Rockwood Strategic is buying underperforming small-caps, revitalising their boards and pushing for takeovers. Maynard Paton reviews the investment trust’s ‘activist approach, portfolio performance and current holdings.

Rockwood Strategic could be the ideal choice for anyone wishing to capitalise on the sorry state of UK small-caps.

A check of your own portfolio may support Rockwood’s belief that numerous UK small-caps are ready to be revitalised by fresh management and then be sold to the highest bidders.

You may not be able to appoint new board executives and argue for takeovers, but this £60 million ‘activist’ investment trust can do so on your behalf and has a 125% return to prove it.

Let’s take a closer look.

Introducing Rockwood Strategic

“I am not looking for well-run businesses, but undervalued companies that have lost their way and can benefit from strategic redirection.”

Richard Staveley explained during this interview how he puts Rockwood’s money purely into turnarounds. He looks for shares that offer a potential 100% recovery upside within five years.

The “strategic redirection” referred to by Mr Staveley is a polite way of saying Rockwood’s manager pushes for boardroom changes to ensure positive results.

You see, companies that have, as Mr Staveley puts it, “lost their way“, have typically undertaken duff acquisitions, embarked on misguided projects, suffered operational mishaps or simply employed complacent/tired/inept leadership — and all are ripe for a management reset:

Most investors tend to sell out of troubled companies, especially if a degree of balance sheet stress becomes apparent.

Mr Staveley in contrast is happy to wade in on behalf of Rockwood’s shareholders at hopefully rock-bottom valuations… and then start to instigate changes to capture the recovery upside.

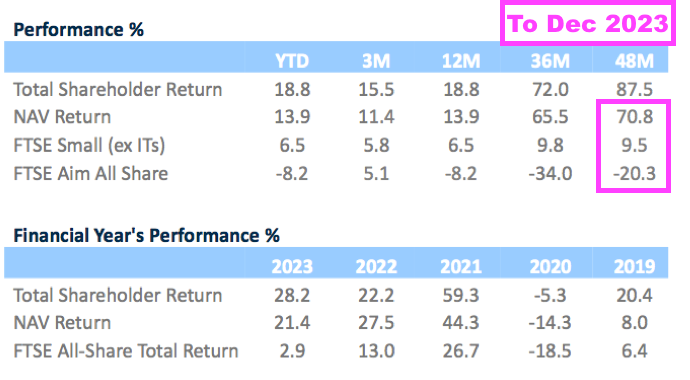

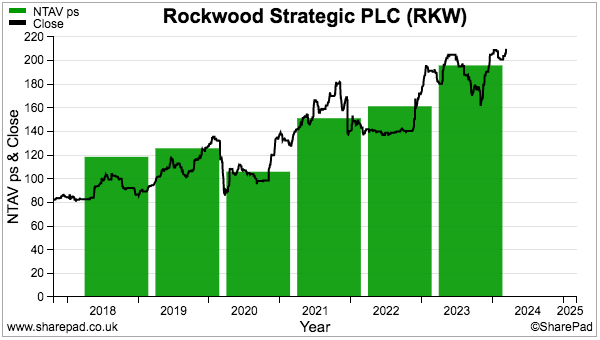

Rockwood’s performance during recent years underlines the success of Mr Staveley’s activist approach. The trust’s Q4 2023 presentation revealed Rockwood’s net asset value improving 71% during the four years to December 2023 versus a 10% advance for the FTSE Small-Cap Index and a 20% decline for AIM:

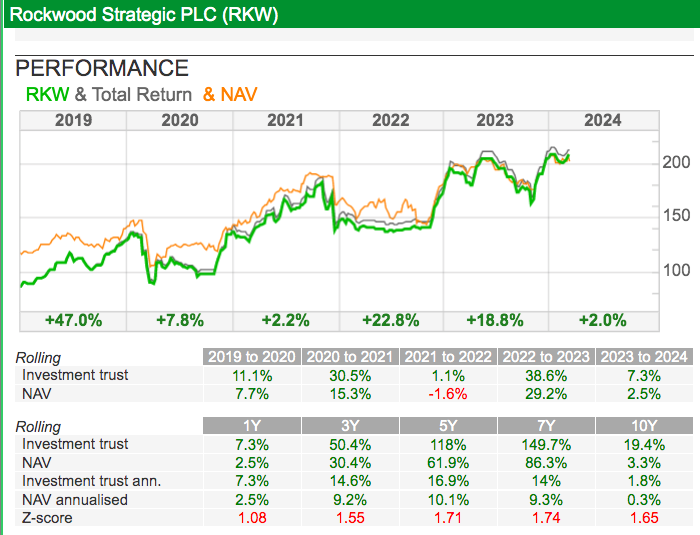

SharePad offers the following positive statistics:

SharePad in fact places Rockwood at the top of the five-year small-cap charts with a 125% total return:

Anyone who has managed their own UK small-cap portfolio during the last five years should recognise how impressive that 125% return really is.

Do note that Rockwood’s history is not straightforward and that Mr Staveley’s tenure at the trust extends back to only September 2019.

Formed initially as New Media Spark during the late Nineties tech bubble, the trust invested in early-stage digital ventures until 2015. Gresham House was then appointed to employ a “strategic public equity” investment process.

Gresham’s activist approach — as with Rockwood today — focused on “taking influential block stakes in smaller companies and then constructively engage to identify value-creation catalysts”.

Mr Staveley joined Gresham during 2019 and was involved with Rockwood until mid-2021, at which point he left Rockwood and Gresham to join Harwood Capital. A few months later, Mr Staveley returned to Rockwood after Harwood replaced Gresham as the trust’s activist manager.

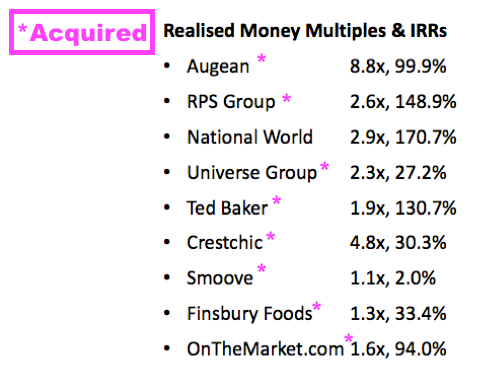

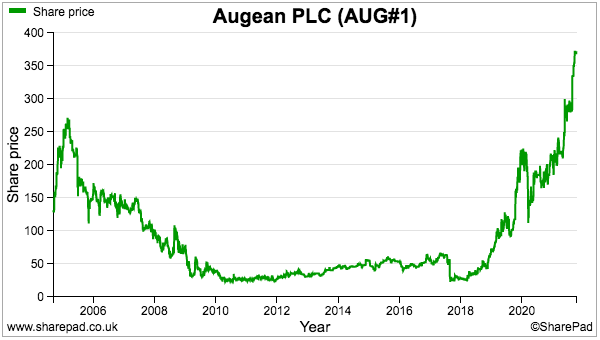

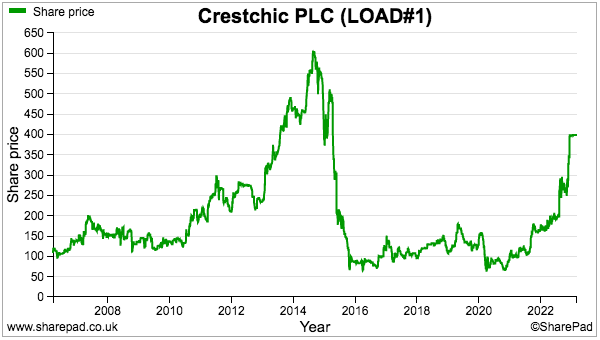

A few of Rockwood’s big winners were first acquired before Mr Staveley’s involvement with Rockwood. Initial purchases of Augean and Crestchic for example took place during 2017 and 2016 respectively:

But Mr Staveley was happy to keep Augean and Crestchic within Rockwood, and ran both of them to their eventual takeover conclusions:

Other winners such as RPS, Finsbury Foods, City Pub and OnTheMarket — all of which concluded with bids as well — were first selected with Mr Staveley at Rockwood.

Mr Staveley’s position as Rockwood’s stock-picker is endorsed by Christopher Mills, who effectively owns 27% of the trust and is among the UK’s very best small-cap fund managers.

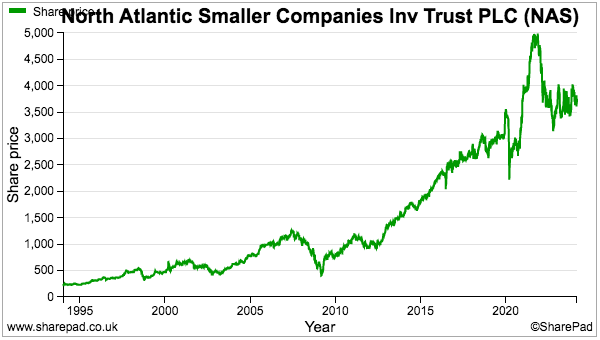

Mr Mills has managed the North Atlantic Smaller Companies Investment Trust (NASCIT) since 1982, and during the subsequent four decades has turned a £4 million market cap into £500 million:

Mr Mills’ NASCIT vehicle is not afraid of ruffling a few boardroom feathers either; NASCIT cites “install ‘change makers’ where appropriate” as one of its strategy bullet points. Mr Mills is also a member of Rockwood’s investment advisory group that assists Mr Staveley’s research.

Rockwood’s 209p shares compare to a 206p per share net asset value, making it one of the few investment trusts currently trading at a premium:

With a £60 million market cap, Rockwood still has some way to go before reaching the size of NASCIT and may therefore offer a greater opportunity for superior long-term gains.

Larger portfolio holdings

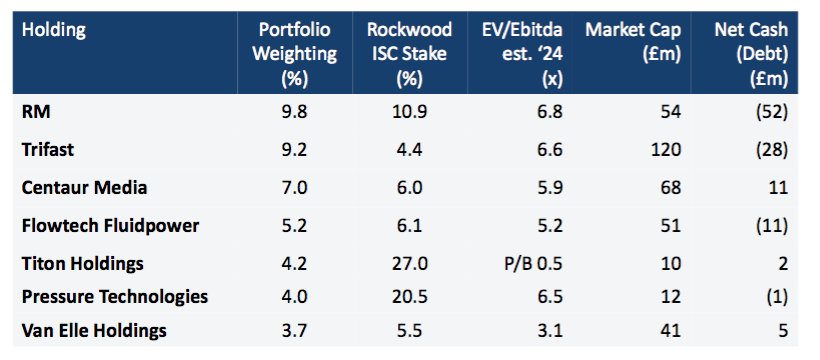

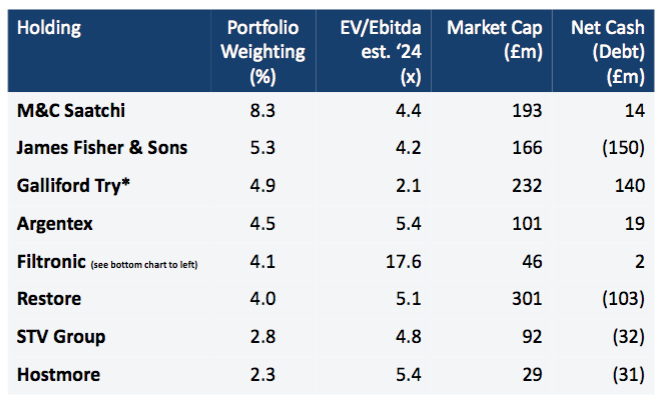

Rockwood runs a relatively concentrated portfolio. Mr Staveley’s Q4 2023 presentation confirmed 19 holdings and listed 15 names:

‘Core’ holdings can represent anywhere between 5% and 15% of net assets, while the 27% ownership of Titon (market cap: £10 million) shows the trust is not afraid of holding major stakes in very small companies.

Note that Rockwood’s investments may be complemented by similar holdings owned by other Harwood-managed funds.

Centaur Media for example is 6% owned by Rockwood, but a further 23% is controlled by fellow Harwood portfolios. Being part of the larger Harwood ‘concert party’ provides Rockwood with greater boardroom influence than would otherwise be the case.

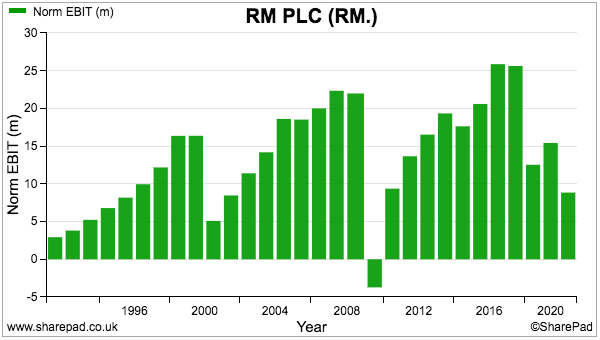

The profit record of Rockwood’s largest holding, RM, shows this £45 million supplier of educational IT is not unused to setbacks and recoveries:

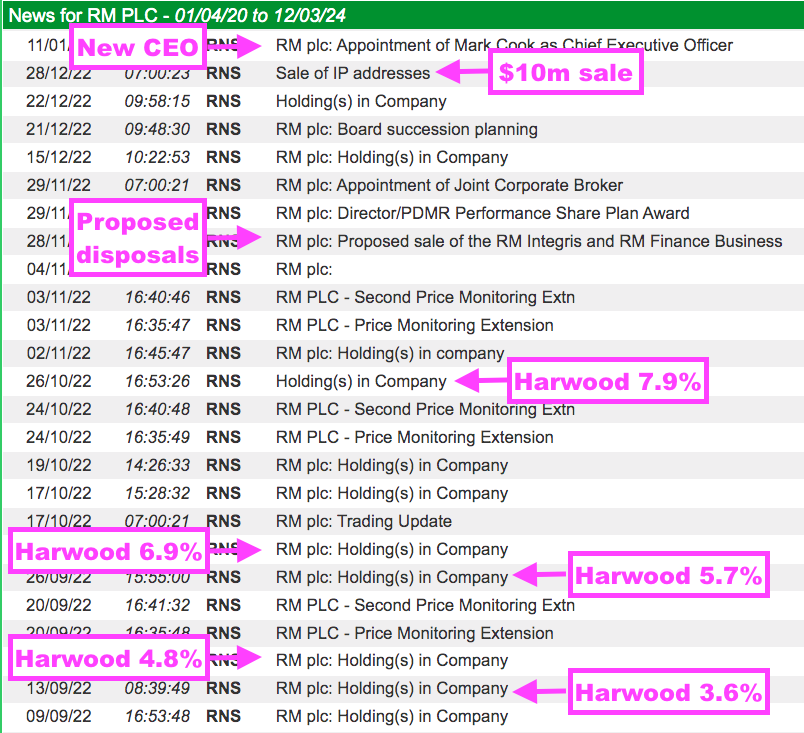

Rockwood first appeared publicly on RM’s share register in September 2022 when the shares were 60p versus a recent price of 54p.

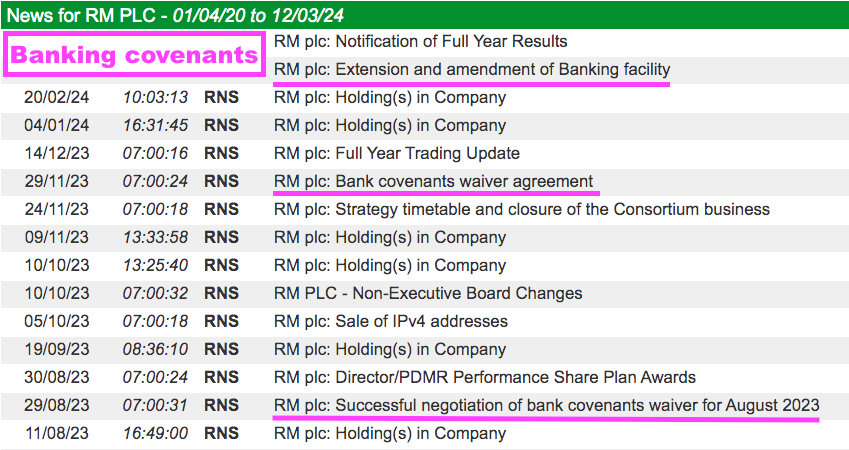

SharePad shows corporate actions picking up soon after Rockwood’s appearance. Within four months, disposals were proposed, a batch of IP addresses were sold for $10 million (book value: £nil) and a new chief executive was appointed:

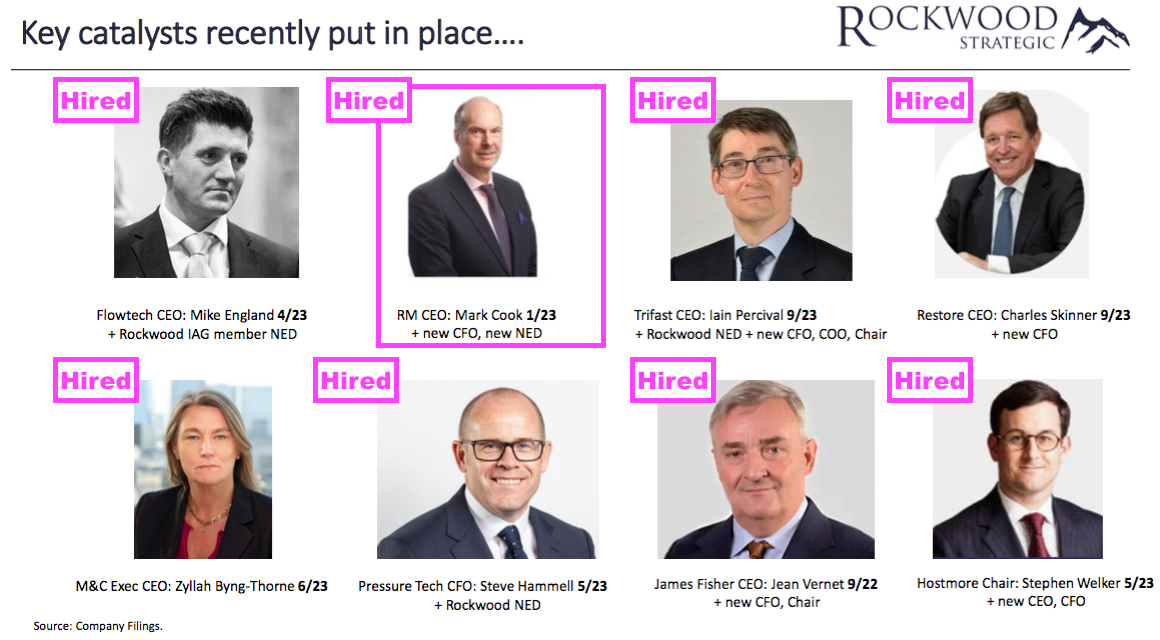

RM’s new boss is in fact one of a number of “key catalysts recently put in place” to revive Rockwood’s holdings:

RM’s newsflow admittedly includes some unnerving banking-covenant headlines…

…while results issued the other week showed substantial write-offs, significant borrowings and minimal profit.

But at least management also unveiled its ‘EdTech’ strategy that aims to convert RM into a “high performing” business from 2025.

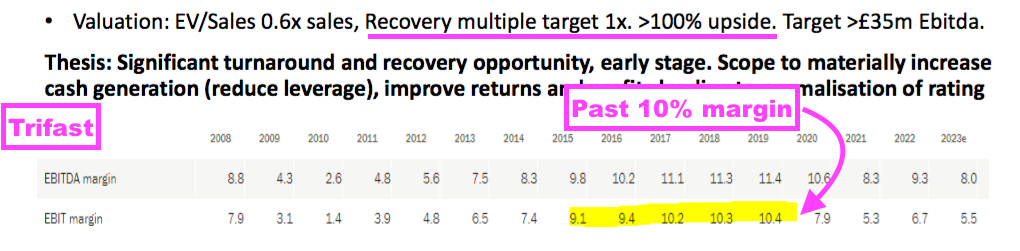

Second largest holding Trifast, a £100 million manufacturer of industrial fasteners, has yet to set Rockwood’s portfolio alight.

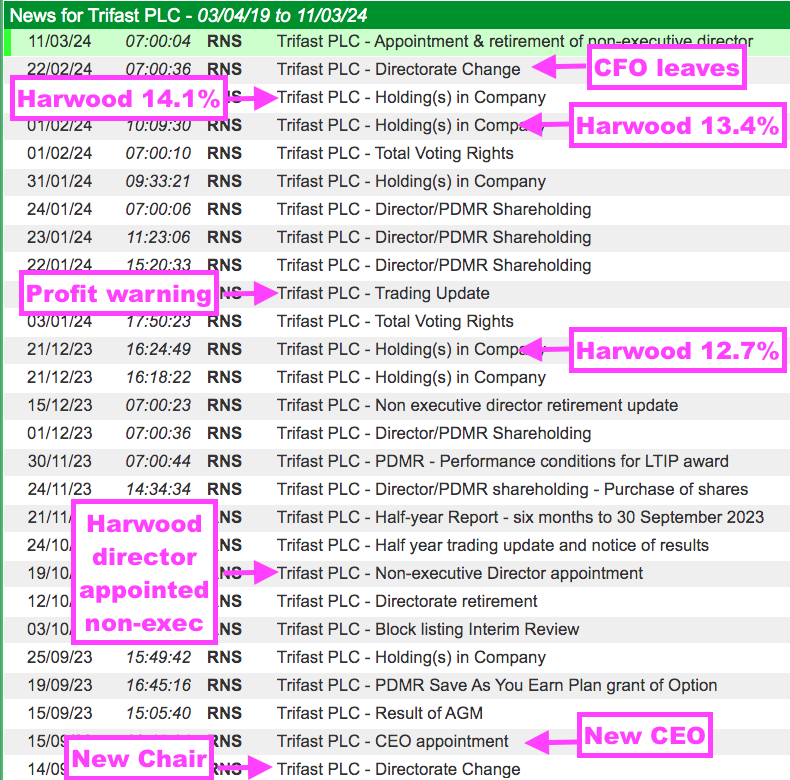

Rockwood (and Harwood) first appeared publicly on Trifast’s register during

July 2023 when the price was 79p. Since then a new chairwoman, a new chief executive, a new (interim) finance director and a new Harwood-connected non-exec have been appointed:

Trifast’s profit warning during January was not ideal:

“The Board now expects that the Group’s results for the year ending 31 March 2024 to be significantly below its previous expectations, with revised revenue at c.£230m and adjusted EBIT margin percentage of c.5%.”

But Rockwood and/or Harwood have since increased their combined stake. The general investment thesis is margins can recover to 10%, debt can be reduced and the market cap can equate to 1x revenue… thereby more than doubling the recent 74p share price:

Smaller portfolio holdings

Some of Rockwood’s holdings may struggle to meet Mr Staveley’s target of doubling the trust’s investment within five years.

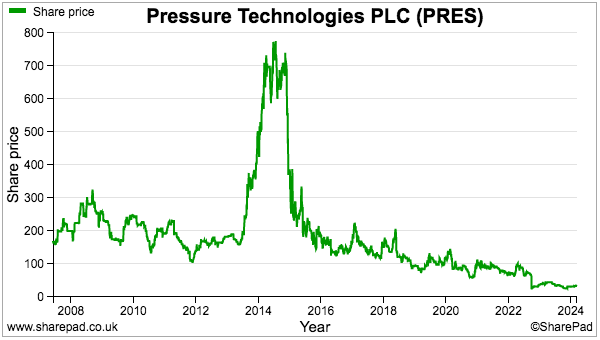

Pressure Technologies for instance was selected by Gresham during 2019 and has been backed by Rockwood and Mr Staveley ever since.

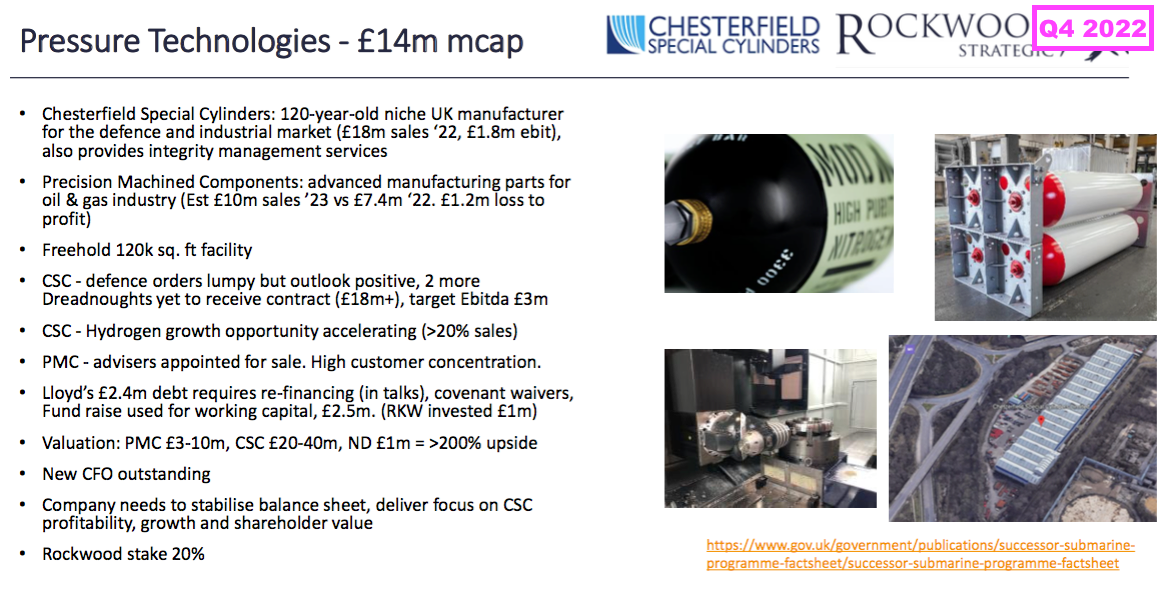

The £15 million manufacturer of industrial cylinders featured within Mr Staveley’s Q4 2022 presentation:

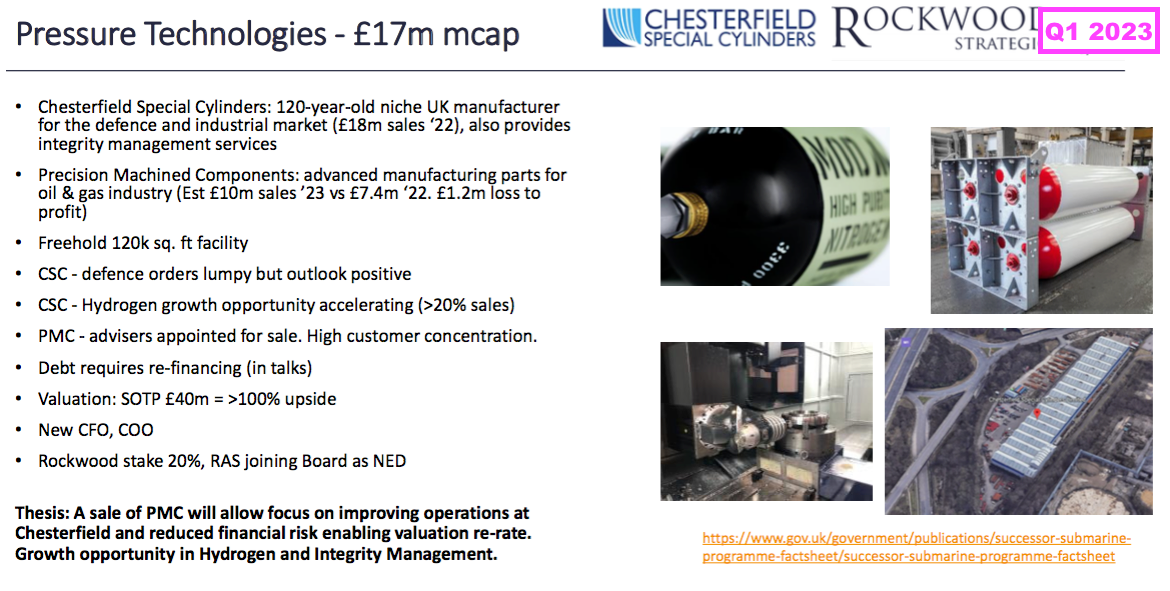

…and his Q1 2023 presentation…

…but has been absent from his PowerPoints thereafter.

Newsflow during the last 18 months has not been entirely positive.

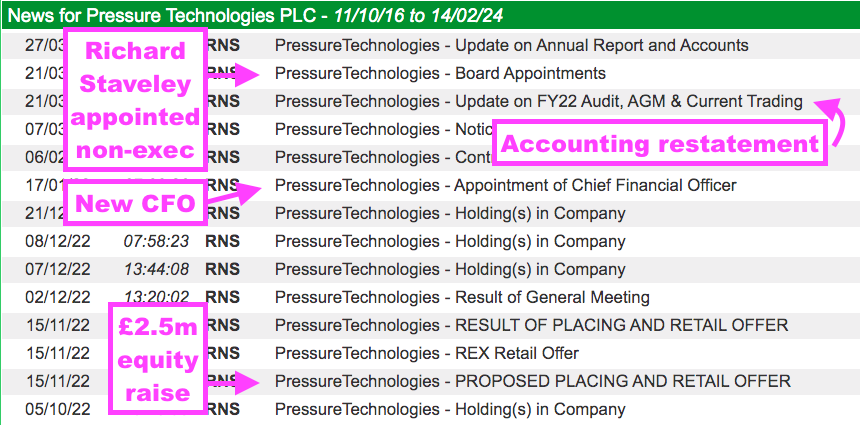

SharePad shows a £2.5 million share placing followed an accounting re-jig that restated an expected £1.4 million loss into an actual £2.6 million loss. With Rockwood a 20% shareholder, no wonder Mr Staveley appointed himself as a Pressure Tech non-exec:

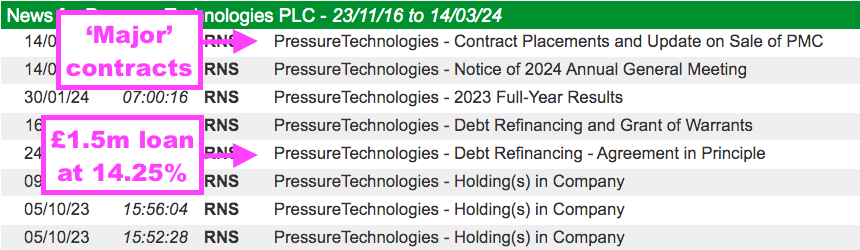

More recently, Rockwood and another shareholder have refinanced Pressure Tech’s £0.9 million bank loan with £1.5 million charged at 14.25% annual interest — a rate that suggests Pressure Tech offers material credit risk:

Still, lending money at 14.25% a year may help Rockwood’s overall investment return on Pressure Tech. This month’s news of “major” contracts has pushed the shares from their all-time low:

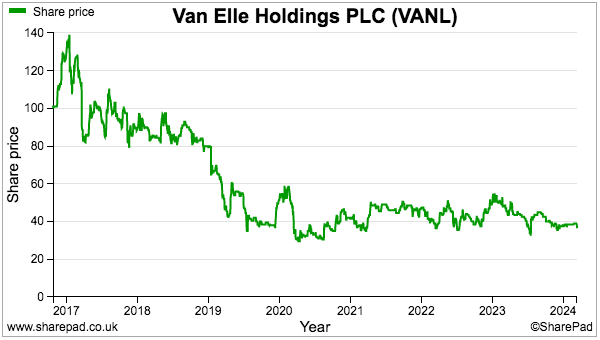

Van Elle has not really performed to expectations either.

Although Rockwood was unlucky to buy into the piling contractor just before the pandemic, the trust did “subsequently act as a cornerstone investor in an issue of new stock, building a significant 7% stake to support the business through the disruption and onto the opportunities which lie ahead.”

That “cornerstone” support was conducted at 25p per share and four years later the price is 36p:

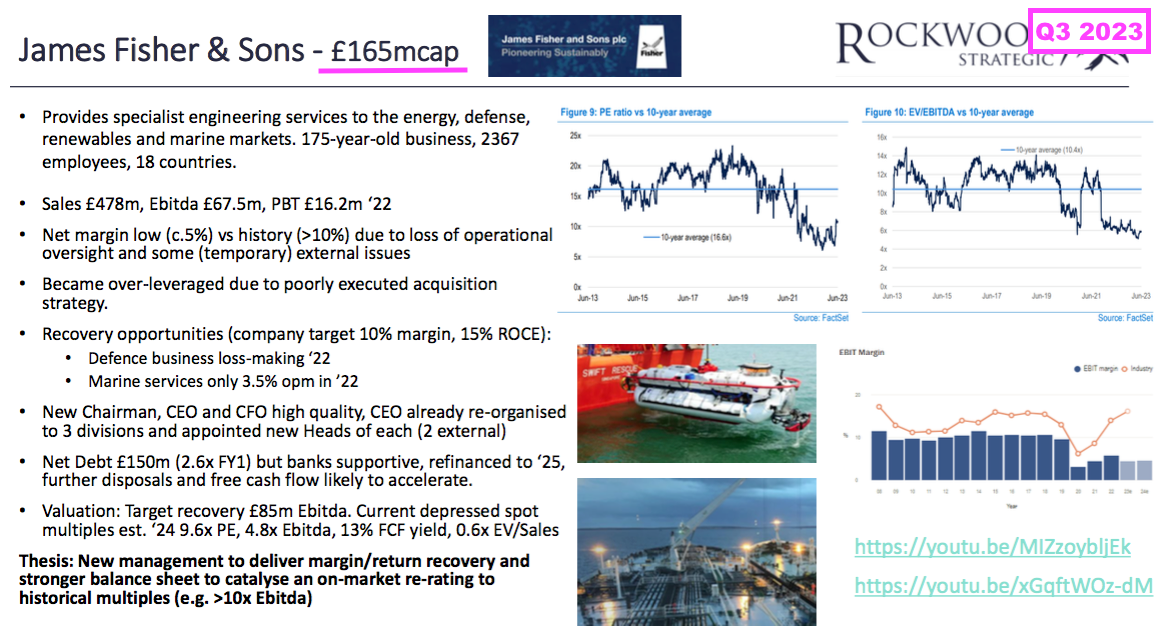

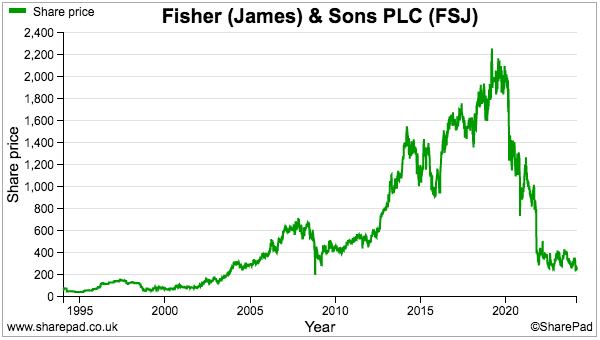

Other holdings where the early omens have not been promising include marine-services group James Fisher and forex specialist Argentex.

James Fisher was purchased during 2023 and featured in the Q3 2023 presentation with a £165 million market cap:

A mixed update during February has since left the market cap 22% lighter at £129 million and the shares testing 15-year lows:

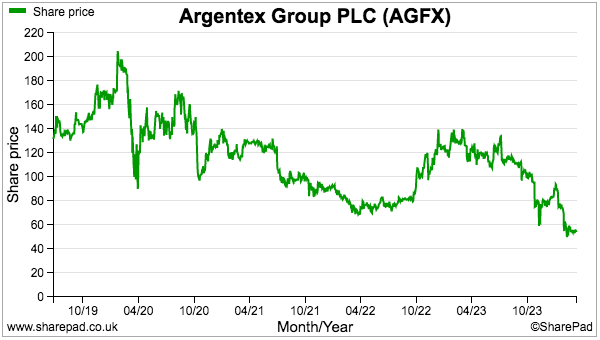

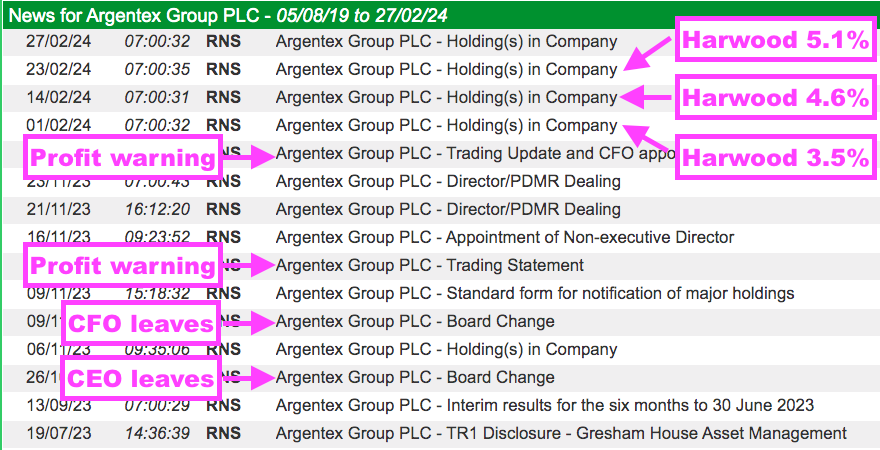

Argentex meanwhile appears to have been purchased initially during 2022 at approximately 84p and the shares currently trade at a 55p all-time low:

Argentex’s newsflow implies Rockwood and Harwood were not impressed with the board, as both the chief exec and the finance director suddenly resigned before two profit warnings. Mr Staveley seems confident of a recovery with further Rockwood/Harwood purchases:

Summary and verdict

Rockwood’s activist approach is not the easiest to employ. The trust’s strategy requires:

- Building notable shareholdings that may be hard to sell;

- Engaging constantly with board members;

- Recruiting capable new executives, and;

- Withstanding adverse newsflow for some time.

And quite often the accounts of the investee companies are blighted by significant adjustments, onerous liabilities and minimal profit.

Most fund managers don’t want the extra hassle of activist engagement, while private investors stand no chance of spearheading executive changes. The door is therefore left open for the likes of Rockwood to take its pick from no shortage of recovery candidates.

And right now, the UK small-cap market is awash with underperforming shares on multi-year lows with ‘inactive’ investors yearning for somebody to shake up the board, trigger a recovery and find a bidder.

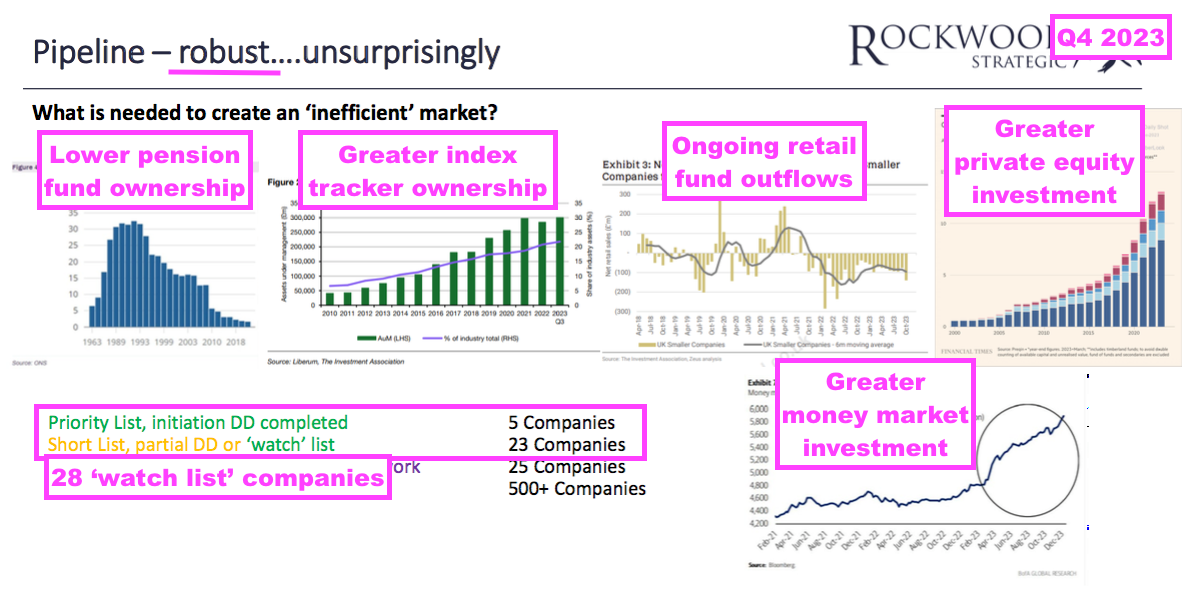

Mr Staveley’s latest presentation explained why the research pipeline was “robust” and implied investments could be made in a further 28 companies:

No wonder then — with plenty of possible opportunities and a growing list of investments having already attracted takeovers — that Rockwood is presently one of the very few investment trusts to trade at (or above) net asset value.

With Rockwood’s net asset value now at £60 million, the trust pays Harwood a 1% management fee alongside a 10% performance fee should net assets advance by 6% or more.

Assuming Rockwood’s investments can — as Mr Staveley hopes — climb 100% over five years, then the fees would be money well spent to receive what should be approximately 13% compound returns after costs.

Plus Rockwood investors will enjoy exposure to probably the most unloved corner of the entire UK stock market, with performances dictated almost entirely by company-specific recoveries rather than wider market/economic factors.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Rockwood Strategic.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.