Richard slims down his flabby SharePad setup to start the year with a lean, clean investing machine. He sets out his goals for 2022 and says thank you to Phil Oakley, who hung up his boots in December. It is that time of year when many of us eat and drink too much and then […]

Category: Company analysis

Screening For My Next Long-Term Winner: Ashmore

Terrific margins, plenty of cash, a reliable dividend and a modest rating could make Ashmore a decent QARP stock. Maynard Paton studies the fund manager and discovers how lower charges have limited past growth. Shares offering ‘Quality At a Reasonable Price’ have been hard to find during the last few years. But recent market conditions […]

Warehouse REIT | Real estate on the rise

Today’s featured company is a departure from the riskier and possibly sexier future opportunities and in many ways, Warehouse REIT (WHR) is a boring real estate investment trust, which is not known for its sex appeal or excitement. Sometimes, boring companies build wealth by stealth, as is the case with Warehouse REIT. It invests in […]

Marks Electrical plc | I liked the service so much, I nearly bought the company

Richard was so impressed by his first look at newly listed Marks Electrical, he was tempted to buy something from the online retailer of cookers and other domestic appliances. As for the investment, he was tempted too… I do not know whether it is a glitch or a feature, but a quirk of SharePad has […]

DFS plc | Will the investment last as long as the sofa?

Richard likes a business that is in control of its own destiny. He takes a look at DFS plc, the sofa seller that unexpectedly featured in his list of vertically integrated businesses. Of all the names that came up in my trawl for vertically integrated businesses, sofa seller DFS was perhaps the most surprising. To […]

Small-Cap Spotlight Report: Goodwin

30-bagger Goodwin has pivoted towards higher-margin contracts to widen its competitive ‘moat’. Maynard Paton weighs up the engineer’s haphazard financials with the delightfully old-school management. This quote from Richard Beddard caught my eye the other week: “If something truly special is incubating, we may profit from our investment for decades.” I am always up for […]

How profitable is Genus PLC?

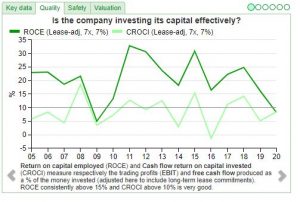

Animal breeder Genus Plc is at the forefront of animal genetics and highly valued by investors, yet standard measures of Return on Capital Employed (ROCE), a marker for quality, indicate only modest levels of profitability. Unusually (for me) I rediscovered Genus because of an idea, rather than as a result of trawling through shares in […]

Empyrean Energy | High hopes for Topaz and Jade

Empyrean Energy PLC (EME) is a small Australian oil 7 gas exploration company with huge potential upside if it can succeed with the drill. The company has big hopes for black stuff turning into gold, or wads of cash for investors and the board. The CEO, Tom Kelly, has serious skin in the game. Empyrean […]

Weekly Commentary 04/10/21: Distance and Perspective

The FTSE 100 had a volatile week, rallying, selling off then recovering to 7,040 last Friday. The Nasdaq100 was down -4% and S&P500 -3.3% last week. US 10y Govt bond yield continued to trend upwards to 1.55% versus a low of 1.19% at the start of August. The UK 10y bond yield is up even […]

Four live pivots: Next, Goodwin, Bloomsbury Publishing and Victrex

Richard goes hunting in his own portfolio for companies incubating better businesses. They may be undervalued as a result. As promised, this week I am following up my last article on past pivots that worked with an article about live pivots that look like they are working. I used the word pivot to describe a […]

Weekly Commentary 27/09/21: New tech, old laws

Markets lurched downwards at the start of last week, with the FTSE 100 falling to 6,906 before recovering to 7,067. Nasdaq and the S&P also recovered during the week to 15,316 and 4,449 both moving less than half a percent. The FTSE China 50 was down 3.6%, and down 18% since the start of the […]

Screening For My Next Long-Term Winner: Curtis Banks

Specialist SIPP firm Curtis Banks has seen its dividend go up but shares go nowhere during the last five years. Maynard Paton now wonders whether the small-cap’s recurring income and high margins make it a ‘QARP’ stock. Shares offering ‘Quality At a Reasonable Price’ have been hard to find during the last few years. But […]

Should you buy SDI shares? | Screening For My Next Long-Term Winner

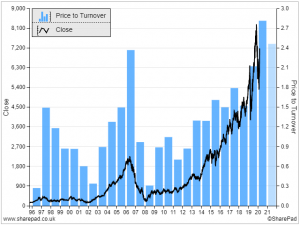

Acquiring private companies that make precision instruments has propelled SDI shares to 12-bagger status over the last five years. Maynard Paton recaps the story and prospects of the ‘buy and build’ specialist. Everybody loves a share that keeps going up. SharePad lists 168 names that have delivered 15% or more annualised turns during the last […]

Weekly Commentary 06/09/21: The Decline in r

The FTSE 100 was up less than half a percent last week to 7,164, towards the top of the trading range that it has occupied since early May. The Nasdaq 100 was up +1.1% ahead of the S&P500 +0.6%. The China 50 was one of the best performing major indices up +2.8% to 18,291 as […]

History of Games Workshop shares | When turnarounds become transformations

Inspired by Maynard’s article on Hornby’s turnaround, Richard examines the history of Games Workshop to imagine what challenges lie ahead if Hornby is to emulate the success of this outwardly similar hobby business. The idea for this article came from Maynard’s article about Hornby. To my mind he convincingly described a turnaround that is already […]

Weekly Commentary 31/08/21: Lower profits, improving performance?

The FTSE 100 was up half a percent last week to 7,124. The Nasdaq 100 had a better week +1.2% and the China 50 rebounded +4.5%, though that index is still down -14% in the last 3 months. The US 10-year bond yield finished last week at 1.35%, recovering from a low of 1.19% in […]

3 questions about Oxford Instruments plc | Deep dive into financials

Richard goes deep into Oxford Instruments’ annual reports and SharePad for answers to three questions to establish whether it is a good “pick and shovel play”. In my last article I explained how I used custom tables to find Oxford Instruments, a highly profitable business that seemed to have lost its way and then found […]

Should you buy Hornby shares? | Small-Cap Spotlight Report

Events at Hornby prove how turnarounds can take years. But fresh capital, better management and a return to profit could mean the model-train specialist is over the worst and finally heading towards a proper recovery. Turnarounds can be tempting. You find a business that has hit big trouble with a stock price at rock bottom… […]

Journeo PLC | Small-cap, ESG-friendly and on the rise

Journeo PLC (JNEO) is a tiddler I have had on my watchlist for a year or more. At today’s share price of 122p, the market cap is just £10.7 million, so very much at the lower end of valuations of the companies I have covered. Many investors would view this as a concern, a risk […]

Weekly Commentary 09/08/21: What $16 trillion of negative yields are signalling

Last week the FTSE 100 was up +1.1% to 7,111, Nasdaq was up 1.5% to 15,181, outperforming the S&P 500, up +0.8% to 4,429. Both the Hang Seng index in Hong Kong and the FTSE China 50 Index were up less than 1% last week. The US 10Y bond yield continued to fall to 1.19% […]

Should you buy ASOS shares? | Screening For My Next Long-Term Winner

ASOS share news Fashion website ASOS is among the market’s greatest growth stocks, but a recent update knocked 18% off the share price. The P/E may not be outrageous if huge warehouse and IT costs can one day deliver a suitable return. One of my favourite screening strategies is to hunt for attractive growth companies […]

Castings PLC: Why I’m reconsidering a failed trade

Richard was a long-term shareholder in Castings PLC, but he sold his entire holding in 2020. What did he see in the company? Why did he lose confidence after so many years? And what has changed to make him think perhaps it could be a good long-term investment after all? Castings PLC and I have […]

Making strides in forex: Should you buy Argentex shares?

I am sure many readers will be familiar with the impact of COVID-19 on the foreign exchange market. Subjugated to the rises and falls of major economies, the foreign exchange market faced wrath like so many other industries. As unemployment reached unimaginable figures, remittances fell to tragic lows. The year 2020 is a year of […]

Should you buy Calnex shares? | Small-Cap Spotlight Report

Warren Buffett admitted the other year that he had not bought shares at an IPO since 1955. “They’re picking the time to sell to you; I like it when I am picking the time to buy“, the investing master warned when asked about flotations. Mind you, every great share went public at some point… and […]

Investing in Sopheon PLC: A good niche is hard to find

Investors often find resilient businesses occupying specialist niches. Richard takes a first look at Sopheon, which makes software that helps big businesses manage the many products they are developing, and the strategic projects they are working on.

Investing in Team17 shares: A team worth joining?

Richard is thinking about joining computer games developer and publisher Team17 as a shareholder. It would be a bold decision, but he would rather invest in Team17 shares than the closest alternative, Frontier Developments. The first thing that attracted me to Team17 was the financials. The second thing was the chief executive. That is because […]

Equals Group PLC: Are they making a comeback?

Equals Group Plc (EQLS) is a provider of international payment services. The company operates through the following segments: Currency Cards, International Payments, Travel Cash, Banking and Central. It develops a cloud-based person-to-person payments platform that enables personal and business customers to make payments in a range of currencies and countries. The company was founded […]

Screening For My Next Long-Term Winner: Impax Asset Management

Impressive profit growth, a ‘scalable’ business, hefty insider ownership and a P/E re-rating have helped Impax Asset Management become a huge share winner. Maynard Paton looks closer at the ‘green’ fund manager.

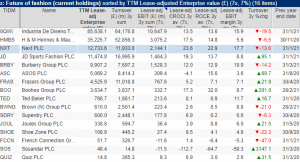

What’s next in fashion retail

Richard examines Next’s bold strategy as it seeks to win the Internet by becoming an enabler of fashion brands. Surprisingly the strategies of the racier names in fashion retail look staid in comparison.

The Elephant Crypto-fans Ignore: De La Rue

If you believe cryptocurrencies are the future, then the bank notes and passports printer De La Rue (DLAR) is not for you.

When is a bargain not a bargain?

Richard’s pursuit of Quarto, a publisher of illustrated books, takes him on a trail that leads to Hong Kong and Delaware. What he finds is anything but a straightforward turnaround.

Small-Cap Spotlight Report: WANdisco

WANdisco has raised $217 million since 2012 yet has never made a profit. But could deals with Microsoft and Amazon finally trigger a sales boost? The board’s optimism is not backed by its share dealing.

Getting to know Moneysupermarket

Moneysupermarket wants to get to know us, so it can sell us more products. Innovation and diversification are the pillars of a strategy responding to a maturing market.

PZ Cussons doubles down on focus

PZ Cussons is sharpening its focus on 8 “Must Win” hygiene, baby and beauty brands in the UK, Nigeria, Indonesia and Australia.

Good strategy/Bad strategy

A company’s strategy should not just tell us what it wants to achieve, but why and how. Richard introduces a simple framework for analysing strategy and highlights a good strategy, and one that is more difficult to fathom.

Small-Cap Spotlight Report: Norcros

Let me start by confessing this article covers pension deficits. What follows may not be that thrilling and does require you to concentrate. But please stick with me, especially if you have ever fallen victim to a ‘value trap’.

Weekly Commentary 22/03/21: Ports and platforms

Bruce compares a couple of Direct Carrier Billing (DCB), mobile payment platforms: Boku v Bango. He wonders if platform economics has become too popular, with the benefits well recognised but not downside. Also Ocean Wilsons, the Brazilian (Salvador, Bahia) port business.

Quality cyclicals – not for the faint-hearted

Over the years I have ignored Kingspan because it is big, acquisitive, and supplies building materials. My gut reaction to these facts is that Kingspan is best avoided, but my gut could well be wrong.

Weekly Commentary 15/03/21: Fungible vs flammable

Bruce looks at the fungible vs non fungible assets, using examples from recent events in the art markets. Stocks covered this week are Kape, Somero and Tremor.

Screening For My Next Long-Term Winner: Best of the Best

One of my favourite SharePad screens identifies good-quality companies that have grown without acquisition. One such is Best of the Best.

Weekly Commentary 08/03/21: Baillie Gifford vs Albert Bridge

With Scottish Mortgage Inv Trust down 9% last week, Bruce looks at the debate between Lawrence “usually a mistake to sell” Burns of Baillie Gifford and Andrew “take profits” Dickson of Albert Bridge Capital. Companies covered Renishaw, Solid State, K3 Capital and Franchise Brands.

Turning over even more rocks

Recently, I have adapted my SharePad setup so I can turn over even more rocks. The cornerstone of my setup remains the KISS+ filter. KISS, stands for Keep it Simple (Stupid) and the plus sign is just a reminder that I have improved this filter over the years.

The Trader: Trading Turnarounds

Everyone likes a turnaround. This is because people like the idea of buying at the bottom and reaping the rewards.

However, trading turnarounds can take a lot of time. Businesses are often slow to change and it is not a quick process.

This article will show you how to trade some potential turnaround stocks and give you some pointers to look at next time you are considering trading a turnaround.

Weekly Commentary 01/03/21: What has been will be again

Nasdaq sold off last week, down 7% since the middle of February, though still up since the start of the year. Tesla fell to $680, versus a peak of $896 earlier in February. US 10y yields hit 1.49% last week up over 50bp in the last month Financial bubbles don’t pop because speculators suddenly start […]

Small-Cap Spotlight Report: Argo Blockchain

Let’s start with a wealth warning: This article covers bitcoin miner Argo Blockchain; I am not a bitcoin expert; The bitcoin price is highly unpredictable; Argo’s share price is highly unpredictable, and; Argo issues frequent updates. The upshot is my logic and calculations may be completely wrong or out-of-date by the time you read what […]

Weekly Commentary: 22/02/21 – All Aboard for Mu Mu Land

At midnight, on 1st January this year, the K.L.F. released their back catalogue of music (hits such as 3AM Eternal, Justified and Ancient, Last Train to Trancentral) on Spotify and uploaded their old videos to YouTube. This was their first activity as a band since 1992, when they announced they were leaving the music industry […]

The second most important ratio

If you look DotDigital, as I did a few years ago, you will find much to like about the business: Source: SharePad financial summary It is highly profitable in terms of Return on Capital Employed and profit margin. The exciting thing about a company like this is, as long as it can reinvest the cash […]

Weekly Commentary: 15/02/21 – Getting high on junk bonds

Last week Bloomberg reported that junk bond yields in the US fell below 4% the lowest level ever recorded and down from 11.5% peak yield in March last year. This is the opposite direction to the yield on the “risk free rate” of US 10y bond (hitting 1.18% last week) which has been steadily rising […]

Screening For My Next Long-Term Winner: IG Group

For some time now IG Group has been flashing on my SharePad filters. The three screenshots just below show IG offers: High margins; Decent returns on equity; Cash-rich accounts; Attractive five-year growth; A lack of past acquisitions, and; A modest P/E. Those characteristics are an unusual mix in a market presently bereft of obvious quality […]

Weekly Commentary: 08/02/21 – The signs are here

Moonpig IPO’ed last week at 350p, valuing the company at £1.2bn, and the shares rose +24% to 430p the following day. Meanwhile the FT reported that Elon Musk is expecting SpaceX to be valued at $60bn in a funding round later this month. Virgin Galactic is up +163% in the last 3 months. Valuations are […]

Roll up! Get yer easy returns here…

Bunzl, a company I investigated last year, is a classic roll up A distributor of everyday items consumed by businesses and organisations, it routinely acquires much smaller distributors, improves their efficiency and creates economies of scale. This reduces customer’s procurement costs, and improves the profitability of the mothership. To grow, the company has repeated this […]

Weekly Commentary: 01/02/21 – Bored Markets Hypothesis

Some of the speculative exuberance has spilled over the punch bowl at the cryptocurrency party into a number of glass half empty equities. GameStonk, err I mean GameStop, rose from below $20 a share earlier this month to over $500 per share, as retail traders from the Reddit thread “Wall Street Bets” piled in to […]

Small-Cap Spotlight Report: LoopUp

Welcome to a series of occasional articles in which I shine an investigative spotlight on particular small-caps. My aim is to demonstrate how to analyse companies in SharePad and beyond to help you become a more informed investor. I start today with LoopUp (LOOP), a £44 million developer of software for remote meetings and conference […]

Weekly Commentary: 25/01/21 – Expectation v surprise

I was initially unimpressed by the UK’s mass vaccination rollout. However it is important to keep updating your beliefs when data is better than you had been expecting and not miss the inflection point. From below 150K per week in December, we now have almost 5m vaccinated. My mistake was to extrapolate in a linear […]

Weekly Commentary: 18/01/21 – Reincarnation as the bond market

In the early days of a new Democrat presidency, the President’s campaign manager observed that: “I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a 0.400 baseball hitter. But now I want to come back as the bond market. You can intimidate anybody.” The […]

Screening For My Next Long-Term Winner: Avon Rubber

Happy 2021! I trust SharePad will help bring you good fortune in what could be another twelve months of financial thrills and spills. As usual I plan to trawl the market for interesting shares that I hope assists your company analysis and stock-picking. I start the year with Avon Rubber, a FTSE 250 member that […]

Weekly Commentary: 11/01/21 – Gatekeepers

The FTSE 100 started the year strongly +6% during the week to 6857. Both the S&P 500 +1.3% to 3804 Nasdaq +1.4% to 13068 were more subdued, though largely unaffected by events in Washington. 10 years ago when I was in Tbilisi, I remember a US dignitary explaining to the Georgians that the point of […]

Annual reports made simple

Happy New year. This year, I have resolved to keep things simple, which is not easy in investing. Aide memoire… Just before Christmas Chris, a SharePad customer, emailed me with a request: When I look at company reports which often run to a couple of hundred pages I find the position somewhat daunting… It would […]

Weekly Commentary: 04/01/21 – Wait and Hope

“Until the day when God shall deign to reveal the future to man, all human wisdom is summed up in these two words… wait and hope.” – The Count of Monte Cristo The FTSE 100 finished the year at 6460, down 14% from 7585 this time last year. There were some odd movements in share […]

Weekly Commentary: 29/12/20 – Amateurs

The FTSE 100 closed around 6,487 to 24 December down -15% from the start of the year. From a peak of 7670 in mid-January the index fell by -35% to a low of 4998 at the end of March before recovering +30%. A reminder of the importance of pound cost averaging, because a -30% drop, […]

Lessons from lockdown and other stories

This year has confirmed that most of the news is at best irrelevant to me as an investor. Worse, the news stressed me out. It regularly fed my mind with impossible problems to solve. Companies I admired closed down, temporarily I hoped. They raised money in emergency fund-raisings. They furloughed staff. So far, the determination […]

Weekly Commentary: 21/12/20 – Bidding up Codemasters

The FTSE stayed level around 6580, while Nasdaq hit a new high of 12752. Bitcoin rose through $20,000 for the first time. I have a dim memory of a party in South London, around 2006-2007, when someone began trying to convince me that everyone could create their own electronic currency. After all, he said, money […]

Weekly Commentary: 14/12/20 – Taxes steering behaviour?

After a strong November and start of December the FTSE 100 was largely unchanged this week at 6566. More broadly, the signs of a cyclical recovery are evident: oil price rose through $50 a barrel and copper and other industrial commodities have also been strong. Airbnb IPO’ed with the shares closing on their first day […]

Nichols: More than Vimto

Having prospected for investments in the soft drinks industry, I think Nichols is perhaps the most intriguing of quite an interesting group. It has been enormously profitable and a steady grower, unlike the other candidate, Fever-Tree, which has experienced both extraordinary profit and extraordinary growth. Fever-Tree makes me nervous. Explosive growers rarely keep growing rapidly […]

Weekly Commentary: 07/12/20 – Vaccine inoculating risk tolerance

The best performing FTSE 100 stock last week was Rolls Royce, up 19%. The worst was Unilever down 6.5%, which suggests expectations of a vaccine are inoculating investors against risk. On Nasdaq, the vaccine stock Moderna, was the best performing up 44% in the last 5 days, while Zoom was the second worst performing down […]

Weekly Commentary: 30/11/20 – The platform bandwagon rolls on

FTSE weakened slightly to 6300 in the second half of last week, but the bounce of former “Covid losers” continued with Rolls Royce, Glencore, Shell and BP all up 8% in the last 5 days. Nasdaq continued to rise to 12152 and Tesla’s value exceeded half a trillion dollars. airbnb IPO Last week airbnb filed […]

Finding the soft drinks companies with the most fizz

I know this is going to make me sound like an alcoholic, but I rarely drink soft drinks. When a reader requested an overview of the soft drinks sector, I was not, therefore, particularly enthusiastic. For me, liking the product, or at least seeing its value, is a prerequisite for investment, and, on health grounds, […]

Weekly Commentary: 23/11/20 – Expectations rising

We are beginning to see companies operating in the “real” economy announce raised guidance. Somero (exceeding previous revenue guidance by +7%), but also Headlam (materially ahead), Acesso (comfortably ahead). Saga share price was also up +57% during the week. The FTSE 100 is currently 6378, which is the same level as early March this year. […]

Screening For My Next Long-Term Winner: Manolete Partners

I am always looking for ‘multi-baggers’ — investments that can double, triple, quadruple or more. And here’s some very good news: I have stumbled on a company that can find them for me. Not just the occasional five-bagger or ten-bagger mind, but 20-baggers. It’s incredible stuff, especially as the track record of success extends for […]

Weekly Commentary: 16/11/20 – Reflation trade

Banks and other “covid losers” were up strongly at the start of last week as Pfizer announced they believe they have a credible vaccine. US Treasuries 10 year yield jumped up to 0.98% (the red dot on the chart below) from the 0.79% last week. This is a significant move, the yield curve seems to […]

Investing through the pandemic

When I told my wife I was researching Hotel Chocolat and my first action would be to buy some chocolate, she reminded me that the most important thing about research is to include lots of participants. Scuttlebutting chocolate 70% dark chocolate promised to be our optimal pleasure point, and so it was. When I brought […]

Weekly Commentary: 09/11/20 – Study silence to learn the music

The US Presidential election turned out to be closer than most people expected. Nasdaq up almost +10% over the week to 12078. Tech stocks reacted well to the uncertainty, but so did 10 year US Bond yields, which initially jumped to 0.9% before falling back to 0.78%. I’m not sure if you’d predicted the result, […]

Screening For My Next Long-Term Winner: Jarvis Securities

Today I have returned to one of my favourite SharePad screens. This screen applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE). The main filter criteria are: 1) An operating margin (latest and 10-year average) of 20% or more, and; 2) An ROE (latest and 10-year average) of 20% […]

Weekly Commentary: 02/11/20 – Insiders selling at the top?

Last week markets sold off into the rising cases of Covid. The FTSE 100 fell 5% last week to 5561. Large UK banks HSBC and NatWest reported encouraging results, although the sector remained unloved. Directors selling Given the strength of the market’s rally over the last 6 months, and then last week’s sell off, I […]

Floored

James Halstead makes vinyl flooring, the kind we see in hospital corridors, GP surgeries, clinics, schools, offices, laboratories, prisons, factories, shops, trains and boats around the world. James Halstead’s biggest brand is Polyflor. The company’s social media accounts are a good way to get a feel for the product and you can take the Commercial […]

Weekly Commentary: 26/10/20 – Paying up for quality?

Markets recovered slightly towards the end of the week, with the FTSE 100 at 5888. Nasdaq was at 11662. Last week Netflix reported Q3 results, with “only” 2m net new subscribers in the quarter, v 16m in Q1 and 10m in Q2. The company had previously guided that subscribers would slow in Q3 to 2.5m […]

Weekly Commentary: 19/10/20 – On network effects and fads

“Fad companies are companies with good business models or good products. So, why would we be interested in shorting a company that has a good product? Because of the threat it presents to others and their likely response to that threat. For example, Netflix had a terrific idea of renting DVDs through the mail, which […]

Don’t waste a good crisis

Before I started fishing for a share to investigate for this week’s article, I culled my personal filter library. Many of the filters are derivations, refinements that effectively render older filters redundant. Some are failed experiments. Being a simple sole, I cut the library down to four: The old ones are the good ones – […]

Weekly Commentary: 12/10/20 – On content, distribution and kurtosis

Last week the FTSE recovered to just over 6000. The (perhaps inappropriately named) Bond film No Time to Die, was postponed until next year by its Hollywood studio, MGM, which has left cinemas in trouble. Cineworld is on the brink, a victim of an overly leveraged balance sheet but no product to distribute. Up until […]

Weekly Commentary: 05/10/20 – On uncertainty and confidence

Last week Andy Haldane at the Bank of England gave an interesting speech on “Economic Anxiety” noting that pessimism can be as contagious as the disease. Haldane is most famous for his “Dog and the Frisbee” speech, which he co-wrote with the famous psychologist Gerd Gigarenzer in 2012. Catching a frisbee is difficult; theoretically it […]

What does not kill a business can make it stronger

This article was not supposed to be about paper maker James Cropper. I set out to write about Animalcare, a veterinary pharmaceutical company, but I quickly became disillusioned, wretched even. You probably will hear about Animalcare one day, because it is an interesting business, but it is also complicated and its complicatedness was epitomised by […]

Screening For My Next Long-Term Winner: Polar Capital

I am not a great fan of the fund-management industry. I cannot think of another sector where the employees collect enormous salaries while the customers pay hefty fees and sometimes get nothing in return. Quite often us amateur investors are better off with simple index trackers rather than falling for the industry’s persuasive advisers and […]

Weekly Commentary: 28/09/20 – Beginner’s mind and Buy and Build

Markets sold off last week as virus case rises rose (FTSE 100 fell to below 5800 before recovering slightly later in the week, Nasdaq down 4% to 10,800). The virus itself seems reasonably predictable, everyone has been expecting cases to rise as summer turns to autumn. What hasn’t been predictable is Government responses around the […]

Weekly Commentary: 21/09/20 – The long journey to exoneration

The FTSE 100 just about held its level above 6000 last week. Last week was Chilean Independence Day. It is a little known footnote in history that Lord Cochrane, who was involved in the great Stock Exchange scam of 1814 (accused of starting rumours of Napoleon’s death via the Admiralty’s semaphore telegraph) helped not one, […]

This time is different for Design Group

If you watch Design Group’s annual results presentation, you may detect a bashful smile on chief executive Paul Fineman’s face. Paul Fineman, chief executive of Design Group. Source: Design Group Full Year Results 2020 (video). Despite unexpected tariffs on products imported into the USA from China and the onset of the pandemic, Design Group was […]

Weekly Commentary: 14/09/20 – Americans on AIM

The oil price fell to a 3 month low in the middle of last week to below $40 a barrel. Oil is in contango (futures price higher than spot price) which suggests that despite production cuts, traders are still worried about demand over the next few months. Ironically Tesla shares were off even more sharply […]

Screening For My Next Long-Term Winner: Fuller, Smith & Turner

First, a wealth warning. The last price-to-book ‘bargain’ I looked at for SharePad was Hammerson. Back then the property group’s £5 billion asset base could be acquired for a £1.6 billion market cap. Investors were in theory able to purchase £1 of assets for just 30p. Twelve months on, and the share price below tells […]

Weekly Commentary: 07/09/20 – Come back on St Leger Day

St Leger Day, as in ““Sell in May and go away, don’t come back till St Leger Day”, is approaching. I’ve always wondered who St Leger was, and why a saint might have had a horse race named in his honour. Was Saint Leger the patron saint of book making? Well no, it turns out […]

Weekly Commentary: 31/08/20 – Let the future ≠ the past

Nasdaq continued to hit new highs, at 11,666 up +30% from the start of the year and up 2.5x in the last 5 years. I can’t think of anyone suggesting in January that all three of I) Gold, II) Govt bonds and III) Nasdaq would be up strongly from the start of the year. Such […]

A safety first stock

I found James Latham a couple of months ago when I was trawling for cheap shares with strong balance sheets. The shares are still cheap, James Latham’s Price Earnings (PE) ratio is 13, and the balance sheet should remain strong… Centuries trading timber James Latham has a long and storied history. It manufactured plywood for […]

UK banks – in the eye of the storm?

Every crisis presents opportunities. A contrarian strategy of buying bank shares during the point of maximum gloom during a recession has often, but not always, been a good idea. It most definitely failed in 2008 when banks needed to raise capital and had to rely on Government bail outs. But it has worked in previous […]

Preparing for the worst, capitalising on the best

Listening to Porvair’s long-standing chief executive Ben Stocks talk about the challenges ahead, it is clear the company is bracing itself. Phrases like “preparing for the worst, hoping for the best”, and “the overall balance is negative”, come readily to him. This is a company I have long admired, but I have never had the […]

Screening For My Next Long-Term Winner: Fever-Tree Drinks

They say mums always know best. Mine has bought Fever-Tree tonic waters for some years now and I recently asked whether she remained a customer. This was her response. “While we don’t buy many commercial drinks for home consumption these days I would still definitely buy Fever-Tree, generally the original tonic water. I went into […]

Making a new discoverIE

I discovered discoverIE using a simple and fruitful method of finding new investment ideas: a list of shares sorted in SharePad by previous annual report date. Having squinted for a few minutes at financial charts showing profitability, cashflow and debt (more on that later), I thought the company looked promising: Sorting a list in SharePad […]

Volex: Reassuringly above average

If you’ve read my recent articles you will know I have been ranking shares using basic financial statistics. I found Bioventix by ranking five criteria. The objective was to find profitable companies mostly financed by equity rather than debt, with high quality assets and low valuations. The more profitable, the more conservatively financed, and the […]

A cheap profitable share with a strong balance sheet

Today I have added two more criteria to turn the list of cheap shares with strong balance sheets I made in my last article into a list of cheap profitable shares with strong balance sheets! The profitability criteria are free cash conversion and return on capital employed. This table shows the individual and aggregated rankings […]

Ranking potential bargains

A SharePad customer, Chris, reminded me of the power of ranking recently, when he emailed to say (among other things): “I find that I am playing with spreadsheets to get the data in place rather than actually making decisions. I guess sometimes too much data can be detrimental…” Decisions are hard, and messing around with […]

Getting to grips with software companies

First, an admission. The software biz is a bit of a mystery to me. There’s a vast ecosystem of enterprise solutions, software that businesses increasingly need to operate, but how do those of us whose technical skills extend little further than Word and Excel decide whether these solutions and the companies that code them are […]

The changing shape of QinetiQ

I have picked QinetiQ from my “Cash King” filter because it was one of the more reasonably priced companies that passed all the criteria. It’s debt-adjusted PE ratio is 14. QinetiQ makes Rattler, a supersonic target that simulates air-launched anti-radiation missiles. Source: QinetiQ annual report 2019 The company is a defence technology business, once part […]

Screening For My Next Long-Term Winner: Hikma Pharmaceuticals

One way to invest during the pandemic is to consider shares that have climbed higher as the market has dropped. Such companies may well be ‘safe havens’ — businesses that are coping well with the lockdown, or perhaps even benefitting from the crisis. I applied the following simple criteria within SharePad to identify potential ‘pandemic-proof’ […]