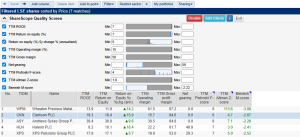

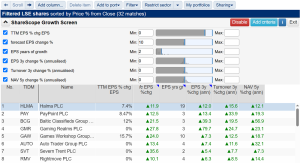

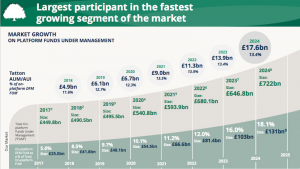

Screening again for high margins and high ROEs pinpoints the super accounts of AJ Bell. Maynard Paton studies the investing platform’s impressive business that has attracted 681,000 customers – including himself. Last month I revisited a ShareScope screen that applied two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE). The […]