With the pound falling by -14% so far this year against the dollar, Bruce looks at two companies that help SME businesses manage currency risk: AFX and EQLS. Plus payments company PCIP. The FTSE was up +1.3% at 7373 last week, with power and commodity companies leading the way Centrica, Glencore, Antofagasta and Anglo American […]

Category: Company analysis

Weekly Market Commentary 05/09/22 |BMS, CBOX, BGO| Winter is coming

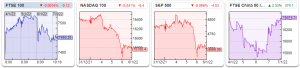

Looking at the sectors that have been worst hit by the cost of living crisis, Bruce suggests a sector filter could be used to ‘read across’ where problems are yet to emerge. Companies covered BMS, CBOX and BGO. The FTSE 100 was down -3.5% last week to 7,210. The S&P500 was down -2.2% and the Nasdaq 100 […]

Risky business

Richard writes an obituary for RM, his investment, rather than RM the business. It surprised him when it updated its risk report mid-term last week, despite what he had already learned. Perhaps it is because I do not scrutinise interim (half-year) results very often, or perhaps it is because I generally avoid heavily indebted companies, […]

Weekly Market Commentary 30/08/22 |SMV, KBT, SPE| Interest rates: the first 5,000 years

Central Bankers are having their annual shindig in Jackson Hole, so Bruce looks at the long-term history of interest rates and questions how much policy rates control activity and inflation. Companies covered SMV, KBT and SPE. The FTSE 100 was down -0.7% last week. The S&P500 and Nasdaq100 were also down less than -1% over […]

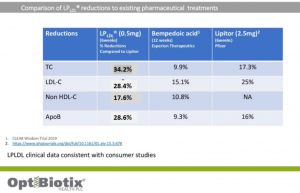

Small Company Champion: The Human Biome, a developing health frontier (Part 2)

Our second feature in this mini-series on the human microbiome explores skin health, which is far more complex as well as exciting in terms of addressing important skin health opportunities. In this feature Elric Langton looks at two very different British Companies, both leading the world in skin care products, and science. You can read […]

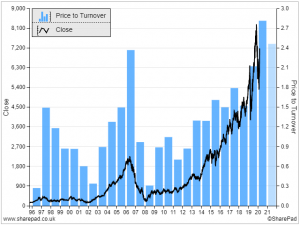

Screening For My Next Long-Term Winner: Cerillion (LSE: CER)

Cerillion’s shares have five-bagged since their pandemic low and remain near their all-time high. Maynard Paton studies the software group’s revenue profile, cash conversion and current valuation. Another month and another round of ‘back to basics’ filtering. Introduced earlier this year to identify James Halstead, this screen shortlists companies that offer cash-flush balance sheets, robust […]

Weekly Market Commentary 22/08/22 | MANU, DARK, TET, GHH | Just a bus stop in Hounslow

Looking at the returns from investing in football clubs, Bruce suggests the key is to identify well managed teams that have developed an effective way of operating. Stocks covered DARK, and profit warnings from TET and GHH. The FTSE 100 was up +0.9% last week to 7,571. The S&P500 was down -0.5%, and the Nasdaq100 […]

XP Power Ltd: Stick, twist, or fold (LSE:XPP)

A fellow investor is in a dilemma about one of her holdings: “Not sure what to do with the shares…” she writes. XP Power Ltd faces unanticipated challenges and the share price has more than halved. What should she do? An email from a reader has prompted me to think hard about XP Power. She […]

Weekly Market Commentary 15/08/22 | HAT, TCAP, OCM | Trust in long time horizons

Bruce discusses how long term compounders capitalise on trust. When applied shrewdly, this can be very rewarding. Companies covered HAT, TCAP and OCN The FTSE 100 was up less than 1% last week to 7,492. The Nasdaq 100 was up +0.7%, while the S&P500 was stronger up +1.5%. The US 10Y government bond yield continued […]

Weekly Market Commentary 08/08/22|BGO, KWS, DUKE|The orthodoxy of St James’s

Bruce suggests that if you’re looking for uncorrelated investment returns, you are better to invest your own money, rather than give it to a poker-playing long-short hedge fund manager. Stocks covered BGO, KWS and DUKE. The FTSE 100 was flat last week at 7,438. The Nasdaq100 continued to show good momentum +2.9%, but the […]

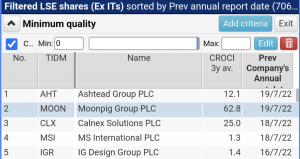

Finding quality flotations

Finding good investment ideas among companies that have floated on the stockmarket recently can be like looking for a needle in a haystack. Richard thinks he knows what to look for, maybe it is Moonpig. Some of my favourite new investment ideas in recent months have been recent flotations, companies like Marks Electrical and Dr. […]

Weekly Market Commentary 01/08/22| JDG, GAW, BOKU| Whatever it takes…

Bruce suggests that government debt to GDP ratios should include unfunded pension liabilities, and some of the issues from the Eurozone crisis a decade ago remain unresolved. Companies covered JDG, GAW and BOKU. The FTSE 100 finished the week at 7,423 up +2.0%. The Nasdaq 100 was up +4.5% and the S&P500 +4.3% with July […]

Small Company Champion: The Human Biome, a developing health frontier

During the three decades of investing, I have always tried to adapt to the changing landscape of the equity markets. This has included the use of investment funds, tip sheets as well as following economic commentators, but I have a passion for doing my own research – not to pit myself against anyone, but myself. […]

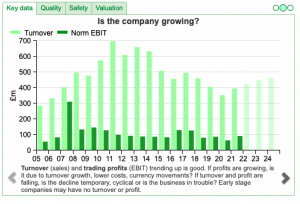

Screening For My Next Long-Term Winner: Liontrust Asset Management (LSE: LIO)

Poor fund performances, sizeable client withdrawals and generally rough markets have left the shares of Liontrust Asset Management yielding 8%. Maynard Paton weighs up the fund manager’s pros and cons. Difficult market conditions have prompted yet another bout of ‘back to basics’ filtering. Introduced the other month to identify James Halstead, this screen short-lists companies […]

Weekly Market Commentary 25/07/22| SDI, RBGP, HOTC | The capital cycle

Bruce considers whether profit warnings in the insurance and adtech signal that too much capital has been chasing too few opportunities. Sophisticated data models are no replacement for management turning cautious at the top of the cycle. Stocks covered SDI, RBGP and HOTC profit warning. The FTSE 100 recovered +1.6% last week to 7,276. Markets […]

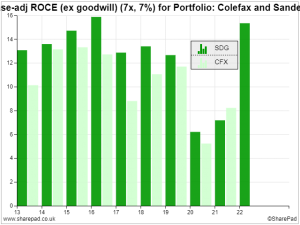

Sanderson Design: What now?

The fabric and wallpaper business is cheap and has a profitable past. Richard considers whether recovery will lead to sustainable growth… I am looking into Sanderson Design because an investor I know rates it and because as a former investor in Colefax, a customer and a competitor of Sanderson, I know (a little) about the […]

Weekly Market Commentary 18/07/22| CKN, CRL, TM17| Brands warning on costs

Following the profit warnings from Fevertree and Creightons, Bruce questions the conventional wisdom that companies with strong brands do well in an inflationary environment. Companies covered CKN, CRL, and TM17. The FTSE 100 was down -1.6% last week to 7,082. The Nasdaq100 and S&P500 were down -2.95% and -2.8% respectively. The 2yr – 10yr yield […]

Weekly Market Commentary 11/07/22| PRV, EQLS, AGFX| The seeds have been planted

Bruce looks at the BoE twice-yearly Financial Stability Report and wonders if the regulator is too sanguine about the risks of stagflation. Companies covered PRV, the industrial filtration company, and forex/payments companies EQLS and AGFX. The FTSE 100 was flat at 7,162, the S&P 500 and Nasdaq100 were up +2.0% and +4.5% respectively. That stock […]

Dr. Martens: fad or timeless staple?

The world’s biggest bootmaker Dr Martens may be the strongest single brand company available to UK investors, but before he becomes invested for the second time in his life, there are a couple of objections Richard must overcome. Today, I am taking a first look at Dr. Martens, for three reasons: It has just published […]

Weekly Market Commentary 04/07/22|SHOE, WISE, DDDD |Containership contango

Bruce sees more trouble on the horizon for the retail sector, fearing heavy discounting of unsold inventory later this year. Stocks covered SHOE, WISE and a post-mortem on DDDD. The FTSE 100 was down -0.6% last week to 7,160. The Nasdaq100 and S&P500 fell -1.66% and -0.27% respectively. The US 10Y Government bond fell back […]

Weekly Market Commentary 27/06/22|STEM, K3C, REC| Wirecard: fraud and flawed

Bruce looks at Dan McCrum’s book on Wirecard and suggests that there are still a couple of details that don’t make sense about the fraud. Plus upbeat releases from STEM, K3C and REC. The FTSE 100 recovered +1.2% to 7,101 last week. The Nasdaq100 and S&P500 were up 0.9% and flat over the last 5 […]

The promise and the peril: Learning Technologies

Richard takes a first look at Learning Technologies, a company aggressively buying businesses that make employee training and development content and software. Learning Technologies’ is a slightly bewildering agglomeration of businesses that helps organisations get the best out of employees. It creates training content for employers and makes software both for the creation of training […]

Weekly Market Commentary 20/06/22|DEVO, FDEV, BOTB| Remembering the days of Pali

Bruce reminisces about the demise of Pali, a firm he worked at in 2008 and looks at a couple of computer games companies (DEVO and FDEV) plus BOTB that reported last week. Markets had a difficult week with the FTSE 100 was down -3% to 7,114. The S&P500 and Nasdaq100 both fell -9% as the […]

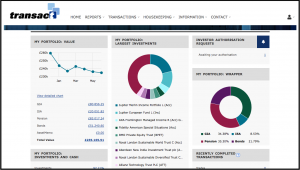

Screening For My Next Long-Term Winner: IntegraFin (LSE: IHP)

Difficult markets prompt Maynard Paton to search for ‘quality’ companies at reasonable prices. Filters for robust financials and director shareholdings lead to investment platform IntegraFin. Difficult market conditions for highly-rated ‘quality’ shares have prompted further back-to-basics filtering. Hence a new screen to identify companies offering robust financials, respectable growth, useful director ownership… and a reasonable […]

Weekly Market Commentary 13/06/22|ORPH, MRK, AO|Life sciences catch the software bug

Bruce looks at the spread of expressions like ‘platform’ and ‘flywheel’ from software companies to other sectors, including life sciences. Companies covered ORPH, MRK and AO. The FTSE 100 was down -1.5% in the last 5 days to 7,418. That’s better than the Nasdaq100 -4.8% and S&P500 down -3.8% over the same time frame. Brent […]

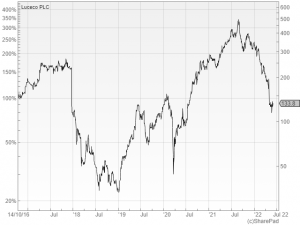

When the facts change…

Events at Luceco and Oxford Metrics may tell us more about the companies’ strategies, and whether they might make good long-term investments. Richard investigates. It is hard to believe Luceco’s share price is below the price it floated at in 2016, when turnover was 71% higher in the year to December 2021 than it was […]

Weekly Market Commentary 06/06/22|SFOR, IPX, OMG|The Price of War

Bruce looks at the performance of the UK economy muddling through WWI and the Spanish flu pandemic, an era when global trade flows and productivity also went into retreat. Stocks cover SFOR, IPX and OMG. The FTSE 100 rose +1.3% to 7592, in a short week due to the Platinum Jubilee. The price of oil […]

Weekly Market Commentary 30/05/22| AIM, KNOS, RNT, MORE| Analysing the de-rating

Bruce looks at how the market has de-rated on a price to sales metric since Q4 last year. But there are still 111 AIM shares trading on more than 10x revenue. Companies this week KNOS, MORE and RTN. The FTSE 100 rose +2.5% to 7569 last week. The S&P500 +4% and the Nasdaq100 +3.4% both […]

JDG V SDI: The Battle of Buy and Build

Shortly after Judges Scientific makes its biggest-ever acquisition, Richard sets out to discover whether the pasture is greener over at SDI, a smaller listed business that does much the same thing: buys and builds companies that make scientific instruments. If I were to use one measure to compare highly acquisitive businesses it would be Return […]

Weekly Market Commentary 23/05/22| OWIL, EQLS, FUTR, MONY| The value of amnesia

Bruce ponders the ingredients required to precipitate a systemic crisis, and why memories are so short in financial services. The FTSE 100 was flat at 7413 over the last 5 days. US markets had a more difficult week with the S&P500 -0.75% and Nasdaq100 -0.60%. The S&P500 is approaching bear market territory down […]

Weekly Market Commentary 16/05/22 |WATR, CCT, TET| Come on Eileen

With the BoE now suggesting inflation peaks at 10% later this year, Bruce goes back to 1982 when Dexys Midnight Runners were topping the charts to compare household indebtedness then v now. Stocks covered WATR, CCT and TET. The FTSE 100 fell -1.3% to 7286 last week. The Nasdaq100 was down -7% and the S&P500 […]

New companies for the watchlist

Richard surveys the latest annual reports for promising long-term investments. Big Technologies, Digitalbox, Somero, and Xaar catch his eye, but only one of them holds his gaze. Still, a strike rate of one out of four is not bad. Almost every weekday I open a table of all the shares listed in London in SharePad […]

Weekly Market Commentary 09/05/22 |LUCE, RCH, SFOR, LTG| Lazy formulas

Bruce looks at how successful formulas, if copied without thought, can become lazy thinking. He looks at a profit warnings from last week LUCE and RCH. Plus a couple of acquisitive “roll-ups” which the auditors delayed signing off the results: SFOR and LTG. The FTSE was down -0.9% at to 7,443 last week. The US […]

Weekly Market Commentary 03/05/22 |ZOO, SWG, SMV| An infinite puzzle with no edge

Bruce discusses the concept of “edge” – now that we all have access to the same information, how can anyone enjoy an advantage? Companies covered this week ZOO, SWG, SMV. The FTSE 100 was flat at 7,516 over the last week. The Nasdaq100 and S&P500 were down -2% and -2.4% over the same time period. […]

Portmeirion Group PLC: Portmeirion goes back to the future (LSE:PMP)

Richard re-examines one of his worst trades and considers whether changes at Portmeirion, the manufacturer of tableware and other home accessories, are enough to make him reconsider. Half a failed trade Portmeirion is one of the more severe of many blots on my trading history. I added Portmeirion to the model portfolio I run for […]

Weekly Market Commentary 25/04/22 |NFLX, CBOX, SOLI, CAPD| Lion King v Tiger King

Bruce questions whether the value of intangible assets on Netflix’s balance sheet are of the same character as Disney’s intangible assets. Plus a mix of UK stocks that reported last week CBOX, SOLI and CAPD. The FTSE 100 was down -0.2% to 7,563 last week. The Nasdaq100 was down -3.5% as Netflix was the latest […]

Small-Cap Spotlight Report: Beeks Financial Cloud (LSE : BKS)

Beeks Financial Cloud offers investors a convincing growth story backed by recurring revenue balanced by hefty expenditure and a racy valuation. Maynard Paton weighs up the pros and cons. Every share has a bull case and a bear case. Our job as investors should be to consider the arguments from both sides, and decide which […]

Weekly Market Commentary 19/04/22 |ARKK, PZC, MRK, AGFX | Growth Stocks and the St Petersburg Paradox

Bruce digs out an obscure 1957 paper on growth investing, that Warren Buffett refers to when answering a shareholder question at his AGM and applies the thinking to the ARKK Innovation ETF. Plus PZC, MRK and AGFX trading updates last week. The FTSE 100 closed ahead of the Easter weekend at just above 7,600, that’s […]

Morgan Advanced Materials | Follow the fd (LSE : MGAM)

Prompted by the notion that executives sometimes vote with their feet, Richard takes a first look at Morgan Advanced Materials. It recently poached Victrex’s chief financial officer. A by-product of attending the Victrex Annual General Meeting earlier this year was the opportunity to ask its chief financial officer why he was leaving for the arguably […]

Weekly Market Commentary 11/04/22 |DEVO, IGP, AFM, ELIZX | Clubs money can’t buy

This week Bruce takes a look at Elon Musk’s Twitter activism and what the London Stock Exchange might learn from Musk’s other activities. Companies covered computer game publisher DEVO, online identity company IGP and management consultancies AFM and ELIX. The FTSE 100 was 7,619 +1.1% last week. The UK index of blue chips has been […]

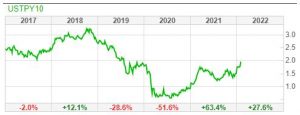

Weekly Market Commentary 04/04/22 | TND, BUR, EQLS | Diversification through time

Bruce looks at how pound-cost-averaging can help when the investing environment is particularly uncertain or the relationship between asset classes breaks down. Companies covered BUR, TND and EQLS. The FTSE 100 was up +0.8% last week to 7535. The Russian stock market was up +28%, after it re-opened following it being closed for a month, […]

Luceco PLC| Climbing the wall of worry (LSE : LUCE)

Richard finds answers to his questions about Luceco, a manufacturer of electrical products that power our homes. Knowledge, he finds, can be as powerful as electricity… This time last year one of my screens picked up Luceco, a company that makes electrical products like sockets. I wrote down my hopes and fears in SharePad and […]

Weekly Market Commentary 28/03/22 | SPSY, FNTL, JDG | Engines that move markets

Bruce suggests that strong equity markets may be reflecting asset class rotation out of government bonds, rather than optimism about the situation in Ukraine. Companies covered this week SPSY, FNTL, JDG The FTSE was up less than 1% to 7,492 last week. The Nasdaq100 and S&P500 were up +2.4% and 1.3% respectively. US Government bonds […]

Screening For My Next Long-Term Winner: Focusrite

From touring with Led Zeppelin to a £193 million shareholding: Phil Dudderidge has enjoyed enormous success leading music-equipment specialist Focusrite. Maynard Paton recaps the investment story. The market continues to wobble and I have therefore kept with my ‘back to basics’ filtering. Applied the other week to identify James Halstead, this screen short-lists companies that […]

Weekly Market Commentary 21/03/22 | FNX, TCAP, LIT | Off Ramps

Based on conversations with a first hand source, Bruce believes the narrative about Ukraine may be too optimistic. But would be very happy to be proved wrong in the next week or two if a cease fire is signed AND upheld. Companies covered Fonix Mobile PLC, TP ICAP Group PLC and Litigation Capital Management. The […]

Weekly Market Commentary 14/03/22 | CKN, BGO, FCH | Frameworks for resolution

Bruce remains in risk averse mode, keeping an open mind and updating beliefs to see how the conflict in Ukraine might resolve. He looks at Clarkson, which should benefit from high commodity prices, and also Bango and Funding Circle. The FTSE 100 was up +2.7% to 7,178, having had a very volatile week. The S&P […]

Calnex Solutions PLC (LSE : CLX)

Elric Langton explores provider of test and measurement solutions for the telecommunications sector Calnex, a company he has had his eye on since their IPO in 2020 and who released a positive trading update last week. I have had my eye on this next gem for some time, in fact, I was growing concerned I […]

Weekly Market Commentary 07/03/22 | CLX, NICL, SPA | The rich trade of the Black Sea and beyond

Bruce looks at the root causes of the conflict in Ukraine, and outlines two scenarios that the Bank of Georgia research team (who know a thing or two about Russian invasions) have discussed. Plus 3 companies reporting last week. “All civil wars are dynastic wars, my lord King; all overseas wars are trade wars…Troy commanded […]

Macfarlane Group PLC| Boring is best (LSE : MACF)

Richard takes a first look at protective packaging distributor Macfarlane, a company so boring even he could not bring himself to investigate it. The idea of investing in Macfarlane has been sitting with me for a while because an investor I follow has been banging its drum on Twitter. I have ignored him for all […]

Weekly Market Commentary 28/02/22 | NWG, LLOY, BARC, HSBA | Banking on Price to Book

Bruce looks at UK banks’ FY Dec 2021 results and draws out some themes on revenue, profitability, “one off items”, competition, interest rates and price / book valuation. The FTSE 100 sold off sharply last week down -4% on Thursday last week. US markets were more sanguine with the S&P500 down -1.4% and the Nasdaq100 […]

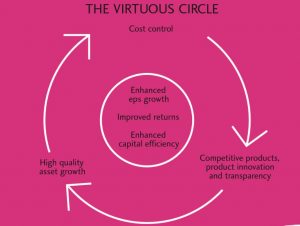

Roll-out, Roll-up and public market arbitrage | SBRY, PRZ, COST, DCC, MRL, BREE

Jamie Ward takes a detailed walk through two expansion strategies and outlines the types of company and sectors where investors are likely to find these strategies as well as highlighting how to spot companies using them well. Two common ways for profitable growth for many companies can be summarised as roll-out and roll-up. Roll-out is […]

Screening For My Next Long-Term Winner: James Halstead (LSE:JHD)

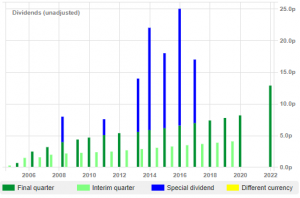

A wobbly market prompts Maynard Paton to search for potential ‘safe havens’. Filters for net cash, high margins and a pandemic-defiant dividend lead to vinyl flooring specialist James Halstead. Recent market wobbles have prompted some ‘back to basics’ filtering. Hence a new screen to identify companies that have strong balance sheets, robust margins and a […]

Weekly Market Commentary 21/02/22 |STAN, HEIQ, THG, FLTA, FRAN| Banking on the metaverse

Bruce remembers a former colleague, who preferred face to face interactions and was rarely at his desk during the afternoon (clue: he wasn’t in the metaverse either). Plus comments on Standard Chartered, HeiQ and Franchise Brand’s bid for Filta. The FTSE was down -1.5% to 7,543 last week. The Nasdaq100 was down -0.6% and the […]

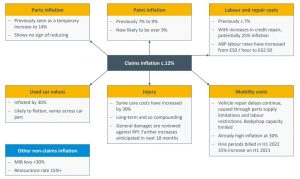

Beazley PLC | Property & casualty insurance and diversification (LSE : BEZ)

The task of investors is to find businesses that have created value, have a good chance of doing so in the future and are run by honest actors. This task is complicated by certain sectors where businesses don’t ‘look’ like most businesses. Jamie Ward returns with a look at Insurance through the lens of one […]

Garmin Ltd | Buy what excites you (NYSE : GRMN)

Richard takes a first look at Garmin. The World’s Simplest Stockpicking Strategy told him to. I can tell you precisely the moment I first thought of buying shares in Garmin, because I tweeted about it. It was Sunday 30 January and I was sitting on the sofa, checking my watch to see what kind of […]

Weekly Market Commentary 14/02/22 |PZC, K3C, SOLI| Never says “never banks” again?

Bruce suggests that while long term “expensive quality” investments have become increasingly popular as discount rates have fallen, a natural hedge for such a portfolio is bank shares, which could now benefit as rates rise with inflation. The FTSE 100 was up +2% to 7,617 last week. The S&P500 and Nasdaq100 were flat. The real […]

Weekly Market Commentary 07/02/22 |RSW, JHD, JOUL| Quality can’t be quantified…

While he is away skiing, Bruce asked ex-fund manager (with 16 years experience) and private Investor Jamie Ward to manage his weekly commentary this week. Jamie looks at the best things about being a private investor compared to being in the Square Mile as well as results from three companies that at some points in […]

Future PLC | One that got away (LSE : FUTR)

Future PLC is one of the outstanding growth stories of the last five years, but it is also one that eluded Richard. He fesses up to the biases that blinded him to the opportunity, and discusses whether it is still one today… Today’s company, Future, is one I should have taken a look at a […]

Weekly Market Commentary 31/01/22 |CBOX, DLAR, CNS|: All I want to know is…

There’s considerable institutional pressure on financial analysts to be positive, but often the most valuable information is negative: what to avoid. Bruce looks at a couple of case studies that reported last week. The FTSE 100 was flat last week, at 7,497. Matt Moulding’s THG fell to 134p, down -10% in the week and now […]

Cake Box Holdings has some accounting issues | Small-Cap Spotlight Report (LSE:CBOX)

Cake Box’s shares have tripled as its franchisees sell more egg-free cakes and open more shops. But Maynard Paton discovers the accounts contain some unusual financial disclosures and alarming remarks from the auditor. Oh dear. I had expected this article to celebrate a dynamic growth company that had commendably prospered during the pandemic. I find […]

Weekly Commentary 10/01/21: What’s new in 2022?

Bruce looks at how 3 ideas he crowded sourced from readers did in 2021, and asks for suggestions for 2022. Plus 4 companies that have been busy with corporate activity (acquisitions, approaches, disposals). The FTSE 100 was up +1% in the first week of 2022 at 7,450. Markets in the US were less positive […]

Rolls-Royce PLC | Investment in a greener future

As investors, we need to be nimble and embrace market developments wherever they may take us. Climate change, the topic of the moment, has sparked a cavalcade of “green” businesses that have caught my eye. My previous greener features include Insig AI (INSG), Kinovo (KINO), and *Powerhouse Energy (PHE) *before the valuation got silly. Rolls-Royce […]

Happy New Year

Richard slims down his flabby SharePad setup to start the year with a lean, clean investing machine. He sets out his goals for 2022 and says thank you to Phil Oakley, who hung up his boots in December. It is that time of year when many of us eat and drink too much and then […]

Screening For My Next Long-Term Winner: Ashmore

Terrific margins, plenty of cash, a reliable dividend and a modest rating could make Ashmore a decent QARP stock. Maynard Paton studies the fund manager and discovers how lower charges have limited past growth. Shares offering ‘Quality At a Reasonable Price’ have been hard to find during the last few years. But recent market conditions […]

Warehouse REIT | Real estate on the rise

Today’s featured company is a departure from the riskier and possibly sexier future opportunities and in many ways, Warehouse REIT (WHR) is a boring real estate investment trust, which is not known for its sex appeal or excitement. Sometimes, boring companies build wealth by stealth, as is the case with Warehouse REIT. It invests in […]

Marks Electrical plc | I liked the service so much, I nearly bought the company

Richard was so impressed by his first look at newly listed Marks Electrical, he was tempted to buy something from the online retailer of cookers and other domestic appliances. As for the investment, he was tempted too… I do not know whether it is a glitch or a feature, but a quirk of SharePad has […]

DFS plc | Will the investment last as long as the sofa?

Richard likes a business that is in control of its own destiny. He takes a look at DFS plc, the sofa seller that unexpectedly featured in his list of vertically integrated businesses. Of all the names that came up in my trawl for vertically integrated businesses, sofa seller DFS was perhaps the most surprising. To […]

Small-Cap Spotlight Report: Goodwin

30-bagger Goodwin has pivoted towards higher-margin contracts to widen its competitive ‘moat’. Maynard Paton weighs up the engineer’s haphazard financials with the delightfully old-school management. This quote from Richard Beddard caught my eye the other week: “If something truly special is incubating, we may profit from our investment for decades.” I am always up for […]

How profitable is Genus PLC?

Animal breeder Genus Plc is at the forefront of animal genetics and highly valued by investors, yet standard measures of Return on Capital Employed (ROCE), a marker for quality, indicate only modest levels of profitability. Unusually (for me) I rediscovered Genus because of an idea, rather than as a result of trawling through shares in […]

Empyrean Energy | High hopes for Topaz and Jade

Empyrean Energy PLC (EME) is a small Australian oil 7 gas exploration company with huge potential upside if it can succeed with the drill. The company has big hopes for black stuff turning into gold, or wads of cash for investors and the board. The CEO, Tom Kelly, has serious skin in the game. Empyrean […]

Weekly Commentary 04/10/21: Distance and Perspective

The FTSE 100 had a volatile week, rallying, selling off then recovering to 7,040 last Friday. The Nasdaq100 was down -4% and S&P500 -3.3% last week. US 10y Govt bond yield continued to trend upwards to 1.55% versus a low of 1.19% at the start of August. The UK 10y bond yield is up even […]

Four live pivots: Next, Goodwin, Bloomsbury Publishing and Victrex

Richard goes hunting in his own portfolio for companies incubating better businesses. They may be undervalued as a result. As promised, this week I am following up my last article on past pivots that worked with an article about live pivots that look like they are working. I used the word pivot to describe a […]

Weekly Commentary 27/09/21: New tech, old laws

Markets lurched downwards at the start of last week, with the FTSE 100 falling to 6,906 before recovering to 7,067. Nasdaq and the S&P also recovered during the week to 15,316 and 4,449 both moving less than half a percent. The FTSE China 50 was down 3.6%, and down 18% since the start of the […]

Screening For My Next Long-Term Winner: Curtis Banks

Specialist SIPP firm Curtis Banks has seen its dividend go up but shares go nowhere during the last five years. Maynard Paton now wonders whether the small-cap’s recurring income and high margins make it a ‘QARP’ stock. Shares offering ‘Quality At a Reasonable Price’ have been hard to find during the last few years. But […]

Should you buy SDI shares? | Screening For My Next Long-Term Winner

Acquiring private companies that make precision instruments has propelled SDI shares to 12-bagger status over the last five years. Maynard Paton recaps the story and prospects of the ‘buy and build’ specialist. Everybody loves a share that keeps going up. SharePad lists 168 names that have delivered 15% or more annualised turns during the last […]

Weekly Commentary 06/09/21: The Decline in r

The FTSE 100 was up less than half a percent last week to 7,164, towards the top of the trading range that it has occupied since early May. The Nasdaq 100 was up +1.1% ahead of the S&P500 +0.6%. The China 50 was one of the best performing major indices up +2.8% to 18,291 as […]

History of Games Workshop shares | When turnarounds become transformations

Inspired by Maynard’s article on Hornby’s turnaround, Richard examines the history of Games Workshop to imagine what challenges lie ahead if Hornby is to emulate the success of this outwardly similar hobby business. The idea for this article came from Maynard’s article about Hornby. To my mind he convincingly described a turnaround that is already […]

Weekly Commentary 31/08/21: Lower profits, improving performance?

The FTSE 100 was up half a percent last week to 7,124. The Nasdaq 100 had a better week +1.2% and the China 50 rebounded +4.5%, though that index is still down -14% in the last 3 months. The US 10-year bond yield finished last week at 1.35%, recovering from a low of 1.19% in […]

3 questions about Oxford Instruments plc | Deep dive into financials

Richard goes deep into Oxford Instruments’ annual reports and SharePad for answers to three questions to establish whether it is a good “pick and shovel play”. In my last article I explained how I used custom tables to find Oxford Instruments, a highly profitable business that seemed to have lost its way and then found […]

Should you buy Hornby shares? | Small-Cap Spotlight Report

Events at Hornby prove how turnarounds can take years. But fresh capital, better management and a return to profit could mean the model-train specialist is over the worst and finally heading towards a proper recovery. Turnarounds can be tempting. You find a business that has hit big trouble with a stock price at rock bottom… […]

Journeo PLC | Small-cap, ESG-friendly and on the rise

Journeo PLC (JNEO) is a tiddler I have had on my watchlist for a year or more. At today’s share price of 122p, the market cap is just £10.7 million, so very much at the lower end of valuations of the companies I have covered. Many investors would view this as a concern, a risk […]

Weekly Commentary 09/08/21: What $16 trillion of negative yields are signalling

Last week the FTSE 100 was up +1.1% to 7,111, Nasdaq was up 1.5% to 15,181, outperforming the S&P 500, up +0.8% to 4,429. Both the Hang Seng index in Hong Kong and the FTSE China 50 Index were up less than 1% last week. The US 10Y bond yield continued to fall to 1.19% […]

Should you buy ASOS shares? | Screening For My Next Long-Term Winner

ASOS share news Fashion website ASOS is among the market’s greatest growth stocks, but a recent update knocked 18% off the share price. The P/E may not be outrageous if huge warehouse and IT costs can one day deliver a suitable return. One of my favourite screening strategies is to hunt for attractive growth companies […]

Castings PLC: Why I’m reconsidering a failed trade

Richard was a long-term shareholder in Castings PLC, but he sold his entire holding in 2020. What did he see in the company? Why did he lose confidence after so many years? And what has changed to make him think perhaps it could be a good long-term investment after all? Castings PLC and I have […]

Making strides in forex: Should you buy Argentex shares?

I am sure many readers will be familiar with the impact of COVID-19 on the foreign exchange market. Subjugated to the rises and falls of major economies, the foreign exchange market faced wrath like so many other industries. As unemployment reached unimaginable figures, remittances fell to tragic lows. The year 2020 is a year of […]

Should you buy Calnex shares? | Small-Cap Spotlight Report

Warren Buffett admitted the other year that he had not bought shares at an IPO since 1955. “They’re picking the time to sell to you; I like it when I am picking the time to buy“, the investing master warned when asked about flotations. Mind you, every great share went public at some point… and […]

Investing in Sopheon PLC: A good niche is hard to find

Investors often find resilient businesses occupying specialist niches. Richard takes a first look at Sopheon, which makes software that helps big businesses manage the many products they are developing, and the strategic projects they are working on.

Investing in Team17 shares: A team worth joining?

Richard is thinking about joining computer games developer and publisher Team17 as a shareholder. It would be a bold decision, but he would rather invest in Team17 shares than the closest alternative, Frontier Developments. The first thing that attracted me to Team17 was the financials. The second thing was the chief executive. That is because […]

Equals Group PLC: Are they making a comeback?

Equals Group Plc (EQLS) is a provider of international payment services. The company operates through the following segments: Currency Cards, International Payments, Travel Cash, Banking and Central. It develops a cloud-based person-to-person payments platform that enables personal and business customers to make payments in a range of currencies and countries. The company was founded […]

Screening For My Next Long-Term Winner: Impax Asset Management

Impressive profit growth, a ‘scalable’ business, hefty insider ownership and a P/E re-rating have helped Impax Asset Management become a huge share winner. Maynard Paton looks closer at the ‘green’ fund manager.

What’s next in fashion retail

Richard examines Next’s bold strategy as it seeks to win the Internet by becoming an enabler of fashion brands. Surprisingly the strategies of the racier names in fashion retail look staid in comparison.

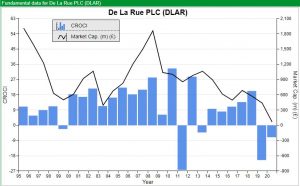

The Elephant Crypto-fans Ignore: De La Rue

If you believe cryptocurrencies are the future, then the bank notes and passports printer De La Rue (DLAR) is not for you.

When is a bargain not a bargain?

Richard’s pursuit of Quarto, a publisher of illustrated books, takes him on a trail that leads to Hong Kong and Delaware. What he finds is anything but a straightforward turnaround.

Small-Cap Spotlight Report: WANdisco

WANdisco has raised $217 million since 2012 yet has never made a profit. But could deals with Microsoft and Amazon finally trigger a sales boost? The board’s optimism is not backed by its share dealing.

Getting to know Moneysupermarket

Moneysupermarket wants to get to know us, so it can sell us more products. Innovation and diversification are the pillars of a strategy responding to a maturing market.

PZ Cussons doubles down on focus

PZ Cussons is sharpening its focus on 8 “Must Win” hygiene, baby and beauty brands in the UK, Nigeria, Indonesia and Australia.

Good strategy/Bad strategy

A company’s strategy should not just tell us what it wants to achieve, but why and how. Richard introduces a simple framework for analysing strategy and highlights a good strategy, and one that is more difficult to fathom.

Small-Cap Spotlight Report: Norcros

Let me start by confessing this article covers pension deficits. What follows may not be that thrilling and does require you to concentrate. But please stick with me, especially if you have ever fallen victim to a ‘value trap’.

Weekly Commentary 22/03/21: Ports and platforms

Bruce compares a couple of Direct Carrier Billing (DCB), mobile payment platforms: Boku v Bango. He wonders if platform economics has become too popular, with the benefits well recognised but not downside. Also Ocean Wilsons, the Brazilian (Salvador, Bahia) port business.

Quality cyclicals – not for the faint-hearted

Over the years I have ignored Kingspan because it is big, acquisitive, and supplies building materials. My gut reaction to these facts is that Kingspan is best avoided, but my gut could well be wrong.