A search for ‘owner managers’ leads Maynard Paton to the impressive dividend record of Lok’nStore and the ‘extremely stable’ nature of self storage.

I love ‘owner managers’ — company bosses with significant shareholdings who want to build wealth for the long haul.

Such leaders do seem to act differently to standard chief executives. A hefty investment complemented by substantial dividends should certainly focus the mind on long-term operational matters…

…versus the more typical executive considerations such as bonuses, expense accounts, awaydays and career progression.

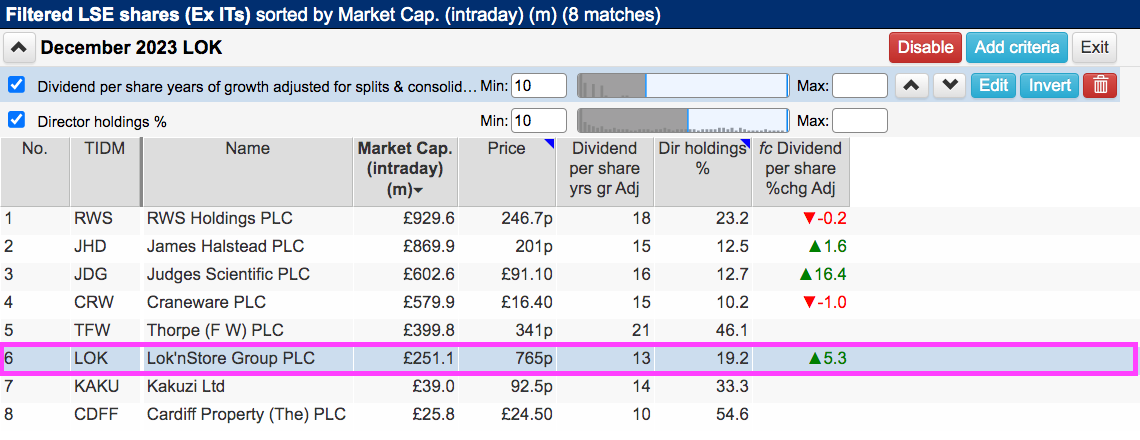

I have attempted to identify promising ‘owner managers’ by screening for companies with the following criteria:

- At least ten years of annual dividend increases, and;

- A minimum 10% total director shareholding.

SharePad returned only eight companies — including James Halstead, Judges Scientific and Craneware:

(You can run this screen for yourself by selecting the “Maynard Paton 15/12/23: Lok’nStore” filter within SharePad’s legendary Filter Library. My instructions show you how.)

I selected Lok’nStore as it offered the highest forecast dividend growth among the shares I had not previously evaluated for SharePad.

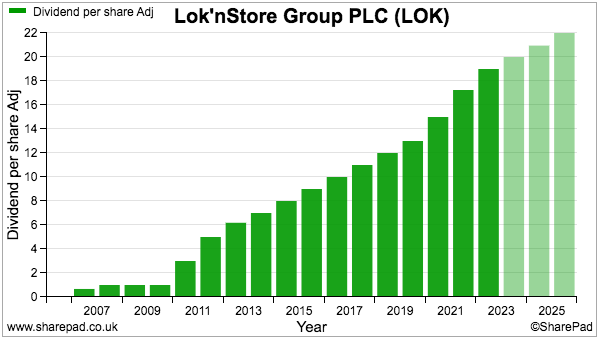

Lok’nStore’s history of annual dividend increases runs to 13 years, with another three years of payout advances predicted:

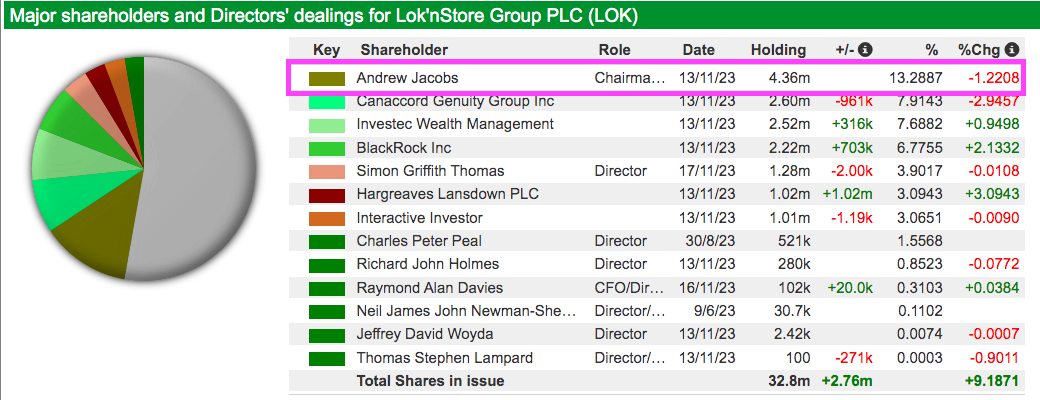

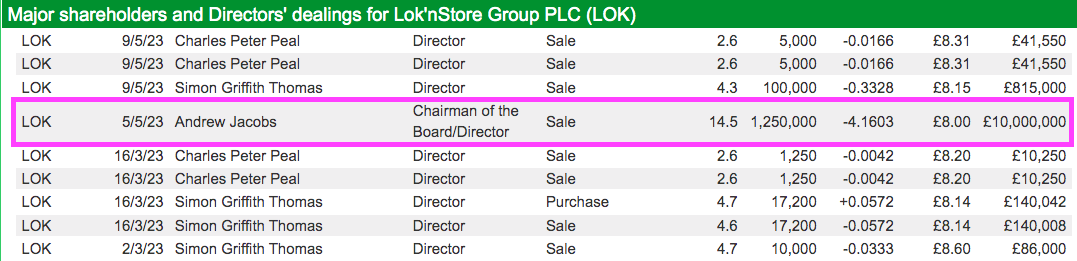

SharePad reveals Lok’nStore’s ‘owner manager’ to be executive chairman Andrew Jacobs, who controls 13% of the business:

Let’s take a closer look.

Introducing Lok’nStore

“The reason I am in self storage is that it is an extremely stable business”

So recounted Andrew Jacobs during this interview when he explained why he established Lok’nStore after eight years working for a Japanese bank.

That earlier dividend chart underlined the “extremely stable” nature of self storage; demand for extra space from individuals and businesses has continually grown despite economic, political and pandemic upheavals.

The Self Storage Association UK reckons the industry operated only 200 sites consisting of 8 million square feet of space back in 2000. This year some 2,200-plus sites offered 55 million square feet for storage.

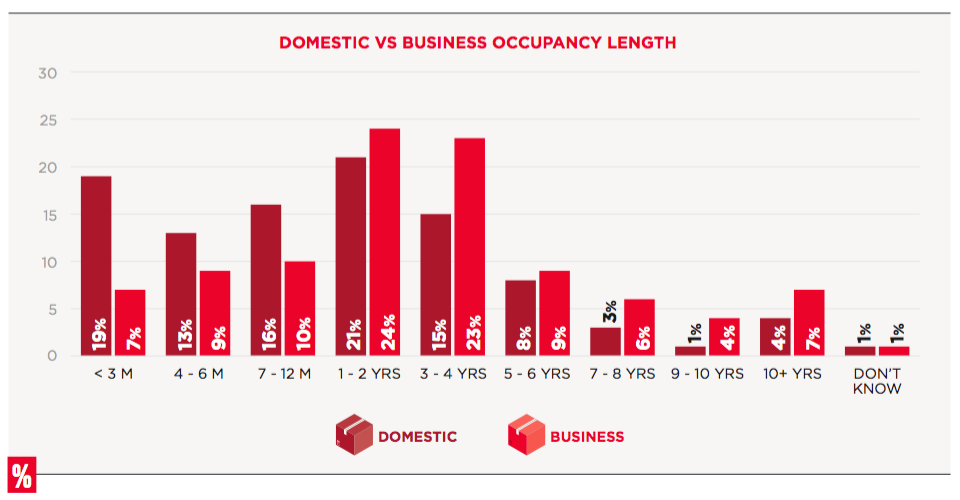

The trade body reckons 52% of domestic customers and 73% of commercial customers occupy their storage units for more than a year, with some tenures extending beyond a decade:

Individual customers tend to be prompted by house moves, divorces or the simple desire for more room at home. Commercial usage tends to be undertaken by small businesses for holding stock and archiving documents.

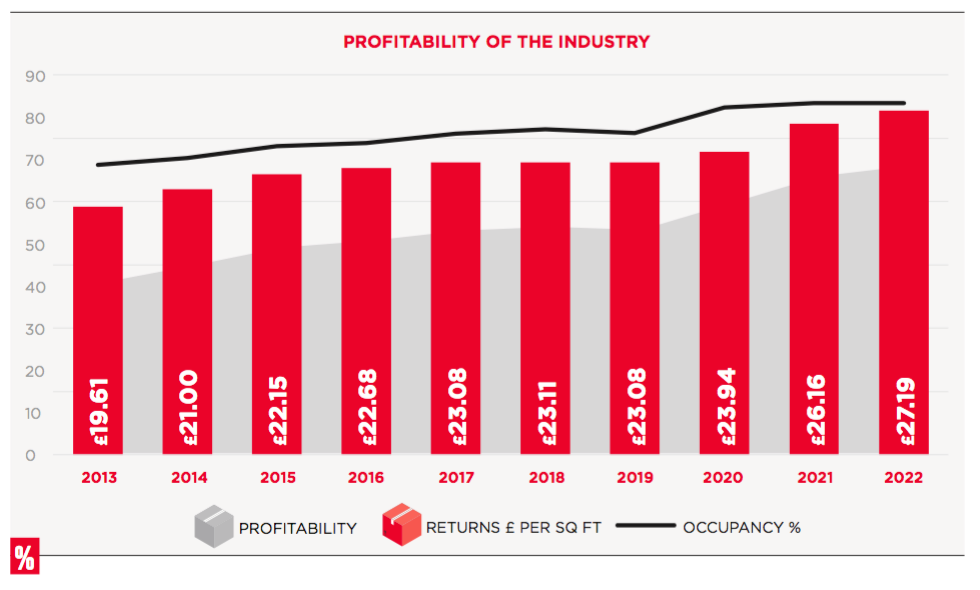

Further SSA UK statistics show unit occupancy increasing from 69% to 83% and returns per square foot advancing from £19.61 to £27.19 during the last decade:

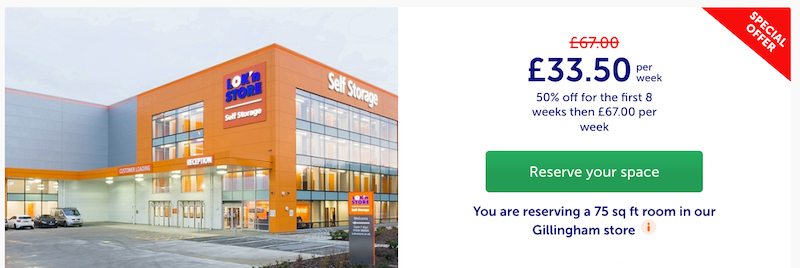

Lok’nStore’s latest results disclosed pricing at £27.37 per square foot. An online quote from my nearest Lok’nStore for 75 square feet (“about the size of an average single bedroom“) returned £33.40 per week for the first eight weeks and then £67 per week thereafter:

£67 a week comes to almost £3,500 a year and is equivalent to approximately £46 per square foot.

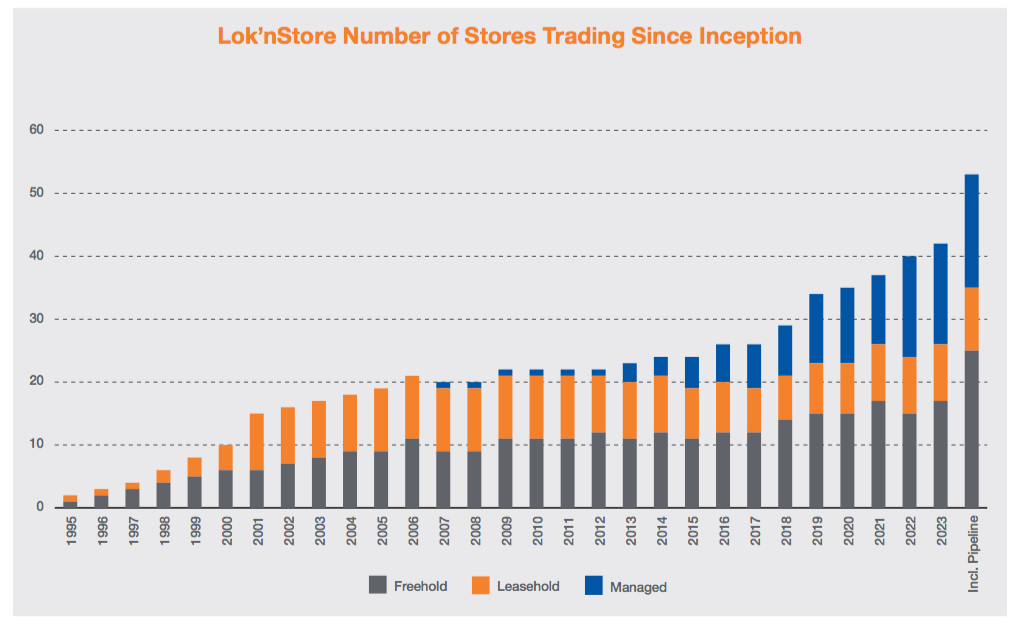

Mr Jacobs opened the first Lok’nStore in Horsham, West Sussex, during 1995 and the subsequent 28 years have witnessed the group expand to 42 sites with a further 11 locations in various stages of development:

After converting early sites from existing buildings, Lok’nStore opened its first purpose-built location during 2006. New sites are now all described as ‘landmark’ stores, which take prominent positions within busy urban areas and come complete with “bright orange elevations” to “raise the profile of the Lok’nStore brand”:

As well as operating its own stores, Lok’nStore manages Lok’nStore-branded facilities for third parties in return for monthly management fees. All capital costs and operating expenses of the managed sites are borne by the third parties.

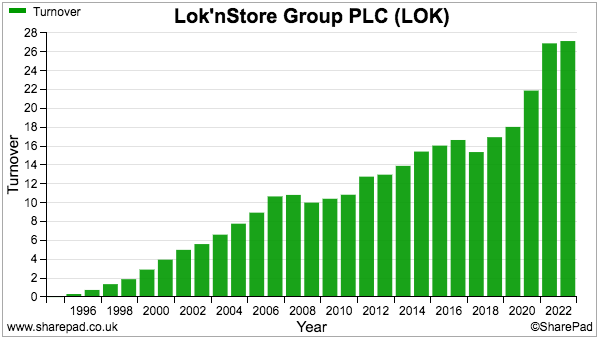

The additional stores have underpinned an impressive top line. SharePad shows revenue advancing from approximately £50,000 to £27 million between 1995 and 2023:

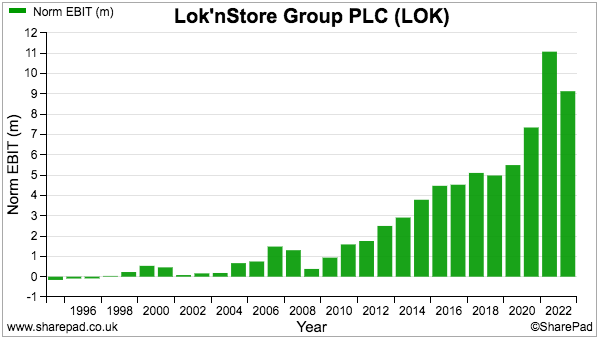

Profit growth has not been as consistent as revenue, with regular improvements witnessed only after 2011:

Profit fell markedly last year due to the prior year enjoying notable one-off transaction fees from managed stores.

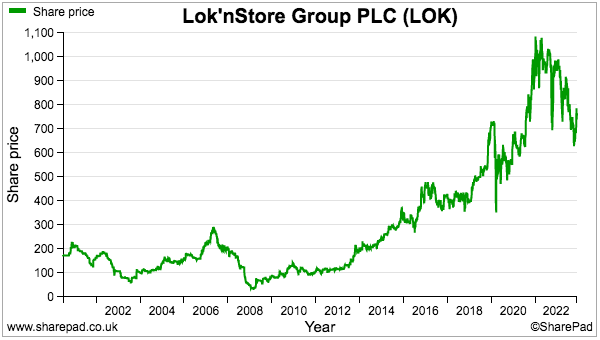

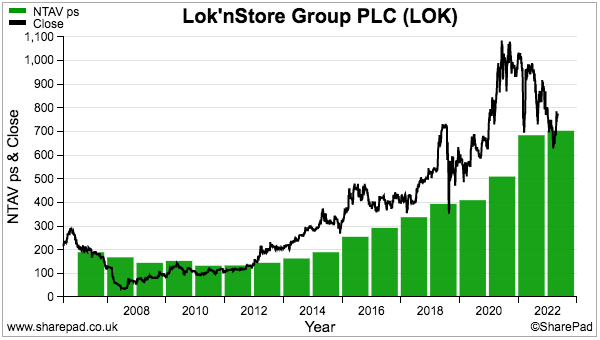

The shares joined what was OFEX during 1997 and switched to AIM during 2000, at which point the price traded at around 170p. The price slid to 35p during the depths of the 2008/9 banking crash before surpassing £10 last year:

The recent 765p supports a £251 million market cap.

Lok’nStore’s SharePad summary

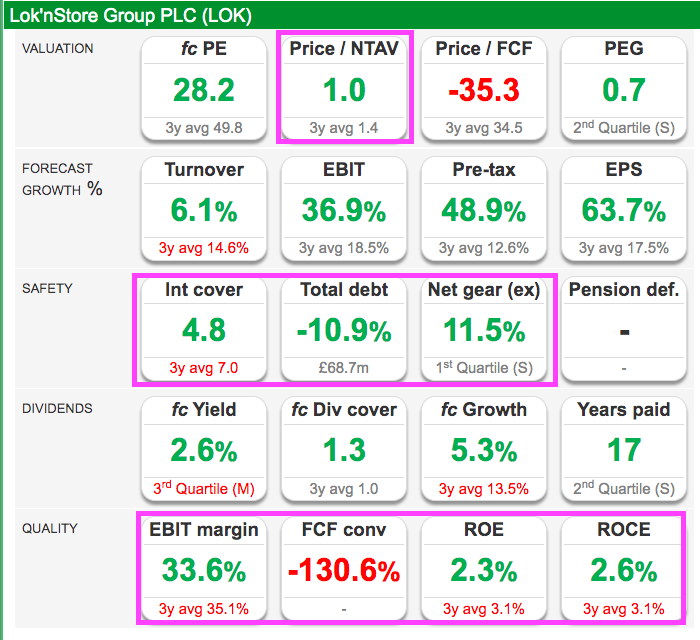

Lok’nStore’s SharePad summary appears very mixed:

The bottom row shows a very appealing 34% profit margin but cash conversion looks poor while returns on equity (ROE) and capital employed (ROCE) are very modest.

The middle row then confirms the group carries debt, with the top row intriguingly showing the market cap priced equal to the group’s net tangible asset value.

Let’s start with cash conversion to discover what is going on.

Cash flow, capex and debt

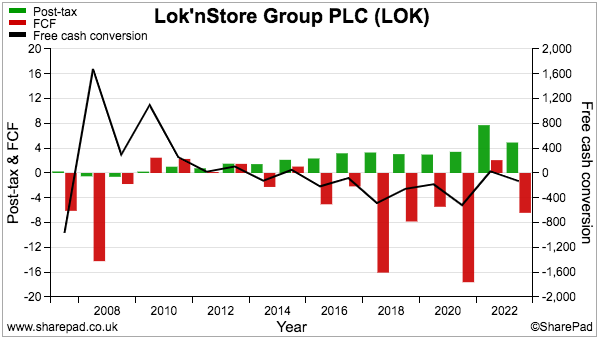

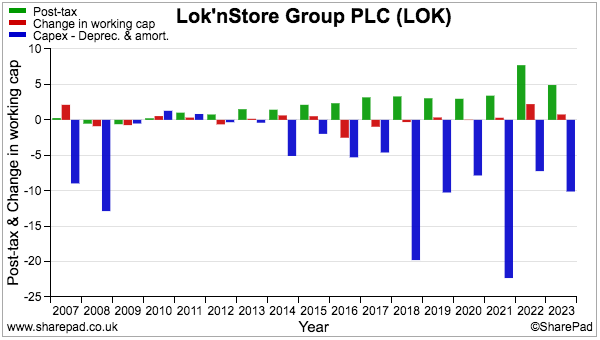

Lok’nStore has for some years reported positive earnings but significant levels of negative free cash:

Earnings often convert into low (or negative) levels of cash flow due to:

1) Significant cash absorbed by additional working capital (i.e. through slow-moving stock, late customer payments and early supplier payments), and;

2) Expenditure on tangible assets (i.e. property, plant and equipment) and intangible assets (e.g. capitalised development costs) substantially exceeding the associated depreciation and amortisation charged against profit.

The chart below compares Lok’nStore’s earnings to the additional working-capital investment and ‘excess’ capital expenditure:

Working capital (red bars) is not the problem. Indeed, the group carries minimal stock (mostly boxes for packaging) while customers typically pay upfront via direct debit leading to extremely few bad debts.

Lok’nStore’s capital expenditure (blue bars) has absorbed all of the group’s cash flow. More than £150 million has been spent on new storage facilities since 2007, with the corresponding depreciation charge against earnings at approximately £40 million.

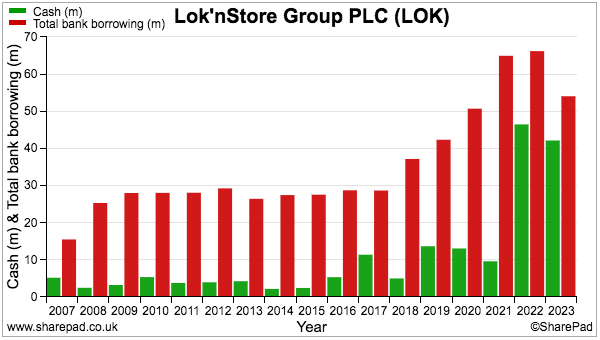

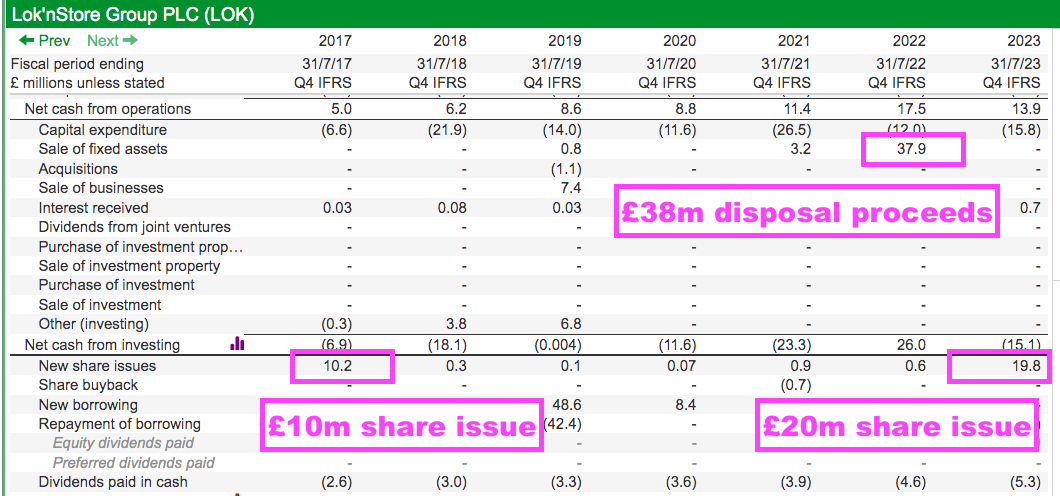

Additional debt has funded the hefty capex. Gross bank borrowings had soared £66 million by 2022:

Net borrowings, however, have been kept under control and were only £12 million at the 2023 year-end.

The net debt position was reduced during 2022 through a £38 million sale of four stores. In addition, £20 million was raised via new shares during 2023 that followed a £10 million placing during 2017.

Lok’nStore’s 2023 results revealed that a £20 million equity raise was subsequently used to reduce year-end debt of £54 million to what should now be approximately £35 million. The group also disclosed interest costs on its borrowings were currently 6.7% versus 4.8% during 2023 and only 1.6% during 2022.

I estimate interest may presently be running at £2.3 million a year on that £35 million, versus interest of £3.1 million incurred during 2023, £1.3 million incurred during 2022 and just £500k or so incurred between 2017 and 2021.

Lok’nStore’s debts are all unhedged and higher interest rates appear to have prompted fresh capital-allocation thinking. After all, choosing to raise £20 million to repay debt at 6.7% could arguably suggest new storage facilities are projected to generate returns lower than that 6.7%.

At least the latest results did mention a “large cushion of comfort” with a lending covenant:

“At the year-end senior interest cover was 4 times finance charges on gross debt tested on a 12-month rolling basis, against a bank covenant of 2.5 times. At the year-end our loan-to-value ratio based on net bank debt was 3.7% versus a bank covenant of 60% providing a large cushion of comfort.”

The “large cushion of comfort” compares Lok’nStore’s debt to its all-important asset value,

Net asset values and revaluations

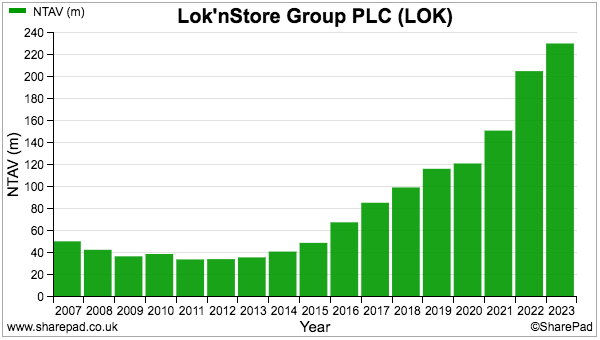

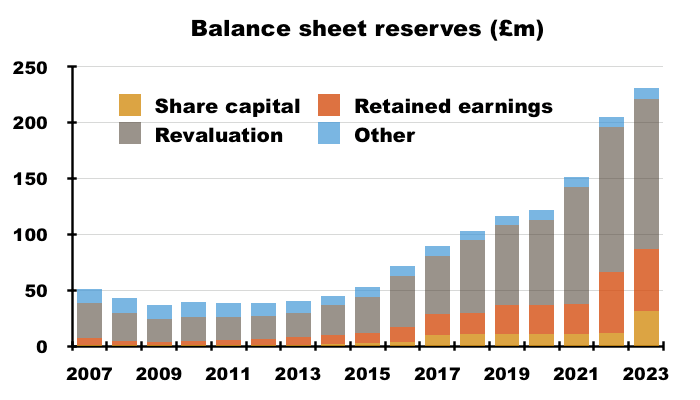

SharePad shows Lok’nStore’s net assets advancing every year since 2013 to reach £230 million for 2023:

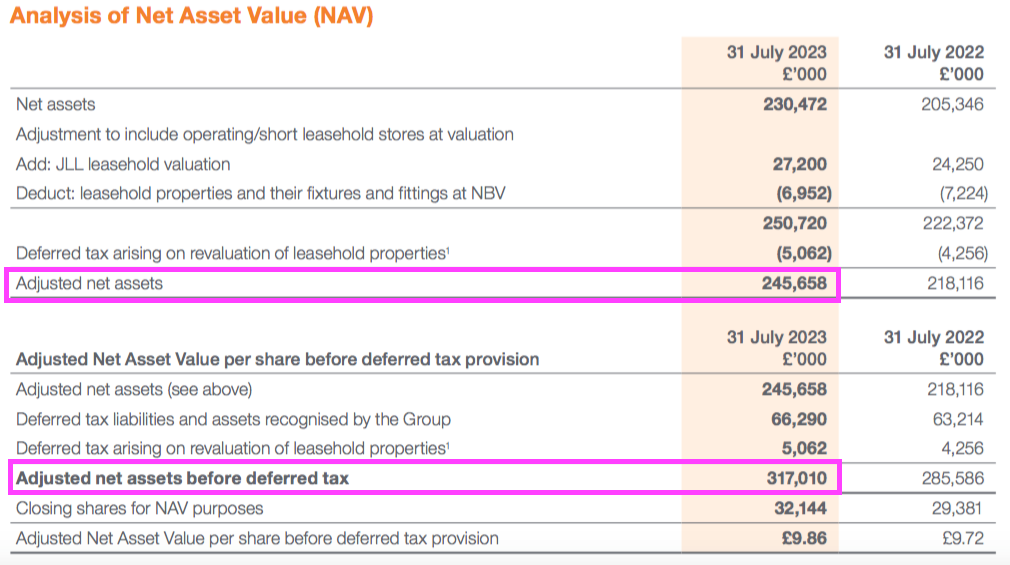

Lok’nStore calculates adjusted net assets as well as adjusted net assets before deferred tax:

Adjusted net assets are £246 million, and include an up-to-date valuation of the group’s leasehold properties that accounting standards dictate must be carried on the balance sheet at cost.

The same accounting standards in contrast allow the group’s freeholds to be carried at their market value, and including the leaseholds on the same basis does validate the group’s adjusted calculation.

Adjusted net assets before deferred tax are £317 million, and are derived by taking adjusted net assets and adding back the tax liability that would arise should the group sell all of its properties.

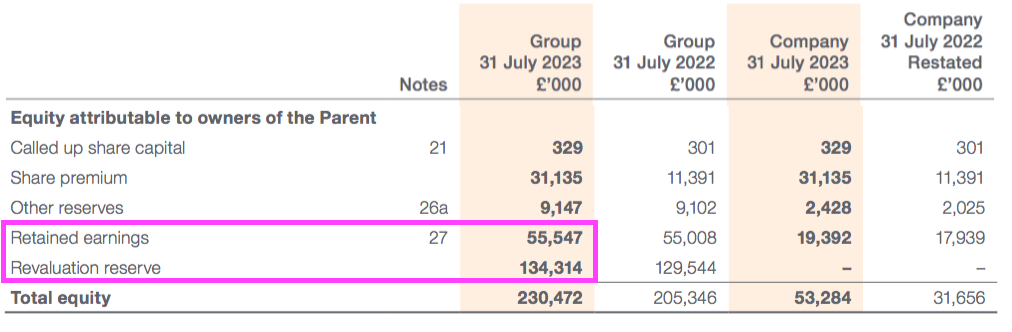

Lok’nStore’s balance sheet reveals the main sources of net asset growth. Since the group’s formation, retained earnings have contributed £56 million to the balance sheet…

… but (freehold) property revaluations have contributed £134 million (after deferred tax):

The property revaluations are vital for shareholders because they underpin the group’s asset valuation — especially as adjusted net assets of £246 million are a fraction below the recent £251 million market cap.

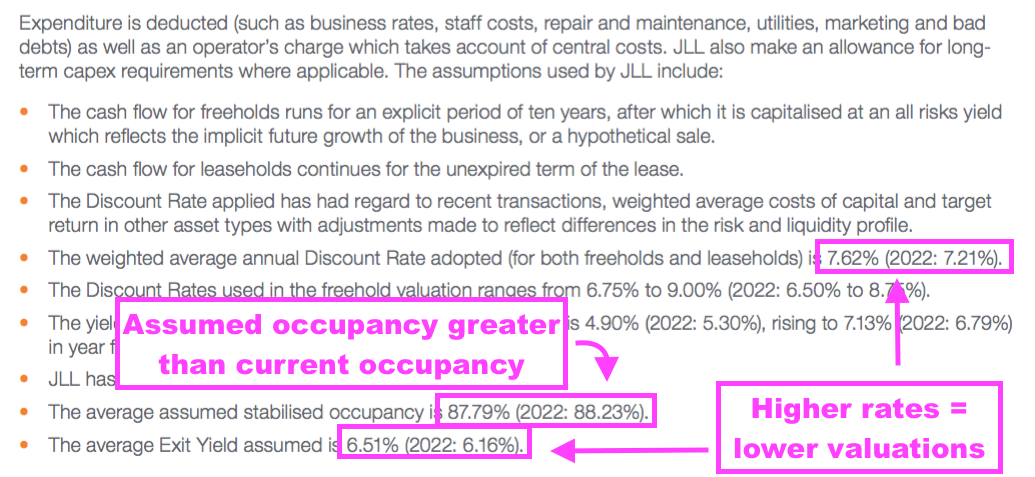

Assumptions fed into the yearly revaluations are disclosed within the annual report:

I do wonder if some of the assumptions are ambitious.

Unit occupancy for example is projected at almost 88%, while Lok’nStore admits occupancy at its locations that are more than three years old is only 81%.

The assumed discount rates and valuation yields may have to be lifted again, too, given debt costs that were 4.8% during 2023 are now 6.8%.

Lok’nStore admitted small assumption changes last year knocked £15 million from the market value of its freeholds, although that reduction was counterbalanced by improved trading:

“On our Owned freehold trading stores we have seen exit yields increase on average by 33 basis points, with discount rates increasing by 45 basis points. These changes had the effect of reducing the valuation by £15.45 million. Improved cash flows in the stores that were valued last year added £14.20 million, which materially reversed the effects from the changing capitalisation rates.”

The risk I suppose is weaker assumptions continue to knock the property valuations further, but without improved trading to help offset the reduction.

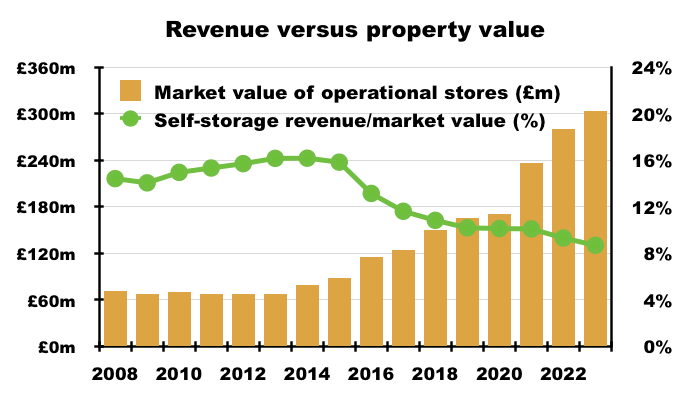

I note last year’s self-storage revenue of £25 million was generated from properties with a year-end market value of £303 million — equating to an effective gross income yield of 8-9%. My chart below shows that yield-reducing significantly from 2016, and I am not convinced property values can outpace revenue growth indefinitely:

I should add the aforementioned £38 million proceeds from the sale of four stores realised a profit of £6 million on their £32 book value, which does provide some evidence of the group’s yearly valuations being slightly conservative. That said, the agreement to sell those four sites was announced during February 2022 when the UK base rate was 0.25%.

ROE, employees and margin

A further three points about the accounts:

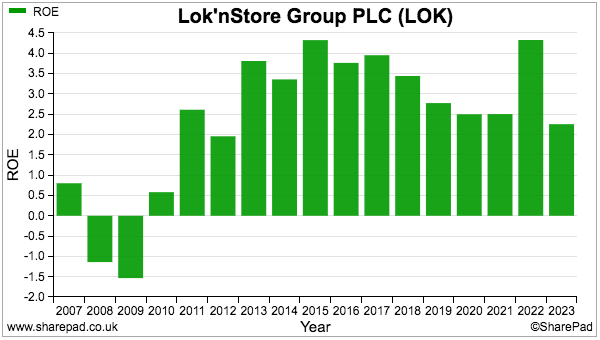

1) Lok’nStore’s freehold revaluation gains — which represent the bulk of shareholders’ returns — are recorded straight onto the balance sheet and do not interfere with reported earnings. The group’s ROE and ROCE therefore include the revaluations only in the denominator and lead to very modest percentages:

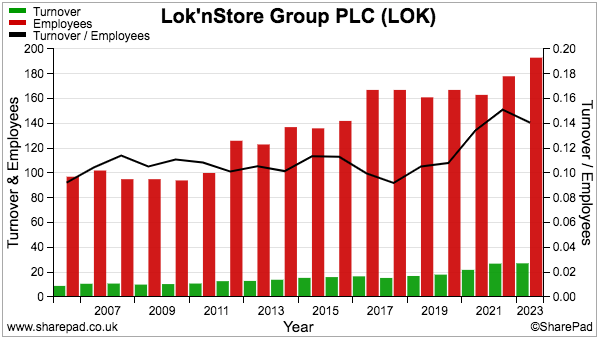

2) The aforementioned 34% operating margin is due partly to storage facilities requiring relatively few workers. The group employed 193 workers last year to give a headcount-per-store of less than five:

Last year’s wage bill came to £4 million — some 15% of revenue — and equated to an average £21k salary.

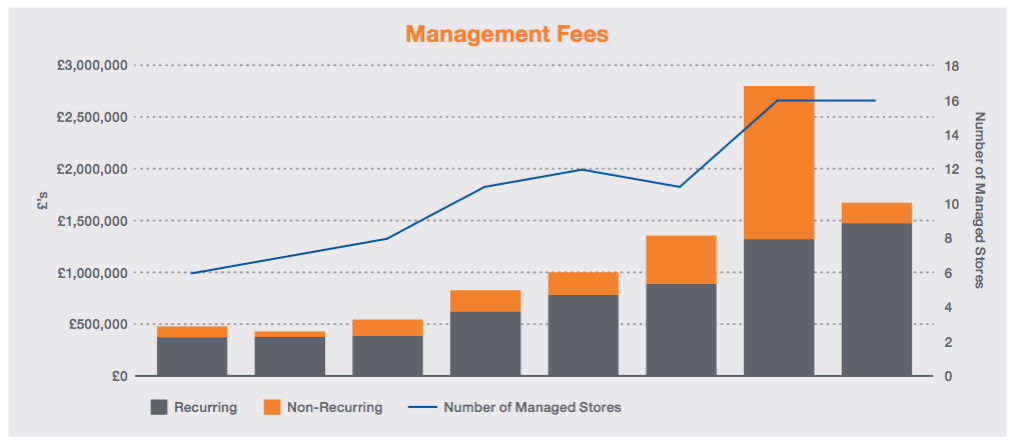

3) The group’s rising profitability is helped by greater management fees that the group claims have a 100% margin:

Directors and shareholdings

Mr Jacobs’ share dealings certainly give the impression of an ‘owner manager’.

His only significant disposal during the last two decades occurred this year when he sold 1.25 million shares at £8 to raise £10 million:

His 13% shareholding presently rewards him with an annual £800k-plus dividend income that encouragingly exceeds his £235k salary by a wide margin.

Further evidence that Mr Jacobs is aligned with outside shareholders is his salary advancing just 17% since 2007 and bonuses averaging only a third of his wage.

Elsewhere on the board, a long-time non-exec enjoys a 4% (£10 million) stake while the other three executives have worked at the group for at least ten years:

Succession planning seems in hand as well, given Lok’nStore’s managing director and property director are both in their 40s. Mr Jacobs and the finance director are both in their 60s.

I must admit Mr Jacobs is happy to operate various option schemes that at present would add 5% to the share count.

However, the group’s latest ‘partnership plan’ may not create near-term dilution with the shares at 765p. This scheme demands the share price exceeds £10 — a target that then increases £1 a year to £15 by 2028 — before anything is paid out.

Valuation and summary

Mr Jacobs gave an optimistic outlook within Lok’nStore’s last results:

“We have an exciting period of growth ahead. With Lok’nStore’s resilient and flexible business model enabling the business to manage its conservative debt structure the Board is confident the Group will continue to thrive.”

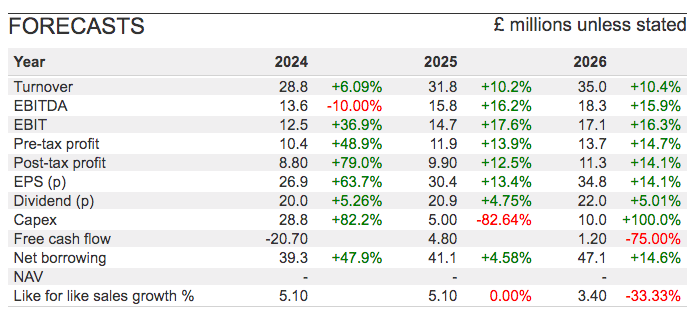

The “exciting period of growth ahead” includes three new sites (including one managed store) opening during the current financial year. Brokers have translated the board’s optimism and extra facilities into the following forecasts:

The estimates sadly do not include any projected net asset values, which would give shareholders some indication about possible (unfavourable) property revaluations.

But detailed balance-sheet estimates may not be required at present, given the shares trade at a historically small premium to the reported book value:

Bear in mind Lok’nStore has various sites contracted for future development, which when completed would take the number of company-operated facilities from last year’s 26 to 35 and perhaps lift net assets by a third. Those extra stores may even ensure the ‘partnership plan’ with that £15 price target pays out during 2028.

The greatest risk I believe is today’s interest rates dampening the economics and valuations of new self-storage facilities. But those SSA UK statistics do not suggest a letup in the demand for extra space, and I dare say Lok’nStore’s revenue will remain resilient, and that impressive dividend progress will be extended…

…and that Mr Jacobs can continue to ‘owner manage’ this “extremely stable” business for some time to come.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Lok’nStore.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.