Prompted by the notion that executives sometimes vote with their feet, Richard takes a first look at Morgan Advanced Materials. It recently poached Victrex’s chief financial officer. A by-product of attending the Victrex Annual General Meeting earlier this year was the opportunity to ask its chief financial officer why he was leaving for the arguably […]

Category: Richard Beddard

Luceco PLC| Climbing the wall of worry (LSE : LUCE)

Richard finds answers to his questions about Luceco, a manufacturer of electrical products that power our homes. Knowledge, he finds, can be as powerful as electricity… This time last year one of my screens picked up Luceco, a company that makes electrical products like sockets. I wrote down my hopes and fears in SharePad and […]

From ideas to investments: Investing in local heroes

Richard makes the case for investing in local firms, helped by analysts from The Yorkshire Fund. As usual, SharePad can help. I am starting this article with a shout-out to the analysts of the Yorkshire Fund. You probably have not heard of the Yorkshire Fund. We cannot invest in it. It is a mini financial […]

Macfarlane Group PLC| Boring is best (LSE : MACF)

Richard takes a first look at protective packaging distributor Macfarlane, a company so boring even he could not bring himself to investigate it. The idea of investing in Macfarlane has been sitting with me for a while because an investor I follow has been banging its drum on Twitter. I have ignored him for all […]

Garmin Ltd | Buy what excites you (NYSE : GRMN)

Richard takes a first look at Garmin. The World’s Simplest Stockpicking Strategy told him to. I can tell you precisely the moment I first thought of buying shares in Garmin, because I tweeted about it. It was Sunday 30 January and I was sitting on the sofa, checking my watch to see what kind of […]

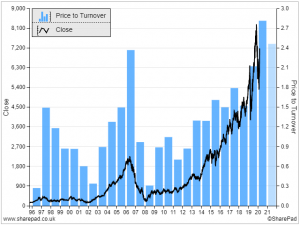

Future PLC | One that got away (LSE : FUTR)

Future PLC is one of the outstanding growth stories of the last five years, but it is also one that eluded Richard. He fesses up to the biases that blinded him to the opportunity, and discusses whether it is still one today… Today’s company, Future, is one I should have taken a look at a […]

Oxford Metrics | Profiting from the augmented age (LSE:OMG)

Oxford Metrics has an illustrious past, and judging by management’s targets it expects to augment it in future. Richard investigates the past, and ponders the future… I discovered Oxford Metrics while paging through SharePad’s list of the whole market (LSE shares, excluding Investment Trusts) skimming the summary pages of companies that had recently published annual […]

Happy New Year

Richard slims down his flabby SharePad setup to start the year with a lean, clean investing machine. He sets out his goals for 2022 and says thank you to Phil Oakley, who hung up his boots in December. It is that time of year when many of us eat and drink too much and then […]

Rediscovering the father of value investing | Benjamin Graham

Richard warms the cockles of his heart in front of a digital fire, while reading his favourite investment book… Christmas is approaching, and I must confess to a new and slightly eccentric guilty pleasure. In addition to mince pies and Irish Coffee, I have taken to working (from home of course) in front of an […]

Bytes: Which is the best IT reseller?

Recent flotation Bytes Technology has joined bigger rivals Softcat and Computacenter on the stock market. Richard wants to know what it does differently. In my last article I introduced Marks Electrical, a company that had recently floated that might be an exception that proves the rule that Initial Public Offerings (IPOs) make terrible investments. The […]

Marks Electrical plc | I liked the service so much, I nearly bought the company

Richard was so impressed by his first look at newly listed Marks Electrical, he was tempted to buy something from the online retailer of cookers and other domestic appliances. As for the investment, he was tempted too… I do not know whether it is a glitch or a feature, but a quirk of SharePad has […]

DFS plc | Will the investment last as long as the sofa?

Richard likes a business that is in control of its own destiny. He takes a look at DFS plc, the sofa seller that unexpectedly featured in his list of vertically integrated businesses. Of all the names that came up in my trawl for vertically integrated businesses, sofa seller DFS was perhaps the most surprising. To […]

Winners in an uncertain world | Vertical integration

In the chaotic business conditions we are experiencing, self-reliance has been a source of competitive advantage. Since we do not ever know what the future will hold, Richard goes in search of companies that have an element of vertical integration. I hope it is not smugness, but I have felt a sense of satisfaction when […]

How profitable is Genus PLC?

Animal breeder Genus Plc is at the forefront of animal genetics and highly valued by investors, yet standard measures of Return on Capital Employed (ROCE), a marker for quality, indicate only modest levels of profitability. Unusually (for me) I rediscovered Genus because of an idea, rather than as a result of trawling through shares in […]

Four live pivots: Next, Goodwin, Bloomsbury Publishing and Victrex

Richard goes hunting in his own portfolio for companies incubating better businesses. They may be undervalued as a result. As promised, this week I am following up my last article on past pivots that worked with an article about live pivots that look like they are working. I used the word pivot to describe a […]

Betting on change

In the first of two articles, Richard celebrates perhaps the sweetest investment of them all: The humdrum business that incubates a better one. Though my stock-in-trade is businesses reliably executing established and successful strategies, my biggest winners have often been businesses that pivoted. They incubated better businesses from within the business they already operated. In […]

History of Games Workshop shares | When turnarounds become transformations

Inspired by Maynard’s article on Hornby’s turnaround, Richard examines the history of Games Workshop to imagine what challenges lie ahead if Hornby is to emulate the success of this outwardly similar hobby business. The idea for this article came from Maynard’s article about Hornby. To my mind he convincingly described a turnaround that is already […]

3 questions about Oxford Instruments plc | Deep dive into financials

Richard goes deep into Oxford Instruments’ annual reports and SharePad for answers to three questions to establish whether it is a good “pick and shovel play”. In my last article I explained how I used custom tables to find Oxford Instruments, a highly profitable business that seemed to have lost its way and then found […]

Financials, filters and FOMO | Using SharePad to find opportunities

Filters are one of the most powerful tools in SharePad, but Richard has been experimenting with another way to discover investment ideas and increase his “market intimacy”. Traders, of course, have price charts to guide them. Many investors focus on financials, and use filters to find new shares with attractive financial characteristics. Being a buy-and-hold […]

Investing in Sopheon PLC: A good niche is hard to find

Investors often find resilient businesses occupying specialist niches. Richard takes a first look at Sopheon, which makes software that helps big businesses manage the many products they are developing, and the strategic projects they are working on.

Investing in Team17 shares: A team worth joining?

Richard is thinking about joining computer games developer and publisher Team17 as a shareholder. It would be a bold decision, but he would rather invest in Team17 shares than the closest alternative, Frontier Developments. The first thing that attracted me to Team17 was the financials. The second thing was the chief executive. That is because […]

Screening For My Next Long-Term Winner: Impax Asset Management

Impressive profit growth, a ‘scalable’ business, hefty insider ownership and a P/E re-rating have helped Impax Asset Management become a huge share winner. Maynard Paton looks closer at the ‘green’ fund manager.

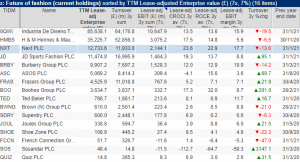

What’s next in fashion retail

Richard examines Next’s bold strategy as it seeks to win the Internet by becoming an enabler of fashion brands. Surprisingly the strategies of the racier names in fashion retail look staid in comparison.

When is a bargain not a bargain?

Richard’s pursuit of Quarto, a publisher of illustrated books, takes him on a trail that leads to Hong Kong and Delaware. What he finds is anything but a straightforward turnaround.

Getting to know Moneysupermarket

Moneysupermarket wants to get to know us, so it can sell us more products. Innovation and diversification are the pillars of a strategy responding to a maturing market.

PZ Cussons doubles down on focus

PZ Cussons is sharpening its focus on 8 “Must Win” hygiene, baby and beauty brands in the UK, Nigeria, Indonesia and Australia.

Good strategy/Bad strategy

A company’s strategy should not just tell us what it wants to achieve, but why and how. Richard introduces a simple framework for analysing strategy and highlights a good strategy, and one that is more difficult to fathom.

Shares to help you sleep at night

I am probably jinxing it now, but owning shares in Howden Joinery has never lost me sleep. Despite the pandemic and a fall in profit, this year’s annual report has the same calming effect it does every year, and not just because of the pictures. Howdens explains the business very well, and quietly delivers on the promise.

Quality cyclicals – not for the faint-hearted

Over the years I have ignored Kingspan because it is big, acquisitive, and supplies building materials. My gut reaction to these facts is that Kingspan is best avoided, but my gut could well be wrong.

Turning over even more rocks

Recently, I have adapted my SharePad setup so I can turn over even more rocks. The cornerstone of my setup remains the KISS+ filter. KISS, stands for Keep it Simple (Stupid) and the plus sign is just a reminder that I have improved this filter over the years.

The second most important ratio

If you look DotDigital, as I did a few years ago, you will find much to like about the business: Source: SharePad financial summary It is highly profitable in terms of Return on Capital Employed and profit margin. The exciting thing about a company like this is, as long as it can reinvest the cash […]

Roll up! Get yer easy returns here…

Bunzl, a company I investigated last year, is a classic roll up A distributor of everyday items consumed by businesses and organisations, it routinely acquires much smaller distributors, improves their efficiency and creates economies of scale. This reduces customer’s procurement costs, and improves the profitability of the mothership. To grow, the company has repeated this […]

Made from girders

Barr makes Irn Bru, which I drank once, getting on for forty years ago in Scotland. Irn Bru is to Barr what Coke is to Coca-Cola and Vimto is to Nichols, the drink upon which the business was built. Being a southern softy I may not have been a regular drinker of Irn Bru, but […]

Annual reports made simple

Happy New year. This year, I have resolved to keep things simple, which is not easy in investing. Aide memoire… Just before Christmas Chris, a SharePad customer, emailed me with a request: When I look at company reports which often run to a couple of hundred pages I find the position somewhat daunting… It would […]

Lessons from lockdown and other stories

This year has confirmed that most of the news is at best irrelevant to me as an investor. Worse, the news stressed me out. It regularly fed my mind with impossible problems to solve. Companies I admired closed down, temporarily I hoped. They raised money in emergency fund-raisings. They furloughed staff. So far, the determination […]

Nichols: More than Vimto

Having prospected for investments in the soft drinks industry, I think Nichols is perhaps the most intriguing of quite an interesting group. It has been enormously profitable and a steady grower, unlike the other candidate, Fever-Tree, which has experienced both extraordinary profit and extraordinary growth. Fever-Tree makes me nervous. Explosive growers rarely keep growing rapidly […]

Finding the soft drinks companies with the most fizz

I know this is going to make me sound like an alcoholic, but I rarely drink soft drinks. When a reader requested an overview of the soft drinks sector, I was not, therefore, particularly enthusiastic. For me, liking the product, or at least seeing its value, is a prerequisite for investment, and, on health grounds, […]

Investing through the pandemic

When I told my wife I was researching Hotel Chocolat and my first action would be to buy some chocolate, she reminded me that the most important thing about research is to include lots of participants. Scuttlebutting chocolate 70% dark chocolate promised to be our optimal pleasure point, and so it was. When I brought […]

Floored

James Halstead makes vinyl flooring, the kind we see in hospital corridors, GP surgeries, clinics, schools, offices, laboratories, prisons, factories, shops, trains and boats around the world. James Halstead’s biggest brand is Polyflor. The company’s social media accounts are a good way to get a feel for the product and you can take the Commercial […]

Don’t waste a good crisis

Before I started fishing for a share to investigate for this week’s article, I culled my personal filter library. Many of the filters are derivations, refinements that effectively render older filters redundant. Some are failed experiments. Being a simple sole, I cut the library down to four: The old ones are the good ones – […]

What does not kill a business can make it stronger

This article was not supposed to be about paper maker James Cropper. I set out to write about Animalcare, a veterinary pharmaceutical company, but I quickly became disillusioned, wretched even. You probably will hear about Animalcare one day, because it is an interesting business, but it is also complicated and its complicatedness was epitomised by […]

This time is different for Design Group

If you watch Design Group’s annual results presentation, you may detect a bashful smile on chief executive Paul Fineman’s face. Paul Fineman, chief executive of Design Group. Source: Design Group Full Year Results 2020 (video). Despite unexpected tariffs on products imported into the USA from China and the onset of the pandemic, Design Group was […]

A company that is already successful

It would be convenient to report that I diligently pick every share I investigate from a Sharepad filter of exquisite construction, but it would be untrue. Sometimes I click around randomly until I find an interesting stock. I had heard Bunzl had had a “good pandemic”, and when I saw that its PE ratio and […]

A safety first stock

I found James Latham a couple of months ago when I was trawling for cheap shares with strong balance sheets. The shares are still cheap, James Latham’s Price Earnings (PE) ratio is 13, and the balance sheet should remain strong… Centuries trading timber James Latham has a long and storied history. It manufactured plywood for […]

Preparing for the worst, capitalising on the best

Listening to Porvair’s long-standing chief executive Ben Stocks talk about the challenges ahead, it is clear the company is bracing itself. Phrases like “preparing for the worst, hoping for the best”, and “the overall balance is negative”, come readily to him. This is a company I have long admired, but I have never had the […]

Making a new discoverIE

I discovered discoverIE using a simple and fruitful method of finding new investment ideas: a list of shares sorted in SharePad by previous annual report date. Having squinted for a few minutes at financial charts showing profitability, cashflow and debt (more on that later), I thought the company looked promising: Sorting a list in SharePad […]

Volex: Reassuringly above average

If you’ve read my recent articles you will know I have been ranking shares using basic financial statistics. I found Bioventix by ranking five criteria. The objective was to find profitable companies mostly financed by equity rather than debt, with high quality assets and low valuations. The more profitable, the more conservatively financed, and the […]

A cheap profitable share with a strong balance sheet

Today I have added two more criteria to turn the list of cheap shares with strong balance sheets I made in my last article into a list of cheap profitable shares with strong balance sheets! The profitability criteria are free cash conversion and return on capital employed. This table shows the individual and aggregated rankings […]

Ranking potential bargains

A SharePad customer, Chris, reminded me of the power of ranking recently, when he emailed to say (among other things): “I find that I am playing with spreadsheets to get the data in place rather than actually making decisions. I guess sometimes too much data can be detrimental…” Decisions are hard, and messing around with […]

Getting to grips with software companies

First, an admission. The software biz is a bit of a mystery to me. There’s a vast ecosystem of enterprise solutions, software that businesses increasingly need to operate, but how do those of us whose technical skills extend little further than Word and Excel decide whether these solutions and the companies that code them are […]

The changing shape of QinetiQ

I have picked QinetiQ from my “Cash King” filter because it was one of the more reasonably priced companies that passed all the criteria. It’s debt-adjusted PE ratio is 14. QinetiQ makes Rattler, a supersonic target that simulates air-launched anti-radiation missiles. Source: QinetiQ annual report 2019 The company is a defence technology business, once part […]

In search of the cash kings

While the stock market and the pandemic may have stabilised, I’m still thinking about financially strong firms. We never know when the next shock will happen, and a cash cushion gives us confidence a company will make it through when revenue melts away. I spent the last two articles experimenting with filters to find financially […]

Filtering for financial fortresses

The conclusion of my last article on finding companies with strong finances contained two caveats. Companies with seasonal cash flows can look like they have strong finances at the end of the financial year, when they report, but be weaker at other times during the financial year. Also, strong finances are not necessarily the result […]

Putting safety first

Funny thing (peculiar, not ha! ha!). Search SharePad news for the phrase “strong balance sheet” and there are dozens of companies every day confirming their finances are strong as they reflect on the prospect of reduced, or in some cases, no revenue for a while. Search SharePad news for the phrase “weak balance sheet” though […]

Getting more out of return on capital

How we measure return on capital depends on what we want to know: whether a company is good at making profit from its operations, or whether it is good at buying other businesses. As I write, the stockmarket is crashing. I have invested in strong businesses that should prosper through thick and thin, but that […]

Going for repeat business

Fundsmith Equity probably needs no introduction. Since its launch in November 2010 the fund has racked up class-leading annualised returns of more than 18%, compared to less than 12% for an index of global equities, by investing in high quality businesses at attractive valuations. You can, of course, make further comparisons, and explore the makeup […]

Taking back control

Richard investigates Dialight, a supplier of industrial LED lighting that flared up ten years ago briefly setting the stock market alight, and subsequently dimmed alarmingly. What are its prospects now it is taking back control of manufacturing? Ten years ago Dialight was a feted, fast growing business in a booming industry, LED lighting, but it […]

When bad news is good news

Richard investigates Vitec, which has reported some bad news in 2019. It could be an opportunity to buy shares in a high quality business at a low valuation. I don’t always follow up on reader suggestions, sometimes people recommend companies so repugnant it’s difficult to believe they have ever read a line of mine. But […]

Death in paradise

The demise of Thomas Cook impacted the whole package tour industry including London listed Online Travel Agent, On The Beach. Whether you trust the accounting regulations or On The Beach’s adjustments makes a big difference to the company’s profitability in 2019. Richard unravels the exceptional items. It’s January, The BBC is screening Death in Paradise, […]

Out with the old, in with the new

Richard enters 2020 with a cleaned-up SharePad setup primed to help him find companies developing competitive advantages. He expects it to make him a better long-term investor too. Happy New Year! As a full time writer/investor the festive season is the only set time in the year when I fully shut down. Like an ancient […]

Alpha FX speaks my language

In response to a reader’s suggestion, Richard investigates Alpha FX. It is exactly the kind of people-first business that could be building a long-term competitive advantage and consequently grow inexorably. As I was considering what to write about for my last article before the Christmas break, a present from a reader arrived in my inbox. […]

The ultimate competitive advantage

Business schools identify the sources of competitive advantage that tie customers to companies and what they produce. Fundamentally though, there is only one true competitive advantage: people. If I could recommend one book for long-term investors, it would be “Intelligent Fanatics Project” by Sean Iddings and Ian Cassell, which is subtitled “How great leaders build […]

Skin in the game: Two for the watchlist

Richard uses his “Skin in the game” table to find companies whose directors are major shareholders. The experiment starts off badly with Asset Co., but gets better. Frontier Development and Focusrite could be great owner-managed businesses. To recap: We can use SharePad to find companies that are run by managers who are themselves significant shareholders. […]

Investing alongside managers with skin in the game

Richard uses SharePad to find companies whose managers are also significant shareholders. They are likely to be building businesses for the long-term, he says. The reasons for investors to look kindly on owner-managers, executives that have large shareholdings in the firms they run, are ably described in this article by Harry Fraser, manager of the […]

Burberry joins “Future of Fashion” portfolio

In his quest for companies that control their own destinies, Richard discovers luxury fashion brand Burberry, a company whose products he is in no danger of buying. Last time, I promised to investigate one of the shares I found while filtering for vertically integrated companies, companies that control their own destinies because they control many […]

Finding companies that control their own destinies

Fallout from the demise of Thomas Cook reminds Richard of the virtues of vertical integration. In the month since the demise of Thomas Cook, the company that invented package tours, there has been much talk of rivals who will benefit from the fact that perhaps 2.5m Thomas Cook customers will be looking elsewhere for their […]

What PZ Cussons’ cashflow tells us about its strategy

Having found PZ Cussons through his Keep It Simple, Stupid filter, Richard examines the company through its cash flow statement. To his delight, he finds a company promising to keep things simple too. Two weeks ago I augmented my Keep it Simple, Stupid filter to keep things even simpler. The filter is designed to rule […]

Filtering out the big spenders

Richard invents a new filter that promises to weed out big acquirers in a drive for simplicity he hopes will make investigating his next company easier. Complications tend to keep investors awake at night and wakeful nights are not conducive to long-term investment. You join me today on a quest for simplicity. Keeping it simple […]

The future of holidays portfolio

Richard returns from his holiday and wonders whether he can put the experience to use by investing in holiday companies. First step: Create a portfolio of holiday companies. It is early September, so I am going to take a wild guess and assume you have been on holiday. Hopefully it was a good one. Mine […]

Hidden potential in new division

Richard analyses Bloomsbury Publishing’s segmental report to work out where the profit is coming from. The Harry Potter effect is still evident, but the company is conjuring up another source of profit without recourse to magic. My last article ended on something of a cliffhanger because I had found something out, but I did not […]

Finding the best companies to analyse

A wise man once advised investors to stick to their circle of competence. Richard uses SharePad to keep his eye on the prize, and it leads him to Bloomsbury Publishing… My base filter in SharePad currently returns a total of 596 shares listed in London. It does not do anything clever. It just excludes the […]

The art of the sale

In response to a reader’s request for a sell filter, Richard goes looking for trouble in his portfolio by setting some “curiosity triggers”…. One of the better bits of advice passed between investors is to sell shares when the reasons you bought them no longer hold true. Most of us will have all sorts of […]

How to work out whether a firm is good acquirer

Richard uses a trick from Judges Scientific’s playbook to assess local hero Scientific Digital Imaging. Both companies acquire scientific instrument manufacturers using a “buy and build strategy”. Last month we worked out how to populate Google Maps with SharePad data to find local companies to invest in. Today, we will take the process a stage […]

The Future of Retail portfolio

Rule number one in investing is to buy what you know, but how does that work when what you know is changing day by day? Richard grapples with clothing and fashion retailers, who are themselves grappling with the emergence of the Internet. Just about every type of retailing is going through profound change thanks to […]

Checking the numbers match the story

One thing we should always check is that a company’s long-term performance matches the story it tells us. Churchill China says it is “adding value” to tableware, a horrible bit of jargon that is easily corroborated in SharePad. I received a nasty shock last time I reviewed one of my long-standing investments. Familiarity, I said, […]

Hidden treasure on your doorstep

Finding local businesses listed on the stock market is easy with the help of SharePad and Google Maps. Richard maps the market to find out what’s good in the ‘hood. When I wrote about Portmeirion last time, I promised to review a second “old favourite” in this article. In the meantime, though, I have been […]

Portmeirion: When confidence crumbles

SharePad is not just about discovering new shares, it can help us see shares we are familiar with in a new light. Richard uses it to re-evaluate old favourite Portmeirion and his confidence begins to crumble even before events take a nasty turn… This week, and in a fortnight’s time, we will look at two […]

Bodycote: A stalwart in cyclical clothing

Richard investigates a company that not only walks the walk, it talks the talk. I am not going to lie, even if it means shattering the illusion investors are cool rational calculating machines. I experienced a prolonged period of joy when I started investigating Bodycote. Snared by my Fundsmith filter, the company not only walks […]

RM: Will profit endure?

Richard considers whether the supplier of educational resources and software services can sustain profitability and reignite growth. There’s a good chance, he thinks, which makes RM an intriguing proposition at its current valuation. In my last article, we took a tour through SharePad and RM’s annual report to check its profit was real. RM is […]

RM: Is profit real?

Richard investigates RM, one of the stock market’s great survivors, starting with just one question. It takes him on a twisty trail… Before we get into the numbers, some reasons why RM, a supplier of 50,000 educational products and IT to schools and nurseries and on-screen marking services to exam boards, is worthy of investigation: […]

Moneysupermaaaaaaahhhhhhket

The veteran price comparison company is changing, and maybe for the better. Richard investigates one of the companies that easily met the criteria of his Fundsmith filter. I avoid Price Comparison Websites. The notion we should all be like hamsters in a wheel, swapping insurance policies and energy suppliers every year for cheaper alternatives is […]

Fishing like Fundsmith

Richard builds a Fundsmith filter, taking it from concept to conclusion. The aim: To reduce the “junk” in our watchlists so we are fishing in a better-stocked pool of shares. My editor wonders whether my obsession with Fundsmith Equity Fund is a ‘fatal attraction’ but he has permitted one more article. It would be remiss […]

Performance measurement for pros

Investors tend to judge their portfolios by how much they go up or down in value, typically compared to a benchmark index like the FTSE All-Share, over perhaps a year. Taking a leaf out of Fundsmith Equity’s playbook, Richard thinks he has found a better way. In my last article, I questioned Fundsmith Equity, a […]

Putting performance into perspective

Richard reads Fundsmith Equity Fund’s annual letter to fundholders and suggests a modest improvement that could change your perception of financial history. He also responds to reader’s queries about On The Beach, the company he profiled two weeks ago. If you are a fundholder in Fundsmith Equity Fund, then congratulations. You’ve just received fund manager […]

Starting with the big picture

Richard starts his analysis of fast growing online beach holiday retailer On The Beach with new SharePad views designed to give him the big picture at a glance. Before I start dreaming about holidays, some humble pie. A few weeks ago I ridiculed the idea of using more than three SharePad windows by suggesting they […]

Assessing whether profit is real

On the face of it Ricardo is a great company, but in recent years its earnings have deviated a long way from the cold hard cash that has flowed into the company. That may be changing. Though I don’t normally pay much attention to share prices, a 40% slump in the price of Ricardo values […]

A SharePad for every occasion

Richard takes a break from company analysis and reveals a new layout for news, and reflects on some of the other tweeks he has used this year to make SharePad even easier to use. Season’s greetings! As the New Year approaches even my enthusiasm for digging into financials wanes and I indulge myself – and not […]

Two good companies, but which is better?

Richard takes a first look at Softcat, and he likes what he sees, even in comparison to rival Computacenter, another fine business. Both companies make good money distributing IT, but in Softcat he may have spotted a company with a growth culture. I wrote favourably about Computacenter in October, so I have two good reasons […]

Searching SharePad for something special

Richard Beddard investigates DotDigital in SharePad. The data indicates it has been very prosperous since it floated on the London Stock Exchange in 2011. A surge in investment suggests it intends to keep things that way. The starting point for many of the ideas I discover in SharePad is a basic four stage process that […]

What really makes a great business?

To identify great businesses we must go beyond the numbers and understand what causes them. In this article I revisit 4Imprint, an investment I should have made in 2013, and a business probably still worthy of investment today. Back in May 2013 I wrote excitedly about a company selling promotional products to US companies. 4Imprint’s […]

Evaluating a hot tip

Psst, company XYZ is going great guns, it’s shooting for the moon, get in before it is too late!!! In today’s article, Richard uses SharePad to evaluate Clipper Logistics, a tip he received anonymously on the Internet. Tips passed online are sometimes little more than ramps, invitations to boost the tipster’s wealth by buying shares […]

When dull businesses come good

Stroll into a WH Smith and you might wonder why a shop that sells Sellotape, colouring books and slime (really!) exists today, but the company thrives. Smith’s creeping reinvention is an example to investors seeking to profit from businesses people casually write off because they see no future in them. Perhaps Computacenter is another. The […]

Filtering new issues

New issues have a reputation for delivering poor investment returns. In this article we filter SharePad for companies that may be more seasoned than they look. In my last article, I filtered SharePad for the firms that had been listed longest on the London Stock Exchange. Statistically speaking, the longer an investment has been listed […]

The old ones are the good ones

Exciting news: Aston Martin is readying itself to float on the stock market. Investors should think twice though, before buying the shares. Typically, it is the most seasoned firms that make the best investments. This is how you can find them. The Aston Martin story has many of the hallmarks of a big flotation. The […]

Building a base filter

To demonstrate how to filter in SharePad, we’ll build a base filter that filters out the shares we are least likely to be interested in. Our criteria will be personal, but the filtering technique can be applied to almost any investment style. Establishing your sweet spot To exclude shares we don’t want, we must decide […]

The perils of filtering stocks

This is the second article in the series “From ideas to investments” in which I look at the process of finding and evaluating investment ideas. Fishing for stocks using filtering, or stock screening, is a quick way to create a shortlist of shares that are likely to perform well – but only if we buy […]

How the stock market actually works

Today’s article is the first in a new series called ‘From ideas to investments’ which takes an in-depth look at how to generate investment ideas from fundamental data and develop those ideas into profitable investments. We’ll be looking at the benefits and pitfalls of stock screening and subsequent steps in developing a unique style incorporating […]

Motorpoint: A car dealer that stands out from the crowd

Financial statistics from SharePad and non-financial data from the company itself all indicate Motorpoint is no ordinary car dealer. If you’ve bought a vehicle from the company, or read its annual reports, you’ll probably know why. My article on Electrocomponents showed how I find most of my investing ideas with the simplest of SharePad filters, […]

When bad companies become good: IG Design

IG Design, formerly International Greetings, is one of my biggest investment mistakes—even though I made a few quid on it. Since I sold my shares in International Greetings—as it was called then—in April 2014, the company’s share price has risen from 71p to nearly £5.00. Clearly I misjudged the prospects of the business and that […]

Face-off: Tenpin versus Hollywood Bowl

Tenpin bowling chains are like London buses. You wait around for years and then two of them list almost at the same time. Phil Oakley has already reviewed the UK’s biggest operator, Hollywood Bowl, but there’s more to be learned from the number two. Private equity owners of companies tend to list them on the […]