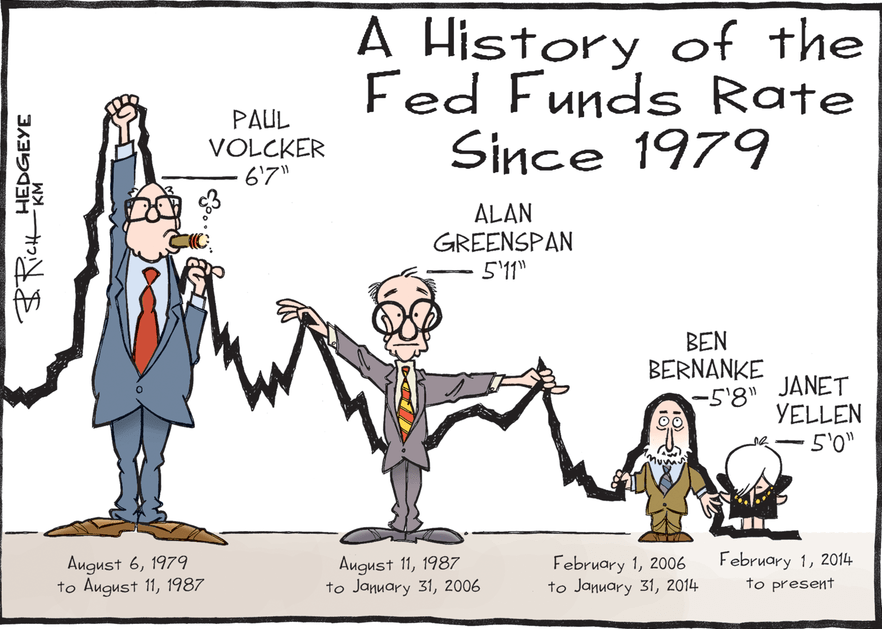

On a general market view, we need to grasp what might challenge the narrative that market weakness is always met with a positive response. It wasn’t always the case that economic and, more importantly, market weakness begot looser conditions. One would be tempted to think that the monetary loosening that has met all such weakness came about post-GFC. Certainly, it is the case that quantitative easing is post-GFC phenomenon, however it could be argued that the Pavlovian monetary response to loosen actually goes back to the early 1990s, when the economic fallout from the first gulf war (Operation Desert Storm) caused economic and market weakness, and was met with lower interest rates (in the US – the UK was a special case related to some combination of the Exchange Rate Mechanism, Helmut Kohl and German re-unification). The Federal Reserve chairman of the time was Alan Greenspan and, in later years, further recessionary bouts were met almost mechanistically with easier financial conditions. This became known as the Greenspan Put, whereby Alan Greenspan was effectively providing a Put option on the economy (and by extension the stock market).

Aside: A Put option is a legal contract that provides the bearer with the right, but not the obligation to sell an asset at a predetermined price. Euphemistically then, the Greenspan Put is an idea that there is a minimum asset prices can hit in general since severe weakness will see indiscriminate buying by the central bank.

As time passed, this was replaced with the Bernanke Put, Yelled Put and Powell Put. All named for successive chairs of the Federal Reserve.

Prior to Mr Greenspan’s tenure, monetary probity was very much in vogue. His immediate predecessor was the 6 feet 7-inch Paul Volcker. Very much a giant of central banking in more than just stature. In the late 1970s, inflation was a seemingly intractable problem having been on a relentless positive trajectory since the height of the Vietnam war in the mid-1960s. Appointed by Jimmy Carter in the dying days of his presidency, Mr Volcker was tasked by the incoming president, Ronald Reagan, to ‘break the back of inflation’ once and for all. This meant something anathema to today’s thinking, monetary conditions were tightened and kept tight even in the face of the early 1980s recession – a recession was considered a price worth paying for lower inflation. Doubtless, this was hugely unpopular, but this tightness persisted all the way through to the beginning of Mr Greenspan’s tenure in 1987. An inauspicious start to Mr Greenspan’s tenure set the tone for monetary largesse for the next 35 years. Whatever the cause, October 19th 1987 saw the single-largest-percentage one-day loss in stock market history. At just ten weeks into his tenure, the response of the Greenspan-fed era could have been cowed given his predecessor’s strategy. Alas not, on November 4th of the same year, the committee decisively lowered the federal funds rate by an unorthodox 44bps. This was followed by a further 56bps in early-February of the following year. This total of 1% cut over a few months represented a tacit support of markets because, whilst the market unexpectedly collapsed, the (US) economy remained in good health and the problem of inflation remained very much unresolved. At first, this looked like a bold strategy; a one-off salve on a wounded market. Nevertheless, the early 90s recession and poor stock market, caused in part by the aforementioned Operation Desert Storm, suggests this boldness was the foretaste of a new regime of lax monetary policy.

Compared to the quantitative easing we see today, fed fund rate cuts are relatively tame. A fed fund cut stimulates market activity by lowering the cost of investment for private institutions, whereas quantitative easing represents direct investment into capital markets by the central bank itself. If the economy was a car, rate cuts would be the equivalent of servicing i.e. an oil change and renewal of air filters. Quantitative easing is the vehicular version of fitting a nitrous oxide tank.

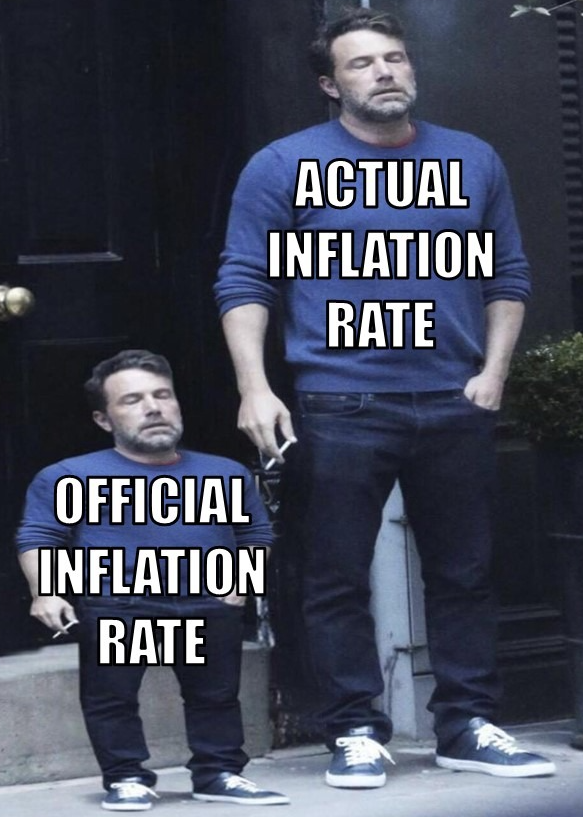

Inflation is always and everywhere a monetary phenomenon

The sub-heading above is a quote from Milton Friedman. He and his acolytes, the so-called monetarists, believe that inflation was caused purely by monetary conditions – that is to say, too much money chasing too few goods. Intuitively this makes sense however, officially in the years of pedal-to-the-metal nitrous-boosted monetary policy, inflation globally has been notable in its absence. Note; officially. As hinted above, central bank-induced liquidity via quantitative easing remains in capital markets and proxies for capital markets like the art market. Within contains an insidious form of inflation that isn’t found in the official measures. The problem with official measures is that they only seek to quantify day-to-day cost of living items and services like food, bills and rent. They do not adequately capture the parts of life that intersect with capital markets however.

Consider the following:

In 1995, an annuity of £10,000 cost a 65-year-old £87,900; at the time of writing, it costs £192,455. Actually, it’s far worse though, because £10,000 in 2022 buys 54% of the goods and services that it did in 1995. Therefore, a pensioner retiring in 2022 needs a pension pot of c. £354,000 to enjoy the standard of living of a 1995 vintage retiree with a pension pot of £87,900. That greater than four-fold increase in the cost of retirement represents a 6% rate of inflation every year for a quarter of a century but, in reality, most of that inflation has occurred in the last decade – that, in a nutshell, is a serious legacy of quantitative easing.

Ultimately, factors like this and the fact that a modest family home in an average part of South London now costs 7x what it did 25 years ago, are the cause of increasing social friction. Essentially, cheap money, which disproportionately benefits the owners of capital (importantly, at the expense of those who do not own capital) drives genuine economic inequality. Thus, the dream of an ‘ordinary’ life is moving further out of grasp of the majority. When people are happy with their prospects in life, they are disinclined to upset the status quo and the populace remains generally compliant. In the past seven years we have seen a sharp increase in both unexpected democratic results (Brexit, Trump, Modi, Salvini etc) and general militancy (Canadian Truckers, Gilet Jeune, etc). Eventually, governments will have to start placating the majority by lessening the extreme mismatch between earnings and asset values. Extremely low rates of return are terrible for social cohesion because the cost of acquiring assets becomes prohibitively high for the vast majority who do not own much capital in the first place.

This placation is beginning and is likely to continue to take the form of debasement. There appears to have been a shift in attitude towards fiscal responsibility, which has been exacerbated by the COVID measures when massive stimuli were launched globally simultaneous to huge increases in quantitative easing. You can hardly blame legislators the world over for believing that debts and deficits don’t matter. For a long time, they haven’t.

I was an inflationista before it was cool (unfortunately)

Sadly, I’m one of those people who has been worrying about inflation returning ever since quantitative easing first began. I was wrong (if we’re being charitable, you could say I was early – very early) and my investment returns suffered as a result – not dramatically, but holding on for dear life to the ‘best’ businesses with the highest growth, regardless of valuation, has been the winning strategy for a long time rather than worrying about risk management.

Aside: Risk management is an archaic term of unknown origins that used to be all the craze amongst successful investors. It has something to do with not placing all your capital on the same fundamental bet.

If inflation begins to hit the ‘real’ economy persistently then central banks might have to revert to an old-fashioned way of doing things a la Mr Volcker. By ‘persistently’, we mean serious items like food and energy going up in price and, not only not going back down again but also going up more… and more. In this case, we might find central banks are left with little choice but to tighten monetary conditions, not only during strong economic periods but potential tighten them in the face of poor economic performance if inflation really takes hold. No longer will the Put be there; indeed, it could be replaced by its opposite – the Call. Here is an old City joke:

Question – what’s the definition of a stock that fell 90%?

Answer – one that fell 80% and then halved

OK, its not funny, but then neither is buying a dip only to have your knees cut from under you. Just because something has fallen a lot, doesn’t mean it can’t fall more.

Current Events

Events over the past few weeks in Ukraine have highlighted something important for investors; it is possible to lose everything. We are only mentioning Ukraine in passing and is not intended to litigate events there as the author is neither qualified nor well enough informed to do so and it is beyond the realms of an investment blog.

Nevertheless, as it stands at the time of writing, a reasonable, working assumption of the fallout from the conflict and particularly western sanctions are as follows:

- Inflation – 13% of the world’s oil production, 10% of the world’s wheat production, 17% of the world’s gas production and 17% of the world’s potash production has effectively gone off line. It is still being produced but it isn’t coming to the West any time soon. This has happened in the last few weeks with only some reaction in capital markets. This could be severe. Recall, that inflation is too much money chasing too few goods; there are likely to be far fewer goods than there used to be.

- Shortages – this is the flip side to inflation. Demand isn’t going down for the commodities listed, in fact it could be argued that potash in particular could see a rise in demand. Shortages have real humanitarian effects. Last time wheat prices rose so as precipitously, we had the Arab Spring movement tear apart order in many countries for which food shortages can be catastrophic. Below is the price of wheat – it has risen 65% in the last year; it is up 150% in the past three years (see chart below).

- Supply chains – some of the supply chain issues that have plagued the world since COVID-19 first emerged may be beginning to be fixed but with rationed fuel owing to very high prices (see below chart of the Brent Crude Oil over the last twelve months), that might change – even if you can get the stuff you want, the price of transit might be prohibitively high. Further, at present China is providing tacit support for Russia. If this support became more muscular, supply chain issues might worsen again.

Knowing what you own

It is sensible to invest broadly. A concentrated portfolio can yield spectacular results but the key to longevity is diversity because going up 1,000% and then falling 100% is still falling 100% overall. I have, both professionally and personally, always maintained capital preservation mindset in investing. My attitude can often be summarised as ‘worry about the downside and let the upside take care of itself’. As private investors we can do this by really understanding individual securities in which we invest. Risk is often defined down to certain, often calculable metrics like volatility. However, risk is a very personal and necessarily qualitative measure. In recent weeks, certain Russian-exposed businesses have collapsed. These include FTSE100 businesses like Evraz. For some, the risk has always been substantial. For me, I never wanted to own something in a jurisdiction where there aren’t clearly defined and properly arbitrated property rights – in other words are you really sure you own what you think you own? As it stands right now, Evraz is down 92% from its high. In reality it is either worthless to a UK investor or it is worth a lot more. Worthless is not a risk I’m willing to take for the opportunity to make x-times my money but that risk-attitude is personal to me and, when I ran institutional money, what I was mandated to do.

When your chicken smells like fish, don’t worry about which bit is fishy, just don’t eat it

Losing large amounts of capital isn’t confined solely to the present geopolitical situation. In reality, there are often large amounts of money lost in businesses for which many investors should have known better. In the last few years, much has been written about both Wirecard and NMC (including by Bruce Packard). Both were fraudulent, both were suspected to be such openly and both had serious investors of great repute heavily invested. Once again, risk is personal (unless you are fund manager in which case it is defined by a prospectus) and, for me, Wirecard and NMC never passed the sniff test. Don’t take risks on things you don’t understand and for which there is a distinctly unpleasant odour emanating.

Boring though it might be especially when parts of the market are going gangbusters, a portfolio of dull, well-capitalised, simple businesses with good management teams is all that is required to help with one’s financial goals. Your capital is precious, treat it that way.

Below is a short list of businesses that might help you sleep at night.

Localised, capital-intensive producers with good balance sheets that plug into their own local economy. We mentioned Breedon last week also in a similar vein, SigmaRoc; amongst the brickmakers Ibstock and Forterra; as well as Polypipe. All of these are effectively investments in picks and shovels type economic activity. CRH fits in here too for those seeking international exposure.

Next; one of the best ran businesses I’ve ever come across. It is well financed, consistent, conservative and innovative.

Diageo; one of the largest alcoholic drink makers in the world. It owns a large number of very valuable brands including Johnny Walker, Smirnoff and Baileys.

British American Tobacco; the world’s largest cigarette maker. This is an industry in decline with huge amounts of debt however, it has the best economics of any business I’ve come across. Perversely this is because of the huge amount of duty that is applied to packets of tobacco products, which allows tobacco makers to put in quite large price rises with almost no effect on the product’s consumer price. If you find tobacco distasteful, ignore it.

DCC was mentioned in detail last week. Good balance sheet and even better culture.

PZ Cussons; a branded good producer that makes things like soap. It has been disappointing for many years but has a good balance sheet and new, seemingly capable management team. Bruce Packard has written about this one too.

Sadly, this is my last article for ShareScope as I am taking up a new role in the industry. Thank you to ShareScope for providing an outlet for my writing these few weeks and in particular thank you to Bruce Packard for introducing me to this exceptional organisation.

Jamie Ward

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Thank you for your educational final article, and good luck. Because of age and IHT reliefs I have been interested in AIM shares for some time and, as you point out, the downturn has hit hard. One factual question: why did you not mention Mitchelmersh Brick, quoted on AIM? Is it too small?

Hi Rusty.

I didn’t think to mention Michelmersh but that fits within the theme

Best

Jamie

Superb educational read, thank you Jamie.

As a newcomer to the world of investing over the past year my fiscal education continues on an ad-hoc basis. Your (and Bruces’) articles are informative, accurate and sapient reads.

Thank you again and all the best in your new role.

Phil.

Thank you very much Phil, I appreciate that

Jamie

Really enjoyed reading your articles. Thanks for sharing your insight with us

That’s very kind of you to say thank you Ian

Jamie

Virtually as Bob Pretcher predicted in 1999 in his book “Conquer the Crash”

Buying the dip has been a global practice for centuries- this is a piece out of extremely rare trading book “What’s new?, Let’s see the chart! Is that dip going to become an abyss? what do you think of it, worth buying?” – From a publication in the 1930’s

Inflationary tactics as Pretcher covers in his book won’t light the fire in a deflationary environment – this has been proved 100% correct – Inflationary tactics in an Inflationary environment, well we are starting to see the results – the question is “Are the powers that be really smart enough to prevent the fire before it starts or will they lag as they always do?”

I’ve not read that one. Will have a look thanks.

Jamie