Property Franchise has consistently exhibited attractive financials and will soon combine with rival Belvoir. Maynard Paton delves into the small-cap’s balance sheet, acquisitive history, franchising KPIs and merger prospects.

Today I am studying Property Franchise, an estate-agency franchising business that appeared on my radar after I reviewed fellow estate-agency franchisor Belvoir last year.

To recap, I finished my Belvoir write-up by suggesting Property Franchise might have been the better sector opportunity:

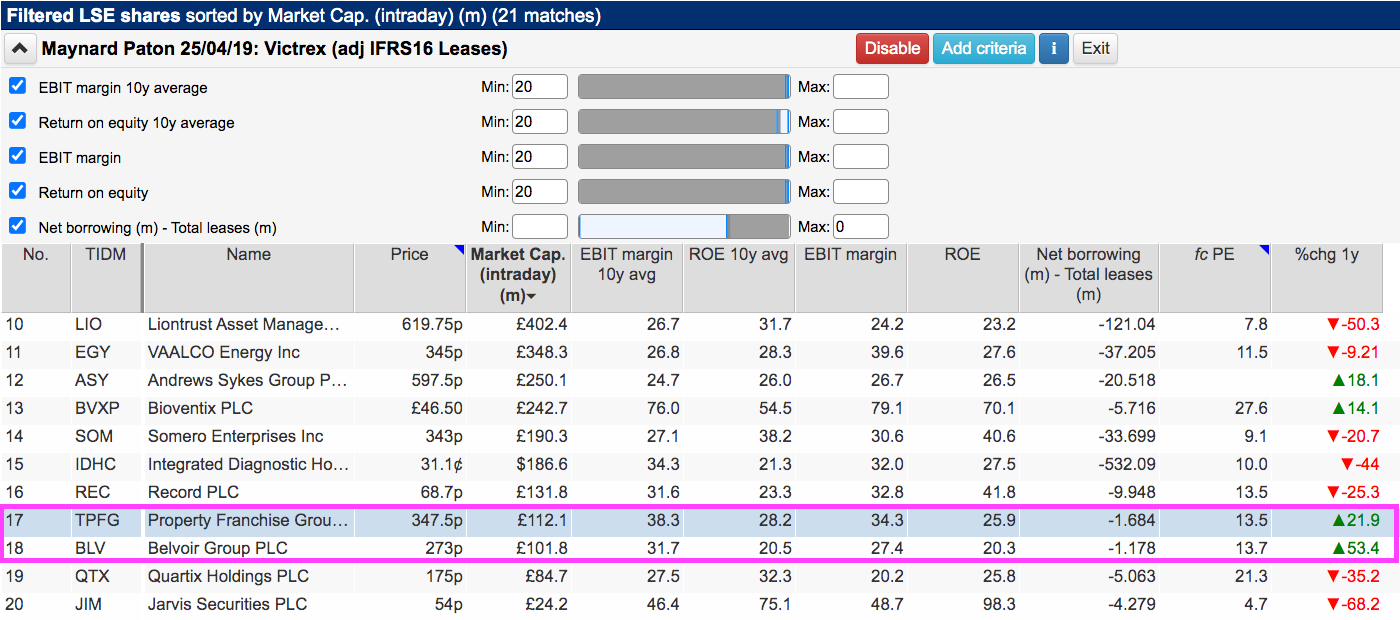

“The outperformance of Property Franchise following Belvoir’s [unsuccessful bid] approach could in fact mean Property Franchise is the better business of the two. Just like Belvoir, Property Franchise claims to be the country’s largest property franchisor and, funnily enough, was also among the 21 matches from this SharePad screen…

I feel a review of Property Franchise is required to give greater shareholder perspective and to perhaps highlight a more attractive sector opportunity.“

Determining whether Property Franchise or Belvoir is the better sector opportunity has now become academic because the two companies recently agreed to merge.

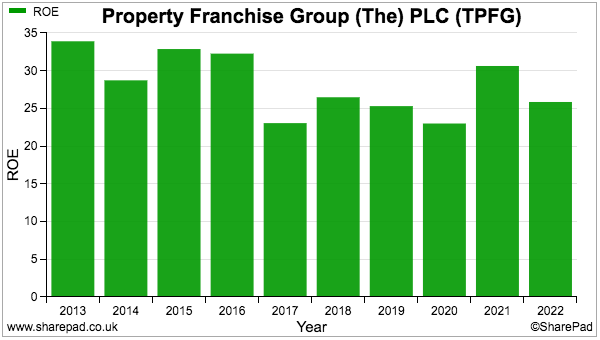

According to my SharePad filtering, the Property Franchise/Belvoir combination should be an attractive operator. Both Property Franchise and Belvoir continue to appear on my SharePad screen that seeks companies exhibiting:

- An operating margin (latest and 10-year average) of 20% or more, and;

- A return on equity (latest and 10-year average) of 20% or more.

(You can run this screen for yourself by selecting the “Maynard Paton 25/04/19: Victrex” filter within SharePad’s comprehensive Filter Library. My instructions show you how.)

Businesses blessed with a consistent margin and return on equity of at least 20% are probably quite special.

Let’s take a closer look at Property Franchise and the Belvoir merger.

Introducing Property Franchise

“When I founded Martin & Co in Yeovil in 1986 it began life as an estate agency. Later I realised that the strong demand for rented properties could provide my business with a recurring and accretive monthly income. When the franchise launched in 1995 we focused primarily on lettings because the rental market was expanding rapidly and serviced by relatively few professional letting specialist companies and none with a national brand profile.”

So explained Richard Martin within Property Franchise’s 2018 annual report about why he and his wife Kathy founded Martin & Co. almost 40 years ago.

Nine years of running a conventional estate agency all changed after Mr Martin read the story of Ray Kroc and how the McDonald’s fast-food franchise system was established.

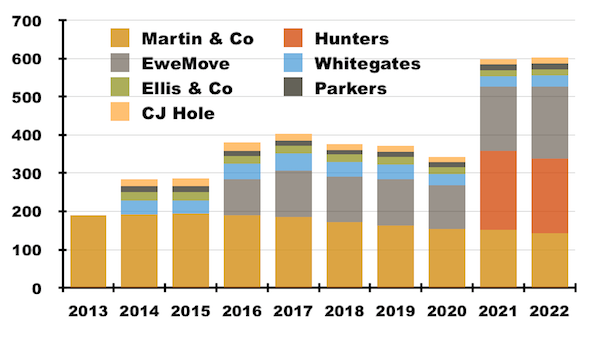

Martin & Co. became a franchise operation during 1995 and thereafter focused on lettings. Branches — both high street and hybrid — now total approximately 600 after the group consistently attracted new franchisees and undertook a number of acquisitions.

Notable purchases include:

- Ellis & Co, Parkers, CJ Hole and Whitegates (a combined £6 million, 2014);

- EweMove (£9 million, 2016), and;

- Hunters (£29 million, 2021).

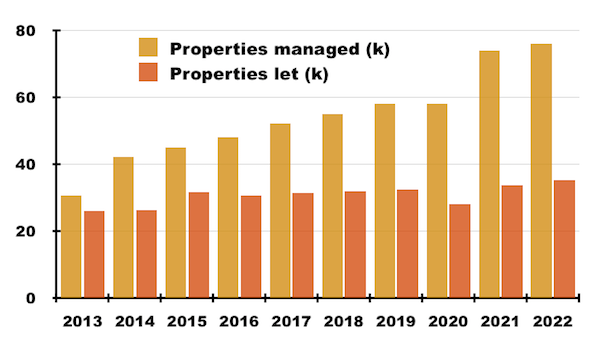

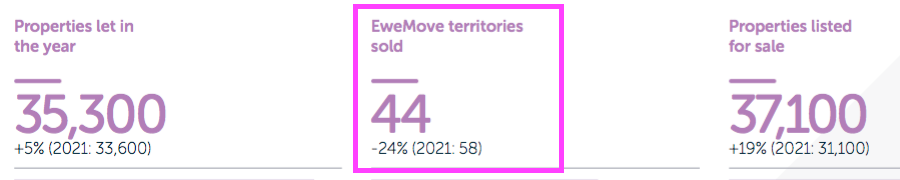

The group was renamed Property Franchise during 2017 and its franchisee network presently manages approximately 76,000 rental properties with new letting arrangements during 2022 topping 35,000:

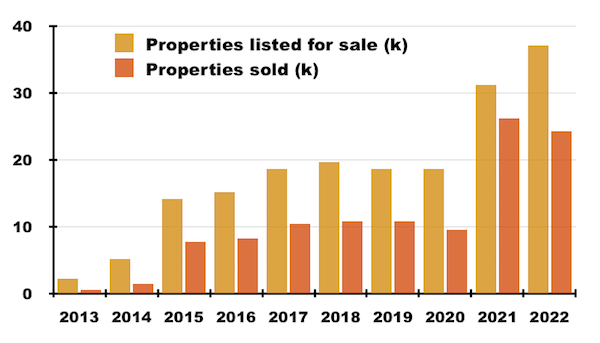

Properties sold through the network have grown significantly after the group re-entered the sales market during 2012:

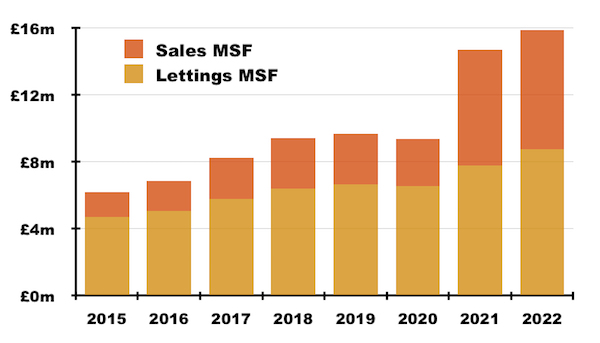

During 2022, the franchisees generated total commissions for themselves of £163 million, of which £16 million (10%) was paid to Property Franchise as a management service fee for using an established brand and £4 million paid for additional support services.

Property Franchise earned further revenue of £7 million through a handful of group-owned branches and various financial-service arrangements.

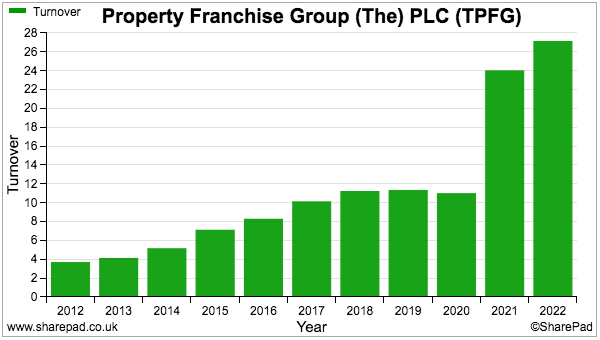

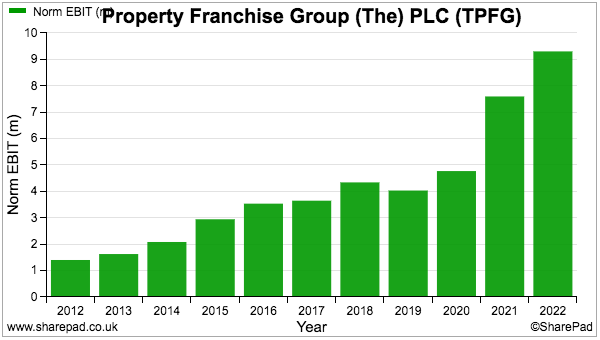

That £27 million total revenue led to a £9 million profit, which compares well to the £4 million revenue and near-£2 million profit reported when Property Franchise joined AIM during 2013:

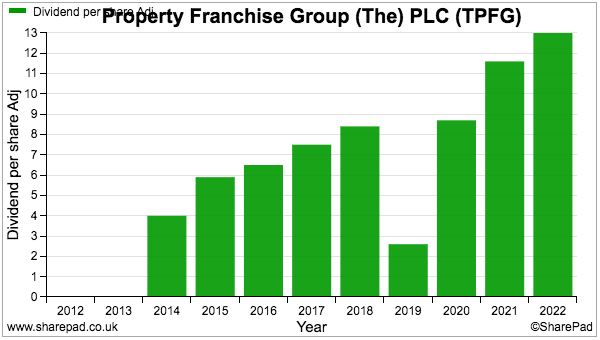

Only the dividend chart shows an obvious setback, with the pandemic prompting the absence of the 2019 final payout:

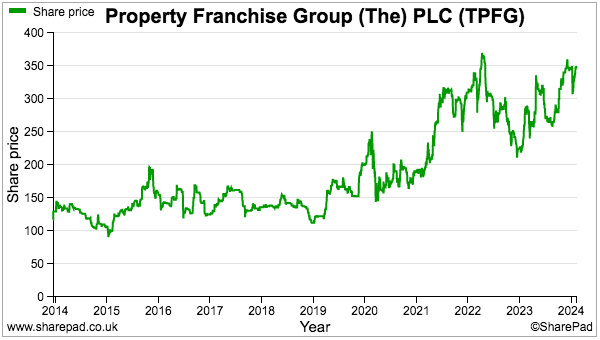

The positive financial history has delivered a useful share-price gain:

Anybody buying at the 100p flotation price has since tripled their money. The recent 348p supports a £112 million market cap.

Growth by acquisition

Expenditure on those aforementioned acquisitions totals £44 million, which is a significant investment given operating profit during 2022 was £9 million.

Have those purchases complemented an appealing growth story…

…or have they masked a stagnant (or even shrinking) underlying business?

Changes to the number of franchisee branches provide a mixed picture:

Only the number of EweMove territories has increased significantly, from less than 100 at the time of purchase during 2016 to almost 200 now.

The original Martin & Co brand has meanwhile lost approximately 40 offices within ten years, and Whitegates, Ellis & Co. and CJ Hole have each lost a handful since 2015.

Recruiting more hybrid franchisees via EweMove while reducing conventional high street locations perhaps shows which way the estate-agency wind is blowing. Indeed, one of Property Franchise’s formal KPIs is the number of new territories opened by EweMove:

The EweMove deal was not an instant success; the group suffered an £0.5 million impairment the next year and paid only £1 million of the initially expected £2 million earn-out. Companies House indicates the hybrid franchisor has been profitable since 2018.

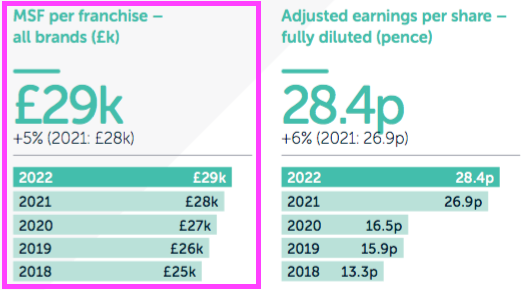

Another group KPI tracks management service fee (‘MSF’) per franchisee branch, which shows a commendably steady upward trend:

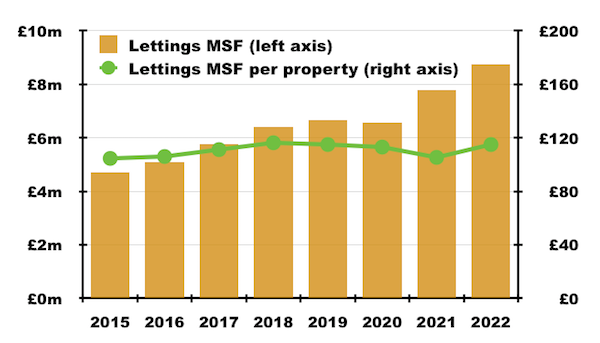

Property Franchise revealed lettings represented 55% of its management service fee during 2022:

“Whilst pursuing a mix of revenues, the lettings side of our business with 76,000 rental properties under management remains at the core of our activities. We remain committed to this being the most significant element of our revenue and MSF. Lettings represented 47% of total revenue (2021: 48%) and 55% of total MSF (2021: 53%) in the period.”

I calculate 55% of the group’s £16 million management service fee spread across 76,000 rental properties equates to approximately £115 per property:

The £115 per managed property has barely changed over the years, which seems somewhat disappointing given the regular headlines about the ever-greater cost of renting.

The unchanged £115 also suggests lettings growth has been derived simply by franchisees handling a greater number of rental properties.

Collecting £115 a year from a rental property does not sound like a lot, but the sum is very close to the £120 a year I calculated for Belvoir. A tenant paying £11,500 a year rent of which 10% is paid to the letting agent of which 10% is then paid to Property Franchise gets to that £115.

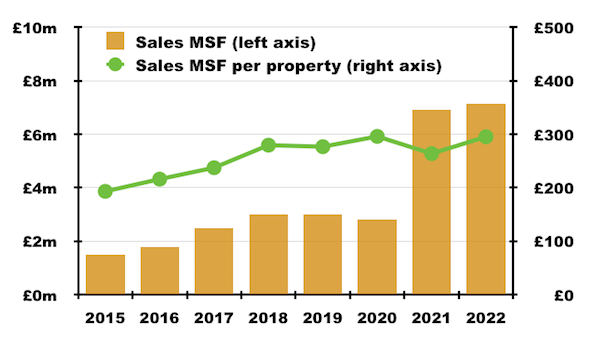

I calculate the average fee per property sale is almost £300:

I get the impression that the steady upward trend of management service fee per franchisee branch has been driven mostly by selling more properties. Certainly, the purchase of Hunters during 2021 bulked up the group’s sales-related income:

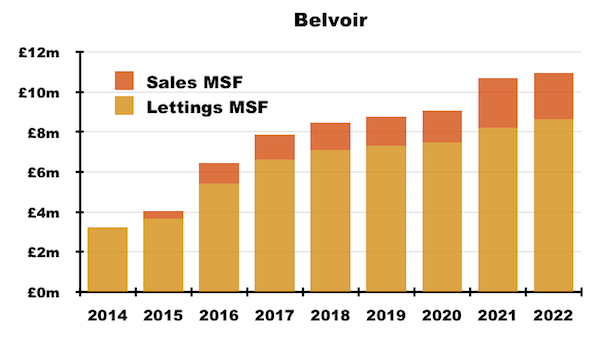

I do wonder if the Belvoir merger was prompted by Property Franchise seeking to rebalance its franchisee fees more towards predictable lettings income. Approximately 80% of Belvoir’s management fees relate to lettings:

Margin, cash conversion and return on equity

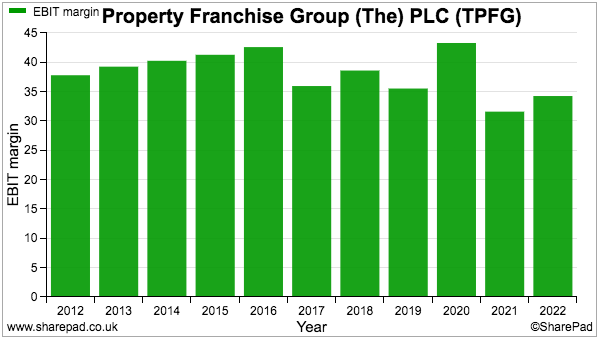

The SharePad chart below confirms Property Franchise’s 20%-plus operating margin highlighted within my original screen:

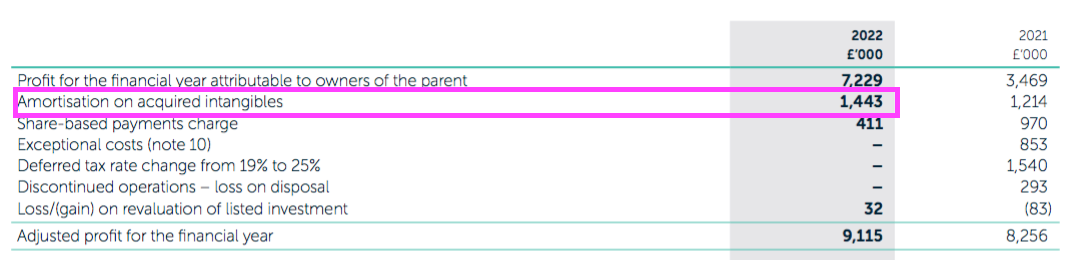

The group’s margin is very impressive, with at least 30% recorded every year since the flotation. Note that the statutory profit is suppressed by an annual amortisation charge that accounting rules require to reflect the purchase cost of Hunters:

Add back this £1.4 million amortisation charge, and arguably ‘underlying’ profit during 2022 was close to £11 million and the operating margin was in fact a superb 40%.

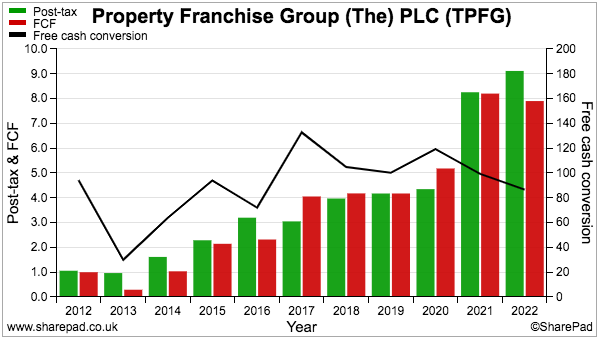

Conversion of profit into cash has been very satisfactory:

SharePad shows an average of 102% of adjusted earnings converting into free cash during the last five years. The small deterioration during 2022 reflects an adverse working capital movement alongside relatively hefty website spending, the costs of which were capitalised onto the balance sheet.

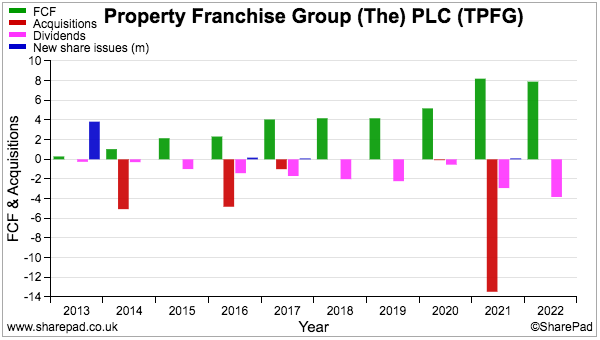

This next chart demonstrates how a combination of flotation proceeds (£4 million) and free cash flow (£40 million) has funded the cash element of acquisition payments (£23 million) alongside dividends (£16 million) since 2013:

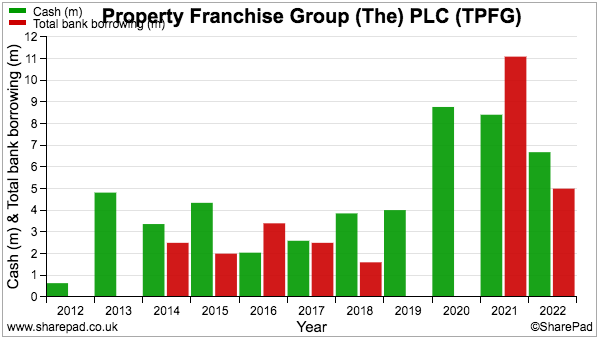

The Hunters acquisition did prompt borrowings to exceed cash by almost £3 million during 2021, but significant debt repayments the following year brought the group back to its usual net cash position:

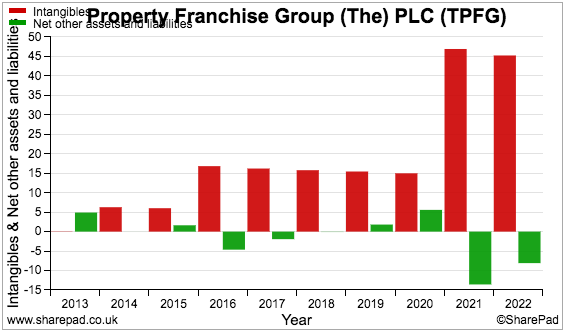

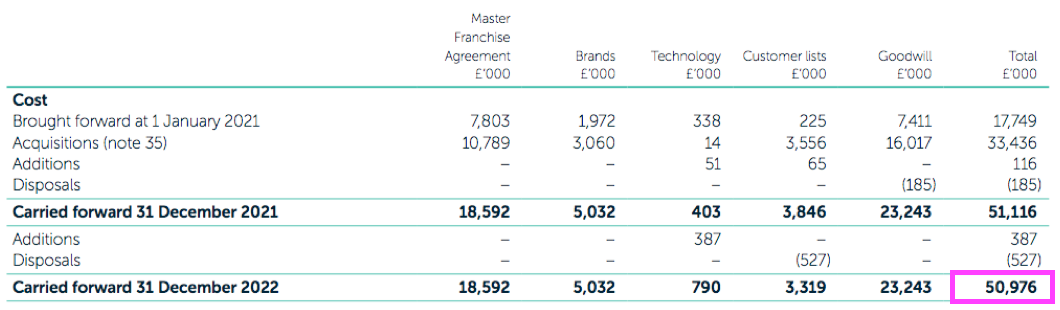

The acquired goodwill and intangibles now dominate Property Franchise’s balance sheet:

Conventional return on equity calculations suggest the acquired businesses have generated worthwhile returns. As my initial SharePad filter indicated, return on equity last year was 26% and the ten-year average is 28%:

The accounting note below provides further perspective on the effectiveness of Property Franchise’s expansion. The historic cost of Property Franchise’s intangible assets is £51 million, almost all of which was acquired since the flotation:

During the same time as the intangibles were being acquired, adjusted earnings climbed more than £8 million.

Acquiring an extra £51 million of intangibles to generate an extra £8 million of adjusted earnings suggests Property Franchise has invested shareholders’ money at a useful 17%.

Management and employees

The aforementioned Richard Martin no longer runs Property Franchise. He stepped down from executive duties at the flotation and will retire from his non-exec role after the Belvoir merger.

Mr Martin has reduced his shareholding by 36% following sales at 139p, 150p, 173p and 300p since 2018. But he retains a 22% holding with a £25 million market value, so presumably, he still had shareholders in mind when agreeing to the Belvoir deal:

Gareth Samples, a veteran manager at LSL Property Services, became chief executive during 2020. Mr Samples has to date spent just £21k buying Property Franchise shares and his latest options grant requires adjusted earnings and/or total shareholder return to advance by 20% over three years:

“In respect of both performance conditions, growth of 20% in adjusted EPS and 20% in TSR over the three-year period will be required for threshold vesting of the awards, with growth of 42% or higher in adjusted EPS and 42% or higher in TSR required for all of the awards to vest Straight-line vesting applies between the floor and the cap.”

20% over three years is equivalent to a 6.3% CAGR and may reflect the modest growth potential of the business without acquisitions and mergers.

Total pay for Mr Samples during 2022 was £507k, which was 19% greater than the sum paid to his opposite number at Belvoir. But Property Franchise is the more profitable business, generating 10% more adjusted Ebitda than Belvoir (£11.8 million versus £10.7 million) during the same time.

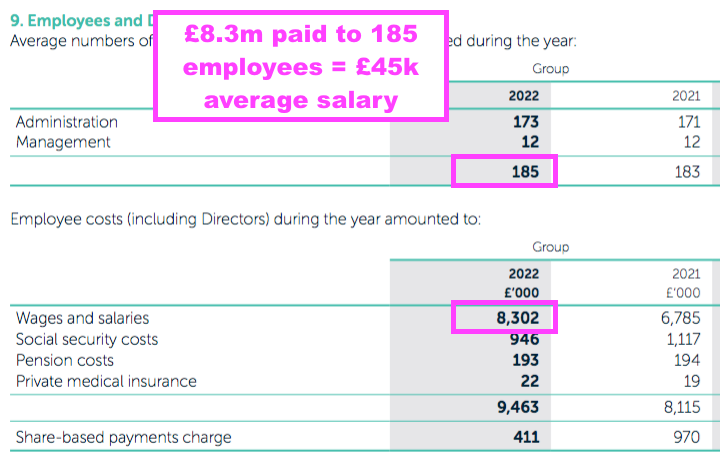

The comparable chief-exec pay reflects the wider wage differences at both companies. The average salary at Property Franchise during 2022 was £45k, versus £34k at Belvoir:

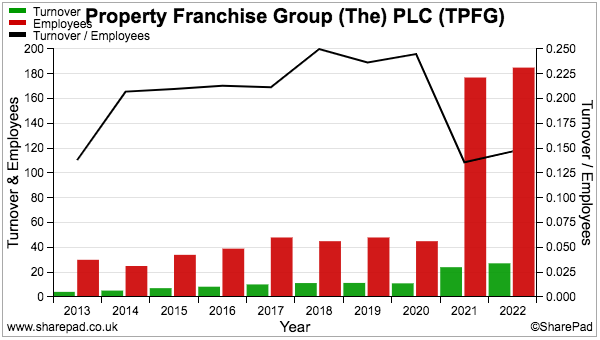

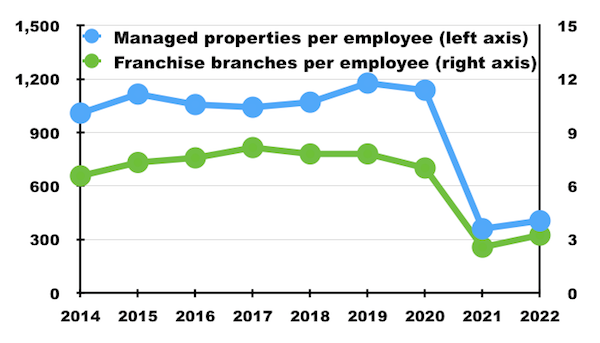

SharePad shows the number of Property Franchisee employees soaring after the Hunters acquisition:

I must confess, the workforce productivity of Hunters does not seem great. Revenue per employee has dived from more than £200k to approximately £150k per person following the Hunters purchase.

Hunters continue to operate conventional estate-agency offices as well as a franchising operation, and I get the impression a large proportion of Hunters employees are not direct revenue earners.

To be frank, I am not really sure what many Hunters’ staff do. They certainly don’t seem to be involved with administering managed properties or assisting the franchisees, as the number of rental properties and franchisee branches per group employee has also plunged:

Belvoir merger, valuation and summary

The all-share merger with Belvoir was approved by shareholders the other week and shares in the combined group will start trading on 8 March.

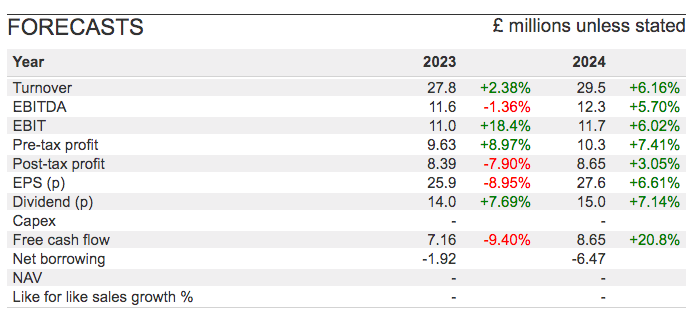

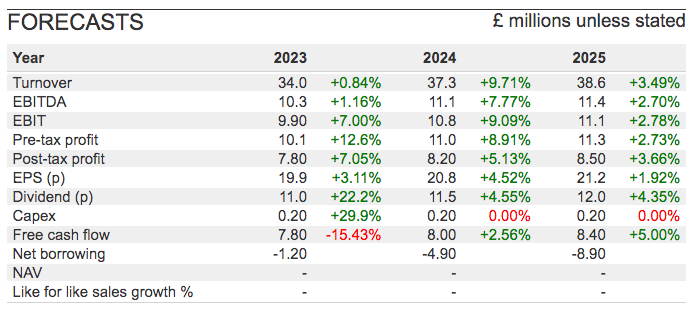

An investor presentation referred to “earnings accretion and annual synergies” but did not disclose what the accretion and synergies could be. Broker forecasts issued prior to the merger predicted earnings of 26p per share for Property Franchise…

…and 20p per share for Belvoir…

…which blended together gives approximately 25p per share for the combined group. The merger will see Belvoir investors receive Property Franchise shares, which at 348p values the combined group at £217 million and a possible 14x multiple before any cost savings.

Property Franchise did confirm the combined group would pay a 7.4p per share final dividend for 2023, which by my calculations means shareholders of both firms will receive the same combined level of payout for 2023 as 2022.

I note Property Franchise said the combined group was “expected to sell more than 28,000 properties per annum“.

Expecting to sell 28,000-plus properties compared to a total 35,000 properties sold by both firms during 2022, which suggests transactions within the property market may be slowing and why this merger was perhaps proposed in the first place.

Indeed, the combined group — with 150,000-plus managed properties generating predictable franchisee fees from monthly rents — could provide both sets of shareholders a more defensive investment in a difficult economy.

But neither Property Franchise nor Belvoir have obviously enhanced the economics of their traditional letting-agency franchise operations.

In particular, letting income per managed property for both firms have been stagnant at £115-£120 per annum for years. The number of managed properties per employee has also shown no clear improvement.

I would therefore conclude ‘growth’ has been achieved mostly through i) acquisitions and ii) expanding beyond letting-agency franchising into property sales, company-owned branches and financial services.

I can understand why shareholders previously happy with both companies would want to retain their position within the combined group. But I believe future returns will be dictated largely by further estate-agency consolidation rather than a radical business improvement post-merger.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Property Franchise.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.