The task of investors is to find businesses that have created value, have a good chance of doing so in the future and are run by honest actors. This task is complicated by certain sectors where businesses don’t ‘look’ like most businesses. Jamie Ward returns with a look at Insurance through the lens of one of its constituents, Beazley.

Company analysis basics (very basic)

The majority of business analysis follows a similar process. We are essentially looking for four things

- What and how much capital the business has employed i.e. what stuff has the business invested in historically, factories, warehouses, brands, goodwill, working capital etc? This is balance sheet analysis and should also include an assessment of sources of funding.

- What level of return the business can generate on that capital on a sustainable, through the cycle basis? This is usually some measure of profitability as a proportion of capital. Sharepad is invaluable here for those who do not wish to spend days trawling company accounts. It provides several measures but I have a preference for CROCI or cash return on invested capital. The reason is that cash is a truest indication of a business’s profit, whilst invested capital is the most conservative measure of capital because it includes acquired capital.

- How likely is that further capital can be employed at commensurate levels as the rest of the business and for how long i.e. what is the growth potential? This is much more difficult and is far more qualitative in nature by which we mean, it’s a guess. My own preference here is to try and identify industries with modest growth prospects rather than those growing like topsy and focus on worrying about the threat. The reasoning is low growth businesses; those for which expectations are modest, having easier hurdles to hop over and are often underappreciated. And, by focusing on the threats you can hopefully avoid businesses that are about to be disrupted.

- Do the people who run it display the following three characteristics:

- Competence – there are a lot of businesses that aren’t stewarded competently. Remember; the key attribute you require to become a CEO is the ability to sell yourself – there is no correlation between this attribute and competence. In reality this is a judgment call and is, as much as anything, a call on whether the culture within a business is conducive to value creation.

- Alignment – there are many cases whereby management can become rich irrespective of what happens to the business.

- Honesty – the case on alignment and competence is, in reality, subordinate to the integrity with which a management team acts. You do not need to meet these people. As a fund manager, I made a point of maintaining a very arms-length relationship with the management of investee businesses. Once again, remember; the key attribute you require to become a CEO is the ability to sell yourself, CEOs are often very charismatic and it is easy to be romanced into believing a business is better than it is by these individuals when seeing them in person. It is better to read what they say and see for yourself whether they can be trusted asking yourself questions like:

- Did they do what they said they were going to do?

- Not everything goes according to plan, do they shift blame?

- Do they change the order and style of what they say from one announcement to the next?

To summarise, our task is to find businesses that have created value, that you think have a good chance of doing so in the future and are run by honest actors. Once we’ve done that, we try not to overpay, but in reality, focusing on business performance over valuation is the key. Nevertheless, this task is complicated immensely by certain businesses that don’t ‘look’ like most businesses. The most obvious example is banking where balance sheet analysis is back to front, in that value is created by determination of the quality of the liabilities not assets. Bruce Packard wrote about the sector in his most recent note and why investors should perhaps reconsider the sector https://knowledge.sharescope.co.uk/2022/02/14/weekly-market-commentary-14-02-22-pzc-k3c-soli-never-says-never-banks-again/

This week then we shall look at another often ignored sector through the lens of one of its constituents.

Beazley

Summary

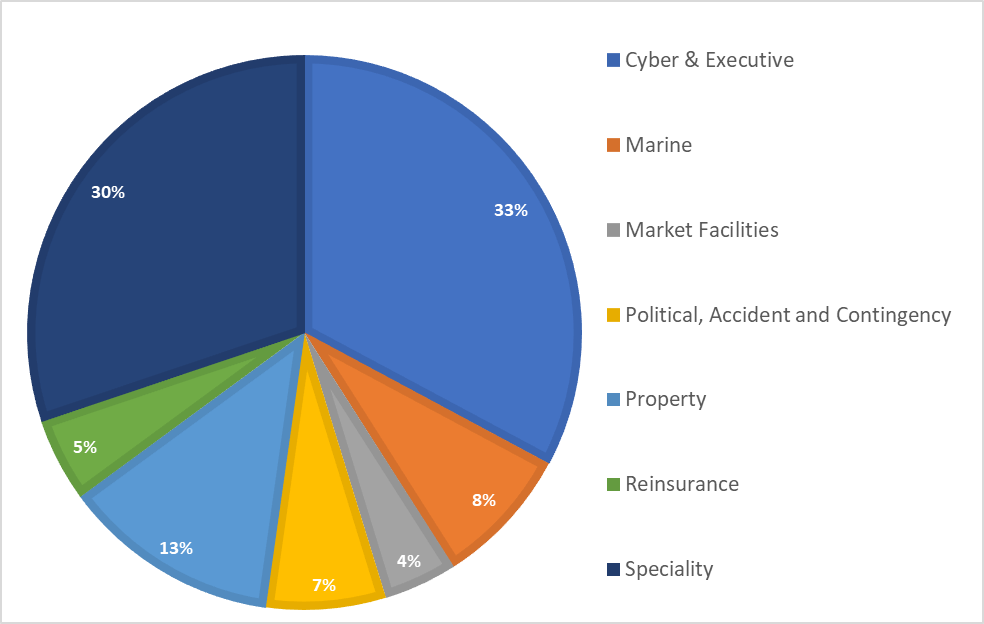

Beazley is specialist non-life insurer. Specialist because it focuses on areas where it has a specialised underwriting knowledge that allows for super normal returns, like cybercrime for example, rather than commoditise insurance, like car insurance for example. A general rule for non-life insurance is that the more specialised an area, the greater the returns available but the more limited the addressable market. As markets become more commoditised, the returns tend towards the cost of capital but the addressable market can be enormous. Beazley is a portfolio of businesses diversified by both geography and business line. Below is a breakdown taken from the accounts but, for our purposes, it is sufficient to think of it as c. 50% lower return but dependable and 50% higher return but less predictable.

- Cyber & Executive Risk seems somewhat amorphous and one assumes that it will be split in due course. It effectively insures against key person risks and other related personnel risks. Perhaps because it mainly ensures general business, the cyber risk and related parts are lumped in here, which largely relates to hacking. As a division, it has grown well as Beazley have carved out a sizeable niche and expertise here.

- Marine is a common form of insurance seen across the sector and would sit within more commoditised end. It is dependable, but the pandemic proved that nothing is immune from every external shock. The resultant breakdown in supply chains and periods of manufacturing idling has seen a rare dip in sector as shipping fleets were mothballed. Beazley was not immune.

- Market Facilities somewhat blurs the line with banking in that it insures portfolios of businesses.

- Political, Accident & Contingency is a diverse division itself covering a large range of sectors that wish protection against things like terrorism and political interference. It is specialised in nature.

- Property, much like Marine is a common form of insurance and is rather self-explanatory. Beazley largely focuses on small commercial property but will also insure high value residential property where the market is less commoditised and thus slightly higher returns can be generated.

- Reinsurance can almost be seen as a balancing item in the insurance industry. Balance sheets give these companies a capacity for writing a certain amount of business. When risk adjusted returns are insufficient within preferred business lines, an insurer can reinsure other insurers liabilities for a modest return.

Balance Sheet

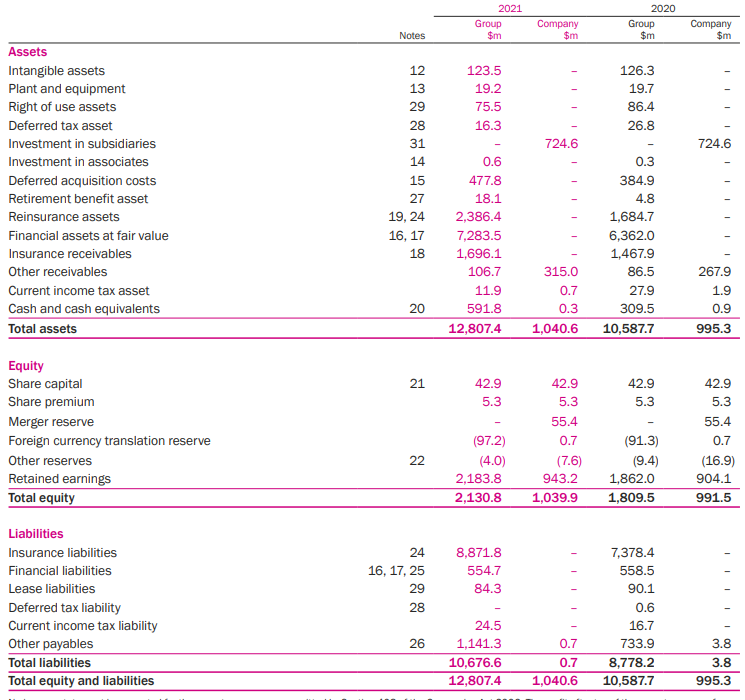

Insurance company balance sheets, like bank balance sheets are confusing. The figures you will see are often very large compared to value. There is a part of them that look like normal (non-financial) businesses, that is to say property, plant & equipment and working capital, but this is dwarfed by financial assets and liabilities. Before looking at Beazley’s balance sheet, it is worth thinking about what you should expect to see. An insurance company has financing capital, largely in the form of equity, that forms its basis. Depending on the types of risk it is taking, this financing capital determines how much business the company can ‘write’ i.e. how much it can insure per annum. This written insurance business is found on its liabilities and is the key determinant of the ‘quality’ of the business. Much like banks, insurance companies are unusual in that they have commoditised assets but non-commoditised liabilities. Its quality is determined by the skill of the underwriting teams, the Chief Underwriter and the culture fostered in the group.

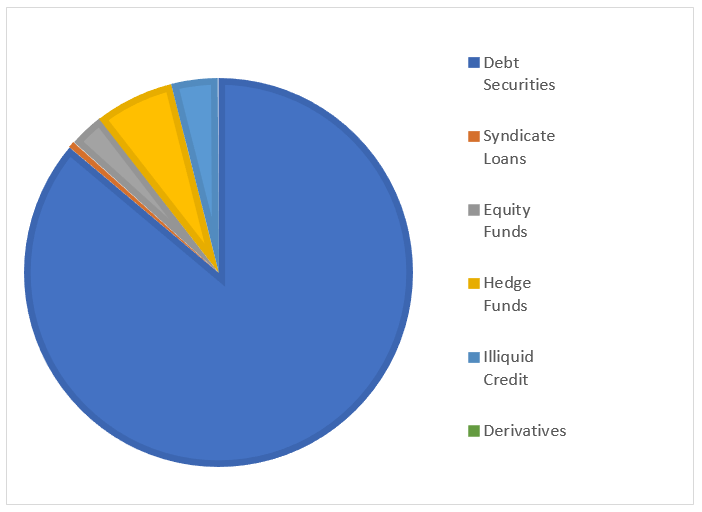

On the assets side, the company lists what it invests its insurance premia into – sometimes known as the float. These are, broadly speaking, split into three:

- Financial Assets – mostly short duration fixed income with a maturity profile that largely matches the expected outflows from insurance claims but also other assets that may generate higher returns and are unlikely to be need to satisfy claims.

- Reinsurance Assets – This is when Beazley insures its own insurance portfolio with other large (Re)Insurers such as MunichRe. It allows the business to free up capital when demand is higher at the expense of a portion of the return.

- Insurance Receivables – these are monies due to Beazley from third party insurers brokers who, in effect, utilise Beazley’s balance sheet for insurance business outside of Beazley directly. Property and Casualty insurance is typically done for short periods of time (annually) with renewals. Consequently, insurance receivables tend to be almost entirely short term.

There is a fourth position called Deferred Acquisition Costs, which are the costs incurred for the renewal of insurance policies. it is fees expected to be paid in the future but not yet received. As an asset it is a use of capital, but reflects money yet to be received.

In summary, an insurance company has a capital position, that capital position allows it to insure third parties, those third parties give the insurance company money (premia), that money is invested and as insurance claims are made those investments are liquidated to satisfy these claims. Below is the balance sheet of Beazley as of December 31st 2021.

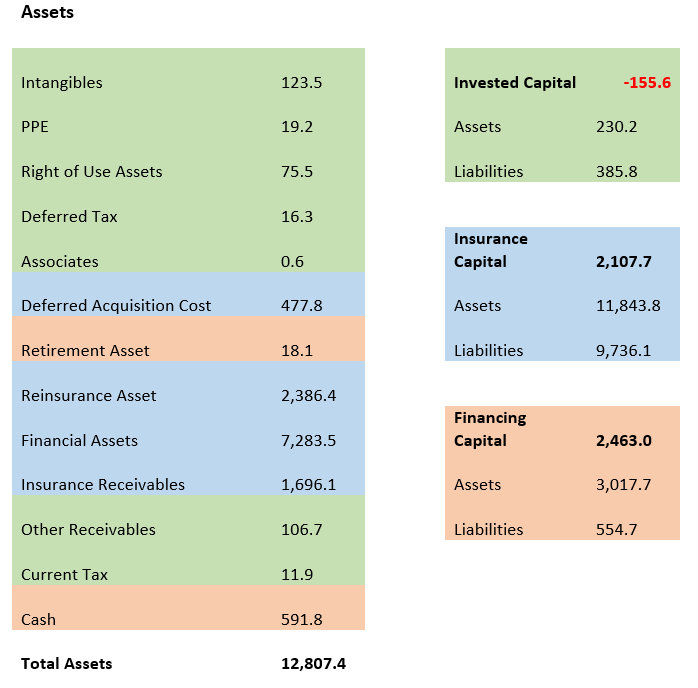

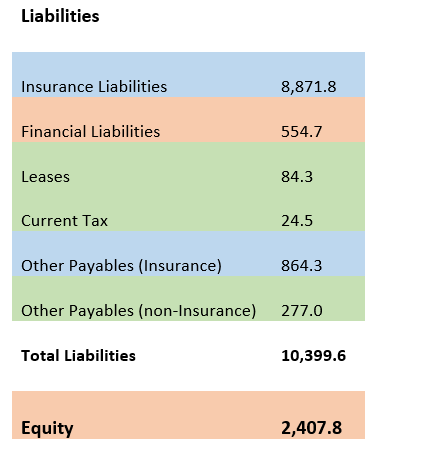

Below is our simplified summary:

Here we see that the business is a negative invested capital (green bits) business before insurance capital is considered. This makes sense, an insurance company is little more than an office, a bit of equipment and some staff. Many costs are paid in arrears (including remuneration) hence liabilities are larger than assets. On a net basis, the business is largely funded through equity (orange bits). This is both sensible and a regulatory imperative since in very bad loss years, a large debt pile can (and will) bankrupt an insurer. The gross size of the insurance business (blue bits) is determined by the financial strength of the company. We only get an indication of this strength from the balance sheet and need to delve slightly deeper to understand its robustness.

Solvency 2

Solvency 2 is a wide-ranging set of regulations that intend to maintain systemic strength in insurance markets. It is similar to what the various Basel regulations etc aim at achieving within banking. It includes proscribed capital requirements for companies referred to as the Solvency Capital Requirement (SCR). Under the regime, insurance companies are required to hold sufficient capital to ensure it can meet all of its obligations with a 99.5% confidence over a 12-month period. In other words, the amount of money capital needed to pay-out in the event of a 1 in 200-year loss year (think of a year with a massive earthquake in a high value area). Insurance companies report their Solvency 2 capital levels in reference to this requirement e.g if a company reported a Solvency 2 of 120%, it would mean it has sufficient capital to pay out all of its liabilities in the worst year in a 200-year period and still have 20% left over.

Additional to this, certain Lloyd’s companies target an Enhance Capital Requirement to further strengthen the industry, which is roughly 35% higher than the SCR; this is in order to help maintain Lloyd’s credit rating. Over and above this, Beazley targets a level of capital between 15% and 25% higher still.

Insurance, by its nature, is uncertain but in line with a conservative manner of balance sheet management, Lloyd’s of London requires its syndicates to maintain robust financial health; in turn Beazley adds further constraints upon itself adding greater financial strength.

Financial strength in insurance companies is important because the greatest returns are available when capital is most constrained. Typically, capital is most constrained following large loss years. By having sufficient strength prior to large loss years, insurers can capitalise in the aftermath as competitors, with weaker balance sheets are forced to withdraw.

Profitability

Insurance companies make money in two ways:

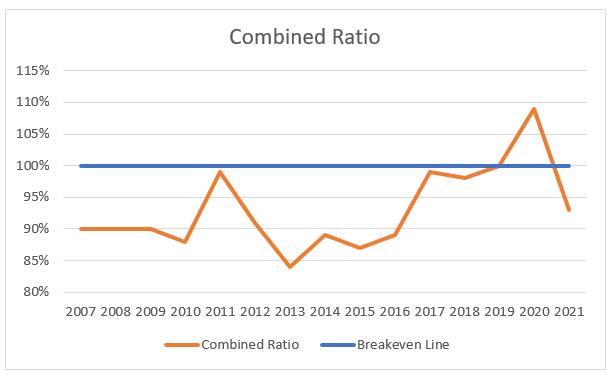

- By writing insurance well. This means that the insurance premia are larger than the losses expected in a typical year from insurance claims. In a ‘strong’ insurance market, insurance companies will be largely writing profitable business i.e. when capital is scarce/constrained. In a ‘weak’ market, most insurers will be writing loss making business i.e. when capital is abundant. The measure used here is called the Combined Ratio, which is incurred losses + expenses as a proportion of earned premium. Therefore, a Combined Ratio of less than 100% indicates profitable insurance environment and greater than 100% means a loss-making insurance environment.

- Investment Returns. The insurance premia paid to insurance companies is effectively free financial capital (free in the sense that there is no interest due). It can therefore be invested in low-risk assets to earn a return. Insurance companies are competing against the rest of the capital market to maximise their return and as such, these assets returns are somewhat commoditised. Nevertheless, there are instances of insurance companies that have made much larger returns. The most famous of which is Berkshire Hathaway.

The insurance returns and investment returns combine to the total profit of the business. The key determinant though is the combined ratio. Below is the long-term combined ratio achieved at Beazley.

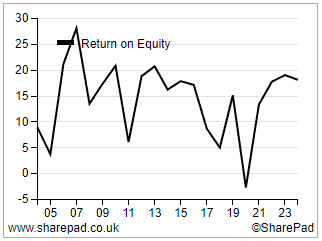

Historically, the company has generated decent returns. However, in line with much of the industry, returns since 2017 have been difficult as there has been an excess of capital in the sector as easy financial conditions has seen capital flood to anything that offers a positive return. In 2020, the business posted an insurance loss as COVID-19 caused a spike in claims. This led to a capital raising (roughly equal to COVID-19 related losses) very early on in the crisis (May 2020). The management anticipated that, given the widespread disruption, much capital will be lost and therefore the insurance market would ease markedly in the coming years. The result was that 2021 was the best year since 2016. The difficult markets we’ve witnessed in recent years can also be seen in the progression of Return on Equity, which over the long term has averaged 14% but has struggled since 2016.

Management

There is a low staff turnover within Beazley. The company was founded in the mid-80s and is only on its third CEO. Andrew Beazley stepped down in 2008, whilst battling the cancer to which he succumbed in 2010. He was replaced by the former CFO, Andrew Horton, who held the role until 2021 when he took up the equivalent role at QBE Insurance Group. He was replaced by Adrian Cox, who has been at Beazley for 21 years and is the former Chief Underwriter. Sally Lake joined the group as an actuary in 2006, becoming group actuary in 2014 followed by CFO.

Dividend

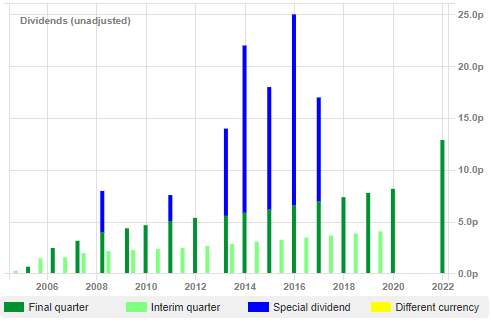

The company’s uninterrupted dividend record ended in 2020 when it was cancelled (understandably). Overall, the policy is to raise the dividend in line with the level of growth that management believe is sustainable in the business supplemented with special dividends when capital is excessive.

Diversification

Non-life insurance markets follow a different cycle to other equities. Insurance is a necessity and thus whether business can be written or not is not really what investors should be asking themselves. Instead, insurance returns are driven by how easy financial conditions are. Equities, bonds and any number of other assets are best suited to the opposite conditions. That is to say easy capital means high prices but low insurance returns. Difficult capital conditions are bad for asset prices but mean that insurers tend to generate better returns.

We appear to be at an inflexion, whereby inflation expectations might finally see a return monetary tightening. Asset prices are vulnerable in this situation as capital is withdrawn. However, an investment in an insurer may help offset this as the industry becomes more profitable.

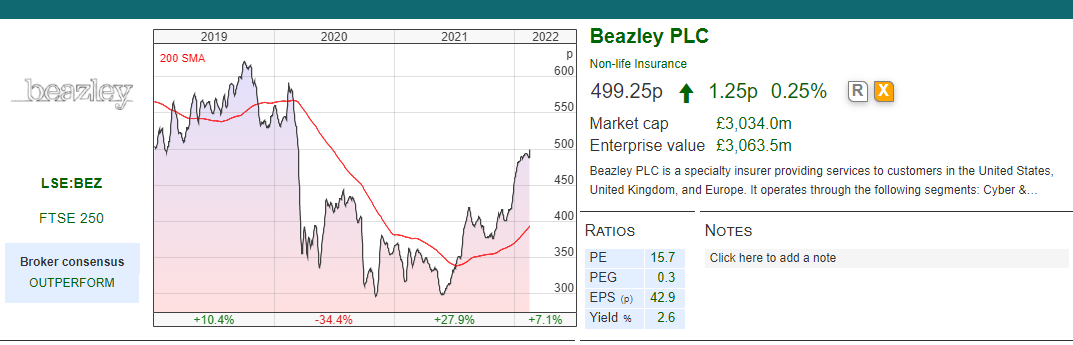

Valuation

Beazley has a long track record of growth, niche expertise and, seemingly a good culture. Its return on equity, dividend track record and business lines ought to provide a runway for profitable growth. Recently, the company has released well received figures, which has seen the share price move higher. Consequently, the shares are trading at roughly twice its tangible book value having been available much lower for much of the last two years. This seems high(ish) for a 14% ROE business, however were the business to grow its capital base in line with its history, it is entirely feasible it will more than grow into that valuation, especially if a higher return environment emerges.

Jamie Ward

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Hi Jamie,

A very detailed review; thanks. I’ve been a fan of Beazley since 2015 and a shareholder for most of that period, so it’s nice to see someone else’s thoughts on this company and a sector (specialist insurers) that doesn’t get a lot of coverage.

I think your point about the internally-hired CEOs and the length of their tenure really get to the heart of what makes Beazley special: Its people and culture.

The only thing I would add is that Beazley’s cyber business is doing exceptionally well and has really taken off over the last year or two, largely thanks to the ransomware epidemic.

Beazley’s ownership of Lodestone (https://lodestone.com) cyber security services is interesting because it gives Beazley the ability to do pre-underwriting work, i.e. help clients reduce their exposure to cybercrime which is of course what the client wants and it obviously reduces the claims that Beazley has to pay.

Also, cyber premium rates have gone through the roof in response to the skyrocketing number and size of claims.

After massive insurance industry losses during the pandemic, the next few years could be interesting and I intend to hold on as long as the valuation doesn’t get silly.

John

Hi John,

Very good point about Cyber, I had started writing a lot more about it, but felt I was going down a bit of a rabbit hole. It was beginning to get a bit long. The older I get, the more I think all business analysis should focus on culture as a start before moving on to the financial stuff.

Hiscox has a similar culture but with different specializations. Fascinating sector but I think a lot of people become a little intimidated by the apparent complexity.

Best

Jamie