Screening for consistently high margins and ROE leads to currency manager Record. Maynard Paton weighs up the small-cap’s super cash flow, well-paid workforce, diversification ambitions and bold targets.

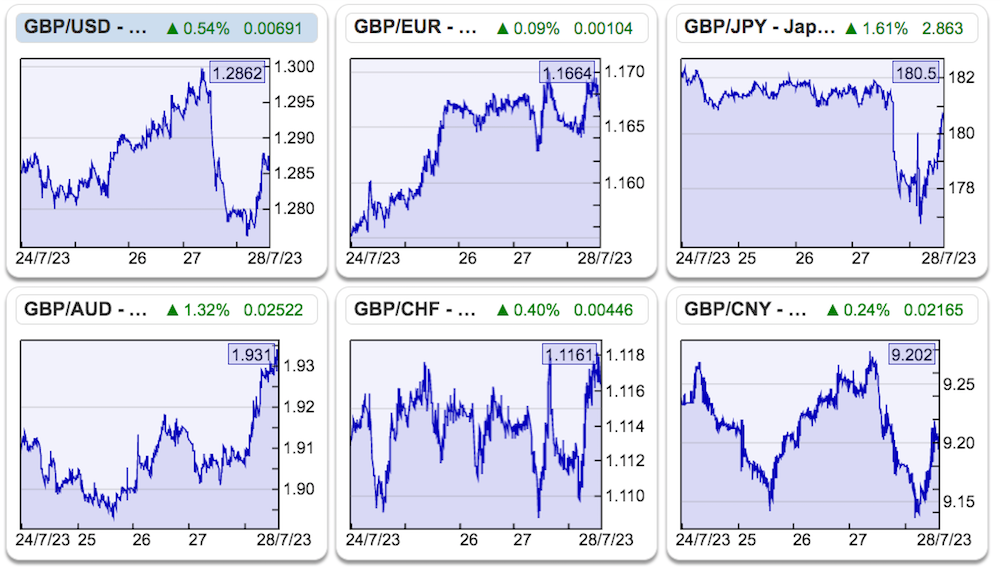

I have once again revisited a SharePad screen that applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE).

The exact criteria I re-used were:

- An operating margin (latest and 10-year average) of 20% or more, and;

- An ROE (latest and 10-year average) of 20% or more.

Any business with a persistent margin and ROE of at least 20% could be very special.

To narrow the field down further, I also sought companies that carried net cash (i.e. net borrowings excluding IFRS 16 finance leases of less than zero):

(You can run this screen for yourself by selecting the “Maynard Paton 25/04/19: Victrex” filter within SharePad’s brilliant Filter Library. My instructions show you how.)

This time the filter yielded 20 matches, including Games Workshop, Hargreaves Lansdown, Plus 500 and Polar Capital.

I selected Record because it was among the better share-price performers of the last twelve months that I had not already studied for SharePad. Let’s take a closer look.

The History of Record

A £6 million loss handed Neil Record the opportunity that today helps investors mitigate currency fluctuations on portfolios worth more than $80 billion.

A senior director at Mars made the wrong foreign-exchange decision and Mr Record, then a commodity-price forecaster at the food manufacturer, was asked to devise a system to ensure his employer would not be caught out so badly by currency movements again.

Convinced other companies would want to employ his forex skills, Mr Record went his own way during 1983. He initially supplied hedging services for businesses with overseas operations, but bagged his first institutional client — the UK Water Authorities Superannuation Fund — in 1985.

Record today specialises in the forex requirements of institutional investors, and its ‘currency overlay’ process allows large money managers to:

- ‘Passively’ hedge their portfolios to eliminate currency risks, and/or;

- ‘Dynamically’ hedge their portfolios — whereby favourable forex movements can be captured to enhance returns, but unfavourable movements can be hedged to avoid currency losses.

From 2001 Record pioneered a ‘currency for return’ product that marketed forex as a separate asset class. Institutions could invest and, in theory, enjoy positive returns based upon Record’s methodical analysis of currency markets.

Record’s forex decisions are based upon trend analysis, range trading and a phenomenon called the ‘forward rate bias’, which the group once described as “higher interest-rate currencies tending to outperform expectations implied in the short-to-medium-term forward market“.

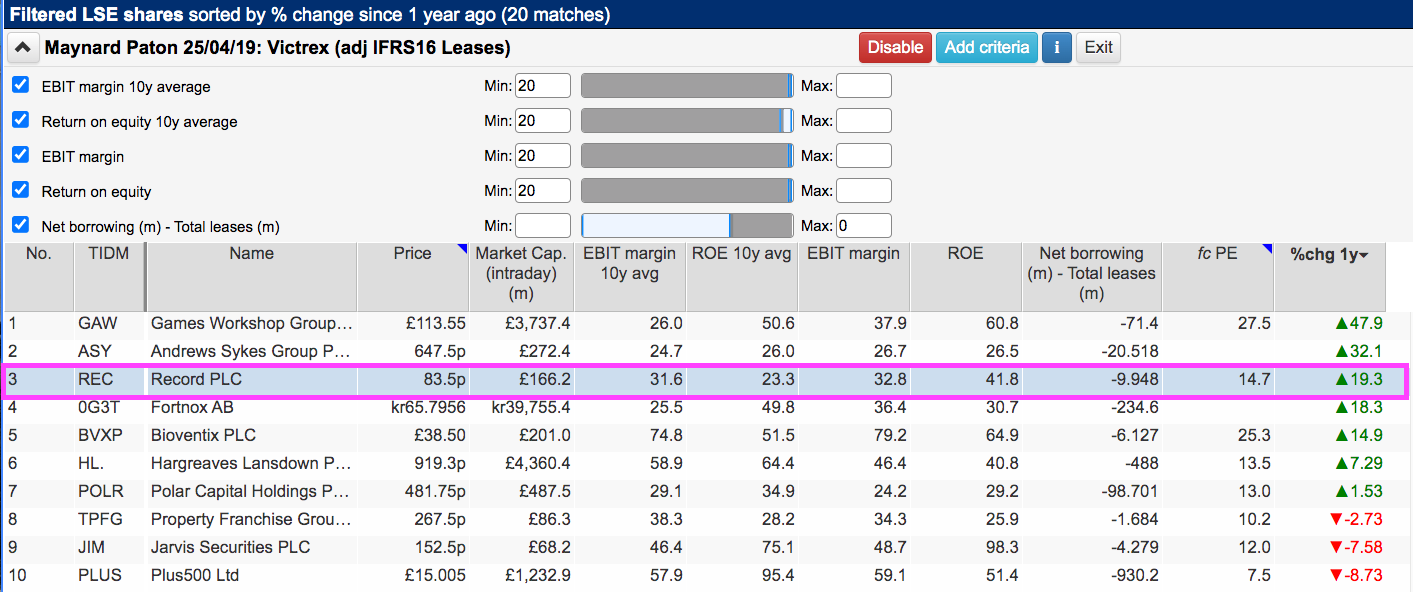

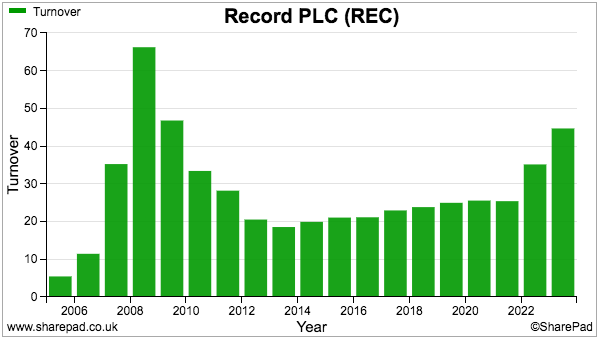

The currency-for-return product took off during 2005, with institutional money invested surging from $1.4 billion to $28.5 billion by 2007:

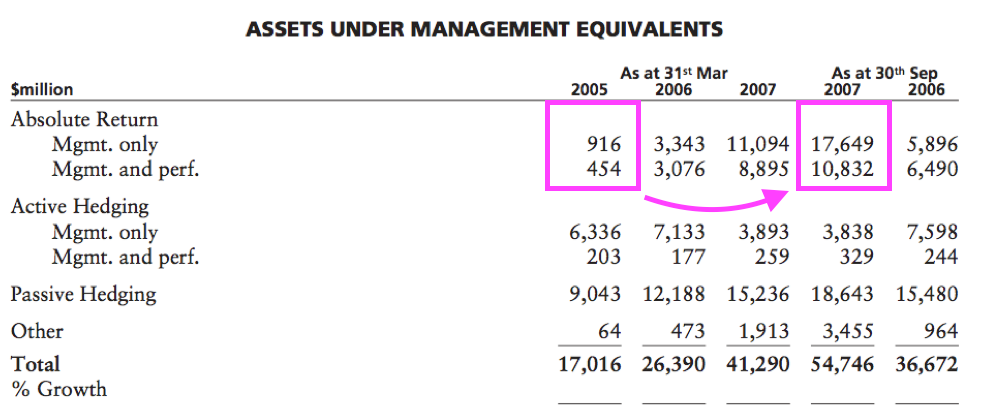

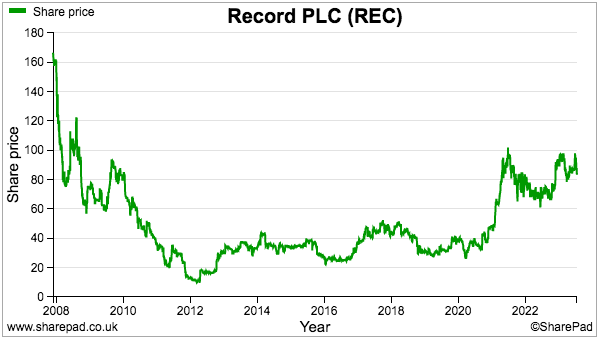

The breakneck growth turbo-charged revenue and profit, and led to an opportune flotation at 160p during December 2007.

Sadly for incoming shareholders, the banking crash caused Record’s clients to flee while subsequent rock-bottom interest rates up-ended Record’s ‘forward rate bias’ system.

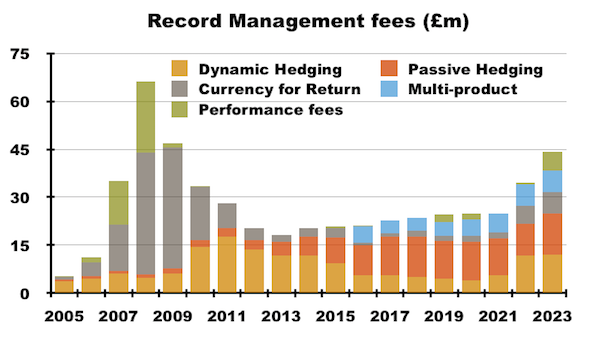

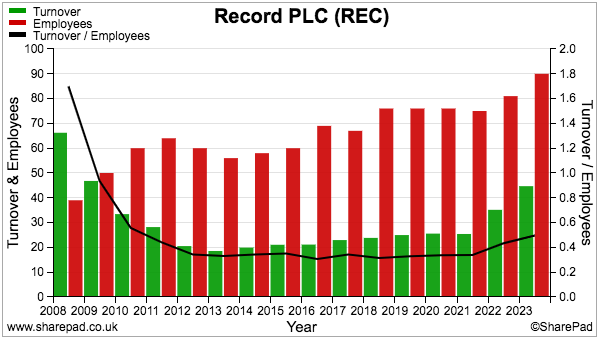

Revenue that had topped £66 million during 2008 dropped to £19 million by 2013…

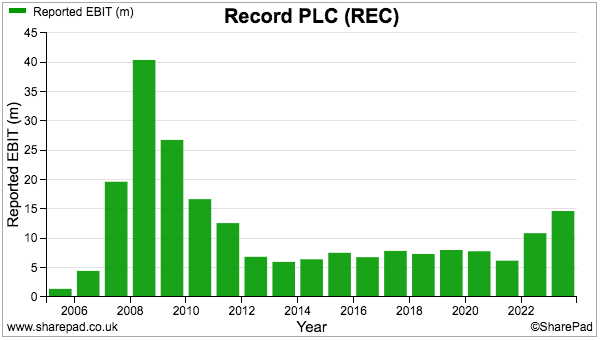

…while profit slumped from £41 million to less than £6 million during the same five years:

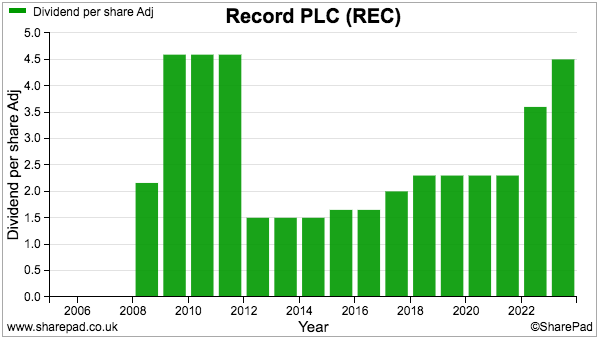

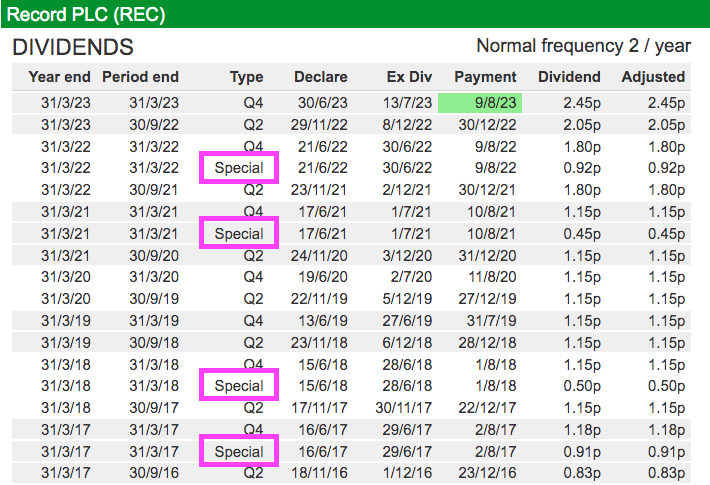

The ordinary dividend was understandably chopped by two-thirds after the banking crash…

…although a number of specials have been declared since 2017:

The shares have unsurprisingly never troubled the original flotation price:

The price bottomed out at 10p during 2012 but has since eight-bagged to 83.5p to support a £166 million market cap.

Improved earnings, a new chief exec and some bold financial targets have supported the shares during the last few years.

Client money, customer concentration and management fees

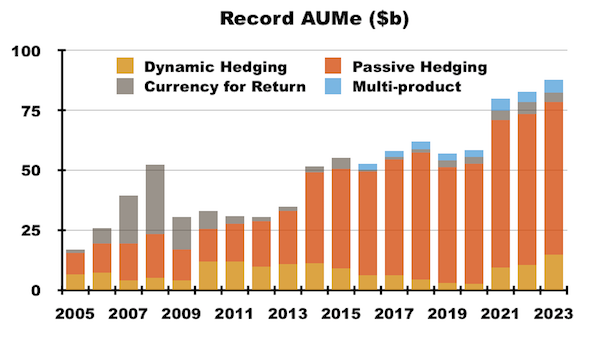

My chart below shows the spread of client money among Record’s currency services:

Passive hedging represents 73% of client money and has clearly proven to be the most popular service over time. The currency-for-return product that was so sought-after before 2008 has since shrivelled to only 4% of client money.

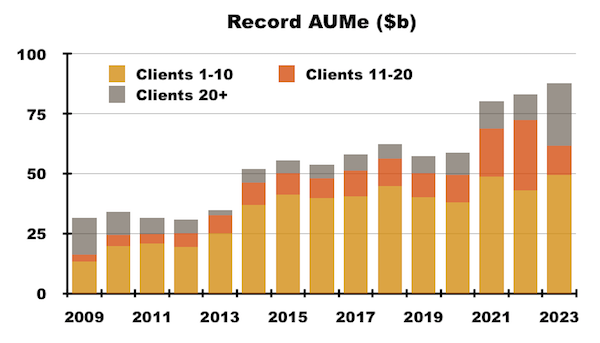

Client concentration is a matter to consider. The group’s ten largest customers have regularly represented more than 50% of total client money:

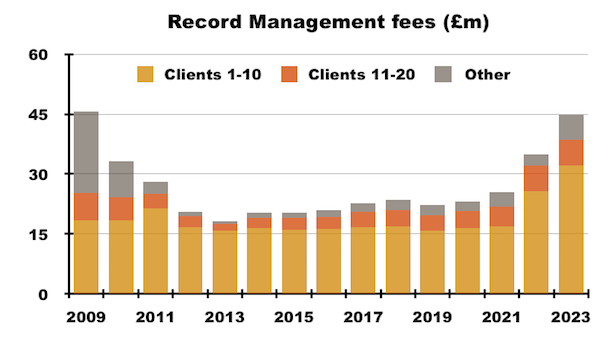

The ten largest clients naturally dominate Record’s management fees:

Last year four clients paid fees of £23 million that supported 51% of total revenue:

“During the year ended 31 March 2023, four clients individually accounted for more than 10% of the Group’s revenue. The four largest clients generated revenues of £6.6 million, £6.3 million, £5.2 million and £4.9million in the year (2022: two clients generated revenues of more than 10% totalling £4.9 million and £4.8 million in the year).”

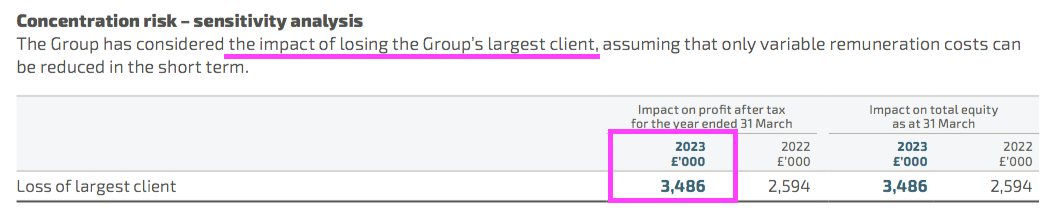

Record commendably reveals 2023 earnings of £3.5 million — or 31% — were generated by the group’s largest client:

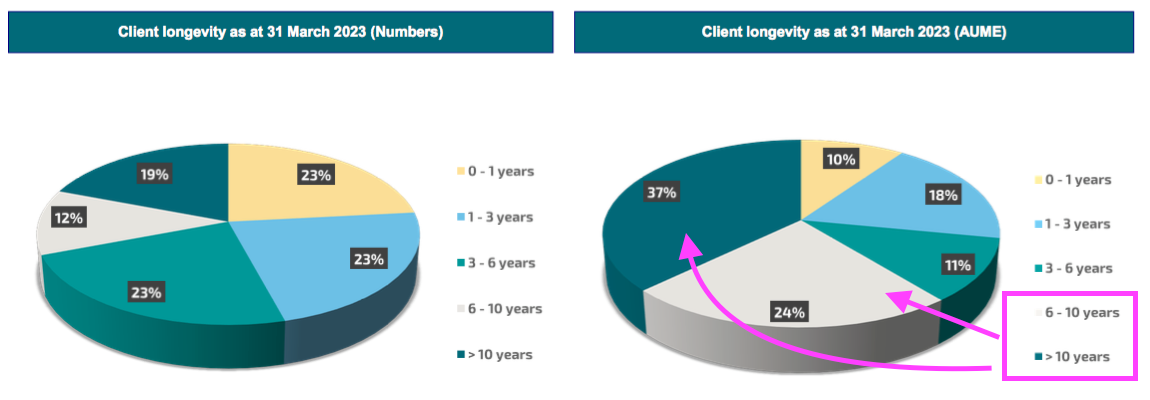

Record claims 61% of clients by portfolio size have used its services for more than six years, so at least the larger customers seem reasonably loyal:

Clients are predominantly pension funds located in Switzerland and the United States, with other customers mostly from the UK and elsewhere within Europe.

Management fees are predominantly collected through passive and dynamic hedging:

Notable performance fees were earned last year for the first time since 2008, and that long absence implies Record has generally not delivered better-than-expected hedging.

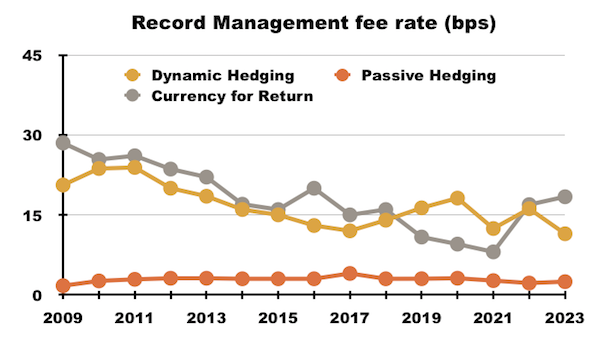

Similar to many City firms, Record has experienced clients chipping away at fees over time:

The group no longer discloses its fee rates, but I calculate dynamic hedging last year earned approximately 11 basis points (0.11%) and currency-for-return earned approximately 18 basis points (0.18%) on client portfolios.

Passive hedging — by far the largest service by portfolio value — meanwhile earns approximately 3 basis points (0.03%).

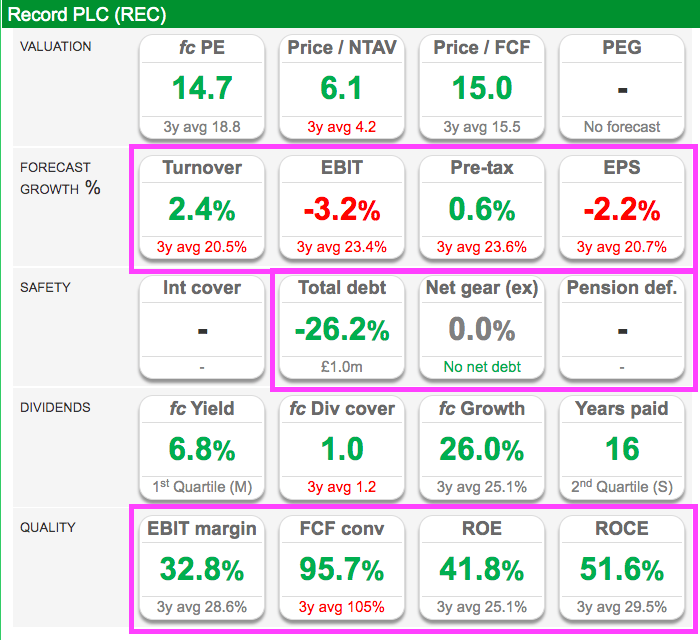

Record’s SharePad summary

SharePad’s summary for Record is shown below:

The second row emphasises 2024 will not show fantastic progress versus 2023, although the middle row confirms Record enjoys net cash and no pension complications.

The bottom row meanwhile discloses terrific cash flow conversion as well as the decent margin and ROE numbers flagged by my initial SharePad screen.

Let’s start with the ‘quality’ ratios.

Cash flow and ROE

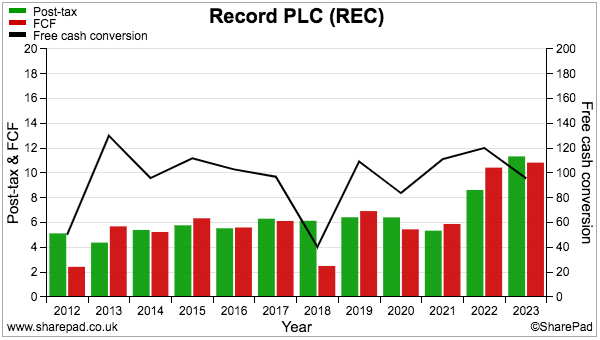

Record has demonstrated superb cash conversion. The black line (right axis) shows approximately 100% of earnings converting into free cash during most of the last decade:

The lower conversions witnessed during 2012 and 2018 appear to be one-off events. High cash taxes from 2011 hit the 2012 conversion, while an investment distorted the 2018 figures.

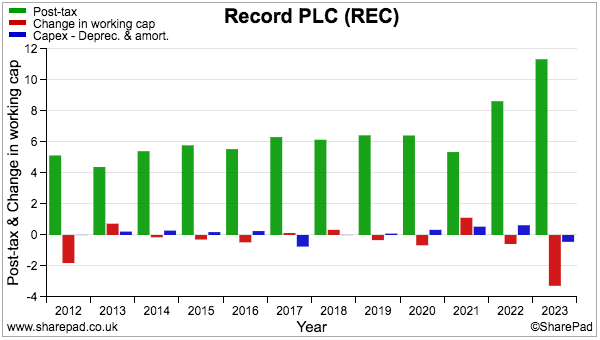

Assisting cash flow are very low capital-expenditure demands. ‘Surplus’ cash capex beyond the depreciation and amortisation charged to the income statement (blue bars) is typically minimal:

Cash absorbed by working-capital (red bars) has generally been modest, too. The large movement for 2023 reflects higher trade debtors (i.e. unpaid invoices) and looks quite understandable given last year’s 27% revenue advance.

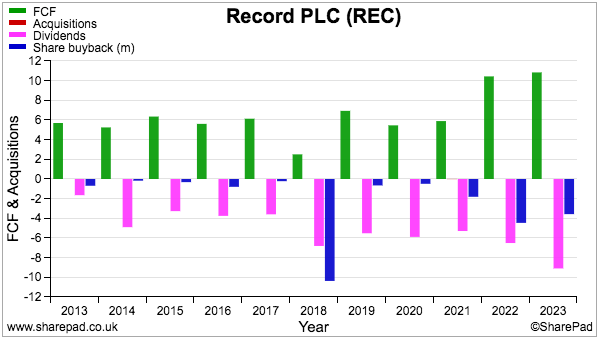

This next chart shows how aggregate free cash flow of £71 million has funded dividends of £56 million and buybacks of £24 million since 2013:

Record’s capital-allocation highlight was a £10 million tender offer during 2018, which bought back 10% of the company at 45p per share — a good decision with hindsight given the recent 83.5p price.

Note that the rest of the buyback expenditure is effectively payment for employees via purchases of shares for staff incentive schemes.

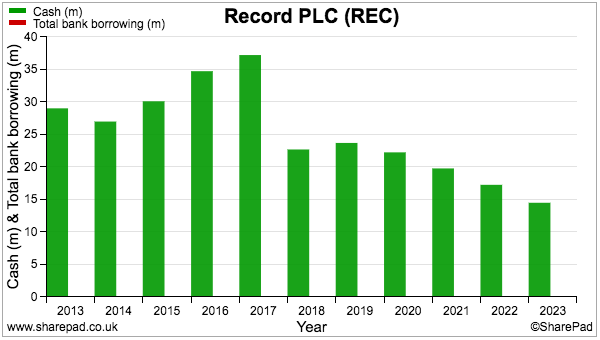

The tender offer and subsequent dividends (including a handful of specials) have reduced net cash from £37 million to £15 million since 2017:

As well as the cash, the balance sheet carries investments of £5 million and has never carried any conventional bank loans.

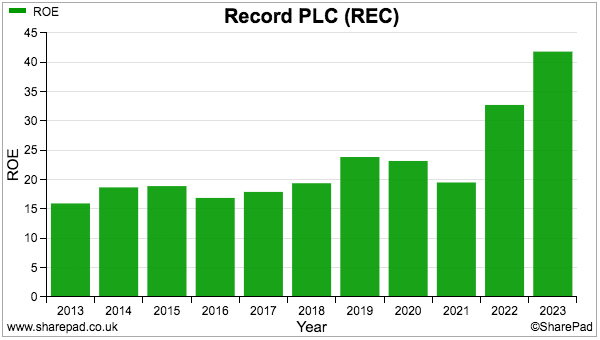

ROE was weighed down by the significant cash position for years, but has improved dramatically of late:

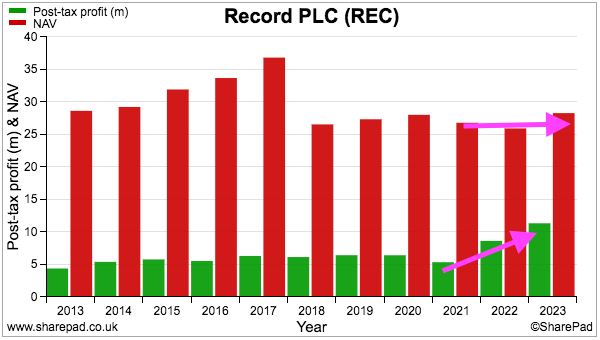

The improvement is due to higher earnings combined with a steady equity base:

Record though is not really the type of business where progress is driven by extra retained capital. Higher earnings and ROE are in fact a function of employees attracting more clients and generating extra fees.

Employees and margin

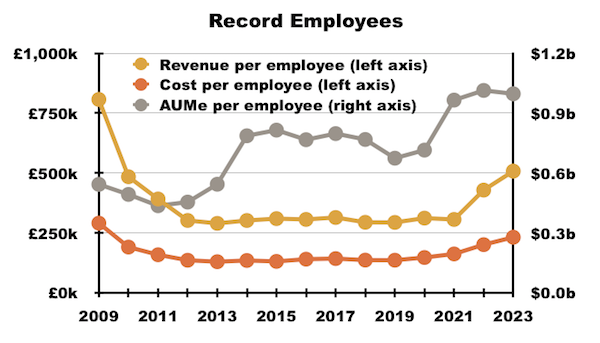

Record’s employees have become more productive during recent years. Revenue per head has become a very handy £500k after years of languishing around £300k:

The workforce now handles much greater client money per head than it once did — almost $1 billion each versus $500 million a decade ago:

Greater employee productivity of course means greater employee pay, and the average cost per employee last year was a tidy £250k. Record’s workforce absorbs approximately 46% of revenue in any given year.

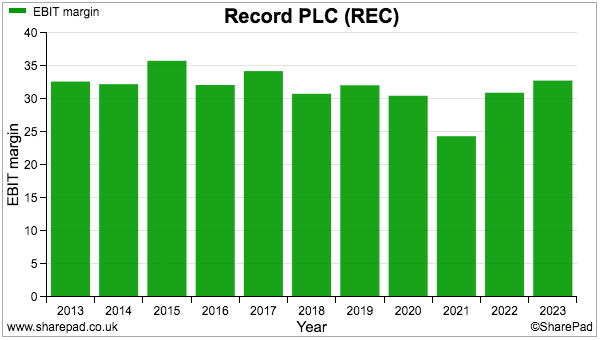

Despite the chunky wages, the group’s margin has typically topped 30%:

While their pay may be City-like, Record’s employees may not be as ‘scalable’ as other City workers.

Traditional fund managers for example can lump clients together in a few funds and enjoy economies of scale that way. Record in contrast talks about “bespoke solutions“…

“Record provides bespoke solutions and delivers best-in-class services in order to meet our clients’ needs. Many of these solutions revolve around a number of core products and services, delivered both in-house and with select partners in order to deliver the best results for our clients.”

…which I presume explains why client numbers are relatively small, and client money is relatively concentrated…

…and why Record has bold ambitions to diversify its product range:

Management and diversification

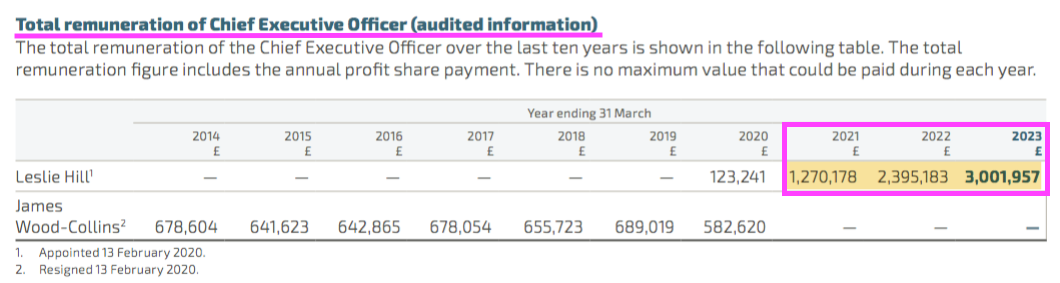

Long-time director Leslie Hill became chief executive during 2020 and is the driving force behind Record’s diversification and some enthusiastic three-year targets:

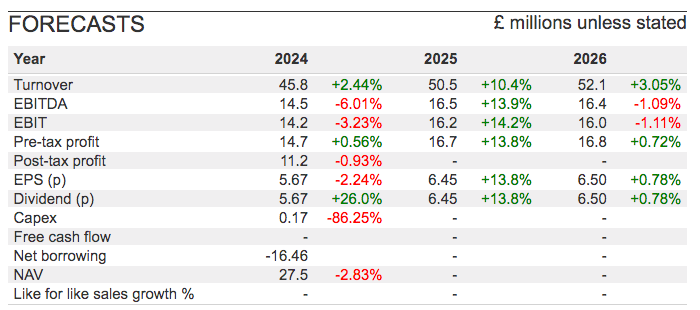

Revenue ambitions of £60 million for 2025 imply a 33% increase during the next two years, while the 40% margin goal would then leave a £24 million profit for 2025 and a £10 million increase on 2023.

The diversification plan involves expanding into fund management as well as taking stakes in early-stage ‘fintech’ ventures.

But after watching recordings of Record’s Capital Markets Day and 2023 results presentation, I must admit the details are somewhat hazy as to how exactly revenue may improve by 33% within two years.

At least Record will separately identify revenue generated by the diversification plan:

“Material new revenue streams derived from Record’s diversification into asset management products and services will be reported separately from the current financial year (FY-24) onwards.”

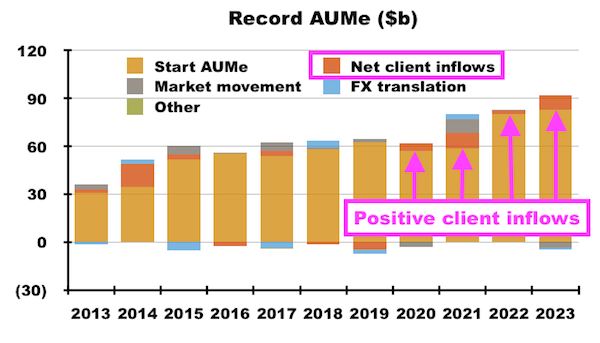

Somewhat ironically, the group’s diversification comes at a time when the conventional hedging services have been attracting more client money.

During the last four years, customers have handed Record a further $26 billion to manage — of which $9 billion occurred during 2023 alone:

The board appears very confident of Ms Hill and her diversification strategy; her total pay has surged to £3 million following her appointment as chief exec:

Ms Hill certainly offers loyalty to shareholders. She joined Record during 1992, became head of sales and marketing during 1999 and has served as an executive since the flotation. Her 31-year tenure has resulted in an 8%/£13 million shareholding.

The aforementioned Neil Record retired from the boardroom earlier this year but retains a 27%/£54m shareholding.

Valuation and summary

Brokers are unconvinced about the diversification ambitions, and do not expect revenue to surpass £60 million nor the margin to reach 40% (and therefore profit to hit at least £24 million) by 2025:

Note that the forecasts for earnings and dividends are identical — which I presume reflects the prospect of Record distributing ‘excess’ earnings through further special dividends.

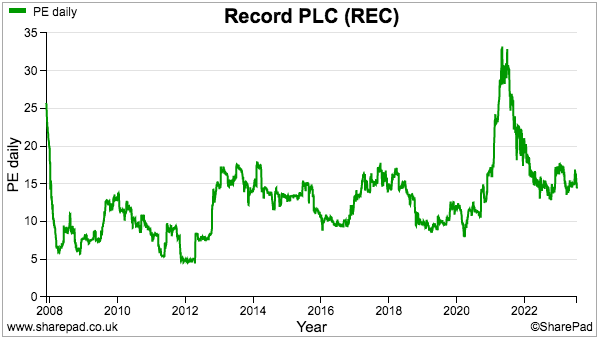

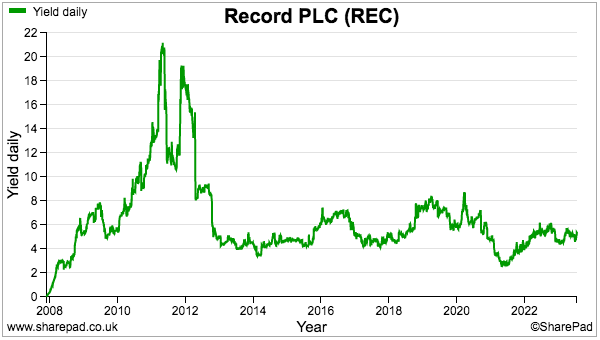

For 2023, Record reported earnings of 5.95p per share, an ordinary dividend of 4.5p per share and a special payout of 0.68p per share. SharePad therefore shows the trailing P/E to be 14x and ordinary yield to be 5.4%:

Assume Record will one day meet Ms Hill’s plans and report revenue of £60 million and achieve a 40% margin, earnings at that point would be approximately 9p per share.

Assume also that the 9p per share can be achieved as planned during 2025, and the shares would trade at a near-term 9x multiple with an income yield of 11%.

Right now the 83.5p shares look acceptable on an income basis as shareholders back a very cash-generative business while awaiting the diversification plan to unfold.

If the plan comes good and earnings do indeed approach 9p per share within two years, then the shares would look remarkably undervalued given the intervening growth rate.

Somewhat tellingly perhaps, Ms Hill is reluctant to back her plan by using surplus cash to repurchase shares. During the last results webinar, Ms Hill said:

“If I was going to buy back shares, however we did it, I would use those shares to incentivise the staff who are building this new business with us.”

Ms Hill added she would like to give the group’s high flyers a “few million shares each“:

“It’s hard to get them… to forego some of their bonus to participate in the LTIP. It’s not easy work to get them a few million shares each, but I would very much like to try and achieve that if I can“.

Those comments highlight the tension outside shareholders can face with City businesses dependent on handsomely paid staff.

Very often you’re not quite sure whether such companies are run for the benefit of shareholders or for the benefit of the employees.

The worry I suppose is Ms Hill’s surging remuneration sets a much higher benchmark for the wider workforce…

…that leaves outside investors unable to capture the full rewards from any successful diversification plan.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Investor’s Roundtable Podcast with Roland Head, Mark Simpson and Bruce Packard. Maynard does not own shares in Record.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.