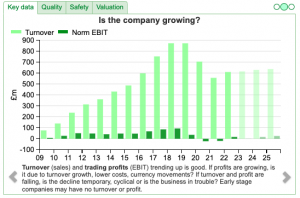

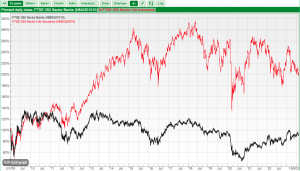

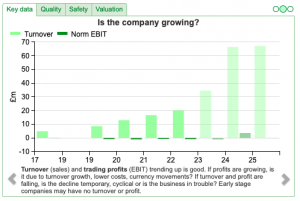

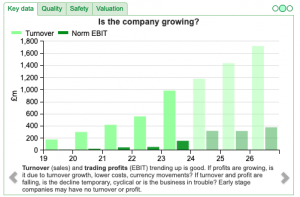

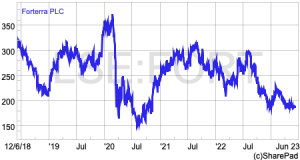

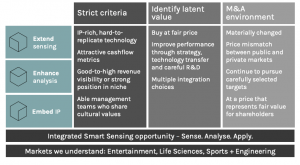

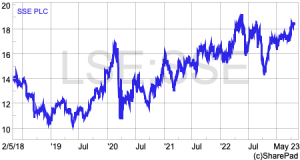

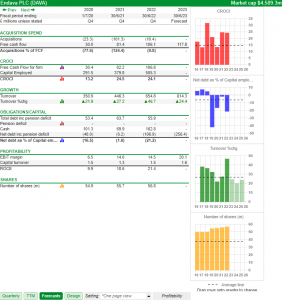

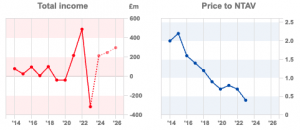

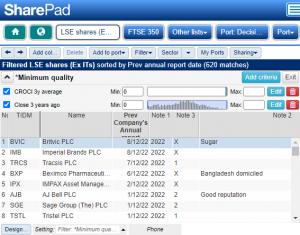

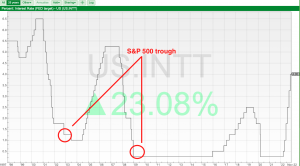

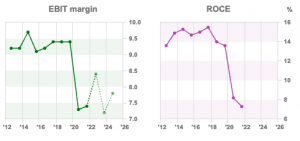

Shares in SDI have plummeted. Richard examines the price differential between the company, a manufacturer of scientific equipment, and Judges Scientific, a firm it is often compared to. In the last two weeks, my 5 strikes system* has only surfaced two new investment ideas: SDI and Goodwin. These businesses have good financial track records, but […]