Welcome to the new look funds focus where we shine a spotlight on some of the most interesting, listed funds on the London market, be they actively managed investment trusts (and closed-end funds) or index tracking exchange traded funds (otherwise known as ETFs). In each article, I’m going to try and pull together four very distinct fund ideas which should appeal to a wide variety of investors, be they beginners, the income hungry or even the adventurous. In most cases, you’ll be able to find out more about these ideas over in my regular Adventurous investing newsletter at davidstevenson.substack.com.

Worth researching? Ecofin Global Utilities

My overall macro view is that the US and UK markets are dangerously unstable with more volatility to come as investors realise that we are entering a recession, which tends to imply lower corporate earnings. At a more meta level, investors are also unsure of how to think through valuations in a more inflationary era. I have no idea how long this bout of turbulence will last – punctuated by frequent market rallies – but in the US at least I think we might be closer to the trough than we were to the peak.

In these uncertain markets, it’s important to seek out defensive sectors and funds which can provide some defensive qualities, and top of that list comes the utilities sector. Traditionally I would have suggested the listed infrastructure space as a defensive safe haven but yields in this space are low and premiums still stubbornly high. Utility stocks are less stable and open to outside policy pressure but there’s also some real potential for upside.

The Ecofin Global Utilities and Infrastructure fund combine the best of both worlds. It boasts a large slug of quality utility stocks plus a decent slug (around 25%) of exposure to direct infrastructure companies. Crucially many of the businesses in its portfolio should be the direct beneficiaries of heightened inflation over the medium term. Fund analysts at broker Stiefel put a little more flesh on the bones of this pro-inflation argument. They reckon that “as well as benefiting from high power prices, many of the portfolio companies [ in the Ecofin portfolio] benefit from inflation in three ways:

1) Inflation indexation – Most of the portfolio benefits from regulated contracted cash flows which are directly or indirectly indexed to inflation. For example companies such as Tern and National GRID.

2) Essential infrastructure with pricing power – some companies without indexation still have pricing power operating essential infrastructure e.g. Veolia, Drax and Ferrovial.

3) Margin expansion – power generators generally see their margins expand in periods of inflation due to positive exposure to commodity prices. RWE and Exelon are two companies falling into this category.

Now it’s important to say that I don’t want to over-egg the case for Ecofin and utility stocks generally. There are some obvious risks that I’m sure the adventurous type can work out all by themselves: windfall taxes, increasing interest rates impacting leveraged balance sheets, increasing cost pressures, the need for massive CapEx cutting into dividend payouts, recession crimping demand. And those dastardly Russians could cause German and Italian utility carnage by shutting off the Nord Stream 1 tap.

Basic Fund Facts

Ecofin Global Utilities and Infrastructure Trust plc

Ticker – EGL

Share price 209p

NAV 216p

Discount 3.34%

Net assets £229m

YTD returns +9.7%

1 year returns 24.8%

Yield 3.5%

Portfolio Geography: US 39%, Cont Europe 41%

Portfolio sector mix : Integrated Utilities 34%, Renewables 25%, regulated utilities 25%

Quoted Data (paid for) research report

https://uk.ecofininvest.com/media/4852/egl-annual-overview-by-marten-co-28-october-2021.pdf

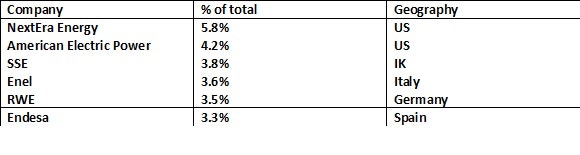

Top ten holdings

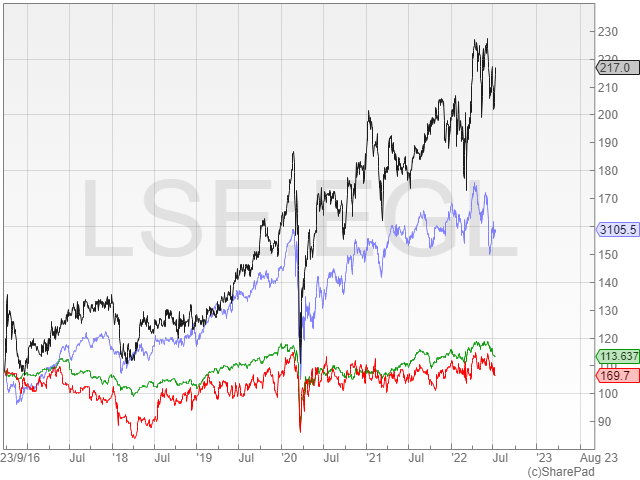

In terms of performance metrics, the Ecofin fund has also been fairly successful in recent years. It’s up 9.7% year to date while most everything else is down. Over 1 year it’s up 24%. And the chart below shows that over the last six years the Ecofin fund has trounced the opposition. Ecofin is the black line, while the nearest ETF equivalent (from Deutsche XTrackers) is in blue. From the infrastructure space, I have added the classic infra bellwether stock HICL in red and the excellent VT Gravis UK Infra fund in green.

Graph colours :

Ecofin in Black

Xtrackers MSCI World Utilities UCITS ETF (XDMU) in Blue

VT Gravis UK Infrastructure Income Fund 1 in Green

HICL in Red

Based on current prices, the fund is on a 3.5% yield and a 3.3% discount. I think there’s more to go for this defensive fund in these uncertain markets and I can see the fund potentially trading at a small premium if volatility increases. If the fund can return 10% total returns in the next 12 months (3.5% yield plus a 6% price increase which could include a 3 to 4% discount compression) I’d be delighted. I’d have a 225p price target for the next year (assumes a very low 5% NAV increase), plus a 7p (I think) dividend

Income and discount play – Taylor Maritime Investments

Taylor Maritime along with Tufton Oceanic represent the vanguard of a renewed interest in shipping amongst equity investors. TMI is not a traditional shipping company, but rather a fund that invests in a portfolio of ships which are then hired out on leases that last anything between a few months and a few years. Just to confuse matters it’s also a big shareholder in a NASDAQ-listed shipping company called Grindrod (it holds a 22% stake) which owns a modern fleet of 31 dry bulk vessels. Taylor Maritime’s core portfolio consists of mid-sized, handysize bulk carriers. The fund raised an initial $254m at IPO in May last year followed by subsequent placings which helped it to buy a fleet of 31 vessels. It currently owns 27 ships as a result of an active ship trading strategy – five vessels have been sold since IPO, generating an average 116% IRR and an average return on capital invested of1.6x. The fleet average net charter rate is currently c.$19k per day, with an average duration of seven months and an average gross unlevered yield in excess of 25% pa. The average age of the fleet is 11.4 years. Recent annual results showed that NAV per share was at $1.74, dividend cover was 4.3x in the period with total dividends declared for the period from IPO to 31 March 2022 8.47 cents per share.

The current regular yield is running at around 5.3% but investors have also benefitted from a steady increase in net asset value, yet the discount per share has widened out to around 25%. I think this discount is too high, even if you assume that shipping rates are about to fall very sharply – which they aren’t for the ships Taylor Maritime currently charters out. Add in a successful ship trading strategy plus that equity holding in cheap as chips shipping company Grindrod, and you have a cheap income stock with a decent chance of a discount narrowing.

Left field – NFT Investments

It’s obvious that the bottom has fallen out of the cryptocurrency market and that many bits of the digital assets spectrum have turned into no-go zones for sensible investors. But some of the businesses set up in the crypto boom still offer adventurous investors some potential for upside. Top of that list is Aquis quoted NFT Investments. This listed just last year at 5p a share and has seen its share price go south virtually non-stop. NFT Investments invests in non-fungible tokens. I wrote a long column about this highly speculative space a year ago in the Financial Times – you can read the article HERE. I stand by most of what I said and I still think there is a remarkable opportunity in NFTs and collectables/emotional assets. But that is almost beside the point with this fund.

According to the Aquis page, the fund is currently valued at £10.2 million, with the share price at 1.05p. Yet the fund also has a net asset value of £34.38m or 3.43p with cash amounting to £21.9m. There’s also a total NAV for crypto investments of £12.5m. Now let’s assume those investments are worth zero and lets further assume that cash burn from administrative expenses carries on running at around £1.2m pa, we still have a disjuncture – the shares are currently trading at something like 50% to 45% (depending on admin cash burn) of net cash value. And who knows some of those crypto investments might actually be worth something.

Fund basics:

· Fund website :

· The Company’s shares are traded on the Access segment of Aquis Stock Exchange Growth Market (TIDM) under the symbol: NFT

· ISIN: GB00BMW34204; SEDOL: BMW3420; Legal Entity Identifier: 984500E15WF052FFEB19

· Raised £35m before expenses through a flotation on the Aquis Stock Exchange Growth Market (“AQSE”), a record for AQSE, on 16 April 2021.

· Made seven investments and one exit in early-stage growth technology and media businesses engaged in NFTs and digital assets totalling approximately £5.8m.

ETF ideas – Short pound, long dollar

Wisdom Tree Europe is a successful ETF business which issues, you a variety of exchange-traded funds, commodities and currencies. The latter – the currencies – come under its platform which in effect offers investors a structured note which promises to pay a return based on a key spot price. This is incredibly useful for complex traded commodities and currencies where most normal trading is done via futures contracts – which are themselves complicated beasts.

I want to focus on the currency platform because I think some of the products do offer investors access to safe havens which can be useful in uncertain times. I first though want to emphasise that FX or currency trading is largely a fools errand. I know of some hedge fund managers who can make a go of it but in my experience, short-term FX trading offers even worse odds that a roulette wheel.

But there are a few very broad trades where if one has a big picture view, you can invest sensibly. I want to highlight what I think has been, and will continue to be, an obvious trade: sterling is weak and getting weaker, especially against a resurgent dollar. The reasons behind the dollar’s strength is obvious – the dollar is a safe haven in volatile times and the US Federal reserve is now aggressively increasing interest rates.

By contrast, our Bank of England has been slow to react and even slower to raise interest rates. I won’t labour the obvious macro-economic headwinds the UK is suffering, suffice to say that UK inflation rates are some of the worst in the developed world and we also boast some of the slowest growth rates. And of course, our political system is a paragon of stability!

So the cable rate – the dollar sterling rate – has taken the strain, and sterling has continued to weaken. Wisdom Tree Europe offers a relatively uncomplicated exchange-traded currency which is long the US Dollar and short sterling. Its ticker name is GBUS and the index tracker charges 0.39% a year in expenses. Year to date it is up 14.37%. My own sense is that this depreciation of sterling has further to go, and we could see $1.15 or even $1.10 tested. If you are really convinced of this trade you could even look at a product with the ticker USP3, which leverages this trade up by 3 times – 3x Long USD, Short GBP (ticker USP3, TER 0.98%). Year to date this is up 47.80%

David Stevenson

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.