The UK stock market is undoubtedly cheap, but that doesn’t mean it won’t stay that way. Phil uses SharePad to show how you might sift this unpopular market for undervalued shares and creates 4 new SharePad stock screening filters for good measure.

When I first entered the world of investing over a quarter of a century ago, one of the most commonly cited strategies was to buy cheap shares.

Back then, value investing was still very popular. The main argument for it was that the prospects for good, growing companies were already reflected in their share prices and were probably overpriced.

A famous quote from Warren Buffett of “you pay a very high price for a cheery consensus” can be translated as meaning that it’s difficult to make a lot of money by buying popular shares.

Whilst it is true that buying shares when they are expensive lowers the future returns you may receive from owning them, that does not necessarily mean that you will make good returns by buying cheaper shares – it just improves your chances of doing so.

In fact, my experience and that of others over the last 25 years is that buying cheap shares because they are cheap has generally been a lousy way to make money from shares.

This can be highlighted by the spectacular underperformance of the UK stock market since then and over the last decade.

The UK market has arguably looked very cheap – particularly against the US – for a very long time, but a UK investor would have made a lot more money owning US stocks than UK ones over the last 10 years.

Performance of UK stock market exchange traded funds (ETFs) against global peers

Source: SharePad

Of course, that doesn’t mean this trend will continue going forward. Many commentators believe that the US market has been expensively valued for a while and that a downwards correction could be on the way.

Perhaps investors should buy unloved and cheaper UK shares instead?

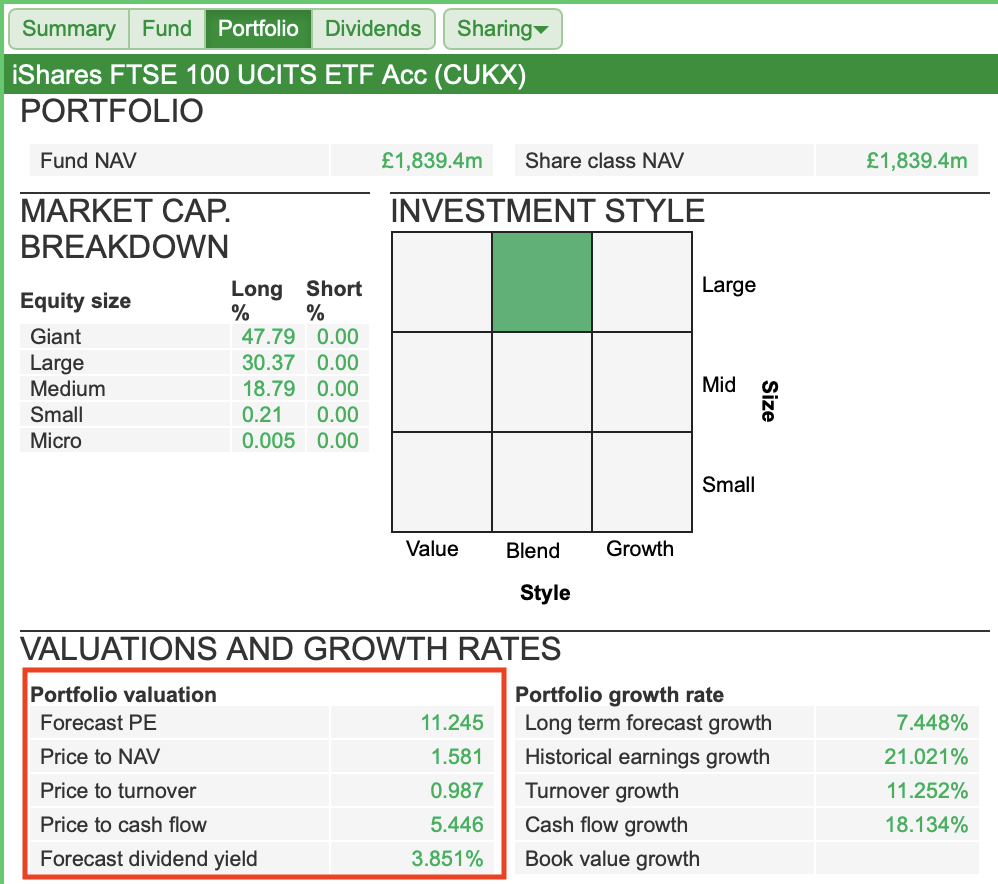

One of the ways you can quickly weigh up the valuation of world stock markets in SharePad is to look at the very useful data linked to exchange traded funds (ETFs) which track them.

Select an ETF and then click on the “Portfolio” tab in Financials and you will be able to view the portfolio valuation data. An index tracking ETF therefore gives you a pretty decent proxy for the valuation of the market it is tracking.

ETF Portfolio valuation data in SharePad

Source: SharePad

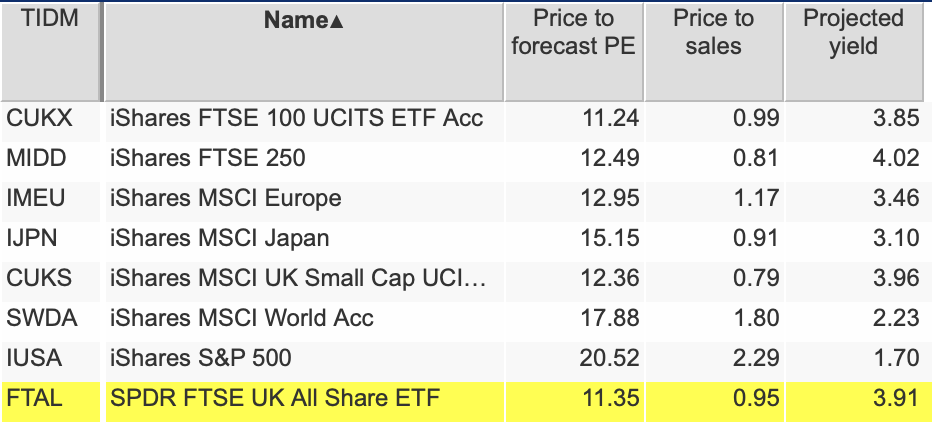

Performing this exercise for a range of global stock market ETFs allows you to see that the UK market remains very cheap relative to other major markets.

You can create a table in SharePad to show you this by adding column data from the Funds and Bonds section.

Global stock market valuations based on ETFs

Source: SharePad. Based on prices as of 23/8/2023

Source: SharePad. Based on prices as of 23/8/2023

The stock market does occasionally get too pessimistic about markets and shares but rarely gives away free lunches.

The UK market is arguably cheap for very good reasons.

The main reason is that the market is dominated by economically sensitive and low growth sectors such as oil and gas, banks and mining which do not tend to command high valuations.

Companies with a high exposure to the UK economy and its consumers are generally expected to find it hard to grow which also reduces the valuation attached to their shares.

In stark contrast, the US market is much more favourably exposed to growing and highly profitable sectors such as software, semiconductors and the internet in general.

One of the biggest lessons I have learned in all my years of investing and analysing companies is that the value factor has arguably been significantly overstated when it comes to selecting shares.

Over the long haul, it is growth in revenues, profits and cash flows underpinned by a strong and defensible business model that gives investors the best chance of growing the value of their portfolios.

That is not to say that valuation does not matter and cannot be used as a way to make money. The important point to realise is that cheapness on its own is probably not enough.

For example, according to SharePad, there are currently 154 shares in the FTSE All Share index trading on a one year forecast rolling PE of 10 times or lower.

Does that mean all of these shares are undervalued and ripe for big future gains? Some of them may well be, but many of them will be related to companies that are struggling with falling profits and challenged businesses.

Many of these shares are classic value traps- they are cheap because they deserve to be and can and do get cheaper with investors losing money.

In order to try and avoid value traps, I have looked at four possible SharePad filters that might help inventors find bargains in the FTSE All Share index that could appreciate in value over time:

- Cheap shares with expected earnings growth.

- Distressed shares trading at five year lows.

- Cheap shares where you could be paid to wait for things to get better.

- Quality businesses trading at attractive valuations

1. Cheap shares with expected earnings growth

This filter is very simple. I have asked SharePad to look for shares with the following characteristics:

- A rolling one year forecast PE of less than 10 times.

- Forecast EPS growth of at least 5 per cent.

(To apply this screening filter yourself to any list. Follow these instructions: In the blue list view > Filter > Apply or manage filter > Library > Locate “Phil Oakley: Cheap shares with expected earnings growth” > Click on filter > Click Install > Close > Select filter in your filter list > Click ok to apply screen.)

Filter: Low PE with expected EPS growth

| TIDM | Name | Market Cap. (m) | fc EPS %chg | PE roll 1 |

|---|---|---|---|---|

| HSBA | HSBC Holdings | 115,606.60 | 11.5 | 6.1 |

| NWG | NatWest Group | 20,212.90 | 13.7 | 4.9 |

| ICP | Intermediate Capital Group | 3,716.90 | 52.9 | 10 |

| BEZ | Beazley | 3,637.20 | 329.9 | 5.5 |

| HSX | Hiscox | 3,372.90 | 1090.2 | 7.9 |

| ENOG | Energean | 1,998.30 | 783.4 | 2.6 |

| TBCG | TBC Bank Group | 1,555.00 | 8.9 | 4.5 |

| BGEO | Bank of Georgia Group | 1,551.90 | 19 | 4 |

| CEY | Centamin | 971.1 | 143.3 | 8.3 |

| TLW | Tullow Oil | 539.3 | 35.7 | 2.1 |

| OCN | Ocean Wilson Holdings | 354.5 | 384.5 | 8.5 |

| MACF | Macfarlane Group | 175.8 | 19.9 | 9.4 |

| STB | Secure Trust Bank | 125.8 | 14.3 | 3.4 |

Source: SharePad

The thinking behind this filter is that a low valuation with some growth may trigger a higher valuation over time.

That said, the list of qualifying shares is dominated by banks and financial companies which often trade on low valuations. This suggests that there may not be much encouragement here.

2. Distressed shares trading at five year lows

Buying very depressed shares is a strategy used by contrarian value investors.

Here, I’ve just asked SharePad to show me a list of shares trading at five-year lows to see ones where sentiment is through the floor.

(To apply this screening filter yourself to any list. Follow these instructions: In the blue list view > Filter > Apply or manage filter > Library > Locate “Phil Oakley: Distressed shares trading at five year lows” > Click on filter > Click Install > Close > Select filter in your filter list > Click ok to apply screen.)

Filter: Shares trading at five year lows

| Name | Market Cap. (m) | Price | 5 y low | Date 5 y low | fc PE | fc Yield | fc EPS %chg |

|---|---|---|---|---|---|---|---|

| Fresnillo PLC | 3,743.40 | 508 | 508 | 21/8/23 | 29.5 | 2.3 | -40.5 |

| Johnson Matthey PLC | 2,946.30 | 1606 | 1599.5 | 18/8/23 | 9.2 | 4.9 | -3.2 |

| Derwent London PLC | 2,086.90 | 1858.5 | 1858.5 | 21/8/23 | 17.7 | 4.3 | -0.4 |

| Bridgepoint Group PLC | 1,384.00 | 171.8 | 171.8 | 21/8/23 | 12.6 | 5.1 | -0.6 |

| Assura PLC | 1,304.10 | 43.98 | 43.98 | 21/8/23 | 13 | 7.4 | 2.7 |

| Great Portland Estates PLC | 989.8 | 389.9 | 389.9 | 21/8/23 | 40.5 | 3.2 | 2 |

| CLS Holdings PLC | 488.8 | 123 | 123 | 21/8/23 | 12.7 | 6.3 | -14.3 |

| Ferrexpo PLC | 472.5 | 79 | 79 | 21/8/23 | 7.9 | 4.9 | -65.7 |

| Mobico Group PLC | 467.8 | 76.175 | 76.175 | 21/8/23 | 6.1 | 7.5 | -15.2 |

| Essentra PLC | 434 | 148.4 | 148.4 | 21/8/23 | 14.6 | 2.4 | |

| Molten Ventures PLC | 347 | 226.8 | 226.8 | 21/8/23 | 8.5 | ||

| Capita PLC | 319 | 18.75 | 18.75 | 21/8/23 | 5.2 | -40.6 | |

| Synthomer PLC | 318 | 68.05 | 68.05 | 21/8/23 | 121.7 | -97.2 | |

| Helical PLC | 283.1 | 229.5 | 229.5 | 21/8/23 | 21.7 | 5.3 | 13.9 |

| Vanquis Banking Group PLC | 277.3 | 108.1 | 108.1 | 21/8/23 | 7.6 | 14.1 | -62.7 |

| Regional REIT Ltd | 215.6 | 41.8 | 41.8 | 21/8/23 | 6.4 | 15.7 | -0.2 |

| Avon Protection PLC | 213.5 | 705.5 | 705.5 | 21/8/23 | 41.7 | 5.1 | 5.7 |

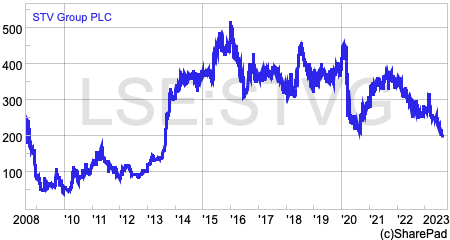

| STV Group PLC | 92.5 | 198 | 198 | 21/8/23 | 5.6 | 5.7 | -11.8 |

Source: SharePad

Many of these companies are going through very tough times which is why their shares are so disliked.

Scottish ITV franchise, STV, is a classic cyclical stock with the bulk of its revenues and profits coming from advertising where the outlook isn’t too good right now.

People may rightly question the future of TV advertising given the continued shift to online advertising and declining TV viewing amongst younger people. That said, the shares are trading on a similar valuation to the one seen in the Covid-19 pandemic and could bounce with a profit recovery as they did back then and from the 2008/09 financial crisis.

However, the company still has a big pension fund deficit and this may put some investors off the shares.

3. Cheap shares where you could be paid to wait for things to get better

This is a classic value investors’ filter. Stocks where the dividend yield percentage is greater than the PE ratio is often a sign of distress but it also can highlight undervalued companies with a decent and possibly secure income stream.

(To apply this screening filter yourself to any list. Follow these instructions: In the blue list view > Filter > Apply or manage filter > Library > Locate “Phil Oakley: Cheap shares where you could be paid to wait” > Click on filter > Click Install > Close > Select filter in your filter list > Click ok to apply screen.)

At the time of writing, there are currently 41 shares where the one year forecast rolling dividend yield is greater than the one year forecast rolling PE. In addition to this, these shares have the prospect of dividend growth with the forecast dividend per share in three years’ time expected to be greater than the next expected dividend.

Filter: Forecast dividend yield greater than forecast PE with expected dividend growth

| Name | Yield roll 1 > PE roll 1 | Market Cap. (intraday) (m) | PE roll 1 | Yield roll 1 | Div Cover | 3y fc DPS> fc DPS |

|---|---|---|---|---|---|---|

| Kier Group PLC | TRUE | 368.7 | 4 | 4.9 | 5.1 | TRUE |

| Costain Group PLC | TRUE | 126.9 | 4 | 5.8 | 4.3 | TRUE |

| Secure Trust Bank PLC | TRUE | 125.6 | 3.4 | 7.5 | 3.9 | TRUE |

| Energean PLC | TRUE | 2,007.30 | 2.6 | 10.9 | 3.5 | TRUE |

| Barclays PLC | TRUE | 22,519.80 | 4.3 | 6.6 | 3.5 | TRUE |

| STV Group PLC | TRUE | 92.5 | 5.2 | 5.9 | 3.3 | TRUE |

| Virgin Money UK PLC | TRUE | 2,176.50 | 5 | 6.2 | 3.2 | TRUE |

| TBC Bank Group PLC | TRUE | 1,557.70 | 4.5 | 6.9 | 3.2 | TRUE |

| Reach PLC | TRUE | 222.4 | 3.1 | 10.5 | 3.1 | TRUE |

| Bank of Georgia Group PLC | TRUE | 1,546.20 | 4 | 8.8 | 2.8 | TRUE |

| Ithaca Energy PLC | TRUE | 1,605.50 | 2.1 | 17 | 2.8 | TRUE |

| OSB Group PLC | TRUE | 1,471.50 | 4 | 9.2 | 2.7 | TRUE |

| Harbour Energy PLC | TRUE | 1,927.60 | 4.4 | 8.5 | 2.7 | TRUE |

| Lloyds Banking Group PLC | TRUE | 27,170.60 | 5.3 | 7.1 | 2.7 | TRUE |

| NatWest Group PLC | TRUE | 20,221.80 | 4.9 | 8.1 | 2.5 | TRUE |

| Paragon Banking Group PLC | TRUE | 1,129.20 | 5.9 | 6.9 | 2.5 | TRUE |

Source: SharePad

I have narrowed the selection down to shares with dividend cover greater than 2.5 times which might suggest that the dividend is relatively safe in the short term.

This is not a list which looks too exciting, but some of the shares look incredibly cheap.

Construction companies are not to everyone’s taste due to their cyclicality, low margins and often volatile cash flows. However, the chunky dividend yields of Kier and Costain are very well covered. Both companies’ share prices have gone nowhere for some time now which suggests that the market is generally not keen on them,

Pension fund deficits are an issue for Reach and STV, but the valuation and dividend yields of Barclays, Lloyds and NatWest may be worthy of further scrutiny by value investors.

Can good quality businesses still be bought cheaply?

4. Quality businesses trading at attractive valuations

Buying good companies which can keep growing has been a very successful investing strategy.

The problem with this approach is that the quality of many companies is very well known and is usually reflected in their stock market valuations.

Rising interest rates have brought down the valuations of many so called “quality shares” which has perhaps presented a better entry point for investors.

I have asked SharePad to find me companies and shares with the following characteristics.

- Return on operating capital employed (ROCE ex goodwill) averaging at least 20 per cent over the last 10 years.

- Minimum interest cover of 5 times.

- Average free cash flow conversion over the last five years of at least 70 per cent.

- Annualised expected EPS growth between the one year forecast and three year forecast of at least 10 per cent. This means that some companies which are expected to have a dip in earnings this year are included if profits are expected to recover and grow at a decent rate.

- A maximum one year forecast rolling PE of 30 times. Paying up for quality can work in the long run but it is important to set some limit to the price that you will pay.

(To apply this screening filter yourself to any list. Follow these instructions: In the blue list view > Filter > Apply or manage filter > Library > Locate “Phil Oakley: Quality businesses trading at attractive valuations” > Click on filter > Click Install > Close > Select filter in your filter list > Click ok to apply screen.)

For additional information, I have also included their total returns over the last year and their average PE ratio since the start of 2023. This is to show how their valuation has fared.

Filter: Quality Shares with expected growth

| Name | Price | Market Cap (m) | ROCE (ex goodwill) 10y av. | PE roll 1 | Interest cover | FCF conv 5y av. | 3y fc EPS 1y %chg (ann) | % TR 1y | PE daily |

|---|---|---|---|---|---|---|---|---|---|

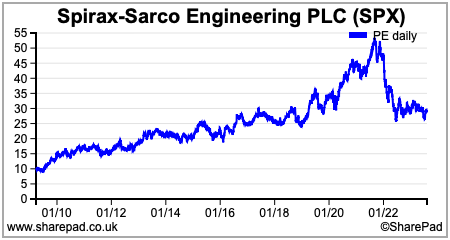

| Spirax-Sarco Engineering | 9875 | 7,284.40 | 25.5 | 25.8 | 33.5 | 75.6 | 10.2 | -10.4 | 29.7 |

| Rentokil Initial | 586.2 | 14,772.50 | 20.2 | 23.7 | 7.1 | 89.7 | 14.8 | 9.94 | 27.5 |

| Experian | 2694 | 24,785.60 | 48.4 | 22.9 | 14.5 | 93.4 | 10.3 | -4.48 | 27.1 |

| Rightmove | 536.6 | 4,367.00 | 1397.1 | 21.3 | 3962.7 | 96.5 | 12.9 | -14.1 | 23.4 |

| Aptitude Software | 298.5 | 171.2 | 36.3 | 20.4 | 8.6 | 144.2 | 15.2 | -27 | 35.1 |

| Compass Group | 1958 | 33,815.40 | 48.8 | 20.2 | 16.7 | 108.2 | 11.4 | 2.29 | 31.5 |

| InterContinental Hotels | 5946 | 9,955.90 | 32 | 19.2 | 6.2 | 94.9 | 10.4 | 20.6 | 24.7 |

| Greggs | 2410 | 2,464.40 | 20.6 | 18.9 | 25.1 | 175.6 | 11.5 | 22.8 | 22.7 |

| NCC | 97.7 | 304.9 | 40 | 16.4 | 9.6 | 114.8 | 37.1 | -51.6 | 15.4 |

| Pets at Home | 356.3 | 1,707.90 | 45.5 | 16 | 9.8 | 105.3 | 11.4 | 9.33 | 16.8 |

| Barr (AG) | 478.75 | 536.3 | 21 | 14.4 | 49.4 | 104.9 | 12.8 | -7.37 | 17.1 |

| Moneysupermarket.com | 233.6 | 1,254.10 | 95.2 | 14.3 | 25.4 | 96.8 | 15.1 | 16.1 | 17.4 |

| Hays | 99.325 | 1,578.70 | 48 | 13 | 37.5 | 94.2 | 25.8 | -10.7 | 12.5 |

| Savills | 849.25 | 1,226.20 | 33.4 | 11.8 | 39.5 | 117 | 12.2 | -11 | 10.4 |

| JD Sports Fashion | 152.05 | 7,880.80 | 30.7 | 10.4 | 13.8 | 110.4 | 11.1 | 23.2 | 12.1 |

| Robert Walters | 380.5 | 277.8 | 22 | 9.5 | 19.1 | 303 | 17.8 | -26.5 | 8.5 |

| Halfords | 180.25 | 394.6 | 33.5 | 9.2 | 5.3 | 77.2 | 23.1 | 21.4 | 11.3 |

| SThree | 344 | 462.7 | 40.5 | 8.6 | 154.9 | 72.6 | 16 | -4.51 | 0.1 |

| PayPoint | 542 | 393.9 | 64.8 | 8.5 | 19.3 | 117.1 | 22.4 | -12.7 | 7.6 |

| CMC Markets | 125.6 | 351.4 | 29.7 | 7.8 | 5.6 | 116.6 | 32.7 | -46.9 | 11.1 |

| Imperial Brands | 1749 | 15,799.40 | 30.3 | 5.8 | 10.6 | 101.9 | 10.1 | -1 | 7.4 |

Source: SharePad

For me, Spirax-Sarco remains one of the most impressive companies listed on the London market but its shares will still be too highly rated for some investors.

That said, the valuation of the shares has plummeted over the last 18 months from very lofty levels. Its trailing PE ratio is now more reasonable but an uncertain economic outlook – its profits are highly correlated with global industrial production – and the possibility of higher interest rates could still bring its valuation down further.

As I wrote a few weeks ago, JD Sports shares looked cheap, but profit warnings from Puma and slowing sales momentum revealed in its AGM statement have unnerved investors.

This week, a big profit warning from US peer, Dicks Sporting Goods (NYSE:DKS) has hurt sentiment towards JD Sports some more given the size of its business in the US.

Events such as these, highlight the risks of basing investment decisions and screening criteria on forecast data. This is what most investors do but when those forecasts unravel, it can change the investment case for a company quite rapidly.

SharePad filters should not be used as an automatic buy list but as an idea generator for further research.

Despite the uncertain and difficult economic outlook, the list of good quality companies generated by SharePad unveils some interesting possibilities which could form part of a watchlist at the very least.

Phil Oakley

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.