Beeks Financial Cloud offers investors a convincing growth story backed by recurring revenue balanced by hefty expenditure and a racy valuation. Maynard Paton weighs up the pros and cons.

Every share has a bull case and a bear case.

Our job as investors should be to consider the arguments from both sides, and decide which is the stronger before buying or selling.

Beeks Financial Cloud is a good example of a company with distinct pros and cons:

For the bull case, the cloud-computing specialist offers:

- A strong competitive position in a fast-growing industry;

- A wonderful revenue history created by recurring customer payments, and;

- Shareholder-friendly management led by a ‘thin cat’ entrepreneur.

But for the bear case:

- Past growth has required substantial investment and extra funding;

- The underlying economics of the business remain unclear at best, and;

- Plenty of future expansion is already priced into the shares.

Let’s take a closer look.

The bull case for Beeks

Beeks’ website boasts a tantalising bull case for prospective shareholders.

A significant attraction is the company’s direct exposure to an industry enjoying structural growth:

“Beeks Financial Cloud plc is ideally positioned to benefit from long-term trends towards cloud-computing within the Financial Services industry with a proven ability to expand into the Tier 1 market.

Dependable customers and economies of scale are also offered:

“Beeks is an established, profitable and growing business with strong relationships and a reliable client base. We have invested in our core infrastructure so that we can scale the business significantly on our current operational asset base.”

And there’s a possible ‘moat’ based upon “cross-connects“:

“Our principal strategy is to grow our institutional customer base in the institutional Forex and Futures markets. We have an established customer base in both markets and a strong competitive advantage through the breadth of our cross-connects to trading venues, the sophistication of our self-service web portal and the breadth of our services.”

A “cross-connect” is a fibre-optic cable within a data centre that links two servers together. These cables ensure much faster communication compared to servers connected through a wide area network or the public internet.

Connection speed is all-important for Beeks. Customers pay Beeks to host their algorithmic-trading software on the group’s servers, and super-fast data is essential for successful trading when prices move every millisecond.

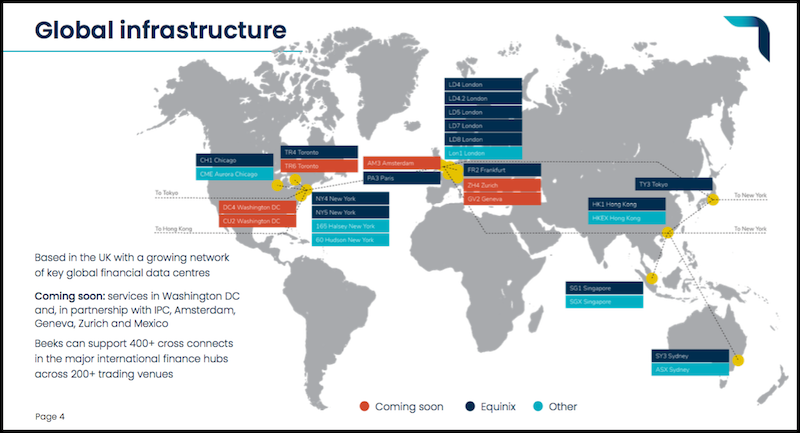

Beeks has servers installed within 22 data centres operated by various financial exchanges, and claims to be “one of the few companies in the world that can build, connect and analyse” the super-fast “cross-connects” required for institutional trading:

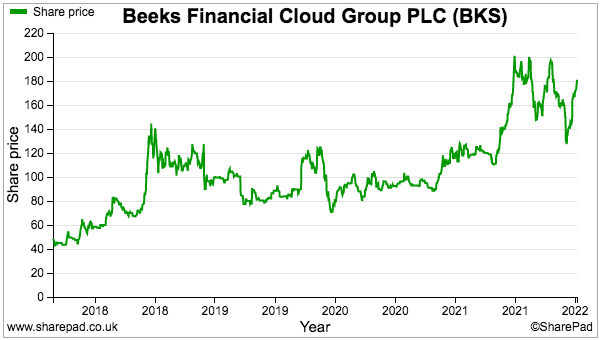

Beeks joined AIM during 2017 and the shares have since rallied from an initial 50p to 180p to support an effective £118 million market cap:

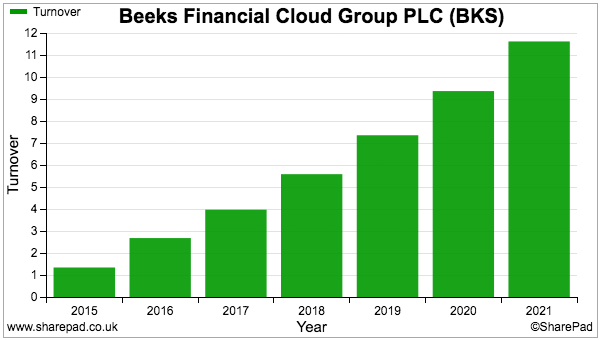

Driving the shares higher have been new servers attracting new customers to deliver this lovely upwards revenue chart:

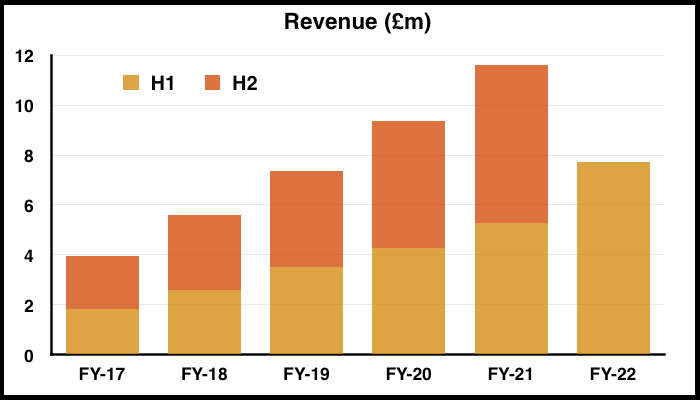

Beeks’ top-line growth has been impressively consistent. My spreadsheet chart below shows sales during every six-month period since flotation improving on the preceding six months:

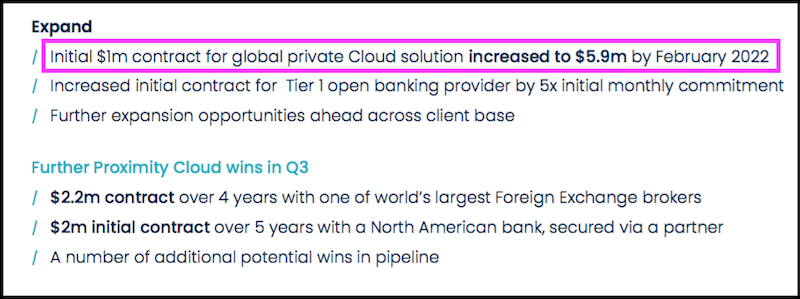

Capturing ‘tier 1′ institutional customers has underpinned Beeks’ progress.

The company’s early success was founded upon serving smaller clients that joined on plans costing less than £10,000 a year. But today Beeks serves larger financial institutions with initial contracts of $1 million that have scope to increase to $5.9 million:

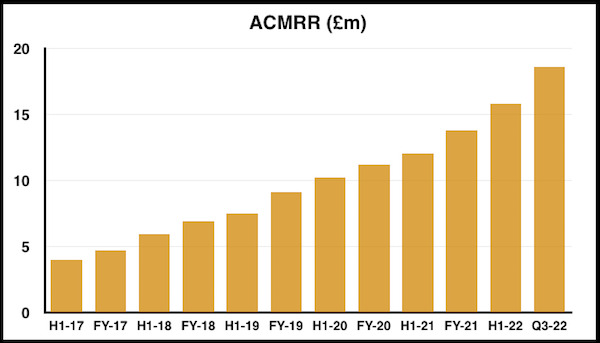

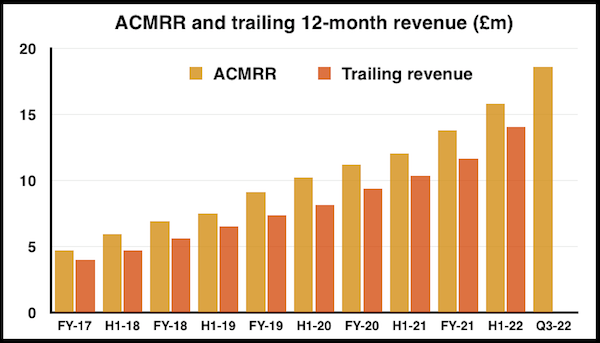

Notable contracts are currently rolling in, which led to Beeks announcing last month that annualised committed monthly recurring revenue (ACMRR) had reached almost £19 million:

And where ACMRR leads, reported revenue eventually follows:

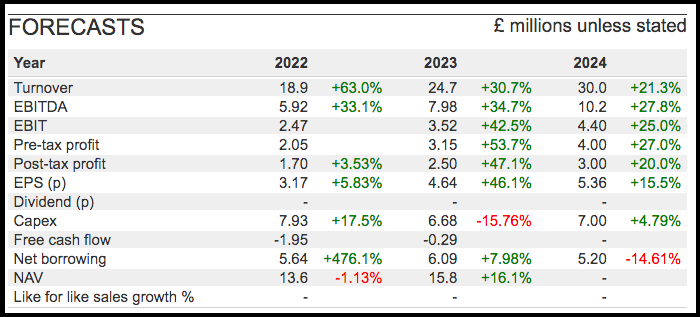

Forecasts for the next few years are therefore bullish…

… and broker projections are buoyed by talk of serving up to 5,000 larger customers (versus a handful today) alongside new “unique” products:

Note that management is even more optimistic than the City forecasts.

Speaking during a results webinar last month, chief executive Gordon McArthur said the sales projections of £25 million for 2023 and £30 million for 2024 “do not look too much of a stretch“.

Mr McArthur intriguingly added: “We have internal forecasts that are higher than that“.

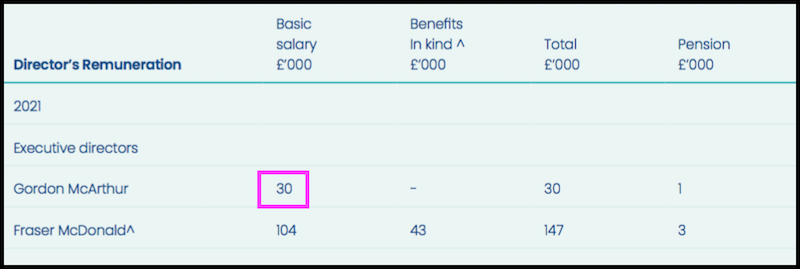

Mr McArthur is the type of owner-orientated chief exec you might like. He founded the business, retains an effective 38%/£45 million shareholding and collects one of the most ‘thin cat’ pay packets on AIM:

Mr McArthur’s basic salary for 2021 was just £30,000 versus £60,000 for 2020, £67,000 for 2019 and £85,000 for 2018. I doubt there are many AIM executives that have accepted similar wage reductions of late.

Mr McArthur has never collected a bonus since the flotation and neither does he own any options.

The bear case for Beeks

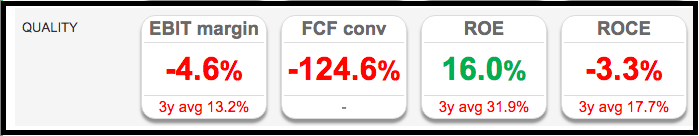

SharePad’s ‘quality’ ratios indicate Beeks’ financials are not without drawbacks:

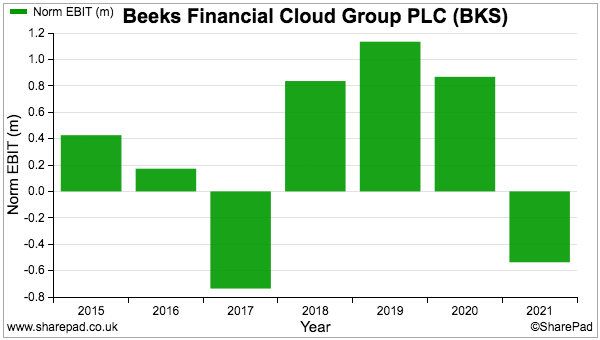

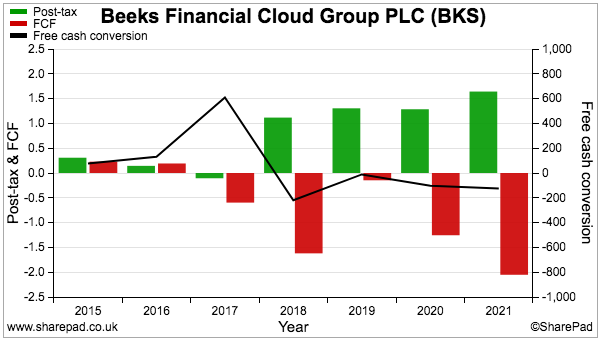

In particular, that lovely upwards revenue chart has not translated into a lovely upward profit chart:

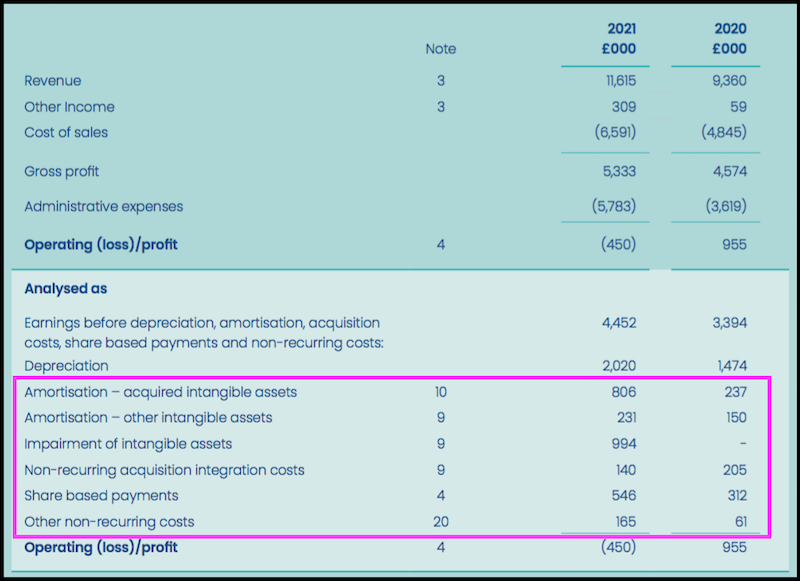

Bear in mind Beeks’ profit is subject to several adjustments, including regular ‘non-recurring’ costs:

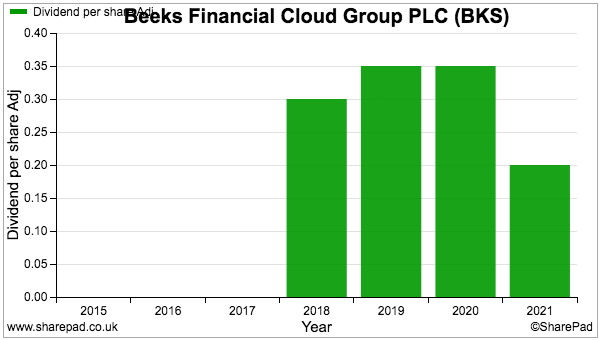

Oh, and the dividend was stopped last year and is no longer being paid:

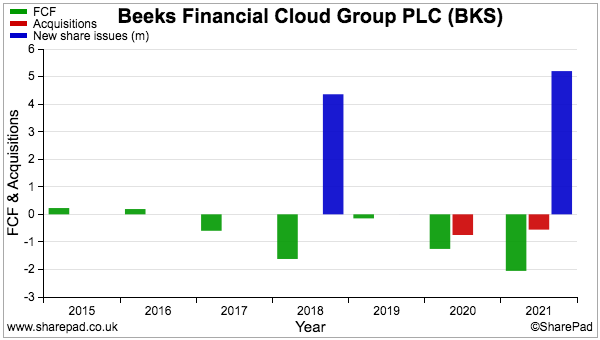

The payout cessation follows Beeks’ hefty investment in new servers that has led to negative free cash flow throughout the last five years:

The expenditure has been funded by the £4 million raised at the flotation and the £5 million raised from new shares issued last year:

A further £15 million was raised through new shares earlier this month. Beeks said this extra money would be employed to “accelerate the Company’s growth strategy and capitalise on the significant market opportunity and solid sales pipeline“.

The latest fund-raising should also appease Barclays, the group’s lender. The ‘going concern’ small-print within March’s interims revealed a banking covenant breach:

“The directors are of the opinion that the Group can operate within their current debt facilities and comply with its new banking covenants which are being realigned in conjunction with the bank and updated forecasts. Given the accelerated investment profile over the past period, there was a cash covenant breach in December but this was discussed and agreed beforehand with the bank who were kept fully informed and supported the business by providing a waiver.”

Despite the breach, the same results described net debt as “comfortable“:

“Net debt remains at comfortable levels at 1 times annualised underlying EBITDA.”

All told, Beeks’ super-smooth revenue growth has clearly not come cheap with aggregate free cash flow at a negative £6 million since 2017.

Plus the underlying economics of the business (e.g. profit margins, return on capital employed and so on) have yet to become obvious — let alone become obviously superior.

Could Beeks enjoy superior economics in the future?

I’m not sure.

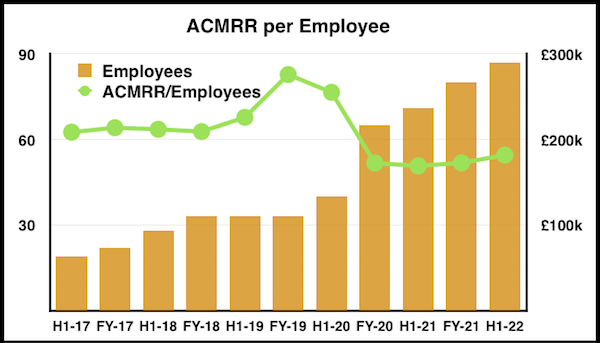

The workforce has not really demonstrated the productivity qualities of a truly scalable business. Those bumper ‘tier 1’ contracts have generated greater ACMRR, but those contracts have also required a proportionally greater number of employees:

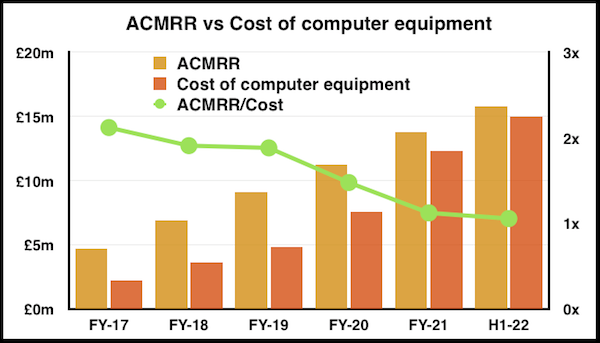

The trend is worse when comparing ACMRR to the historical cost of the computer equipment purchased:

Back in 2017, Beeks’ owned computer equipment with a £2.2 million historical cost while stated ACMRR was then more than double that cost at £4.7 million.

Fast forward to last month’s interim results, and computer equipment with a £15.0m historical cost compares to ACMRR of £15.8 million.

Expenditure on new equipment has grown much faster than ACMRR, which is not ideal and might actually be evidence of ‘dis-economies’ of scale. I had hoped this business would be showing ACMRR increasing at least as fast as the total cost of the equipment employed.

The adverse trends in my charts above may be due to the changing client mix.

Early Beeks customers were small traders that could be handled using a low number of shared servers. Recent customers in contrast are larger institutions with more demanding employee and equipment requirements.

And the demanding requirements look set to become even more demanding.

Customers using Beeks’ new Proximity Cloud service for example insist upon servers located in their own data centres with bespoke setups — which no doubt require greater manpower and expenditure from Beeks to get up and running.

Still, those big contracts are now coming through that will push ACMRR even higher… and perhaps those green trend lines on my charts above will eventually revert to past levels.

But for now I can only surmise the ‘tier 1’ contracts require much greater upfront resources — and I feel the correlation between revenue versus the cost of new equipment remains unclear at best.

Valuation and summary

Beeks’ valuation forms part of the bear case, at least in the short term. The effective £118 million market cap compares to a predicted £3 million profit for 2024 to give a racy 39x P/E multiple.

But the 180p shares may well offer worthwhile upside over the longer term. Assuming for instance the next ten years sees:

- Revenue grow more than six-fold to £125 million;

- The operating margin climb to 20%, to give a £25 million profit;

- Tax applied at 25%, to give earnings of £19 million, and;

- The shares trade at 25x earnings…

… the market cap would expand to £475 million to deliver a 15% compound annual return by 2032.

However, long-term estimates projecting revenue of £100-plus million must consider the extra capital investment to support such growth.

To date Beeks has spent £15 million on equipment to attract ACMRR of almost £20 million… so could the additional investment required total a further £50 million or more?

Bear in mind the sums may have to include the extra cost of revamping the existing network with upgraded equipment (the accounts show the useful life of the servers to be five years).

All I can really conclude from judging both sides of the Beeks story is the share price presently reflects the bull case. But the accounting evidence to date is not overwhelmingly persuasive towards the business model, and a lot of trust is needed for Beeks to one day deliver the free cash today’s market cap expects.

I therefore confess to favouring the bear case.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and hosts an investment discussion forum at quidisq.com. He does not own shares in Beeks Financial Cloud.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

I really enjoyed that Maynard.

I’m a shareholder in BKS, and it’s good to have cold water thrown over the bull case, particularly in a clear manner like that. The capital costs of BKS setting up new clients is certainly becoming more of a concern over the last 6-12 months, but the overriding (bull) idea is that the capital costs will at some point reduce drastically (similar to heavy marketing spend for consumer facing online businesses being dialled down when the business is much more mature), and at that point the lovely free cash flow and profit flows through from the (by that point) high levels of ACMRR.

Anecdotally, these big banks are incredibly hard to get in to, but once you’re in it’s very sticky business. I’ve seen similar things in other big corporates, even though the product is dreadful it’s easier to just keep going than roll out a new product. As I understand the potential growth in this market to be big, then capital costs will probably stay high for for a while, and we will have to see what happens to the share count in that time. They mentioned in the results webinar that they have other sources of funding – although they would say that.

I remain a bull.

Thanks

Chris

Thanks Chris, glad you enjoyed the article. I can imagine banks are very reluctant to swap providers, but once in as you say that reluctance can then provide a sticky income. Superior economics of this business have yet to really emerge, but I can imagine one day contracts from existing customers could be significantly enhanced with little additional capex requirements from BKS. Those days are what the share price expects currently I think.

Maynard

I really enjoyed that Maynard.

I’m a shareholder in BKS, and it’s good to have cold water thrown over the bull case, particularly in a clear manner like that. The capital costs of BKS setting up new clients is certainly becoming more of a concern over the last 6-12 months, but the overriding (bull) idea is that the capital costs will at some point reduce drastically (similar to heavy marketing spend for consumer facing online businesses being dialled down when the business is much more mature), and at that point the lovely free cash flow and profit flows through from the (by that point) high levels of ACMRR.

Anecdotally, these big banks are incredibly hard to get in to, but once you’re in it’s very sticky business. I’ve seen similar things in other big corporates, even though the product is dreadful it’s easier to just keep going than roll out a new product. As I understand the potential growth in this market to be big, then capital costs will probably stay high for for a while, and we will have to see what happens to the share count in that time. They mentioned in the results webinar that they have other sources of funding – although they would say that.

I remain a bull.

Thanks

Chris

Maynard I very much appreciate the quality and depth of your analysis. I have been a holder since 2018. I agree that the main investment issue is, can Beeks convert its investment into cash and when? However the bull case could be stronger than you have portrayed. BKS is in the process of creating a market for low latency private cloud on a global scale specifically for the larger financial companies. This is at a time when global institutions, such as Amazon with AWS and Hewlett Packard with HPE, are expanding into general financial services through their existing system of servers. In contrast, Beeks is successfully addressing the core elements of the global financial world, i.e. the brokers, banks, insurance companies and exchanges with a range of products specific to their needs for low latency private trading. It is no surprise that such rapid innovative expansion needs substantial investment from virtually a standing start. It could be a long haul but the next two years or so should show the strength of their offering and whether they can convert it into cash. I remain a bull. Roger

Hi Roger, glad you appreciated the article. Yes, the new unique Proximity Cloud service could be a real money-spinner. But how much upfront investment will be needed to maximise this opportunity is not clear, and a lot of the potential already seems priced into the shares. But we shall see. Will be fascinating to see how Beeks evolves and whether the true ‘scalable’ economics of the business begin to emerge during the next few years!

Maynard