THE SETTING

Kainos (Greek for fresh, innovative) was launched in 1986 when the old British IT champion ICL recognised the quality of computer science graduates from Queen’s University Belfast. ICL had a new project involving electricity network analysis and Queen’s had just set up one of the first university incubator companies, Qubis, which was keen to establish some partnerships. Qubis held 49% and ICL, 51%. The company had 15 employees – mostly young graduates from Queen’s. The electricity product was duly launched in 1989 by which time Kainos had recruited a few other customers including Marks & Spencer and some more employees including Brendan Mooney, a freshly minted computer studies graduate from Ulster University. In 1993 Kainos launched Meridio, an enterprise-scale document management system designed to plug into Microsoft’s .NET platform. This became a major success and was eventually demerged, then acquired by Autonomy for £20m. Kainos developed call processing software for 3,500 BT exchanges, the core ticketing system for London underground and Littlewoods’ customer process system – the small outfit in Belfast was pulling in blue chip assignments.

Brendan Mooney was sent to drum up business from the burgeoning financial district in Dublin. It’s said he took two years to bring in a project but it was the start of a new phase which turned Kainos into a useful player in financial sector software and kept its ball rolling. In 2001 he was appointed CEO of what was now a 200 employee company with about £5m in sales. In the meantime ICL had been acquired by Fujitsu which sold 31 per cent of the shares to Dublin-based ACT Venture Capital.

Kainos is an exponent of a software development model known as Agile. It is important for investors to understand what this means and a good starting point is the more traditional Waterfall model. Under Waterfall, the objectives of the project are defined in detail at the start. Programmers then write the code to implement the project. Every aspect is documented in detail. The code is tested against the specification and delivered to the customer. Job done. But life is messy: objectives change all the time and in any case those set out at the beginning are almost always flawed. Under Waterfall, the working software emerges only towards the end of the project and if it fails to deliver what is actually required as opposed to what was thought to be required in the beginning, the results will be unsatisfactory. I would wager that most of the huge IT projects which have been abandoned after costing the taxpayer millions and sometimes billions of pounds were run according to the Waterfall model.

The Agile model was formally set out in 2001 with a complete (one page) manifesto issued by 17 high level programmers from the left field of the sector. You can read the whole story at the admirably austere site, agilemanifesto.org where Agile is summarised as follows:

“We are uncovering better ways of developing software by doing it and helping others do it. Through this work we have come to value:

- Individuals and interactions over processes and tools

- Working software over comprehensive documentation

- Customer collaboration over contract negotiation

- Responding to change over following a plan

That is, while there is value in the items on the right, we value the items on the left more.”

Agile emphasises continuous discussion with the client and recognises that major projects cannot be defined in full at their start. Instead of plotting a complete route-map before starting the programming process, the final destination is recognised to be unclear and is to be reached in short stages which will both deliver working product and further discover the real destination. Principle 1 is “Our highest priority is to satisfy the customer through early and continuous delivery of valuable software”. Agile has drawbacks including that budgeting the whole project is fuzzy and documentation less rigorous. But it should ultimately deliver a better result for less outlay.

And it has taken Kainos a long way. In 2005, Kainos got its first UK public sector job which was a case management system for the Information Commissioner’s Office. It set up a London office, a programming centre in Gdansk and carried out a management buyout of Fujitsu’s remaining shares. By 2009, sales were £21m. But the financial crisis put it into reverse. The Dublin work dropped away and sales fell for a couple of years. ACT decided to exit at this point. Its shares were eventually sold to the Kainos management who now refocused on three sectors: 1) patient notes for the NHS, 2) implementations of the cloud-based Workday platform used by large companies to run core financial and personnel systems and 3) projects promoted by the UK Government Digital Service which oversees the process of digitising governmental interactions with citizens.

This strategy worked well and by 2015 sales reached £60m, setting Kainos up for a flotation in July 2015 when Qubis sold half its shares, the founding CEO sold his entire holding and the top management sold smaller amounts. The company sold no new shares. The price was 139p which raised £50m and capitalised Kainos at £164m. The shares went to 300p within three months before falling briefly below the offer price in 2016. Then they moved steadily forward until a major spike and reversal during 2019 which has brought them to an interesting level for long term investors.

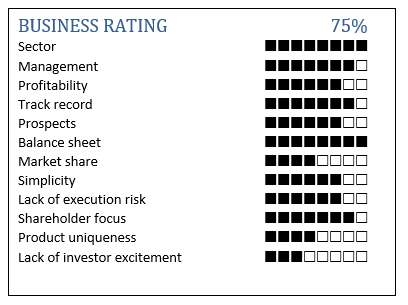

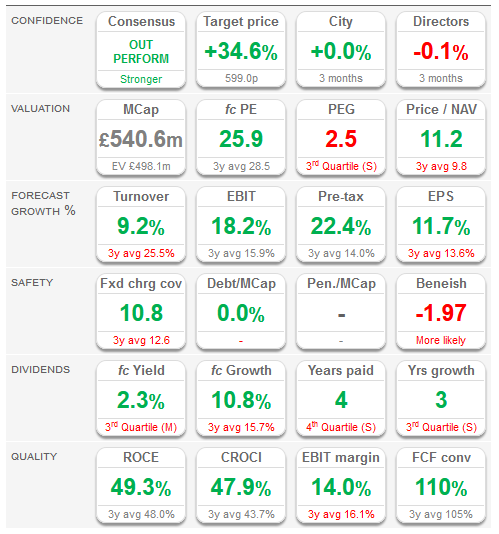

(Source: Alistair’s own rating system)

THE BUSINESS

Digital Transformation (est £98m / 65% of total sales)

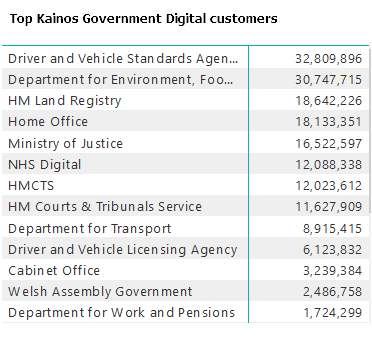

Kainos undertakes medium and large-scale projects to create custom software for corporate and government customers. Government accounted for about 60% of revenue in the last financial year. Examples of recent and current work include the Passport Application Service for The Home Office, an app for the NHS called the NHS app (available on your smartphone app store and I thought pretty good) and a number of assignments for the Ministry of Justice which is running some 25 IT projects digitisation covering courts and tribunals. As an example, Kainos took the Ministry of Justice’s Divorce Service online on May 2018. This produced an 85% reduction in the number of applications returned due to errors. Kainos is the lead Digitisation Partner of the Land Registry – an £8m assignment over two years. There is a lot of information about the Land Registry project at this website which records that Kainos succeeded against 37 other applicants. Kainos also carries out a meaningful amount of work for the Irish government and its agencies.

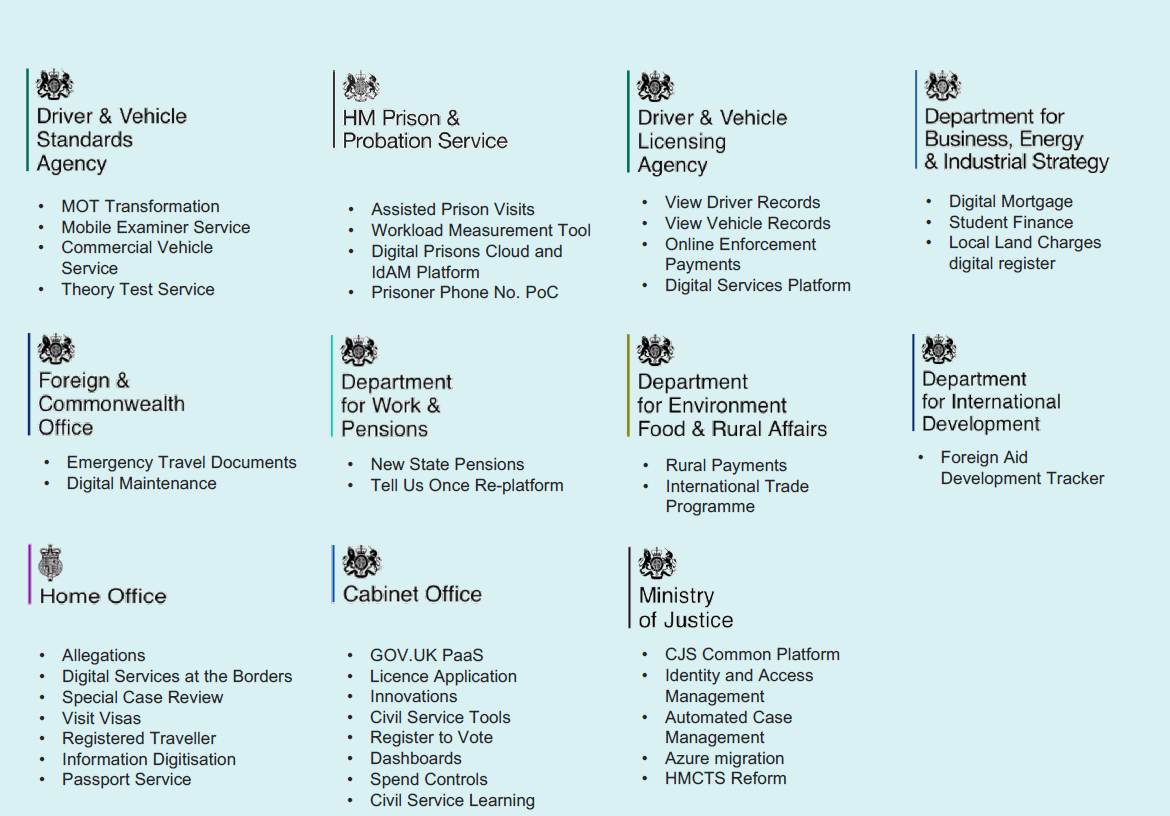

The following slide from 2018 itemises Kainos’ track record with the UK central government:

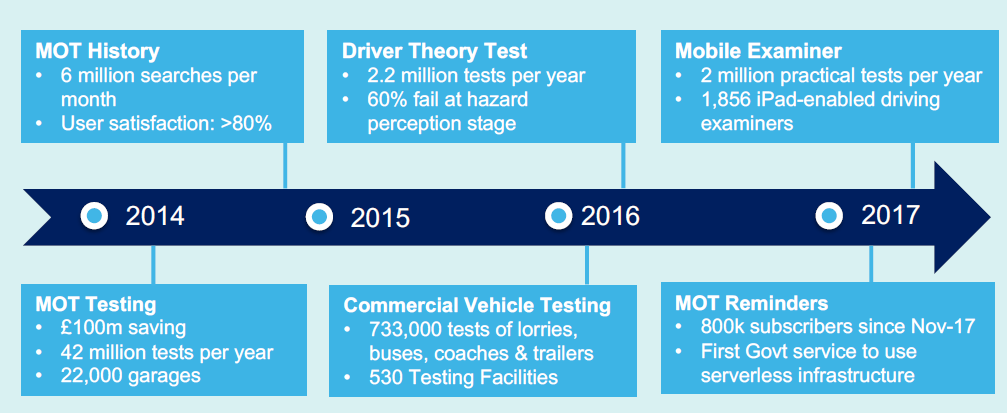

This slide from the same date shows how Kainos has picked up multiple follow-on contracts after a first engagement with the Driver & Vehicle Standards Agency.

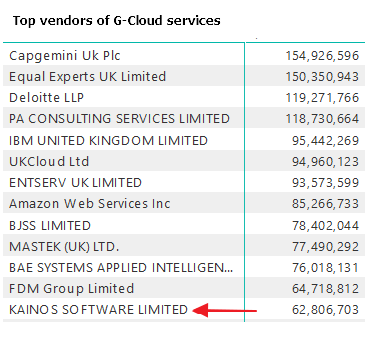

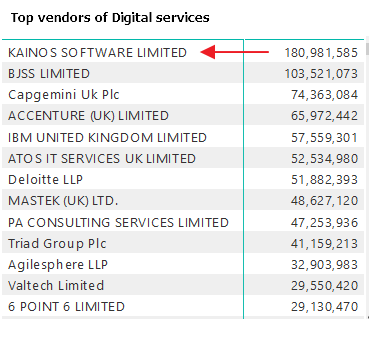

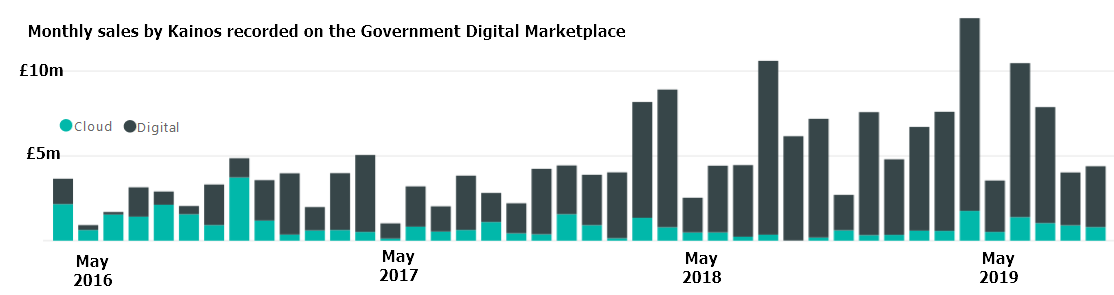

The UK government has been pressing digitisation down into all branches of the public sector over the last 5 years. The Government Digital Service has 900 staff who evangelise digitisation in part by running a digital marketplace where any public department can post a project and bring in bids for the work from 2,300 screened software providers. The site records spend on cloud (cloud served – 75% of the total) and digital (served on premises – 25%) implementation rising from £100m in 2014 to almost £2bn in 2019 – a total of 7bn, and provides extraordinarily detailed statistics (supplier/customer/value) for 70,000 public sector software contracts since 2012. These show 700 projects for Kainos which tops the table for Digital (on premises applications) projects and stands at number 13 for cloud served services.

In the commercial sphere there is much less data. But the 2019 annual report recorded two recent wins in Germany: Concardis which handles €500bn of digital payments in central Europe and Skeyos, a spinout of Lufthansa which provides procurement for the maintenance, repair and overhaul of aircraft. This project is described here.

Kainos is a major user of Microsoft enterprise level software and in 2018 won the Microsoft UK Partner of the Year award. Kainos has won many other awards.

Workday Implementation (est £33m / 22% of total sales)

Workday is a US company providing personnel and financial systems to large companies. A competitor of Oracle and SAP, it was founded in 2005 by the disgruntled founders of Peoplesoft after its hostile takeover by Oracle. They set about creating from scratch a new version of their previous offerings which would be based on the cloud, then only just emerging as a practical concept. Workday was floated on the New York Stock Exchange in 2012. It has revenues of $3bn and a market value of $40bn (undeterred by losses of $500m). Workday only rarely delivers its services directly. Most customers deploy Workday via one of 35 accredited implementation partners. Their role is discussed here and here.

Kainos first became involved with Workday in 2011 at its European HQ in Dublin which needed extra people to work on the innermost elements of Workday software as it began to be unrolled to the European market. Kainos seconded a group of software engineers. Building on the insight thus gained, Kainos became a Workday partner soon after and in 2014 implemented Workday for its own Human Resources function. Kainos now has 250 Workday-accredited employees (out of 1,500).

This area of work has kept pace with the overall Kainos expansion. Workday is rapidly penetrating the UK public sector with Kainos winning seven of the eight implementations as of July 2019. But the bigger opportunity is abroad: since 2015, Kainos has opened Workday-focused offices in Copenhagen, Amsterdam, Frankfurt, Atlanta, Paris and Toronto, so far yielding nearly 60 customers. Many implementation customers go on to sign up for Post Deployment Services typically paying £100,000 pa. Kainos had 44 such agreements in place in 2018 and 84 in 2019. Kainos’ Workday customers include Sun Life, Primark, Booking.com, easyJet, Travelex and Netflix.

Workday has two major projects expected to accelerate its progress. The first is its expansion from human resources software into financial software. Financial is twice as big as human resources. The second is opening up Workday from a “closed” Software as a Service basis to an “open” Platform as a Service basis. This will enable applications developers to plug into the core Workday product (much as you can buy an app for anything on your smartphone).

Digital Platforms (£18m / 12% of total sales)

Under this heading, Kainos promotes two standardised products designed to be used by multiple organisations. Evolve EMR (Electronic Medical Records) replaces paper patient records in NHS acute care hospitals with digital records. Kainos developed Evolve in 2009 for a single NHS Trust (Ipswich), initially as a major scanning project with accessibility from desktop computers. Within five years it had supplied Evolve to another 70 hospitals run by a further 25 Acute NHS Trusts. Through these deployments, Evolve’s functionality expanded to include “next action reminders”, access via iPad, summarised patient history, patient discharge documentation and statistical analysis. It has subsequently been developed into a cloud-based system which massively increases its attractiveness. Evolve is the market leader in this sector, now used by 30 of the 80 NHS Acute trusts which have so far implemented electronic medical records – way ahead of its EMS competitors. But Evolve costs about £2m per customer and the NHS has run out of money. Currently 90 Acute Trusts still run on paper – these look like an attractive potential market for Evolve, but not yet.

Kainos’ second platform product is doing better. This is Smart which is an automated testing system used by Workday customers to check that their implementation is working properly. Just like your phone’s operating system, Workday is updated on a very regular basis. Every Workday implementation is unique and is usually integrated with other applications which will inevitably need tweaks to keep up with Workday updates. In a perfect world, a Workday implementation will be tested almost continuously. Smart comprises a battery of typically 2000 individual tests which save users time. It is used by 150 companies and its bookings rose 38% to £18m last year.

Staff

Obviously, Kainos’ main asset is its workforce. As of March 2019, this comprised 1,470 people of whom about 150 are independent contractors (Kainos targets this mix of 90% permanent, 10% contractors). This figure was 26% up on the previous year. Attrition is 15% so the number of new hires was about 350. Taking on this number of new employees requires a major permanent recruitment effort, which is successful to the extent of generating 22,000 job applications last year. Like many competitors, Kainos starts young: it has run one week code camps in Belfast for 14-18 year olds for the last seven years and this year added another in Birmingham. It also offers an Earn As You Learn scheme paying student fees and maintenance to selected students studying Computing Systems at Ulster University. It gets high ratings in public surveys of good places to work.

MANAGEMENT

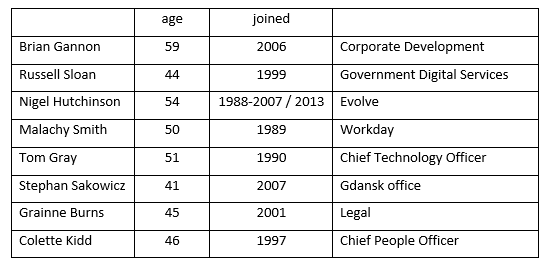

An outstanding attraction for investors is that the top management of Kainos all have long records with the company. Brendan Mooney (52) is covered above. The CFO (and COO) is Richard McCann (54) who was in charge of acquisitions and investor relations at Galen until its acquisition by Almac after which he ran one of its units which developed software for drug companies, moving to Kainos in 2011. Sales are overseen by Paul Gannon (56) who joined in 1998 after a stint with Accenture. The long-standing chairman has just retired. The new one as of September 2019 is Tom Burnet who joined as a non-executive before the flotation. He was CEO/executive chairman of Aim-listed ticketing software specialist Accesso for eight years and before that at Serco. His period at Accesso was very successful until a stumble a year ago which punctured an ambitious share price. There are two other long-standing non-executive directors. Both have highly relevant backgrounds.

The rest of the senior team:

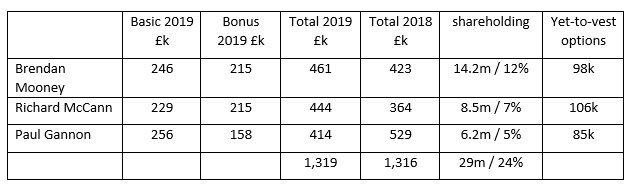

Director pay is pretty reasonable:

In addition to basic and bonus, in the year to March 2019 about £1m of shares vested with executive directors from a 2015 LTIP and a similar quantity seem likely to vest in the current financial year.

CURRENT TRADING

In a routine trading update in early February, Kainos said its results for the year to March would exceed market expectations. This moved the shares from 430p to 600p by the time the results were released in late May and they went on to 670p where they stood on a prospective price earnings ratio of 39x. This fit of optimism expired fast. The shares were back to 435p by early September when Kainos released its pre-interim trading statement noting good performance with Workday combined with caution about public sector spending. It said however that it expected to meet market expectations which are for a 20% increase in earnings per share to 17.2p. Interim results are due on 11th November.

BALANCE SHEET

With no debt and £42m of cash and rising, the balance sheet is beyond reproach.

THE ISSUES

What stands in the way of more of the same? Barring a scandal, which seems unlikely under this management team (although the Beneish score recorded in the Sharepad dashboard below should be noted), probably very little stands in the way.

Kainos is cautious about current UK government spending and the effect of Brexit remains to be seen. But there can be no doubt the UK and Irish governments will continue to digitise their transactions with citizens for many years to come. Kainos seems not to have put a foot wrong in this arena so far and has achieved a fabulous position in the sector which it no doubt intends to keep.

The other workhorse, Workday, is on a vertiginous growth path. Its sales have increased from $800m to $3bn over the last five years.

What is Kainos going to do with the £50m+ of cash it will likely have accumulated by next spring? This management seems unlikely to blow it on an acquisition. But it’s not doing much good in the bank. Could a special dividend be in order?

Will one of the global systems integrators buy Kainos? They’d love its Workday capability. The government business would come a bit cheaper, and the clear espirit de corps might be a discouragement. But there must be 300 software vendors around the world capable of buying Kainos and likely at least a few to whom it would make sense.

CONCLUSION

The SharePad dashboard shows 19 green signals out of 23. Looking at the reds: The director share sale was a very neat and presumably irresistible deal as the summer madness got into gear: Paul Gannon sold 6% of his shareholding at 622p. But the senior management have been notably restrained in selling shares since the flotation, so this red signal must be considered technical only. The PEG is fair for a quality company. The Beneish score (risk of financial manipulation) – is a more real concern. It would be intriguing to delve more deeply into this. But on the basis of my gut feel for the integrity of the board, I think it should probably be overlooked.

Alistair Blair

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.