One way to invest during the pandemic is to consider shares that have climbed higher as the market has dropped. Such companies may well be ‘safe havens’ — businesses that are coping well with the lockdown, or perhaps even benefitting from the crisis. I applied the following simple criteria within SharePad to identify potential ‘pandemic-proof’ […]

Category: Company analysis

In search of the cash kings

While the stock market and the pandemic may have stabilised, I’m still thinking about financially strong firms. We never know when the next shock will happen, and a cash cushion gives us confidence a company will make it through when revenue melts away. I spent the last two articles experimenting with filters to find financially […]

Filtering for financial fortresses

The conclusion of my last article on finding companies with strong finances contained two caveats. Companies with seasonal cash flows can look like they have strong finances at the end of the financial year, when they report, but be weaker at other times during the financial year. Also, strong finances are not necessarily the result […]

Putting safety first

Funny thing (peculiar, not ha! ha!). Search SharePad news for the phrase “strong balance sheet” and there are dozens of companies every day confirming their finances are strong as they reflect on the prospect of reduced, or in some cases, no revenue for a while. Search SharePad news for the phrase “weak balance sheet” though […]

Getting more out of return on capital

How we measure return on capital depends on what we want to know: whether a company is good at making profit from its operations, or whether it is good at buying other businesses. As I write, the stockmarket is crashing. I have invested in strong businesses that should prosper through thick and thin, but that […]

Screening For My Next Long-Term Winner: AB Dynamics

Recent market ructions have sent many shares tumbling — and perhaps created some buying opportunities. Amid the mayhem, I devised a straightforward screen. I simply looked for decent-sized businesses that were still expected to grow, paid a dividend and were conservatively financed, too I applied the following criteria within SharePad to identify some respectable candidates: […]

Taking back control

Richard investigates Dialight, a supplier of industrial LED lighting that flared up ten years ago briefly setting the stock market alight, and subsequently dimmed alarmingly. What are its prospects now it is taking back control of manufacturing? Ten years ago Dialight was a feted, fast growing business in a booming industry, LED lighting, but it […]

XP POWER

Older readers may recall a distant era when electrical devices used to plug straight into the wall. Nowadays, everything electrical seems to need an annoying little box between it and the wall. That box is called a power supply and these are the business of XP Power. But not the annoying ones. XP doesn’t do […]

Screening For My Next Long-Term Winner: Boohoo

Cash flow movements can often indicate whether or not a business enjoys a powerful operational advantage. A strong business might: Receive customer payments upfront for goods/services it has yet to deliver, and/or; Pay suppliers months after goods/services have been received. However, a weak business might: Receive customer payments months after its goods/services have been delivered, […]

When bad news is good news

Richard investigates Vitec, which has reported some bad news in 2019. It could be an opportunity to buy shares in a high quality business at a low valuation. I don’t always follow up on reader suggestions, sometimes people recommend companies so repugnant it’s difficult to believe they have ever read a line of mine. But […]

Screening For My Next Long-Term Winner: Greggs

‘Run your winners’ is popular stock-market advice. Great companies often remain great investments for a lot longer than most people expect… … and can deliver life-changing rewards to anyone who refrains from selling out too soon. Where can we find potential winners to run? I thought the best performing shares of 2019 would provide a […]

Out with the old, in with the new

Richard enters 2020 with a cleaned-up SharePad setup primed to help him find companies developing competitive advantages. He expects it to make him a better long-term investor too. Happy New Year! As a full time writer/investor the festive season is the only set time in the year when I fully shut down. Like an ancient […]

Alpha FX speaks my language

In response to a reader’s suggestion, Richard investigates Alpha FX. It is exactly the kind of people-first business that could be building a long-term competitive advantage and consequently grow inexorably. As I was considering what to write about for my last article before the Christmas break, a present from a reader arrived in my inbox. […]

Screening For My Next Long-Term Winner: Mears

This article has not turned out as I had expected. I searched on SharePad for magnificent dividend histories, and thought I would be evaluating a business with glorious financials and tip-top management. I have instead ended up with accounting alarm bells and a dissident shareholder trying to oust the boardroom. The screen I applied in […]

The ultimate competitive advantage

Business schools identify the sources of competitive advantage that tie customers to companies and what they produce. Fundamentally though, there is only one true competitive advantage: people. If I could recommend one book for long-term investors, it would be “Intelligent Fanatics Project” by Sean Iddings and Ian Cassell, which is subtitled “How great leaders build […]

Screening For My Next Long-Term Winner: Dotdigital

Today I have returned to the share screen I employed to pinpoint Victrex earlier this year. To quickly recap, this screen applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE). The exact criteria I re-used were: 1) An operating margin (latest and 10-year average) of 20% or more, and; […]

Burberry joins “Future of Fashion” portfolio

In his quest for companies that control their own destinies, Richard discovers luxury fashion brand Burberry, a company whose products he is in no danger of buying. Last time, I promised to investigate one of the shares I found while filtering for vertically integrated companies, companies that control their own destinies because they control many […]

Screening For My Next Long-Term Winner: Rightmove

Studying free cash conversion is vital when evaluating a set of accounts. The measure compares free cash flow to reported earnings, and can indicate whether a business is a ‘cash fountain’ or a ‘cash guzzler’. Ideally we want to own companies that generate plenty of spare cash, because such cash can: * Underpin accounting profits; […]

Finding companies that control their own destinies

Fallout from the demise of Thomas Cook reminds Richard of the virtues of vertical integration. In the month since the demise of Thomas Cook, the company that invented package tours, there has been much talk of rivals who will benefit from the fact that perhaps 2.5m Thomas Cook customers will be looking elsewhere for their […]

KAINOS

THE SETTING Kainos (Greek for fresh, innovative) was launched in 1986 when the old British IT champion ICL recognised the quality of computer science graduates from Queen’s University Belfast. ICL had a new project involving electricity network analysis and Queen’s had just set up one of the first university incubator companies, Qubis, which was keen […]

What PZ Cussons’ cashflow tells us about its strategy

Having found PZ Cussons through his Keep It Simple, Stupid filter, Richard examines the company through its cash flow statement. To his delight, he finds a company promising to keep things simple too. Two weeks ago I augmented my Keep it Simple, Stupid filter to keep things even simpler. The filter is designed to rule […]

Screening For My Next Long-Term Winner: Medica

Dynamic growth shares are among the market’s most exciting investments. Find a business that has expanded rapidly and offers the prospect of further earnings growth — but also has an overlooked share price — and you could be on to a winner. Let’s use SharePad to pinpoint a possible example. Filter criteria These days many […]

Filtering out the big spenders

Richard invents a new filter that promises to weed out big acquirers in a drive for simplicity he hopes will make investigating his next company easier. Complications tend to keep investors awake at night and wakeful nights are not conducive to long-term investment. You join me today on a quest for simplicity. Keeping it simple […]

The future of holidays portfolio

Richard returns from his holiday and wonders whether he can put the experience to use by investing in holiday companies. First step: Create a portfolio of holiday companies. It is early September, so I am going to take a wild guess and assume you have been on holiday. Hopefully it was a good one. Mine […]

Why shorting is good for investors

Although I am much more of a trader myself as I rely on trading profits to pay my bills, I do think investors have much to be gained learning from the art of short selling stocks. There are several reasons that will be explained in this article, but first it is important to understand what […]

Screening For My Next Long-Term Winner: Hammerson

Buying a share at a discount to its book (or net asset) value ought to be the safest way of investing. Indeed, what could go wrong if you can effectively buy assets worth £1 per share for, say, 50p? The reality — sadly — is not always that simple. Let me show you what I […]

Hidden potential in new division

Richard analyses Bloomsbury Publishing’s segmental report to work out where the profit is coming from. The Harry Potter effect is still evident, but the company is conjuring up another source of profit without recourse to magic. My last article ended on something of a cliffhanger because I had found something out, but I did not […]

Finding the best companies to analyse

A wise man once advised investors to stick to their circle of competence. Richard uses SharePad to keep his eye on the prize, and it leads him to Bloomsbury Publishing… My base filter in SharePad currently returns a total of 596 shares listed in London. It does not do anything clever. It just excludes the […]

Screening For My Next Long-Term Winner: AG Barr

Quality companies undergoing temporary problems can often become attractive investment opportunities. On that basis, perhaps AG Barr is worth closer inspection. The soft-drinks manufacturer famous for Irn-Bru recently warned that profits would be lower than expected… and the share price plunged accordingly: However, AG Barr does boast a quality track record. During the last 40 […]

How to work out whether a firm is good acquirer

Richard uses a trick from Judges Scientific’s playbook to assess local hero Scientific Digital Imaging. Both companies acquire scientific instrument manufacturers using a “buy and build strategy”. Last month we worked out how to populate Google Maps with SharePad data to find local companies to invest in. Today, we will take the process a stage […]

Screening For My Next Long-Term Winner: Imperial Brands

Imagine this. You find a blue-chip company that offers: * 21 years of consecutive dividend increases, with the last ten years showing 10% per annum growth; * Management guidance of further 10% annual dividend growth “over the medium term”, and; * A share price with a 10% dividend yield. Too good to be true? Well, […]

The Future of Retail portfolio

Rule number one in investing is to buy what you know, but how does that work when what you know is changing day by day? Richard grapples with clothing and fashion retailers, who are themselves grappling with the emergence of the Internet. Just about every type of retailing is going through profound change thanks to […]

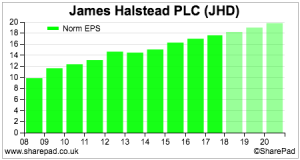

Screening For My Next Long-Term Winner: JD Sports Fashion

Today I am revisiting the share screen that pinpointed Games Workshop back in January. The shares of the quirky wargaming retailer have soared more than 60% since that review… …and I wonder whether the same screen can unearth another promising opportunity. To recap, the exact criteria I am re-using are: 1) Annualised earnings per share […]

Weekly commentary: 17/06/19

It’s “avoid the warnings” time Last week saw a few profit warnings. Somero, Ted Baker, Quiz, Pendragon warnings were based on revenue disappointments but I suspect cost pressures are building too at the moment. The trend of increasing warnings appears to be a growth trend with Q1 showing the highest number of warnings in this […]

Scapa has had a rocky three weeks. Its market capitalisation is down by 50%. Is it a buy?

THE SETTING After nine years of impressive revivification under CEO Heejae Chae, the specialist tapes maker Scapa has just delivered three tingling episodes in three weeks. It could have stabilised now but it’s worth well under half its starting price. Knock one came on the day of its annual results, 21 May. The results were […]

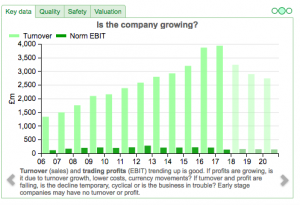

Checking the numbers match the story

One thing we should always check is that a company’s long-term performance matches the story it tells us. Churchill China says it is “adding value” to tableware, a horrible bit of jargon that is easily corroborated in SharePad. I received a nasty shock last time I reviewed one of my long-standing investments. Familiarity, I said, […]

Screening For My Next Long-Term Winner: Jupiter Fund Management

Today I have revisited a share screen that applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE). The exact criteria I re-used were: 1) An operating margin (latest and 10-year average) of 20% or more, and; 2) An ROE (latest and 10-year average) of 20% or more. Any business […]

Hidden treasure on your doorstep

Finding local businesses listed on the stock market is easy with the help of SharePad and Google Maps. Richard maps the market to find out what’s good in the ‘hood. When I wrote about Portmeirion last time, I promised to review a second “old favourite” in this article. In the meantime, though, I have been […]

Screening For My Next Long-Term Winner: Domino’s Pizza

This in-depth article covers one of the most impressive UK growth stocks of the last 20 years — Domino’s Pizza. Domino’s appeared on my radar after I revisited one of my previous SharePad screens. The screen in question searches for companies with dependable dividends and reasonable yields. The exact criteria are: 1) 10 or more […]

Portmeirion: When confidence crumbles

SharePad is not just about discovering new shares, it can help us see shares we are familiar with in a new light. Richard uses it to re-evaluate old favourite Portmeirion and his confidence begins to crumble even before events take a nasty turn… This week, and in a fortnight’s time, we will look at two […]

Screening For My Next Long-Term Winner: Abcam

Today I have returned to the share screen I employed to pinpoint Victrex the other week. To quickly recap, this screen applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE). The exact criteria I re-used were: 1) An operating margin (latest and 10-year average) of 20% or more, and; […]

Bodycote: A stalwart in cyclical clothing

Richard investigates a company that not only walks the walk, it talks the talk. I am not going to lie, even if it means shattering the illusion investors are cool rational calculating machines. I experienced a prolonged period of joy when I started investigating Bodycote. Snared by my Fundsmith filter, the company not only walks […]

Screening For My Next Long-Term Winner: Victrex

This week I am tracking down a potential long-term winner by employing two ratios favoured by ‘quality’ investors. The first measure is operating margin, which represents the percentage of sales converted into profit. In theory, a company exhibiting a high operating margin may enjoy pricing power over customers — which in turn may indicate a […]

Screening For My Next Long-Term Winner: Renishaw

I am convinced the very best shares to own are often led by executives who truly act in the interests of ordinary shareholders. In particular, bosses who: * do not dilute investors by issuing shares willy-nilly; * create dependable returns through a rising dividend, and; * own a lot of shares themselves… …should deliver better […]

RM: Is profit real?

Richard investigates RM, one of the stock market’s great survivors, starting with just one question. It takes him on a twisty trail… Before we get into the numbers, some reasons why RM, a supplier of 50,000 educational products and IT to schools and nurseries and on-screen marking services to exam boards, is worthy of investigation: […]

Screening For My Next Long-Term Winner: Craneware

Years ago I read Super Stocks, an investment book that claimed to reveal “powerful new ideas” to uncover “opportunities for spectacular profits”. I sadly can’t recall identifying any “opportunities for spectacular profits”… …but the book’s “powerful new ideas” did make some sense — not least the concept of identifying companies that undertook significant research and […]

Moneysupermaaaaaaahhhhhhket

The veteran price comparison company is changing, and maybe for the better. Richard investigates one of the companies that easily met the criteria of his Fundsmith filter. I avoid Price Comparison Websites. The notion we should all be like hamsters in a wheel, swapping insurance policies and energy suppliers every year for cheaper alternatives is […]

Screening For My Next Long-Term Winner: Accesso Technology

This article has not turned out as I had expected. I was hoping to study a quality growth business that had seen its share price slump to attractive levels… …but instead I have ended up untangling some very awkward accounts and guessing whether management changes are signalling problems ahead. Sit back and brace yourself. The […]

Fishing like Fundsmith

Richard builds a Fundsmith filter, taking it from concept to conclusion. The aim: To reduce the “junk” in our watchlists so we are fishing in a better-stocked pool of shares. My editor wonders whether my obsession with Fundsmith Equity Fund is a ‘fatal attraction’ but he has permitted one more article. It would be remiss […]

Screening For My Next Long-Term Winner: Hargreaves Lansdown

Quality companies often produce exceptional returns for ordinary investors. Just ask Terry Smith or Nick Train. These ace fund managers have delivered wonderful gains by investing in first-class businesses such as Diageo, Reckitt Benckiser and London Stock Exchange. Let’s use SharePad to find a quality company to study for ourselves. Immense figures imply an incredibly […]

Performance measurement for pros

Investors tend to judge their portfolios by how much they go up or down in value, typically compared to a benchmark index like the FTSE All-Share, over perhaps a year. Taking a leaf out of Fundsmith Equity’s playbook, Richard thinks he has found a better way. In my last article, I questioned Fundsmith Equity, a […]

Screening For My Next Long-Term Winner: Apple

Being able to analyse international shares — at no extra cost! — is a wonderful feature of SharePad. And finding overseas shares within SharePad is easy, too. Simply click on Other Lists within the main toolbar… …and take your pick from the various US and European indices available. I have chosen the top 500 US […]

Screening For My Next Long-Term Winner: Games Workshop

Could now be the time to return to dynamic growth shares? Wonder-stocks such as Fever-Tree, Boohoo.com and Keywords Studios are all well below their highs of 2018… …and I wonder whether the widespread selling has created a super-growth bargain somewhere in the market! Let’s employ SharePad to find out. I bought the shares at £8 […]

Starting with the big picture

Richard starts his analysis of fast growing online beach holiday retailer On The Beach with new SharePad views designed to give him the big picture at a glance. Before I start dreaming about holidays, some humble pie. A few weeks ago I ridiculed the idea of using more than three SharePad windows by suggesting they […]

Magic Formula stocks for 2019 & 2018 performance

Back in 2016 we began testing and tracking three model portfolios based on Joel Greenblatt’s magic formula approach (click here to read more about this) and last year we added a forth model (click here to read this article). Regular readers will know how these portfolios are put together. Here’s a quick recap for the […]

Screening For My Next Long-Term Winner: Plus500

Before I start looking at Plus500 (LSE: PLUS), I have some good news…. …you can now employ my SharePad screening criteria with just a few clicks! The process involves SharePad’s amazing Filter library. This facility gives you complete access to numerous pre-defined filters that have been used within various SharePad articles. Just follow these instructions […]

Assessing whether profit is real

On the face of it Ricardo is a great company, but in recent years its earnings have deviated a long way from the cold hard cash that has flowed into the company. That may be changing. Though I don’t normally pay much attention to share prices, a 40% slump in the price of Ricardo values […]

How I build and manage my share portfolio

The key thing to stress at the beginning and, as many of you will already be well aware, there are many ways to become a good investor. There are many different techniques, many different styles and strategies from fundamental analysis, technical analysis to even astrology and Biorhythms. It sounds like a cliché but the best […]

Screening For My Next Long-Term Winner: Somero Enterprises

How did your portfolio fare during 2018? If you managed to side-step the market falls, very well done. For the rest of us — including me — I guess we can only cross our fingers and hope the FTSE performs a lot better during 2019! Still, with share prices in the doldrums and many investors […]

A SharePad for every occasion

Richard takes a break from company analysis and reveals a new layout for news, and reflects on some of the other tweeks he has used this year to make SharePad even easier to use. Season’s greetings! As the New Year approaches even my enthusiasm for digging into financials wanes and I indulge myself – and not […]

Two good companies, but which is better?

Richard takes a first look at Softcat, and he likes what he sees, even in comparison to rival Computacenter, another fine business. Both companies make good money distributing IT, but in Softcat he may have spotted a company with a growth culture. I wrote favourably about Computacenter in October, so I have two good reasons […]

A Special SharePad Investigation: Patisserie Valerie

Before I go any further, let me just state that I am not here to say “I told you so”. But whenever I have lost money on a share, I have always found going back to see where I went wrong to be very instructive. In fact, trying to spot the warning signs from any […]

Screening For My Next Long-Term Winner: Mattioli Woods

Many years ago, one of my favourite sources for investment ideas was the Financial Times. However, the FT’s articles did not interest me, and nor did the Lex column. Instead, I studied a small table that was tucked away on those pages that listed every share price. You see, this table named the shares that […]

Searching SharePad for something special

Richard Beddard investigates DotDigital in SharePad. The data indicates it has been very prosperous since it floated on the London Stock Exchange in 2011. A surge in investment suggests it intends to keep things that way. The starting point for many of the ideas I discover in SharePad is a basic four stage process that […]

Screening For My Next Long-Term Winner: Warpaint London

I am always looking for shares that can double, triple, quadruple or more during the years ahead. And one good way of finding such great investments is to study shares that have, well, already doubled, tripled, quadrupled or more. Take Fever-Tree (LSE: FEVR). This tonic-water specialist has rewarded savvy investors handsomely since the firm floated […]

What really makes a great business?

To identify great businesses we must go beyond the numbers and understand what causes them. In this article I revisit 4Imprint, an investment I should have made in 2013, and a business probably still worthy of investment today. Back in May 2013 I wrote excitedly about a company selling promotional products to US companies. 4Imprint’s […]

Filtering new issues

New issues have a reputation for delivering poor investment returns. In this article we filter SharePad for companies that may be more seasoned than they look. In my last article, I filtered SharePad for the firms that had been listed longest on the London Stock Exchange. Statistically speaking, the longer an investment has been listed […]

The old ones are the good ones

Exciting news: Aston Martin is readying itself to float on the stock market. Investors should think twice though, before buying the shares. Typically, it is the most seasoned firms that make the best investments. This is how you can find them. The Aston Martin story has many of the hallmarks of a big flotation. The […]

Building a base filter

To demonstrate how to filter in SharePad, we’ll build a base filter that filters out the shares we are least likely to be interested in. Our criteria will be personal, but the filtering technique can be applied to almost any investment style. Establishing your sweet spot To exclude shares we don’t want, we must decide […]

The perils of filtering stocks

This is the second article in the series “From ideas to investments” in which I look at the process of finding and evaluating investment ideas. Fishing for stocks using filtering, or stock screening, is a quick way to create a shortlist of shares that are likely to perform well – but only if we buy […]

How the stock market actually works

Today’s article is the first in a new series called ‘From ideas to investments’ which takes an in-depth look at how to generate investment ideas from fundamental data and develop those ideas into profitable investments. We’ll be looking at the benefits and pitfalls of stock screening and subsequent steps in developing a unique style incorporating […]

Next – A closer look at its online business

For many years Next has been a very profitable retailer of clothes and homewares. Like most of its peers it has had to face up to the changing world of shopping that has led more people to buy stuff over the internet instead of from shops on the high streets or in retail parks. Profits […]

Avoiding bad shares is just as important as picking good ones

If you’ve been investing in individual shares for a while then you’ve probably gone through the experience of losing some money on one or more of them. It’s a horrible feeling that happens to the best investors. You’d rather it hadn’t happened but the lessons you can learn from it can be invaluable in making […]

First steps to an inheritance tax-exempt portfolio

Investing in AIM-listed shares can help you reduce inheritance tax but you have to be picky. Not all shares qualify, and they must be good investments too. As usual, SharePad can help narrow down the field. What is an IHT-exempt portfolio? People with large estates can reduce the inheritance tax bill when they die by […]

Buying quality on its own is no guarantee of success

There are many different ways to make money from the stock market. Over the last few years, one of the most popular and discussed strategies has been about buying the shares of high quality businesses or quality investing. Warren Buffett has long been a cheerleader for long-term investing in quality companies. In the UK, the […]

A new issue that is already a winner

Looking through the prisms of profitability, debt, cash flow, strategy and valuation, Strix may be an exception to the rule that new issues make bad investments. Finance professor Elroy Dimson and his colleagues made a startling find when they studied the long term returns of UK Initial Public Offerings between 1980 and 2014. The longer […]

AGMs – If in doubt, ask

Most companies will answer questions from shareholders and potential shareholders. At Annual General Meetings shareholders have a right to ask questions and get answers. A large proportion of listed companies report full-year results in late winter and spring because their financial year-ends coincide with the end of the calendar year in December. As surely as […]

Should investors avoid low margin companies?

Highly profitable companies can make outstanding long-term investments. Arguably, the best way to measure a company’s profitability is to compare its profits with the amount of money invested to make them. This is known as the return on investment or return on capital employed (ROCE). One person’s definition of a highly profitable business will differ […]

Putting performance in perspective

To get a grip on where a company is going you have to understand where it has come from. Fortunately, that doesn’t mean reading every annual report. Usually, it’s not enough to read the latest annual report. To understand a firm’s business model and strategy, how it makes money, how it plans to make more, […]

Working out what could go wrong with a share

Investors pin their hopes on what could go right. The great product. The winning strategy. The growing market. The new technology. These may be good reasons to own a share, but only if you have also considered what could go wrong. In my last article I left you on a cliff-hanger. I described power adapter […]

Checking out a company’s cash conversion

A couple of weeks ago I wrote about the issues investors faced in working out a company’s true profits. In many cases, the ways in which companies calculate their so-called adjusted profits are becoming increasingly absurd. Investors are frequently asked to ignore certain real costs so that profits are as big as possible. The harsh […]

Decrypting a company’s business model and strategy

While it’s comforting to know a business has enjoyed success, long-term investors must also form an opinion on its prospects if we’re to hold the shares through thick and thin. In How to read an annual report, I identified the sections of a typical annual report that explain how a company has made money, how […]

Can you trust a company’s profits?

This article is more suited to experienced investors. Profits are all important when it comes to investing in companies. To make money over the long haul it usually helps to invest in a company that is growing its profits. The more profitable a company is, the more valuable its shares tend to be. However, profits […]

How to read an annual report

Rule number one in long-term investing is to understand how the businesses you expect to profit from will make money – otherwise, how can you be confident they will? Annual reports are the most complete source of public information on how businesses make money, and how they intend to make more money. Investors who read […]

A smarter way to use analysts’ EPS forecasts

Should investors pay much attention to analysts’ profit forecasts? There is a school of thought that suggests that they should not. Detractors say that forecasts are nothing more than educated guesswork and that analysts are very bad at predicting changes such as profit warnings or recessions. In many cases, forecasts are merely the extrapolation of […]

The Terry Smith algorithm

In this article I’ve attempted to find Fundsmith-like companies using SharePad. The results are mixed but there’s a lot to be learned from the experiment. A letter from Terry If like me you hold units in Fundsmith, last month you will have received a letter from the fund’s celebrated manager Terry Smith. In publishing an […]

A checklist for busy investors

There are many full time private investors out there but for others investing is a hobby or something that they fit around their day to day activities. If you don’t have a lot of time on your hands one of the toughest tasks you will have is narrowing down the list of potential investments on […]

Using SharePad’s “Live” tables in your own spreadsheets

Maybe you already download tables of data from SharePad by clicking on the sharing button in SharePad’s blue Table view, but this data is dead. It doesn’t change in your spreadsheet if it changes in SharePad. Now there is a new option: Export “Live” Table. This allows you to incorporate data into spreadsheets that updates […]

A better way to track changes in company performance

It doesn’t take too much time to get a feel for how well a company is doing. Most people do this by looking at percentage changes in key numbers – such as turnover and profit – from one period to the next. They may also look at key ratios such as profit margins or return […]

Buy and build

If you take a look at Diploma through the lens of SharePad’s summary page (under the green ‘Financials’ tab), you will find it shares many qualities of a good business. It has raised the dividend every year since 1999, a significant period in the company’s history as we shall see. It has grown turnover, profit, […]

Settings for the big picture

Happy New Year! I’ve started mine by tidying up my many desktops: my physical desk, my laptop’s desktop, and SharePad. I did so much experimenting with SharePad in 2017, I’ve overwhelmed the lists of settings. Settings are how we make SharePad our own. They are where we save list and chart configurations we use repeatedly, […]

Two charts to unlock a company’s finances

By way of introducing two charts I’m routinely using to suss out how companies are financed – the twin pillars of debt and equity – I need to return briefly to my last article on hire firms. In the main, tool and plant hire firms serve the construction industry which is notable for its instability. If […]

Is the current ratio an outdated measure of company safety?

One of the most commonly cited measures of a company’s financial strength is something known as the current ratio. It is a measure of liquidity and compares a company’s current assets – defined as assets that can be turned into cash within one year – with its current liabilities (those which have to be paid […]

Income Opportunities From Dividends

In the last of his Investors Chronicle articles, Phil looks at companies reinstating dividends or starting to pay them for the 1st time. Read pdf article

How to steer clear of dividend traps

First published in Investors Chronicle, Phil explains how to avoid the shares that might let you down. Read pdf article

Finding safe high-yielding shares

First published in Investors Chronicle, Phil explains how to identify which high-yielding shares are most likely to maintain or grow their dividends. Read pdf article

Finding companies that speak your language

Finding companies that speak your language It’s a commonly held view that the only bits of financial reports worth paying attention to are the numbers at the back – in the profit loss account and balance sheet for example. For investors alive to potential shenanigans, the audited numbers get us close to the unalloyed truth […]

How much is a company worth? A look at different ways to value shares

Two weeks ago I wrote about how to try and value companies that aren’t making a profit. This week I’m going back to basics for more inexperienced investors. Although I’m sure there will be some reminders here for regular readers. For many successful investors, the price they pay for a share of a company is […]

How to value loss-making companies

One of the questions I am frequently asked is: “How do I value loss-making companies?”. The short answer is that it can be really quite difficult. It is so much easier to try and value profitable businesses with an established financial history. However, the value of any business is based on how much money it […]

How I choose my next share using filters and charts

After many years of investment I still feel a sense of anticipation when I examine lists of shares looking for new opportunities. It’s like opening a map to find new places to visit, or a menu at a restaurant that serves everything. There are other ways to generate investment ideas, but in my experience they’re […]